Clinical Workflow Solutions Market by Product (Data Integration, Nurse Call Systems, Rounding Solutions, Patient Flow Management, Enterprise Reporting), End Users (Hospitals, Long-term Care, Ambulatory Care Centers) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global clinical workflow solutions market growth forecasted to transform from USD 9.1 billion in 2020 to USD 18.1 billion by 2025, driven by a CAGR of 14.8%. Growth in this market is driven by the implementation of government initiatives supporting the adoption of HCIT solutions, advantages of clinical workflow solutions in enhancing patient care and safety, increasing patient volume due to the COVID-19 pandemic, growing adoption of EHRs and other HCIT solutions, and the rising need to curtail healthcare costs.

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Workflow Solutions Market Dynamics

Driver: Advantage of clinical workflow solutions in enhancing patient care and safety

Clinical workflow solutions have become increasingly meaningful to healthcare organizations seeking more seamless, attractive, and impactful ways to improve patient outcomes and safety. This is because these solutions enable the flow of real-time health data for constant monitoring, resulting in more informed care decisions and improved outcomes. The clinical workflow solutions offer functionalities to help improve care quality, care coordination, and overall patient satisfaction while reducing the rate of medication errors and adverse drug events, their adoption is expected to increase in the coming years.

Restraint: Interoperability Issues

Confronted with poor interoperability, hospitals typically build or license interfaces to import and export data from both internal and external sources, such as the hospital’s EHR, laboratories, admit/discharge/transfer, medical devices, as well as outside laboratories. Thus, a single hospital may employ a few dozen interfaces, while a large health system with many sites may have to employ hundreds or even thousands of interfaces. Also, the health information exchanges employed by hospitals as a solution to interoperability pose several challenges, which include financial burden as well as technical difficulties in building and operation. This is a major factor restraining the demand for clinical workflow solutions.

Opportunity: Growing telehealth and remote patient monitoring markets

Advancements in IT have provided an ever-expanding array of options like advanced broadband networks, mobile devices and networks, remote patient monitoring, high-definition video conferencing, and EHRs. This has generated significant opportunities for clinical workflow solution vendors. With the help of these integration solutions, the use of peripheral medical devices has enabled patients to remotely monitor their vital signs, such as blood pressure, weight, glucose levels, ECG, and body temperature, at home (with the data automatically being sent to a nurse or physician).

Challenge: Lack of trained healthcare IT professionals

The lack of qualified resources is a major barrier to implementing IT systems in hospitals. The growing number of healthcare IT initiatives makes it difficult for healthcare organizations and vendors to attract qualified staff. Currently, the demand for healthcare IT professionals far exceeds their supply, not just in developing markets but also in major markets such as the US and Europe.

The data integration solutions segment is expected to account for the largest share of the clinical workflow solutions industry in 2019

Based on products, the clinical workflow solutions market is segmented into workflow automation solutions, care collaboration solutions, real-time communication solutions, data integration solutions, and enterprise reporting and analytics solutions. The data integration segment is further sub segmented into EMR integration solutions and Medical image integration solutions. Data integration solutions accounted for the largest share of the market in 2019. The large share of this segment can be attributed to the increasing demand for using medical records and integrating them across hospital departments has been one of the major drivers for data integration solutions. This is further supported by the implementation of government incentives and penalties.

Ambulatory care centers to witness the highest growth in the clinical workflow solutions industry during the forecast period

Based on end users, the clinical workflow solutions market is segmented into hospitals, long-term care facilities, and ambulatory care centers. The ambulatory care centers segment is estimated to grow at the highest growth during the forecast period. Factors such as the rising need to streamline administrative tasks, secure clinical information, and improve access to information; increasing need for early detection and intervention for reducing the risk of acute complications; and increasing focus on reducing treatment costs are driving the growth of this end-user segment.

