Feed Fats & Proteins Market by Source (Animals, Plants & Others), by Livestock (Ruminant, Poultry, Aqua, Swine & Equine) & by Geography (North America, Europe, Asia-Pacific & ROW) - Global Trends & Forecasts to 2019

Globally, there is an increase in the demand for feed fats & proteins due to an increase in the income of the middle class population and rapid urbanization. The relationship between a balanced diet and optimum productivity has been well-understood by the players of the livestock production sector. In fact, animal feed is a major factor that is controlling the profitability of the livestock production business. Hence, today industries are not conservative when it comes to manufacturing high-quality animal feed ingredients. Feed Fats & Proteins optimize the nutritional levels of feed. This ensures procurement of maximum nutrition from fewer amounts of feed, and thus reducing the cost in the livestock production. This research report provides a separate in-depth market insight into the feed fats & proteins market. The Animal source-based protein meals have been utilized in livestock feed since ages. The Growing livestock industry and improved environment safety technology procedures in producing Feed Fats & Proteins are expected to provide sustainable business opportunity to the industry players.

The utilization of feed fats & proteins as a valuable feed ingredient is important in minimizing the loss (nutrient and economic value) in the production of safe, high-quality poultry meat, eggs, and bio-products. In order to meet this increasing demand, animal farmers as well as animal breeders have to increase their production. This trend has exponentially created a massive demand in the feed fats & proteins market. This report takes into account the wide range of factors affecting the global market and its influence on the market dynamics. The market drivers and restrains are explained in details in the report along with the growth opportunities in the feed protein and fats industry.

The feed fats & proteins market is projected to reach $8,379.7 million by 2019, growing at a CAGR of 5.2% from 2014 to 2019. The global market is estimated by segmenting the market into micromarkets, based on the share of each source, livestock, and geographical region. The market is segmented as animal, plant, and others according to by source, and ruminants, poultry, aqua, swine, equine, and others by livestock. The market data is available from 2012 to 2019 with a forecasted CAGR from 2014 to 2019.

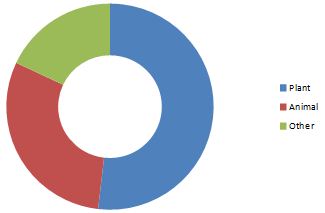

Feed Proteins Market Share(Value), by Source, 2013

Source: MarketsandMarkets Analysis

The feed proteins market by source generated a value worth$3,974.4millionin 2013, and is anticipated to grow at a CAGR of 5.3% by 2019. The market was led by the plant protein segment with the fastest-growing CAGR.

Various secondary sources were used such as encyclopedias, directories, and databases to identify and collect information, useful for this extensive commercial study of the feed fats & proteins market. The primary sources, experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess the future prospects of the market.

Scope of the report

This report focuses on the global feed fats & proteins market. This research categorizes the global market based on geography, source, and livestock:

Based on geography:

- North America

- Europe

- Asia-Pacific

- ROW

Based on livestock:

- Ruminant

- Poultry

- Aqua

- Swine

- Equine

Based on source:

- Animal

- Plant

Customization Options:

- Region-wise identification of the feed fats & protein market

The feed fats & proteins market is different in different regions of the world and can be segregated based on their source (animals, plants,&others), and livestock (ruminant, poultry, aqua, swine,&equine).

- To identify particular regions with high demand forfeed fats & proteins obtained from a particular source (animals, plants,&others).

- To identify particular regions with high demand forfeed fats & proteins for a particular livestock (ruminant, poultry, aqua, swine,&equine).

- Among such regions, identification of countries with the largest market for feed fats & proteins from various sources

- Major animal feed consuming regions

The size of the feed fats & proteins market can be identified by studying the regions which haveestablished meat & livestock industries. A region with high meat production (poultry, swine, andcattle) will subsequently affect the animal feed market.

- To identify regions with high demand for animal feed for the livestock and meat industry.

