Steam Boiler System Market by Component (Boiler, Economizer, Superheater, Air Preheater, and Feed Pump), Type (Watertube Boiler, and Fire Tube Boiler), Fuel (Coal, Gas, Biomass, Oil, and Electric), End-user, and Region- Global Forecast to 2023

The global steam boiler system market is projected to reach USD 21.63 billion by 2023 at a CAGR of 4.13% from an estimated USD 17.66 billion in 2018.The growth of the steam boiler system market is mainly driven by the increased usage of steam boilers across various end-user industries such as power generation, oil & gas, chemical, process industries, and metal and mining. The chemical industry is expected to grow at the highest CAGR in Asia Pacific because of large investments during the forecast period.

The years considered for the study are as follows:

- Base Year: 2017

- Estimated Year: 2018

- Projected Year: 2023

- Forecast Period: 20182023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define and segment the steam boiler system market with respect to component, type, fuel, end-user, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, Middle East, South America, and Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive strategies such as new product development, mergers & acquisitions, expansions & investments, partnership & collaboration, and contracts & agreements in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets; newsletters and databases such as Hoovers, Bloomberg, Businessweek, and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the global steam boiler system market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of major players providing steam boiler system

- Analysis of the major end-users of the steam boiler system

- Assessment of future trends and growth of the market on the basis of investments in key end-user segments such as power generation utilities, oil & gas, chemical, primary metals, and process industry

- Study of contracts & developments related to the steam boiler system market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chains, and annual revenues of companies manufacturing steam boiler system across the globe

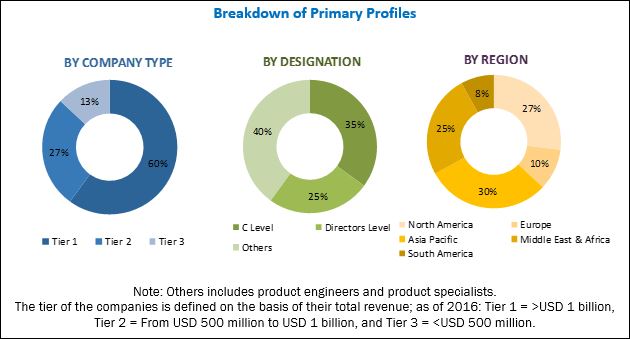

After arriving at the overall market size, the steam boiler market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Major players operating in the steam boiler system market include Bosch (Germany), GE (US), Alfa Laval (Sweden), Thermax (India), Cochran (UK), Viessmann (Germany), and Doosan (South Korea).

Target Audience:

- Steam boiler manufacturers

- Central and state utilities and the private players involved in power generation

- Distributors and suppliers

- Government and research organizations

- Industry, energy, and environmental associations

- Investment banks

- Manufacturing technology providers

- Manufacturing and processing industries

Scope of the Report:

By Component

- Boiler

- Economizer

- Superheater

- Air Preheater

- Feed Pump

By Type

- Water tube Boiler

- Fire tube Boiler

By Fuel

- Coal-fired Steam Boiler

- Gas-fired Steam Boiler

- Biomass-fired Steam Boiler

- Oil-fired Steam Boiler

- Electric Steam Boiler

By End-User

- Power Generation

- Oil & Gas

- Chemical

- Process Industry

- Primary Metals

By Region

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

Detailed analyses and profiling of additional market players (up to five)

Drivers

Rapid increase in the demand for electricity

Industrialization and the increasing use of electrical appliances and machinery along with the growing economic activities in the developing countries has driven strong demand for electricity. This trend is more pronounced in the Asia Pacific, which is expected to reach 5.1 billion, in population by 2050. The urban population will account for more than 60% of the total population. Also, supportive industrial growth policies, low-cost raw materials, ease of availability, and cheap labor cost has turned China and India into attractive industrial markets and fastest growing economies in the world.

Increase in power plant capacity addition

The International Energy Agencys World Energy Investment Outlook 2014, estimated that around USD 9.5 trillion would be spent on the construction of new power plants and in the refurbishment of existing ones across the world from 2014 to 2035. More than 30% of which is expected to be utilized for fossil-fuel based thermal power plants. An increase in generation capacity is expected to be achieved primarily through fossil-fuel based thermal power plants, which serve as a primary source for generation of electricity in these countries. The Chinese and Indian markets are projected to be among the fastest-growing economies during the forecast period and are estimated to account for nearly 70% of all the proposed thermal power capacity addition during the same period. Such investments tend to increase the electricity tariff to reach economies of scale. The surging prices of energy have resulted in increased demand for the steam boiler system.

