Workflow Automation Market by Process (Automated Solution, Decision Support & Management Solution, and Interaction Solution), Operations, Deployment (Cloud, and On-Premise), Organization Size, Offering, Industry, and Geography - Global Forecast to 2023

[169 Pages Report] The workflow automation market was valued at USD 4.26 Billion in 2016 and is expected to reach USD 18.45 Billion by 2023, at a CAGR of 23.56% between 2017 and 2023. The base year considered for the study is 2016 and the forecast period is between 2017 and 2023.

The workflow automation market was valued at USD 4.26 Billion in 2016 and is expected to reach USD 18.45 Billion by 2023, at a CAGR of 23.56% between 2017 and 2023. Key factors such as ease in process with the installation of workflow automation tools, convergence of workflow automation with traditional business processes, focus on streamlining business processes, and cost efficiency through workflow automation are driving the workflow automation market.

The workflow automation market has been segmented on the basis of process, operation, deployment, organization size, offering, industry, and region. The market for workflow automation software market held the largest market share owing to the demand for software in structured data format in various organizations. The function of workflow automation software is mainly based on the optical character recognition (OCR); optical mark recognition (OMR); and text, audio, video, and other file formats. These formats are used to maintain the records of business processes so that they are easily recognizable by workflow automation, thus eliminating mundane business processes and reducing human intervention.

The automated solution market for workflow automation held the largest market share owing to the growth of banking, financial services, and insurance industries that have been using automated solution since 2010. Owing to the high degree of flexibility and scalability of the automated solution, it has witnessed widespread deployment in business environments with a greater requirement for data processing and workflow management. The availability of automated solutions capable of large-scale deployment in data management systems is a major driver for the market growth.

The workflow automation in the BFSI industry held the largest market share among all industries. In the BFSI industry, processes such as data entry for clearance and registration processes, updating systems and producing client information, gathering information from various systems and generating a renewal premium, processes such as order-to-cash (order management, invoicing and collections, etc.), record-to-report (fixed asset accounting), conduct compliance, legal and credit checks, and claims processing and general data entry are done by workflow automation in the insurance and banking sectors to facilitate the monotonous and time-consuming processes.

The workflow automation market by organization size for large enterprises held a larger market share. Large enterprises are apprehensive about their crucial organizational information and widely prefer on-premise deployment. With the option of deploying these solutions available on the cloud, the workflow automation market has seen an increase in the deployment of solutions by SMEs and large enterprises. An increasing number of large enterprises are deploying workflow automation, both on premise and cloud, which is driving the market growth.

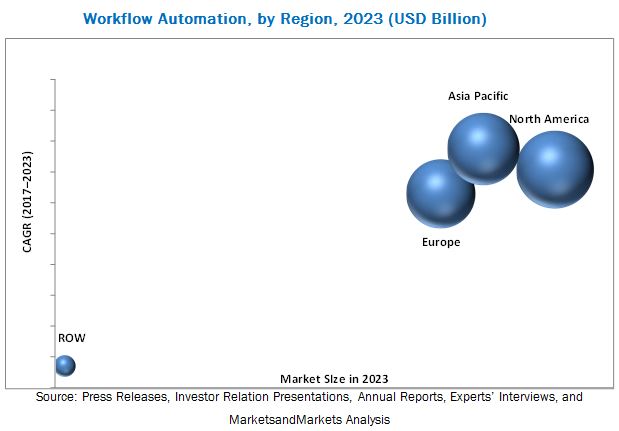

The workflow automation market in North America held the largest market share in 2016. North America is estimated to account for the largest share of the overall market in 2017. BFSI; telecom and IT; and travel, hospitality, and transportation industries in the US, Canada, and Mexico are adopting workflow automation for different functions to better manage business processes. This has resulted in significant growth of the workflow automation market in North America.

The major restraint of the workflow automation market is data insecurity, which is hindering the implementation of workflow automation in the financial sector.