- To identify regions with high production of meat (poultry, swine,and cattle) that will ultimately boost the demand for animal feed

- Low-cost sourcing locations

The advancement of technology and its liberal availability has made the production cost more or less similar across the industry. Under such circumstances, it is important to have cost-effective sourcing of raw material for producing feed fats & proteins.

- To identify locations that can provide raw material in a cost-effective manner

- To identify locations with cost-effective raw material availability and subsequent logistical and supply chain connectivity with the production facility

- Product mapping

To study competitors offering for the same market segment and present a comparative analysis of their products and their applications.

- Descriptive product portfolio of top players of Poultry Feed additives industry

- Detailed segment-wise and country-wise production capacity and revenue of top players of the market in the region

- Trade analysis

- Feed fats & proteins imported annually in each country tracked till sub-segment level,by source and by livestock

- Feed fats & proteins exported annually in each country tracked till sub-segment level,by source and by livestock

- Historical Data and Trends

To study the data of the feed fats & proteinsmarket over a period, for generalization of market trends.

- Country-specific markets in terms of feed fats & proteins, by source and by livestock

- Regulatory issues

Human safety and environmental issues have compelled many countries to adopt strict regulatory measures.

- To identify & study any country-specific regulatory issues that may adversely affect the feed fats & proteins market

- Benefit analysis

Feed fats & proteins have several benefits as feed additives

- Diseases prevented by intake of protein

- Diseases prevented by intake of fats

- Type of fats preferred for particular animaland its statistical analysis

- Type of proteins preferred for particular animal and its statistical analysis

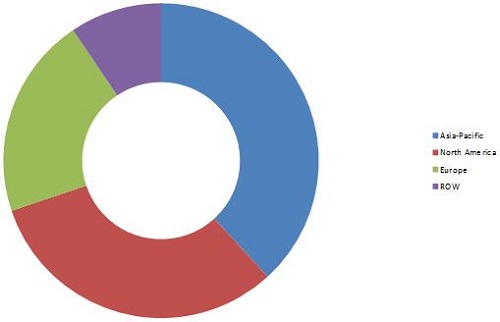

The Asia-Pacific market topped the consumption chart of the global feed fats and proteins market and accounted for around 37.5% of the total share in 2013.The market value is expected to grow at a CAGR of 5.3%by 2019, with the highest growth projected to be observed in the Asia-Pacific region. In this region, China is projected to be the market leader due to the steady population increase and rapid economic growth. This has encouraged the demand for Feed Fats & Proteins used in animal feed in China.

Feed Fats & Proteins Market share( Value), by Geography ,2013

Source: MarketsandMarkets Analysis

The feed fats & proteins market share was dominated by Asia-Pacific in 2013. A strong economic growth and population growth is the key driver of the market in this region especially in China. North America is the second largest market for the market. Europe ranks third, where the increasing meat consumption, food safety concerns, and improving meat prices were important drivers for the growth of the industry in 2013. ROW occupied the least share, but the consumption is increasing at a greater pace due to the rise in population, transition to nutritious food, increased demand in animal proteins, and so on. There are variations in the type of animal products, but more or less poultry sector dominates the overall demand for animal feed. This overall growth in the meat sector will stimulate the demand for the animal feed fats and proteins.

ADM Archer Daniels Midland Company(U.S.),Darling International Inc (U.S.), The Scoular company (U.S.), Omega Protein Corporation (U.S.), RoquetteFreres (France), Aarhuskarlshamn Ab (AAK) (Sweden), Bunge Ltd. (Bunge) (U.S.), EURODUNA Rohstoffe GmbH (Germany), Lansing Trading Group Llc (U.S.), Agrana Beteiligungs-AG(AGRANA) (Austria), are some of the key players in the feed fats and protein market and their recent development strategies have been studied in detail in this report.