Restraints

Focus on renewable energy sources for power generation

Global investment in the renewable energy has increased by 5% from 2014 and reached an all-time highest of USD 288 billion in 2015. China alone contributed more than 30% of this investment, followed by the US. These investments are likely to go up in the coming years directly impacting the growth of the thermal and nuclear power plants and restraining the steam boiler system growth. In August 2015, the US Environmental Protection Agency released clean power plan regulations, when related to a 2005 baseline, these focused on a reduction of 32% in the power sector carbon emissions by 2030. As far as the renewable electricity mandates are concerned, these are the laws that require utilities to produce a certain percentage of power from the renewable energy resources.

High installation cost

The cost of steam boilers varies because of the design parameters and varying levels of after-sales support. Budget steam boilers offer shorter lifespans, shorter warranties, and a lower level of customer support compared to the standard steam boilers. The use of special alloys and advanced technologies result in the development of boilers with improved performance. The installation of a steam boiler system requires high capital, which makes it one of the most critical expenditures of the manufacturing plant. The cost associated with the installation of steam boilers amounts to 15-20% of the total boiler cost. This cost is expected to remain same because of the high level technical expertise involved in the operation of steam boilers and separate construction of boiler houses in the utility area.

Competitive Landscape

Contracts & Agreements

|

Date |

Company Name |

Development |

|

April 2018 |

Thermax |

Thermax was awarded a contract from a fertilizer company to set up their captive cogeneration plant at Trombay, India. The scope of the project is to supply a Gas Turbine Generator- cum- Heat Recovery Steam Generator based co-generation plants of 50MW capacity on an EPC basis. |

|

March 2018 |

Thermax |

Thermax was awarded a contract from a public sector fertilizer company to set up three natural gas based EPC co-generation plants (each of 20 MW capacity) at its facilities in Haryana and Punjab. |

Source: Company Websites and Press Releases

New Product Developments

|

Date |

Company Name |

Development |

|

February 2017 |

Bosch |

Bosch introduced its new double-flame tube boiler, which has a height of six meters. The boiler has an output of up to 55,000 kilograms of steam per hour and weighs up to 120 tons. |

|

December 2017 |

Cleaver-Brooks |

Cleaver-Brooks launched its new water-tube boilers, CBCW. The CBCW configured water-tube boilers are suitable for institutional, healthcare, food and beverage, pharmaceutical, ethanol and bio-diesel, pulp and paper, and miscellaneous manufacturing and heavy industry applications. |

Source: Company Websites and Press Releases

The global steam boiler system market is projected to reach a market size of USD 21.63 billion by 2023, at a CAGR of 4.13%, from an estimated USD 17.66 billion in 2018. This growth can be attributed to the increase in the use of steam boilers in manufacturing and process industry globally. Moreover, to support the rise in demand for power from manufacturing industries new power plants are being setup which is further increasing the demand for steam boiler system.

The report segments the steam boiler system market, by component, into boiler, economizer, superheater, air preheater, and feed pump. The boiler segment is expected to hold the largest market share by 2023. Increase in demand for power from the developing countries and large investments for capacity addition are likely to drive the demand for steam boilers.

The steam boiler system market, by type, is segmented into water-tube boiler and fire-tube boiler. The water-tube boiler segment is expected to be the largest market for the steam boiler system by 2023. Water-tube boilers provide higher efficiency and can produce high-temperature steam suitable for power generation utilities. Increase in capacity addition to meet the rise in demand for power would drive the water-tube boiler segment during the forecast period.

Coal is one of the major fuels used in the steam boiler system market. According to the IEA, coal fuels 40% of global electricity production. Moreover, it is the most widely used fossil fuel for power generation in the developing countries. Easy availability and relatively lower cost are some of the major factors driving the coal-fired steam boilers market.

Chemical is expected to hold the highest CAGR during the forecast period in the end-user segment. The Asia Pacific is anticipated to lead the chemical, by end-user segment, for the steam boiler system market. Capacity expansion coupled with the higher consumer purchasing power is likely to drive the demand for chemicals.

