Wheat Protein Market by Product (Gluten, Protein Isolate, Textured Protein, Hydrolyzed Protein), Form, Concentration, Application (Bakery & Snacks, Pet Food, Nutritional Bars & Drinks, Processed Meat, Meat Analogs) & Region - Global Forecast to 2028

Wheat Protein Market Overview

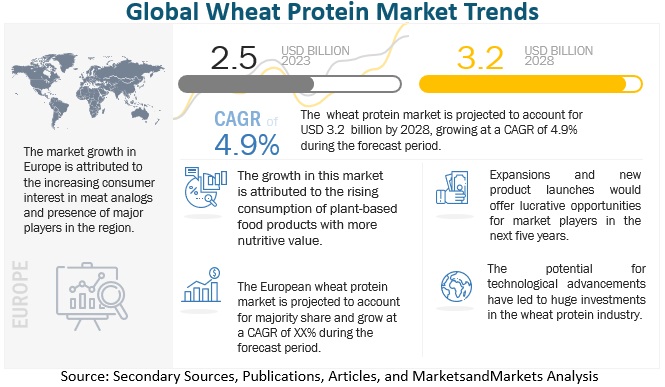

The global wheat protein market is projected to grow from $2.5 billion in 2023 to $3.2 billion by 2028, with a compound annual growth rate (CAGR) of 4.9% during this period. Owing to the increase in demand for meat-free diets, rising obesity cases resulting in demand for low-calorie foods, and consumers seeking healthy foods. Wheat gluten, being rich in proteins, is a suitable option and has boosted the demand for it in the global wheat protein market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increase in consumer preference for meat analogs

Various plant-based alternatives to meat products have acquired an increasingly growing market globally. Consumers demand meat alternatives that emulate the fibrous structure, texture, and mouthfeel of meat products. This has increased interest in developing plant protein-based meat alternatives globally. Rising awareness about healthy and nutritious food options among consumers has also led to a growing number of new consumer groups called "flexitarians" looking to reduce their daily meat consumption. This gradual shift in consumers' eating patterns has also led to the creation of novel products aimed at fulfilling consumer demand for meat products, which act as the perfect substitute not only for their taste but also for their high protein nutritional value. For instance, academic researchers and many small and medium-sized enterprises have successfully developed new meat alternatives under the European research project called LikeMeat. The project created fibrous meat-like structures from plant proteins using an adapted cooking extrusion process, which was eventually processed into different food products.

The initial launch of meat alternatives began with the production of texturized vegetable protein (TVP), which is produced by the cooking extrusion of defatted soy meals, soy protein concentrates, or wheat gluten. These products have an elastic and spongy texture, which can be used in stews, patties, and sauces. Soy protein and wheat gluten formed the two most important and dominant raw materials for meat alternatives for a long time, only to be recently joined by protein products from other plant-based raw materials, such as peas, chickpeas, lupins, rice, corn, and canola.

Restraint : Ban on plant proteins and wheat of GM origin

Research studies have cited many health and environmental risks associated with the production and consumption of genetically modified (GM) commodities, including soybean, pea, and wheat. They are opposed by the various industry stakeholders, including regulatory bodies of countries in Europe and Asia Pacific, who are demanding non-genetically modified (non-GMO) sources of plant-based proteins. Thus, most of the countries in these regions have made it mandatory to declare the GM/non-GM status of food ingredients on the packaging of all processed foods. India also brought into effect, in 2013, the rule that packaged food products containing GM products as ingredients should carry labels as a mandate. Some European countries, such as Germany and the UK, have made it mandatory even for dairy and processed meat products. A legal ruling in Argentina's Province of Buenos Aires has officially barred the release of HB4, the first-ever GMO wheat. The group "Un Trigo de Libertad" put forth a case that gathered substantial evidence of the risks associated with introducing a new GMO, describing the new creation as exotic and invasive and warning that it could result in irreversible genetic contamination of native Argentine wheat varieties.

Opportunity: Growing role of wheat protein in the pet industry

The pet food market is driven by two primary trends globally. These trends are premiumization and humanization. There is a growing trend of pet humanization as a "family member" among owners. Due to this, there is a rise in the demand for premium pet food with nutritional benefits, better digestibility, and improved ingredient quality for pets. Considering this changing human tendency, the major players, such as Crespel & Deiters Group (Germany), are offering wheat protein as an ingredient that can be incorporated in pet food products.

In dry dog foods and biscuits, wheat is a grain that provides high-quality carbohydrates. In addition to giving us energy for daily tasks, it also gives food the ability to be processed. Wheat is a major source of nutrients and offers a wide range of advantages. Wheat-based products offer holistic, wheat-based solutions for optimizing pet food because they are rich in starches, vitamins, minerals, trace elements, and fiber, which aid in the formation of balanced pet food products.