Table Of Contents

1 Introduction (Page No. - 22)

1.1 Objectives

1.2 Report Description

1.3 Stakeholders

1.4 Research Methdology

1.4.1 Markets Covered

1.4.2 Market Size

1.4.3 Secondary Sources

1.4.4 Assumptions Made For the Report

1.4.5 Key Data Points Validated From Primary& Secondary Sources

1.4.6 Key Questions Answered

2 Executive Summary (Page No. - 28)

3 Feed Fats & Proteins Market Market Overview (Page No. - 30)

3.1 Introduction

3.2 Feed Fats & Proteins Market: An Overview

3.3 Winning Imperatives

3.3.1 Investment in R&D

3.3.2 Product Quality & Hygiene

3.4 Burning Issues

3.4.1 Concerns Against Rendered Fats & Oils From Animal Sources

3.4.2 Feed Safety Issues

3.5 Feed Fats & Proteins Market Dynamics

3.5.1 Drivers

3.5.1.1 Cost Mitigation in Livestock Production

3.5.1.2 Substantial Growth in Demand For Animal Meat

3.5.1.3 increasing Demand For Milk & Milk Products

3.5.1.4 Industrialization of Animal Husbandry

3.5.2 Restraints

3.5.2.1 Outbreak of Diseases

3.5.2.2 Environmental Concerns

3.5.3 Opportunities

3.5.3.1 Sustainable Business Opportunities

3.5.3.2 Growth in Demand in Asia-Pacific & Latin American Markets

3.6 Porter’s Five Forces Analysis

3.6.1 Bargaining Power of Supplier

3.6.2 Threat of Substitutes

3.6.3 Threat of New Entrants

3.6.4 Bargaining Power of Buyers

3.6.5 Degree of Competition

3.7 Supply Chain Analysis

3.8 Value Chain Analysis

3.9 Market Share Analysis

3.9.1 Feed Fats & Proteins Market

4 Premium Insights (Page No. - 48)

4.1 Plant Source Dominating the Feed Fats & Proteins Market

4.2 Blood Meal: Largest Share, By Animal Source

4.3 Soybean: Leading the Plant-Source Feed Fats & Proteins Market

4.4 Asia-Pacific: Feed Proteins Market Leader

4.5 Plant-Source Feed Fats: Fastest Growing Market

4.6 Poultry Meal: Major Market Share in Feed Fats & Proteins

4.7 Soybean: Leading Plant-Source Feed Fats & Proteins

4.8 Asia-Pacific Dominating the Feed Fats & Proteins

4.9 Poultry: Highest Contributor to Feed Fats and Proteins

4.10 Asia-Pacific: Generating High Market Value

4.11 Poultry Holds Large Market Share in Asia-Pacific

4.12 Poultry Dominates the Market (Value) in Asia-Pacific

4.13 Asia-Pacific: Animal-Source Feed Proteins Market Leader

4.14 Highest Growth in ROW

4.15 Feed Market: Higher Protein Share

4.16 Soybean: Highest Growth Rate

4.17 Soybean: Major Shareholder in Feed Fats & Proteins

4.18 China Will Dominate the Asia-Pacific Market in the Future

5 Feed Fats Market, By Source (Page No. - 66)

5.1 Introduction

5.2 Animal

5.2.1 Meat & Bone Meal

5.2.2 Poultry Meal

5.2.3 Tallow

5.2.4 Others

5.3 Plant

5.3.1 Corn

5.3.2 Soybean

5.3.3 Cotton Seeds

5.3.4 Others

6 Feed Proteins Market, By Source (Page No. - 84)

6.1 Introduction

6.2 Animal

6.2.1 Meat & Bone Meal

6.2.2 Blood Meal

6.2.3 Feather Meal

6.2.4 Others

6.3 Plant

6.3.1 Wheat

6.3.2 Corn

6.3.3 Soybean

6.3.4 Others

6.4 Other Sources

7 Feed Fats & Proteins Market, By Livestock (Page No. - 103)

7.1 Introduction

7.2 Ruminants

7.3 Poultry

7.4 Aqua

7.5 Swine

7.6 Equine

7.7 Others

8 Feed Fats & Proteins Market, By Geography (Page No. - 115)

8.1 Introduction

8.1.1 Feed Fats Market

8.1.2 Feed Proteins Market

8.2 North America

8.2.1 North America: Feed Fats Market, By Country

8.2.2 North America: Feed Proteins Market, By Country

8.2.3 North America: Feed Fats and Proteins Market, By Livestock

8.2.4 North America: Feed Fats Market, By Source

8.2.4.1 North America: Animal-Source Feed Fats Market

