Gas Turbine Market by Technology (Open Cycle and Combined Cycle), Design Type (Heavy Duty and Aeroderivative), End User (Power Generation, Oil & Gas), Rated Capacity (1–40 MW, 40–120 MW, 120–300 MW, Above 300 MW) and Region - Global Forecast to 2026

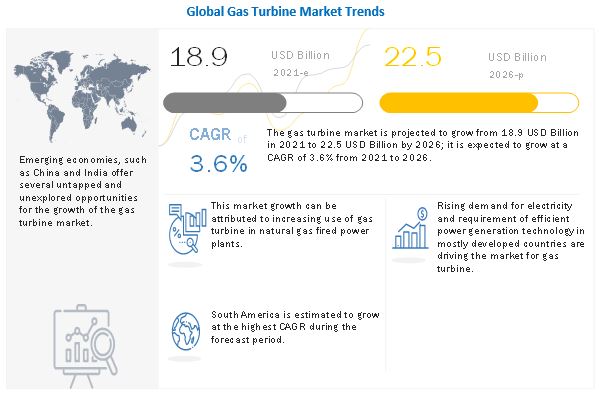

[231 Pages Report] The global gas turbine market in terms of revenue was estimated to be worth $18.9 Billion in 2021 and is projected to reach $22.5 Billion by 2026, growing at a CAGR of 3.6% from 2021 to 2026. Gas turbines are majorly used for power generation. However, they are also used for mechanical drive purposes and in jet engines.

To know about the assumptions considered for the study, Request for Free Sample Report

Gas Turbine Market Dynamics

Driver: Rising demand for electricity

Growing industrialization and increasing use of electrical appliances-because of rising economic activities in developing countrieshave escalated electricity demand. According to the Ministry of Statistics and Program Implementation Government of India, electricity production from utilities increased from 13, 03,493 GWh during 2017–2018 to 13,71,779 GWh during 2018-2019, registering an annual growth of about 5.24%. Thus, the strict emission norms followed by developed nations and growing demand for electricity are expected to drive the installation of natural gas power plants, as natural gas emits less carbon dioxide.

Opportunity: Increased trend of distributed power generation

Electricity was previously delivered through small power plants with low voltage DC-based power distribution. Distributed generation can be used for electric supply and mechanical work (providing torque to move objects). The higher efficiency of gas turbines and reliable generation capacity give them an edge over other distributed generation technologies for providing backup power and onsite generation needs. Hence, the rise of distributed power generation represents a major opportunity for the gas turbines market.

Challenge: Shifting focus toward renewable energy

According to the BP Statistical Review of World Energy June 2017, total global natural gas reserves are 186.6 trillion cubic meters, which are enough to last for 55 years at the current consumption rate. If the US starts exporting natural gas to other markets, the reserve to production ratio would significantly decline. At the current production rate, the supply of global natural gas is sufficient to last for only half the time as that of coal, despite coal production and consumption being much higher in the fast-growing economies of Asia Pacific. Solar and wind power plants act as clean sources of energy. Investment in renewable energy is expected to impact fossil-fired power plants. Therefore, limited natural gas reserves pose a challenge to the gas turbines market.

By design type, aeroderivative segment is expected to grow at a faster rate during 2021-2026

Aeroderivative gas turbine market is expected to grow at a faster rate during the forecast period. The design for aeroderivative gas turbines is based on aircraft engines or aviation gas turbines. Compared to heavy duty gas turbines, aeroderivative gas turbines weigh less, are easy to install, and are faster to start up.

By rated capacity, above 300MW is expected to grow at a faster rate during the forecast period of 2021 to 2026

Lower emission and more power is expected to drive the gas turbine market for this segment. A combined cycle refers to the combination of multiple cycles to generate power. They have lower total emissions since the exhaust is utilized for other operational purposes.

By technology, combined cycle segment is expected to grow at a faster rate during the forecast period of 2021 to 2026

Replacement of old coal-fired power generation capacity is expected to drive the growth for this segment. Gas turbines with a rated capacity of above 300 MW exclusively serve large capacity combined cycle power plants. This segment constitutes the most expensive and largest gas turbines currently available.

By end user, the power generation segment is expected to lead the market during the forecast period

The power generation segment is projected to lead the market during 2021-2026. Gas turbine power plants are widely used as medium-sized peak load plants used to run intermittently during short durations of high power demand on an electric system. They are also used as cogeneration plants for industrial plants with high heat load and district heating schemes.