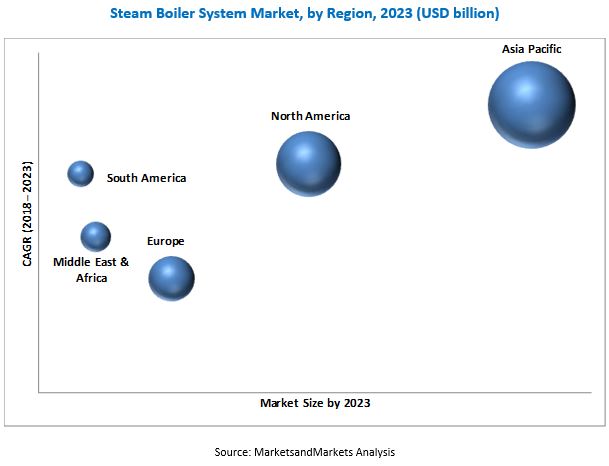

In this report, the steam boiler system market has been analyzed with respect to 5 regions, namely, North America, Europe, South America, the Asia Pacific, the Middle East, and Africa. The steam boiler system market in the Asia Pacific is estimated to be the largest market from 2018 to 2023. Countries such as China, India, and Japan are heavily investing in the power capacity addition, which would positively impact the market. Also, massive investments in the manufacturing industry are significant factors that would propel the growth of the market. For instance, as per the Asian Development Bank, the region will need an investment of USD 26 trillion from 2016 to 2030 or USD 1.7 trillion per year to maintain its growth momentum and respond to climate change.

Focus on renewable energy sources for power generation and high installation costs could act as restraints for the steam boiler system market. The leading players in the steam boiler system market include Bosch (Germany), GE (US), Alfa Laval (Sweden), Thermax (India), Cochran (UK), Viessmann (Germany), and Doosan (South Korea). New product developments and contracts & agreements were the most commonly adopted strategies by the top players. This was followed by mergers & acquisitions and investments & expansions.

Opportunities

Rise in the demand for compact design of the steam boiler

Utility space is the major cause of concern for plant installations and existing plant expansions. In process industries, components such as boiler, economizer, super-heater, and air preheater should have a compact design for optimum space utilization. With capacity installations, the existing floor space becomes limited for utility machines. The need to ensure space utilization has contributed to a high demand of steam boilers that have compact designs and are fuel-efficient. Boiler manufacturers are focused on promoting steam boilers that are customized for different process requirements in various industries such as power generation, oil & gas, chemical and process industries.

Aging power generation Infrastructure

Developed countries such as the US, Canada, UK, and Germany have aging power infrastructure with low-efficiency levels and high carbon emissions. These old power plants are scheduled to retire soon. However, plant extension and replacement plans, as well as to increase the scope for new and refurbished boilers, measures for upgradation are in place. The International Energy Agencys World Energy Investment Outlook 2014, estimated that around USD 9.5 trillion would be spent cumulatively on the construction of new power plants and in the refurbishment of the existing ones across the world from 2014 to 2035, with 30% of the amount being used for fossil-fueled power plants. Such increasing investment toward the thermal power capacity, construction, and upgradation of power plants will boost the market for the steam boiler system market.

Challenges

Strict emission standards

The governments of developed countries worldwide have formulated strict emission standards for boilers, which, in turn, is projected to affect the growth of the steam boiler system market. Steam boiler system utilizes fuel to generate steam, which results in the release of pollutants into the atmosphere. Emission standards are formulated to limit the emission of air pollutants such as sulfur dioxide, soot, nitrogen oxide, and mercury and its compounds. Manufacturers of steam boilers find it challenging to comply with these stringent emission standards, owing to the high R&D investments involved in designing eco-friendly boilers.

Boiler efficiency and steam quality

The steam quality plays a significant role in assessing the boiler performance and its efficiency. Inefficient boilers lead to higher fuel consumption and more harmful gas emission that increases the cost of power generation. Inadequate steam and water separation can cause boiler deposits, corrosion, erosion, or foreign object damage (FOD), thereby, leading to equipment failure. Boiler efficiency is measured as the ratio of steam energy generated to the amount of combustion energy required to generate the steam. Presently, the maximum efficiency of a thermal boiler is around 42 to 45% which is only applicable for ultra-supercritical technology. The need to improve efficiency and steam quality to meet the market demand is one of the key challenges faced by the steam boiler system manufacturers.

