Rolling Stock Management Market by Management (Rail, Infrastructure), Rail (Remote Diagnostic, Wayside, Train, Asset, Cab Advisory), Infrastructure (Control Room, Station, Automatic Fare Collection), Maintenance Service & Region - Global Forecast to 2025

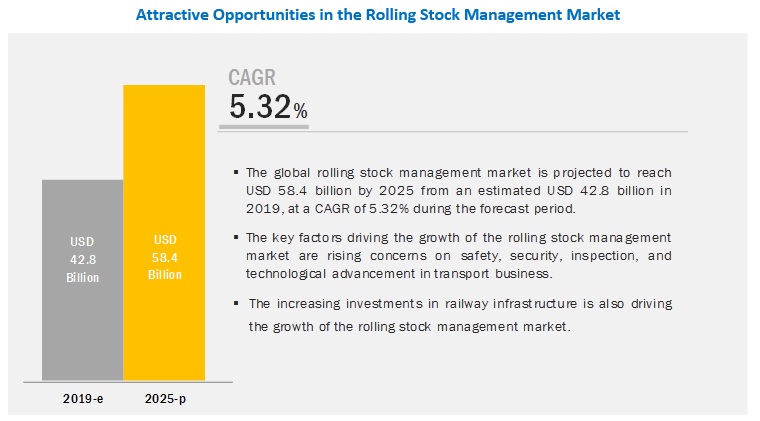

[171 Pages Report] The global rolling stock management market is projected to grow from USD 42.8 billion in 2019 to reach USD 58.4 billion by 2025, at a CAGR of 5.32%. The rising concerns over safety, security, inspection, maintenance, and in the transport business has led to the growth of the rolling stock management market. It not only includes the fact of reducing long term cost but also mitigating the traditional methods of maintenance. Transport can be through the medium of air, road, or train but its efficiency and effect on the environment. The emerging nations support railways as a well-suited means of mass transport for passengers and freight.

To know about the assumptions considered for the study, Request for Free Sample Report

Asset Management segment is estimated to account for the largest market size during the forecast period

Rail asset management system is a safe, reliable, substantial, and efficient approach to manage the entire rail infrastructure. It includes route plans that involve activities, resources, and timescales for interventions on the infrastructure; route asset strategies to manage the asset involved in a specific route; and delivery schedules/programs that form detailed plans to optimize the delivery of renewals, maintenance, and enhancement. The rail asset management system assists freight managers, passengers, rail operators, and infrastructure managers in addressing issues, such as the improvement in service availability; performance and utilization for mobile, fixed, and linear assets; increased reliability and punctuality along with reduced service failures and delay minutes; and minimized asset costs.

Remote diagnostic management is estimated to account for the fastest market size during the forecast period

Remote diagnostic management provides complete information about components, controls, and the entire system of the train from a range or distance. This management processes wide data and provides a comprehensive analysis of the status. It helps save time in operations and maintenance. Remote diagnostic management helps in rail maintenance management for preventive and corrective maintenance planning. These solutions enable the proactive management and maintenance of all the rail assets. The technical capabilities of this solution include real-time remote diagnostics, component condition monitoring, and onboard condition monitoring. It also includes key monitoring and reporting features that help support the whole lifecycle management of rail assets. This helps in greatly improving maintenance strategies and planning.

The European region is estimated to be the largest market for remote diagnostic management. The reason is the increased focus of operators in rolling stock management on real-time information so that faults can be prevented and decision-making can be accelerated.

To know about the assumptions considered for the study, download the pdf brochure

Europe is expected to be the largest market during the forecast period

The European region is estimated to be dominated by countries such as Germany, France, and the UK. Technological advancements and the demand for the long-term working of rolling stock without failures or errors are expected to drive the rolling stock management market in Europe. The European region has been at the forefront of technological innovation in rolling stock management. The investment projects undertaken for infrastructure and transportation have fuelled the research for services that will extend the lifecycle of assets, which, in turn, affect the flow of working conditions of railroads and rolling stock components.

