Optical Communication and Networking Equipment Market by Component (Fiber, Transceiver, and Switch), Technology (WDM, Fiber Channel), Application (Telecom, Data Center, and Enterprise), Data Rate, Vertical and Region (2022-2027)

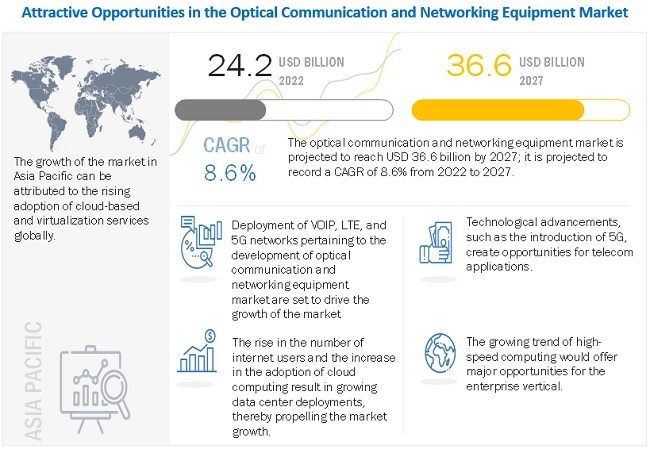

Global optical communication and networking equipment market in terms of revenue was estimated to be worth USD 24.2 billion in 2022 and is poised to reach USD 36.6 billion by 2027, growing at a CAGR of 8.6% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

Expansion of telecom infrastructure in developing economies is the major driving factor for the growth of the optical communication and networking market.

To know about the assumptions considered for the study, Request for Free Sample Report

Optical Communication and Networking Equipment Market Dynamics:

Driver: Rise in demand for compact and energy-efficient transceivers

The manufacturers of optical transceivers are concentrating more on R&D for serving different applications in the metro network, data center interconnect, long haul applications, and others, which require optical transceivers to be compatible with the complex network. Optical transceiver OEMs such as Fujitsu Optical Components (Japan) and Broadcom (US) are offering transceivers that are compact and consume little power. This trend is expected to increase the market growth of small and compact optical modules due to their high range of data connectivity at a faster speed. These factors provide large growth potential for optical transceivers in the optical communication and networking equipment market.

Restraint: Increased network complexity

The existence of multiple protocols and platforms and consistent requirements for compact networks have resulted in the growing use of connectivity ICs. Also, hardware and software both play a key role in emerging technology-based products, such as the Internet of Things (IoT) devices, which are deployed in optical communication networks. However, the use of ICs and IoT devices makes the network more complex. Similarly, for network monitoring and control, drop modules, variable optical attenuators, and tap power monitors are required to be fixed in a single compact unit. In addition, the increasing connectivity speed and a growing number of high-bandwidth connections over fixed and wireless networks have also resulted in increased complexity of the network. All these factors are generating need for more compact form factors to enable compatibility and increase space inside the network. Current network infrastructure is fragmented, focused more on domain-specific growth than consumer-centric joint approach. The companies need to adopt more innovative and network-oriented approach to minimize the network complexity, which acts as a restraining factor for the growth of the optical communication and networking equipment market.

Opportunity: Expansion of telecom infrastructure in developing economies

The expansion of telecommunication infrastructure will have a substantial effect on developing countries in a positive way. With the advent of IoT, AI, and Big Data, there is an increasing demand for smart devices and other connected applications. The interconnected technologies across telecommunication sectors play an important role in capturing, translating, and transferring data into meaningful information, which is crucial for the reinforcement of urban infrastructure. The backbone for this kind of infrastructural development is a high-speed fiber optics network, which can transfer enormous amounts of data, at high speed, from one end to another. The implementation of the 5G network and 6G network requires high-bandwidth oriented fiber optical cables integrated with optical transceivers for secured and reliable data transfers. Therefore, the expansion of optical communication infrastructure across developing nations will drive the optical communication and networking equipment market in the future.

Challenge: Vulnerability of optical networks to hacking

Fiber optic technology-based storage and communication systems were deemed to be safer than the conventional copper cable-based systems as hacking into data within a fiber optic-based system required extremely sophisticated technology, which used to be only available to government agencies. However, in recent times, inexpensive hardware and software have started emerging. Hardware equipment such as optical/electrical converters transfer the converted signal via the Ethernet connection. Moreover, hacking is possible using sniffer software. With the advancement in technology, fiber hack is becoming commonplace, and the belief that the fiber-optic cable networks are secure is proving to be wrong. With these technologies, data theft is becoming easily possible for hackers, and it is not even getting detected. Fiber hack has been a major challenge for the optical network community and might lead to serious ramifications if not checked at the right time.

By vertical, BFSI vertical held the largest share of optical communication and networking equipment market in 2021

The BFSI vertical accounted for the largest share of ~42% of the optical communication and networking equipment market in 2021. Optical communication and networking devices are being increasingly deployed in the BFSI sector to protect their customers’ confidential data, meet compliance standards to ensure data security, facilitate security auditing, and avoid reputation damage caused by data breaches. Owing to this, the BFSI vertical drives the growth of the market.

