Steam Turbines Market by Type (Steam Cycle, Combined Cycle and Cogeneration), by Rated Capacity (1-120 MW, 121-350 MW, 351-750 MW and Above 750 MW), by Exhaust Type (Condensing and Noncondensing), by Application (Coal, Nuclear, Biomass and Others) and by Region (Americas, Asia-Pacific, Europe and Middle East & Africa) - Global Trends and Forecasts to 2020

[187 Pages Report] Factors driving the steam turbines market include increase in electricity consumption and demand from emerging economies, and the consequent capacity expansions carried out by utilities in the region, particularly thermal power capacity. The global steam turbines market size was estimated to be around USD 14.8 Billion in 2014, at USD 19,292 Million by 2020 and is expected to grow at a CAGR of 4.4% during the forecast period. The steam turbines market is segmented on the basis of its type, application, rated capacity, exhaust type, and region. The years considered for the study are:

- Historical Year 2013

- Base Year 2014

- Estimated Year 2015

- Projected Year 2020

- Forecast Period 2015 to 2020

For company profiles, 2014 has been considered as the base year for calculating market share and the competitive landscape. Where information is unavailable for the base year, the prior year has been considered.

Research Methodology:

- Major regions were identified along with countries contributing the maximum share

- Installed capacity powered by steam turbines is categorized. Specific data for each type of power plant, different fuel types used in the plants and type of turbine used was collected and analysed.

- Market size for different regions has been calculated by taking into account the geographic break-up of demand and consumption, further validating it with the geographic presence of top steam turbine product and service companies in those regions and their corresponding revenues.

- Primary interviews from manufacturers and suppliers helped to obtain and verify critical qualitative and quantitative information as well as assess future market prospects. Information obtained was used to estimate the share of different segments of steam turbines in regional markets.

- Key companies revenues (regional/global), product pricing, and industry trends along with top-down, bottom-up, and MnM KNOW were used to calculate market size

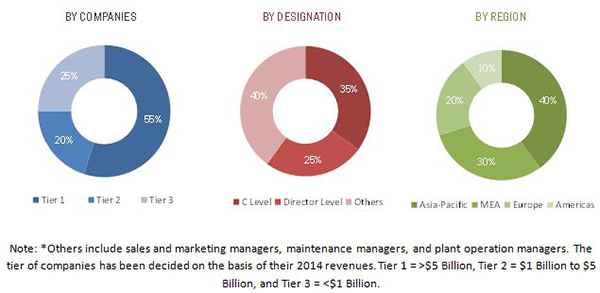

The figure below shows the breakdown of the primaries on the basis of company, designation, and region, conducted during the research study.

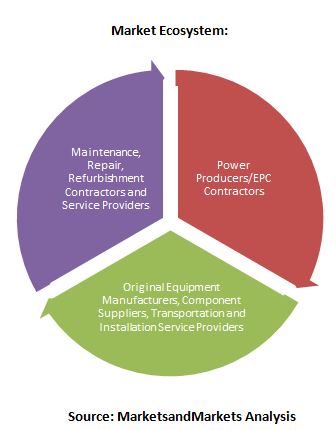

Study addresses several of the stakeholders which include OEMs, EPC companies, Utility service providers, Distributers & Suppliers, Consulting firms, Private Equity groups, investment houses, equity research firms and other stakeholders. It gives them information about market segments to focus in next two to five years for prioritizing the efforts and investments

Scope of the report:

- By Type:

- Steam Cycle

- Combined Cycle

- By Application:

- Coal

- Nuclear

- Biomass

- Others

- By Rated Capacity

- 1-120 MW

- 121-350 MW

- 351-750 MW

- Above 750 MW

- By Exhaust Type

- Condensing

- Non-condensing

- By Region

- Americas

- Europe

- Asia-Pacific

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Global steam turbine market is projected to grow at a CAGR of 4.4% from 2015 to 2020, to reach a market size of USD 19,292 Million by 2020. The growth is attributed to the continuing investments in electricity generation infrastructure, particularly in the large economies of Asia-Pacific region.