Key Market Players

The global rolling stock management market is dominated by major players such as Bombardier (Canada), Alstom (France), General Electric (US), and Siemens (Germany). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive service range in the rolling stock management market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scopeof the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Management type, Rail Management, Infrastructure Management, Maintenance Service, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Rest of the World |

|

Companies Covered |

Bombardier (Canada), Trimble (US), Alstom (France), Siemens (Germany), GE (US), and ABB (Switzerland), |

This research report categorizes the rolling stock management market based on management type, rail management, infrastructure management, maintenance service, and region.

On the basis of management type, the rolling stock management has been segmented as follows:

- Rail Management

- Infrastructure Management

On the basis of rail management, the rolling stock management has been segmented as follows:

- Remote Diagnostic Management

- Wayside Management

- Train Management

- Asset Management

- Cab Advisory

On the basis of infrastructure management, the rolling stock management has been segmented as follows:

- Control Room Management

- Station Management

- Automatic Fare Collection Management

On the basis of maintenance service, the rolling stock management has been segmented as follows:

- Corrective

- Preventive

- Predictive

On the basis of region, the rolling stock management has been segmented as follows: <

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- UK

-

Middle East & Africa

- UAE

- Iran

- Egypt

- South Africa

-

Rest of the World

- Brazil

- Russia

Recent Developments

- Bombardier signed an MoU with the Malaysian Industry Government Group for High Technology (MIGHT) outlining their collaboration on developing home-grown rail industry expertise in the coming years.

- Nuovo Trasporto Viaggiatori (Italy) and Alstom signed a contract worth USD 406 million for the purchase of 5 additional Pendolino EVO trains, exercising an option to the contract signed in October 2015. The contract also includes 30 years of maintenance.

- General Electric signed a contract to provide maintenance services and support for Rio Tinto’s locomotive network in the Pilbara region of Western Australia, the largest privately-owned and operated rail system in the country.

- Siemens started a new state-of-the-art control center for centralized rail traffic management in the province of Gauteng, South Africa. The control center-Gauteng Nerve Centre (GNC)-has 35 control rooms in one place. It is capable of monitoring 600 trains and up to 500,000 passengers every day.

Critical Questions:

- Where will remote diagnostics take the industry in the long term?

- How will the rolling stock management market cope with the challenge of the high cost of service implementation?

- What is the impact of asset management on the rolling stock management market?

- What are the upcoming trends in the rail management and infrastructure management markets? What impact would they make post 2022?

- What are the key strategies adopted by the top players to increase their revenue?

Frequently Asked Questions (FAQ):

What is the market size of the rolling stock management?

The global rolling stock management market is projected to reach USD 58.4 billion by 2025 from USD 42.8 billion in 2019, at a CAGR of 5.32%.

Which is the largest market in rolling stock management market?

Europe is estimated to have the largest market for rolling stock management. Adoption of high end technologies and shift towards rapid transit systems would create more opportunity for rolling stock management providers in the region.

Who are the frontrunners in the rolling stock management market, and what strategies have been adopted by them?

The global rolling stock management market is dominated by major players such as Bombardier (Canada), Alstom (France), Siemens (Germany), and General Electric (US). These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

What are the major technologies and trends in the rolling stock management market?

Increasing usage of big data analytics, cloud computing, and IoT devices are going to shape the rolling stock management market. Data analytics delivering intelligent asset data to rolling stock passengers and freight operators is helping in understanding end-to-end rail asset lifecycle solutions to maintain rolling stock assets from remote diagnostics and condition monitoring.

What is the largest rail management application in terms of market share and why?

The asset management will have largest share in the rolling stock management market. Asset management helps freight managers, rail operators, and infrastructure managers help improve service availability, performance and utilization of mobile and fixed assets to reduce failure and minimize asset costs. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Rolling Stock Management Market to Grow at A Significant Rate During the Forecast Period (2019–2025)

4.2 Europe to Lead the Global Market

4.3 Global Market, By Management Type and Maintenance Service

4.4 Market, By Management Type

4.5 Market, By Maintenance Service

4.6 Market, By Rail Management

4.7 Market, By Infrastructure Management

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Delivering Intelligent Asset Management