Optical transceiver segment of optical communication and networking equipment market is expected to grow with the highest CAGR during the forecast period.

The optical transceiver segment accounted for the largest share of ~32% of the optical communication and networking equipment market, by component, in 2021. This growth is mainly attributed to the advent of technological advancements, such as AI, machine learning, and 5G communication, that lead to an increase in data traffic, which creates demand for high-scale data centers. The optical transceiver segment is projected to grow at the highest CAGR during the forecast period. The growing use of the internet by users of smartphones and other connected devices, as well as the adoption of cloud computing as a mainstream IT deployment option, leads to increasing demand for data centers. These factors are expected to accelerate the growth of the optical transceiver segment in the near future.

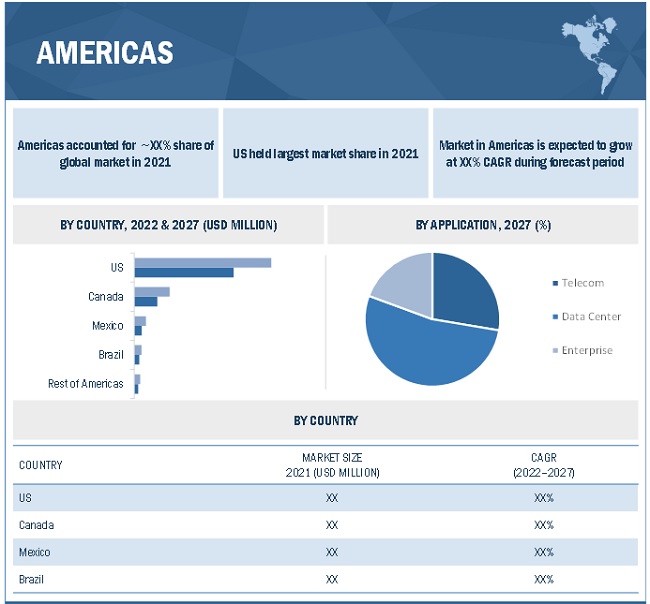

In 2027, Optical communication and networking equipment market in North America region is projected to hold the largest share of the overall market

To know about the assumptions considered for the study, download the pdf brochure

The Americas accounted for the largest share of ~40% of the optical communication and networking equipment market in 2021. The Americas has emerged as a major data center and cloud computing hub. It is the largest consumer of market. Also, the optical communication and networking equipment industry growth in the region can be attributed to the enhanced application of advanced optical technologies such as quantum optics in aviation, industries, and the commercial sector in the region. Further, high defense spending and the presence of numerous important market players in the US are the key factors supporting the expansion of the market in the region.

Optical Communication and Networking Equipment Market Key Players

Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Ciena Corporation (US), Nokia (Finland), II-VI Incorporated (US), ZTE Corporation (China), ADTRAN Inc. (US), Infinera Corporation (US), ADVA Optical Networking (Germany), and FUJITSU (Japan) are some of the optical communication and networking equipment companies in the market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 24.2 Billion |

|

Projected Market Size |

USD 36.6 Billion |

|

Growth Rate |

8.6% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By component, technology, application, data rate, vertical, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Ciena Corporation (US), Nokia (Finland), II-VI Incorporated (US), ZTE Corporation (China), ADTRAN Inc. (US), Infinera Corporation (US), ADVA Optical Networking (Germany), and FUJITSU (Japan) are some of the key players in the optical communication and networking equipment market. |

This research report categorizes the optical communication and networking equipment market based on component, technology, application, data rate, vertical, and region.

Optical Communication and Networking Equipment Market:

Based on Component:

-

Optical Fibers

- Single-Mode Fibers

- Multi-Mode Fibers

-

Optical Transceivers

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP14, and QSFP28

- CFP, CFP2, and CFP4

- XFP

- CXP

-

Optical Amplifiers

- Erbium-Doped Fiber Amplifiers

- Fiber Raman Amplifiers

- Semiconductor Optical Amplifiers

- Optical Switches

- Optical Splitters

- Optical Circulators

- Others

Based on Technology:

- SONET/SDH

- WDM

- CWDM

- DWDM

- Fiber Channel

Based on Application:

- TELECOM

- Data Center

- Enterprise

Based on Data Rate:

- Up To 40 GBPS

- Greater Than 40 Gbps To 100 Gbps

- Greater Than 100 Gbps

Based on Vertical:

- BFSI

- Government

- Healthcare

- Cloud

- Energy & Utilities

- Others

Based on Region:

-

Americas

- US

- Canada

- Mexico

- Brazil

- Rest Of Americas

-

Europe

- Germany

- France

- UK

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

Recent Developments

- In March 2022, ADVA Optical Networking launched a new pluggable MicroMux Edge BiDi device that enables operators to boost capacity and address fiber constraints in access networks. The BiDi pluggable will minimize cost and latency in access networks.

