Connected Rail Market by Service (Passenger Mobility, PIS, Train Tracking & Monitoring, Automated Fare Collection, Predictive maintenance, Freight Management), Rail Signaling System (PTC, CBTC & ATC), Rolling Stock and Region - Global forecast to 2027

The global connected rail market size valued at USD 124.5 billion in 2022 and projected to reach USD 94.6 billion by 2027, growing at a CAGR of 5.6% from 2022 to 2027. This increase is triggered by various factors, which covers various aspects, like need for safety and security, be connected while traveling, government regulations, increase in population, growing urbanization etc. which leads to demand for high-end technology that results in increase in demand of different rail systems and services.

The market in Asia Pacific is projected to experience the fastest growth owing to increase in population, growing urbanization from countries such China, Japan, South Korea and India. The growth of the connected rail industry in the region can be attributed to rising investments for digital transformation, growing GDP of countries such as China and India, and investments in freight rail infrastructure to support the mining and natural resource markets. These developing nations are facing concerns like population growth and a lack of infrastructure, which have increased passenger dependence on public transport. In September 2021, Hitachi launched its PTC application that helps the company in automating product development processes, enhancing product innovation, and reducing delivery time for rail applications. Government initiatives to increase transport services and rise in the adoption of real-time information systems in the transport segment will drive the Asia Pacific connected rail market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID- 19 on Connected Rail Market

With the COVID-19 outbreak, major railway component manufacturers/solution providers announced the suspension of production/service offering due to the decline in demand, supply chain bottlenecks, and to protect the safety of their employees. The demand for mass transportation and commercial rail vehicles declined in 2020, further delaying the deployment of connected rail projects. Additionally, budget allocations for R&D are expected to be significantly affected, in turn hampering rail development. The demand for connected rail services/solutions is largely proportional to government budgets, along with the demand from rail operators. The COVID-19 pandemic led to a major decline in production as well as sales of rail vehicles in 2020 and 2021. This decline had a significant impact on the connected rail market, as the demand for freight trains decreased in 2020 and 2021. The COVID-19 hit again with a second wave in March 2021, taking a heavy toll on human lives and affecting the global economy. It posed a great logistical challenge to meet the massive demand in supply gaps that emerged. With the supply chain across the globe disrupted, the transfer of essential goods and services was badly affected.

Driver: Deployment of Internet of Things in Railways

IoT in railways also improves the reliability and safety of the train infrastructure. Data generated by IoT sensors enables the analysis and interpretation of conditions that could not be done earlier. With the deployment of IoT, a lot of data could now be used to optimize train schedules and maintain equipment ¯two serious challenges for railway efficiency. When combined with analytics, IoT can streamline railway operations for better efficiency. The technology uses networks of intelligent onboard devices that are connected to cloud-based applications for improving communications and control systems. The data, displayed to drivers and monitoring stations, is stored in a database from where it can be used later for troubleshooting and maintenance. Technology manufacturers are working to improve network connectivity by partnering with telecommunications companies. IoT in railways represents an opportunity for various digital railway solutions providers and telecommunication technology providers.

Restraint: Lack of technology infrastructure and interoperability

The poorly developed telecommunication infrastructure and limited availability of access to smart devices in developing countries create barriers in the connected rail market. High internet access cost also acts as a barrier to smart railways. With organizations increasingly adopting IoT technologies, pursuing ambient computing technology, and offering various IoT solutions, standardization across data standards, wireless protocols, and technologies has become more divergent to reduce complexities and costs.

Opportunity: Autonomous train represents significant opportunity for connected rail market

Semi-autonomous and autonomous train technologies are witnessing rapid evolution with substantial technological advancements. Autonomous trains drive themselves with minimal or no human intervention. The trend of developing driverless vehicles can be observed throughout the transportation industry. Though large-scale adoption of autonomous trains would take significant time, several railway operators are expected to adopt semi-autonomous trains in the near future. Semi-autonomous vehicle technology is currently deployed in cars by some companies providing mobility-on-demand services. The deployment of autonomous vehicles is crucial for the growth of the smart transportation industry, as these vehicles do not require drivers and would result in cost reduction for mobility service providers.

Challenge: Data and privacy security of commuters

The core functionality of the fleet management industry is transportation, which is a high-risk job. Incidents such as accidents and vehicle breakdowns can hamper a company’s goods and services and increase the damage expense. Moreover, they delay the delivery of a consignment and add to the repair, downtime, and liability expenses for the companies. To minimize such risks and damages, advanced transportation solutions with integrated security sensors and cameras have been adopted by the companies. However, there can be issues with driver safety and security, as the drivers may not be fully trained with, and accustomed to, new technology operations. The digitalized train functions, in the case of cyberattacks, provide greater access to train functionalities for the attackers. Damages caused by cyberattacks can be high in highly digitalized railway operations as compared to train operations with few digital components.

The Freight Wagon segment is estimated to lead the market during the forecast period

Freight wagons are rolling stocks that are used to transport goods and commodities. The railway is one of the many modes of transportation available for trade, and it is likely to be the cheapest. As compared to road transportation, this mode of transportation can carry a large amount of cargo in a single trip, while still taking less time over long distances than a maritime route. Governments all over the world are putting a premium on last-mile connectivity for trade, resulting in a boom in investment in logistical infrastructure. The number of projects to expand the railway network for inter-state and intra-state trade is growing. On similar grounds, innovations such as dedicated freight corridors are expected to boost trading opportunities, thus increasing the demand for freight wagons. In June 2021, Sinara Transport Machines Holding (STM) secured a contract from Russian Railways for the supply of 200 2TE5A freight diesel locomotives, which will be delivered by 2031. The locomotives will be equipped with electro-pneumatic brakes, sensors (to gather data on milage), and digital brake indicators.