8.2.4.2 North America: Plant-Source Feed Fats Market

8.2.5 North America: Feed Proteins Market, By Source

8.2.5.1 North America: Animal-Source Feed Proteins Market

8.2.5.2 North America: Plant-Source Feed Proteins Market

8.2.6 U.S.

8.2.6.1 U.S.: Feed Fats Market, By Source

8.2.6.2 U.S.: Feed Proteins Market, By Source

8.2.7 Canada

8.2.7.1 Canada: Feed Fats Market, By Source

8.2.7.2 Canada: Feed Proteins Market, By Source

8.2.8 Mexico

8.2.8.1 Mexico: Feed Fats Market, By Source

8.2.8.2 Mexico: Feed Proteins Market, By Source

8.3 Europe

8.3.1 Europe: Feed Fats Market, By Country

8.3.2 Europe: Feed Proteins Market, By Country

8.3.3 Europe: Feed Fats & Proteins Market, By Livestock

8.3.4 Europe: Feed Fats Market, By Source

8.3.4.1 Europe: Animal-Source Feed Fats Market

8.3.4.2 Europe: Plant-Source Feed Fats Market

8.3.5 Europe: Feed Proteins Market, By Source

8.3.5.1 Europe: Animal-Source Feed Proteins Market

8.3.5.2 Europe: Plant-Source Feed Proteins Market

8.3.6 Germany

8.3.6.1 Germany: Feed Fats Market, By Source

8.3.6.2 Germany: Feed Proteins Market, By Source

8.3.7 U.K.

8.3.7.1 U.K: Feed Fats Market, By Source

8.3.7.2 U.K.: Feed Proteins Market, By Source

8.3.8 Russia

8.3.8.1 Russia: Feed Fats Market, By Source

8.3.8.2 Russia: Feed Proteins Market, By Source

8.3.9 Poland

8.3.9.1 Poland: Feed Fats Market, By Source

8.3.9.2 Poland: Feed Proteins Market, By Source

8.3.10 France

8.3.10.1 France: Feed Fats Market, By Source

8.3.10.2 France: Feed Proteins Market, By Source

8.3.11 Ukraine

8.3.11.1 Ukraine: Feed Fats Market, By Source

8.3.11.2 Ukraine: Feed Proteins Market, By Source

8.3.12 Others

8.3.12.1 Others: Feed Fats Market, By Source

8.3.12.2 Others: Feed Proteins Market, By Source

8.4 Asia-Pacific

8.4.1 Asia-Pacific: Feed Fats Market, By Country

8.4.2 Asia-Pacific: Feed Proteins Market, By Country

8.4.3 Asia-Pacific: Feed Fats & Proteins Market, By Livestock

8.4.4 Asia-Pacific: Market, By Source

8.4.4.1 Asia-Pacific: Animal-Source Feed Fats Market

8.4.4.2 Asia-Pacific: Plant-Source Feed Fats Market

8.4.5 Asia-Pacific: Feed Proteins Market, By Source

8.4.5.1 Asia-Pacific: Animal-Source Feed Proteins Market

8.4.5.2 Asia-Pacific: Plant-Source Feed Proteins Market

8.4.6 China

8.4.6.1 China: Feed Fats Market, By Source

8.4.6.2 China: Feed Proteins Market, By Source

8.4.7 Japan

8.4.7.1 Japan: Feed Fats Market, By Source

8.4.7.2 Japan: Feed Proteins Market, By Source

8.4.8 India

8.4.8.1 India: Feed Fats Market, By Source

8.4.8.2 India: Feed Proteins Market, By Source

8.4.9 Australia

8.4.9.1 Australia: Feed Fats Market, By Source

8.4.9.2 Australia: Feed Proteins Market, By Source

8.4.10 Others

8.4.10.1 Others: Feed Fats Market, By Source

8.4.10.2 Others: Feed Proteins Market, By Source

8.5 ROW

8.5.1 ROW: Feed Fats Market, By Country

8.5.2 ROW: Feed Proteins Market, By Country

8.5.3 ROW: Feed Fats & Proteins Market, By Livestock

8.5.4 ROW: Market, By Source

8.5.4.1 ROW: Animal-Source Feed Fats Market

8.5.4.2 ROW: Plant-Source Feed Fats Market

8.5.5 ROW: Feed Proteins Market, By Source

8.5.5.1 ROW: Animal-Source Feed Proteins Market

8.5.5.2 ROW: Plant-Source Feed Proteins Market

8.5.6 South Africa

8.5.7 South Africa: Feed Fats Market, By Source

8.5.8 South Africa: Feed Proteins Market, By Source

8.5.9 Brazil

8.5.9.1 Brazil: Feed Fats Market, By Source

8.5.9.2 Brazil: Feed Proteins Market, By Source

8.5.10 Argentina