- In March 2022, Huawei partnered with ZainTech, a leading telecommunications operator across the Middle East and Africa, providing mobile voice and data services. With this partnership, both the companies would explore opportunities for digital solution development. Also, develop ZainTech's ecosystem with Huawei’s expertise and best practices in public cloud, and explore new local cloud opportunities.

- In February 2022, FUJITSU acquired oobe, a services and product portfolio that spans end-user computing, applications, data, cloud and cyber, with a focus on Microsoft and Azure. The acquisition enables Fujitsu to leverage oobe’s market-leading expertise and experience as a leading Microsoft cloud, modern workplace, and security provider to accelerate its customers’ digital transformation journeys.

- In February 2022, ZTE Corporation launched a series of new 5G products and solutions at the Mobile World Congress event. The new products and solutions showcase ZTE's great commitment to building the simplest 5G network with energy efficiency, boosting the digital transformation of industries with all-in-one private network, and operating the complex network with ease.

- In February 2022, ADVA Optical Networking launched Ensemble Simulator for virtual end-to-end network testing, which would enable optical network operators to evaluate network growth strategies and verify interworking with umbrella management systems in a safe virtual test environment accurately and reliably.

Frequently Asked Questions (FAQ):

Which are the major companies in the optical communication and networking equipment market? What are their major strategies to strengthen their market presence?

The major companies in the optical communication and networking equipment market are – Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Ciena Corporation (US), Nokia (Finland), II-VI Incorporated (US), ZTE Corporation (China), ADTRAN Inc. (US), Infinera Corporation (US), ADVA Optical Networking (Germany), and FUJITSU (Japan) are some of the key players in the optical communication and networking equipment market. The major strategies adopted by these players are product launches and developments, collaborations, expansions, and agreements.

Which is the potential market for optical communication and networking equipment in terms of the region?

Americas region is expected to dominate the optical communication and networking equipment market due to the growing market for wearable devices and increasing deployment of data centers.

Who are the winners in the global optical communication and networking equipment market?

Companies such as Huawei Technologies Co., Ltd. (China), Cisco Systems, Inc. (US), Ciena Corporation (US), Nokia (Finland), II-VI Incorporated (US), fall under the winner’s category. These companies cater to the requirements of their customers by providing technological advanced optical communication and networking equipment’s. Moreover, these companies are highly adopting inorganic and organic growth strategies to strengthen their market position and customer base worldwide. Such advantages give these companies an edge over other optical communication and networking equipment ecosystem player.

What are the drivers and opportunities for the optical communication and networking equipment market?

Factors such as Rising adoption of cloud-based and virtualization services globally, growing adoption of data centers, and expansion of telecom infrastructure in developing economies are the major driving factors for the growth of the optical communication and networking equipment market. Moreover, growing focus of market players on filing patents and spending more on R&D activities to create lucrative opportunities in the optical communication and networking equipment market.

Who are the major applications of optical communication and networking equipment that are expected to drive the growth of the market in the next 5 years?

The major application for optical communication and networking equipment is data center and is expected to have a significant share in this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET SEGMENTATION

1.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.3 MARKET SHARE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 7 GROWTH PROJECTIONS FOR OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 8 MARKET FOR OPTICAL TRANSCEIVER COMPONENT-BASED OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 DATA CENTER APPLICATION TO HOLD LARGEST MARKET SHARE IN 2027

FIGURE 10 CLOUD SEGMENT TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC LIKELY TO BE FASTEST-GROWING REGION IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING 2022–2027

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET

FIGURE 12 RISING ADOPTION OF CLOUD-BASED AND VIRTUALIZATION SERVICES DRIVES OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET GROWTH

4.2 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY APPLICATION

FIGURE 13 DATA CENTER APPLICATION EXPECTED TO DOMINATE OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING FORECAST PERIOD

4.3 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY AND COMPONENT

FIGURE 14 CHINA AND OPTICAL SWITCHES CAPTURED LARGEST SHARE OF OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY AND COMPONENT, RESPECTIVELY, IN 2021

4.4 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY TECHNOLOGY

FIGURE 15 WDM TECHNOLOGY TO HOLD LARGEST SHARE OF OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING FORECAST PERIOD