Investments & Expansions

|

Date |

Company Name |

Development |

|

July 2017 |

Thermax |

Thermax inaugurated its new manufacturing facility in Indonesia to expand its footprint in international markets, especially the ASEAN countries such as Indonesia, Malaysia, Philippines, Singapore, and Thailand. |

|

July 2015 |

Byworth Boilers |

Byworth Boilers expanded its business in Glasgow, Scotland by opening a new regional office. The main aim of this expansion was to increase its regional reach to support the rapidly growing customer base. |

Source: Company Websites and Press Releases

Mergers & Acquisitions

|

Date |

Company Name |

Development |

|

March 2017 |

Thermax |

Thermax agreed to acquire 100% share capital of Barite Investments. As part of the agreement with Weiss, Poland, Thermax will acquire certain assets and production activities related to boiler manufacturing. This acquisition would help the company expand its regional presence across Europe. |

|

March 2016 |

Cleaver-Brooks |

Cleaver-Brooks acquired Camus Hydronics, a Toronto-based company that designs and manufactures condensing hydronic boilers and heaters for commercial, institutional, large residential, and light industrial markets. The aim of the acquisition was to strengthen Cleaver-Brooks position in the rapidly expanding condensing hydronic boiler market. |

Source: Company Websites and Press Releases

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Steam Boiler System Market

4.2 Steam Boiler System Market, By Country

4.3 Asia Pacific Steam Boiler System Market, By End-User & Country

4.4 Steam Boiler System Market, By Component

4.5 Steam Boiler System Market, By Type

4.6 Steam Boiler System Market, By Fuel

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Increase in the Demand for Electricity