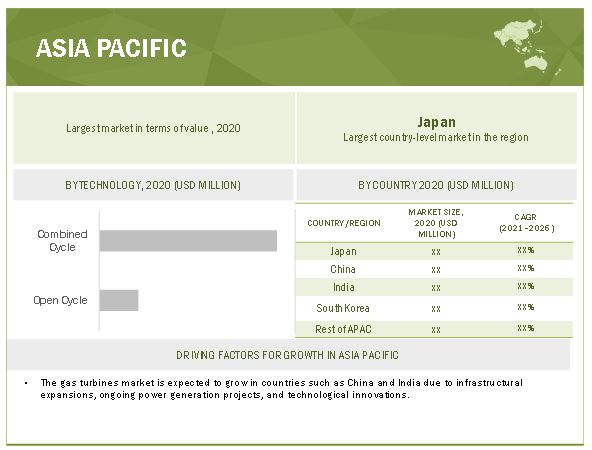

Asia Pacific dominated the gas turbine market in 2020

Asia Pacific dominated the global gas turbines market share, in terms of value, in 2020. Investment in new large gas-fired combined cycle power generation plants and large coal-fired plants, along with rising electricity demand, is expected to drive the Asia Pacific gas turbine market growth. Also, the growth is expected due to rapid regional industrialization, urbanization, and economic growth, leading to the installation of new power plants in various emerging economies.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key gas turbine industry players include Kawasaki Heavy Industries, Ltd. (Japan), Siemens Energy (Germany), Capstone Green Energy Corporation (US), General Electric (US), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), United Engine Corporation (Russia), Rolls-Royce plc (England), Harbin Electric Machinery Company Limited (China), OPRA Turbines (Netherlands), Solar Turbines Incorporated (US), Bharat Heavy Electricals Limited (India), Centrax Gas Turbine (England), MTU Aero Engines AG (Germany), IHI Corporation (Japan), Wartsila (Finland), Doosan Heavy Industries & Construction (South Korea), MAPNA Group (Iran), Vericor Power Systems (US), Zorya Mashproekt (Ukraine), MAN Energy Solutions (Germany). These players have adopted product launches, contracts, partnerships, agreements, collaborations, Memorandum of Understanding (MoU), and joint ventures as their growth strategies.

Gas Turbine Market Report Scope

|

Report Attributes |

Details |

|

Market size: |

USD 18.9 Billion in 2021 to USD 22.5 Billion by 2026 |

|

Growth Rate: |

3.6% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2021-2026 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Gas Turbine Market by Design Type, End User, Technology, Rated Capacity, and Region |

|

Geographies Covered: |

Asia Pacific, North America, Europe, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Increased trend of distributed power generation |

|

Key Market Drivers: |

Increasing demand for natural gas-fired power plants |

This research report categorizes the gas turbines market based on design type, end user, technology, rated capacity, and region.

Based on Design Type

The market has been segmented as follows:

- Heavy duty (frame)

- Aeroderivative

Based on Backing Material

The market has been segmented as follows:

- Power Generation

- Oil & gas

- Other industrial (mechanical drive processes in the steel, aluminum, and manufacturing industries)

Based on Technology

The market has been segmented as follows:

- Open Cycle

- Combined Cycle

Based on Rated Capacity

The market has been segmented as follows:

- 1–40 MW

- 40–120 MW

- 120–300 MW

- Above 300 MW

Based on Region

The market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments:

- In October 2019, GE launched 7HA.03, the newest version of its HA gas turbine, to power FPL's Dania Beach Clean Energy Center in Fort Lauderdale, Florida.

- In June 2021, OPRA Turbines signed an agreement with Quanta. This partnership enabled Quanta to become a reseller for OPRA Turbines in the offshore oil & gas segment in the North Sea region.

FAQs

What is the current size of the global gas turbine market?

The global gas turbine market size was valued at USD 18.9 Billion in 2021 and is projected to reach USD 22.5 Billion by 2026, at a CAGR of 3.6% during the forecast period.

Who are the leading players in the global gas turbine market?

