Diesel Particulate Filter Market for On-Highway Vehicle by Substrate (Cordierite, Silicon Carbide), Regeneration Catalyst, Vehicle Type, Aftermarket, Off-highway Equipment Regeneration Process, Equipment Type, and Region - Global Forecast to 2025

The Diesel Particulate Filter Market (DPF) is primarily driven by the increasing stringency of emission regulations across the globe. The OE DPF market is projected to grow at a CAGR of 11.29% from 2018 to 2025. From a market size of USD 10.27 billion in 2017, it is projected to reach a market size of USD 24.81 billion by 2025. The DPF aftermarket is projected to grow at a CAGR of 3.89% from 2018 to 2025, from a market size of USD 14.47 billion in 2017 to USD 20.59 billion by 2025. The base year considered for the study is 2017, and the forecast has been provided for the period between 2018 and 2025

Market Dynamics

Drivers

-

Introduction of stringent emission regulations

- Emission regulation for on-road vehicles

- Emission Regulation of Off-Road Vehicles

- Increased demand for diesel engines in developing regions

Restraints

- Shifting trend toward gasoline and hybrid propulsion in light duty vehicles in developed countries

Opportunities

- Increase in demand for other particulate filters

- Introduction of Active Regenerative Electronically Controlled DPF

Challenges

- Commercialization of DPF and introduction of low cost DPFs variants

- Harmonization of emission standards

Increasing demand for diesel engines in developing regions will drive the diesel particulate filter market.

Demand for commercial vehicles is increasing at 2.66% during the forecast period globally due to rapid industrialization. The growth is significantly observed in the Asia Pacific region. China and India are one of the top countries which are under rapid transformation in terms of industrialization, infrastructure development, and manufacturing. Commercial vehicles run mostly on diesel and with the introduction of stringent emission norms for commercial and heavy-duty engines, the need for meeting these mandates is increased. These mandates are driving the growth of this market.

The following are the major objectives of the study.

- To define, describe, and forecast the global Diesel Particulate Filter (DPF) market based on equipment type, catalyst, vehicle type, region, and aftermarket

- To forecast the market size, by volume and value, of the DPF market with respect to type (Cordierite DPF, Silicon Carbide, Others)

- To forecast the market size, by volume and value, of the DPF market with respect to regeneration catalyst (Platinum-Rhodium, Palladium-Rhodium, Platinum-Palladium-Rhodium)

- To forecast the DPF market, in terms of volume and value, with respect to ICE vehicle (passenger cars, light commercial vehicles, buses, and trucks)

- To forecast the DPF market, in terms of volume and value, with respect to off-highway vehicle, by process (Passive, active fuel assisted regeneration, active electrically assisted regeneration)

- To forecast the DPF aftermarket, in terms of volume and value, with respect to off highway vehicle (construction equipment and agriculture tractors)

- To forecast the country-level aftermarket size, by volume and value, of the DPF market in terms of ICE vehicle type (passenger car, light commercial vehicles, buses, and trucks)

- To forecast the DPF aftermarket, in terms of volume and value, with respect to 4 key regions—Asia Pacific (China, India, Japan, South Korea and Rest of Asia Pacific), Europe (Germany, France, UK, Spain, Italy and Rest of Europe), North America (USA, Canada, Mexico), and RoW (Brazil, Iran, and others)

- To provide detailed information about major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends and prospects, and determine the contribution of each segment to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and R&D in the DPF market

