Power Plant Boiler Market by Type (Pulverized Coal Towers, CFB, Others), Capacity (<400 MW, 400–800 MW, ≥800 MW), Technology (Subcritical, Supercritical, Ultra-supercritical), Fuel Type (Coal, Gas, Oil), and Region- Global Forecast to 2025

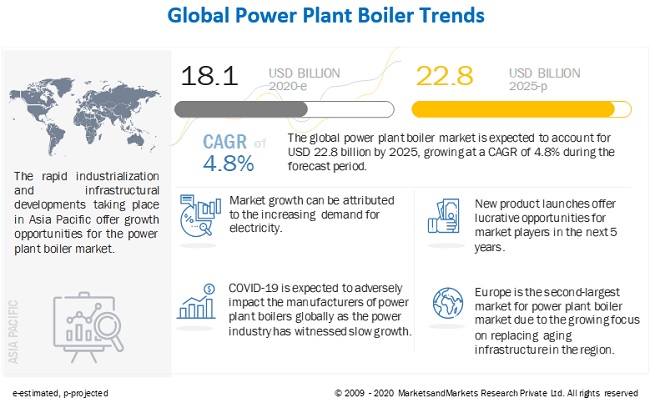

[196 Pages Report] The global power plant boiler market size is projected to reach USD 22.8 billion by 2025, at a CAGR of 4.8%, from an estimated USD 18.1 billion in 2020. Increasing demand for electricity and a rise in the adoption of supercritical and ultra-supercritical boiler technologies to improve efficiency are expected to drive the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Power plant boiler Dynamics

Driver: Increasing demand for electricity

Power plant boilers use various fuels such as coal, natural gas, petroleum, and biomass/wastes to produce high-pressured steam so that plants can generate electricity. Electricity is the fastest-growing source of energy demand. According to the IEA, in the Stated Policies Scenario, the global electricity demand is projected to grow at 2.1% per year to 2040, which is twice the rate of primary energy demand. This increases the share of electricity in total final energy consumption from 19% in 2018 to 24% in 2040.

Developed countries continue to consume huge amounts of energy, thus increasing the demand in developing countries. Rising incomes, expanding industrial output, and growing services sector push the electricity demand. The US Energy Information Administration (EIA) has estimated world energy consumption to grow by nearly 50% between 2018 and 2050. Most of this growth is focused on regions where strong economic growth is driving demand, particularly in Asia Pacific. Asia Pacific was the largest consumer of electricity—accounting for almost 50% of the global consumption—in the world in 2018. According to the IEA, Southeast Asia’s electricity demand, growing at an average of 6% per year, has been among the fastest in the world.

Furthermore, in the US, net electricity generation increased by 4% in 2018, reaching a record high of 4,178 MWh due to increasing demand from commercial and residential sectors. Economic growth and industrial demand have also increased the consumption of electricity in Canada, Brazil, and Russia. Consumption of electricity also increased in the Middle East & Africa, especially in Egypt and Iran. Hence, increasing demand for electricity is likely to drive the power plant boiler market.

Restraint: High capital requirement to install power plant boilers

A power plant is a complex facility and requires high investments in terms of engineering, procurement, construction (EPC) or turnkey services, technology, among others. Construction costs for new power plants are widely dependent on the type of electricity generation technology it is harnessing. In addition, post-construction phases, such as maintenance, and installation of technology, also require considerable capital investment. Furthermore, stringent environmental regulations and the high cost of technology used in supporting power plants impact the final construction cost.

The cost of power plant boilers varies considerably due to design parameters and varying levels of after-sales support. These parameters include operating pressure, operating temperature, type of firing, and efficiency desired. The need for high pressure and high temperature increases the cost of the boiler. The installation of power plant boilers also requires huge capital. In addition, the system used for coal firing or gas firing in the boiler also influences the cost of the boiler. The costs of steam generation are usually referred to as a system cost covering the entire boiler life cycle. For a full-load steam system having a utilization rate of 86–94%, the cost of fuel accounts for 96% of the total life-cycle cost, whereas investments and operating and maintenance costs usually account for 3% and 1%, respectively. In addition, a power plant uses multiple boilers and multiple fuels, which increases cost. This cost is expected to remain the same due to the high level of technical expertise involved in the operation of industrial boilers, thus restraining the present market for power plant boilers.

