Medical Electrodes Market by Product [Diagnostic Electrodes (ECG, EEG, EMG), Therapeutic Electrodes (Defibrillator, Pacemaker)], Technology (Wet, Dry, Needle), Application (Neurophysiology, IOM), Usage (Disposable, Reusable) & Region - Global Forecast to 2026

Market Growth Outlook Summary

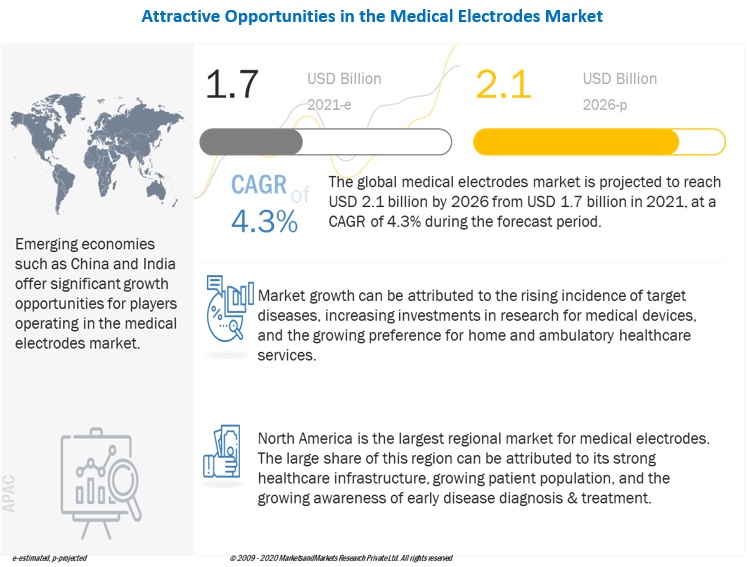

The global medical electrodes market growth forecasted to transform from $1.7 billion in 2021 to $2.1 billion by 2026, driven by a CAGR of 4.3%. Growth in this market is primarily driven by the increase in the incidence rate of neurological and cardiovascular disorders and the increasing preference for home and ambulatory care services.

Medical Electrodes Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Medical Electrodes Market Dynamics

Driver: Rising incidence of neurological & cardiovascular disorders

The incidence of neurological, cardiovascular, and sleep disorders has significantly increased over the years. This increase has, in turn, accelerated the number of diagnostic and treatment procedures conducted. Thus, the increasing demand for these procedures is likely to support market growth. For instance, according to the World Health Organization (WHO), cardiovascular disease (CVD) is a leading cause of death and disability worldwide. Globally, 17.9 million deaths due to CVD were reported in 2016; this figure is projected to increase to 23.6 million deaths by 2030.

Opportunity: Growth opportunities in emerging economies

Emerging economies such as BRIC (Brazil, Russia, India, and China) and countries in Latin America and Southeast Asia are expected to provide significant growth opportunities to players operating in the global market. This can be attributed in large part to the low competition in these markets, the large population, the rising number of cardiovascular and neurological diseases, and an increase in disposable income.

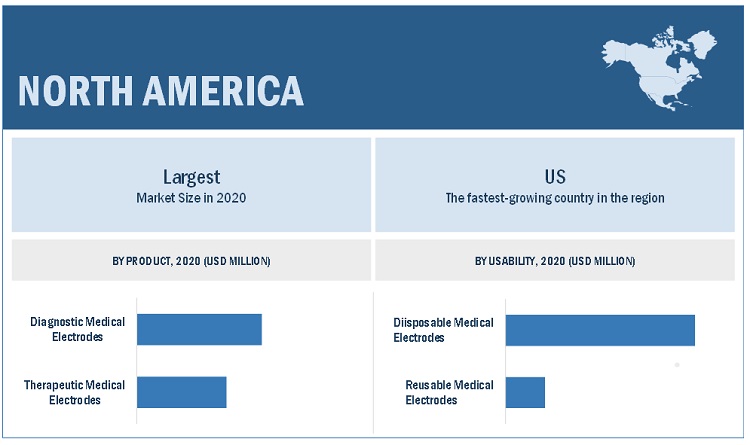

The diagnostic medical electrodes segment accounted for the largest share of the medical electrodes industry, by product

Based on product, the medical electrodes market is segmented into diagnostic medical electrodes and therapeutic medical electrodes. The diagnostic medical electrodes segment accounted for the largest share of the global market. The large share of this segment is primarily due to the rising emphasis on preventive medicine, coupled with rising the number of patients with chronic diseases.