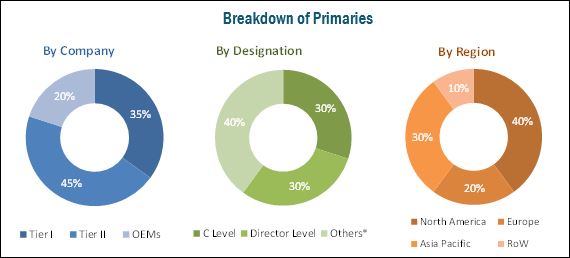

During this research study, major players operating in the global market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Various secondary sources such as Marklines, European Automobile Manufacturers Association (ACEA), Automotive Maintenance and Repair Association (AMRA), and paid databases and directories have been used. The market numbers are based on country-wise production, which is further added to arrive at the regional market. The regional data is then added to derive the global data. Vehicle production has been considered to arrive at the market size, in terms of volume. The country-wise market volume is then multiplied with the country-wise average OE price of DPF. This gives the country-wise market size for DPF, in terms of value. The summation of the country-wise and regional-level market size, in terms of value, provides the global market size.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the diesel particulate filter market are Faurecia (France), BASF (Germany), Tenneco (US), Eberspaecher (Germany), Johnson Matthey (UK), Denso (Japan), Continental (Germany), Bosal (Belgium), Friedrich Boysen (Germany), and NGK Insulators (Japan).

Major Market Developments

- In March 2018, Faurecia announced that it inaugurated its 15th plant in Mexico, located in San Jose Iturbide, Guanajuato. The 110,000-square-meter facility, part of Faurecia’s Clean Mobility division, would manufacture exhaust systems for GM and FCA.

- In November 2017, BASF SE established a chemical catalysts manufacturing plant in Caojing, Shanghai, China. The new plant is BASF’s first chemical catalysts manufacturing facility in the Asia Pacific region. It serves its clientele in Asia Pacific

- In May 2017, Tenneco announced that it had signed an agreement to acquire Federal-Mogul. Federal-Mogul was acquired from Icahn Enterprises. It plans to separate the combined businesses into two independents, publicly traded companies an aftermarket & ride performance company and a powertrain technology company.

Target Audience

- Diesel particulate filter manufacturers

- Investment and equity research firms

- Private equity firms

- DPF substrate manufacturers

- Aftermarket DPF providers

- DPF regeneration catalyst providers

Scope of the Report

Diesel Particulate Filter Market, By Substrate Type:

- Cordierite

- Silicon Carbide

- Others

Diesel Particulate Filter Market, By Regeneration Catalyst:

- Platinum-Rhodium

- Palladium-Rhodium

- Platinum-Palladium-Rhodium

On-Highway, By Vehicle type

- Passenger Car

- LCV

- Truck

- Bus

Off-Highway, By Regeneration process:

- Passive

- Active-Fuel assisted

- Active-Electrically assisted

Off-Highway Aftermarket, By Equipment type:

- Agriculture equipment

- Construction equipment

On-Highway, By Region

- Americas

- Asia Pacific

- Europe

- RoW

On-Highway Aftermarket, By Region

- Asia Pacific

- Europe

- North America

- RoW

Critical questions which the report answers

- Which new regions DPF companies are exploring for potential business avenues?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

- How will the mandates affect the global market?

Available Customization

ON-HIGHWAY DPF MARKET BY COUNTRY, BY VEHICLE TYPE

- Passenger Car

- LCV

- Truck

- Bus

(Note: Countries that are included in the study: China, India, Japan, South Korea, France, Germany, UK, Spain, Russia, Turkey, Canada, US, Mexico, Brazil, Iran)

ON-HIGHWAY DPF MARKET BY COUNTRY, BY SUBSTRATE TYPE

- Cordierite

- Silicon Carbide

- Others

(Note: Countries that are included in the study: China, India, Japan, South Korea, France, Germany, UK, Spain, Russia, Turkey, Canada, US, Mexico, Brazil, Iran)

OFF-HIGHWAY DPF AFTERMARKET BY COUNTRY, BY EQUIPMENT TYPE

- Agriculture Equipment

- Construction Equipment

(Note: Countries that are included in the study: China, India, Japan, France, Germany, Italy, UK, Spain, Qatar, Saudi Arabia, UAE, Canada, US, Mexico)