The leading companies in the gas turbine market include Kawasaki Heavy Industries, Ltd. (Japan), Siemens Energy (Germany), Capstone Green Energy Corporation (US), General Electric (US), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), United Engine Corporation (Russia), Rolls-Royce plc (England), Harbin Electric Machinery Company Limited (China), OPRA Turbines (Netherlands), Solar Turbines Incorporated (US), Bharat Heavy Electricals Limited (India), Centrax Gas Turbine (England), MTU Aero Engines AG (Germany), IHI Corporation (Japan), Wartsila (Finland), Doosan Heavy Industries & Construction (South Korea), MAPNA Group (Iran), Vericor Power Systems (US), Zorya Mashproekt (Ukraine), MAN Energy Solutions (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 GAS TURBINES MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 RESEARCH LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 GAS TURBINE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR GAS TURBINE

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 GAS TURBINES MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 GAS TURBINE MARKET SNAPSHOT

FIGURE 8 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2020

FIGURE 9 COMBINED CYCLE SEGMENT IS EXPECTED TO LEAD MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 10 POWER GENERATION WAS LARGEST END-USER SEGMENT FOR GAS TURBINES IN 2020

FIGURE 11 GAS TURBINES OF ABOVE 300 MW RATING CAPACITY ARE EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 SIGNIFICANT OPPORTUNITIES IN GAS TURBINE MARKET

FIGURE 12 REPLACEMENT OF PHASED NUCLEAR & COAL POWER PLANTS ALONG WITH REQUIREMENT OF EFFICIENT POWER GENERATION TECHNOLOGY IS EXPECTED TO DRIVE MARKET GROWTH

4.2 GAS TURBINES MARKET, BY REGION

FIGURE 13 MARKET IN SOUTH AMERICA IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 14 COMBINED CYCLE SEGMENT HELD LARGEST SIZE OF MARKET IN 2020

4.4 MARKET, BY DESIGN TYPE

FIGURE 15 HEAVY DUTY SEGMENT DOMINATED MARKET IN 2020

4.5 MARKET, BY RATED CAPACITY

FIGURE 16 ABOVE 300 MW SEGMENT DOMINATED MARKET IN 2020

4.6 MARKET, BY END-USER

FIGURE 17 POWER GENERATION SEGMENT DOMINATED MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS FOR GAS TURBINE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for natural gas-fired power plants

FIGURE 19 NATURAL GAS CONSUMPTION, 2017–2019

5.2.1.2 Rising demand for electricity

FIGURE 20 GLOBAL ELECTRICITY GENERATION, 2016–2020

FIGURE 21 ELECTRICITY GENERATION OF SOME MAJOR COUNTRIES, 2016–2020

FIGURE 22 ELECTRICITY GENERATION BY NATURAL GAS OF SOME MAJOR COUNTRIES

5.2.1.3 Efficient power generation technology

5.2.1.4 Reduction in emission of carbon dioxide

5.2.1.5 Impact of shale gas

FIGURE 23 IMPACT OF DRIVERS ON GAS TURBINE MARKET

5.2.2 RESTRAINTS

5.2.2.1 Natural gas price volatility

5.2.2.2 Natural gas infrastructure concerns

FIGURE 24 IMPACT OF RESTRAINTS ON GAS TURBINES MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increased trend of distributed power generation

5.2.3.2 Replacement of phased out nuclear & coal plants

FIGURE 25 US: NATURAL GAS EXPORT, 2016–2020

FIGURE 26 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Shifting focus toward renewable energy

5.2.4.2 Impact of COVID-19 on market

FIGURE 27 IMPACT OF CHALLENGES ON MARKET

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 28 GAS TURBINE MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM/MARKET MAP