The wet electrode segment dominated the medical electrodes industry, by technology.

Based on technology, the medical electrodes market is segmented into dry electrodes, wet electrodes, and needle electrodes. The wet electrodes segment accounted for the largest share of the global market. The large share of this segment can be attributed to the rising preference for the high signal quality that is offered efficiently by wet electrodes.

The disposable electrodes segment is expected to witness the highest CAGR in the medical electrodes industry by usability during the forecast period.

The medical electrodes market is segmented into disposable electrodes and reusable electrodes, based on usability. In 2020, the disposable electrodes segment accounted for the largest share and is also expected to register a higher growth rate during the forecast period. The large share of the disposable electrodes segment is due to factors such as the rising adoption of disposable electrodes due to the low risk of cross-contamination and cost-effectiveness associated with disposable electrodes.

The cardiology segment accounted for the largest share by application in the medical electrode industry

Based on application, the medical electrodes market is segmented into cardiology, neurophysiology, sleep disorders, intraoperative monitoring (IOM), surgical applications, and other applications. Factors such as the increasing prevalence of cardiovascular diseases (CVD), rising cardiovascular health awareness, and technological innovations in diagnostics tools have accelerated the growth of the segment.

North America was the largest region for medical electrodes industry.

The medical electrodes market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. In 2020, North America was the largest regional segment of the overall market, followed by Europe. The large share of the North American market is due to factors such as the, rising geriatric population, the growing incidence of chronic diseases, and the increasing focus on innovative technologies by medical electrode manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players operating in the medical electrodes market include Medtronic (Ireland), Ambu A/S (Denmark), 3M (US), Natus Medical Incorporated (US), Koninklijke Philips N.V. (Netherlands), B. Braun Melsungen AG (Germany), ZOLL Medical Corporation (US), Cardinal Health (US), CONMED Corporation (US), Nihon Kohden Corporation (Japan), Rhythmlink International, LLC (US), Cognionics, Inc. (US), GE Healthcare (US), Compumedics Limited (Australia), and Nissha Medical Technologies (Japan).

Scope of the Medical Electrodes Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$1.7 billion |

|

Projected Revenue Size by 2026 |

$2.1 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 3.6% |

|

Market Driver |

Rising incidence of neurological & cardiovascular disorders |

|

Market Opportunity |

Growth opportunities in emerging economies |

This report categorizes the global medical electrodes market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Diagnostic Medical Electrodes

- Electrocardiography (ECG) Electrodes

- Electroencephalography (EEG) Electrodes

- Electromyography (EMG) Electrodes

- Other Diagnostic Electrodes [electroretinography (ERG) electrodes and electrooculography (EOG) electrodes]

-

Therapeutic Medical Electrodes

- Defibrillator Electrodes

- Pacemaker Electrodes

- TENS Electrodes

- Electrosurgical Electrodes

- Neuromuscular Stimulation Electrodes (NMES)

- Other Therapeutic Electrodes (wound healing electrodes, blood gas electrodes, and iontophoresis electrodes)

By Technology

- Wet Electrodes

- Dry Electrodes

- Needle Electrodes

By Usability

- Disposable Medical Electrodes

- Reusable Medical Electrodes

By Application

- Cardiology

- Neurophysiology

- Sleep Disorders

- Intraoperative Monitoring (IOM)

- Surgical Applications

- Other Applications (vision disorders and wound healing)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Medical Electrodes Industry:

- In 2021, Sticky Pad Surface Electrodes manufacturered by Rhythmlink International, LLC (US) received FDA clearance for MR Conditional for 1.5 and 3 Tesla MRI environments and now can be used safely and effectively in imaging environments.