The report segments steam turbines market by fuel type, into coal, nuclear, biomass, and other. Steam turbines in coal power application are expected to be the fastest growing segment during the forecast period. Coal fired power generation continues to remain one of the most affordable option for developing economies in the world, particularly in Asia-Pacific. Moreover, there is sufficient supply of coal for usage as fuel, while other options such as natural gas require creation of new infrastructure for its import and use. Although, the world as a whole is slowly moving away from coal based power generation in view of growing environmental concerns, the transition is expected to be slow and would need syndicated efforts across different economies to take place.

In this report, the steam turbines market has been categorized on the basis of exhaust type into condensing and non-condensing. Condensing steam turbines are the most widely used type, largely due to its higher efficiency and the ability to produce more electricity at comparatively lower operational cost. The market for condensing turbines is also projected to grow at a faster pace than non-condensing ones, particularly due to demand from the large capacity thermal power plants.

Asia-Pacific is the leading market for steam turbines in 2014 with strong demand from China and India. It is also projected to be the fastest growing market with CAGR of 5% during the forecast period. China is expected to be the fastest growing market for steam turbines across the world, followed by India, with a CAGR of 5.7% and 5.5% during the forecast period respectively. These countries account for around 60% of the global thermal power capacity additions projected for the next five years helping drive the market for steam turbines.

Regulatory and policy restrictions on fossil-fuel fired power plants can however, restrain the growth of the steam turbines market. Growing concerns about the negative impact of carbon emissions on climate and consequent measures by regional and country level policies such as capping the amount of emissions acceptable from these plants have led to retirements of existing plants as well as shelving of future construction in favor of other options, even if they are more costly.

Market consolidation through mergers & acquisitions, along with joint ventures and collaborations has emerged as a distinct trend in the market. The recent acquisition of Alstom SAs power systems business by General Electric is an example of this consolidation and is expected to alter the competitive dynamics of the market. The leading players in the steam turbines market include Alstom SA (France), Siemens AG (Germany), General Electric (U.S.), Mitsubishi Hitachi Power Systems (Japan), and Toshiba Corporation (Japan) among others.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Covered

1.4 Years Considered in the Report

1.5 Currency

1.6 Package Size

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 35)

4.1 Attractive Market Opportunities

4.2 Asia-Pacific: Potential Market to Invest During the Forecast Period

4.3 Coal Fired Power Plants Dominated the Steam Turbines Market, By Application in 2014

4.4 Steam Cycle (Conventional) Type Dominated the Steam Turbines Market in 2014

4.5 Increase in Demand for Steam Turbine for Coal Fired Power Plants in the Asia-Pacific Region

4.6 Steam Turbines Market, By Exhaust Type

5 Market Overview (Page No. - 41)

5.1 Market Evolution

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Rated Capacity

5.2.3 By Application

5.2.4 By Exhaust Type

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Electricity Consumption

5.3.1.2 Rising Thermal Power Capacity Additions

5.3.1.3 Increase in Combined Cycle and Co-Generation Operations

5.3.2 Restraint

5.3.2.1 Regulatory Policy Restrictions on Fossil-Fuel Fired Power Plants

5.3.2.2 Slowdown in Construction of New Nuclear Power Plants

5.3.3 Opportunity

5.3.3.1 Replacement/Upgrades of Aged Power Generation Infrastructure

5.3.4 Challenge

5.3.4.1 Boiler Efficiency and Steam Quality

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.1.1 High Capital Requirements