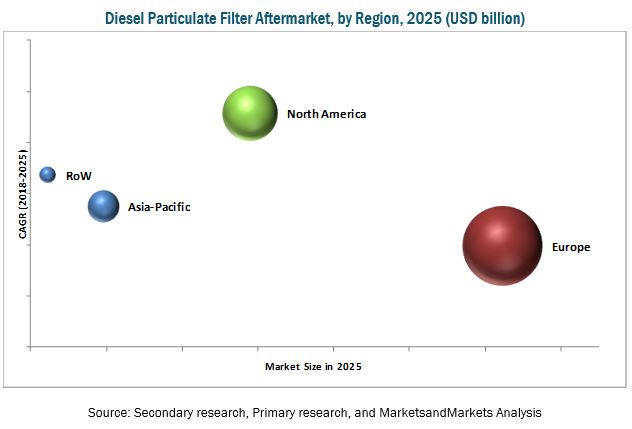

The OE Diesel Particulate Filter Market is projected to grow at a CAGR of 11.29% during the forecast period. From an estimated market size of USD 10.55 billion in 2018, it is projected to reach a market size of USD 24.81 billion by 2025. The DPF aftermarket is projected to grow at a CAGR of 3.89% during the forecast period, from an estimated market size of USD 15.18 billion in 2018 to USD 20.59 billion by 2025. This growth can be attributed to the increasing stringency of emission regulations.

Pd-Rh regeneration catalyst is estimated to be the largest segment of DPF market, by regeneration catalyst, due to its increasing use in most of the passenger cars. Pt-Pd-Rh regeneration catalyst is the fastest growing segment due to its use in heavy commercial vehicles. The diesel penetration in HCV is the highest among all vehicle types. Thus, to conform to the emission regulations, the use of DPF in HCV would increase drastically during the forecast period.

Silicon carbide is the largest segment of the DPF market, by substrate, due to its large-scale use in passenger cars. It is also the fastest growing segment during the forecast period. Emission regulations in developing countries are projected to increase the use of silicon carbide. The production of passenger cars is significantly higher than commercial vehicles, making passenger cars the largest market for silicon carbide DPF.

With the implementation of Euro V in 2009, the emission regulations in Europe have necessitated the use of DPF. Europe is thus estimated to be the largest on-highway aftermarket during the forecast period. The huge vehicle parc and high diesel vehicle penetration make Europe the largest aftermarket for DPF during the forecast period. In case of Off-Highway aftermarket, the agriculture equipment segment is projected to have the largest market share by 2025.

Currently, the Asia Pacific DPF aftermarket is relatively smaller than Europe and North America. The emission regulations in the Asia Pacific countries are not stringent. Hence, the demand for DPF is minimal at present. India, South Korea, and China have seen increased production of diesel vehicles over the last two decades. Also, China and India have the largest vehicle production in the region. However, they have limited penetration of DPF due to lax emission regulations at present. Both these countries have decided to implement stringent emission regulations by 2020. Hence, the demand for DPF is estimated to increase in the Asia Pacific region during the forecast period. However, the aftermarket is projected to remain small as the replacement miles for DPF are significantly more than other components.

Silicon Carbide and Cordierite to drive the growth of Diesel Particulate Filter Market

Silicon Carbide

The silicon carbide DPF substrate has uniform pore structure due to better control over its raw materials and its manufacturing process compared to cordierite. This enables it to trap particulate matter consistently that leads to safer regeneration. Silicon carbide has a higher filtration efficiency than cordierite substrate. LDVs in Europe and North America use silicon carbide as a substrate due to its superior features. Silicon carbide is also the preferred substrate in premium passenger vehicles and LCVs.

Cordierite

Cordierite is the most common substrate used to manufacture DPF. It provides excellent filtration efficiency, is relatively inexpensive, and has thermal properties that make its packaging and installation simple. The major drawback is that cordierite has a relatively low melting point of about 1200 °C and cordierite substrates melt down during filter regeneration. This is mostly an issue when the filter becomes more heavily loaded than usual that is more of an issue with passive systems than active systems, unless there is a system breakdown. Cordierite filter cores are similar to catalytic converter cores that have their alternate channels plugged—the plugs force the exhaust gas flow through the wall and the particulate collects on the inlet face. Cordierite is the preferred substrate in HDVs such as trucks and buses. With stringent emission regulations expected in Asia Pacific, the demand for cordierite is projected to increase significantly in this region

The increasing usage of gasoline and hybrid propulsion vehicles acts as a major restraint for the diesel particulate filter market.

Critical questions the report answers:

- Which new regions DPF companies are exploring for potential business avenues?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

The major players in the diesel particulate filter market are Faurecia (France), BASF (Germany), Tenneco (US), Eberspaecher (Germany), Johnson Matthey (UK), Denso (Japan), Continental (Germany), Bosal (Belgium), Friedrich Boysen (Germany), and NGK Insulators (Japan), among others.