5.2.1.2 Growth in Efficient Technologies

5.2.1.3 IoT in Data Analytics and Predictive Analytics for Rolling Stock

5.2.2 Restraints

5.2.2.1 Slow Pace in Developing Nations

5.2.3 Opportunities

5.2.3.1 Cost Reduction in IoT Components and the Need for Asset Optimization

5.2.3.2 Automatic Monitoring

5.2.4 Challenges

5.2.4.1 Technological Changes Offer New Challenges

5.2.4.2 High Cost of Deployment

5.2.5 Impact of Market Dynamics

6 Industry Trends (Page No. - 41)

6.1 Technological Overview

6.1.1 IoT in Rolling Stock Management

6.1.2 Big Data Analytics and Cloud Computing in Rolling Stock

6.1.3 Asset Management

6.2 Value Chain Analysis

6.3 Macroindicator Analysis

6.3.1 Growth of the Rolling Stock Management Market

6.3.2 GDP (USD Billion)

6.3.3 GNI Per Capita, Atlas Method (USD)

6.3.4 GDP Per Capita PPP (USD)

6.3.5 Macro Indicators Influencing the Market, Top 3 Countries

6.3.5.1 Germany

6.3.5.2 US

6.3.5.3 China

7 Rolling Stock Management Market, By Management Type (Page No. - 47)

7.1 Introduction

7.2 Research Methodology

7.3 Rail Management

7.3.1 Rising Focus on Real-Time Solutions to Prevent Failures is Driving the Overall Market

7.4 Infrastructure Management

7.4.1 High Focus on Efficiency, Optimization, and Cost Effectiveness Will Boost the Market During the Forecast Period

8 Rolling Stock Management Market, By Rail Management (Page No. - 52)

8.1 Introduction

8.2 Research Methodology

8.3 Remote Diagnostic Management

8.3.1 Real-Time Remote Diagnostics

8.3.1.1 Increasing Number of Rail Projects in Middle East & Africa Will Boost the Market

8.3.2 Component Condition Monitoring

8.3.2.1 Focus on Advanced Railway Technologies in European Countries Will Boost the Rail Management Market

8.3.3 Onboard Condition Monitoring

8.3.3.1 Expansion of Railway Projects in UAE and Egypt is Likely to Drive the Market

8.4 Wayside Management

8.4.1 Wheel Tread and Surface

8.4.2 Brakes and Brake Components

8.4.3 Bogie Inspection

8.4.4 Coupler Securement Inspection

8.4.5 Undercarriage Inspection

8.4.6 Pantograph Measurement and Inspection

8.4.7 Full-Scale Train Imaging and Inspection

8.4.8 Automatic Train Control

8.4.9 Centralized Traffic Control

8.4.10 Interlocking

8.5 Train Management

8.5.1 Passenger Information System (PIS)

8.5.1.1 Increasing Hold of Private Sector in the Railway Industry in Middle East & Africa Will Boost the Market

8.5.2 In-Train Surveillance System

8.5.2.1 Growth of Rail Supply Industry in Europe Will Boost the Market

8.5.3 Others

8.5.3.1 Europe Will Boost the Demand for the Rail Management Market for Others Segment

8.6 Asset Management

8.6.1 Reducing Operational Costs for Infrastructure Assets Will Fuel the Market

8.7 Cab Advisory

8.7.1 Increasing Investment By Developing Countries for the Will Boost the Market During the Forecast Period

8.8 Others

8.8.1 Increasing Investments By Developing Countries Will Boost the Market

9 Rolling Stock Management Market, By Infrastructure Management (Page No. - 66)

9.1 Introduction

9.2 Research Methodology

9.3 Control Room Management

9.3.1 Video Wall Controller System

9.3.1.1 Need to Enhance Situational Awareness Will Fuel the Market for Video Wall Controller System

9.3.2 Pscada System

9.3.2.1 Increased Lifecycle of Rolling Stock Through Maintenance and Operations Will Fuel the Market for Pscada Systems

9.3.3 Others

9.3.3.1 Rise in Safety and Security Systems in Railway Industry is Fueling the Overall Market Growth

9.4 Station Management

9.4.1 Integrated Supervisory Control System

9.4.1.1 Reliable Hardware and Software Will Boost the Demand in the Rolling Stock Industry

9.4.2 Fire Alarm System

9.4.2.1 Growing Investments in Infrastructure Will Boost Demand

9.4.3 Building Automation System

9.4.3.1 Well-Maintained Escalators and Room Temperature to Drive the Building Automation System Market

9.4.4 Others

9.4.4.1 Increased Focus on Efficiency, Optimization, and Cost Effectiveness Will Boost the Market

9.5 Automatic Fare Collection Management

9.5.1 Automatic Gate Machine System

9.5.1.1 Need for Automatic Data Collection and Management of Passengers Will Drive the Automatic Gate Machine System Market