4.5 COUNTRY-WISE ANALYSIS OF OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET

FIGURE 16 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 18 MARKET GROWTH PROJECTIONS CONSIDERING DRIVERS

FIGURE 19 MARKET GROWTH PROJECTIONS CONSIDERING OPPORTUNITIES

FIGURE 20 MARKET GROWTH PROJECTIONS CONSIDERING CHALLENGES AND RESTRAINTS

5.2.1 DRIVERS

5.2.1.1 Rise in demand for compact and energy-efficient transceivers

5.2.1.2 Rising adoption of cloud-based and virtualization services globally

FIGURE 21 SAAS: MOST HIGHLY DEPLOYED CLOUD SERVICE MODEL GLOBALLY, 2016–2021

FIGURE 22 GLOBAL IP TRAFFIC, 2017–2022

FIGURE 23 GLOBAL MOBILE DATA TRAFFIC FROM 2017 TO 2022

5.2.1.3 Growing number of data centers

FIGURE 24 IP TRAFFIC GROWTH IN GLOBAL DATA CENTERS

FIGURE 25 HYPERSCALE DATA CENTER GROWTH: REGIONAL VIEW

5.2.2 RESTRAINTS

5.2.2.1 High initial investment

5.2.2.2 Increased network complexity

5.2.3 OPPORTUNITIES

5.2.3.1 Expansion of telecom infrastructure in developing economies

5.2.3.2 Deployment of VOIP, LTE, and 5G networks

FIGURE 26 WIRELESS NETWORK CONNECTIONS IN NORTH AMERICA, BY TECHNOLOGY

FIGURE 27 5G CONNECTION FORECAST, BY 2025

5.2.3.3 Expansion of networks in developing countries

FIGURE 28 MOBILE SUBSCRIBER PENETRATION RATE, BY REGION

5.2.3.4 Adoption of IoT

FIGURE 29 CONNECTED DEVICES, 2018–2023

5.2.4 CHALLENGES

5.2.4.1 Ever changing customer demands for portable device and high speed

5.2.4.2 Vulnerability of optical networks to hacking

5.2.4.3 Susceptibility of optical fibers to physical damage and transmission losses

5.3 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED BY COMPONENT MANUFACTURERS AND SYSTEM INTEGRATORS

6 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY COMPONENT (Page No. - 72)

6.1 INTRODUCTION

FIGURE 31 OPTICAL TRANSCEIVER SEGMENT TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING FORECAST PERIOD

TABLE 1 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 2 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 3 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY COMPONENT, 2018–2021 (SHIPMENT UNITS)

TABLE 4 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY COMPONENT, 2022–2027 (SHIPMENT UNITS)

6.2 OPTICAL FIBER

6.2.1 SINGLE-MODE FIBERS

6.2.1.1 Single-mode fibers are used for long-distance and high-bandwidth applications

6.2.2 MULTI-MODE FIBERS

6.2.2.1 Multi-mode fibers are used for building applications

TABLE 5 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY MODE, 2018–2021 (USD MILLION)

TABLE 6 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY MODE, 2022–2027 (USD MILLION)

FIGURE 32 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS DURING FORECAST PERIOD

TABLE 7 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 8 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 9 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 10 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL FIBERS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 11 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SINGLE-MODE OPTICAL FIBERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 12 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SINGLE-MODE OPTICAL FIBERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 13 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SINGLE-MODE OPTICAL FIBERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 14 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SINGLE-MODE OPTICAL FIBERS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 15 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR MULTI-MODE OPTICAL FIBERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 16 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR MULTI-MODE OPTICAL FIBERS, BY REGION, 2022–2027 (USD MILLION)

FIGURE 33 ENTERPRISE APPLICATION TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR MULTI-MODE OPTICAL FIBERS DURING FORECAST PERIOD

TABLE 17 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR MULTI-MODE OPTICAL FIBERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR MULTI-MODE OPTICAL FIBERS, BY APPLICATION, 2022–2027 (USD MILLION)

6.3 OPTICAL TRANSCEIVER

6.3.1 SFF AND SFP

6.3.1.1 SFF and SFP form factors are known for manufacturing interconnects for telecom and datacom sectors

6.3.2 SFP+ AND SFP28

6.3.2.1 Market for SFP+ AND SFP28 form factors to grow at highest CAGR during forecast period

6.3.3 QSFP, QSFP+, QSFP14, AND QSFP28

6.3.3.1 QSFP, QSFP+, QSFP14, AND QSFP28 form factors to hold large market share

6.3.4 CFP, CFP2, AND CFP4

6.3.4.1 CFP, CFP2, and CFP4 to experience rapid growth during forecast period

6.3.5 XFP

6.3.5.1 XFP form factor designed mostly in synchronous optical networking (SONET)

6.3.6 CXP

6.3.6.1 CXP form factor adopted for high-density signal transmission in industrial applications

TABLE 19 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY FORM FACTOR, 2018–2021 (USD MILLION)

TABLE 20 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY FORM FACTOR, 2022–2027 (USD MILLION)

TABLE 21 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 23 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL TRANSCEIVERS, BY APPLICATION, 2022–2027 (USD MILLION)

6.4 OPTICAL AMPLIFIER

6.4.1 ERBIUM-DOPED FIBER AMPLIFIERS

6.4.1.1 Erbium-doped amplifiers are extensively used in optical communication networks

6.4.2 FIBER RAMAN AMPLIFIERS

6.4.2.1 Fiber Raman amplifiers are deployed in long-haul and ultra-long-haul transmission systems

6.4.3 SEMICONDUCTOR OPTICAL AMPLIFIERS

6.4.3.1 Semiconductor optical amplifiers amplify optical signals at varying wavelengths

FIGURE 34 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL AMPLIFIERS DURING FORECAST PERIOD

TABLE 25 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL AMPLIFIERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL AMPLIFIERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL AMPLIFIERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL AMPLIFIERS, BY APPLICATION, 2022–2027 (USD MILLION)