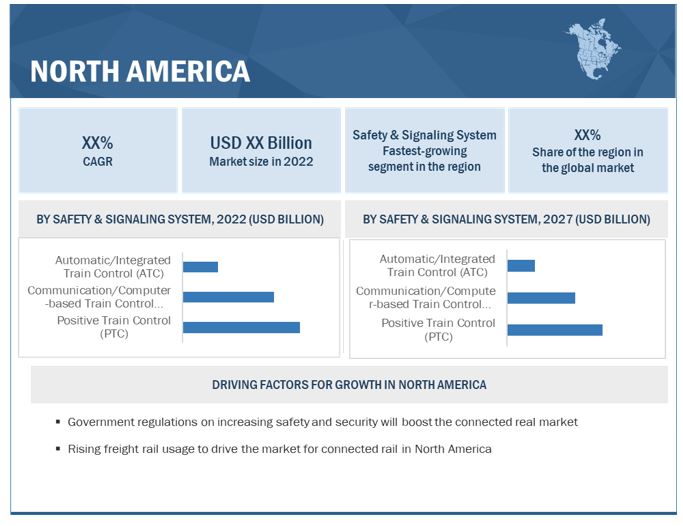

North America is expected to be the largest market during the forecast period

North America has a diverse transportation system with an extensive transcontinental rail network. The increase in the adoption of advanced technologies leads to the development of smart cities and smart transportation projects in North America. Hence, the connected rail market will grow in the future. Rail freight in the US is considered the most cost-efficient, largest, and safest freight system in the world, running a 140,000 route miles network as of 2020. In 2019, with seven class 1 locomotives, the railroad generated a revenue of USD 505 million, which accounted for 68% through freight transportation. North America has been the largest market for diesel freight locomotives due to its vast geography that deals with the challenge of electrification of rail routes. Due to the continuous adoption of railway management systems and cloud services, the demand for connected rail services is expected to grow in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global connected rail market is dominated by major players such as Robert Bosch GmbH (Germany), Siemens (Germany), Hitachi (Japan), Huawei (China), and Wabtec Corporation (US). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies have adopted strategies such as new product developments, deals and others to sustain their market position.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Volume (Units) and Value (USD Million) |

|

Segments covered |

Service, Rolling Stock, Safety & Signaling System and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, Middle East & Africa and Rest of the World |

|

Companies Covered |

Robert Bosch GmbH (Germany), Siemens (Germany), Hitachi (Japan), Huawei (China), Wabtec Corporation (US) and Others |

This research report categorizes the given market based on service, rolling stock and safety & signaling system and region.

Based on Service:

-

Passenger Mobility and Services

- Wi-Fi Devices

- On Board Entertainment

-

Passenger Information System

- Information Announcement System

-

Rail Display Systems

- Railway Platform Displays

- Railway Concourse Displays

- Railway Onboard Displays

- Emergency Displays (EDNE Displays)

- Station Evacuation (SEVAC)

- Railway Station Clocks

- Train Tracking & Monitoring Solutions

- Automated Fare Collection System

- IP Video Surveillance

- Predictive Maintenance

-

Freight Management System

-

- Freight Operation Management

- Freight Tracking

-

- Others

Based on Rolling Stock:

- Diesel Locomotive

- Electric Locomotive

- DMU

- EMU

- Light Rail/Tram Car

- Subway/Metro Vehicle

- Passenger Coach

- Freight Wagon

Based on Safety & Signaling System:

- Positive Train Control (PTC)

- Communication/Computer-based Train Control (CBTC)

- Automated/Integrated Train Control (ATC )

Based on Region:

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- UK

- Rest of Europe

-

Middle East & Africa

- UAE

- South Africa

- Rest of Middle East & Africa

-

Rest of the World

- Brazil

- Iran

Recent Developments

- In December- 2021, Siemens developed Digital Train Control System in collaboration with VGF (Germany). This system is expected to replace the conventional train control system used in metro and tram networks. This system is developed to increase the capacity and efficiency of train routes, especially in the underground sections.

- In November-2021, Robert Bosch GmbH launched an innovative driver assistance system for city rail transportation. In the event of a possible collision, it first warns the tram driver by means of a signal. If the driver does not intervene or does so too late, the system automatically brakes the tram until it comes to a complete stop, in order to prevent an impact or at least to reduce it as much as possible.

- In October- 2021, as part of the Digital S-Bahn Hamburg project, Deutsche Bahn (DB) and Siemens Mobility (a division of Siemens) developed the world’s first automatic train, which is fully automated and controlled by digital technology and needs no human interference

- In September-2021, Hitachi launched the PTC solution to help automate its product development processes, enhance product innovation, and reduce delivery time for rail applications. This launch will also help improve the company’s manufacturing process and cost management.

- In 2019, Huawei officially released its Urban Rail Light Cloud, next-generation LTE-R, and 5G Digital Indoor System (DIS) solutions. These solutions deliver cloud-based services, broadband connectivity, and better-connected digital railways to help rail operators build safer, smarter, and more efficient rail transportation systems. Digital urban railways can enhance the customer experience in rail journeys. The Urban Rail Light Cloud solution converts computing, storage, network, and security resources from physical devices into virtual resource pools

Frequently Asked Questions (FAQ):

What are different services are covered in report for connected rail market?

