Heat Recovery Steam Generator Market by Rated Power (Up To 30 MW & >30 MW), by Application (Combined Cycle & CHP), by End-User (Utilities, Chemicals, Refineries, Pulp & Paper, Commercial & Others), and by Region - Global Trends & Forecast to 2020

[137 Pages Report] The heat recovery steam generator market is estimated to be USD 740.73 Million in 2015, and is expected to grow at a CAGR of 3.7%, from 2015 to 2020. increasing global electricity demand & subsequent investments in power plants will drive the heat recovery steam generator market.

The years considered for the study are as follows:

- Base Year- 2014

- Estimated Year- 2015

- Projected Year- 2020

- Forecast Period- 2015 to 2020

The year 2014 has been considered as the base year for company profiles. Where information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the heat recovery steam generator market by well type, application, weight and region, in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the heat recovery steam generator

- To strategically analyze the heat recovery steam generator market with respect to individual growth trends, future prospects, and the contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions and investments, new product launches, and mergers & acquisitions in the heat recovery steam generator market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the heat recovery steam generator market. Primary sources are mainly industry experts from core and related industries, technical, market-oriented, standards and certification organizations of companies, and organizations related to all the segments of this industry’s value chain. The points given below explain the research methodology.

- Study of the annual revenues and market developments of the major players that provide heat recovery steam generator to end-user companies

- Analysis of natural gas-fired power plant upgrade and commissioning across various regions

- Assessment of heat recovery steam generator provisions of key operating companies and analysing their spending patterns

- Study of the market trends in various regions and countries with regard to heat recovery steam generator

- Study of the contracts and developments related to the pump jack market by key players across different regions

- Finalization of market size by triangulating the supply-side and demand-side data, which includes product developments, supply chain, and annual revenues of heat recovery steam generator companies across the globe

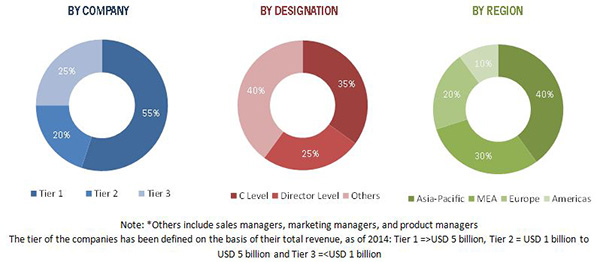

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries, on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

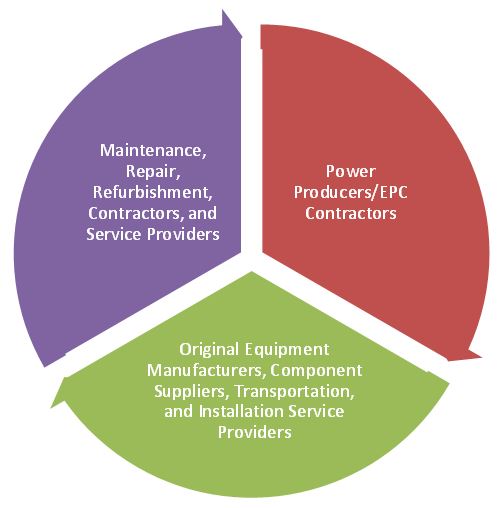

The ecosystem of the heat recovery steam generator market consists of pipes and tubes, among others. In the later stage, assembling of the generator takes place where all the components are integrated. This equipment below shows the distributed to power plants or other industries where they are commissioned.

The heat recovery steam generator providing companies that provides Installation, Maintenance, and transportation services includes General Electric Company (U.S.), Siemens AG (Germany), Amec Foster Wheeler Plc (U.K.), Babcock & Wilcox Company (U.S.), Doosan Engineering & Construction Co., Ltd. (South Korea) among others, are the end-users in the heat recovery steam generator market.