- In 2020, Natus Medical, Inc. (US) entered into a partnership with Holberg EEG AS (Norway). This partnership aims to improve and automate the diagnosis of epilepsy by developing and distributing an AutoSCORE algorithm worldwide.

- In 2019, Medtronic (Ireland) entered into a distribution agreement with Alpha Omega (Israel). This agreement aimed to market Medtronic’s surgical navigation products designed for procedures in the brain.

Frequently Asked Questions (FAQs):

What is the projected market value of the global Medical Electrodes Market?

The global market of Medical Electrodes Market is projected to reach USD 2.1 Billion.

What is the estimated growth rate (CAGR) of the global Medical Electrodes Market for the next five years?

The global Medical Electrodes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.3% from 2021 to 2026.

What are the major revenue pockets in the Medical Electrodes Market currently?

North America was the largest regional segment of the overall market, followed by Europe. The large share of the North American market is due to factors such as the, rising geriatric population, the growing incidence of chronic diseases, and the increasing focus on innovative technologies by medical electrode manufacturers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSION & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MEDICAL ELECTRODES MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 COVID-19 ECONOMIC ASSESSMENT

2.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 INTRODUCTION

FIGURE 11 MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2021 VS. 2026

FIGURE 12 GLOBAL MARKET, BY TECHNOLOGY, 2021 VS. 2026

FIGURE 13 GLOBAL MARKET, BY USABILITY, 2021–2026

FIGURE 14 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 15 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MEDICAL ELECTRODES INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 16 RISING INCIDENCE OF NEUROLOGICAL DISORDERS & CVD TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 ASIA PACIFIC: MARKET, BY DIAGNOSTIC MEDICAL ELECTRODES & COUNTRY (2021)

FIGURE 17 ELECTROCARDIOGRAPHY (ECG) ELECTRODES TO ACCOUNT FOR THE LARGEST SHARE, BY DIAGNOSTIC ELECTRODES, IN 2021

4.3 GLOBAL MARKET, BY PRODUCT, 2021-2026

FIGURE 18 DIAGNOSTIC MEDICAL ELECTRODES ARE EXPECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

FIGURE 19 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MEDICAL ELECTRODES INDUSTRY DYNAMICS

FIGURE 20 GLOBAL MARKET: DRIVERS AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 The rising incidence of neurological & cardiovascular disorders

5.2.1.2 Increasing investments in research for medical devices

5.2.1.3 Growing preference for home & ambulatory care services

5.2.1.4 Rising demand for minimally invasive surgeries

5.2.2 OPPORTUNITIES

5.2.2.1 Growth opportunities in emerging economies

TABLE 1 ASIA: HEALTHCARE EXPENDITURE (% OF GDP), BY COUNTRY

5.3 REGULATORY LANDSCAPE

5.3.1 FDA

TABLE 2 US: REGULATORY APPROVAL PROCESS, BY DEVICE TYPE

5.3.2 EUROPEAN REGULATIONS

5.3.3 OTHER COUNTRIES

TABLE 3 MEDICAL DEVICE REGULATIONS, BY COUNTRY

5.4 COVID-19 IMPACT ON THE GLOBAL MARKET

5.5 TECHNOLOGY ANALYSIS

5.6 PRICING ANALYSIS

TABLE 4 US: PRICE OF MEDICAL ELECTRODES, BY PRODUCT

5.7 TRADE ANALYSIS

TABLE 5 IMPORT DATA FOR ELECTROCARDIOGRAPHS, BY COUNTRY, 2016-2020

TABLE 6 EXPORT DATA FOR ELECTROCARDIOGRAPHS, BY COUNTRY, 2016-2020

5.8 PATENT ANALYSIS

5.9 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 22 DISTRIBUTION: A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.11 MEDICAL ELECTRODES ECOSYSTEM