The connected rail market, by service is covered for Passenger mobility service, passenger information system, train tracking and monitoring solution, automated fare collection system, predictive maintenance, IP video surveillance, freight management system and others.

Who are the major players in the connected rail market?

The connected rail market is dominated by a few globally established players such as Robert Bosch GmbH (Germany), Siemens (Germany), Hitachi (Japan), Huawei (China), and Wabtec Corporation (US). These companies have been marking their presence in the connected rail market by offering advanced and innovative solutions, coupled with their robust business strategies, to achieve constant growth in the connected rail market. Moreover, these companies have a strong presence across the globe.

What are the key strategies adopted by top players to increase their revenue?

These companies adopted multiple strategies, including new product developments, deals and others to stay ahead in this competitive market.

What are the new market trends impacting the growth of the connected rail market?

Increasing emphasis on smart infrastructure, growing need for safety and compliance in rail transit is driving the connected rail market.

Which regions are considered in the report?

The report covers market sizing for regions includes Asia Pacific, Europe, North America, Middle East & Africa and Rest of World .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CONNECTED RAIL MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 MARKET DEFINITION, BY SERVICE

1.2.3 MARKET DEFINITION, BY ROLLING STOCK

1.2.4 MARKET DEFINITION, BY SAFETY & SIGNALING SYSTEM

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 CONNECTED RAIL MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY-SIDE APPROACH

2.4 FACTOR ANALYSIS

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.5 DATA TRIANGULATION

FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ASSESSMENT

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 8 CONNECTED RAIL MARKET: MARKET OVERVIEW

FIGURE 9 MARKET, BY REGION, 2022–2027 (USD BILLION)

FIGURE 10 MARKET, BY SAFETY & SIGNALING SYSTEM, 2022–2027 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN CONNECTED RAIL MARKET

FIGURE 11 GROWING URBANIZATION AND INCREASING GOVERNMENT INVESTMENT IN RAILWAYS WILL BE DRIVING MARKET

4.2 MARKET, BY REGION

FIGURE 12 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4.3 MARKET, BY SERVICE

FIGURE 13 PREDICTIVE MAINTENANCE SEGMENT PROJECTED TO LEAD MARKET, 2022- 2027 (USD BILLION)

4.4 MARKET, BY ROLLING STOCK

FIGURE 14 FREIGHT WAGON SEGMENT PROJECTED TO LEAD MARKET, 2022- 2027 (USD BILLION)

4.5 MARKET, BY SAFETY & SIGNALING SYSTEM

FIGURE 15 COMMUNICATION/COMPUTER-BASED TRAIN CONTROL SEGMENT PROJECTED TO LEAD CONNECTED RAIL MAIL, 2022-2027 (USD BILLION)

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

TABLE 1 IMPACT OF MARKET DYNAMICS

5.2 MARKET DYNAMICS

FIGURE 16 CONNECTED RAIL MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Deployment of Internet of Things in railways

FIGURE 17 IOT IN RAILWAYS

5.2.1.2 Increasing emphasis on smart infrastructure

FIGURE 18 SMART INFRASTRUCTURE ECOSYSTEM

TABLE 2 GLOBAL HIGH-SPEED RAIL NETWORK, 2020

5.2.1.3 Growing need for safety and compliance in rail transit

FIGURE 19 NEED FOR SAFETY AND SECURITY IN RAIL TRANSIT

5.2.1.4 Rising implementation of automated fare collection system

TABLE 3 GLOBAL AUTOMATED FARE COLLECTION SYSTEMS

5.2.2 RESTRAINTS

5.2.2.1 Lack of technology infrastructure and interoperability

5.2.2.2 Slow growth rate of GDP and inadequate infrastructure spending in developing countries

TABLE 4 KEY INDICATORS FOR INVESTMENTS IN RAIL INDUSTRY

5.2.2.3 High initial investment

5.2.3 OPPORTUNITIES

5.2.3.1 Autonomous train represents significant opportunity for connected rail market

TABLE 5 ADVANTAGES OF AUTONOMOUS RAIL

5.2.3.2 Open gateway for telecommunication providers

FIGURE 20 BIT RATES FOR DIFFERENT NETWORKS, 2021

5.2.3.3 Surge in passenger numbers over past few years

TABLE 6 RAIL COMMUTER DATA FOR EUROPE (IN THOUSANDS)

5.2.4 CHALLENGES

5.2.4.1 Data and privacy security of commuters

TABLE 7 INCIDENTS OF RAIL COMMUTER DATA BREACH (2020-2022)

5.2.4.2 Data management difficulties

FIGURE 21 CONNECTED RAIL NETWORK ARCHITECTURE

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS OF CONNECTED RAIL MARKET

TABLE 8 MARKET: IMPACT OF PORTER’S FIVE FORCES

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 9 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.5 CASE STUDY

5.5.1 CISCO CASE STUDY

5.5.2 ALSTOM DEPLOYED CYBERSECURITY FOR MASS TRANSIT SYSTEMS IN MIDDLE EAST & AFRICA

5.5.3 ALSTOM PARTNERED WITH SNC-LAVALIN FOR REM PROJECT IN CANADA

5.6 TRENDS AND DISRUPTIONS

FIGURE 23 TRENDS AND DISRUPTIONS

5.7 DETAILED LIST OF CONFERENCES & EVENTS

TABLE 10 DETAILED LIST OF CONFERENCES & EVENTS

5.8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9 KEY STAKEHOLDERS & BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING CONNECTED RAIL SERVICES (%)