FIGURE 29 GAS TURBINES MARKET: ECOSYSTEM/MARKET MAP

5.5 PRICING ANALYSIS

TABLE 3 AVERAGE PRICE OF GAS TURBINE, BY TECHNOLOGY

FIGURE 30 INSTALLED COST FOR GAS TURBINE

5.6 CASE STUDY ANALYSIS

5.6.1 CASE STUDY 1

5.6.1.1 2 MS6001B Gas turbine & GTE EcoValue 400i Water Wash System

5.6.2 CASE STUDY 2

5.6.2.1 CHP System for a Chemical Manufacturer: 30 MW-class CHP System with Green Gas Turbine for Chemical Manufacturing

5.7 IMPACT OF COVID-19 ON SUPPLY CHAIN

5.8 VALUE CHAIN

FIGURE 31 GAS TURBINE MARKET: VALUE CHAIN

5.9 REGULATORY LANDSCAPE

5.1 TECHNOLOGY ANALYSIS

5.10.1 NEW REDUCED EMISSIONS

5.10.2 NEW TURBINES

5.10.3 ADAPTING TO AN EXTENDED FUEL SPECTRUM

5.11 TRADE DATA

5.11.1 GAS TURBINE IMPORT DATA

5.11.2 GAS TURBINE EXPORT DATA

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 DOCUMENT TYPE

FIGURE 32 NUMBER OF GRANTED PATENT, PATENT APPLICATION, AND LIMITED PATENT

FIGURE 33 PUBLICATION TRENDS - LAST 10 YEARS

5.13 INSIGHT

5.13.1 LEGAL STATUS OF THE PATENTS

FIGURE 34 LEGAL STATUS OF THE PATENTS

5.13.2 JURISDICTION ANALYSIS

FIGURE 35 TOP JURISDICTION- BY DOCUMENT

5.13.3 TOP COMPANIES/APPLICANTS

FIGURE 36 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 4 LIST OF PATENTS BY UNITED TECHNOLOGIES CORP

TABLE 5 LIST OF PATENTS BY GEN ELECTRIC

TABLE 6 LIST OF PATENTS BY SIEMENS AG

TABLE 7 TOP 10 PATENT OWNERS (US) IN LAST 10 Y EARS

6 GAS TURBINE MARKET, BY DESIGN TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 37 HEAVY DUTY SEGMENT TO LEAD GAS TURBINES MARKET DURING FORECAST PERIOD

TABLE 8 MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 9 MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

6.2 HEAVY DUTY

6.2.1 INCREASED NUMBER OF GAS-FIRED POWER PLANTS TO ENHANCE DEMAND FOR HEAVY DUTY SEGMENT

TABLE 10 HEAVY DUTY: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 HEAVY DUTY: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 AERODERIVATIVE

6.3.1 DEMAND FOR HIGHLY EFFICIENT SIMPLE CYCLE GAS TURBINES IS EXPECTED TO PROPEL DEMAND

TABLE 12 AERODERIVATIVE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 AERODERIVATIVE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 GAS TURBINE MARKET, BY TECHNOLOGY (Page No. - 81)

7.1 INTRODUCTION

FIGURE 38 COMBINED CYCLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 14 MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 15 MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 OPEN CYCLE

7.2.1 LOW COST AND LESSER SPACE REQUIREMENT OF OPEN CYCLE GAS TURBINE IS EXPECTED TO ENHANCE DEMAND OF SEGMENT

TABLE 16 OPEN CYCLE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 OPEN CYCLE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 COMBINED CYCLE

7.3.1 MORE POWER AND LOWER EMISSION WILL DRIVE MARKET FOR THIS SEGMENT

TABLE 18 COMBINED CYCLE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 COMBINED CYCLE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 GAS TURBINE MARKET, BY RATED CAPACITY (Page No. - 85)

8.1 INTRODUCTION

FIGURE 39 ABOVE 300 MV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 20 MARKET SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 21 MARKET SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

8.2 1–40 MW

8.2.1 INCREASING INVESTMENT IN DISTRIBUTED POWER GENERATION IS EXPECTED TO ENHANCE DEMAND FOR SEGMENT

TABLE 22 1–40 MW: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 1–40 MW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 40–120 MW

8.3.1 INCREASED COGENERATION APPLICATIONS IN CHP PLANTS WILL ENHANCE MARKET SEGMENT

TABLE 24 40–120 MW: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 40–120 MW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 120–300 MW

8.4.1 GROWING DEMAND FOR COMBINED CYCLE POWER PLANTS IS EXPECTED TO ENHANCE DEMAND

TABLE 26 120–300 MW: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 120–300 MW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 ABOVE 300 MW

8.5.1 REPLACEMENT OF OLD COAL-FIRED POWER GENERATION CAPACITY WILL BE DRIVING FACTOR FOR SEGMENT

TABLE 28 ABOVE 300 MW: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 ABOVE 300 MW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 GAS TURBINE MARKET, BY END-USER (Page No. - 91)

9.1 INTRODUCTION

FIGURE 40 POWER GENERATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 30 MARKET SIZE, BY END-USER, 2017–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY END-USER, 2021–2026 (USD MILLION)

9.2 POWER GENERATION

9.2.1 GROWING ELECTRICITY DEMAND IS EXPECTED TO ENHANCE DEMAND FOR GAS TURBINES IN POWER GENERATION

TABLE 32 POWER GENERATION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 POWER GENERATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 OIL & GAS

9.3.1 VARIOUS APPLICATION OF GAS TURBINE IN OIL & GAS INDUSTRY IS EXPECTED TO FUEL DEMAND FOR SEGMENT

TABLE 34 OIL & GAS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 OIL & GAS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 OTHER INDUSTRIES

TABLE 36 OTHER INDUSTRIES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 OTHER INDUSTRIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 GAS TURBINE MARKET, BY REGION (Page No. - 97)