The Latin America region is expected to grow at the highest CAGR in the clinical workflow solutions industry during the forecast period

The clinical workflow solutions market in the Latin America is expected to grow at the highest CAGR during the forecast period. The increasing government initiatives for eHealth, subsequent improvements in the healthcare infrastructure in emerging LATAM countries, rising medical tourism, and growing demand for quality healthcare are factors driving the growth of the Latin America clinical workflow solutions industry. Also, the population growth and efforts to improve the quality of care, implementation of favorable government initiatives, strategies to digitalize the country in every sector by using IT infrastructure and the increasing awareness about the benefits of clinical workflow solutions are driving the growth of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global clinical workflow solutions market Hill-Rom Holdings, Inc. (US), Ascom Holding AG (Switzerland), Koninklijke Philips N.V. (Netherlands), Cerner Corporation (US), Cisco Systems, Inc. (US), Stanley Black & Decker, Inc. (US), GE Healthcare (US), Epic Systems Corporation (US), Infor, Inc. (US), Allscripts Healthcare Solutions, Inc. (US), Spok, Inc. (US), Vocera Communications, Inc. (US), Capsule Technologies, Inc. (US), AMETEK, Inc. (US), NextGen Healthcare (US), Azure Healthcare Limited (Australia), Getinge Group (Sweden), Change Healthcare (US), athenahealth (US), Sonitor Technologies, Inc. (Norway), and Connexall (Canada).

Scope of the Clinical Workflow Solutions Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$9.1 billion |

|

Projected Revenue Size by 2025 |

$18.1 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 14.8% |

|

Market Driver |

Advantage if clinical workflow solutions in enhancing patient care and safety |

|

Market Opportunity |

Growing telehealth and remote patient monitoring markets |

The research report categorizes the clinical workflow solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Data Integration

- Medical Image Integration Solutions / Imaging Workflow Solutions

- EMR Integration Solutions

-

Real-time Communication Solutions

- Nurse Call Alert Systems

- Unified Communications Solutions

-

Workflow Automation Solutions

- Patient Flow Management Solutions

- Nursing & Staff Scheduling Solutions

-

Care Collaboration Solutions

- Medication Administration Solutions

- Rounding Solutions

- Perinatal Care Management / Perinatal Information Systems

- Others (Specimen Collection Solutions and Blood Products Administration Solutions)

- Enterprise Reporting & Analytics Solutions

By End User

- Hospitals

- Long-term care facilities

- Ambulatory care Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Clinical Workflow Solutions Industry

- In January 2020, Infor entered into an agreement to acquire Intelligent InSites Inc. This acquisition enabled Infor to offer an expanded suite of technology for healthcare organizations.

- In May 2020, Stanley healthcare collaborated with CISCO. Under this collaboration, STANLEY Healthcare’s AeroScout Real-time location System (RTLS) platform has been fully integrated with Cisco DNA Spaces. This collaboration enables STANLEY Healthcare to deliver a more seamless and cost-effective solution to healthcare providers who rely on RTLS as a core part of their operations.

- In April 2020, GE healthcare launched software solutions, virtual care solutions.

- In November 2019, Getinge opened its Experience Center in Tokyo, Japan.

- In April 2020, Capsule technologies acquired Bernoulli. Under this acquisition, Bernoulli’s Clinical Surveillance solution will be integrated with Capsule Technologies’ Medical Device Integration platform. This acquisition further strengthened Capsule Technologies’ connectivity capabilities.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical workflow solutions market?

The global clinical workflow solutions market boasts a total revenue value of $18.1 billion by 2025.

What is the estimated growth rate (CAGR) of the global clinical workflow solutions market?