FIGURE 23 MEDICAL ELECTRODES ECOSYSTEM ANALYSIS

5.11.1 ROLE IN ECOSYSTEM

5.12 YCC SHIFT

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 HIGH CONSOLIDATION IN THE MARKET TO RESTRICT THE ENTRY OF NEW PLAYERS

5.13.1 DEGREE OF COMPETITION

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF SUBSTITUTES

5.13.5 THREAT OF NEW ENTRANTS

6 MEDICAL ELECTRODES MARKET, BY PRODUCT (Page No. - 65)

6.1 INTRODUCTION

TABLE 8 GLOBAL MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

6.2 DIAGNOSTIC MEDICAL ELECTRODES

TABLE 9 MARKET for DIAGNOSTIC MEDICAL ELECTRODES, BY TYPE, 2019–2026

TABLE 10 MARKET for DIAGNOSTIC MEDICAL ELECTRODES , BY REGION, 2019–2026

6.2.1 ELECTROCARDIOGRAPHY (ECG) ELECTRODES

6.2.1.1 The rising prevalence of cardiovascular diseases to drive market growth for ECG electrodes

TABLE 11 ECG ELECTRODES MARKET, BY REGION, 2019–2026

6.2.2 ELECTROENCEPHALOGRAPHY (EEG) ELECTRODES

6.2.2.1 EEG electrodes help in monitoring seizure disorders and other brain conditions

TABLE 12 EEG ELECTRODES MARKET, BY REGION, 2019–2026

6.2.3 ELECTROMYOGRAPHY (EMG) ELECTRODES

6.2.3.1 Increasing incidences of neuromuscular disorders to drive the market growth

TABLE 13 EMG ELECTRODES MARKET, BY REGION, 2019–2026

6.2.4 OTHER DIAGNOSTIC ELECTRODES

TABLE 14 OTHER DIAGNOSTIC ELECTRODES MARKET, BY REGION, 2019–2026

6.3 THERAPEUTIC MEDICAL ELECTRODES

TABLE 15 THERAPEUTIC MARKET, BY TYPE, 2019–2026

TABLE 16 THERAPEUTIC ELECTRODES MARKET, BY REGION, 2019–2026

6.3.1 DEFIBRILLATOR ELECTRODES

6.3.1.1 Rising prevalence of CVD to drive the growth of this segment

TABLE 17 DEFIBRILLATOR ELECTRODES MARKET, BY REGION, 2019–2026

6.3.2 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS) ELECTRODES

6.3.2.1 Low cost and ease of use to support the market growth for this segment

TABLE 18 TENS ELECTRODES MARKET, BY REGION, 2019–2026

6.3.3 ELECTROSURGICAL ELECTRODES

6.3.3.1 Increasing demand for minimally invasive surgical procedures to drive the market growth

TABLE 19 ELECTROSURGICAL ELECTRODES MARKET, BY REGION, 2019–2026

6.3.4 PACEMAKER ELECTRODES

6.3.4.1 Rising geriatric population to drive market growth for pacemaker electrodes

TABLE 20 PACEMAKER ELECTRODES MARKET, BY REGION, 2019–2026

6.3.5 NEUROMUSCULAR ELECTRICAL STIMULATION (NMES) ELECTRODES

6.3.5.1 NMES electrodes are largely used in the field of neurorehabilitation

TABLE 21 NMES ELECTRODES MARKET, BY REGION, 2019–2026

6.3.6 OTHER THERAPEUTIC ELECTRODES

TABLE 22 OTHER THERAPEUTIC ELECTRODES MARKET, BY REGION, 2019–2026

7 MEDICAL ELECTRODES MARKET, BY TECHNOLOGY (Page No. - 78)

7.1 INTRODUCTION

TABLE 23 GLOBAL MEDICAL ELECTRODES INDUSTRY, BY TECHNOLOGY, 2019–2026