5.4.2 Threat of Substitutes

5.4.2.1 Competition From Other Generation Technologies, Particularly Renewables

5.4.3 Bargaining Power of Suppliers

5.4.3.1 Dependence on Regulatory Policy in Buyers Market

5.4.4 Bargaining Power of Buyers

5.4.4.1 Concentration of Buyers in the Market

5.4.5 Intensity of Rivalry

5.4.5.1 High Degree of Competition

5.4.5.2 Most New Thermal Power Orders Coming From Limited Markets

5.5 Supply Chain Analysis

6 Steam Turbines Market, By Type (Page No. - 57)

6.1 Introduction

6.2 Steam Cycle (Conventional)

6.3 Combined Cycle

6.4 Cogeneration

7 Steam Turbines Market, By Rated Capacity (Page No. - 65)

7.1 Introduction

7.2 1-120 Mw

7.3 121-350 Mw

7.4 351-750 Mw

7.5 Above 750 Mw

8 Steam Turbines Market, By Exhaust Type (Page No. - 70)

8.1 Introduction

8.2 Condensing

8.3 Non-Condensing

9 Steam Turbines Market, By Application (Page No. - 74)

9.1 Introduction

9.2 Coal

9.3 Biomass

9.4 Nuclear

9.5 Others

10 Steam Turbines Market, By Region (Page No. - 83)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 By Type

10.2.2 By Rated Capacity

10.2.3 By Application

10.2.4 By Exhaust Type

10.2.5 By Country

10.2.5.1 China

10.2.5.2 India

10.2.5.3 Japan

10.2.5.4 Rest of Asia-Pacific

10.3 Europe

10.3.1 By Type

10.3.2 By Rated Capacity

10.3.3 By Application

10.3.4 By Exhaust Type

10.3.5 By Country

10.3.5.1 Germany

10.3.5.2 Russia

10.3.5.3 France

10.3.5.4 U.K.

10.3.5.5 Rest of Europe

10.4 Americas

10.4.1 By Type

10.4.2 By Rated Capacity

10.4.3 By Application

10.4.4 By Exhaust Type

10.4.5 By Country

10.4.5.1 U.S.

10.4.5.2 Canada

10.4.5.3 Mexico

10.4.5.4 Brazil

10.4.5.5 Rest of Americas

10.5 Middle East & Africa

10.5.1 By Type

10.5.2 By Rated Capacity

10.5.3 By Application

10.5.4 By Exhaust Type

10.5.5 By Country

10.5.5.1 Saudi Arabia

10.5.5.2 South Africa

10.5.5.3 UAE

10.5.5.4 Rest of the Middle East & Africa

11 Competitive Landscape (Page No. - 121)

11.1 Overview

11.2 Market Share Analysis, 2014

11.3 Competitive Situation & Trends

11.4 Contracts & Agreements

11.5 Expansions

11.6 Mergers & Acquisitions

11.7 Others

11.8 New Product Developments

12 Company Profiles (Page No. - 130)

12.1 Introduction

12.2 Alstom SA

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments, 20142015

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Siemens AG

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments, 20142015

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Toshiba Corporation

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments, 20112015

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 General Electric Company

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments, 20122015

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 Mitsubishi Hitachi Power Systems, Ltd.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments, 20132015

12.6.4 SWOT Analysis

12.6.5 MnM View

12.7 Eliott Group

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments, 2015

12.8 Ansaldo Energia S.P.A.

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 Recent Developments, 2014September 2015

12.9 Shanghai Electric Group Co. Ltd.

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.10 Dongfang Electric Corporation Limited

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 Developments, 2014

12.11 Harbin Electric International Company Limited

12.11.1 Business Overview

12.11.2 Products Offered

12.11.3 Developments, 20122013

12.12 Doosan Skoda Power

12.12.1 Introduction

12.12.2 Product Offered

12.12.3 Recent Developments, 2011September 2015

12.13 Bharat Heavy Electricals Limited

12.13.1 Business Overview 175

12.13.2 Products Offered

12.13.3 Recent Developments, 2013April 2015

12.14 Fuji Electric Co., Ltd.

12.14.1 Business Overview

12.14.2 Products Offered

12.14.3 Recent Developments, 2012May 2015

12.15 Man Diesel & Turbo SE

12.15.1 Business Overview

12.15.2 Products Offered

12.15.3 Recent Developments, 2011June 2015

13 Appendix (Page No. - 184)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Available Customizations

13.4 Related Reports

List of Tables (67 Tables)