8.5.10.1 Argentina: Feed Fats Market, By Source

8.5.10.2 Argentina: Feed Fats Market, By Source

8.5.11 Others

8.5.11.1 Others: Feed Fats Market, By Source

8.5.11.2 Others: Feed Proteins Market, By Source

9 Competitive Landscape (Page No. - 229)

9.1 Introduction

9.2 Acquisitions: Most Preferred Strategic Approach

9.3 Key Market Strategies

9.4 Acquistions

9.5 Collaborations

9.6 Expansions

10 Company Profile (Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)* (Page No. - 238)

10.1 Archer Daniels Midland Company (ADM)

10.2 Darling International Inc

10.3 the Scoular Company

10.4 Omega Protein Corporation

10.5 Roquette Freres

10.6 Aarhuskarlshamn AB (AAK)

10.7 Bunge Ltd.

10.8 Euroduna Rohstoffe Gmbh

10.9 Lansing Trade Group LLC.

10.10 Agrana Beteiligungs-AG (Agrana)

*Details on Company At A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (147 Tables)

Table 1 Fat & Oil Sources Available For Use in Feed Lot Rations

Table 2 Feed Fats Market Size, By Source, 2012-2019 ($Million)

Table 3 Animal-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 4 Plant-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 5 Animal-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 6 Meat & Bone Meal: Animal-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 7 Poultry Meal: Animal-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 8 Tallow: Animal-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 9 Others: Animal-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 10 Plant-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 11 Corn: Plant-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 12 Soybean: Plant-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 13 Cotton Seeds: Plant-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 14 Others: Plant-Source Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 15 Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 16 Animal-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 17 Plant-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 18 Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 19 Meat & Bone Meal: Animal-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 20 Blood Meal: Animal-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 21 Feather Meal: Animal-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 22 Others: Animal-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 23 Plant-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 24 Wheat: Plant-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 25 Corn: Plant-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 26 Soybean: Plant-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 27 Others: Plant-Source Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 28 Other Sources: Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 29 Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 30 Ruminants: Feed Fats & Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 31 Poultry: Feed Fats and Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 32 Aqua: Feed Fats & Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 33 Swine: Feed Fats and Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 34 Equine: Feed Fats & Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 35 Others: Feed Fats and Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 36 Feed Fats & Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 37 Feed Fats Market Size, By Geography, 2012-2019 ($Million)