7.2 WET ELECTRODES

7.2.1 WET ELECTRODES OFFER HIGH-QUALITY SIGNAL RECORDING

TABLE 24 WET ELECTRODES MARKET, BY REGION, 2019–2026

7.3 DRY ELECTRODES

7.3.1 TECHNOLOGICAL ADVANCEMENTS IN DRY ELECTRODES PROVIDE BETTER PATIENT COMFORT

TABLE 25 SPIKE SIZE OF ELECTRODES WITH ADVANTAGES AND DISADVANTAGES

TABLE 26 COMMERCIAL EEG SYSTEMS BASED ON DRY ELECTRODES

TABLE 27 DRY ELECTRODES MARKET, BY REGION, 2019–2026

7.4 NEEDLE ELECTRODES

7.4.1 NEEDLE ELECTRODES ARE LESS SUSCEPTIBLE TO MOVEMENT ERRORS

TABLE 28 NEEDLE ELECTRODES MARKET, BY REGION, 2019–2026

8 MEDICAL ELECTRODES MARKET, BY USABILITY (Page No. - 84)

8.1 INTRODUCTION

TABLE 29 GLOBAL MEDICAL ELECTRODES INDUSTRY, BY USABILITY, 2019-2026

8.2 DISPOSABLE MEDICAL ELECTRODES

8.2.1 GROWING PREVALENCE OF HAIS TO DRIVE THE MARKET GROWTH OF THIS SEGMENT

TABLE 30 DISPOSABLE MARKET, BY REGION, 2019-2026

8.3 REUSABLE MEDICAL ELECTRODES

8.3.1 THE HIGH MAINTENANCE COST OF REUSABLE ELECTRODES LIMITS ADOPTION

TABLE 31 REUSABLE MARKET, BY REGION, 2019-2026

9 MEDICAL ELECTRODES MARKET, BY APPLICATION (Page No. - 88)

9.1 INTRODUCTION

TABLE 32 GLOBAL MEDICAL ELECTRODES INDUSTRY, BY APPLICATION, 2019-2026

9.2 CARDIOLOGY

9.2.1 INCREASING INCIDENCE OF CARDIOVASCULAR DISEASES TO DRIVE THE MARKET GROWTH

TABLE 33 GLOBAL MARKET FOR CARDIOLOGY, BY REGION, 2019-2026

9.3 NEUROPHYSIOLOGY

9.3.1 THE GROWING PREVALENCE OF BRAIN DISORDERS TO SUPPORT MARKET GROWTH FOR THIS SEGMENT

TABLE 34 GLOBAL MARKET FOR NEUROPHYSIOLOGY, BY REGION, 2019-2026

9.4 SLEEP DISORDERS

9.4.1 GROWING INCIDENCE OF SLEEP DISORDERS TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 35 GLOBAL MARKET FOR SLEEP DISORDERS, BY REGION, 2019-2026

9.5 INTRAOPERATIVE MONITORING (IOM)

9.5.1 IOM HELPS REDUCE THE RISK OF NEUROLOGICAL DEFICITS

TABLE 36 GLOBAL MARKET FOR INTRAOPERATIVE MONITORING, BY REGION, 2019-2026

9.6 SURGICAL APPLICATIONS

9.6.1 INCREASING NUMBER OF MINIMALLY INVASIVE SURGERIES TO DRIVE THE MARKET GROWTH FOR SURGICAL APPLICATIONS

TABLE 37 GLOBAL MARKET FOR SURGICAL APPLICATIONS, BY REGION, 2019-2026

9.7 OTHER APPLICATIONS

TABLE 38 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2019-2026

10 MEDICAL ELECTRODES MARKET, BY REGION (Page No. - 95)

10.1 INTRODUCTION

TABLE 39 GLOBAL MEDICAL ELECTRODES INDUSTRY, BY REGION, 2019–2026

10.2 NORTH AMERICA

FIGURE 24 NORTH AMERICA: MEDICAL ELECTRODES INDUSTRY SNAPSHOT

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026

TABLE 41 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026

TABLE 42 NORTH AMERICA: DIAGNOSTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 43 NORTH AMERICA: THERAPEUTIC ELECTRODES MARKET, BY TYPE, 2019–2026