9.5.2 Ticket Vending Machine

9.5.2.1 Adoption of New Technologies Will Drive the Ticket Vending Machine Market

9.5.3 Ticket Kiosk and Checking Machine

9.5.3.1 Cost Effectiveness Will Drive the Ticket Kiosk and Checking Machine Market

9.6 Others

9.6.1 Demand for Advanced Systems to Drive the Infrastructure Management Market for Other Services

10 Rolling Stock Management Market, By Maintenance Service (Page No. - 81)

10.1 Introduction

10.2 Research Methodology

10.3 Corrective Maintenance

10.3.1 Investments in Railway Line Projects Will Boost the Demand for Corrective Maintenance

10.4 Preventive Maintenance

10.4.1 Investments in Infrastructure Will Boost the Demand for Preventive Maintenance

10.5 Predictive Maintenance

10.5.1 IoT in Railways Will Boost the Demand for Predictive Maintenance

11 Rolling Stock Management Market, By Region (Page No. - 88)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Spain

11.3.4 Italy

11.3.5 United Kingdom

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 Us

11.5 Middle East & Africa

11.5.1 South Africa

11.5.2 UAE

11.5.3 Iran

11.5.4 Egypt

11.6 Rest of the World (RoW)

11.6.1 Brazil

11.6.2 Russia

12 Competitive Landscape (Page No. - 103)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

12.3.3 Expansions, 2015–2018

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

13 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

13.1 Bombardier

13.2 Alstom

13.3 General Electric (GE)

13.4 Siemens

13.5 ABB

13.6 Hitachi

13.7 Mitsubishi Heavy Industries

13.8 Talgo

13.9 Construcciones Y Auxiliar De Ferrocarriles

13.10 Thales Group

13.11 Trimble

13.12 Tech Mahindra

13.13 Transmashholding

13.14 Other Key Players

13.14.1 Asia Oceania

13.14.1.1 Toshiba

13.14.1.2 Advantech

13.14.1.3 CRRC

13.14.2 Europe

13.14.2.1 Indra Sistemas

13.14.2.2 Eurotech

13.14.2.3 Ansaldo

13.14.2.4 EKE-Electronics

13.14.2.5 Danobat Group

13.14.3 North America

13.14.3.1 Bentley Systems

13.14.3.2 Stadler

13.14.4 Rest of the World

13.14.4.1 UGL

13.14.4.2 Randon

13.14.4.3 Alucast Iran

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 165)

14.1 Discussion Guide – Rolling Stock Management Market

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (48 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Rolling Stock Management Market, By Management, 2017–2025 (USD Million)

Table 3 Rail Management: Market, By Region, 2017–2025 (USD Million)

Table 4 Infrastructure Management: Market, By Region 2017–2025 (USD Million)

Table 5 Market, By Rail Management, 2017–2025 (USD Million)

Table 6 Remote Diagnostic Management: Market, By Rail Management, 2017–2025 (USD Million)

Table 7 Real-Time Remote Diagnostics: Market, By Rail Management, 2017–2025 (USD Million)

Table 8 Component Condition Monitoring: Market, By Rail Management, 2017–2025 (USD Million)

Table 9 Onboard Condition Monitoring: Market, By Rail Management, 2017–2025 (USD Million)

Table 10 Wayside Management: Market, By Rail Management, 2017–2025 (USD Million)

Table 11 Train Management: Market, By Rail Management, 2017–2025 (USD Million)

Table 12 PIS: Market, By Region, 2017–2025 (USD Million)