Target Audience:

The report’s target audience includes:

- Heat recovery steam generator manufacturers

- Suppliers of parts and components to the heat recovery steam generator industry

- Manufacturers and equipment-user’s associations and groups

- Public and private operators of CHP plants and CCPPs

- Government and research organizations

- Consulting companies in energy & power

- Shareholders and investors

- Investment banks

Scope of the Report:

By Application

- Combined cycle

- CHP

By Rated Power

- Up to 30 MW

- >30 MW

By End-User

- Utilities

- Chemicals

- Refineries

- Pulp & Paper

- Commercial

- Others

By Region

- North America

- Asia-Pacific

- Europe

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region and country-specific analysis

Company Information

Detailed analyses and profiling of additional market players (up to five)

The global heat recovery steam generator market is projected to grow at a CAGR of 3.7% from 2015 to 2020 to reach USD 888.20 Million by 2020. Increasing global electricity demand, subsequent investments in power plants, increasing efforts to reduce global greenhouse gas emissions, and growing adoption of CCPP & CHP are the factors driving the heat recovery steam generator market.

Applications of heat recovery steam generators are not limited to use in CCPP and CHP plants alone. They are also used in biomass and integrated solar combined cycle (ISCC) power plants.

The report segments the heat recovery steam generator market on the basis of its application in various end-user industries, which include utilities, chemicals, refineries, pulp & paper, commercial, and other industries. Based on its rated power, the heat recovery steam generator market has been categorized in the following MW ranges, namely, up to 30 MW and >30 MW. The market has also been categorized on the basis of application into combined cycle and CHP.

The CHP segment accounted for more than 50% of the total market share in 2014. Cogeneration or CHP is a technology through which electricity and heat are simultaneously produced. It is highly efficient and can achieve primary energy savings by nearly 40%. Moreover, it is installed close to the end-user, which would help in reducing T&D losses. The typical recoverable temperature ranges from 90oC to 400oC, which are used for district heating or cooling and other factory processes.

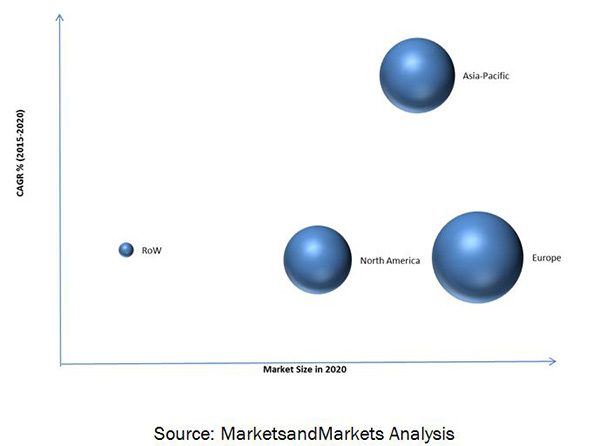

In this report, the heat recovery steam generator market has been analyzed with respect to four regions, namely, Europe, Asia-Pacific, North America, and Rest of the World (RoW). The European region is currently the largest market, followed by Asia-Pacific and North America. Europe would continue to dominate the market, as it has the highest number of CHP plants in the world, and Asia-Pacific is expected to grow at the fastest pace. Factors such as urbanization, industrialization, and fast economic growth necessitates huge requirement for electric power in various countries in the Asia-Pacific region, which demands development of new power plants, especially gas-fired ones; this in turn would increase the demand for heat recovery steam generators. The figure below shows the market sizes for all the regions from 2015 to 2020.

The demand for heat recovery steam generators can be directly linked to the development in CCPP and CHP plants. However, some operators still prefer open or simple cycle power plants as they are less complex, less expensive, and faster to construct. They also require considerably less space and equipment for operation when compared to CCPP. Most importantly, they do not require heat recovery steam generators. This is the major restraint of the market growth. Apart from that, problems associated with flow accelerated corrosion in heat recovery steam generators are also restraining the growth in the market.