TABLE 44 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 45 NORTH AMERICA: MARKET, BY USABILITY, 2019–2026

TABLE 46 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026

10.2.1 US

10.2.1.1 The US accounts for the largest share of the North American market during the forecast period

TABLE 47 US: KEY MACROINDICATORS

TABLE 48 US: MARKET, BY PRODUCT, 2019–2026

TABLE 49 US: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 50 US: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 51 US: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 52 US: MARKET, BY USABILITY, 2019–2026

TABLE 53 US: MARKET, BY APPLICATION, 2019–2026

10.2.2 CANADA

10.2.2.1 Increasing research in the field of cardiology and neurology to drive the market

TABLE 54 RESEARCH GRANTS FOR PATIENT MONITORING DEVICES IN CANADA

TABLE 55 CANADA: KEY MACROINDICATORS

TABLE 56 CANADA: MARKET, BY PRODUCT, 2019–2026

TABLE 57 CANADA: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 58 CANADA: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 59 CANADA: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 60 CANADA: MARKET, BY USABILITY, 2019–2026

TABLE 61 CANADA: MARKET, BY APPLICATION,2019–2026

10.3 EUROPE

TABLE 62 EUROPE: MARKET, BY COUNTRY, 2019–2026

TABLE 63 EUROPE: MARKET, BY PRODUCT, 2019–2026

TABLE 64 EUROPE: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 65 EUROPE: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 66 EUROPE: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 67 EUROPE: MARKET, BY USABILITY, 2019–2026

TABLE 68 EUROPE: MARKET, BY APPLICATION, 2019–2026

10.3.1 GERMANY

10.3.1.1 Germany accounted for the largest share of the market in Europe in 2020

TABLE 69 GERMANY: KEY MACROINDICATORS

TABLE 70 GERMANY: MARKET, BY PRODUCT, 2019–2026

TABLE 71 GERMANY: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 72 GERMANY: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 73 GERMANY: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 74 GERMANY: MARKET, BY USABILITY, 2019–2026

TABLE 75 GERMANY: MARKET, BY APPLICATION, 2019–2026

10.3.2 FRANCE

10.3.2.1 High incidences of neurological disorders drive the market growth in France

TABLE 76 FRANCE: KEY MACROINDICATORS

TABLE 77 FRANCE: MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 78 FRANCE: DIAGNOSTIC MARKET, BY PRODUCT, 2019–2026

TABLE 79 FRANCE: THERAPEUTIC MARKET, BY PRODUCT, 2019–2026

TABLE 80 FRANCE: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 81 FRANCE: MARKET, BY USABILITY, 2019–2026

TABLE 82 FRANCE: MARKET, BY APPLICATION, 2019–2026

10.3.3 UK

10.3.3.1 Increasing investments in public and private sectors to drive the market growth

TABLE 83 UK: KEY MACROINDICATORS

TABLE 84 UK: MARKET, BY PRODUCT, 2019–2026

TABLE 85 UK: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 86 UK: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 87 UK: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 88 UK: MARKET, BY USABILITY, 2019–2026

TABLE 89 UK: MARKET, BY APPLICATION, 2019–2026

10.3.4 REST OF EUROPE (ROE)

TABLE 90 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2018 (% OF GDP)

TABLE 91 ROE: MARKET, BY PRODUCT, 2019–2026

TABLE 92 ROE: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 93 ROE: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 94 ROE: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 95 ROE: MARKET, BY USABILITY, 2019–2026

TABLE 96 ROE: MARKET, BY APPLICATION, 2019–2026

10.4 ASIA PACIFIC

FIGURE 25 APAC: MARKET SNAPSHOT

TABLE 97 APAC: MARKET, BY COUNTRY, 2019–2026

TABLE 98 APAC: MARKET, BY PRODUCT, 2019–2026

TABLE 99 APAC: DIAGNOSTIC DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 100 APAC: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 101 APAC: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 102 APAC: MARKET, BY USABILITY, 2019–2026