The global clinical workflow solutions market has an estimated compound annual growth rate (CAGR) of 14.8% and a revenue size in the region of $9.1 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

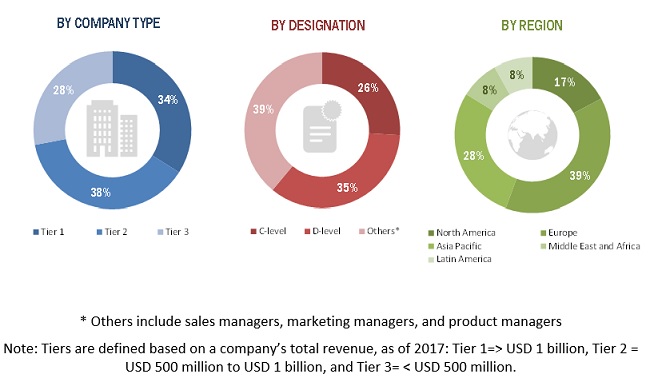

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 CLINICAL WORKFLOW SOLUTIONS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MARKET OVERVIEW

FIGURE 11 NEED TO CURTAIL HEALTHCARE COSTS IS DRIVING MARKET GROWTH

4.2 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 12 CHINA IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD 48

4.3 REGIONAL MIX: MARKET (2020–2025)

FIGURE 13 LATIN AMERICA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2020–2025)

4.4 MARKET: DEVELOPED VS. DEVELOPING MARKETS, 2020 VS. 2025 (USD MILLION)

FIGURE 14 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE STUDY PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 CLINICAL WORKFLOW SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advantages of clinical workflow solutions in enhancing patient care and safety

5.2.1.2 Government initiatives for HCIT adoption

5.2.1.3 Growing adoption of EHRs and other HCIT solutions

FIGURE 16 US: EHR ADOPTION RATE AMONG HEALTHCARE PROVIDERS (2012–2017)

5.2.1.4 Increasing patient volume due to the rising prevalence of chronic diseases and COVID-19

5.2.1.5 Rising need to curtail healthcare costs

FIGURE 17 HEALTHCARE SPENDING (2019) VS. ANNUAL INCREASE IN EXPENDITURE ON HEALTH (2013–2018)

5.2.2 RESTRAINTS

5.2.2.1 Requirement of high initial investments in IT infrastructure

5.2.2.2 Interoperability issues

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.3.2 Low doctor-to-patient ratio leading to increased dependency on healthcare IT solutions

5.2.3.3 Growing telehealth and remote patient monitoring markets

5.2.4 CHALLENGES

5.2.4.1 Issues related to data security

5.2.4.2 Lack of trained healthcare IT professionals

5.2.4.3 Reluctance to use clinical workflow solutions over conventional practices

6 INDUSTRY INSIGHTS (Page No. - 61)

6.1 VALUE CHAIN ANALYSIS

FIGURE 18 CLINICAL WORKFLOW SOLUTIONS MARKET: VALUE CHAIN ANALYSIS

6.1.1 ELECTRONIC EQUIPMENT AND COMPONENTS

6.1.2 CONNECTIVITY TECHNOLOGIES

6.1.3 HARDWARE AND SOFTWARE

6.1.4 SYSTEM INTEGRATION AND SERVICES

6.1.5 APPLICATION/USE CASES

6.2 INDUSTRY TRENDS

6.2.1 INCREASING ADOPTION OF INTEGRATED SYSTEMS TO REDUCE HEALTHCARE COSTS AND IMPROVE CARE QUALITY

6.2.2 INCREASING PREFERENCE FOR CLOUD-BASED SOLUTIONS

6.2.3 ARTIFICIAL INTELLIGENCE AND PREDICTIVE ANALYTICS

6.2.4 IMPACT OF COVID-19 ON THE CLINICAL WORKFLOW SOLUTIONS INDUSTRY

FIGURE 19 IMPACT OF COVID-19 (2020–2025)

6.3 HCIT EXPENDITURE ANALYSIS

6.3.1 NORTH AMERICA

TABLE 1 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

6.3.2 EUROPE

6.3.3 ASIA PACIFIC

6.4 HCIT ADOPTION TRENDS IN THE US

FIGURE 20 US: OFFICE-BASED PHYSICIAN EHR ADOPTION (2004–2017)

FIGURE 21 US: HOSPITAL EHR ADOPTION (2007–2018)

7 CLINICAL WORKFLOW SOLUTIONS MARKET, BY TYPE (Page No. - 68)

7.1 INTRODUCTION

TABLE 2 CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

7.2 DATA INTEGRATION SOLUTIONS

TABLE 3 DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 DATA INTEGRATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.1 EMR INTEGRATION SOLUTIONS