Top workflow automation companies that provide workflow automation software and services globally are IBM Corporation (US), Oracle Corporation (US), Pegasystems Inc. (US), Software AG (Germany), Xerox Corporation (US), Appian Corporation (US), Bizagi (UK), Ipsoft Inc. (US), Newgen Software Technologies Limited (India), and Nintex Global Limited (US). These companies are focusing on product launches and developments, acquisitions, and collaborations strategies to enhance their service offerings and expand their business.

Top companies are adopting an organic approach toward improving their position in the workflow automation market, by either improving their existing portfolio or by adding new offerings. For instance, in 2016, IBM Corporation with its partner Box launched a new workflow solution Box Relay. Box Relay would facilitate employee in a business to build, manage, and track custom or pre-built workflows. In 2017, Oracle Corporation launched 4 cloud-based applications to help supply chain companies automate their operations, which will enable companies to automate their workflow operations related to asset monitoring, production and fleet monitoring, and connected workers. In 2016, Pegasystems introduced Pega Robotic Automation in its Pega 7 Platform to facilitate intelligent optimization capabilities for organizations.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 33)

4.1 Workflow Automation Market

4.2 Market, By Offering

4.3 Market, By Process

4.4 Market: Key Industries to Invest in Different Regions

4.5 Market, By Industry and Region

4.6 Market, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Ease in Business Processes With the Installation of Workflow Automation Tools

5.2.1.2 Convergence of Workflow Automation With Traditional Business Processes

5.2.1.3 Focus on Streamlining Business Processes

5.2.1.4 Cost Efficiency Through Workflow Automation

5.2.2 Restraints

5.2.2.1 Data Insecurity Hindering the Implementation of Workflow Automation in the Financial Sector

5.2.3 Opportunities

5.2.3.1 Integration of New Technologies With Workflow Automation

5.2.3.2 High Demand for Workflow Automation in the Logistics Industry

5.2.3.3 Expected Adoption of Workflow Automation in the Bpo Sector

5.2.3.4 Increased Focus on Digital Transformation Initiatives

5.2.4 Challenges

5.2.4.1 Lack of Awareness Regarding Workflow Automation

5.2.4.2 High Implementation Cost and Difficulty in Integrating New and Existing Systems Through Workflows

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Types of Workflow Automation