5.9.2 BUYING CRITERIA

TABLE 15 KEY BUYING CRITERIA FOR CONNECTED RAIL PRODUCTS AND SERVICES

TABLE 16 INSTRUMENTS FOR QUALITY CONTROL FOR CONNECTED RAIL PRODUCTS AND SERVICES

5.10 REGULATORY OVERVIEW

5.10.1 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY (ENISA)

TABLE 17 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY STANDARDS

5.10.2 GENERAL DATA PROTECTION REGULATION (GDPR)

5.10.3 INTERNATIONAL UNION OF RAILWAYS (UIC)

TABLE 18 QUALITY DIMENSIONS OF RAIL INDUSTRY

TABLE 19 ROLE ASSIGNMENT TO STAKEHOLDERS FOR QUALITY-OF-SERVICE REGULATIONS

5.11 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MARKET

5.12 ECOSYSTEM ANALYSIS

FIGURE 25 ECOSYSTEM ANALYSIS: MARKET

TABLE 20 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

5.13 COVID-19 IMPACT ANALYSIS

5.13.1 INTRODUCTION TO COVID-19

5.13.2 COVID-19 HEALTH ASSESSMENT

TABLE 21 SELECTED MEASURES BY RAILWAYS IN VARIOUS COUNTRIES DURING COVID-19 PANDEMIC

5.14 SCENARIO ANALYSIS

5.14.1 MOST LIKELY SCENARIO

TABLE 22 CONNECTED RAIL MARKET (MOST LIKELY), BY REGION, 2022–2027 (USD BILLION)

5.14.2 OPTIMISTIC SCENARIO

TABLE 23 MARKET (OPTIMISTIC), BY REGION, 2022–2027 (USD BILLION)

5.14.3 PESSIMISTIC SCENARIO

TABLE 24 MARKET (PESSIMISTIC), BY REGION, 2022–2027 (USD BILLION)

5.15 AVERAGE SELLING PRICE

TABLE 25 PRICING ANALYSIS

5.16 PATENT ANALYSIS

TABLE 26 PATENT ANALYSIS: MARKET (ACTIVE PATENTS)

FIGURE 26 EUROPE PATENT APPLICATION: DIGITAL TECHNOLOGY, BY APPLICANT, 2020

5.17 INDUSTRY TRENDS

5.17.1 IOT IN RAILWAYS

5.17.2 BIG DATA ANALYTICS AND CLOUD COMPUTING IN RAILWAYS

5.17.3 HYPERLOOP - FUTURE OF TRANSPORTATION

5.17.4 AUTOMATIC WARNING SYSTEM

5.17.5 DRONES FOR IDENTIFYING RAILWAY INFRASTRUCTURE ISSUES

5.17.6 AUTONOMOUS TRAIN

6 CONNECTED RAIL MARKET, BY SERVICE (Page No. - 90)

6.1 INTRODUCTION

FIGURE 27 BY SERVICE, PREDICTIVE MAINTENANCE SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027 (USD BILLION)

TABLE 27 MARKET, BY SERVICE, 2016–2021 (USD BILLION)

TABLE 28 MARKET, BY SERVICE, 2022–2027 (USD BILLION)

TABLE 29 SERVICE: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 30 SERVICE: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.1.1 OPERATIONAL DATA

TABLE 31 CONNECTED RAIL OFFERINGS BASED ON SERVICE

6.1.2 ASSUMPTIONS

6.1.3 RESEARCH METHODOLOGY

6.2 PASSENGER MOBILITY & SERVICES

6.2.1 RISING NEED TO ENHANCE RAIL OPERATIONAL EFFICIENCY TO DRIVE MARKET FOR PASSENGER MOBILITY & SERVICES

TABLE 32 PASSENGER MOBILITY & SERVICES: CONNECTED RAIL MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 33 PASSENGER MOBILITY & SERVICES: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.2.2 PASSENGER MOBILITY & SERVICES: BY CONNECTIVITY TYPE

6.2.2.1 Wi-Fi service

6.2.2.2 On-board entertainment

TABLE 34 PASSENGER MOBILITY & SERVICES: MARKET, BY CONNECTIVITY TYPE, 2016–2021 (USD BILLION)

TABLE 35 PASSENGER MOBILITY & SERVICES: MARKET, BY CONNECTIVITY TYPE, 2022–2027 (USD BILLION)

6.3 PASSENGER INFORMATION SYSTEM (PIS)

6.3.1 DEMAND FOR REAL-TIME TRANSIT INFORMATION OF PASSENGERS LIKELY TO DRIVE PASSENGER INFORMATION SYSTEM MARKET

TABLE 36 PASSENGER INFORMATION SYSTEM: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 37 PASSENGER INFORMATION SYSTEM: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3.2 INFORMATION ANNOUNCEMENT SYSTEM

6.3.3 RAIL DISPLAY SYSTEM

TABLE 38 PASSENGER INFORMATION SYSTEM MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 39 PASSENGER INFORMATION SYSTEM MARKET, BY TYPE, 2022–2027 (USD BILLION)

6.3.4 INFORMATION ANNOUNCEMENT SYSTEM

TABLE 40 INFORMATION ANNOUNCEMENT SYSTEM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 41 INFORMATION ANNOUNCEMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.5 RAIL DISPLAY SYSTEM

TABLE 42 RAIL DISPLAY SYSTEM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 43 RAIL DISPLAY SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.5.1 Rail display systems, by display type

6.3.5.1.1 LED display system

6.3.5.1.2 LCD system

6.3.5.1.3 Others

TABLE 44 RAIL DISPLAY SYSTEM MARKET, BY DISPLAY TYPE, 2016–2021 (USD MILLION)