Table 38 Feed Proteins Market Size, By Geography, 2012-2019 ($Million)

Table 39 North America: Feed Fats and Proteins Market Size, By Country, 2012-2019 ($Million)

Table 40 North America: Market Size, By Country, 2012-2019 ($Million)

Table 41 North America: Feed Proteins Market Size, By Country, 2012-2019 ($Million)

Table 42 North America: Feed Fats and Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 43 North America: Market, By Source, 2012-2019 ($Million)

Table 44 North America: Animal-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 45 North America: Plant-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 46 North America: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 47 North America: Animal-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 48 North America: Plant-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 49 U.S.: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 50 U.S.: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 51 U.S.: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 52 Canada: Feed Fats and Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 53 Canada: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 54 Canada: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 55 Mexico: Feed Fats and Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 56 Mexico: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 57 Mexico: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 58 Europe: Feed Fats & Proteins Market Size, By Country, 2012-2019 ($Million)

Table 59 Europe: Feed Fats & Proteins Market Size, By Country, 2012-2019 ($Million)

Table 60 Europe: Feed Proteins Market Size, By Country, 2012-2019 ($Million)

Table 61 Europe: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 62 Europe: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 63 Europe: Animal-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 64 Europe: Plant-Source Feed Fats Market Size, By Source, 2012-2019 ($Million)

Table 65 Europe: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 66 Europe: Animal-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 67 Europe: Plant-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 68 Germany: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 69 Germany: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 70 Germany: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 71 U.K.: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 72 U.K.: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 73 U.K.: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 74 Russia: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 75 Russia: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 76 Russia: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 77 Poland: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 78 Poland: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 79 Poland: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 80 France: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 81 France: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 82 France: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 83 Ukraine: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 84 Ukraine: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 85 Ukraine: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 86 Others: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 87 Others: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 88 Others: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 89 Asia-Pacific: Feed Fats & Proteins Market Size, By Country, 2012-2019 ($Million)

Table 90 Asia-Pacific: Feed Fats & Proteins Market Size, By Country, 2012-2019 ($Million)

Table 91 Asia-Pacific: Feed Proteins Market Size, By Country, 2012-2019 ($Million)

Table 92 Asia-Pacific: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 93 Asia-Pacific: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 94 Asia-Pacific: Animal-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 95 Asia-Pacific: Plant-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 96 Asia-Pacific: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 97 Asia-Pacific: Animal-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 98 Asia-Pacific: Plant-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 99 China: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 100 China: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 101 China: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 102 Japan: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 103 Japan: Market Size, By Source, 2012-2019 ($Million)

Table 104 Japan: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 105 India: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 106 India: Feed Fats & Proteins Market Size, By Source, 2012-2019 ($Million)

Table 107 India: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 108 Australia: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 109 Australia: Market Size, By Source, 2012-2019 ($Million)

Table 110 Australia: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 111 Others: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 112 Others: Feed Fats & Proteins Market Size,By Source, 2012-2019 ($Million)

Table 113 Others: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 114 ROW: Feed Fats & Proteins Market Size, By Country, 2012-2019 ($Million)

Table 115 ROW: Feed Fats & Proteins Market Size, By Country, 2012-2019($Million)

Table 116 ROW: Feed Proteins Market Size, By Country, 2012-2019($Million)

Table 117 ROW: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 118 ROW: Market Size, By Source, 2012-2019 ($Million)

Table 119 ROW: Animal-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 120 ROW: Plant-Source Feed Fats Market Size, 2012-2019 ($Million)

Table 121 ROW: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 122 ROW: Animal-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 123 ROW: Plant-Source Feed Proteins Market Size, 2012-2019 ($Million)

Table 124 South Africa: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 125 South Africa: Market Size, By Source, 2012-2019 ($Million)

Table 126 South Africa: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 127 Brazil: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 128 Brazil: Market Size, By Source, 2012-2019 ($Million)