6.2.1 Production Workflow Systems

6.2.2 Messaging-Based Workflow Systems

6.2.3 Web-Based Workflow Systems

6.2.4 Suite-Based Workflow Systems

6.3 Workflow Automation Architecture

6.4 Evolution of Cognitive Process With Business Workflow

6.5 Cognitive Process Within Workflow Automation

6.6 Applications of Cognitive Process and Artificial Intelligence in Workflow Automation

6.6.1 BFSI

6.6.1.1 Wealth Management

6.6.1.2 Fraud Detection

6.6.1.3 Automated Virtual Assistants

6.6.2 Healthcare

6.6.2.1 Health Assistance and Medical Management

6.6.2.2 Drug Development

6.6.3 Others (Law and Education)

6.7 Value Chain Analysis

6.7.1 Workflow Automation Software Providers

6.7.2 Workflow Automation Service Providers

6.7.3 Implementation

6.7.4 Industry Verticals

7 Workflow Automation Market, By Process (Page No. - 52)

7.1 Introduction

7.2 Automated Solution

7.3 Decision Support and Management Solution

7.4 Interaction Solution

8 Workflow Automation Market, By Operation (Page No. - 56)

8.1 Introduction

8.2 Rule Based

8.3 Knowledge Based

8.4 Robotic Process Automation Based

9 Workflow Automation Market, By Deployment (Page No. - 60)

9.1 Introduction

9.2 On-Premise

9.3 Cloud-Based

10 Market Analysis, By Organization Size (Page No. - 63)

10.1 Introduction

10.2 Large Enterprises

10.3 SMES

11 Workflow Automation Market, By Offering (Page No. - 66)

11.1 Introduction

11.2 Software

11.2.1 Model-Based Application

11.2.2 Process-Based Application

11.3 Services

11.3.1 Consulting

11.3.2 Integration and Development

11.3.3 Training

12 Workflow Automation Market, By Industry (Page No. - 82)

12.1 Introduction

12.2 Banking, Financial Services, & Insurance

12.3 Telecom & IT Industry

12.4 Travel, Hospitality, & Transportation Industry

12.5 Retail & Consumer Goods

12.6 Manufacturing & Logistics Industry

12.7 Healthcare & Pharmaceuticals

12.8 Energy & Utilities

12.9 Other Industries

13 Geographic Analysis (Page No. - 100)

13.1 Introduction

13.2 North America

13.2.1 US

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 Germany

13.3.2 UK

13.3.3 France

13.3.4 Italy

13.3.5 Rest of Europe

13.4 Asia Pacific

13.4.1 China

13.4.2 Japan

13.4.3 India

13.4.4 Rest of Asia Pacific

13.5 Rest of World

13.5.1 Middle East and Africa

13.5.2 South America

14 Competitive Landscape (Page No. - 116)

14.1 Overview

14.2 Market Ranking Analysis of the Top Players of Workflow Automation Market

14.3 Competitive Situation and Trends

14.3.1 Battle for Market Share: Product Launches Was the Key Strategy Adopted Between 2015 and 2017

14.3.2 Product Launches

14.3.3 Agreements, Collaborations, and Partnerships

14.3.4 Acquisitions

14.3.5 Expansions

15 Company Profiles (Page No. - 123)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments)*

15.1 Introduction

15.2 IBM Corporation

15.3 Oracle Corporation

15.4 Pegasystems Inc.

15.5 Software AG

15.6 Xerox Corporation

15.7 Appian

15.8 Bizagi

15.9 Ipsoft, Inc.

15.10 Newgen Software Technologies Limited

15.11 Nintex Global Limited

15.12 Key Innovators

15.12.1 Opentext Corp.

15.12.2 Tibco Software Inc.

15.12.3 Uipath SRL

15.12.4 Sourcecode Technology Holdings, Inc.

15.12.5 Thoughtonomy Ltd.

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 159)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

16.7 Author Details

List of Tables (65 Tables)

Table 1 Workflow Automation Market, By Process, 2014–2023 (USD Million)

Table 2 Workflow Automation Market, By Operation, 2014–2023 (USD Million)

Table 3 Market for Robotic Process Automation, By Region, 2014–2023 (USD Million)

Table 4 Workflow Automation Market, By Deployment, 2014–2023 (USD Million)

Table 5 Workflow Automation Market, By Organization Size, 2014–2023 (USD Million)

Table 6 Workflow Automation Market, By Offering, 2014–2023 (USD Million)

Table 7 Market for Software, By Region, 2014–2023 (USD Million)

Table 8 Market for Software, By Industry, 2014–2023 (USD Million)

Table 9 Market for BFSI Based on Software, By Region, 2014–2023 (USD Million)

Table 10 Market for Telecom and IT Based on Software, By Region, 2014–2023 (USD Million)

Table 11 Market for Travel, Hospitality, and Transportation Based on Software, By Region, 2014–2023 (USD Million)

Table 12 Market for Retail and Consumer Goods Based on Software, By Region, 2014–2023 (USD Million)

Table 13 Market for Manufacturing and Logistics Based on Software, By Region, 2014–2023 (USD Million)

Table 14 Market for Healthcare and Pharmaceuticals Based on Software, By Region, 2014–2023 (USD Million)

Table 15 Market for Energy and Utilities Based on Software, By Region, 2014–2023 (USD Million)

Table 16 Workflow Automation Market for Others Based on Software, By Region, 2014–2023 (USD Million)

Table 17 Market for Services, By Region, 2014–2023 (USD Million)

Table 18 Market for Services, By Industry, 2014–2023 (USD Million)