5.2.1.2 Increase in Power Plant Capacity Addition

5.2.2 Restraints

5.2.2.1 Focus on Renewable Energy Sources for Power Generation

5.2.2.2 High Installation Cost

5.2.3 Opportunities

5.2.3.1 Rise in the Demand for Compact Design of the Steam Boiler

5.2.3.2 Aging Power Generation Infrastructure

5.2.4 Challenges

5.2.4.1 Strict Emission Standards

5.2.4.2 Boiler Efficiency and Steam Quality

6 Steam Boiler System Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Boiler

6.3 Economizer

6.4 Superheater

6.5 Air Preheater

6.6 Feed Pump

7 Steam Boiler System Market, By Type (Page No. - 47)

7.1 Introduction

7.2 Water-Tube Boiler

7.3 Fire-Tube Boiler

8 Steam Boiler System Market, By Fuel (Page No. - 51)

8.1 Introduction

8.2 Coal-Fired Steam Boiler

8.3 Gas-Fired Steam Boiler

8.4 Oil-Fired Steam Boiler

8.5 Biomass-Fired Steam Boiler

8.6 Electric Steam Boiler

9 Market, By End-User (Page No. - 57)

9.1 Introduction

9.2 Power Generation

9.3 Oil & Gas

9.4 Chemical

9.5 Process Industry

9.6 Primary Metal

10 Market, By Region (Page No. - 63)

10.1 Introduction

10.2 Asia Pacific

10.2.1 By Component

10.2.2 By Type

10.2.3 By Fuel

10.2.4 By End-User

10.2.5 By Country

10.2.5.1 China

10.2.5.2 India

10.2.5.3 Japan

10.2.5.4 Australia

10.2.5.5 South Korea

10.2.5.6 Rest of Asia Pacific

10.3 North America

10.3.1 By Component

10.3.2 By Type

10.3.3 By Fuel

10.3.4 By End-User

10.3.5 By Country

10.3.5.1 US

10.3.5.2 Canada

10.3.5.3 Mexico

10.4 Europe

10.4.1 By Component

10.4.2 By Type

10.4.3 By Fuel

10.4.4 By End-User

10.4.5 By Country

10.4.5.1 UK

10.4.5.2 Germany

10.4.5.3 France

10.4.5.4 Italy

10.4.5.5 Russia

10.4.5.6 Rest of Europe

10.5 Middle East & Africa

10.5.1 By Component

10.5.2 By Type

10.5.3 By Fuel

10.5.4 By End-User

10.5.5 By Country

10.5.5.1 Saudi Arabia

10.5.5.2 UAE

10.5.5.3 South Africa

10.5.5.4 Iran

10.5.5.5 Rest of Middle East & Africa

10.6 South America

10.6.1 By Component

10.6.2 By Type

10.6.3 By Fuel

10.6.4 By End-User

10.6.5 By Country

10.6.5.1 Brazil

10.6.5.2 Argentina

10.6.5.3 Rest of South America

11 Competitive Landscape (Page No. - 99)

11.1 Overview

11.2 Ranking of Players and Industry Concentration, 2017

11.3 Competitive Scenario

11.3.1 Contracts & Agreements, 20152018

11.3.2 New Product Developments, 20152018

11.3.3 Investments & Expansions, 20152018

11.3.4 Mergers & Acquisitions, 20152018

12 Company Profiles (Page No. - 103)

12.1 Benchmarking

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.2 Alfa Laval

12.3 Bosch

12.4 GE

12.5 Thermax

12.6 Byworth Boilers

12.7 Cleaver-Brooks

12.8 Cochran

12.9 Doosan Heavy Industries & Construction

12.10 Devotion Machineries

12.11 Forbes Marshall

12.12 Fulton

12.13 Parker Boiler

12.14 Rentech Boilers

12.15 Thermodyne Engineering System

12.16 Viessmann

12.17 Zhengzhou Boiler (Group) Co., Ltd.

12.18 Other Key Players in the Market

12.18.1 Bhel

12.18.2 Hurst Boilers

12.18.3 AMEC Foster Wheeler

12.18.4 Siemens

12.18.5 Vapor Power International

12.18.6 Mitsubishi

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 132)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (73 Tables)

Table 1 Steam Boiler System Market Snapshot

Table 2 World Industrial Sector Delivered Energy Consumption, By Region and Energy Source, 2012-2040 (Quadrillion Btu)

Table 3 Steam Boiler System Market Size, By Component, 20162023 (USD Billion)

Table 4 Boiler: Steam Boiler System Market Size, By Region, 20162023 (USD Million)

Table 5 Economizer: Market Size, By Region, 20162023 (USD Million)

Table 6 Superheater: Market Size, By Region, 20162023 (USD Million)

Table 7 Air Pre-Heater: Market Size, By Region, 20162023 (USD Million)

Table 8 Feed Pump: Market Size, By Region, 20162023 (USD Million)

Table 9 Steam Boiler System Size, By Type, 20162023 (USD Billion)

Table 10 Water-Tube Boiler: Market Size, By Region, 20162023 (USD Million)

Table 11 Fire-Tube Boiler: Market Size, By Region, 20162023 (USD Million)

Table 12 Steam Boiler System Market Size, By Fuel, 20162023 (USD Billion)

Table 13 Coal-Fired Steam Boiler: Market Size, By Region, 20162023 (USD Million)

Table 14 Gas-Fired Steam Boilers: Market Size, By Region, 20162023 (USD Million)

Table 15 Oil-Fired Steam Boilers: Market Size, By Region, 20162023 (USD Million)

Table 16 Biomass-Fired Steam Boiler: Steam Boiler System Market Size, By Region, 20162023 (USD Million)

Table 17 Electric Steam Boiler: Market Size, By Region, 20162023 (USD Million)

Table 18 Steam Boiler System Market Size, By End-User, 20162023 (USD Billion)

Table 19 Power Generation: Steam Boiler System Market Size, By Region, 20162023 (USD Million)

Table 20 Oil & Gas: Market Size, By Region, 20162023 (USD Million)

Table 21 Chemical: Market Size, By Region, 20162023 (USD Million)

Table 22 Process Industry: Steam Boiler System Market Size, By Region, 20162023 (USD Million)

Table 23 Primary Metal: Market Size, By Region, 20162023 (USD Million)

Table 24 Steam Boiler System Market, By Region, 20162023 (USD Billion)

Table 25 Asia Pacific: Steam Boiler System Market Size, By Component, 20162023 (USD Million)

Table 26 Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 27 Asia Pacific: Steam Boiler System Market Size, By Fuel, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 30 China: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 31 India:Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 32 Japan: Market Size, By End-User, 20162023 (USD Million)

Table 33 Australia: Market Size, By End-User, 20162023 (USD Million)

Table 34 South Korea: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 35 Rest of Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 36 North America: Steam Boiler System Market Size, By Component, 20162023 (USD Million)

Table 37 North America: Steam Boiler System Market Size, By Type, 20162023 (USD Million)

Table 38 North America: Market, By Fuel, 20162023 (USD Million)

Table 39 North America: Market Size, By End-User, 20162023 (USD Million)

Table 40 North America: Market Size, By Country, 20162023 (USD Million)