6.5 OPTICAL SWITCH

6.5.1 OPTICAL SWITCHES ALLOW PHOTONIC SIGNALS TO BE MANAGED AND SWITCHED WITHOUT CONVERTING THEM INTO ELECTRONIC SIGNALS

TABLE 29 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SWITCHES, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SWITCHES, BY REGION, 2022–2027 (USD MILLION)

TABLE 31 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SWITCHES, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SWITCHES, BY APPLICATION, 2022–2027 (USD MILLION)

6.6 OPTICAL SPLITTER

6.6.1 OPTICAL SPLITTERS ARE INTEGRAL COMPONENT OF PASSIVE OPTICAL NETWORKS

TABLE 33 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SPLITTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SPLITTERS, BY REGION, 2022–2027 (USD MILLION)

FIGURE 35 DATA CENTER APPLICATION TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SPLITTERS DURING FORECAST PERIOD

TABLE 35 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SPLITTERS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL SPLITTERS, BY APPLICATION, 2022–2027 (USD MILLION)

6.7 OPTICAL CIRCULATOR

6.7.1 OPTICAL CIRCULATORS ARE USED TO DIRECT OPTICAL SIGNALS FROM ONE PORT TO ANOTHER

TABLE 37 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL CIRCULATORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL CIRCULATORS, BY REGION, 2022–2027 (USD MILLION)

TABLE 39 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL CIRCULATORS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OPTICAL CIRCULATORS, BY APPLICATION, 2022–2027 (USD MILLION)

6.8 OTHERS

TABLE 41 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHER COMPONENTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHER COMPONENTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 43 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHER COMPONENTS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHER COMPONENTS, BY APPLICATION, 2022–2027 (USD MILLION)

7 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY TECHNOLOGY (Page No. - 94)

7.1 INTRODUCTION

FIGURE 36 WDM TECHNOLOGY TO HOLD LARGEST SIZE OF OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN 2027

TABLE 45 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 46 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

7.2 SONET/SDH

7.2.1 SONET AND SDH ARE WIDELY ADOPTED TRANSMISSION TECHNOLOGIES BY TELECOM CARRIERS

TABLE 47 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SONET TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR SONET TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

7.3 WDM

7.3.1 WDM TECHNOLOGY TO DOMINATE OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET

7.3.2 CWDM

7.3.3 DWDM

TABLE 49 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR WDM TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 50 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR WDM TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 51 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR WDM TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR WDM TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

TABLE 53 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CWDM TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CWDM TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

TABLE 55 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DWDM TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DWDM TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

7.4 FIBER CHANNEL

7.4.1 MARKET FOR FIBER CHANNEL TECHNOLOGY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 57 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR FIBER CHANNEL TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR FIBER CHANNEL TECHNOLOGY, BY REGION, 2022–2027 (USD MILLION)

8 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY APPLICATION (Page No. - 102)

8.1 INTRODUCTION

FIGURE 37 DATA CENTER APPLICATION TO REGISTER HIGHEST CAGR IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET DURING FORECAST PERIOD

TABLE 59 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 TELECOM

8.2.1 REQUIREMENT FOR HIGH-SPEED DATA TRANSMISSION TO DRIVE DEMAND FOR NETWORKING EQUIPMENT IN TELECOM APPLICATIONS

TABLE 61 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 62 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 63 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 64 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

TABLE 65 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR TELECOM APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

8.3 DATA CENTER

8.3.1 RISE IN NETWORK TRAFFIC AND CLOUD COMPUTING SERVICES TO ACCELERATE DEMAND FOR NETWORKING EQUIPMENT IN DATA CENTER APPLICATIONS

TABLE 67 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 68 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 69 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 70 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

TABLE 71 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR DATA CENTER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

8.4 ENTERPRISE

8.4.1 GROWING DEMAND FOR ENTERPRISE-BASED SOLUTIONS BOOST GROWTH OF MARKET FOR NETWORKING EQUIPMENT

TABLE 73 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 74 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 75 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 76 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

TABLE 77 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENTERPRISE APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

9 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY DATA RATE (Page No. - 112)

9.1 INTRODUCTION

FIGURE 38 UP TO 40 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT TO HOLD LARGEST MARKET SIZE IN 2027

TABLE 79 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 80 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY DATA RATE, 2022–2027 (USD MILLION)

9.2 UP TO 40 GBPS

9.2.1 DATA CENTER INTERCONNECT, INTERNET SERVICE PROVIDERS, AND ENTERPRISE NETWORKS TO DRIVE DEMAND FOR OPTICAL NETWORKING DEVICES WITH DATA RATES OF UP TO 40 GBPS

TABLE 81 UP TO 40 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 82 UP TO 40 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3 GREATER THAN 40 GBPS TO 100 GBPS

9.3.1 DATA CENTERS, AND GOVERNMENT AND FINANCIAL INSTITUTIONS TO DRIVE DEMAND FOR OPTICAL NETWORKING DEVICES WITH DATA RATES OF GREATER THAN 40 GBPS TO 100 GBPS