Challenge: Limited technological developments

Although the market for wheat protein is expected to witness progressive growth rates during the forecast period, limited technological developments in the market are expected to hinder higher growth rates. While related industries like those of whey and pulse protein and the market for gluten-free products are expected to invest substantially in R&D activities to develop better, convenient, and more consumer-suitable products, technological advancements in the case of wheat proteins remain stunted. For example, Ingredion launched the new Prista line, HOMECRAFT Prista P 101 pea flour, and VITESSENCE Prista P 155 pea protein in 2021. It facilitates the inclusion of plant protein into more applications, including instant and Ready-To-Eat (RTE) products, to help brands heighten consumer appeal. Also, in 2020, Ingredion launched certified-organic pulse protein. The protein provides key formulation functionality while helping manufacturers create in-demand, high-protein products that support consumer demand for pulse ingredients. By advancing new technological methods to optimize tastes and nutritional capabilities, the company has now successfully mitigated that challenge.

Adoption of plant-based meat substitutes is projected to drive the demand for textured wheat protein

Textured wheat protein, also known as wheat meat, wheat gluten, or seitan, is a popular plant-based protein source used as a meat substitute for many years. A study published in the journal, Foods, in 2021 found that the demand for meat substitutes, including textured wheat protein, is increasing worldwide due to health, ethical, and environmental concerns associated with meat consumption. In 2019, a survey by the International Food Information Council found that 22% of US consumers reported consuming plant-based meat substitutes, including textured wheat protein, at least once a week.

Therefore, the demand for textured wheat protein is increasing globally, driven by factors such as the growing popularity of plant-based diets and the increasing demand for sustainable and ethical food products.

Use of wheat protein to improve pellet quality is expected to boost the market growth

In the pet food industry, wheat gluten is used in products where its water absorption and fat-binding properties improve yield and quality. It is known for its unique binding capacity for improved pellet quality. An increase in the demand for organic and premium food products is one of the major drivers for the wheat protein market. According to a report by the US Department of Agriculture, the market for plant-based pet food is growing rapidly. In 2020, sales of plant-based pet food in the US increased by 27% compared to the previous year, with the total sales reaching USD 600 million. The Pet Food Institute, a trade association representing pet food manufacturers, notes that wheat gluten is a high-quality protein source that is easily digestible for pets. It also states that wheat gluten is a sustainable and environmentally friendly option for pet food manufacturers.

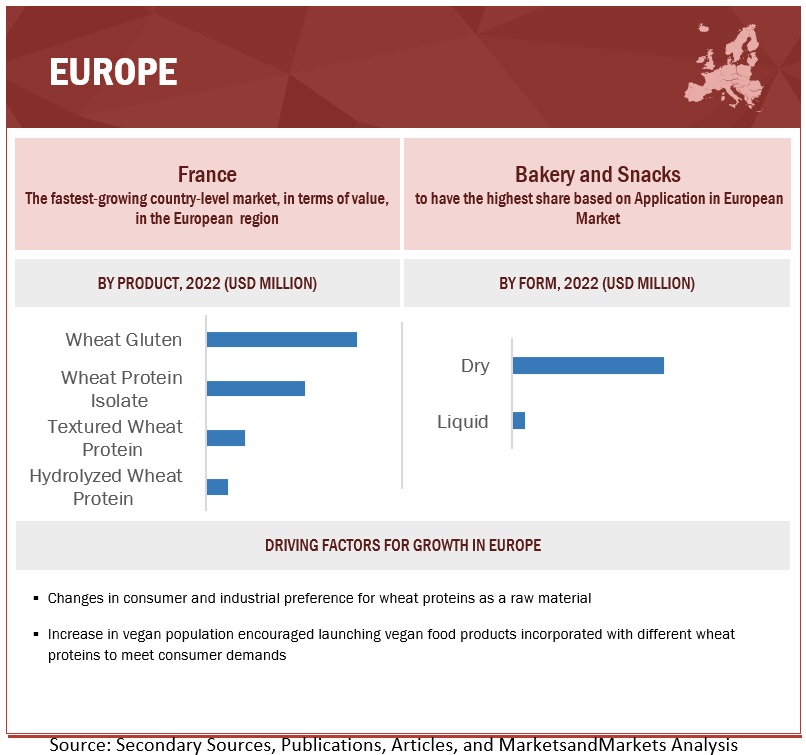

Europe is expected to dominate the market during the forecast period

The consumption of wheat protein in Europe is the highest as compared to the other regions. Consumers increasingly prefer plant-sourced proteins, such as wheat protein, due to the high prices of animal-sourced protein. This has led to the growth of low-cost plant-sourced protein, such as wheat and vegetable proteins, which act as a substitute for animal-sourced protein.

Germany is an attractive market for manufacturing companies as well as exporters. Bread constitutes a significant part of the baked goods sector as it is one of the main components of the German diet. The bakery & snacks industry of Germany is well-established and has a large consumer base with high purchasing power. Health-conscious consumers in this country demand nutritive baked goods without compromising on the taste of products. Key players in the bakery products industry are taking the initiative to develop and promote new products to meet this demand. In Germany, barley and wheat are predominantly used as sources for feed products.