TABLE 45 RAIL DISPLAY SYSTEM MARKET, BY DISPLAY TYPE, 2022–2027 (USD MILLION)

6.3.5.2 Rail display system, by application type

6.3.5.2.1 Railway concourse display

6.3.5.2.2 Railway platform display

6.3.5.2.3 Railway on-board display

6.3.5.2.4 Railway emergency display (EDNE display)

6.3.5.2.5 Railway station clock

6.3.5.2.6 Railway station evacuation display (SEVAC)

TABLE 46 RAIL DISPLAY SYSTEM MARKET, BY APPLICATION TYPE, 2016–2021 (USD MILLION)

TABLE 47 RAIL DISPLAY SYSTEM MARKET, BY APPLICATION TYPE, 2022–2027 (USD MILLION)

6.4 TRAIN TRACKING & MONITORING SOLUTIONS

6.4.1 TRAIN TRACKING & MONITORING SOLUTIONS PROVIDE REAL-TIME TRAIN MONITORING TO IMPROVE EFFICIENCY AND SAFETY

TABLE 48 TRAIN TRACKING & MONITORING SOLUTIONS MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 49 TRAIN TRACKING & MONITORING SOLUTIONS MARKET, BY REGION, 2022–2027 (USD BILLION)

6.5 AUTOMATED FARE COLLECTION SYSTEM

6.5.1 DEMAND FOR PAYMENT INTEGRATION SYSTEM AND AUTOMATIC TICKETING TO DRIVE MARKET IN FUTURE

TABLE 50 AUTOMATED FARE COLLECTION SYSTEM MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 51 AUTOMATED FARE COLLECTION SYSTEM MARKET, BY REGION, 2022–2027 (USD BILLION)

6.6 IP VIDEO SURVEILLANCE

6.6.1 NEED FOR SAFETY AND SECURITY TO DRIVE MARKET FOR IP VIDEO SURVEILLANCE

TABLE 52 IP VIDEO SURVEILLANCE MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 53 IP VIDEO SURVEILLANCE MARKET, BY REGION, 2022–2027 (USD BILLION)

6.7 PREDICTIVE MAINTENANCE

6.7.1 INCREASED ADOPTION OF PREDICTIVE MAINTENANCE SOLUTIONS TO MINIMIZE ERRORS

TABLE 54 PREDICTIVE MAINTENANCE MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 55 PREDICTIVE MAINTENANCE MARKET BY REGION, 2022–2027 (USD BILLION)

6.8 FREIGHT MANAGEMENT SYSTEM

6.8.1 RISE IN DEMAND FOR EFFICIENT FREIGHT OPERATIONS

TABLE 56 FREIGHT MANAGEMENT SYSTEM: CONNECTED RAIL MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 57 FREIGHT MANAGEMENT SYSTEM: MARKET, BY REGION, 2022–2027 (USD BILLION)

6.8.2 FREIGHT OPERATION MANAGEMENT

6.8.3 FREIGHT TRACKING

6.9 OTHERS

6.9.1 INCREASE IN DEMAND FOR TRAFFIC MANAGEMENT SOLUTIONS IN RAILWAYS TO BOOST MARKET

TABLE 58 OTHERS MARKET SIZE, BY REGION, 2016–2021 (USD BILLION)

TABLE 59 OTHERS MARKET SIZE, BY REGION, 2022–2027 (USD BILLION)

6.10 KEY INDUSTRY INSIGHTS

7 CONNECTED RAIL MARKET, BY ROLLING STOCK (Page No. - 116)

7.1 INTRODUCTION

FIGURE 28 BY ROLLING STOCK, FREIGHT WAGON SEGMENT ESTIMATED TO LEAD CONNECTED RAIL MARKET FROM 2022 TO 2027 (USD BILLION)

TABLE 60 MARKET, BY ROLLING STOCK, 2016–2021 (UNITS)

TABLE 61 MARKET, BY ROLLING STOCK, 2022–2027 (UNITS)

TABLE 62 MARKET, BY ROLLING STOCK, 2016–2021 (USD BILLION)

TABLE 63 MARKET, BY ROLLING STOCK, 2022–2027 (USD BILLION)

7.1.1 OPERATIONAL DATA

TABLE 64 CONNECTED RAIL OFFERINGS BASED ON ROLLING STOCK

7.1.2 ASSUMPTIONS

7.1.3 RESEARCH METHODOLOGY

7.2 DIESEL LOCOMOTIVE

7.2.1 ABILITY TO OPERATE FOR LONGER PERIODS TO DRIVE MARKET FOR DIESEL LOCOMOTIVES

TABLE 65 DIESEL LOCOMOTIVE: CONNECTED RAIL MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 66 DIESEL LOCOMOTIVE: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 67 DIESEL LOCOMOTIVE: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 68 DIESEL LOCOMOTIVE: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.3 ELECTRIC LOCOMOTIVE

7.3.1 ELECTRIC LOCOMOTIVES TO MAKE RAIL LINES EMISSION-FREE

TABLE 69 ELECTRIC LOCOMOTIVE: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 70 ELECTRIC LOCOMOTIVE: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 71 ELECTRIC LOCOMOTIVE: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 72 ELECTRIC LOCOMOTIVE: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.4 DIESEL MULTIPLE UNIT (DMU)

7.4.1 NORTH AMERICA EXPECTED TO BE FASTEST-GROWING MARKET FOR DMU DURING FORECAST PERIOD

TABLE 73 DIESEL MULTIPLE UNIT: CONNECTED RAIL MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 74 DIESEL MULTIPLE UNIT: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 75 DIESEL MULTIPLE UNIT: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 76 DIESEL MULTIPLE UNIT: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.5 ELECTRIC MULTIPLE UNIT (EMU)