Opportunity: Upgrading aging power plant boiler infrastructure

Boilers are essential equipment for power plants. The replacement and upgrade of old equipment provide an attractive opportunity for many power producers. The increasing demand for reliable power delivery replacing older boilers with newer advanced, efficient boilers helps increases the thermal efficiency of power plants. Many companies are focusing on offering advanced boiler upgrades for coal- and gas-fueled power plants, which can contribute to their multiple fuel flexibility and reduce the potential impact of CO2 emissions. Developed countries such as the US, Canada, the UK, and Germany have aging power infrastructure with low-efficiency levels and high carbon emissions. Continuous investments are happening in these countries to improve the power generation capacity. According to the IEA, approximately USD 9,553 billion would be spent cumulatively on the construction of new power plants and the refurbishment of the existing ones across the world from 2014 to 2035, with 30% of the amount being used for fossil-fueled power plants. Such high investments in construction and upgrading aging infrastructure offer a lucrative opportunity for the power plant boiler market during the forecast period.

Challenge: Boiler efficiency and steam quality

Boiler efficiency measures how much combustion energy is converted into steam energy, while steam quality is a measurement of the amount of water entrained in the steam. The efficiency and steam quality of boilers play a crucial role in electricity generation. Low steam quality causes various problems such as frequent boiler shutdowns from low water level, damaged steam pipes and valves due to water hammer, vibration, corrosion, erosion, reduced capacity of steam heaters, and overloaded steam traps. In addition, water droplets in high-velocity steam can be as abrasive as sand particles. They can erode pipe fittings and valve seats. Such issues lead to equipment failure, and the resulting downtime can cause heavy loss to the operator. Inefficient boilers lead to higher fuel consumption and more harmful gas emissions that increase the cost of power generation. Owing to the burning of fuels such as coal, excessive ash gets deposits on a boiler’s heat transfer surfaces and reduces its efficiency, which can further lead to the shutdown of the boiler. The need to improve efficiency and steam quality to meet market demand is one of the key challenges faced by power plant boiler manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

By type, the pulverized coal towers segment is the largest contributor in the power plant boiler market during the forecast period.

In pulverized coal tower type boilers, coal is pulverized to a fine powder. The pulverized coal is blown into the boiler plant through a series of burner nozzles using combustion air. Most coal-fired power stations and many large industrial water-tube boilers use pulverized coal. The growth of this segment is driven by advancements in supercritical and ultra-supercritical technologies to upgrade conventional and aging power plant boilers to improve efficiency.

By capacity, the <400 MW segment is expected to grow at the fastest rate during the forecast period.

The <400 MW segment accounted for the highest share of the market, by component during the forecast period. Power plant boilers less than 400 MW are small-sized boilers in terms of capacity. These types of power plant boilers are used for reliable and stable baseloads on a smaller scale. Many companies are investing in providing advanced technologies for power plant boilers.

By technology, the supercritical segment is expected to be the largest contributor during the forecast period.

The supercritical segment held the largest share of the power plant boiler market in 2019. The focus on upgrading power infrastructure and the increased implementation of supercritical technology over subcritical are driving the growth of supercritical technology in the market. Furthermore, the efficiency of a supercritical boiler is higher because it consumes less fuel than a subcritical boiler to generate the same amount of heat energy.

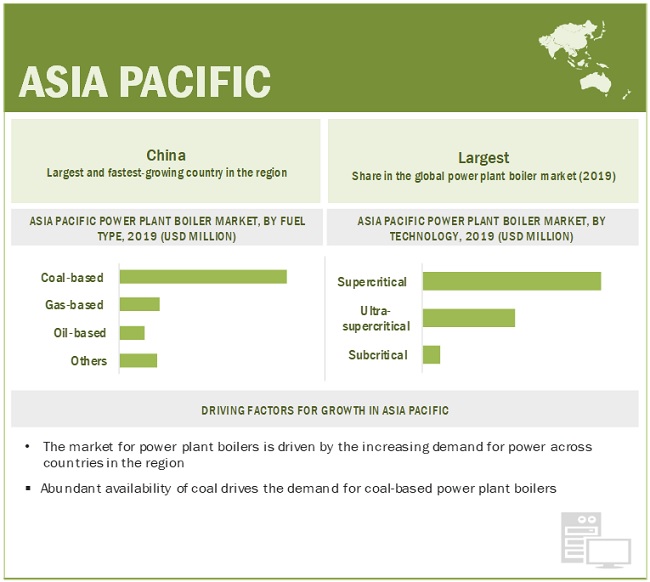

Asia Pacific held the largest share of the market in 2019.

Asia Pacific accounted for the largest share of the power plant boiler market in 2019. The region has been segmented, by country, into China, Japan, India, and the Rest of Asia Pacific. China is the largest consumer of energy in the world. To meet the growing power demand, the country is investing heavily in setting up new power plants across all provinces to ensure a steady power supply for its industries. According to the China Electricity Council (CEC), China's total power capacity has continued to rise. In 2018, the country installed 120 GW of power generating capacity while in 2017, the country had added 133.7 GW of new capacity. The country is one of the major consumers of electricity in Asia Pacific, primarily due to its high rate of industrialization. Fossil fuels, particularly coal, are the major electricity generation sources in the country.