To know about the assumptions considered for the study, download the pdf brochure

Top Companies in Wheat Protein Market

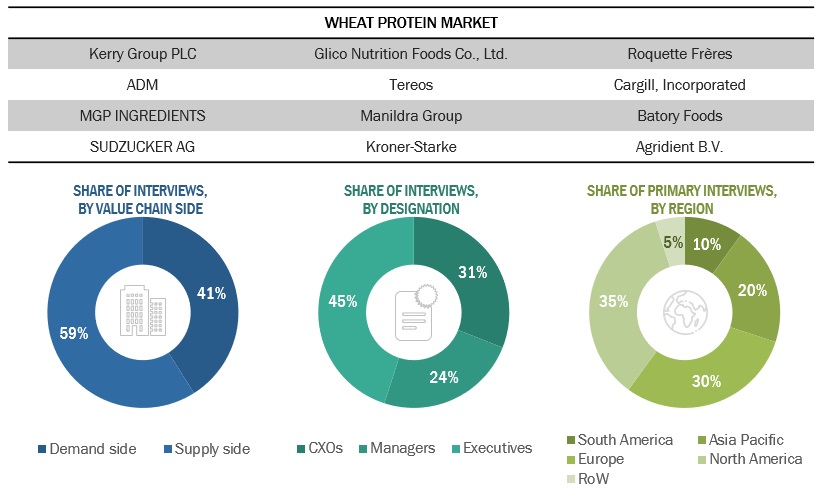

The key players in this market include ADM (US), Cargill, Incorporated (US), Tereos (France), Südzucker AG (US), MGP Ingredients (US), Roquette Frères (France), Glico Nutrition Foods Co., Ltd. (Japan), Kerry Group PLC (Ireland), Manildra Group (Australia), Kröner-Stärke (Germany), Crespel & Deiters Group (Germany), Batory Foods (US), Agridient B.V. (Netherlands), Tate & Lyle (UK), and The Scoular Company (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 2.5 billion |

|

Revenue forecast in 2028 |

USD 3.2 billion |

|

Growth Rate |

CAGR of 4.9% from 2023 to 2028 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023-2028 |

|

Quantitative units |

Value (USD), Volume (KT) |

|

Segments covered |

Application, Form, Product, Concentration, Region |

|

Regional scope |

North America, Europe, Asia Pacific, and RoW |

|

Dominant Geography |

Europe |

|

Key companies profiled |

|

This research report categorizes the wheat protein market, based on type, type, application, form, and region.

By Application

- Bakery & Snacks

- Pet food

- Nutrition Bars & Drinks

- Processed Meat

- Meat Analogs

- Other Applications

By Form

- Dry

- Liquid

By Product

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

By Concentration

- 75%

- 80%

- 95%

By Region

- North America

- Europe

- Asia Pacific

- RoW

Target Audience:

- Supply-side: Wheat protein producers, suppliers, distributors, importers, and exporters

- Demand-side: Large-scale food & beverage manufacturers, manufacturers of animal feed products, food ingredient manufacturers, and research organizations

- Regulatory side: Related government authorities, commercial Research & Development (R&D) institutions, and other regulatory bodies

- Other related associations, research organizations, and industry bodies: International Wheat Gluten Association (IWGA), European Vegetable Protein Association (EUVEPRO), US Wheat Associates (USW), Canadian Celiac Association (CCA), Kansas Wheat Commission and Kansas Association of Wheat Growers, North American Millers’ Association (NAMA), and Food and Agriculture Organization (FAO)

Wheat Protein Market Industry News

- In November 2022, Crespel & Deiters Group introduced its new textured wheat protein in the market. This launch expanded its textured vegetable protein line.

- In April 2022, ADM invested USD 300 million to expand its alternative plant-protein production capacity in Illinois to meet the growing demand for plant-based ingredients.

- In February 2022, MGP Ingredients announced its plant for the construction of a new manufacturing facility for the production of textured protein. This expansion is aimed at meeting the growing demand for plant-based meat.

- In April 2020, MGP Ingredients expanded its line of textured protein to cater to meat analogs. This expansion further enhanced its product portfolio.

Frequently Asked Questions (FAQ):

What is the projected market value of the global wheat protein market?

The global wheat protein market as per revenue was estimated to be worth $2.5 billion by 2023 and is poised to reach $3.2 billion by 2028

What is the estimated growth rate (CAGR) of the global wheat protein market for the next five years?

The global wheat protein market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2027

What are the major revenue pockets in the wheat protein market currently?

The consumption of wheat protein in Europe is the highest as compared to the other regions. Consumers increasingly prefer plant-sourced proteins, such as wheat protein, due to the high prices of animal-sourced protein. This has led to the growth of low-cost plant-sourced protein, such as wheat and vegetable proteins, which act as a substitute for animal-sourced protein.

What are the nutritional benefits of wheat protein?

Wheat protein is a good source of plant-based protein, containing essential amino acids. It also provides minerals such as iron and phosphorus. However, it may lack some nutrients found in complete protein sources.

What are the factors driving the growth of the wheat protein market?