7.5.1 INCREASE IN HIGH-SPEED RAIL LINES EXPECTED TO BOOST MARKET FOR ELECTRIC MULTIPLE UNITS

TABLE 77 ELECTRIC MULTIPLE UNIT: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 78 ELECTRIC MULTIPLE UNIT: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 79 ELECTRIC MULTIPLE UNIT: MARKET SIZE, BY REGION, 2016–2021 (USD BILLION)

TABLE 80 ELECTRIC MULTIPLE UNIT: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.6 LIGHT RAIL/TRAM CAR

7.6.1 INCREASING CONCERNS ABOUT TRAFFIC DUE TO OVERPOPULATION AND MIGRATION DRIVING GLOBAL LIGHT RAIL/TRAM MARKET

TABLE 81 LIGHT RAIL/TRAM CAR: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 82 LIGHT RAIL/TRAM CAR: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 83 LIGHT RAIL/TRAM CAR: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 84 LIGHT RAIL/TRAM CAR: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.7 SUBWAY/METRO VEHICLE

7.7.1 INCREASING URBANIZATION EXPECTED TO DRIVE SUBWAY/METRO VEHICLE MARKET

TABLE 85 SUBWAY/METRO VEHICLE: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 86 SUBWAY/METRO VEHICLE: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 87 SUBWAY/METRO VEHICLE: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 88 SUBWAY/METRO VEHICLE: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.8 PASSENGER COACH

7.8.1 RISING ADOPTION OF SMART TECHNOLOGY IN RAILWAY SECTOR TO DRIVE MARKET FOR PASSENGER COACHES

TABLE 89 PASSENGER COACH: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 90 PASSENGER COACH: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 91 PASSENGER COACH: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 92 PASSENGER COACH: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.9 FREIGHT WAGON

7.9.1 GROWING INTER-STATE AND INTRA-STATE TRADE DRIVING FREIGHT WAGON SEGMENT

TABLE 93 FREIGHT WAGON: MARKET, BY REGION, 2016–2021 (UNITS)

TABLE 94 FREIGHT WAGON: MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 95 FREIGHT WAGON: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 96 FREIGHT WAGON: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.1 KEY PRIMARY INSIGHTS

FIGURE 29 KEY PRIMARY INSIGHTS

8 CONNECTED RAIL MARKET, BY SAFETY & SIGNALING SYSTEM (Page No. - 139)

8.1 INTRODUCTION

FIGURE 30 BY SAFETY & SIGNALING SYSTEM, CBTC SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2027 (USD BILLION)

TABLE 97 MARKET, BY SAFETY & SIGNALING SYSTEM, 2016–2021 (USD BILLION)

TABLE 98 MARKET, BY SAFETY & SIGNALING SYSTEM, 2022–2027 (USD BILLION)

8.1.1 OPERATIONAL DATA

TABLE 99 CONNECTED RAIL OFFERINGS BASED ON SAFETY & SIGNALING SYSTEM

8.1.2 ASSUMPTIONS

8.1.3 RESEARCH METHODOLOGY

8.2 POSITIVE TRAIN CONTROL (PTC)

8.2.1 DEMAND FOR POSITIVE TRAIN CONTROL TECHNOLOGY TO GROW WITH RISING RAIL INFRASTRUCTURE

TABLE 100 POSITIVE TRAIN CONTROL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 101 POSITIVE TRAIN CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 COMMUNICATION/COMPUTER-BASED TRAIN CONTROL (CBTC)

8.3.1 COMMUNICATION-BASED TRAIN CONTROL MARKET WILL GROW TO MAKE RAIL LINES SAFE

TABLE 102 COMMUNICATION/COMPUTER-BASED TRAIN CONTROL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 103 COMMUNICATION/COMPUTER-BASED TRAIN CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AUTOMATED/INTEGRATED TRAIN CONTROL (ATC)

8.4.1 TECHNOLOGICAL DEVELOPMENT LED TO DEMAND FOR AUTOMATED TRAIN CONTROL SYSTEMS

TABLE 104 AUTOMATED/INTEGRATED TRAIN CONTROL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 105 AUTOMATED/INTEGRATED TRAIN CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 KEY PRIMARY INSIGHTS

FIGURE 31 KEY PRIMARY INSIGHTS

9 CONNECTED RAIL MARKET, BY REGION (Page No. - 148)

9.1 INTRODUCTION

FIGURE 32 SAFETY & SIGNALING SYSTEM EXPECTED TO WITNESS HIGHEST GROWTH RATE IN MARKET DURING FORECAST PERIOD

TABLE 106 MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 107 MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 108 MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 109 MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Government initiatives to drive connected rail market in US

9.2.2 CANADA

9.2.2.1 Increasing number of passengers and growing freight traffic to drivemarket growth in Canada

9.2.3 MEXICO

9.2.3.1 Strategic location to play key role in rail infrastructure development in Mexico

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 110 NORTH AMERICA: MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 111 NORTH AMERICA: MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

9.3 EUROPE

9.3.1 UK

9.3.1.1 Need to improve efficiency of existing railway infrastructure to boost market growth

9.3.2 GERMANY

9.3.2.1 Growing adoption of IoT and analytics to boost market growth

9.3.3 FRANCE

9.3.3.1 High investments by railway operators to drive market growth

9.3.4 REST OF EUROPE

TABLE 112 EUROPE: CONNECTED RAIL MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 113 EUROPE: MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 High government investments in railway infrastructure and rapid growth in railway sector to drive market