TABLE 83 GREATER THAN 40 GBPS TO 100 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 84 GREATER THAN 40 GBPS TO 100 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4 GREATER THAN 100 GBPS

9.4.1 CLOUD COMPUTING, METRO, AND LONG-HAUL NETWORK APPLICATIONS TO FUEL DEMAND FOR OPTICAL NETWORKING DEVICES WITH DATA RATE OF GREATER THAN 100 GBPS

TABLE 85 GREATER THAN 100 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 86 GREATER THAN 100 GBPS OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL (Page No. - 118)

10.1 INTRODUCTION

FIGURE 39 BFSI VERTICAL TO HOLD LARGEST SIZE OF OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN 2027

TABLE 87 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 88 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2 BFSI

10.2.1 INCREASING DEMAND FOR DIGITAL BANKING SERVICES TO DRIVE DEMAND FOR OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT

TABLE 89 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR BFSI, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 90 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR BFSI, BY DATA RATE, 2022–2027 (USD MILLION)

TABLE 91 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR BFSI, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR BFSI, BY REGION, 2022–2027 (USD MILLION)

TABLE 93 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR BFSI, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 94 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR BFSI, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 95 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR BFSI, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR BFSI, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR BFSI, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR BFSI, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR BFSI, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR BFSI, BY REGION, 2022–2027 (USD MILLION)

10.3 GOVERNMENT

10.3.1 INCREASING INVESTMENTS IN NETWORKING INFRASTRUCTURE BOOSTS DEMAND FOR OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT

TABLE 101 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR GOVERNMENT, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 102 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR GOVERNMENT, BY DATA RATE, 2022–2027 (USD MILLION)

TABLE 103 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR GOVERNMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR GOVERNMENT, BY REGION, 2022–2027 (USD MILLION)

TABLE 105 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR GOVERNMENT, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR GOVERNMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 107 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR GOVERNMENT, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 108 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR GOVERNMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 109 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR GOVERNMENT, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR GOVERNMENT, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR GOVERNMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 112 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR GOVERNMENT, BY REGION, 2022–2027 (USD MILLION)

10.4 HEALTHCARE

10.4.1 INCREASING DEMAND FOR DIGITAL HEALTHCARE SERVICES TO PROPEL OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET GROWTH

TABLE 113 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR HEALTHCARE, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 114 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR HEALTHCARE, BY DATA RATE, 2022–2027 (USD MILLION)

TABLE 115 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR HEALTHCARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 116 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR HEALTHCARE, BY REGION, 2022–2027 (USD MILLION)

TABLE 117 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR HEALTHCARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 118 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR HEALTHCARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR HEALTHCARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR HEALTHCARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 121 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR HEALTHCARE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR HEALTHCARE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR HEALTHCARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR HEALTHCARE, BY REGION, 2022–2027 (USD MILLION)

10.5 CLOUD

10.5.1 INCREASING DEMAND FOR CLOUD-BASED DATA CENTRES TO FOSTER MARKET GROWTH

TABLE 125 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CLOUD, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 126 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CLOUD, BY DATA RATE, 2022–2027(USD MILLION)

TABLE 127 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CLOUD, BY REGION, 2018–2021 (USD MILLION)

TABLE 128 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR CLOUD, BY REGION, 2022–2027 (USD MILLION)

TABLE 129 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR CLOUD, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 130 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR CLOUD, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 131 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR CLOUD, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 132 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR CLOUD, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 133 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR CLOUD, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR CLOUD, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 135 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR CLOUD, BY REGION, 2018–2021 (USD MILLION)

TABLE 136 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR CLOUD, BY REGION, 2022–2027 (USD MILLION)

10.6 ENERGY & UTILITIES

10.6.1 RISING DEPLOYMENT OF SMART GRIDS TO AUGMENT OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET GROWTH

TABLE 137 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENERGY & UTILITIES, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 138 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENERGY & UTILITIES, BY DATA RATE, 2022–2027 (USD MILLION)

TABLE 139 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENERGY & UTILITIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 140 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR ENERGY & UTILITIES, BY REGION, 2022–2027 (USD MILLION)

TABLE 141 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR ENERGY & UTILITIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR ENERGY & UTILITIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 143 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR ENERGY & UTILITIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 144 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR ENERGY & UTILITIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 145 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR ENERGY & UTILITIES, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR ENERGY & UTILITIES, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR ENERGY & UTILITIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 148 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR ENERGY & UTILITIES, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHERS

TABLE 149 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHERS, BY DATA RATE, 2018–2021 (USD MILLION)

TABLE 150 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHERS, BY DATA RATE, 2022–2027 (USD MILLION)

TABLE 151 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 152 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 153 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 154 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR OTHERS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 155 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR OTHERS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 157 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR OTHERS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 158 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR OTHERS, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 159 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 160 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

11 REGIONAL ANALYSIS (Page No. - 145)

11.1 INTRODUCTION

FIGURE 40 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET: REGIONAL SNAPSHOT

TABLE 161 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 162 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 AMERICAS