Some of the leading players in the heat recovery steam generator market include General Electric Company (U.S.), Siemens AG (Germany), Amec Foster Wheeler plc. (U.K.), Babcock & Wilcox Company (U.S.), CMI Group (Belgium), and Doosan Engineering & Construction Co., Ltd. (South Korea), among others. Contracts & agreements was the most common strategy adopted by top players in the market, constituting more than three quarters of the total development share. It was followed by expansions and mergers & acquisitions.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 25)

3.1 Introduction

3.2 Historical Backdrop & Evolution

3.3 Current Scenario

3.4 Future Outlook

3.5 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities

4.2 Heat Recovery Steam Generator Market, By End-User, 2015-2020

4.3 Heat Recovery Steam Generator Market, Application vs Power Rating

4.4 Europe Held the Largest Market Share (By Value) in 2014

4.5 Heat Recovery Steam Generator Market: Developed vs Developing Nations, 2015-2020

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Heat Recovery Steam Generator Market: By Rated Power

5.2.2 Heat Recovery Steam Generator Market: By Application

5.2.3 Heat Recovery Steam Generator Market: By End-User

5.2.4 Heat Recovery Steam Generator Market: By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Efforts to Reduce Global Greenhouse Gas Emissions & Growing Adoption of Ccpps and CHP

5.3.1.2 Economic Benefits of Implementing the Heat Recovery Steam Generator

5.3.1.3 Increasing Global Electricity Demand & Subsequent Investments in Power Plants

5.3.2 Restraints

5.3.2.1 Problems Associated With Flow Accelerated Corrosion

5.3.3 Opportunities

5.3.3.1 Investments in Ccpp & CHP Plants in the Middle East & Africa

5.3.3.2 Conversion of Simple Cycle Power Plants to Ccpps

5.3.4 Challenges

5.3.4.1 Growing Focus on Renewable Sources for Power Generation

5.4 Supply Chain Analysis

5.5 Porter’s Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Heat Recovery Steam Generator Market, By Rated Power (MW) (Page No. - 50)

6.1 Introduction

6.2 Heat Recovery Steam Generator With Rated Power Up to 30 MW

6.3 Heat Recovery Steam Generator With Rated Power >30 MW

7 Heat Recovery Steam Generator Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Combined Heat & Power

7.3 Combined Cycle

8 Heat Recovery Steam Generator Market, By End-User (Page No. - 58)

8.1 Introduction

8.2 Utilities

8.3 Chemicals

8.4 Refineries

8.5 Pulp & Paper

8.6 Commercial

8.7 Others

9 Heat Recovery Steam Generator Market, By Region (Page No. - 72)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.3 Europe

9.3.1 U.K.

9.3.2 Russia

9.3.3 Germany

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Rest of World

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Contracts & Agreements

10.4 Expansion

10.5 Mergers & Acquisitions

11 Company Profiles (Page No. - 101)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 General Electric Company

11.3 Siemens AG

11.4 AMEC Foster Wheeler PLC

11.5 Babcock & Wilcox Company

11.6 Doosan Engineering & Construction Co., Ltd.

11.7 Thermax Limited

11.8 Cleaver Brooks

11.9 CMI Group

11.10 Greens Power Limited

11.11 Kelvion Holding Gmbh

11.12 Nooter/Eriksen, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 127)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Developments

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (70 Tables)

Table 1 Growing Adoption of Ccpps and CHP Plants is A Key Factor Driving the Heat Recovery Steam Generator Market

Table 2 Problems Associated With Flow Accelerated Corrosion is Restraining the Growth of the Heat Recovery Steam Generator Market

Table 3 Simple Cycle to Ccpp Conversion is an Opportunity in this Market

Table 4 The Focus on Renewable Sources for Power Generation is A Challenge for the Heat Recovery Steam Generator Market

Table 5 By Market Size, By Rated Power, 2013–2020 (USD Million)

Table 6 Heat Recovery Steam Generator: Rated Power > 30 MW Market Size, By Application, 2013-2020 (USD Million)

Table 7 By Market Size, By Application, 2013-2020, (USD Million)