9.4.2 INDIA

9.4.2.1 Growing profits in railway sector and government initiatives for smart cities to drive market growth

9.4.3 JAPAN

9.4.3.1 Higher adoption of railway technologies to boost market

9.4.4 REST OF ASIA PACIFIC

FIGURE 34 ASIA-PACIFIC: CONNECTED RAIL SNAPSHOT

TABLE 114 ASIA PACIFIC: MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 UAE

9.5.1.1 Improving rail infrastructure to drive market growth

9.5.2 SOUTH AFRICA

9.5.2.1 Increased demand for transportation services to match regional trade requirements to drive market growth

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 116 MIDDLE EAST & AFRICA: MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 117 MIDDLE EAST & AFRICA: MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

9.6 REST OF THE WORLD

9.6.1 BRAZIL

9.6.1.1 High scope for further development of railway infrastructure to boost market growth

9.6.2 IRAN

9.6.2.1 High scope for further expansion of railway infrastructure to boost market growth

TABLE 118 REST OF THE WORLD: MARKET, BY SEGMENT, 2016–2021 (USD BILLION)

TABLE 119 REST OF THE WORLD: MARKET, BY SEGMENT, 2022–2027 (USD BILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 166)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS FOR CONNECTED RAIL MARKET

TABLE 120 MARKET SHARE ANALYSIS, 2021

FIGURE 35 MARKET SHARE ANALYSIS, 2021

10.2.1 ROBERT BOSCH GMBH

10.2.2 HUAWEI

10.2.3 HITACHI

10.2.4 SIEMENS

10.2.5 WABTEC CORPORATION

10.3 KEY PLAYER STRATEGIES

TABLE 121 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MARKET

10.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

FIGURE 36 TOP PUBLIC/LISTED PLAYERS DOMINATING MARKET DURING LAST FIVE YEARS

10.5 COMPETITIVE SCENARIO

10.5.1 NEW PRODUCT LAUNCHES

TABLE 122 NEW PRODUCT LAUNCHES, 2018-2022

10.5.2 DEALS

TABLE 123 DEALS, 2018–2022

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE

10.6.4 PARTICIPANTS

FIGURE 37 MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 124 MARKET: COMPANY FOOTPRINT, 2021

TABLE 125 MARKET: PRODUCT FOOTPRINT, 2021

TABLE 126 MARKET: REGIONAL FOOTPRINT, 2021

10.7 START-UP/SME EVALUATION QUADRANT

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 38 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

TABLE 127 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 128 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

10.8 RIGHT TO WIN, 2018-2022

TABLE 129 WINNERS VS. TAIL-ENDERS

11 COMPANY PROFILES (Page No. - 182)

11.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

11.1.1 SIEMENS

TABLE 130 SIEMENS: BUSINESS OVERVIEW

FIGURE 39 SIEMENS: COMPANY SNAPSHOT

FIGURE 40 SIEMENS: CLEAR PRIORITIES FOR SUSTAINABILITY

TABLE 131 SIEMENS: PRODUCTS OFFERED

TABLE 132 SIEMENS: NEW PRODUCT DEVELOPMENTS

TABLE 133 SIEMENS: DEALS

11.1.2 HITACHI

TABLE 134 HITACHI: BUSINESS OVERVIEW

FIGURE 41 HITACHI: COMPANY SNAPSHOT

TABLE 135 HITACHI: PRODUCTS OFFERED

FIGURE 42 HITACHI FUTURE RAIL TICKETING SERVICES

TABLE 136 HITACHI: NEW PRODUCT DEVELOPMENTS

TABLE 137 HITACHI: DEALS

11.1.3 WABTEC CORPORATION

TABLE 138 WABTEC CORPORATION: BUSINESS OVERVIEW

FIGURE 43 WABTEC CORPORATION: COMPANY SNAPSHOT

FIGURE 44 WABTEC CORPORATION: FUTURE OUTLOOK

TABLE 139 WABTEC CORPORATION: PRODUCTS OFFERED

TABLE 140 WABTEC CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 141 WABTEC CORPORATION: DEALS

TABLE 142 WABTEC CORPORATION: OTHERS

11.1.4 TRIMBLE

TABLE 143 TRIMBLE: BUSINESS OVERVIEW

FIGURE 45 TRIMBLE: COMPANY SNAPSHOT

TABLE 144 TRIMBLE: PRODUCTS OFFERED

TABLE 145 TRIMBLE: NEW PRODUCT DEVELOPMENTS

TABLE 146 TRIMBLE: DEALS

11.1.5 ROBERT BOSCH GMBH

TABLE 147 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 46 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 148 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 149 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