FIGURE 41 AMERICAS: OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET SNAPSHOT

TABLE 163 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 164 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Presence of major tech companies to drive growth of market in US

11.2.2 CANADA

11.2.2.1 Adoption of IoT-based platform to drive investments for improvement of network infrastructure

11.2.3 MEXICO

11.2.3.1 Penetration of smartphones that leads to increase in data traffic to fuel market growing in coming years

11.2.4 BRAZIL

11.2.4.1 Presence of start-up companies to drive demand for optical networking equipment

11.2.5 REST OF AMERICAS

11.2.5.1 Use of smartphones to increase demand for optical networking equipment

TABLE 165 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 166 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 167 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 168 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 169 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR WDM TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 170 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS FOR WDM TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 171 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 174 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN AMERICAS, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 42 EUROPE: OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET SNAPSHOT

TABLE 175 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 176 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Implementation of IoT in manufacturing and automotive industries to drive demand for optical networking equipment

11.3.2 FRANCE

11.3.2.1 Introduction of 5G technology to boost growth of optical Communication and networking equipment market

11.3.3 UK

11.3.3.1 Government initiatives on industry 4.0 to drive demand for optical communication and networking equipment

11.3.4 ITALY

11.3.4.1 Presence of unique subscribers to ensure growth of optical communication and networking equipment market

11.3.5 REST OF EUROPE

11.3.5.1 Inclination toward high-speed internet services to boom optical communication and networking equipment market growth

TABLE 177 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 178 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 179 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY TECHNOLOGY, 2018–2021(USD MILLION)

TABLE 180 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 181 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR WDM TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 182 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE FOR WDM TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 183 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 184 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 185 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 186 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN EUROPE, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET SNAPSHOT

TABLE 187 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 188 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Growing adoption of internet plus strategy to drive demand for optical communication and networking equipment

11.4.2 JAPAN

11.4.2.1 Increasing demand for cloud technology to boost optical communication and networking equipment market growth

11.4.3 SOUTH KOREA

11.4.3.1 Increasing demand for computer networking and database services to propel market growth

11.4.4 INDIA

11.4.4.1 Surging demand for network upgrading to fuel optical communication and networking equipment market growth

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Escalating demand for high-connectivity data transmission services to foster market growth

TABLE 189 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 190 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 191 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 192 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 193 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR WDM TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 194 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC FOR WDM TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 196 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 197 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 198 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ASIA PACIFIC, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD

FIGURE 44 ROW: OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET SNAPSHOT

TABLE 199 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 200 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Rising investments toward datacenter applications to drive demand for optical communication and networking equipment

11.5.2 AFRICA

11.5.2.1 Growing number of mobile subscribers and increasing penetration of telecom services to drive optical communication and networking equipment market growth

TABLE 201 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 202 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 203 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 204 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 205 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR WDM TECHNOLOGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 206 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW FOR WDM TECHNOLOGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 207 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 208 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 209 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY OPTICAL FIBER MODE, 2018–2021 (USD MILLION)

TABLE 210 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET IN ROW, BY OPTICAL FIBER MODE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 173)

12.1 OVERVIEW

FIGURE 45 COMPANIES IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2019 TO 2021

12.2 RANKING ANALYSIS OF MARKET PLAYERS

FIGURE 46 MARKET RANKING OF TOP 5 PLAYERS IN OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET, 2021

12.3 COMPETITIVE LEADERSHIP MAPPING

12.3.1 VISIONARY LEADERS

12.3.2 DYNAMIC DIFFERENTIATORS

12.3.3 INNOVATORS

12.3.4 EMERGING COMPANIES

FIGURE 47 OPTICAL COMMUNICATION AND NETWORKING EQUIPMENT MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2021

12.4 STRENGTH OF PRODUCT PORTFOLIO (FOR ALL 25 PLAYERS)

12.5 BUSINESS STRATEGY EXCELLENCE (FOR ALL 25 PLAYERS)

12.6 COMPETITIVE SCENARIO

12.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 211 MAJOR PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019–MARCH 2022