According to the US Energy Information Administration’s (EIA) International Energy Outlook 2019 (IEO2019), India is expected to have the fastest-growing rate of energy consumption globally through 2050. By 2050, India is expected to consume more energy than the US by the mid-2040s, and its consumption will remain second only to China through 2050. This increase in consumption can be attributed to the growth of the manufacturing sector and rapid urbanization. These factors will drive the demand for coal- and gas-based boilers.

Key Market Players

Babcock & Wilcox Enterprise (US), Dongfang Electric Corporation (China), Doosan Heavy Industries & Construction (Korea), General Electric (US), and Mitsubishi Hitachi Power Systems (Japan) are the leading players in the power plant boiler market. Siemens, IHI Corporation, John wood Group, Bharat Heavy Electrical Limited, Thermax, Andritz Group, Sumitomo Heavy Industries, Valmet, and Harbin Electric are other players operating in the market are the leading players in the global market.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Capacity, Technology, Fuel Type, And Region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. |

|

Companies covered |

Babcock & Wilcox Enterprise, Dongfang Electric Corporation, Doosan Heavy Industries & Construction, General Electric, Mitsubishi Hitachi Power Systems, Siemens, IHI Corporation, John wood Group, Bharat Heavy Electrical Limited, Thermax, Andritz Group, Sumitomo Heavy Industries, Valmet, and Harbin Electric. |

This research report categorizes the power plant boiler market based on type, end-user, speed, and region.

Based on the type:

- Pulverized Coal Towers

- Circulating Fluidized Bed Boilers

- Other Boilers

Based on the capacity:

- <400 MW

- 400–800 MW

- ≥800 MW

Based on the technology:

- Subcritical

- Supercritical

- Ultra-supercritical

Based on the fuel type:

- Coal Based

- Gas Based

- Oil Based

- Other Fuel Based

Based on the region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South & Central America

Recent Developments

- In February 2020, General Electric was awarded a contract by Hitachi Zosen Corporation. Under the contract, General Electric will offer a steam turbine generator, CFB boiler, and air quality control system to the Kamisu Biomass Power Generation plant in Japan.

- In April 2020, IHI Corporation collaborated with Malaysian utility Tenaga Nasional Berhad to demonstrate completed remote monitoring service utilizing IoT technology at the Manjung Coal-Fired Power Station, which is owned by TNBJ.

- In June 2019, Mitsubishi Hitachi Power Systems, Ltd. (MHPS) established MHPS-(Philippines) Plant Services Corporation. MHPS-(Philippines) is a new company created to provide services for thermal power generation facilities in the Philippines.

- In May 2018, Thermax completed the acquisition of 100% stake of Thermax Babcock & Wilcox Energy Solutions Pvt. Ltd. (TBWES). TBWES is a joint venture between Babcock & Wilcox India Holdings Inc and Thermax.

- In December 2017, Mitsubishi Hitachi Power Systems, Ltd. (MHPS), collaborated with group companies in Africa and Europe to deliver the third boiler unit to the Medupi Power Station, South Africa. The newly delivered boiler is the fourth of 12 coal-fired units to be installed at the Medupi and Kusile power stations, with each unit providing a power output of 800 MW.

Frequently Asked Questions (FAQ):

What is the current market size of the power plant boiler market?

The size of the global power plant boiler is USD 18.1 billion in 2019.

What are the major drivers for the power plant boiler market?

The power plant boiler is driven by major factors such as increasing demand for electricity and the rising consumption of clean fossil fuel.

Which region dominates during the forecasted period in the power plant boiler market?

Asia Pacific is the largest and fastest-growing market for power plant boilers during the forecast period. The growth of this region is majorly driven by countries such as China and India, as there are continuous investments for setting up new power plants to meet the rise in demand for power and ensure steady power supply.

Who are the leading players in the global power plant boiler market?

Babcock & Wilcox Enterprise, Dongfang Electric Corporation, Doosan Heavy Industries & Construction, General Electric, and Mitsubishi Hitachi Power Systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 SUBCRITICAL

1.2.2 SUPERCRITICAL

1.2.3 ULTRA-SUPERCRITICAL

1.3 INCLUSION & EXCLUSION

1.3.1 MARKET, BY TECHNOLOGY: INCLUSIONS VS. EXCLUSIONS

1.3.2 MARKET, BY FUEL TYPE: INCLUSIONS VS. EXCLUSIONS

1.3.3 MARKET, BY CAPACITY: INCLUSIONS VS. EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 POWER PLANT BOILER MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR POWER PLANT BOILER