10.1 INTRODUCTION

FIGURE 41 REGIONAL SNAPSHOT: RAPID GROWTH IN DEVELOPING MARKETS

TABLE 38 GAS TURBINE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 42 ASIA PACIFIC MARKET SNAPSHOT

TABLE 40 ASIA PACIFIC: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 41 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 42 ASIA PACIFIC: MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 43 ASIA PACIFIC: MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

TABLE 44 ASIA PACIFIC: GAS TURBINES MARKET SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 45 ASIA PACIFIC: GAS TURBINE SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

TABLE 46 ASIA PACIFIC: MARKET SIZE, BY END–USER, 2017–2020 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET SIZE, BY END–USER, 2021–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY COUNTRY 2017–2020 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY COUNTRY 2021–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Increase in electricity demand is driving growth of gas turbines market

TABLE 50 CHINA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 51 CHINA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2.2 INDIA

10.2.2.1 India is moving towards a hydrogen economy, driving growth of gas turbines market

TABLE 52 INDIA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 53 INDIA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2.3 JAPAN

10.2.3.1 Japan's increase in natural gas consumption drives gas turbines market

TABLE 54 JAPAN: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 55 JAPAN: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Natural gas consumption is expected to increase due to increased electricity

TABLE 56 SOUTH KOREA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 57 SOUTH KOREA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.2.5 REST OF ASIA PACIFIC

TABLE 58 REST OF ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 59 REST OF ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 43 EUROPE: MARKET SNAPSHOT

TABLE 60 EUROPE: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

TABLE 64 EUROPE: GAS TURBINE SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 65 EUROPE: GAS TURBINES MARKET SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY END–USER, 2017–2020 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY END–USER, 2021–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY COUNTRY 2017–2020 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY COUNTRY 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increase in demand for new gas-fired power plant capacity, expected to drive gas turbines market in Germany

TABLE 70 GERMANY: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 71 GERMANY: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Focus on renewables and natural gas-driven energy drives demand for gas turbine

TABLE 72 UK: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 73 UK: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3.3 ITALY

10.3.3.1 Natural gas being one of the major sources of power generation, is expected to drive market

TABLE 74 ITALY: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 75 ITALY: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3.4 RUSSIA

10.3.4.1 Growing investments related to natural gas and its usage will fuel market

TABLE 76 RUSSIA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 77 RUSSIA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 78 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 79 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.4 NORTH AMERICA

FIGURE 44 NORTH AMERICAN MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: GAS TURBINES MARKET SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: GAS TURBINE SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY END–USER, 2017–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY END–USER, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY COUNTRY 2017–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY 2021–2026 (USD MILLION)

10.4.1 US

10.4.1.1 Growth of new cogeneration and combined cycle power plants is expected to drive market

TABLE 90 US: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 91 US: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.4.2 CANADA

10.4.2.1 Growing number of combined cycle natural gas-fired power plants is expected to drive market

TABLE 92 CANADA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.4.3 MEXICO

10.4.3.1 Growing investments in power sector will lead to an increase in demand for gas turbine

TABLE 94 MEXICO: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 95 MEXICO: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 96 MIDDLE EAST & AFRICA: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: GAS TURBINES MARKET SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: GAS TURBINE SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MARKET SIZE, BY END–USER, 2017–2020 (USD MILLION)

TABLE 103 MIDDLE EAST & AFRICA: MARKET SIZE, BY END–USER, 2021–2026 (USD MILLION)

TABLE 104 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Efforts to increase natural gas-fired power generation are expected to boost Saudi Arabia’s demand for market

TABLE 106 SAUDI ARABIA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 107 SAUDI ARABIA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.5.2 UAE

10.5.2.1 Growing demand for electricity is expected to drive market

TABLE 108 UAE: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 109 UAE: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.5.3 IRAN

10.5.3.1 Growing domestic demand for power is expected to drive market

TABLE 110 IRAN: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 111 IRAN: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.5.4 EGYPT

10.5.4.1 Natural gas being major electricity generation fuel, is expected to propel demand for gas turbine

TABLE 112 EGYPT: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 113 EGYPT: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 114 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.6 SOUTH AMERICA

TABLE 116 SOUTH AMERICA: GAS TURBINE MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 117 SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 118 SOUTH AMERICA: MARKET SIZE, BY DESIGN TYPE, 2017–2020 (USD MILLION)