The increasing demand for plant-based protein sources, rising consumer awareness about health and wellness, and growing adoption of vegetarian and vegan diets are some of the key factors driving the growth of the wheat protein market.

What are the major players operating in the wheat protein market?

Some of the leading companies in the wheat protein market include Archer Daniels Midland Company, Cargill, Roquette Frères, MGP Ingredients, and Tereos Group, among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSPLANT-BASED DAIRY BEVERAGES & FUNCTIONAL BEVERAGE MARKET BENEFITS FROM LARGE YOUNG DEMOGRAPHICSINCREASED INCIDENCE OF TYPE-2 DIABETES TO INCREASE CONSUMPTION OF PLANT-BASED PROTEIN DIETS

-

5.3 MARKET DYNAMICSDRIVERS- Increase in consumer preference for meat analogs- Growth in applications of wheat protein in varied end-user industries- Growing popularity of protein-rich food products- Rise in lactose intolerance boosted use of wheat protein as dairy alternativeRESTRAINTS- Increase in discussion on gluten intolerance and gluten-free diets- Ban on plant proteins and wheat of GM originOPPORTUNITIES- Growing role of wheat protein in pet food industryCHALLENGES- Limited technological developments- Low consumer awareness about non-soy proteins

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENT AND RAW MATERIAL SOURCINGMANUFACTURINGDISTRIBUTIONEND USERS

- 6.3 SUPPLY CHAIN ANALYSIS

-

6.4 MARKET MAP AND ECOSYSTEM OF WHEAT PROTEIN MARKETDEMAND SIDESUPPLY SIDEECOSYSTEM MAP

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS IN WHEAT PROTEIN MARKET

-

6.6 TECHNOLOGICAL ANALYSISUSE OF MEMBRANE TECHNOLOGY TO PRODUCE DIFFERENTIATED WHEAT PROTEINSHIGH-PRESSURE PROCESSING (HPP)TECHNOLOGICAL ADVANCEMENTS WITHIN EXTRUSION PROCESS

-

6.7 PRICING ANALYSISSELLING PRICE BY KEY PLAYER AND TYPE

-

6.8 WHEAT PROTEIN MARKET: PATENT ANALYSISLIST OF MAJOR PATENTS

-

6.9 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

- 6.10 KEY CONFERENCES AND EVENTS

-

6.11 CASE STUDIESADM: DEVELOPMENT OF PURELY PLANT-BASED PROTEIN TOPPINGS FOR SNACKSMGP INGREDIENTS: USE OF WHEAT PROTEIN ISOLATE TO IMPROVE DOUGH STRENGTH AND FREEZER STABILITY

-

6.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.13 REGULATORY FRAMEWORKINTRODUCTIONCODEX ALIMENTARIUS COMMISSION (CAC)DEFINITIONREGULATIONS, BY COUNTRY- US- Europe- China- India- Brazil- Brazil- South Africa

-

6.14 PORTER’S FIVE FORCES ANALYSISWHEAT PROTEIN MARKET: PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERS

-

6.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 WHEAT GLUTENUSED AS EXCELLENT MEAT ALTERNATIVE

-

7.3 WHEAT PROTEIN ISOLATEUSED FOR ENHANCING TASTE AND TEXTURE OF BREAD DOUGH

-

7.4 TEXTURED WHEAT PROTEINADOPTION OF PLANT-BASED MEAT SUBSTITUTES DRIVING DEMAND FOR TEXTURED WHEAT PROTEIN

-

7.5 HYDROLYZED WHEAT PROTEINRISE IN USE OF HYDROLYZED WHEAT PROTEIN IN BAKERY PRODUCTS

- 8.1 INTRODUCTION

-

8.2 75% CONCENTRATIONCOST-EFFECTIVE SOLUTION DRIVES DEMAND FOR 75% CONCENTRATION MARKET

-

8.3 80% CONCENTRATIONINCREASING DEMAND FOR MEAT SUBSTITUTES TO DRIVE 80% CONCENTRATION WHEAT PROTEIN

-

8.4 95% CONCENTRATIONGROWING DEMAND FOR PLANT-BASED PRODUCTS TO BOOST 95% CONCENTRATION WHEAT PROTEIN

- 9.1 INTRODUCTION

-

9.2 DRYBETTER STABILITY AND EASY HANDLING TO DRIVE DEMAND FOR DRY WHEAT PROTEIN

-

9.3 LIQUIDWIDESPREAD ADAPTABILITY AND EASE IN PROCESSING TO DRIVE DEMAND FOR LIQUID PROCESSING OF WHEAT PROTEINS

- 10.1 INTRODUCTION

-

10.2 BAKERY & SNACKSINNOVATIVE FOOD PRODUCTS AND VEGAN TRENDS TO SUPPORT WHEAT PROTEIN APPLICATION

-

10.3 PET FOODIMPROVEMENT IN PELLET QUALITY BY USING WHEAT PROTEIN TO DRIVE MARKET

-

10.4 NUTRITIONAL BARS & DRINKSHEALTHY EATING HABITS INCREASE APPLICATION OF WHEAT PROTEINS IN NUTRITIONAL BARS & DRINKS

-

10.5 PROCESSED MEATINCREASING DEMAND FOR PLANT-BASED MEAT ALTERNATIVES TO BOOST USE OF WHEAT PROTEIN

-

10.6 MEAT ANALOGSADOPTION OF MEAT-FREE DIET TO DRIVE DEMAND FOR WHEAT PROTEINS

-

10.7 OTHER APPLICATIONSPLANT-BASED DAIRY ALTERNATIVES TO DRIVE DEMAND

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increase in use of bakery food products to drive marketCANADA- Wheat protein market to benefit significantly from increased vegan or vegetarian diet adoptionMEXICO- Changes in consumer preferences toward vegetarian food products to drive market