Table 129 Brazil: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 130 Argentina: Feed Fats & Proteins Market Size, By Livestock, 2012-2019 ($Million)

Table 131 Argentina: Market Size, By Source, 2012-2019 ($Million)

Table 132 Argentina: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 133 Others: Feed Fats & Proteins Market Size, By Type, 2012-2019 ($Million)

Table 134 Others:Market Size, By Source, 2012-2019 ($Million)

Table 135 Others: Feed Proteins Market Size, By Source, 2012-2019 ($Million)

Table 136 Acquisitions, 2010–2013

Table 137 Collaborations 2010-2013

Table 138 Expansions 2010–2013

Table 139 ADM: Products & their Description

Table 140 The Scoular Company: Products & Their Description

Table 141 Omega Protein Corporation :Products & Their Description

Table 142 Roquette: Products & Their Description

Table 143 AAK: Products & Their Description

Table 144 Bunge Ltd.: Products & Their Description

Table 145 Euroduna: Products & Their Description

Table 146 Lansing Trade Group: Products & Their Description

Table 147 Agrana: Products & Their Description

List of Figures (33 Figures)

Figure 1 Feed Fats & Proteins Market Size ($Million), 2014-2019

Figure 2 Benefits of Using Fat in Animal Feed

Figure 3 Feed Fats & Proteins Market Segmentation

Figure 4 Porter’s Five Forces Analysis

Figure 5 Feed Fats and Proteins Supply Chain

Figure 6 Feed Fats & Proteins Value Chain

Figure 7 Feed Fats and Proteins: Market Share Analysis, By Company 2012

Figure 8 Feed Proteins Market Size, By Source, 2013-2019 ($Million)

Figure 9 Feed Proteins Market Share (Revenue), By Animal Source, 2013

Figure 10 Feed Proteins Market Size, By Plant Source, 2013-2019 ($Million)

Figure 11 Feed Proteins Market Size, By Geography, 2013-2019 ($Million)

Figure 12 Feed Fats Market Size, By Source, 2013-2019 ($Million)

Figure 13 Feed Fats Market Share , By Source, 2013

Figure 14 Plant-Source Feed Fats Market Size, 2013-2019 ($Million)

Figure 15 Feed Fats Market Size, By Geography, 2013 ($Million)

Figure 16 Feed Fats & Proteins Market Size, By Livestock, 2013-2019 ($Million)

Figure 17 Feed Fats and Proteins Market Size, By Geography, 2013-2019 ($Million)

Figure 18 Asia-Pacific: Feed Fats & Proteins Market, By Livestock, 2013 ($Million)

Figure 19 Feed Fats and Proteins Market Size, By Livestock, By Geography, 2013 ($Million)

Figure 20 Animal-Source Feed Proteins Market Size, By Geography, 2013 ($Million)

Figure 21 Feed Proteins Market CAGR, By Animal Source, By Geography, (2014-2019)

Figure 22 Feed Fats & Proteins Market Size, By Geography, 2013 ($Million)

Figure 23 Feed Proteins Market CAGR, By Plant Source, By Geography, (2014-2019)

Figure 24 Plant-Source Feed Fats Market Size, By Geography, 2013 ($Million)

Figure 25 Asia-Pacific: Feed Fats & Proteins Market Size, By Country, 2013 ($Million)

Figure 26 Animal Feed Fats & Proteins Market Share, By Growth Strategy, 2010–2013

Figure 27 Animal Feed Fats & Proteins Market: Developments, 2010–2013

Figure 28 Animal Feed Fats & Proteins Market: Development Share, By Company, 2010-2013

Figure 29 ADM: SWOT Analysis

Figure 30 Darling International Inc.: SWOT Analysis

Figure 31 AAK.: SWOT Analysis

Figure 32 Bunge Ltd.: SWOT Analysis

Figure 33 Agrana: SWOT Analysis

Growth opportunities and latent adjacency in Feed Fats & Proteins Market