Table 13 In-Train Surveillance: Market, By Region, 2017–2025 (USD Million)

Table 14 Others: Market, By Region, 2017–2025 (USD Million)

Table 15 Asset Management: Market, By Region, 2017–2025 (USD Million)

Table 16 Cab Advisory: Market, By Region, 2017–2025 (USD Million)

Table 17 Others: Market, By Region, 2017–2025 (USD Million)

Table 18 Market, By Infrastructure Management, 2017–2025 (USD Million)

Table 19 Infrastructure Management Market, By Control Room Management, 2017–2025 (USD Million)

Table 20 Video Wall Controller System: Market, By Region, 2017–2025 (USD Million)

Table 21 Pscada: Market, By Region, 2017–2025 (USD Million)

Table 22 Others: Market, By Region, 2017–2025 (USD Million)

Table 23 Infrastructure Management Market, By Station Management, 2017–2025 (USD Million)

Table 24 Integrated Supervisory Control System: Market, By Region, 2017–2025 (USD Million)

Table 25 Fire Alarm System: Market, By Region, 2017–2025 (USD Million)

Table 26 Building Automation System: Market, By Region, 2017–2025 (USD Million)

Table 27 Others: Market, By Region, 2017–2025 (USD Million)

Table 28 Infrastructure Management Market, By Automatic Fare Collection Management, 2017–2025 (USD Million)

Table 29 Automatic Gate Machine System: Market, By Region, 2017–2025 (USD Million)

Table 30 Ticket Vending Machine: Market, By Region, 2017–2025 (USD Million)

Table 31 Ticket Kiosk and Checking Machine: Market, By Region, 2017–2025 (USD Million)

Table 32 Others: Market, By Region, 2017–2025 (USD Million)

Table 33 Rolling Stock Management Market, By Maintenance Service, 2017–2025 (USD Million)

Table 34 Corrective Maintenance: Market, By Region, 2017–2025 (USD Million)

Table 35 Corrective Maintenance: Market, By Management, 2017–2025 (USD Million)

Table 36 Preventive Maintenance: Market, By Region, 2017–2025 (USD Million)

Table 37 Preventive Maintenance: Market, By Management, 2017–2025 (USD Million)

Table 38 Predictive Maintenance: Market, By Region, 2017–2025 (USD Million)

Table 39 Predictive Maintenance: Market, By Management, 2017–2025 (USD Million)

Table 40 Market, By Region, 2017–2025 (USD Million)

Table 41 Asia Pacific: Market, By Management, 2017–2025 (USD Million)

Table 42 Europe: Market, By Management, 2017–2025 (USD Million)

Table 43 North America: Market, By Management, 2017–2025 (USD Million)

Table 44 Middle East & Africa: Market, By Management, 2017–2025 (USD Million)

Table 45 Rest of the World: Market, By Management, 2017–2025 (USD Million)

Table 46 New Product Developments, 2016–2019

Table 47 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements, 2015–2019

Table 48 Expansions, 2015–2018

List of Figures (54 Figures)

Figure 1 Rolling Stock Management Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Dynamics

Figure 8 Market, By Region, 2019–2025 (USD Million)

Figure 9 Rail Management Held the Largest Share in the Market in 2019

Figure 10 Lucrative Growth Opportunities for the Market Between 2019 and 2025

Figure 11 Market Share, By Region, (USD Million), 2019

Figure 12 Rail Management and Predictive Maintenance Account for the Largest Shares of the Market in 2019

Figure 13 Rail Management to Hold the Largest Market Share, USD Billion, 2019 vs 2025

Figure 14 Predictive Maintenance Segment to Hold the Largest Market Share, USD Billion, 2019 vs 2025

Figure 15 Asset Management Segment to Play A Major Role in the Market (2019–2025)

Figure 16 Automatic Fare Collection Segment to Play A Major Role in the Market (2019–2025)

Figure 17 Market: Market Dynamics

Figure 18 The Scope of Asset Management Activities

Figure 19 Value Chain Analysis

Figure 20 Rolling Stock Management Market, By Management, 2019 vs 2025 (USD Million)

Figure 21 Key Primary Insights

Figure 22 Market, By Rail Management, 2019 vs 2025 (USD Million)