Table 41 US: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 42 Canada: Market Size, By End-User, 20162023 (USD Million)

Table 43 Mexico: Market Size, By End-User, 20162023 (USD Million)

Table 44 Europe: Steam Boiler System Market Size, By Component, 20162023 (USD Million)

Table 45 Europe: Market Size, By Type, 20162023 (USD Million)

Table 46 Europe: Market, By Fuel, 20162023 (USD Million)

Table 47 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 48 Europe: Steam Boiler System Market Size, By Country, 20162023 (USD Million)

Table 49 UK: Market Size, By End-User, 20162023 (USD Million)

Table 50 Germany: Market Size, By End-User, 20162023 (USD Million)

Table 51 France: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 52 Italy: Market Size, By End-User, 20162023 (USD Million)

Table 53 Russia: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 54 Rest of Europe: Market Size, By End-User, 20162023 (USD Million)

Table 55 Middle East & Africa: Steam Boiler System Market Size, By Component, 20162023 (USD Million)

Table 56 Middle East & Africa: Steam Boiler System Market Size, By Type, 20162023 (USD Million)

Table 57 Middle East & Africa: Market, By Fuel, 20162023 (USD Million)

Table 58 Middle East & Africa: Market Size, By End-User, 20162023 (USD Million)

Table 59 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 60 Saudi Arabia: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 61 UAE: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 62 South Africa: Market Size, By End-User, 20162023 (USD Million)

Table 63 Iran: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 64 Rest of Middle East & Africa: Market Size, By End-User, 20162023 (USD Million)

Table 65 South America: Steam Boiler System Market Size, By Component, 20162023 (USD Million)

Table 66 South America: Market Size, By Type, 20162023 (USD Million)

Table 67 South America: Market, By Fuel, 20162023 (USD Million)

Table 68 South America: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 69 South America: Market Size, By Country, 20162023 (USD Million)

Table 70 Brazil: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 71 Argentina: Market Size, By End-User, 20162023 (USD Million)

Table 72 Rest of South America: Steam Boiler System Market Size, By End-User, 20162023 (USD Million)

Table 73 Thermax Was the Most Active Player in the Market Between 2015 and 2018

List of Figures (33 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primaries: By Company Type, Designation, & Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Boiler Segment, By Component, is Expected to Grow at the Highest CAGR During the Forecast Period, 20182023

Figure 8 Water-Tube Boiler Segment is Estimated to Lead the Steam Boiler System Market

Figure 9 Oil-Fired Steam Boiler Segment is Estimated to Lead the Steam Boiler System Market

Figure 10 Process Industry is Estimated to Be the Largest End-User for the Steam Boiler System Market

Figure 11 Asia Pacific to Lead the Steam Boiler System Market

Figure 12 Increase in Demand for Electricity is Driving the Steam Boiler System Market, From 2018 to 2023

Figure 13 The Market in China is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Process Industry and China Dominated the Market in Asia Pacific in 2017

Figure 15 Boiler Segment is Expected to Dominate the Steam Boiler System Market, By Component, During the Forecast Period

Figure 16 Water-Tube Boiler Segment is Estimated to Dominate the Market, By Type, During the Forecast Period

Figure 17 Oil-Fired Steam Boiler Segment is Estimated to Dominate the Steam Boiler System Market, By Fuel, During the Forecast Period

Figure 18 Market Dynamics for the Market

Figure 19 Investment in Renewable Energy, By Country, 2015 (USD Billion)

Figure 20 Boiler Segment is Expected to Hold the Largest Market (By Value), By 2023

Figure 21 Water-Tube Boiler Segment is Expected to Hold the Largest Market Share By 2023

Figure 22 Oil-Fired Steam Boiler Segment Holds the Largest Market (By Value), 20182023

Figure 23 Process Industry is Expected to Hold the Largest Market Share By 2023

Figure 24 Regional Snapshot: the Market in Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Market Share (Value), By Region, 2017

Figure 26 Asia Pacific: Market Snapshot

Figure 27 North America: Market Snapshot

Figure 28 Key Developments in the Market, 20152018

Figure 29 Bosch Led the Market in 2017

Figure 30 Alfa Laval: Company Snapshot

Figure 31 Bosch: Company Snapshot

Figure 32 GE: Company Snapshot

Figure 33 Thermax: Company Snapshot

Growth opportunities and latent adjacency in Steam Boiler System Market