Table 8 Heat Recovery Steam Generator: Combined Heat & Power Market Size, By Rated Power, 2013-2020 (USD Million)

Table 9 Heat Recovery Steam Generator: Combined Heat & Power Market Size, By Region, 2013-2020 (USD Million)

Table 10 Heat Recovery Steam Generator: Combined Cycle Market Size, By Region, 2013-2020 (USD Million)

Table 11 Heat Recovery Steam Generator Market Size, By End-User, 2013–2020 (USD Million)

Table 12 Heat Recovery Steam Generator: Utilities Market Size, By Application, 2013–2020 (USD Million)

Table 13 Heat Recovery Steam Generator: Utilities Market Size, By Rated Power, 2013-2020 (USD Million)

Table 14 Heat Recovery Steam Generator: Utilities Market Size, By Region, 2013-2020 (USD Million)

Table 15 Heat Recovery Steam Generator: Utilities Market Size, By Country, 2013-2020 (USD Million)

Table 16 Heat Recovery Steam Generator: Chemicals Market Size, By Rated Power, 2013-2020 (USD Million)

Table 17 Heat Recovery Steam Generator: Chemicals Market Size, By Region, 2013-2020 (USD Million)

Table 18 Heat Recovery Steam Generator: Chemicals Market Size, By Country, 2013-2020 (USD Million)

Table 19 Heat Recovery Steam Generator: Refineries Market Size, By Rated Power, 2013–2020 (USD Million)

Table 20 Heat Recovery Steam Generator: Refineries Market Size, By Region, 2013-2020 (USD Million)

Table 21 Heat Recovery Steam Generator: Refineries Market Size, By Country, 2013-2020 (USD Million)

Table 22 Heat Recovery Steam Generator: Pulp & Paper Market Size, By Rated Power, 2013–2020 (USD Million)

Table 23 Heat Recovery Steam Generator: Pulp & Paper Market Size, By Region, 2013-2020 (USD Million)

Table 24 Heat Recovery Steam Generator: Pulp & Paper Market Size, By Country, 2013-2020 (USD Million)

Table 25 Heat Recovery Steam Generator: Commercial Market Size, By Rated Power, 2013–2020 (USD Million)

Table 26 Heat Recovery Steam Generator: Commercial Market Size, By Region, 2013-2020 (USD Million)

Table 27 Heat Recovery Steam Generator: Commercial Market Size, By Country, 2013-2020 (USD Million)

Table 28 Heat Recovery Steam Generator: Others Market Size, By Rated Power, 2013–2020 (USD Million)

Table 29 Heat Recovery Steam Generator: Others Market Size, By Region, 2013-2020 (USD Million)

Table 30 Heat Recovery Steam Generator: Others Market Size, By Country, 2013-2020 (USD Million)

Table 31 Heat Recovery Steam Generator Market Size, By Region, 2013–2020 (USD Million)

Table 32 Asia-Pacific: By Market Size, By Country, 2013–2020 (USD Million)

Table 33 Asia-Pacific: By Market Size, By Application, 2013–2020 (USD Million)

Table 34 Asia-Pacific: By Market Size, By End-User, 2013–2020 (USD Million)

Table 35 Asia-Pacific: Heat Recovery Steam Generator Utilities Market Size, By Country, 2013-2020 (USD Million)

Table 36 Asia-Pacific: Heat Recovery Steam Generator Chemicals Market Size, By Country, 2013-2020 (USD Million)

Table 37 Asia-Pacific: Heat Recovery Steam Generator Refineries Market Size, By Country, 2013-2020 (USD Million)

Table 38 Asia-Pacific: Heat Recovery Steam Generator Pulp & Paper Market Size, By Country, 2013-2020 (USD Million)

Table 39 Asia-Pacific: Heat Recovery Steam Generator Commercial Market Size, By Country, 2013-2020 (USD Million)

Table 40 China: By Market Size, By End-User, 2013–2020 (USD Million)