12.6.2 PARTNERSHIP, COLLABORATIONS, AGREEMENTS, AND CONTRACTS

TABLE 212 MAJOR PARTNERSHIPS, COLLABORATIONS, AND AGREEMENTS, JANUARY 2019–MARCH 2022

12.6.3 ACQUISITIONS

TABLE 213 MAJOR ACQUISITIONS, JANUARY 2019–MARCH 2022

13 COMPANY PROFILES (Page No. - 182)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM view)*

13.1.1 HUAWEI TECHNOLOGIES COMPANY, LTD.

FIGURE 48 HUAWEI TECHNOLOGIES COMPANY, LTD.: COMPANY SNAPSHOT

13.1.2 CISCO SYSTEMS, INC.

FIGURE 49 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

13.1.3 CIENA CORPORATION

FIGURE 50 CIENA CORPORATION: COMPANY SNAPSHOT

13.1.4 NOKIA

FIGURE 51 NOKIA: COMPANY SNAPSHOT

13.1.5 II-VI INCORPORATED

FIGURE 52 II-VI INCORPORATED: COMPANY SNAPSHOT

13.1.6 ZTE CORPORATION

FIGURE 53 ZTE CORPORATION: COMPANY SNAPSHOT

13.1.7 ADTRAN, INC.

FIGURE 54 ADTRAN, INC.: COMPANY SNAPSHOT

13.1.8 INFINERA CORP.

FIGURE 55 INFINERA CORP.: COMPANY SNAPSHOT

13.1.9 ADVA OPTICAL NETWORKING

FIGURE 56 ADVA OPTICAL NETWORKING: COMPANY SNAPSHOT

13.1.10 FUJITSU

FIGURE 57 FUJITSU: COMPANY SNAPSHOT

13.2 RIGHT TO WIN

13.3 OTHER KEY PLAYERS

13.3.1 RIBBON COMMUNICATIONS

13.3.2 CALIX, INC.

13.3.3 LUMENTUM HOLDINGS INC.

13.3.4 NEOPHOTONICS CORPORATION

13.3.5 BROADCOM

13.3.6 NEC CORPORATION

13.3.7 JUNIPER NETWORK, INC.

13.3.8 TELEFONAKTIEBOLAGET LM ERICSSON

13.3.9 ALCATEL-LUCENT ENTERPRISE

13.3.10 CORNING

13.3.11 ARISTA NETWORKS, INC.

13.3.12 TE CONNECTIVITY

13.3.13 MICROCHIP

13.3.14 PADTEC

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning imperatives, Current strategies, right to win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 221)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the size of the optical communication and networking equipment market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering optical communication and networking equipment’s have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the optical communication and networking equipment market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of optical communication and networking equipment to identify key players based on their products and prevailing industry trends in the optical communication and networking equipment market by type, application, and region. Secondary research also helped obtain market information and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

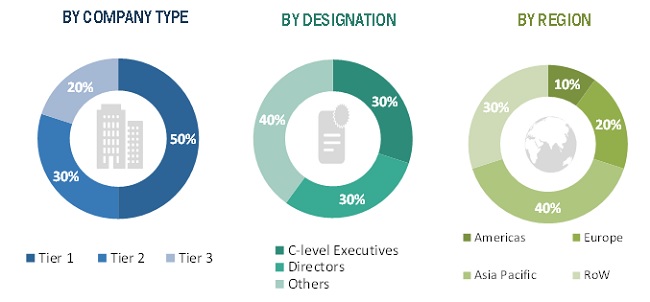

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the optical communication and networking equipment market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

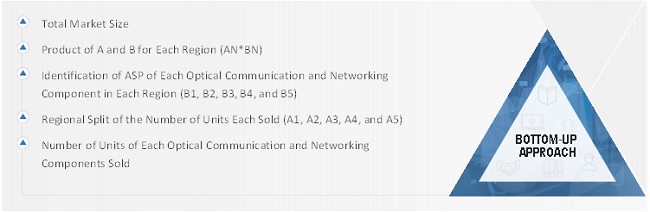

The bottom-up procedure has been employed to arrive at the overall size of the optical communication and networking equipment market.

- Identifying the number of optical communication and networking equipment shipped at the global level

- Identifying average selling prices of optical communication and networking equipment shipped globally

- Conducting multiple discussion sessions with key opinion leaders to understand different optical communication and networking equipment and their deployment in multiple products and applications; analysing the break-up of the work conducted by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases of the company- and region-specific developments undertaken in the optical communication and networking equipment market.

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the optical communication and networking equipment market.

- Focusing initially on the top-line investments and expenditures made in the optical communication and networking equipment ecosystem, splitting further into product, technology, application, and listing key developments in key market areas

- Identifying all major players offering a variety of optical communication and networking equipment’s and technology, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications for which all identified players offer optical communication and networking equipment to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the optical communication and networking equipment market.

Report Objectives

- To describe and forecast the overall optical communication and networking equipment market, by type and application, in terms of value

- To provide the size for the overall optical communication and networking equipment market in terms of volume

- To describe operational frequencies of the optical communication and networking equipment market

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and the Rest of the World, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the optical communication and networking equipment ecosystem, along with the average selling prices of device type

- To strategically analyze the ecosystem, Porter’s five forces, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as partnerships, expansions, investments, and acquisitions in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Communication and Networking Equipment Market

I manage market analyst relationships at a renowned company. We are one of the leading fiber optic module suppliers in the world and I would like to discuss how we be included in future industry reports. We work closely with other similar market research companies for providing useful information.

I want to have an understanding of the current market trends and future growth particularly for data center applications

Interested in evaluating total market of network and telecommunications worldwide, as well as growth potential for North America, Europe, Asia-Pacific, and Rest regions

Hi! I am requesting for a copy of this research to be used as reference for my Strategic Management Paper. The data in this research will be helpful for my market and competitor analysis.

We are seeking information on high speed (at least 10Gbps) internet connection from our northern neighboring CIS Republics Turkmenistan ,Tajikistan Uzbekistan. Is this information covered in the report?