Table 1 Increasing Electricity Consumption and Rising Thermal Power Capacity Additions are Propelling the Growth of the Steam Turbines Market

Table 2 Regulatory Hurdles and Slowdown in Nuclear Power Projects Restrain Market Growth

Table 3 Replacement/Upgrades of Aged Power Generation Infrastructure is an Opportunity for the Steam Turbines Market

Table 4 Boiler Efficiency and Steam Quality is A Challenge

Table 5 Steam Turbines Market Size, By Type, 2013-2020 (USD Million)

Table 6 Steam Cycle (Conventional) Steam Turbines Market Size, By Region, 2013-2020 (USD Million)

Table 7 Combined Cycle Steam Turbines Market Size, By Region, 2013-2020 (USD Million)

Table 8 Cogeneration: Steam Turbines Market Size, By Region, 2013-2020 (USD Million)

Table 9 Steam Turbines Market, By Rated Capacity, 2013-2020 (USD Million)

Table 10 1-120 Mw Steam Turbines Market, By Rated Capacity, 2013-2020 (USD Million)

Table 11 121-350 Mw Steam Turbines Market, By Rated Capacity, 2013-2020 (USD Million)

Table 12 351-750 Mw Steam Turbines Market, By Rated Capacity, 2013-2020 (USD Million)

Table 13 Above 750 Mw Steam Turbines Market, By Rated Capacity, 2013-2020 (USD Million)

Table 14 Difference Between Condensing and Non-Condensing Steam Turbine

Table 15 Steam Turbines Market Size, By Application, 2013-2020 (USD Million)

Table 16 Coal -Powered Steam Turbines Market Size, By Application, 2012-2020 (USD Million)

Table 17 Steam Turbines Coal Application Market Size, By Top Countries, 20132020 (USD Million)

Table 18 Biomass-Powered Steam Turbines Market Size, By Application, 2012-2020 (USD Million)

Table 19 Steam Turbines Biomass Application Market Size, By Top Countries, 20132020 (USD Million)

Table 20 Nuclear Energy Powered Steam Turbines Market Size, By Application, 2012-2020 (USD Million)

Table 21 Steam Turbines Nuclear Application Market Size, By Top Countries, 20132020 (USD Million)

Table 22 Other Fuel Powered Steam Turbines Market Size, By Application, 2012-2020 (USD Million)

Table 23 Steam Turbines Other Application Market Size, By Top Countries, 20132020 (USD Million)

Table 24 Steam Turbines Market Size, By Region, 20132020 (USD Million)

Table 25 Asia-Pacific: Steam Turbines Market Size, By Type, 20132020 (USD Million)

Table 26 Asia-Pacific: Steam Turbines Market Size, By Rated Capacity, 20132020 (USD Million)

Table 27 Asia-Pacific: Steam Turbines Market Size, By Application, 20132020 (USD Million)

Table 28 Asia-Pacific: Steam Turbines Market Size, By Exhaust Type, 20132020 (USD Million)

Table 29 Asia-Pacific: Steam Turbines Market Size, By Country, 20132020 (USD Million)

Table 30 China: By Market Size, By Application, 20132020 (USD Million)

Table 31 India: By Market Size, By Application, 20132020 (USD Million)

Table 32 Japan: By Market Size, By Application, 20132020 (USD Million)

Table 33 Rest of Asia-Pacific: By Market Size, By Application, 20132020 (USD Million)

Table 34 Europe: By Market Size, By Type, 20132020 (USD Million)

Table 35 Europe: By Market Size, By Rated Capacity, 20132020 (USD Million)

Table 36 Europe: By Market Size, By Application, 20132020 (USD Million)