2.4 MARKET SIZE ESTIMATION

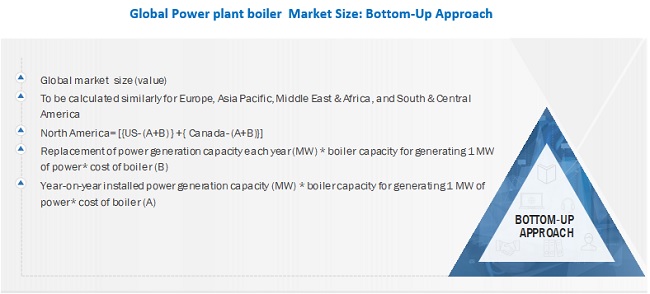

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 IDEAL DEMAND-SIDE ANALYSIS

2.4.3.1 Calculations

2.4.3.2 Assumptions

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR MARKET

2.4.4.1 Calculation

2.4.4.2 Assumptions

FIGURE 7 INDUSTRY CONCENTRATION, 2019

2.4.5 FORECAST

2.5 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 SCENARIO ANALYSIS

FIGURE 8 SCENARIO ANALYSIS: MARKET, 2018–2025

3.1.1 OPTIMISTIC SCENARIO

3.1.2 REALISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

TABLE 1 MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2019

FIGURE 10 PULVERIZED COAL TOWERS SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 11 SUPERCRITICAL SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 12 COAL-BASED SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY FUEL TYPE, DURING FORECAST PERIOD

FIGURE 13 <400-MW SEGMENT TO CONTINUE TO HOLD LARGEST SHARE OF MARKET, BY CAPACITY, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN POWER PLANT BOILER MARKET

FIGURE 14 INCREASING DEMAND FOR ELECTRICITY TO DRIVE MARKET DURING 2020–2025

4.2 MARKET, BY REGION

FIGURE 15 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN ASIA PACIFIC, BY FUEL TYPE & COUNTRY

FIGURE 16 COAL AND CHINA LARGEST SHAREHOLDERS IN MARKET IN ASIA PACIFIC, BY FUEL TYPE AND COUNTRY, RESPECTIVELY, IN 2019

4.4 MARKET, BY TYPE

FIGURE 17 PULVERIZED COAL TOWERS SEGMENT TO CONTINUE TO DOMINATE MARKET, BY TYPE, 2025

4.5 MARKET, BY TECHNOLOGY

FIGURE 18 SUBCRITICAL SEGMENT TO DOMINATE MARKET, BY TECHNOLOGY, 2025

4.6 MARKET, BY FUEL TYPE

FIGURE 19 COAL-BASED SEGMENT TO DOMINATE MARKET, BY FUEL TYPE, 2025

4.7 MARKET, BY CAPACITY

FIGURE 20 <400-MW SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY CAPACITY, 2025

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 21 REVENUE SHIFT FOR POWER PLANT BOILER

5.3 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19: GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.4 ROAD TO RECOVERY

FIGURE 24 RECOVERY ROAD FOR 2020

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2020

5.6 MARKET DYNAMICS

FIGURE 26 POWER PLANT BOILER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.6.1 DRIVERS