Figure 23 Key Primary Insights

Figure 24 Market, By Infrastructure Management, 2019 vs 2025 (USD Million)

Figure 25 Market, By Control Room Management, 2019 vs 2025 (USD Million)

Figure 26 Market, By Station Management, 2019 vs 2025 (USD Million)

Figure 27 Market, By Automatic Fare Collection Management, 2019 vs 2025 (USD Million)

Figure 28 Key Primary Insights

Figure 29 Market, By Maintenance Service, 2019 vs 2025 (USD Million)

Figure 30 Key Primary Insights

Figure 31 Europe to Dominate the Market During the Forecast Period

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 Key Developments By Leading Players in the Market, 2015–2019

Figure 35 Ranking of Key Players, 2019

Figure 36 Rolling Stock Management (Global): Competitive Leadership Mapping, 2018

Figure 37 Bombardier: Company Snapshot

Figure 38 Bombardier: SWOT Analysis

Figure 39 Alstom: Company Snapshot

Figure 40 Alstom: SWOT Analysis

Figure 41 General Electric: Company Snapshot

Figure 42 General Electric: SWOT Analysis

Figure 43 Siemens: Company Snapshot

Figure 44 Siemens: SWOT Analysis

Figure 45 ABB: Company Snapshot

Figure 46 ABB: SWOT Analysis

Figure 47 Hitachi: Company Snapshot

Figure 48 Mitsubishi Heavy Industries: Company Snapshot

Figure 49 Talgo: Company Snapshot

Figure 50 Construcciones Y Auxiliar De Ferrocarriles S.A.: Company Snapshot

Figure 51 Thales Group: Company Snapshot

Figure 52 Trimble: Company Snapshot

Figure 53 Tech Mahindra: Company Snapshot

Figure 54 Transmashholding: Company Snapshot

The study involved 4 major activities in estimating the current size of the rolling stock management market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of automobile OEMs, American Railway Association (ARA), country-level railway associations and the Association of the European Rail Industry (UNIFE)], railway magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global rolling stock management market.

Primary Research

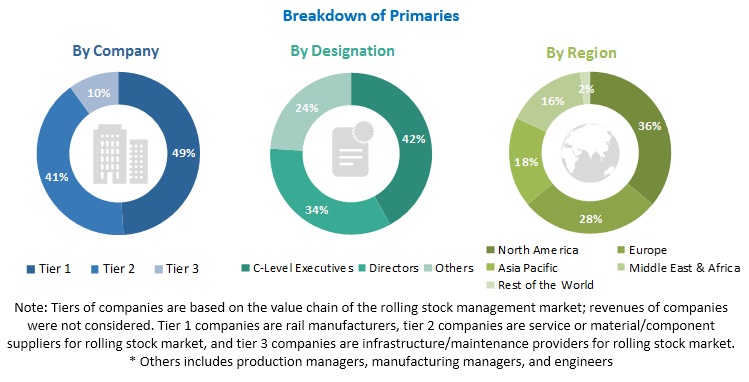

Extensive primary research has been conducted after acquiring an understanding of the rolling stock management market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side [rail manufacturers (in terms of component supply, country-level government associations, and trade associations)] and supply-side (OEMs and component manufacturers) across 5 major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and the Rest of the World. Approximately, 21% and 79% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the rolling stock management. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the rolling stock management market size, in terms of value (USD million)

- To define, describe, and forecast the rolling stock management market on the basis of management type, rail management, infrastructure management, maintenance service, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by management (rail management and infrastructure management)

- To segment and forecast the market size, by rail management (remote diagnostic management, wayside management, train management, engineering asset management, and cab advisory)

- To segment and forecast the market size, by infrastructure management (control room management, station management, and automatic fare collection management)

- To segment and forecast the market size, by maintenance service (corrective, preventive and predictive)

- To forecast the market size with respect to key regions, namely, North America, Europe, Middle East, Asia Pacific, and the Rest of World

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders, and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the rolling stock management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Rolling Stock Management Market, by rail management at country level (for countries not covered in the report)

- Rolling Stock Management Market, by infrastructure management at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Rolling Stock Management Market