Table 41 India: By Market Size, By End-User, 2013–2020 (USD Million)

Table 42 Japan: By Market Size, By End-User, 2013–2020 (USD Million)

Table 43 Europe: By Market Size, By Country, 2013–2020 (USD Million)

Table 44 Europe: By Market Size, By Application, 2013–2020 (USD Million)

Table 45 Europe: By Market Size, By End-User, 2013–2020 (USD Million)

Table 46 Europe: Heat Recovery Steam Generator Utilities Market Size, By Country, 2013-2020 (USD Million)

Table 47 Europe: Heat Recovery Steam Generator Chemicals Market Size, By Country, 2013-2020 (USD Million)

Table 48 Europe: Heat Recovery Steam Generator Refineries Market Size, By Country, 2013-2020, (USD Million)

Table 49 Europe: Heat Recovery Steam Generator Pulp & Paper Market Size, By Country, 2013-2020 (USD Million)

Table 50 Europe: Heat Recovery Steam Generator Commercial Market Size, By Country, 2013-2020 (USD Million)

Table 51 U.K.: By Market Size, By End-User, 2013-2020 (USD Million)

Table 52 Russia: By Market Size, By End-User, 2013-2020 (USD Million)

Table 53 Germany: By Market Size, By End-User, 2013–2020 (USD Million)

Table 54 North America: By Market Size, By Country, 2013–2020 (USD Million)

Table 55 North America: By Market Size, By Application, 2013–2020 (USD Million)

Table 56 North America: By Market Size, By End-User, 2013–2020 (USD Million)

Table 57 North America: Heat Recovery Steam Generator Utilites Market Size, By Country, 2013-2020 (USD Million)

Table 58 North America: Heat Recovery Steam Generator Chemicals Market Size, By Country, 2013-2020 (USD Million)

Table 59 North America: Heat Recovery Steam Generator Refineries Market Size, By Country, 2013-2020 (USD Million)

Table 60 North America: Heat Recovery Steam Generator Pulp & Paper Market Size, By Country, 2013-2020 (USD Million)

Table 61 North America: Heat Recovery Steam Generator Commercials Market Size, By Country, 2013-2020 (USD Million)

Table 62 U.S.: By Market Size, By End-User, 2013–2020 (USD Million)

Table 63 Canada: By Market Size, By End-User, 2013–2020 (USD Million)

Table 64 Mexico: By Market Size, By End-User, 2013–2020 (USD Million)

Table 65 Rest of the World: By Market Size, By Application, 2013–2020 (USD Million)

Table 66 Contracts & Agreements, 2014–2016

Table 67 Expansions, 2013–2015

Table 68 Mergers & Acquisitions, 2011–2015

Table 69 Contracts & Agreements, 2012 - 2015

Table 70 New Product Launches, 2013 - 2014

List of Figures (59 Figures)

Figure 1 Heat Recovery Steam Generator Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Evolution of Heat Recovery Steam Generators

Figure 7 Europe Dominated the Heat Recovery Steam Generator Market in 2014

Figure 8 Europe is A Potential Market for Heat Recovery Steam Generators

Figure 9 Combined Cycle is the Largest Segment, By Application, 2015–2020

Figure 10 Heat Recovery Steam Generator Market Size, By Rated Capacity, 2015-2020 (USD Million)

Figure 11 The Utilities Segment is Likely to Dominate the Heat Recovery Steam Generator During the Forecast Period

Figure 12 Siemens AG Was the Most Active Company in Terms of Market Developments From 2012 to 2015

Figure 13 Upcoming Combined Cycle Power Plant, CHP, & Simple Cycle to Combined Cycle Power Plant Conversion Projects Offer Lucrative Opportunities

Figure 14 The Commercial Sector is Expected to Grow at the Highest Rate in the Global Market During the Forecast Period

Figure 15 The Combined Cycle Application & >30 MW Rated Power Segment are Estimated to Hold the Largest Market Shares in 2015