Table 19 Market for BFSI Based on Service, By Region, 2014–2023 (USD Million)

Table 20 Market for Telecom and IT Based on Service, By Region, 2014–2023 (USD Million)

Table 21 Workflow Automation Market for Travel, Hospitality, and Transportation Based on Service, By Region, 2014–2023 (USD Million)

Table 22 Market for Retail and Consumer Goods Based on Service, By Region, 2014–2023 (USD Million)

Table 23 Market for Manufacturing and Logistics Based on Service, By Region, 2014–2023 (USD Million)

Table 24 Market for Healthcare and Pharmaceuticals Based on Service, By Region, 2014–2023 (USD Million)

Table 25 Market for Energy and Utilities Based on Service, By Region, 2014–2023 (USD Million)

Table 26 Market for Other Industries Based on Service, By Region, 2014–2023 (USD Million)

Table 27 WFA Market, By Industry, 2014–2023 (USD Million)

Table 28 WFA Market for BFSI Industry, By Region, 2014–2023 (USD Million)

Table 29 WFA Market for BFSI Industry, By Offering, 2014–2023 (USD Million)

Table 30 WFA Market for BFSI Industry, By Process, 2014–2023 (USD Million)

Table 31 WFA Market for Telecom & IT Industry, By Region, 2014–2023 (USD Million)

Table 32 WFA Market for Telecom & IT Industry, By Offering, 2014–2023 (USD Million)

Table 33 WFA Market for Telecom & IT Industry, By Process, 2014–2023 (USD Million)

Table 34 WFA Market for Travel, Hospitality, & Transportation Industry, By Region, 2014–2023 (USD Million)

Table 35 WFA Market for Travel, Hospitality, & Transportation Industry, By Offering, 2014–2023 (USD Million)

Table 36 WFA Market for Travel, Hospitality, & Transportation Industry, By Process, 2014–2023 (USD Million)

Table 37 WFA Market for Retail & Consumer Goods Industry, By Region, 2014–2023 (USD Million)

Table 38 WFA Market for Retail & Consumer Goods Industry, By Offering, 2014–2023 (USD Million)

Table 39 WFA Market for Retail & Consumer Goods Industry, By Process, 2014–2023 (USD Million)

Table 40 WFA Market for Manufacturing & Logistics Industry, By Region, 2014–2023 (USD Million)

Table 41 WFA Market for Manufacturing & Logistics Industry, By Offering, 2014–2023 (USD Million)

Table 42 WFA Market for Manufacturing & Logistics Industry, By Process, 2014–2023 (USD Million)

Table 43 WFA Market for Healthcare & Pharmaceuticals Industry, By Region, 2014–2023 (USD Million)

Table 44 WFA Market for Healthcare & Pharmaceuticals Industry, By Offering, 2014–2023 (USD Million)

Table 45 WFA Market for Healthcare & Pharmaceuticals Industry, By Process, 2014–2023 (USD Million)

Table 46 WFA Market for Energy & Utilities Industry, By Region, 2014–2023 (USD Million)

Table 47 WFA Market for Energy & Utilities Industry, By Offering, 2014–2023 (USD Million)

Table 48 WFA Market for Energy & Utilities Industry, By Process, 2014–2023 (USD Million)

Table 49 WFA Market for Other Industries, By Region, 2014–2023 (USD Million)

Table 50 WFA Market for Other Industries, By Offering, 2014–2023 (USD Million)

Table 51 WFA Market for Other Industries, By Process, 2014–2023 (USD Million)

Table 52 Market, By Region, 2014–2023 (USD Million)

Table 53 Market in North America, By Industry, 2014–2023 (USD Million)

Table 54 Market in North America, By Country, 2014–2023 (USD Million)

Table 55 Workflow Automation Market in Europe, By Industry, 2014–2023 (USD Million)

Table 56 Market in Europe, By Country, 2014–2023 (USD Million)

Table 57 Market in Asia Pacific, By Industry, 2014–2023 (USD Million)