5.6.1.1 Increasing demand for electricity

FIGURE 27 GLOBAL ELECTRICITY DEMAND BY REGION IN NEW POLICIES SCENARIO, 2011–2040

5.6.1.2 Rising consumption of clean fossil fuel

5.6.2 RESTRAINTS

5.6.2.1 High capital requirement to install power plant boilers

5.6.2.2 Growth of renewable energy sources for power generation

FIGURE 28 GLOBAL MODERN RENEWABLE ENERGY GENERATION, BY SOURCE, 2011–2019

5.6.3 OPPORTUNITIES

5.6.3.1 Upgrading aging power plant boiler infrastructure

5.6.3.2 Technological advancements and demand for compact designs

5.6.4 CHALLENGES

5.6.4.1 Boiler efficiency and steam quality

5.6.4.2 Impact of COVID-19 on power plant boilers market

5.7 AVERAGE SELLING PRICE TREND

5.8 SUPPLY CHAIN OVERVIEW

FIGURE 29 POWER PLANT BOILER SUPPLY CHAIN

5.8.1 KEY INFLUENCERS

5.8.1.1 Raw material providers

5.8.1.2 Equipment manufacturers

5.8.1.3 End users

5.9 CASE STUDY ANALYSIS

5.9.1 INCREASED EFFICIENCY AND REDUCED EMISSIONS AT 2 POWER PLANTS IN TURKEY

TABLE 2 PROJECT STATISTICS

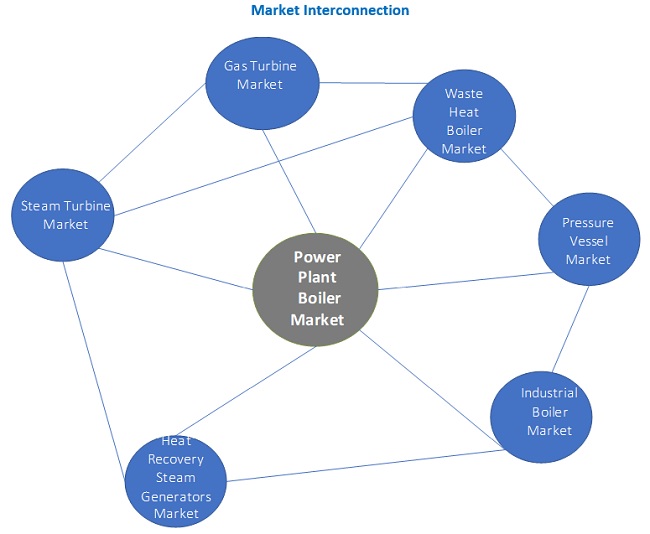

5.1 MARKET MAP

FIGURE 30 POWER PLANT BOILERS MARKET MAP

6 SCENARIO ANALYSIS (Page No. - 65)

6.1 INTRODUCTION

6.2 OPTIMISTIC SCENARIO

TABLE 3 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 REALISTIC SCENARIO

TABLE 4 REALISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 PESSIMISTIC SCENARIO

TABLE 5 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2018–2025 (USD MILLION)

7 POWER PLANT BOILER MARKET, BY TYPE (Page No. - 68)

7.1 INTRODUCTION

FIGURE 31 PULVERIZED COAL TOWERS SEGMENT DOMINATED MARKET, BY TYPE, IN 2019

TABLE 6 MARKET, BY TYPE, 2018–2025 (USD MILLION)

7.2 PULVERIZED COAL TOWERS

7.2.1 ADVANCEMENTS IN COMBUSTION TECHNOLOGIES TO DRIVE MARKET

TABLE 7 PULVERIZED COAL TOWERS: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 CIRCULATING FLUIDIZED BED (CFB) BOILERS

7.3.1 GROWING DEMAND FOR FUEL FLEXIBILITY DRIVING MARKET

TABLE 8 CIRCULATING FLUIDIZED BED (CFB) BOILERS: MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 OTHER BOILERS

TABLE 9 OTHER BOILERS: MARKET, BY REGION, 2018–2025 (USD MILLION)

8 POWER PLANT BOILER MARKET, BY CAPACITY (Page No. - 73)

8.1 INTRODUCTION

FIGURE 32 <400 MW CAPACITY DOMINATED MARKET IN 2019

TABLE 10 MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

8.2 <400 MW

8.2.1 INCREASING INVESTMENTS TO INCREASE POWER PLANT EFFICIENCY

TABLE 11 <400 MW: MARKET, BY REGION, 2018–2025 (USD MILLION)

8.3 400–800 MW

8.3.1 INCREASING DEPLOYMENT OF SUPERCRITICAL POWER PLANT BOILERS FOR RETROFITTING AGING POWER PLANT BOILERS

TABLE 12 400–800 MW: MARKET, BY REGION, 2018–2025 (USD MILLION)

8.4 ≥800 MW

8.4.1 RISE IN DEPLOYMENT OF ≥800-MW CAPACITY BOILERS

TABLE 13 ≥800 MW: POWER PLANT BOILER, BY REGION, 2018–2025 (USD MILLION)

9 POWER PLANT BOILER MARKET, BY TECHNOLOGY (Page No. - 77)

9.1 INTRODUCTION

FIGURE 33 SUPERCRITICAL SEGMENT DOMINATED MARKET IN 2019

TABLE 14 MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

9.2 SUBCRITICAL

9.2.1 POTENTIAL DEMAND FOR SUBCRITICAL TECHNOLOGY IN APAC COUNTRIES

TABLE 15 SUBCRITICAL: MARKET, BY REGION, 2018–2025 (USD MILLION)

9.3 SUPERCRITICAL

9.3.1 UPGRADATION OF AGING INFRASTRUCTURE BY SHIFTING FROM SUBCRITICAL TO SUPERCRITICAL TECHNOLOGY

TABLE 16 SUPERCRITICAL: MARKET, BY REGION, 2018–2025 (USD MILLION)

9.4 ULTRA-SUPERCRITICAL

9.4.1 IMPROVED THERMAL EFFICIENCY FUELING MARKET FOR ULTRA-SUPERCRITICAL TECHNOLOGY

TABLE 17 ULTRA-SUPERCRITICAL: MARKET, BY REGION, 2018–2025 (USD MILLION)