Table 37 Europe: By Market Size, By Exhaust Type, 20132020 (USD Million)

Table 38 Europe: By Market Size, By Country, 20132020 (USD Million)

Table 39 Germany: By Market Size, By Application, 20132020 (USD Million)

Table 40 Russia: By Market Size, By Application, 20132020 (USD Million)

Table 41 France: By Market Size, By Application, 20132020 (USD Million)

Table 42 U.K.: By Market Size, By Application, 20132020 (USD Million)

Table 43 Rest of Europe: By Market Size, By Application, 20132020 (USD Million)

Table 44 Americas: By Market Size, By Type, 20132020 (USD Million)

Table 45 Americas: By Market Size, By Rated Capacity, 20132020 (USD Million)

Table 46 Americas: By Market Size, By Application, 20132020 (USD Million)

Table 47 Americas: By Market Size, By Exhaust Type, 20132020 (USD Million)

Table 48 Americas: By Market Size, By Country, 20132020 (USD Million)

Table 49 U.S.: By Market Size, By Application, 20132020 (USD Million)

Table 50 Canada: By Market Size, By Application, 20132020 (USD Million)

Table 51 Mexico: By Market Size, By Application, 20132020 (USD Million)

Table 52 Brazil: By Market Size, By Application, 20132020 (USD Million)

Table 53 Rest of Americas: By Market Size, By Application, 20132020 (USD Million)

Table 54 Middle East & Africa: By Market Size, By Type, 20132020 (USD Million)

Table 55 Middle East & Africa: By Market Size, By Rated Capacity, 20132020 (USD Million)

Table 56 Middle East & Africa: By Market Size, By Application, 20132020 (USD Million)

Table 57 Middle East & Africa: By Market Size, By Exhaust Type, 20132020 (USD Million)

Table 58 Middle East & Africa: By Market Size, By Country, 20132020 (USD Million)

Table 59 Saudi Arabia: By Market Size, By Application, 20132020 (USD Million)

Table 60 South Africa: By Market Size, By Application, 20132020 (USD Million)

Table 61 UAE: Steam Turbines Market Size, By Application, 20132020 (USD Million)

Table 62 Rest of the Middle East & Africa: Steam Turbines Market Size, By Application, 20132020 (USD Million)

Table 63 Contracts & Agreements, 2015

Table 64 Expansions, 20142015

Table 65 Mergers & Acquisitions, 2014-2015

Table 66 Others, 20132015

Table 67 New Product Developments, 2012-2013

List of Figures (67 Figures)

Figure 1 Markets Covered: Global Steam Turbines Market

Figure 2 Steam Turbines Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Steam Turbines Market: Regional Snapshot (2015 vs 2020)

Figure 7 Asia-Pacific Dominated the Steam Turbines Market in 2014

Figure 8 Asia-Pacific is Expected to Be A Potential Market to Demand Steam Turbine for Coal-Fired Power Plant Application in 2020

Figure 9 Steam Turbines Market Size, By Type, 2015 & 2020 (USD Million)

Figure 10 Steam Turbines Market Size, By Rated Capacity, 2014

Figure 11 Steam Turbines Market Size, By Exhaust Type, 2014-2020 (USD Million)

Figure 12 Consequent Investments on Expanding Power Generation Capacities is Expected to Drive Steam Turbines Market in the Future

Figure 13 Asia-Pacific is Expected to Dominate the Steam Turbines Market By 2020

Figure 14 Steam Turbine With Rated Capacity of 351-750 Mw Dominated the Steam Turbines Market in 2014

Figure 15 Steam Cycle is Expected to Dominate the Steam Turbines Market During the Forecast Period

Figure 16 Demand for Programmable Electronic Sectionalizer is Expected to Be on A Rise During the Forecast Period

Figure 17 Condensing Type Dominated the Exhaust Type Steam Turbines Market in 2014

Figure 18 Improving Efficiency of Steam Turbines is the Top Priority of Modern Steam Turbine Designs