-

11.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Bakery applications drive demand for wheat proteinsFRANCE- High preference for veganism among French consumers to drive marketUK- Growth in flexitarian and vegan population increased demand for wheat proteinsBELGIUM- Export access and rise in processing capacities to encourage market growthNETHERLANDS- Increase in use of wheat protein in bakery products to drive marketSPAIN- Increased demand for bakery products to drive marketRUSSIA- High plant-based product demand to drive marketREST OF EUROPE- Shift in consumer preferences from conventional to plant-based sources to support growth

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rise in use of wheat proteins in bakery products to drive marketJAPAN- Aging population and health concerns to drive demand for wheat proteinsINDIA- Rise in awareness about health benefits associated with wheat protein consumption to drive demandAUSTRALIA & NEW ZEALAND- Sustainability concerns and vegan trend to drive wheat protein acceptanceTHAILAND- Increased health consciousness to drive marketREST OF ASIA PACIFIC- Consumer shift toward clean eating diets to fuel demand for wheat proteins

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Strong agricultural outputs and exports to drive marketARGENTINA- Vegan lifestyle to drive demand for wheat proteinsPERU- Wheat protein manufacturers developed customized products to meet consumer demandREST OF SOUTH AMERICA- Rise in wheat protein application in feed sector to drive market

-

11.6 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTAFRICA- High production of durum wheat to drive marketMIDDLE EAST- Demand for functional foods and nutrition products to boost market growth

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- 12.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 WHEAT PROTEIN MARKET EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSADM- Business overview- Products offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products offered- Recent developments- MnM viewSÜDZUCKER AG- Business overview- Products offered- Recent developments- MnM viewMGP INGREDIENTS- Business overview- Products offered- Recent developments- MnM viewROQUETTE FRÈRES- Business overview- Products offered- Recent developments- MnM viewGLICO NUTRITION FOODS CO., LTD.- Business overview- Products offered- Recent developments- MnM viewTEREOS- Business overview- Products offered- Recent developments- MnM viewMANILDRA GROUP- Business overview- Products offered- Recent developments- MnM viewKRÖNER-STÄRKE- Business overview- Products offered- Recent developments- MnM viewCRESPEL & DEITERS GROUP- Business overview- Products offered- Recent developments- MnM viewBATORY FOODS- Business overview- Products offered- Recent developments- MnM viewAGRIDIENT B.V.- Business overview- Products offered- Recent developments- MnM viewTATE & LYLE- Business overview- Products offered- Recent developments- MnM viewTHE SCOULAR COMPANY- Business overview- Products offered- Recent developments- MnM view

-

13.3 START UPS/SMESAMCO PROTEINS- Business overview- Products offered- Recent developments- MnM viewSACCHETTO S.P.A.- Business overview- Products offered- Recent developments- MnM viewAMINOSIB JSC- Business overview- Products offered- Recent developments- MnM viewGC INGREDIENTS- Business overview- Products offered- Recent developments- MnM viewAARKAY FOOD PRODUCTS LTD.- Business overview- Products offered- Recent developments- MnM viewGLUTEN Y ALMIDONES INDUSTRIALESPUREFIELD INGREDIENTSSTENTORIAN INDUSTRIES CO., LTD.BLATTMANN SCHWEIZ AGAMBER WAVE

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 TEXTURED VEGETABLE PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEWTEXTURED PROTEIN MARKET, BY TYPETEXTURED PROTEIN MARKET, BY REGION

-

14.4 PLANT-BASED PROTEIN MARKETMARKET DEFINITIONMARKET OVERVIEWPLANT-BASED PROTEIN MARKET, BY TYPEPLANT-BASED PROTEIN MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2022

- TABLE 2 WHEAT PROTEIN MARKET SHARE SNAPSHOT, 2023 VS. 2028 (USD MILLION)

- TABLE 3 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE, BY TYPE, 2022 (USD/KG)

- TABLE 5 WHEAT GLUTEN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 6 WHEAT PROTEIN ISOLATE: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 7 TEXTURED WHEAT PROTEIN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 8 HYDROLYZED WHEAT PROTEIN: AVERAGE SELLING PRICE, BY REGION, 2018–2022 (USD/KG)