11.1.6 HUAWEI

TABLE 150 HUAWEI: BUSINESS OVERVIEW

FIGURE 47 HUAWEI: COMPANY SNAPSHOT

TABLE 151 HUAWEI: PRODUCTS OFFERED

TABLE 152 HUAWEI: NEW PRODUCT DEVELOPMENTS

TABLE 153 HUAWEI: DEALS

11.1.7 CISCO

TABLE 154 CISCO: BUSINESS OVERVIEW

FIGURE 48 CISCO: COMPANY SNAPSHOT

TABLE 155 CISCO: PRODUCTS OFFERED

TABLE 156 CISCO: NEW PRODUCT DEVELOPMENTS

TABLE 157 CISCO: DEALS

11.1.8 NOKIA

TABLE 158 NOKIA: BUSINESS OVERVIEW

FIGURE 49 NOKIA: COMPANY SNAPSHOT

TABLE 159 NOKIA: PRODUCTS OFFERED

TABLE 160 NOKIA: DEALS

11.1.9 ATOS

TABLE 161 ATOS: BUSINESS OVERVIEW

FIGURE 50 ATOS: COMPANY SNAPSHOT

TABLE 162 ATOS: PRODUCTS OFFERED

TABLE 163 ATOS: DEALS

11.1.10 IBM

TABLE 164 IBM: BUSINESS OVERVIEW

FIGURE 51 IBM: COMPANY SNAPSHOT

TABLE 165 IBM: PRODUCTS OFFERED

TABLE 166 IBM: NEW PRODUCT DEVELOPMENTS

TABLE 167 IBM: DEALS

11.1.11 TECH MAHINDRA

TABLE 168 TECH MAHINDRA: BUSINESS OVERVIEW

FIGURE 52 TECH MAHINDRA: COMPANY SNAPSHOT

TABLE 169 TECH MAHINDRA: PRODUCTS OFFERED

TABLE 170 TECH MAHINDRA: DEALS

11.1.12 SIERRA WIRELESS

TABLE 171 SIERRA WIRELESS: BUSINESS OVERVIEW

FIGURE 53 SIERRA WIRELESS: COMPANY SNAPSHOT

TABLE 172 SIERRA WIRELESS: PRODUCTS OFFERED

TABLE 173 SIERRA WIRELESS: NEW PRODUCT DEVELOPMENTS

TABLE 174 SIERRA WIRELESS: DEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 TOSHIBA

11.2.2 SCOMI GROUP BHD

11.2.3 WOOJIN INDUSTRIAL SYSTEMS CO., LTD.

11.2.4 ABB

11.2.5 STRUKTON

11.2.6 LEGIOS

11.2.7 DEUTA-WERKE GMBH

11.2.8 THALES GROUP

11.2.9 DEUTSCHE BAHN AG

11.2.10 AMERICAN EQUIPMENT COMPANY

11.2.11 CALAMP

11.2.12 UGL LIMITED

11.2.13 SINARA TRANSPORT MACHINES

11.2.14 TUV RHEINLAND

12 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 237)

12.1 ASIA PACIFIC IS KEY FOCUS REGION FOR CONNECTED RAIL MARKET

12.2 PREDICTIVE MAINTENANCE MARKET ON THE RISE

12.3 CONCLUSION

13 APPENDIX (Page No. - 238)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.3.1 DETAILED ANALYSIS OF DIFFERENT ROLLING STOCK TYPES AT THE COUNTRY LEVEL (UP TO 3)

13.3.2 DETAILED ANALYSIS OF DIFFERENT CONNECTED RAIL SERVICES AT THE COUNTRY LEVEL (UP TO 3)

13.3.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the connected rail market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications such as The European Rail Industry (UNIFE), International Union of Railways, Federal Railroad Administration, Association of American Railroads, International Association of Railway Operation Research etc., railway magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases (Marklines, Factiva etc.) have been used to identify and collect for an extensive commercial study of the global connected rail market.

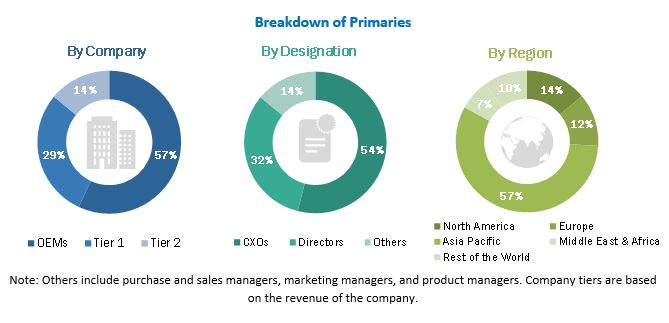

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across major regions, namely, Asia Pacific, Europe, North America, Middle East & Africa and Rest of the World. Approximately 30% and 70% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the connected rail market were identified through secondary research, and their market shares were determined through primary and secondary research

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights

- All major penetration rates, percentage shares, splits, and breakdowns for the connected rail market were determined using secondary sources and verified through primary sources

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast (2022 to 2027) the market size, in terms of value (USD billion) and volume (Units) of the connected rail market

- To define, describe, and provide a detailed analysis of the market

- To forecast the size of market segments with respect to five main regions: Asia Pacific, North America, Europe, the Middle East & Africa, and the Rest of the World (RoW)

- To segment and forecast the market size, by value, based on rolling stock—Diesel Locomotive, Electric Locomotive, Diesel Multiple Unit (DMU), Electric Multiple Unit (EMU), Light Rail/Tram Car, Passenger Coach, Freight Wagon, and Subway/Metro Vehicle

- To segment and forecast the market size, by value, based on service—Passenger Mobility & Services, Passenger Information System, Train Tracking & Monitoring Solutions, Automated Fare Collection System, IP Video Surveillance, Predictive maintenance, Freight Management System, and Others.

- To segment and forecast the market size, by value, based on safety & signaling system—Positive Train Control (PTC), Communication/Computer-based Train Control (CBTC), and Automatic/Integrated Train Control (ATC)

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To analyze and forecast the trends and orientation for connected rail in the global rail industry

- To track and analyze competitive developments such as new product development, deals, and other industry activities carried out by key industry participants

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Detailed analysis of rail systems & services market by different service (up to 3)

- Detailed analysis and profiling of additional market players (up to 3)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Connected Rail Market