Figure 19 Segmentation of Steam Turbines Market

Figure 20 Segmentation of Steam Turbines Market, By Type

Figure 21 Segmentation of Steam Turbines Market, By Rated Capacity

Figure 22 Segmentation of Steam Turbines Market, By Application

Figure 23 Segmentation of the Steam Turbines Market, By Application

Figure 24 Segmentation of the Steam Turbines Market, By Region

Figure 25 Market Dynamics of Steam Turbines

Figure 26 India: Increase in GDP and Electricity Consumption, 2009-2012

Figure 27 Porters Five Forces Analysis: Intensity of Rivalry is High in the Steam Turbines Market

Figure 28 Steam Turbines: Supply Chain

Figure 29 Steam Cycle (Conventional) Steam Turbines Market Expected to Dominate the Steam Turbines Market, By Type During the Forecast Period

Figure 30 Asia-Pacific: A Potential Market for All Types of Steam Turbines

Figure 31 Asia-Pacific & Europe: Key Regions to Demand Steam Cycle Steam Turbine in the Next Five Years

Figure 32 Typical Advantages of Cogeneration

Figure 33 Key Drivers for 351-750 Mw & Above 750 Mw Segment

Figure 34 Condensing Type is Expected to Dominate the Steam Turbines Market During the Forecast Period

Figure 35 Steam Turbines Market Size, By Exhaust Type, 2013-2020 (USD Million)

Figure 36 Condensing Steam Turbines Market Size, By Region, 2013-2020 (USD Million)

Figure 37 Non-Condensing Steam Turbines Market Size, By Region, 2013-2020 (USD Million)

Figure 38 Coal Segment Expected to Dominate the Steam Turbines Market During the Forecast Period

Figure 39 Steam Turbines Market Share (Value), By Region, 2014

Figure 40 China and India are Expected to Witness Strongest Growth During the Forecast Period

Figure 41 Asia-Pacific and the Middle East & Africa are Expected to Be the Two Fastest Growing Markets During the Forecast Period

Figure 42 Regional Snapshot: Asia-Pacific Offers Attractive Market Opportunities

Figure 43 South Africa is Expected to Be A Potential Market for Steam Turbine During the Forecast Period

Figure 44 Companies Adopted Contracts & Agreements as the Key Growth Strategy, 2011-2015

Figure 45 Alstom SA Accounted for the Largest Share in the Steam Turbines Market, 2014

Figure 46 Market Evaluation Framework

Figure 47 Battle for Market Share: Contracts & Agreements is the Key Strategy

Figure 48 Regional Revenue Mix of Top 5 Market Players

Figure 49 Alstom SA: Company Snapshot

Figure 50 Alstom SA: SWOT Analysis

Figure 51 Siemens AG: Company Snapshot

Figure 52 Siemens: SWOT Analysis

Figure 53 Toshiba Corporation: Company Snapshot

Figure 54 Toshiba: SWOT Analysis

Figure 55 General Electric Company: Company Snapshot

Figure 56 General Electric Company: SWOT Analysis

Figure 57 Mitsubishi Hitachi Power Systems, Ltd: Company Snapshot

Figure 58 Mitsubishi Hitachi Power Systems, Ltd: SWOT Analysis

Figure 59 Elliott Group: Company Snapshot

Figure 60 Anslaldo Energia S.P.A.: Company Snapshot

Figure 61 Shanghai Electric Group Co. Ltd.: Company Snapshot

Figure 62 Dongfang Electric Corporation Limited: Company Snapshot

Figure 63 Harbin Electric International Company Limited: Company Snapshot

Figure 64 Doosan Skoda Power: Company Snapshot

Figure 65 Bharat Heavy Electricals Limited: Company Snapshot

Figure 66 Fuji Electric Co. Ltd.: Company Snapshot

Figure 67 Man Diesel & Turbo SE: Company Snapshot

Growth opportunities and latent adjacency in Steam Turbines Market