TABLE 103 APAC: MARKET, BY APPLICATION, 2019–2026

10.4.1 JAPAN

10.4.1.1 The elderly population in Japan drives the market growth for medical devices

TABLE 104 JAPAN: KEY MACROINDICATORS

TABLE 105 JAPAN: MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 106 JAPAN: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 107 JAPAN: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT,2019–2026

TABLE 108 JAPAN: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 109 JAPAN: MARKET, BY USABILITY, 2019–2026

TABLE 110 JAPAN: MARKET, BY APPLICATION, 2019–2026

10.4.2 CHINA

10.4.2.1 Developing healthcare infrastructure to boost the market growth for medical electrodes in China

TABLE 111 CHINA: KEY MACROINDICATORS

TABLE 112 CHINA: MARKET, BY PRODUCT, 2019–2026

TABLE 113 CHINA: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 114 CHINA: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 115 CHINA: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 116 CHINA: MARKET, BY USABILITY, 2019–2026

TABLE 117 CHINA: MARKET, BY APPLICATION, 2019–2026

10.4.3 INDIA

10.4.3.1 High incidence of cardiovascular and neurological diseases to drive the market

TABLE 118 INDIA: KEY MACROINDICATORS

TABLE 119 INDIA: MARKET, BY PRODUCT, 2019–2026

TABLE 120 INDIA: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 121 INDIA: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 122 INDIA: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 123 INDIA: MARKET, BY USABILITY, 2019–2026

TABLE 124 INDIA: MARKET, BY APPLICATION, 2019–2026

10.4.4 ROAPAC

TABLE 125 ROAPAC: MARKET, BY PRODUCT, 2019–2026

TABLE 126 ROAPAC: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 127 ROAPAC: THERAPEUTIC MEDICAL ELECTRODES MARKET, BY PRODUCT, 2019–2026

TABLE 128 ROAPAC: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 129 ROAPAC: MARKET, BY USABILITY, 2019–2026

TABLE 130 ROAPAC: MARKET, BY APPLICATION, 2019–2026

10.5 REST OF THE WORLD

TABLE 131 ROW: MARKET, BY PRODUCT, 2019–2026

TABLE 132 ROW: DIAGNOSTIC MARKET for MEDICAL ELECTRODES, BY PRODUCT, 2019–2026

TABLE 133 ROW: THERAPEUTIC MEDICAL ELECTRODES INDUSTRY, BY PRODUCT, 2019–2026

TABLE 134 ROW: MARKET, BY TECHNOLOGY, 2019–2026

TABLE 135 ROW: MARKET, BY USABILITY,2019–2026

TABLE 136 ROW: MARKET, BY APPLICATION, 2019–2026

11 COMPETITIVE LANDSCAPE (Page No. - 139)

11.1 OVERVIEW

FIGURE 26 KEY DEVELOPMENTS IN THE MEDICAL ELECTRODES MARKET, JANUARY 2018–APRIL 2021

11.2 MARKET SHARE ANALYSIS

TABLE 137 GLOBAL MARKET: DEGREE OF COMPETITION (2019)

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 27 GLOBAL MARKET: COMPANY EVALUATION QUADRANT, 2020

11.4 COMPANY EVALUATION QUADRANT: SMES/START-UPS

11.4.1 PROGRESSIVE COMPANIES

11.4.2 STARTING BLOCKS

11.4.3 RESPONSIVE COMPANIES

11.4.4 DYNAMIC COMPANIES

FIGURE 28 GLOBAL MARKET: COMPANY EVALUATION QUADRANT FOR SMES & START-UPS, 2020

11.5 COMPETITIVE SCENARIO

FIGURE 29 MARKET EVALUATION MATRIX, 2018–2021

11.5.1 DEALS

TABLE 138 DEALS

11.5.2 PRODUCT LAUNCHES

TABLE 139 PRODUCT LAUNCHES/APPROVALS

11.5.3 OTHER DEVELOPMENTS

TABLE 140 OTHER DEVELOPMENTS

11.6 COMPANY PRODUCT FOOTPRINT

TABLE 141 COMPANY FOOTPRINT

TABLE 142 COMPANY PRODUCT FOOTPRINT

TABLE 143 COMPANY GEOGRAPHICAL FOOTPRINT

12 COMPANY PROFILES (Page No. - 152)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 CARDINAL HEALTH

FIGURE 30 CARDINAL HEALTH: COMPANY SNAPSHOT (2020)