The increasing stringency of emission regulations has changed the market dynamics for diesel particulate filter. The major growth strategies include expansions, new product development, and acquisitions. Faurecia, for example, has adopted expansion as its key strategy. In 2017, Faurecia established a new facility in Mexico. It provides exhaust systems for GM and FCA. In the same year, it inaugurated its new headquarters in South Korea with a testing center, a prototype center, and an exhibition center. This helped to expand the company’s business and increased the global footprint.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Package Size

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Vehicle Production

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Diesel Particulate Filter Market – Global Trends

4.2 Diesel Particulate Filter Market, By Vehicle Type

4.3 Diesel Particulate Filter Market, By Substrate Type

4.4 Diesel Particulate Filter Market, By Regeneration Catalyst

4.5 Off-Highway Diesel Particulate Filter Market, By Type

4.6 Off-Highway Diesel Particulate Filter Aftermarket, By Equipment Type

4.7 Diesel Particulate Filter Aftermarket, By Country

4.8 Diesel Particulate Filter Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Introduction of Stringent Emission Regulations

5.1.1.1.1 Emission Regulation for On-Road Vehicles

5.1.1.1.2 Emission Regulation for Off-Road Vehicles

5.1.1.2 Increased Demand for Diesel Engines in Developing Regions

5.1.2 Restraints

5.1.2.1 Shifting Trend Toward Gasoline and Hybrid Propulsion in Light Duty Vehicles in Developed Countries

5.1.3 Opportunities

5.1.3.1 Increase in Demand for Other Particulate Filters

5.1.3.2 Introduction of Active Regenerative Electronically Controlled DPF

5.1.4 Challenges

5.1.4.1 Commercialization and Theft of DPF

5.1.4.1.1 Commercialization of DPF and Introduction of Low Cost DPFs Variants

5.1.4.1.2 DPF Theft

5.1.4.2 Harmonization of Emission Standards

6 Global Diesel Particulate Filter Market, By Substrate Type (Page No. - 47)

(Note: This Chapter has Been Further Segmented By Vehicle Type Into Passenger Car, LCV, Truck and Bus)

6.1 Introduction

6.2 Cordierite

6.3 Silicon Carbide

6.4 Other Substrates

7 Global Diesel Particulate Filter Market, By Regeneration Catalyst (Page No. - 53)

(Note: This Chapter has Been Further Segmented By Vehicle Type Into LDV and HDV)

7.1 Introduction

7.2 Platinum-Rhodium (Pt-Rh)

7.3 Palladium-Rhodium(Pd-Rh)

7.4 Platinum-Palladium-Rhodium (Pt-Pd-Rh)

8 Global Diesel Particulate Filter Market, By On-Highway Vehicle Type (Page No. - 58)

(Note: This Chapter has Been Further Segmented By Substrate Type Into Cordierite, Silicon Carbide and Others)

8.1 Introduction

8.2 Passenger Car

8.3 Light Commercial Vehicles (LCV)

8.4 Truck

8.5 Bus

9 On-Highway Diesel Particulate Filter Market, By Region (Page No. - 66)

(Note: This Chapter has Been Further Segmented By Vehicle Type Into Passenger Car, LCV, Truck and Bus)

9.1 Introduction

9.2 Americas

9.3 Asia Pacific

9.4 Europe

9.5 RoW

10 Off-Highway Diesel Particulate Filter Market, By Regeneration Process (Page No. - 74)

(Note: This Chapter has Been Further Segmented By Equipment Type Into Construction Equipment and Agriculture Tractors)

10.1 Introduction

10.2 Passive Regeneration DPF

10.3 Active Fuel Assisted DPF

10.4 Active Electrically Assisted DPF

11 Off-Highway Diesel Particulate Filter Aftermarket, By Equipment (Page No. - 79)

(Note: This Chapter has Been Further Segmented By Substrate Type Into Cordierite, Silicon Carbide and Others)