TABLE 119 SOUTH AMERICA: MARKET SIZE, BY DESIGN TYPE, 2021–2026 (USD MILLION)

TABLE 120 SOUTH AMERICA: GAS TURBINES MARKET SIZE, BY RATED CAPACITY, 2017–2020 (USD MILLION)

TABLE 121 SOUTH AMERICA: GAS TURBINE SIZE, BY RATED CAPACITY, 2021–2026 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY END–USER, 2017–2020 (USD MILLION)

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY END–USER, 2021–2026 (USD MILLION)

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Country's oil & gas sector is expected to boost market

TABLE 126 BRAZIL: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 127 BRAZIL: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Growing utilization of natural gas for production of electricity is expected to be one of the major growth factors for gas turbines in country

TABLE 128 ARGENTINA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 129 ARGENTINA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 130 REST OF SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 131 REST OF SOUTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 131)

11.1 KEY PLAYERS' STRATEGIES

TABLE 132 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2021

11.2 REVENUE ANALYSIS

FIGURE 45 REVENUE SHARE ANALYSIS IN MARKET

11.3 MARKET SHARE ANALYSIS

FIGURE 46 MARKET: MARKET SHARE ANALYSIS

TABLE 133 MARKET: DEGREE OF COMPETITION

11.3.1 GENERAL ELECTRIC

11.3.2 MITSUBISHI HEAVY INDUSTRIES, LTD.

11.3.3 SIEMENS ENERGY

11.3.4 ANSALDO ENERGIA

11.3.5 UNITED ENGINE CORPORATION

11.3.6 KAWASAKI HEAVY INDUSTRIES, LTD.

TABLE 134 MARKET: TECHNOLOGY FOOTPRINT

TABLE 135 MARKET: DESIGN FOOTPRINT

TABLE 136 MARKET: REGION FOOTPRINT

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STARS

11.4.2 PERVASIVE

11.4.3 EMERGING LEADERS

11.4.4 PARTICIPANTS

FIGURE 47 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 STARTING BLOCKS

11.5.4 DYNAMIC COMPANIES

FIGURE 48 OTHER ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR MARKET

11.6 COMPETITIVE SCENARIO

TABLE 137 MARKET: PRODUCT LAUNCHES, 2018–2021

TABLE 138 MARKET: DEALS, 2018–2021

TABLE 139 MARKET: OTHER DEVELOPMENTS, 2018–2021

12 COMPANY PROFILES (Page No. - 158)

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 GENERAL ELECTRIC

TABLE 140 GENERAL ELECTRIC: COMPANY OVERVIEW

FIGURE 49 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 141 GENERAL ELECTRIC: PRODUCT OFFERINGS

TABLE 142 GENERAL ELECTRIC: PRODUCT LAUNCHES

TABLE 143 GENERAL ELECTRIC: DEAL

TABLE 144 GENERAL ELECTRIC: OTHERS

12.1.2 MITSUBISHI HEAVY INDUSTRIES, LTD.

TABLE 145 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 50 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 146 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCT OFFERINGS