12.1.2 3M

FIGURE 31 3M: COMPANY SNAPSHOT (2020)D

12.1.3 ZOLL MEDICAL CORPORATION (PART OF ASAHI KASEI CORPORATION)

FIGURE 32 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2020)

12.1.4 MEDTRONIC

FIGURE 33 MEDTRONIC: COMPANY SNAPSHOT (2020)

12.1.5 AMBU A/S.

FIGURE 34 AMBU A/S: COMPANY SNAPSHOT (2020)

12.1.6 NATUS MEDICAL INCORPORATED

FIGURE 35 NATUS MEDICAL INCORPORATED: COMPANY SNAPSHOT (2020)

12.1.7 B. BRAUN MELSUNGEN AG

FIGURE 36 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2020)

12.1.8 CONMED CORPORATION

FIGURE 37 CONMED CORPORATION: COMPANY SNAPSHOT (2020)

12.1.9 COMPUMEDICS LIMITED

FIGURE 38 COMPUMEDICS LIMITED.: COMPANY SNAPSHOT (2020)

12.1.10 COGNIONICS, INC.

12.1.11 GE HEALTHCARE (SUBSIDIARY OF GENERAL ELECTRIC COMPANY)

FIGURE 39 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT (2020)

12.1.12 KONINKLIJKE PHILIPS N.V.

FIGURE 40 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

12.1.13 NIHON KOHDEN CORPORATION

FIGURE 41 NIHON KOHDEN CORPORATION.: COMPANY SNAPSHOT (2019)

12.1.14 RHYTHMLINK INTERNATIONAL, LLC

12.1.15 NISSHA MEDICAL TECHNOLOGIES (SUBSIDIARY OF NISSHA CO., LTD)

FIGURE 42 NISSHA CO., LTD.: COMPANY SNAPSHOT (2019)

12.2 OTHER PLAYERS

12.2.1 BOSTON SCIENTIFIC CORPORATION

12.2.2 COMEPA

12.2.3 EMED

12.2.4 G.TEC MEDICAL ENGINEERING GMBH

12.2.5 MEDICO ELECTRODES INTERNATIONAL LTD.

12.2.6 TZ MEDICAL

12.2.7 SOMNOMEDICSGMBH

12.2.8 R&D MEDICAL PRODUCTS

12.2.9 MEDLINE INDUSTRIES, INC.

12.2.10 WELLMMLEN HEALTHCARE TECH. (SUZHOU) CO., LTD.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 201)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the medical electrodes market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the medical electrodes market. The secondary sources used for this study include World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), National Center for Biotechnology Information (NCBI), World Federation of Neurology (WFN), American Brain Foundation, Neurology Asia Journal, Brain Injury Association of America (BIAA), American Neurological Association (ANA), American Heart Association (AHA), British Cardiac Patients Association (BCPA), European Journal of Neurology, Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

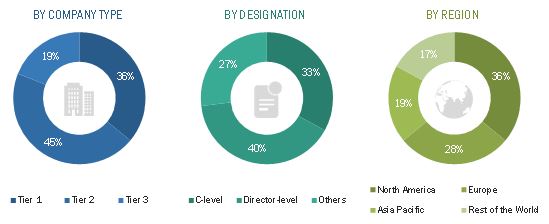

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical electrodes market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the medical electrodes business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global medical electrodes market based on the product, usability, technology, application and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall medical electrodes market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the medical electrodes market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Electrodes Market

What are the challenges faced by the key players in the global Medical Electrodes Market?

Which of the segments of Medical Electrodes Market is expected to grow at a highest CAGR during the forecast period?

How the technological innovations are fueling the revenue growth of the global Medical Electrodes Market?