Table 58 Market in Asia Pacific, By Country, 2014–2023 (USD Million)

Table 59 Market in RoW, By Industry, 2014–2023 (USD Million)

Table 60 Market in RoW, By Region, 2014–2023 (USD Million)

Table 61 Ranking of Top 5 Players: Workflow Automation Market, 2016

Table 62 Product Launches, 2015–2017

Table 63 Agreements, Collaborations, and Partnerships, 2015–2017

Table 64 Acquisitions, 2015–2017

Table 65 Expansions, 2015–2017

List of Figures (45 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Automated Solution Expected to Hold the Largest Size of Workflow Automation Process Market in 2017

Figure 7 Market for Robotic Process Automation (RPA)-Based Operation Expected to Grow at Highest CAGR During Forecast Period

Figure 8 On-Premise Deployment Expected to Hold Larger Market Size Between 2017 and 2023

Figure 9 Market for SMES Expected to Grow at Higher CAGR During Forecast Period

Figure 10 Software Expected to Hold Larger Size of Workflow Automation Market By 2023

Figure 11 Workflow Automation Market for BFSI Industry Expected to Grow at Highest CAGR Between 2017 and 2023

Figure 12 North America Expected to Hold Largest Share of Workflow Automation Market in 2017

Figure 13 Attractive Opportunities in Workflow Automation Market Between 2017 and 2023

Figure 14 Market for Services Expected to Grow at Higher CAGR Between 2017 and 2023

Figure 15 Automated Solution Expected to Hold Largest Market Share in 2017

Figure 16 Telecom & IT Industry and China Expected to Hold Largest Share of APAC Workflow Automation Market in 2017

Figure 17 US Expected to Account for Largest Share of Workflow Automation Market in 2017

Figure 18 Drivers, Restraints, Opportunities, and Challenges in the Workflow Automation Market

Figure 19 Value Chain Analysis: Major Value Addition Done During the Implementation Phase

Figure 20 Automated Solution Expected to Hold Largest Size of Workflow Automation Market By 2023

Figure 21 Rule-Based Operation Expected to Hold Largest Size of Workflow Automation Market By 2023

Figure 22 On-Premise to Hold Larger Size of Workflow Automation Market By 2023

Figure 23 Large Enterprises to Hold Larger Size of Workflow Automation Market By 2023

Figure 24 Market for Services to Grow at Higher CAGR Between 2017 and 2023

Figure 25 APAC to Lead Market for Retail and Consumer Goods Based on Software Between 2017 and 2023

Figure 26 Market for Telecom and IT Based on Service in APAC to Grow at Highest CAGR Between 2017 and 2023

Figure 27 North America to Hold Largest Size of Market for Other Industries Based on Service Between 2017 and 2023

Figure 28 BFSI Sector Expected to Hold the Largest Size of the Market By 2023

Figure 29 Automated Solution Expected to Hold the Largest Size of the Market in the BFSI Industry By 2023

Figure 30 Europe Expected to Hold the Largest Market Size of the Workflow Automation in Travel, Hospitality, & Transportation Industry By 2023

Figure 31 Software Expected to Hold the Largest Market Size of the Workflow Automation in Manufacturing & Logistics Industry By 2023

Figure 32 Market for the Energy & Utilities Industry in Asia Pacific Expected to Hold the Largest Size By 2023

Figure 33 Market in India to Grow at the Highest Rate During the Forecast Period

Figure 34 Snapshot of the Workflow Automation Market in North America

Figure 35 Snapshot of Market in Europe

Figure 36 Germany Likely to Dominate the Workflow Automation Market in Europe During the Forecast Period

Figure 37 Snapshot of the Market in Asia Pacific

Figure 38 Market in the Middle East and Africa to Hold A Higher Share in RoW During the Forecast Period

Figure 39 Product Launches Was the Key Growth Strategy Adopted By the Companies Between 2015 and 2017