TABLE 147 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEAL

TABLE 148 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHERS

12.1.3 SIEMENS ENERGY

TABLE 149 SIEMENS ENERGY: COMPANY OVERVIEW

FIGURE 51 SIEMENS ENERGY: COMPANY SNAPSHOT

TABLE 150 SIEMENS ENERGY: PRODUCT OFFERINGS

TABLE 151 SIEMENS ENERGY: DEALS

12.1.4 ANSALDO ENERGIA

TABLE 152 ANSALDO ENERGIA: COMPANY OVERVIEW

FIGURE 52 ANSALDO ENERGIA: COMPANY SNAPSHOT

TABLE 153 ANSALDO ENERGIA: PRODUCT OFFERINGS

TABLE 154 ANSALDO ENERGIA: PRODUCT LAUNCHES

TABLE 155 ANSALDO ENERGIA: DEALS

TABLE 156 ANSALDO ENERGIA: OTHERS

12.1.5 UNITED ENGINE CORPORATION

TABLE 157 UNITED ENGINE CORPORATION: COMPANY OVERVIEW

TABLE 158 UNITED ENGINE CORPORATION: PRODUCT OFFERINGS

TABLE 159 UNITED ENGINE CORPORATION: OTHERS

12.1.6 KAWASAKI HEAVY INDUSTRIES, LTD.

TABLE 160 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

FIGURE 53 KAWASAKI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

TABLE 161 KAWASAKI HEAVY INDUSTRIES, LTD.: PRODUCT OFFERINGS

TABLE 162 KAWASAKI HEAVY INDUSTRIES, LTD.: DEALS

TABLE 163 KAWASAKI HEAVY INDUSTRIES, LTD.: OTHERS

12.1.7 CAPSTONE GREEN ENERGY CORPORATION

TABLE 164 CAPSTONE GREEN ENERGY CORPORATION: COMPANY OVERVIEW

FIGURE 54 CAPSTONE GREEN ENERGY CORPORATION: COMPANY SNAPSHOT

TABLE 165 CAPSTONE GREEN ENERGY CORPORATION: PRODUCT OFFERINGS

TABLE 166 CAPSTONE GREEN ENERGY CORPORATION: DEALS

12.1.8 ROLLS-ROYCE PLC

TABLE 167 ROLLS-ROYCE PLC: COMPANY OVERVIEW

FIGURE 55 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

TABLE 168 ROLLS-ROYCE PLC: PRODUCT OFFERINGS

12.1.9 HARBIN ELECTRIC MACHINERY COMPANY LIMITED

TABLE 169 HARBIN ELECTRIC MACHINERY COMPANY LIMITED: COMPANY OVERVIEW

FIGURE 56 HARBIN ELECTRIC MACHINERY COMPANY LIMITED: COMPANY SNAPSHOT

TABLE 170 HARBIN ELECTRIC MACHINERY COMPANY LIMITED: PRODUCT OFFERINGS

12.1.10 OPRA TURBINES

TABLE 171 OPRA TURBINES: COMPANY OVERVIEW

TABLE 172 OPRA TURBINES: PRODUCT OFFERINGS

TABLE 173 OPRA TURBINES: DEALS

12.1.11 SOLAR TURBINES INCORPORATED

TABLE 174 SOLAR TURBINES INCORPORATED: COMPANY OVERVIEW

TABLE 175 SOLAR TURBINES INCORPORATED: PRODUCT OFFERINGS

12.1.12 BHARAT HEAVY ELECTRICALS LIMITED

TABLE 176 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW

FIGURE 57 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

TABLE 177 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCT OFFERINGS

12.1.13 CENTRAX GAS TURBINE

TABLE 178 CENTRAX GAS TURBINE: COMPANY OVERVIEW

TABLE 179 CENTRAX GAS TURBINE: PRODUCT OFFERINGS

12.1.14 MTU AERO ENGINES AG

TABLE 180 MTU AERO ENGINES AG: COMPANY OVERVIEW

FIGURE 58 MTU AERO ENGINES AG: COMPANY SNAPSHOT

TABLE 181 MTU AERO ENGINES AG: PRODUCT OFFERINGS

TABLE 182 MTU AERO ENGINES AG: DEALS

TABLE 183 MTU AERO ENGINES AG: OTHERS

12.1.15 IHI CORPORATION

TABLE 184 IHI CORPORATION: COMPANY OVERVIEW

FIGURE 59 IHI CORPORATION: COMPANY SNAPSHOT

TABLE 185 IHI CORPORATION: PRODUCT OFFERINGS

TABLE 186 IHI CORPORATION: DEALS

TABLE 187 WARTSILA: COMPANY OVERVIEW

FIGURE 60 WARTSILA: COMPANY SNAPSHOT

TABLE 188 WARTSILA: PRODUCT OFFERINGS

TABLE 189 WARTSILA: DEALS

TABLE 190 WARTSILA: OTHERS

12.1.17 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION

TABLE 191 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: COMPANY OVERVIEW

FIGURE 61 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: COMPANY SNAPSHOT

TABLE 192 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: PRODUCT OFFERINGS