Figure 16 The Heat Recovery Steam Generator Market in Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Developing Economies in Asia-Pacific are Expected to Grow at the Fastest Rate During the Forecast Period

Figure 18 The Heat Recovery Steam Generator Market in Asia-Pacific is Expected to Grow at the Highest Rate During the Forecast Period

Figure 19 Heat Recovery Steam Generator Market Segmentation

Figure 20 Heat Recovery Steam Generator Market: By Rated Power

Figure 21 Heat Recovery Steam Generator Market: By Application

Figure 22 Heat Recovery Steam Generator Market: By End-User

Figure 23 Heat Recovery Steam Generator Market: By Region

Figure 24 Increasing Use of CCPPS and CHP to Propel the Heat Recovery Steam Generator Market

Figure 25 Global Co2 Emissions From Fossil Fuel Use and Cement Production, 1994–2014

Figure 26 Electric Power Consumption and Urban Population Growth, 1992–2002

Figure 27 Electricity Production From Renewable Sources, Excluding Hydroelectric (Kwh), 1992–2002

Figure 28 Supply Chain Analysis: Heat Recovery Steam Generator Market

Figure 29 Porter’s Five Forces Analysis: Heat Recovery Steam Generator Market

Figure 30 The Rated Power > 30 MW Segment is Expected to Dominate the Market During the Forecast Period

Figure 31 Heat Recovery Steam Generator: Rated Power Up to 30 MW Market Size, , 2013-2020 (USD Million)

Figure 32 Heat Recovery Steam Generator: Combined Cycle Market Size, By Rated Power, 2013-2020 (USD Million)

Figure 33 The Utilities Segment is Estimated to Account for the Largest Market Share (Value) in 2015

Figure 34 Heat Recovery Steam Generator: Chemicals Market Size, By Application, 2013-2020 (USD Million)

Figure 35 Heat Recovery Steam Generator: Refineries Market Size, By Application, 2013-2020 (USD Million)

Figure 36 Heat Recovery Steam Generator: Pulp & Paper Market Size, By Application, 2013-2020 (USD Million)

Figure 37 Heat Recovery Steam Generator: Commercial Market Size, By Application, 2013-2020 (USD Million)

Figure 38 Heat Recovery Steam Generator: Others Market Size, By Application, 2013-2020 (USD Million)

Figure 39 Regional Snapshot (2014): Growing Markets are Emerging as New Hot Spots

Figure 40 Heat Recovery Steam Generator Market Size, By Region, 2015–2020 (USD Million)

Figure 41 Asia-Pacific: By Market Overview

Figure 42 Europe: Market Overview

Figure 43 Companies Adopted Contracts & Agreements as the Key Growth Strategy From 2012 to 2015

Figure 44 Battle for Market Share: Contracts & Agreements Was the Key Strategy Adopted By Top Players, From 2012 to 2015

Figure 45 Market Leaders Based on Recent Developments, From 2012 to 2015

Figure 46 Market Evolution Framework: Contracts & Agreements Supplemented the Market Growth, From 2012 to 2015

Figure 47 Regional Mix of the Top Players

Figure 48 General Electric Company: Company Snapshot

Figure 49 General Electric Company: SWOT Analysis

Figure 50 Siemens AG: Company Snapshot

Figure 51 Siemens AG: SWOT Analysis

Figure 52 AMEC Foster Wheeler PLC: Company Snapshot

Figure 53 AMEC Foster Wheeler PLC: SWOT Analysis

Figure 54 Babcock & Wilcox Company: Company Snapshot

Figure 55 Babcock & Wilcox Company: SWOT Analysis

Figure 56 Doosan Engineering & Construction Co., Ltd.: Company Snapshot

Figure 57 Doosan Engineering & Construction Co., Ltd.: SWOT Analysis

Figure 58 Thermax Limited: Company Snapshot

Figure 59 CMI Group: Company Snapshot

Growth opportunities and latent adjacency in Heat Recovery Steam Generator Market