- TABLE 9 LIST OF FEW PATENTS IN POST-HARVEST TREATMENT, 2019–2022

- TABLE 10 EXPORT DATA OF WHEAT GLUTEN FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 11 IMPORT DATA WHEAT GLUTEN FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- TABLE 12 KEY CONFERENCES AND EVENTS IN POST-HARVEST TREATMENT, 2023–2024

- TABLE 13 PLANT-BASED TOPPING TO MEET EVOLVING CONSUMER PREFERENCES

- TABLE 14 IMPROVED DOUGH POROSITY AND EXTENSIBILITY FOR LONGER PERIOD

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 20 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 21 WHEAT PROTEIN MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 22 WHEAT PROTEIN MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 23 WHEAT GLUTEN: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 WHEAT GLUTEN: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 WHEAT PROTEIN ISOLATE: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 WHEAT PROTEIN ISOLATE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 TEXTURED WHEAT PROTEIN: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 TEXTURED WHEAT PROTEIN: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 HYDROLYZED WHEAT PROTEIN: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 HYDROLYZED WHEAT PROTEIN: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 WHEAT PROTEIN MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 32 WHEAT PROTEIN MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 33 75% CONCENTRATION: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 75% CONCENTRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 80% CONCENTRATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 80% CONCENTRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 95% CONCENTRATION: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 95% CONCENTRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 40 MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 41 DRY: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 DRY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 LIQUID: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 LIQUID: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 WHEAT PROTEIN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 46 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 BAKERY & SNACKS: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 BAKERY & SNACKS: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 PET FOOD: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 PET FOOD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 NUTRITIONAL BARS & DRINKS: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 NUTRITIONAL BARS & DRINKS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 PROCESSED MEAT: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 PROCESSED MEAT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MEAT ANALOGS: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 MEAT ANALOGS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER APPLICATIONS: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 MARKET, BY REGION, 2018–2022 (KT)

- TABLE 62 MARKET, BY REGION, 2023–2028 (KT)

- TABLE 63 NORTH AMERICA: WHEAT PROTEIN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: WHEAT PROTEIN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2022 (KT)

- TABLE 74 NORTH AMERICA: MARKET, BY PRODUCT TYPE, 2023–2028 (KT)

- TABLE 75 US: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 76 US: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 80 MEXICO: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: WHEAT PROTEIN MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: WHEAT PROTEIN MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY PRODUCT TYPE, 2018–2022 (KT)

- TABLE 92 EUROPE: MARKET, BY PRODUCT TYPE, 2023–2028 (KT)

- TABLE 93 GERMANY: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 94 GERMANY: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 95 FRANCE: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 96 FRANCE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 97 UK: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 98 UK: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 99 BELGIUM: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 100 BELGIUM: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 101 NETHERLANDS: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 102 NETHERLANDS: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 103 SPAIN: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 104 SPAIN: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 105 RUSSIA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 106 RUSSIA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: WHEAT PROTEIN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: WHEAT PROTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: WHEAT PROTEIN MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2018–2022 (KT)

- TABLE 120 ASIA PACIFIC: MARKET, BY PRODUCT TYPE, 2023–2028 (KT)

- TABLE 121 CHINA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 126 INDIA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 129 THAILAND: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 130 THAILAND: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 133 SOUTH AMERICA: WHEAT PROTEIN MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 138 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH AMERICA: MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 140 SOUTH AMERICA: MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2018–2022 (KT)

- TABLE 144 SOUTH AMERICA: MARKET, BY PRODUCT TYPE, 2023–2028 (KT)

- TABLE 145 BRAZIL: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 146 BRAZIL: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 147 ARGENTINA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 148 ARGENTINA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 149 PERU: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 150 PERU: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 151 REST OF SOUTH AMERICA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: WHEAT PROTEIN MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 153 ROW: WHEAT PROTEIN MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 154 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 155 ROW: MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 156 ROW: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 157 ROW: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 158 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 ROW: MARKET, BY CONCENTRATION, 2018–2022 (USD MILLION)

- TABLE 160 ROW: MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 161 ROW: MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 162 ROW: MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 163 ROW: MARKET, BY PRODUCT TYPE, 2018–2022 (KT)

- TABLE 164 ROW: MARKET, BY PRODUCT TYPE, 2023–2028 (KT)

- TABLE 165 AFRICA: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 166 AFRICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST: WHEAT PROTEIN MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 169 WHEAT PROTEIN MARKET: DEGREE OF COMPETITION

- TABLE 170 STRATEGIES ADOPTED BY KEY WHEAT PROTEIN MANUFACTURERS

- TABLE 171 COMPANY FOOTPRINT, BY TYPE

- TABLE 172 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 173 COMPANY FOOTPRINT, BY REGION

- TABLE 174 OVERALL COMPANY FOOTPRINT

- TABLE 175 WHEAT PROTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 176 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 177 MARKET: NEW PRODUCT LAUNCHES, 2020