TABLE 193 DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: DEALS

12.1.18 MAPNA GROUP

TABLE 194 MAPNA GROUP: COMPANY OVERVIEW

TABLE 195 MAPNA GROUP: PRODUCT OFFERINGS

TABLE 196 MAPNA GROUP: DEALS

TABLE 197 MAPNA GROUP: OTHERS

12.1.19 VERICOR POWER SYSTEMS

TABLE 198 VERICOR POWER SYSTEMS: COMPANY OVERVIEW

TABLE 199 VERICOR POWER SYSTEMS: PRODUCT OFFERINGS

TABLE 200 VERICOR POWER SYSTEMS: DEALS

12.1.20 ZORYA MASHPROEKT

TABLE 201 ZORYA MASHPROEK: COMPANY OVERVIEW

TABLE 202 ZORYA MASHPROEKT: PRODUCT OFFERINGS

TABLE 203 ZORYA MASHPROEKT: DEALS

TABLE 204 ZORYA MASHPROEKT: OTHERS

12.1.21 MAN ENERGY SOLUTIONS

TABLE 205 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

TABLE 206 MAN ENERGY SOLUTIONS: PRODUCT OFFERINGS

TABLE 207 MAN ENERGY SOLUTIONS: OTHERS

12.2 OTHER PLAYERS

12.2.1 POWER MACHINES

TABLE 208 POWER MACHINES: COMPANY OVERVIEW

12.2.2 GAS TURBINE RESEARCH ESTABLISHMENT

TABLE 209 GAS TURBINE RESEARCH ESTABLISHMENT: COMPANY OVERVIEW

12.2.3 HINDUSTAN AERONAUTICS LIMITED

TABLE 210 HINDUSTAN AERONAUTICS LIMITED: COMPANY OVERVIEW

12.2.4 GKN AEROSPACE SERVICES LIMITED

TABLE 211 GKN AEROSPACE SERVICE LIMITED: COMPANY OVERVIEW

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12.1 KEY COMPANIES

13 APPENDIX (Page No. - 225)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

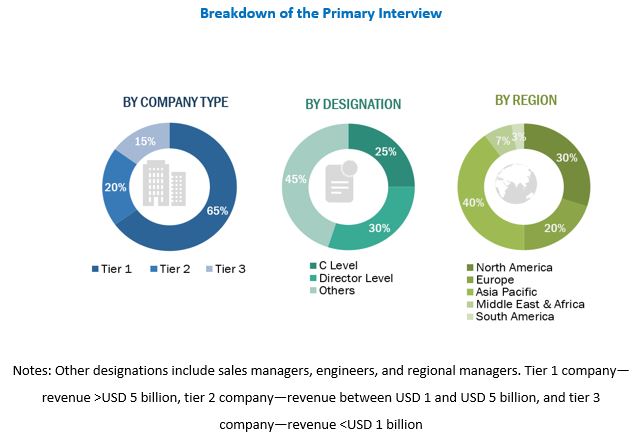

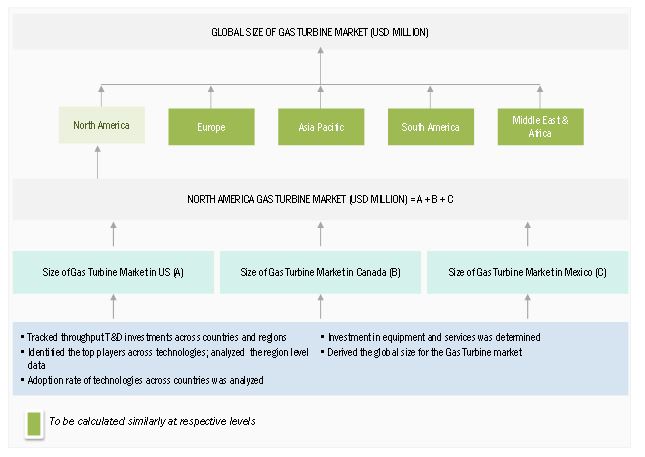

The study involved four major activities in estimating the current size of the gas turbine market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the gas turbine value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports; press releases and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, gas turbine manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The gas turbine market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of gas turbine manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by the presence of key technology providers for gas turbine, end users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of construction companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and gas turbine manufacturing companies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the gas turbines market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Gas Turbine Market Size: Bottom-Up Approach

Report Objectives

Market Intelligence

- To analyze and forecast the size of the gas turbine market in terms of value

- To define, describe, and forecast the market size by design, technology, end use, rated capacity, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, contracts, partnerships, agreements, collaborations, Memorandum of Understanding (MoU), and joint ventures as in the gas turbines market

Competitive Intelligence

- To identify and profile the key players in the gas turbines market

- To determine the top players offering various products in the global market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gas Turbine Market

We want to know more about the Gas Turbine Market and the opportunities for gas turbines in combined cycle power plants for the 2022 to 2026 forecast year.

I would like to know more about the Gas Turbine Market size and expected CAGR in Europe and North America in 2022 to 2026.

Gas Turbine Market report was published in January this year and the report provides the latest industry trends from both supply-side and demand-side, market trends at a regional level and country level and quantifies the market size and growth forecast at a regional and country level, by multiple industry segments.

Gas Turbines Market share analysis of key players including their revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and all other key development including SWOT analysis are provided for all global and regional players.

What is the total market size and Vertical outlook Gas Turbine Market? I am looking for North America.