10 POWER PLANT BOILER MARKET, BY FUEL TYPE (Page No. - 82)

10.1 INTRODUCTION

FIGURE 34 COAL-BASED SEGMENT DOMINATED MARKET IN 2019

TABLE 18 MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

10.2 COAL BASED

10.2.1 RISING DEMAND FOR POWER GENERATION IN APAC

TABLE 19 COAL BASED: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.3 GAS BASED

10.3.1 GROWING DEMAND FOR NATURAL GAS IN POWER GENERATION

TABLE 20 GAS BASED: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.4 OIL BASED

10.4.1 HIGH AVAILABILITY OF CRUDE OIL RESERVES IN MIDDLE EAST TO DRIVE MARKET GROWTH

TABLE 21 OIL BASED: MARKET, BY REGION, 2018–2025 (USD MILLION)

10.5 OTHER FUEL BASED

TABLE 22 OTHER FUEL BASED: MARKET, BY REGION, 2018–2025 (USD MILLION)

11 POWER PLANT BOILER MARKET, BY REGION (Page No. - 87)

11.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC POWER PLANT BOILERS MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 36 ASIA PACIFIC DOMINATED MARKET IN 2019

TABLE 23 MARKET, BY REGION, 2018–2025 (TONS/HOUR)

TABLE 24 MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: REGIONAL SNAPSHOT

11.2.1 BY TYPE

TABLE 25 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.2.2 BY CAPACITY

TABLE 26 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

11.2.3 BY TECHNOLOGY

TABLE 27 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 28 ASIA PACIFIC: SUBCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 ASIA PACIFIC: SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 ASIA PACIFIC: ULTRA-SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.2.4 BY FUEL TYPE

TABLE 31 ASIA PACIFIC: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 32 ASIA PACIFIC: COAL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 ASIA PACIFIC: GAS-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 ASIA PACIFIC: OIL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 ASIA PACIFIC: OTHER FUEL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.2.5 BY COUNTRY

TABLE 36 ASIA PACIFIC: POWER PLANT BOILER MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.2.5.1 China

11.2.5.1.1 Investments to increase power generation capacities driving market

11.2.5.1.2 By fuel type

TABLE 37 CHINA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.2.5.1.3 By technology

TABLE 38 CHINA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.2.5.2 India

11.2.5.2.1 Increasing domestic power demand driving market

11.2.5.2.2 By fuel type

TABLE 39 INDIA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.2.5.2.3 By technology

TABLE 40 INDIA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.2.5.3 Japan

11.2.5.3.1 Growing investments in setting up highly efficient thermal power plants and refurbishment of existing market to drive market

11.2.5.3.2 By fuel type

TABLE 41 JAPAN: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.2.5.3.3 By technology

TABLE 42 JAPAN: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.2.5.4 Rest of Asia Pacific

11.2.5.4.1 By fuel type

TABLE 43 REST OF ASIA PACIFIC: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.2.5.4.2 By technology

TABLE 44 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.3 EUROPE

FIGURE 38 EUROPE: REGIONAL SNAPSHOT

11.3.1 BY TYPE

TABLE 45 EUROPE: POWER PLANT BOILER MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.3.2 BY CAPACITY

TABLE 46 EUROPE: MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

11.3.3 BY TECHNOLOGY

TABLE 47 EUROPE: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: SUBCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: ULTRA-SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.3.4 BY FUEL TYPE

TABLE 51 EUROPE: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: COAL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: GAS-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: OIL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: OTHER FUEL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.3.5 BY COUNTRY

TABLE 56 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.3.5.1 UK

11.3.5.1.1 Discontinuation of coal-fired power plant boilers to boost demand for natural gas-fired power plant boilers

11.3.5.1.2 By fuel type

TABLE 57 UK: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.3.5.1.3 By technology

TABLE 58 UK: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.3.5.2 Germany

11.3.5.2.1 Rising adoption of ultra-supercritical driving market

11.3.5.2.2 By fuel type

TABLE 59 GERMANY: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.3.5.2.3 By technology

TABLE 60 GERMANY: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.3.5.3 Russia

11.3.5.3.1 Upgrading aged power infrastructure fueling market

11.3.5.3.2 By fuel type

TABLE 61 RUSSIA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.3.5.3.3 By technology

TABLE 62 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.3.5.4 Rest of Europe

11.3.5.4.1 By fuel type

TABLE 63 REST OF EUROPE: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.3.5.4.2 By technology

TABLE 64 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.4 NORTH AMERICA

11.4.1 BY TYPE

TABLE 65 NORTH AMERICA: POWER PLANT BOILER MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.4.2 BY CAPACITY

TABLE 66 NORTH AMERICA: MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

11.4.3 BY TECHNOLOGY

TABLE 67 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: SUBCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 NORTH AMERICA: ULTRA-SUPERCRITICAL MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.4 BY FUEL TYPE