Figure 40 Market Evolution Framework: Product Launches Fuelled the Growth of the Market

Figure 41 IBM Corporation: Company Snapshot

Figure 42 Oracle Corporation: Company Snapshot

Figure 43 Pegasystems Inc.: Company Snapshot

Figure 44 Software AG: Company Snapshot

Figure 45 Xerox Corporation: Company Snapshot

The adoption of workflow automation in various business processes has increased the number of strategic partnerships between workflow automation tool vendors, and BPO and other service providers. For instance, BluePrism (US) partnered with IBM (US) and HCL Technologies Limited (India). Using BluePrism’s workflow automation tools, HCL serves retail banking, investment banking, insurance, and telecom industries. Moreover, there are plans to implement workflow automation in the utilities sector, supply chain management, and finance and accounting. In addition to fueling its business process outsourcing capabilities, IBM is planning to leverage BluePrism as part of its management toolset and business process management portfolio. This integration of workflow automation in different business functions and processes drive its market growth.

The objective of the report is to provide a detailed analysis of the workflow automation market based on offering, process, operation, organization size, deployment, industry, and geography. The report provides detailed information regarding the major factors influencing the growth of the market. The report also gives a detailed overview of the value chain in the workflow automation market and analyzes the market trends.

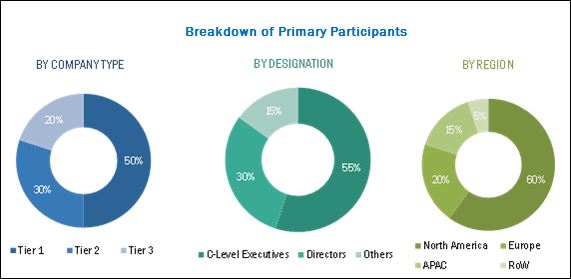

The research methodology used to estimate and forecast the workflow automation market begins with capturing data on key vendor revenue through the secondary research such as Institute for Robotic Process Automation (IRPA), press releases, investor relation presentations, and annual reports. The vendor offerings are also considered to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global market from the revenue of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The workflow automation ecosystem comprises system integrators, software providers, and distributors. The players involved in the development of workflow automation include IBM Corporation (US), Oracle Corporation (US), Pegasystems Inc. (US), Software AG (Germany), Xerox Corporation (US), Appian Corporation (US), Bizagi (UK), Ipsoft Inc. (US), Newgen Software Technologies Limited (India), and Nintex Global Limited (US).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

IBM Corporation (US), Oracle Corporation (US), Pegasystems Inc. (US), Software AG (Germany), Xerox Corporation (US), Appian Corporation (US), Bizagi (UK), Ipsoft Inc. (US), Newgen Software Technologies Limited (India), and Nintex Global Limited (US) |

Target Audience of the Report:

- Government and research organizations

- Workflow automation software vendors

- Workflow automation consulting companies

- Workflow automation service providers

- System integrators

- Value-added resellers

- Workflow automation investors

- Technology consultants

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments”

Scope of the Report:

This research report categorizes the overall workflow automation market segmented on the basis of offering, process, operation, organization size, deployment, industry, and geography.

Workflow Automation Market, by Offering

- Software

- Services

Workflow Automation Market, by Process

- Automated solution

- Decision support and Management solution

- Interaction solution

Workflow Automation Market, by Operation:

- Rule-based

- Knowledge-based

- Robotic Process Automation-based

Workflow Automation Market, by Organization Size

- Large Enterprises

- SMEs

Workflow Automation Market, by Deployment

- Cloud

- On-Premise

Workflow Automation Market, by Industry

- Banking, Financial Services, & Insurance

- Telecom & IT

- Travel, Hospitality, & Transportation

- Retail & Consumer Goods

- Manufacturing & Logistics

- Healthcare & Pharmaceuticals

- Energy & utilities

- Others (government and academics)

Workflow Automation Market, by Geography

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companies’ specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Workflow Automation Market