11.1 Introduction

11.2 Construction Equipment

11.3 Agriculture Tractors

12 Diesel Particulate Filter Aftermarket, By Region (Page No. - 84)

(Note: This Chapter has Been Further Segmented By Vehicle Type Into Passenger Car, LCV, Hcv)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 India

12.2.3 Japan

12.2.4 South Korea

12.2.5 Rest of Asia-Pacific

12.3 Europe

12.3.1 France

12.3.2 Germany

12.3.3 Italy

12.3.4 Spain

12.3.5 UK

12.3.6 Rest of Europe

12.4 North America

12.4.1 Canada

12.4.2 Mexico

12.4.3 US

12.5 RoW

12.5.1 Brazil

12.5.2 Russia

13 Competitive Landscape (Page No. - 107)

13.1 Market Share Analysis

13.2 Competitive Scenario

13.2.1 New Product Developments

13.2.2 Expansions

13.2.3 Mergers & Acquisitions

13.2.4 Partnerships/Agreements/Supply Contracts/Collaborations/Joint Ventures

14 Company Profile (Page No. - 113)

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis)*

14.1 Faurecia

14.2 Tenneco

14.3 Eberspaecher

14.4 BASF

14.5 Johnson Matthey

14.6 Continental

14.7 Denso

14.8 Friedrich Boysen

14.9 Bosal

14.10 NGK Insulators

14.11 Additional Company Profiles

14.11.1 North America

14.11.1.1 Corning

14.11.1.2 Clean Diesel Technologies

14.11.1.3 Rypos

14.11.1.4 Katcon

14.11.2 Europe

14.11.2.1 Unicore

14.11.3 Asia Pacific

14.11.3.1 Yungjin

14.11.3.2 Yutaka Giken

14.11.3.3 Ibiden

14.11.3.4 Sankei Giken Kogyo

*Details on Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 138)

15.1 Primary Insights

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Available Customizations

15.4.1 On-Highway DPF Market By Country, By Vehicle Type

15.4.1.1 Passenger Car

15.4.1.2 LCV

15.4.1.3 Truck

15.4.1.4 Bus

15.4.2 On-Highway Diesel Particulate Market By Country, By Substrate Type

15.4.2.1 Cordierite

15.4.2.2 Silicon Carbide

15.4.2.3 Others

15.4.3 Off-Highway DPF Aftermarket By Country, By Equipment Type

15.4.3.1 Agriculture Tractors

15.4.3.2 Construction Equipment

15.5 Related Reports

15.6 Author Details

List of Tables (102 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Global Diesel Particulate Filter Market Dynamics Impact

Table 3 On-Road Vehicle Emission Regulation Outlook for Passenger Cars, 2016–2021

Table 4 Engine Technology vs Aftertreatment Requirement

Table 5 Commercial Vehicle Production: Diesel Vehicle Penetration for Key Countries, By Vehicle Type , 2017

Table 6 Government Incentives for Electric Vehicles

Table 7 Average Cost of DPF

Table 8 Faurecia’s Supplies to Global Automotive Manufacturers: Exhaust System and Components

Table 9 Diesel Particulate Filter Market, By Substrate Type, 2016–2025 (‘000 Units)

Table 10 Diesel Particulate Filter Market, By Substrate Type, 2016–2025 (USD Million)

Table 11 Cordierite: Specifications

Table 12 Cordierite Market, By Vehicle Type, 2016–2025 (‘000 Units)

Table 13 Cordierite Market, By Vehicle Type, 2016–2025 (USD Million)

Table 14 Silicon Carbide: Specifications

Table 15 Silicon Carbide Market, By Vehicle Type, 2016–2025 (‘000 Units)

Table 16 Silicon Carbide Market, By Vehicle Type, 2016–2025 (USD Million)

Table 17 Other Substrates: Market, By Vehicle Type, 2016–2025 (‘000 Units)

Table 18 Other Substrates: Market, By Vehicle Type, 2016–2025 (USD Million)

Table 19 Global Diesel Particulate Filter Market, By Regeneration Catalyst, 2016—2025 (‘000 Units)

Table 20 Pt-Rh: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 21 Pd-Rh: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 22 Pt-Pd-Rh: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 23 Global Market, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 24 Global Market, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 25 Passenger Car: Market, By Substrate Type, 2016—2025 (‘000 Units)