TABLE 71 NORTH AMERICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 72 NORTH AMERICA: COAL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: GAS-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 NORTH AMERICA: OIL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: OTHER FUEL-BASED MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.5 BY COUNTRY

TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.5.1 US

11.4.5.1.1 Power generation through gas-fired power plant driving market growth

11.4.5.1.2 By fuel type

TABLE 77 US: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.4.5.1.3 By technology

TABLE 78 US: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.4.5.2 Canada

11.4.5.2.1 Rising adoption of supercritical and ultra-supercritical to increase efficiency of power plants

11.4.5.2.2 By fuel type

TABLE 79 CANADA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.4.5.2.3 By technology

TABLE 80 CANADA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 BY TYPE

TABLE 81 MIDDLE EAST & AFRICA: POWER PLANT BOILER MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.5.2 BY CAPACITY

TABLE 82 MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

11.5.3 BY TECHNOLOGY

TABLE 83 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: SUBCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA: SUPERCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: ULTRA-SUPERCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

11.5.4 BY FUEL TYPE

TABLE 87 MIDDLE EAST & AFRICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: COAL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: GAS-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: OIL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: OTHER FUEL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

11.5.5 BY COUNTRY

TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.5.5.1 Saudi Arabia

11.5.5.1.1 Government initiatives to meet rising power demand driving market

11.5.5.1.2 By fuel type

TABLE 93 SAUDI ARABIA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.5.5.1.3 By technology

TABLE 94 SAUDI ARABIA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.5.5.2 South Africa

11.5.5.2.1 Rapid industrialization and increasing power generation capacity driving market

11.5.5.2.2 By fuel type

TABLE 95 SOUTH AFRICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.5.5.2.3 By technology

TABLE 96 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.5.5.3 Egypt

11.5.5.3.1 Increasing investments in power sector to meet rising demand

11.5.5.3.2 By fuel type

TABLE 97 EGYPT: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.5.5.3.3 By technology

TABLE 98 EGYPT: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.5.5.4 Rest of Middle East & Africa

11.5.5.4.1 By fuel type

TABLE 99 REST OF MIDDLE EAST & AFRICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.5.5.4.2 By technology

TABLE 100 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.6 SOUTH & CENTRAL AMERICA

11.6.1 BY TYPE

TABLE 101 SOUTH & CENTRAL AMERICA: POWER PLANT BOILER MARKET, BY TYPE, 2018–2025 (USD MILLION)

11.6.2 BY CAPACITY

TABLE 102 SOUTH & CENTRAL AMERICA: MARKET, BY CAPACITY, 2018–2025 (USD MILLION)

11.6.3 BY TECHNOLOGY

TABLE 103 SOUTH & CENTRAL AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 104 SOUTH & CENTRAL AMERICA: SUBCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 105 SOUTH & CENTRAL AMERICA: SUPERCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 SOUTH & CENTRAL AMERICA: ULTRA-SUPERCRITICAL POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

11.6.4 BY FUEL TYPE

TABLE 107 SOUTH & CENTRAL AMERICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

TABLE 108 SOUTH & CENTRAL AMERICA: COAL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 109 SOUTH & CENTRAL AMERICA: GAS-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 110 SOUTH & CENTRAL AMERICA: OIL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 111 SOUTH & CENTRAL AMERICA: OTHER FUEL-BASED POWER PLANT BOILER, BY COUNTRY, 2018–2025 (USD MILLION)

11.6.5 BY COUNTRY

TABLE 112 SOUTH & CENTRAL AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

11.6.5.1 Brazil

11.6.5.1.1 Upgrading power infrastructure and increasing investments driving market

11.6.5.1.2 By fuel type

TABLE 113 BRAZIL: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.6.5.1.3 By technology

TABLE 114 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.6.5.2 Argentina

11.6.5.2.1 Increasing investments in gas-fired power plant drive market

11.6.5.2.2 By fuel type

TABLE 115 ARGENTINA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.6.5.2.3 By technology

TABLE 116 ARGENTINA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.6.5.3 Mexico

11.6.5.3.1 Growing industrialization boosting market

11.6.5.3.2 By fuel type

TABLE 117 MEXICO: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.6.5.3.3 By technology

TABLE 118 MEXICO: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

11.6.5.4 Rest of South & Central America

11.6.5.4.1 By fuel type

TABLE 119 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY FUEL TYPE, 2018–2025 (USD MILLION)

11.6.5.4.2 By technology

TABLE 120 REST OF SOUTH & CENTRAL AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 137)

12.1 OVERVIEW

FIGURE 39 KEY DEVELOPMENTS IN GLOBAL MARKET, APRIL 2017–SEPTEMBER 2020

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 40 MARKET EVALUATION FRAMEWORK: CONTRACTS & AGREEMENTS AND MERGER & ACQUISITIONS FUELED GROWTH OF COMPANIES FROM 2017 TO 2020