7.2.1.1 Adoption of solutions has grown due to the COVID-19 pandemic

TABLE 5 EMR INTEGRATION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 6 EMR INTEGRATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.2 MEDICAL IMAGE INTEGRATION SOLUTIONS

7.2.2.1 Use of medical image integration solutions is expected to provide evidence-based patient care and reduce overall costs

TABLE 7 MEDICAL IMAGE INTEGRATION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 8 MEDICAL IMAGE INTEGRATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 REAL-TIME COMMUNICATION SOLUTIONS

TABLE 9 REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 10 REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.1 NURSE CALL ALERT SYSTEMS

7.3.1.1 Nurse call alert-as-a-Service model eliminates the capital expenditure associated with integrating these solutions

TABLE 11 NURSE CALL ALERT SYSTEMS OFFERED BY MAJOR PLAYERS

TABLE 12 NURSE CALL ALERT SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.2 UNIFIED COMMUNICATION SOLUTIONS

7.3.2.1 Upload of highly sensitive patient information to the cloud is posing challenges to the adoption of UCaaS

TABLE 13 UNIFIED COMMUNICATION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 14 UNIFIED COMMUNICATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 WORKFLOW AUTOMATION SOLUTIONS

TABLE 15 WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 16 WORKFLOW AUTOMATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4.1 PATIENT FLOW MANAGEMENT SOLUTIONS

7.4.1.1 Use of hybrid RTLS technology is expected to aid in better patient flow management

TABLE 17 PATIENT FLOW MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 18 PATIENT FLOW MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4.2 NURSING & STAFF SCHEDULING SOLUTIONS

7.4.2.1 Use of predictive analytics in nurse & staff scheduling is growing at a rapid rate

TABLE 19 NURSING & STAFF SCHEDULING SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 20 NURSING & STAFF SCHEDULING SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 CARE COLLABORATION SOLUTIONS

TABLE 21 CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 22 CARE COLLABORATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.1 MEDICATION ADMINISTRATION SOLUTIONS

7.5.1.1 Up to two-thirds of all prescription medications recorded have one or more errors

TABLE 23 MEDICATION ADMINISTRATION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 24 MEDICATION ADMINISTRATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.2 PERINATAL CARE MANAGEMENT SOLUTIONS

7.5.2.1 Favorable support for perinatal care management will drive market growth

TABLE 25 PERINATAL CARE MANAGEMENT SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 26 PERINATAL CARE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.3 ROUNDING SOLUTIONS

7.5.3.1 The emergence of remote rounding tools for COVID-19 patients is creating opportunities for players

TABLE 27 ROUNDING SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 28 ROUNDING SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.4 OTHER CARE COLLABORATION SOLUTIONS

TABLE 29 SPECIMEN COLLECTION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 30 BLOOD PRODUCT ADMINISTRATION SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 31 OTHER CARE COLLABORATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6 ENTERPRISE REPORTING & ANALYTICS SOLUTIONS

7.6.1 CARE TEAMS CAN UTILIZE INFORMATION FROM THESE TOOLS IN RESOURCE ALLOCATION AND PLANNING DURING COVID-19

TABLE 32 ENTERPRISE REPORTING AND ANALYTICS SOLUTIONS OFFERED BY MAJOR PLAYERS

TABLE 33 ENTERPRISE REPORTING & ANALYTICS SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

8 CLINICAL WORKFLOW SOLUTIONS MARKET, BY END USER (Page No. - 96)

8.1 INTRODUCTION

TABLE 34 CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

8.2 HOSPITALS

8.2.1 LARGE PATIENT POOL DUE TO THE COVID-19 OUTBREAK IS DRIVING THE ADOPTION OF CLINICAL WORKFLOW SOLUTIONS IN HOSPITALS

TABLE 35 MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 LONG-TERM CARE FACILITIES

8.3.1 GROWING GERIATRIC POPULATION TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 36 MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 AMBULATORY CARE CENTERS