- TABLE 178 MARKET: DEALS, 2022

- TABLE 179 WHEAT PROTEIN MARKET: OTHERS, 2019–2022

- TABLE 180 ADM: BUSINESS OVERVIEW

- TABLE 181 ADM: PRODUCTS OFFERED

- TABLE 182 ADM: NEW PRODUCT LAUNCHES

- TABLE 183 ADM: OTHER DEVELOPMENTS

- TABLE 184 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 185 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 186 CARGILL, INCORPORATED: OTHER DEVELOPMENTS

- TABLE 187 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 188 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 189 SÜDZUCKER AG: BUSINESS OVERVIEW

- TABLE 190 SÜDZUCKER AG: PRODUCTS OFFERED

- TABLE 191 SÜDZUCKER AG: DEALS

- TABLE 192 SÜDZUCKER AG: OTHER DEVELOPMENTS

- TABLE 193 MGP INGREDIENTS: BUSINESS OVERVIEW

- TABLE 194 MGP INGREDIENTS: PRODUCTS OFFERED

- TABLE 195 MGP INGREDIENTS: NEW PRODUCT LAUNCHES

- TABLE 196 MGP INGREDIENTS: OTHER DEVELOPMENTS

- TABLE 197 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 198 ROQUETTE FRÈRES: PRODUCTS OFFERED

- TABLE 199 ROQUETTE FRÈRES: DEALS

- TABLE 200 GLICO NUTRITION FOODS CO., LTD.: BUSINESS OVERVIEW

- TABLE 201 GLICO NUTRITION FOODS CO., LTD.: PRODUCTS OFFERED

- TABLE 202 TEREOS: BUSINESS OVERVIEW

- TABLE 203 TEREOS: PRODUCTS OFFERED

- TABLE 204 MANILDRA GROUP: BUSINESS OVERVIEW

- TABLE 205 MANILDRA GROUP: PRODUCTS OFFERED

- TABLE 206 MANILDRA GROUP: NEW PRODUCT LAUNCHES

- TABLE 207 KRÖNER-STÄRKE: BUSINESS OVERVIEW

- TABLE 208 KRÖNER-STÄRKE: PRODUCTS OFFERED

- TABLE 209 KRÖNER-STÄRKE: OTHER DEVELOPMENTS

- TABLE 210 CRESPEL & DEITERS GROUP: BUSINESS OVERVIEW

- TABLE 211 CRESPEL & DEITERS GROUP: PRODUCTS OFFERED

- TABLE 212 CRESPEL & DEITERS GROUP: NEW PRODUCT LAUNCHES

- TABLE 213 BATORY FOODS: BUSINESS OVERVIEW

- TABLE 214 BATORY FOODS: PRODUCTS OFFERED

- TABLE 215 BATORY FOODS: DEALS

- TABLE 216 AGRIDIENT B.V.: BUSINESS OVERVIEW

- TABLE 217 AGRIDIENT B.V.: PRODUCTS OFFERED

- TABLE 218 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 219 TATE & LYLE: PRODUCTS OFFERED

- TABLE 220 TATE & LYLE: DEALS

- TABLE 221 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 222 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 223 THE SCOULAR COMPANY: OTHER DEVELOPMENTS

- TABLE 224 AMCO PROTEINS: BUSINESS OVERVIEW

- TABLE 225 AMCO PROTEINS: PRODUCTS OFFERED

- TABLE 226 AMCO PROTEINS: NEW PRODUCT LAUNCHES

- TABLE 227 SACCHETTO S.P.A.: BUSINESS OVERVIEW

- TABLE 228 SACCHETTO S.P.A.: PRODUCTS OFFERED

- TABLE 229 AMINOSIB JSC: BUSINESS OVERVIEW

- TABLE 230 AMINOSIB JSC: PRODUCTS OFFERED

- TABLE 231 GC INGREDIENTS: BUSINESS OVERVIEW

- TABLE 232 GC INGREDIENTS: PRODUCTS OFFERED

- TABLE 233 GC INGREDIENTS: OTHER DEVELOPMENTS

- TABLE 234 AARKAY FOOD PRODUCTS LTD.: BUSINESS OVERVIEW

- TABLE 235 AARKAY FOOD PRODUCTS LTD.: PRODUCTS OFFERED

- TABLE 236 ADJACENT MARKETS TO WHEAT PROTEIN

- TABLE 237 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 238 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 239 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 240 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 241 PLANT-BASED PROTEIN MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 242 PLANT-BASED PROTEIN MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 243 PLANT-BASED PROTEIN MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 244 PLANT-BASED PROTEIN MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 WHEAT PROTEIN: MARKET SEGMENTATION

- FIGURE 2 WHEAT PROTEIN: GEOGRAPHIC SEGMENTATION

- FIGURE 3 WHEAT PROTEIN MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 8 MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 WORLD INFLATION RATE: 2011–2021

- FIGURE 12 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON WHEAT PROTEIN MARKET

- FIGURE 14 GLOBAL WHEAT PROTEIN MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 15 WHEAT PROTEIN MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 19 INCREASE IN TREND OF VEGANISM TO DRIVE WHEAT PROTEIN MARKET

- FIGURE 20 75% CONCENTRATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 DRY FORM TO BE MAJOR SEGMENT IN EUROPE IN 2022