Table 26 Passenger Car: Market, By Substrate Type, 2016—2025 (USD Million)

Table 27 LCV: Market, By Substrate Type, 2016—2025 (‘000 Units)

Table 28 LCV: Market, By Substrate Type, 2016—2025 (USD Million)

Table 29 Truck: Market, By Substrate Type, 2016—2025 (‘000 Units)

Table 30 Truck: Market, By Substrate Type, 2016—2025 (USD Million)

Table 31 Bus: Market, By Substrate Type, 2016—2025 (‘000 Units)

Table 32 Bus: Market, By Substrate Type, 2016—2025 (USD Million)

Table 33 DPF Market, By Region, 2016—2025 (‘000 Units)

Table 34 DPF Market, By Region, 2016—2025 (USD Million)

Table 35 Americas: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 36 Americas: Market, By Vehicle Type, 2016—2025 (USD Million)

Table 37 Asia Pacific: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 38 Asia Pacific: Market, By Vehicle Type, 2016—2025 (USD Million)

Table 39 Europe: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 40 Europe: Market, By Vehicle Type, 2016—2025 (USD Million)

Table 41 RoW: Market, By Vehicle Type, 2016—2025 (‘000 Units)

Table 42 RoW: Market, By Vehicle Type, 2016—2025 (USD Million)

Table 43 Off-Highway Market, By Regeneration Process, 2016-2025 ('000 Units)

Table 44 Off-Highway Market, By Regeneration Process, 2016-2025 (USD Million)

Table 45 Passive Regeneration: Market, By Ohv Equipment Type, 2016—2025 ('000 Units)

Table 46 Passive Regeneration: Market, By Ohv Equipment Type, 2016—2025 (USD Million)

Table 47 Active Fuel Assisted: Market, By Ohv Equipment Type, 2016—2025 ('000 Units)

Table 48 Active Fuel Assisted: Market, By Ohv Equipment Type, 2016—2025 (USD Million)

Table 49 Active Electrically Assisted: Market, By Ohv Equipment Type, 2016—2025 ('000 Units)

Table 50 Active Electrically Assisted: Market, By Ohv Equipment Type, 2016—2025 (USD Million)

Table 51 Off- Highway DPF Aftermarket, By Equipment Type, 2016-2025 ('000 Units)

Table 52 Off- Highway DPF Aftermarket, By Equipment Type, 2016-2025 (USD Million)

Table 53 Construction Equipment: DPF Aftermarket, By Substrate Type, 2016—2025 ('000 Units)

Table 54 Construction Equipment: DPF Aftermarket, By Substrate Type, 2016—2025 (USD Million)

Table 55 Agriculture Tractors: DPF Aftermarket, By Substrate Type, 2016—2025 ('000 Units)

Table 56 Agriculture Tractors: DPF Aftermarket, By Substrate Type, 2016—2025 (USD Million)

Table 57 Aftermarket (For On-Highway Vehicles), By Region, 2016—2025 (‘000 Units)

Table 58 Aftermarket (For On-Highway Vehicles), By Region, 2016—2025 (USD Million)

Table 59 Asia Pacific: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 60 Asia Pacific: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 61 China: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 62 China: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 63 India: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 64 India: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 65 Japan: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 66 Japan: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 67 South Korea: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 68 South Korea: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 69 Rest of Asia-Pacific: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 70 Rest of Asia-Pacific: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 71 Europe: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 72 Europe: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 73 France: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 74 France: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 75 Germany: Aftermarket, By On-Highway Vehicle Type 2016—2025 (‘000 Units)

Table 76 Germany: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 77 Italy: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 78 Italy: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 79 Spain: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 80 Spain: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 81 UK: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 82 UK: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 83 Europe Others: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 84 Rest of Europe: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 85 North America: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 86 North America: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 87 Canada: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 88 Canada: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 89 Mexico: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 90 Mexico: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 91 US: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 92 US: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 93 RoW: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 94 RoW: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 95 Brazil: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 96 Brazil: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 97 Russia: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (‘000 Units)

Table 98 Russia: Aftermarket, By On-Highway Vehicle Type, 2016—2025 (USD Million)