8.4.1 NEED TO REDUCE THE INCREASING HEALTHCARE COSTS IS SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 37 MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

9 CLINICAL WORKFLOW SOLUTIONS MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 22 CLINICAL WORKFLOW SOLUTIONS INDUSTRY: GEOGRAPHICAL SNAPSHOT (2019)

TABLE 38 MARKET, BY REGION, 2018–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing need for integrated healthcare IT systems to support market growth

TABLE 46 US: KEY MACROINDICATORS

TABLE 47 US: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 US: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 US: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 US: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 US: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 52 US: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Rising healthcare spending to support the adoption of clinical workflow solutions in Canada

TABLE 53 CANADA: KEY MACROINDICATORS

TABLE 54 CANADA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 CANADA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 CANADA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 CANADA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 CANADA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3 EUROPE

FIGURE 24 EUROPE: CLINICAL WORKFLOW SOLUTIONS MARKET SNAPSHOT

TABLE 60 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 EUROPE: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 EUROPE: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Germany dominates the European market

TABLE 67 GERMANY: KEY MACROINDICATORS

TABLE 68 GERMANY: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 GERMANY: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 GERMANY: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 GERMANY: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 GERMANY: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Growing patient volume to drive the demand for workflow solutions in the UK

TABLE 74 UK: KEY MACROINDICATORS

TABLE 75 UK: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 UK: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 UK: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 UK: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 UK: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 UK: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Government initiatives to promote the adoption of healthcare IT solutions to drive market growth in France

TABLE 81 FRANCE: KEY MACROINDICATORS

TABLE 82 FRANCE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 FRANCE: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 FRANCE: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 FRANCE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 FRANCE: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growing focus on improving patient care to drive the clinical workflow solutions market in Italy

TABLE 88 ITALY: KEY MACROINDICATORS

TABLE 89 ITALY: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 ITALY: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 ITALY: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 ITALY: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 ITALY: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 ITALY: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 The need for optimization in healthcare workflows to drive market growth in Spain

TABLE 95 SPAIN: KEY MACROINDICATORS

TABLE 96 SPAIN: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 SPAIN: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 SPAIN: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 SPAIN: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2016–2023 (USD MILLION)

TABLE 100 SPAIN: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 102 ROE: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 ROE: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 ROE: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 ROE: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 ROE: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 ROE: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 108 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 111 ASIA PACIFIC: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 ASIA PACIFIC: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 JAPAN

9.4.1.1 Japan to dominate the clinical workflow solutions market in APAC

TABLE 115 JAPAN: KEY MACROINDICATORS

TABLE 116 JAPAN: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 JAPAN: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 JAPAN: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 JAPAN: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 JAPAN: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 JAPAN: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Large patient pool due to the COVID-19 pandemic to drive the adoption of clinical workflow solutions

TABLE 122 CHINA: KEY MACROINDICATORS

TABLE 123 CHINA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 CHINA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 CHINA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 126 CHINA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 CHINA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Increasing government initiatives to improve the healthcare system are driving the demand for clinical workflow solutions

TABLE 129 INDIA: KEY MACROINDICATORS

TABLE 130 INDIA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 INDIA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 INDIA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 INDIA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 INDIA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 INDIA: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.4.4 REST OF ASIA PACIFIC

TABLE 136 ROAPAC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 137 ROAPAC: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 ROAPAC: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 ROAPAC: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 ROAPAC: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 FAVORABLE GOVERNMENT INITIATIVES TO SUPPORT MARKET GROWTH

TABLE 142 LATIN AMERICA: CLINICAL WORKFLOW SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 LATIN AMERICA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 LATIN AMERICA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 LATIN AMERICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 LATIN AMERICA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 147 LATIN AMERICA: CLINICAL WORKFLOW SOLUTIONS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 HEALTHCARE INFRASTRUCTURE IMPROVEMENTS TO SUPPORT MARKET GROWTH

TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: DATA INTEGRATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: REAL-TIME COMMUNICATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 MIDDLE EAST & AFRICA: WORKFLOW AUTOMATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: CARE COLLABORATION SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 157)

10.1 OVERVIEW

FIGURE 25 KEY DEVELOPMENTS IN THE CLINICAL WORKFLOW SOLUTIONS MARKET, JANUARY 2018−JUNE 2020

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 26 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES & UPGRADES WERE THE MOST WIDELY ADOPTED STRATEGIES

10.3 COMPETITIVE SITUATION AND TRENDS

10.3.1 PRODUCT LAUNCHES & ENHANCEMENTS

10.3.2 EXPANSIONS

10.3.3 ACQUISITIONS

10.3.4 AGREEMENTS, PARTNERSHIPS, AND COLLABORATIONS

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 163)

11.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE

11.2.4 EMERGING COMPANIES

FIGURE 27 CLINICAL WORKFLOW SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

11.3 MARKET SHARE ANALYSIS

11.3.1 NURSE CALL ALERT SYSTEMS MARKET

FIGURE 28 NURSE CALL ALERT SYSTEMS MARKET SHARE, BY KEY PLAYER, 2019

11.4 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.4.1 HILL-ROM HOLDINGS, INC.

FIGURE 29 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2019)

11.4.2 ASCOM HOLDING AG

FIGURE 30 ASCOM HOLDING AG: COMPANY SNAPSHOT (2019)

11.4.3 EPIC SYSTEMS CORPORATION

11.4.4 CERNER CORPORATION

FIGURE 31 CERNER CORPORATION: COMPANY SNAPSHOT (2019)

11.4.5 GE HEALTHCARE

FIGURE 32 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

11.4.6 KONINKLIJKE PHILIPS N.V.

FIGURE 33 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2019)

11.4.7 CISCO SYSTEMS, INC.

FIGURE 34 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT (2019)

11.4.8 STANLEY BLACK & DECKER, INC.

FIGURE 35 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT (2019)

11.4.9 INFOR, INC.

FIGURE 36 INFOR, INC.: COMPANY SNAPSHOT (2019)

11.4.10 RAULAND-BORG CORPORATION

FIGURE 37 AMETEK, INC.: COMPANY SNAPSHOT (2019)

11.4.11 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

FIGURE 38 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2019)

11.4.12 CHANGE HEALTHCARE

FIGURE 39 CHANGE HEALTHCARE: COMPANY SNAPSHOT (2019)

11.4.13 GETINGE GROUP

FIGURE 40 GETINGE GROUP: COMPANY SNAPSHOT (2019)

11.4.14 AZURE HEALTHCARE LIMITED

FIGURE 41 AZURE HEALTHCARE LIMITED: COMPANY SNAPSHOT

11.4.15 NEXTGEN HEALTHCARE

FIGURE 42 NEXTGEN HEALTHCARE, INC.: COMPANY SNAPSHOT (2019)

11.4.16 CAPSULE TECHNOLOGIES, INC.

11.4.17 VOCERA COMMUNICATIONS, INC.

FIGURE 43 VOCERA COMMUNICATIONS, INC.: COMPANY SNAPSHOT (2019)

11.4.18 SPOK, INC.

FIGURE 44 SPOK, INC.: COMPANY SNAPSHOT (2019)

11.4.19 ATHENAHEALTH

11.4.20 CONNEXALL

11.4.21 SONITOR TECHNOLOGIES, INC.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 219)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

Secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical workflow solutions market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the global clinical workflow solutions market. The primary sources from the demand side included industry experts, such as doctors, nurses, and purchase managers in hospitals.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, end user, and region).

Data Triangulation

After arriving at the market size, the total clinical workflow solutions market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the clinical workflow solutions market by products, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the clinical workflow solutions market in five main regions North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa (along with major countries)

- To profile key players in the clinical workflow solutions market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, partnerships, agreements, and R&D activities of the leading players in the clinical workflow solutions market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific clinical workflow solutions market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Latin American clinical workflow solutions market into Brazil, Mexico, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Workflow Solutions Market