12.3 COMPETITIVE SCENARIO

TABLE 121 DEVELOPMENTS OF KEY PLAYERS IN MARKET, 2017–2020

12.4 INDUSTRY CONCENTRATION, 2019

FIGURE 41 INDUSTRY CONCENTRATION, 2019

12.5 KEY MARKET DEVELOPMENTS

12.5.1 CONTRACTS & AGREEMENTS

12.5.2 INVESTMENTS & EXPANSIONS

12.5.3 MERGERS & ACQUISITIONS

12.5.4 PARTNERSHIPS, COLLABORATIONS, ALLIANCE, JOINT VENTURES, AND INVESTMENTS & EXPANSIONS

12.6 COMPANY EVALUATION MATRIX TO DEFINITIONS AND METHODOLOGY

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE

12.6.4 PARTICIPANTS

12.7 COMPANY EVALUATION MATRIX, 2019

FIGURE 42 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING (2019)

12.8 WINNERS VS. TAIL ENDERS

12.8.1 WINNERS

12.8.2 TAIL ENDERS

13 COMPANY PROFILES (Page No. - 146)

(Business and Financial Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 GENERAL ELECTRIC

FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT

FIGURE 44 GENERAL ELECTRICS: SWOT ANALYSIS

13.2 SIEMENS

FIGURE 45 SIEMENS: COMPANY SNAPSHOT

FIGURE 46 SIEMENS: SWOT ANALYSIS

13.3 BABCOCK & WILCOX ENTERPRISES, INC.

FIGURE 47 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY SNAPSHOT

FIGURE 48 BABCOCK & WILCOX ENTERPRISES, INC: SWOT ANALYSIS

13.4 DONGFANG ELECTRIC CORPORATION LTD.

FIGURE 49 DONGFANG ELECTRIC CORPORATION LTD.: COMPANY SNAPSHOT

13.5 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION

FIGURE 50 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: COMPANY SNAPSHOT

FIGURE 51 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: SWOT ANALYSIS

13.6 SUMITOMO HEAVY INDUSTRIES, LTD.

FIGURE 52 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

FIGURE 53 SUMITOMO HEAVY INDUSTRIES, LTD.: SWOT ANALYSIS

13.7 IHI CORPORATION

FIGURE 54 IHI CORPORATION: COMPANY SNAPSHOT

13.8 JOHN WOOD GROUP PLC

FIGURE 55 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

13.9 MITSUBISHI HITACHI POWER SYSTEMS, LTD.

13.10 SOFINTER GROUP

13.11 BHARAT HEAVY ELECTRICALS LIMITED

FIGURE 56 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

13.12 THERMAX LIMITED

FIGURE 57 THERMAX LIMITED: COMPANY SNAPSHOT

13.13 ANDRITZ GROUP

FIGURE 58 ANDRITZ GROUP: COMPANY SNAPSHOT

13.14 VALMET

FIGURE 59 VALMET: COMPANY SNAPSHOT

13.15 HARBIN ELECTRIC CORPORATION

* Business and Financial Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.16 JFE ENGINEERING CORPORATION

13.17 ZHENGZHOU BOILER CO., LTD.

13.18 RENTECH BOILER

13.19 SHANGHAI ELECTRIC POWER CO., LTD.

13.20 PJSC KRASNY KOTELSHCHIK

14 APPENDIX (Page No. - 189)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

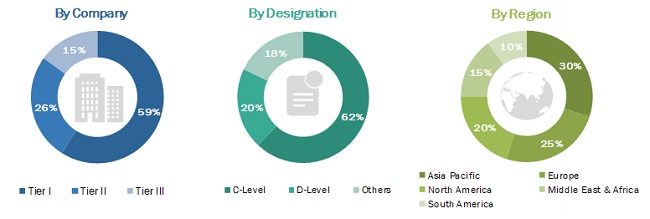

This study involved four major activities in estimating the current power plant boiler market size. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, World Bank, BP Statistical Review of World Energy 2020, US DOE, and IEA, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power plant boiler market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as power companies, power plant boiler manufacturers, government and research organizations, consulting companies, and power & energy associations. The demand side of this market is characterized by estimating the year-on-year installed power generation capacity and replacement of power generation capacity each year. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global power plant boiler market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define and describe the global power plant boiler market by type, technology, fuel type, capacity, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the global market with respect to individual growth trends, future expansions, and the contribution of each segment to the market

- The impact of COVID-19 on the market has been analyzed for the estimation of the market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the global market with respect to the main regions (North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa)

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, mergers & acquisitions, new product launches, and partnership & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Power Plant Boiler Market