Table 99 New Product Developments

Table 100 Expansions

Table 101 Mergers & Acquisitions

Table 102 Partnerships/Agreements/Supply Contracts/Collaborations/ Joint Ventures

List of Figures (45 Figures)

Figure 1 Diesel Particulate Filter Market Segmentation

Figure 2 Research Design – DPF Market

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Global Diesel Particulate Filter Market: Bottom-Up Approach

Figure 6 Global Diesel Particulate Filter Market: Market Outlook

Figure 7 Global Diesel Particulate Filter Market, By Region, 2018 vs 2025 (USD Billion)

Figure 8 Attractive Growth Opportunities in Passenger Car Diesel Particulate Filter Market

Figure 9 Passenger Car to Be the Leading Market, 2016-2025 (USD Million)

Figure 10 Silicon Carbide to Be the Largest Market, By Substrate Type, 2018 vs 2025 (USD Million)

Figure 11 Pd-Rh Regenertaion Catalyst to Dominate the DPF Market, 2018 vs 2025

Figure 12 Passive DPF Type is Projected to Have the Largest Share of Off-Highway DPF Market, 2025 (USD Million)

Figure 13 Agriculture Tractors to Dominate the Off-Highway Diesel Particulate Filter Aftermarket, 2025 (USD Billion)

Figure 14 US to Account for the Largest Diesel Particulate Filter Aftermarket in 2018 (USD Million)

Figure 15 Asia Pacific to Be the Largest and the Fastest Growing Market, 2018 vs 2025 (USD Billion)

Figure 16 DPF : Market Dynamics

Figure 17 On-Road Vehicle Emission Regulation Outlook for Heavy Duty Vehicles, 2014–2025

Figure 18 Off-Road Vehicle Emission Regulation Outlook, 2014–2025

Figure 19 Passenger Car Production: Diesel Vehicle Penetration for Key Countries, 2017

Figure 20 GDI Vehicles Equipped With GPF, By Region (‘000 Units)

Figure 21 Diesel Particulate Filter Market (For On-Highway Vehicles) , By Substrate Type, 2018 vs 2025 (USD Billion)

Figure 22 Diesel Particulate Filter Market (For On-Highway Vehicles), By Regeneration Catalyst, 2018 vs 2025 (Million Units)

Figure 23 Diesel Particulate Filter Market, By On-Highway Vehicle Type, 2018 vs 2025 (USD Billion)

Figure 24 Diesel Particulate Filter Market (For On-Highway Vehicles), By Region, 2018 vs 2025 (USD Billion)

Figure 25 Off-Highway Diesel Particulate Filter Market, By Regeneration Process, 2016 -2025 (USD Million)

Figure 26 Off Highway Diesel Particulate Filter Aftermarket, By Equipment Type, 2016 -2025 (USD Million)

Figure 27 Diesel Particulate Filter Aftermarket (For On-Highway Vehicles), By Region, 2018 (Value)

Figure 28 Europe to Remain the Largest On-Highway Vehicles Aftermarket for Diesel Particulate Filter

Figure 29 North America to Remain the Second Largest On-Highway Vehicles Aftermarket for Diesel Particulate Filter

Figure 30 Diesel Particulate Filter Market Share (For On-Highway & Off-Highway Vehicles), for Key Players, 2017

Figure 31 Companies Adopted Expansion as A Key Growth Strategy

Figure 32 Faurecia: Company Snapshot

Figure 33 SWOT Analysis: Faurecia

Figure 34 Tenneco: Company Snapshot

Figure 35 SWOT Analysis: Tenneco

Figure 36 Eberspaecher: Company Snapshot

Figure 37 SWOT Analysis: Eberspaecher

Figure 38 BASF: Company Snapshot

Figure 39 SWOT Analysis: BASF

Figure 40 Johnson Matthey: Company Snapshot

Figure 41 SWOT Analysis: Johnson Matthey

Figure 42 Continental: Company Snapshot

Figure 43 Denso: Company Snapshot

Figure 44 Friedrich Boysen: Company Snapshot

Figure 45 NGK Insulators: Company Snapshot

Growth opportunities and latent adjacency in Diesel Particulate Filter Market