- FIGURE 22 US ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 23 EUROPE TO ACCOUNT FOR LARGEST SHARE BY TYPE DURING FORECAST PERIOD (VALUE)

- FIGURE 24 WORLD: POPULATION, BY AGE GROUP ESTIMATE, 1950–2025 (BILLION)

- FIGURE 25 DIABETES WORLDWIDE IN 2021

- FIGURE 26 WHEAT PROTEIN MARKET DYNAMICS

- FIGURE 27 ESTIMATED PREVALENCE OF LACTOSE MALABSORPTION (%), BY COUNTRY, 2022

- FIGURE 28 US: REASON TO ADOPT GLUTEN-FREE DIET

- FIGURE 29 WHEAT PROTEIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 WHEAT PROTEIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 MARKET: ECOSYSTEM MAP

- FIGURE 32 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN WHEAT PROTEIN MARKET

- FIGURE 33 SELLING PRICE OF KEY PLAYERS FOR WHEAT PROTEIN TYPE

- FIGURE 34 AVERAGE SELLING PRICE, BY TYPE, 2017–2022 (USD/KG)

- FIGURE 35 NUMBER OF PATENTS GRANTED FOR WHEAT PROTEIN, 2011–2022

- FIGURE 36 REGIONAL ANALYSIS OF PATENTS GRANTED FOR WHEAT PROTEIN, 2019–2022

- FIGURE 37 WHEAT GLUTEN EXPORT, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 38 WHEAT GLUTEN IMPORTS, BY KEY COUNTRY, 2017–2021 (USD THOUSAND)

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 40 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 41 WHEAT GLUTEN SEGMENT TO DOMINATE WHEAT PROTEIN MARKET FROM 2023 TO 2028

- FIGURE 42 75% CONCENTRATION SEGMENT TO DOMINATE WHEAT PROTEIN MARKET FROM 2023 TO 2028

- FIGURE 43 DRY SEGMENT TO DOMINATE WHEAT PROTEIN MARKET FROM 2023 TO 2028

- FIGURE 44 BAKERY & SNACKS APPLICATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 45 WHEAT PROTEIN MARKET, BY REGION, 2022 VS. 2028 (USD MILLION)

- FIGURE 46 GEOGRAPHIC SNAPSHOT (2023–2028): JAPAN AND CHINA TO EMERGE AS NEW HOTSPOTS IN TERMS OF VALUE

- FIGURE 47 NORTH AMERICA: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 48 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 49 EUROPE: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 50 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 EUROPE: WHEAT PROTEIN MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 53 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 54 ASIA PACIFIC: WHEAT PROTEIN MARKET SNAPSHOT

- FIGURE 55 SOUTH AMERICA: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 56 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 57 REST OF THE WORLD: INFLATION RATE, BY KEY COUNTRY, 2017–2021

- FIGURE 58 REST OF THE WORLD: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 59 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 60 WHEAT PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 61 MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 62 ADM: COMPANY SNAPSHOT

- FIGURE 63 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 64 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 65 SÜDZUCKER AG: COMPANY SNAPSHOT

- FIGURE 66 AGRANA GROUP: COMPANY SNAPSHOT

- FIGURE 67 MGP INGREDIENTS: COMPANY SNAPSHOT

- FIGURE 68 GLICO NUTRITION FOODS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 69 TEREOS: COMPANY SNAPSHOT

- FIGURE 70 TATE & LYLE: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the wheat protein market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), Wheat Protein Association, International Wheat Gluten Association, European Vegetable Protein Association, Plant-based Foods Association, Vegan Society, Europe Cereals & Grains Association, British Dietetic Association, Alternative Proteins Association, India Pulses and Grains Association (IPGA), Protein Foods and Nutrition Development Association of India (PFNDAI), National Association of Wheat Growers, and World Grain, were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The wheat protein market comprises several stakeholders, including wheat protein solution manufacturers and suppliers, agrochemical manufacturers, floriculture and horticulture organizations, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, wheat protein solution distributors and wholesalers, importers & exporters of wheat protein solution, wheat protein solution manufacturers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of horticulture and floriculture companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Wheat Protein Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the wheat protein market. These approaches were extensively used to determine the size of the subsegments in the market. The research methodology used to estimate the market size includes the following details:

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry's supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent market—the protein ingredients and plant-based protein market—was considered to validate further the market details of wheat protein.

Bottom-up approach:

- The market size was analyzed based on the share of each type of wheat protein and its penetration within the application and form at regional and country levels. Thus, the global market was estimated with a bottom-up approach of the type at the country level.

- Other factors include demand within the supply chain including food and feed industry; and function trends; pricing trends; the adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting wheat protein market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall wheat protein market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for wheat protein market on the basis of type, application, form, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the vegetable oils in beauty and personal care market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European wheat protein market, by key country

- Further breakdown of the Rest of South America wheat protein market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wheat Protein Market

I want to gather information on the requirement of wheat quality for noodle in Vietnam. Could you share any data related to this?