Voice Biometrics Market by Component, Type (Active and Passive), Application (Authentication and Customer Verification, Transaction Processing), Authentication Process, Organization Size, Deployment Mode, Vertical, and Region - Global Forecast to 2026

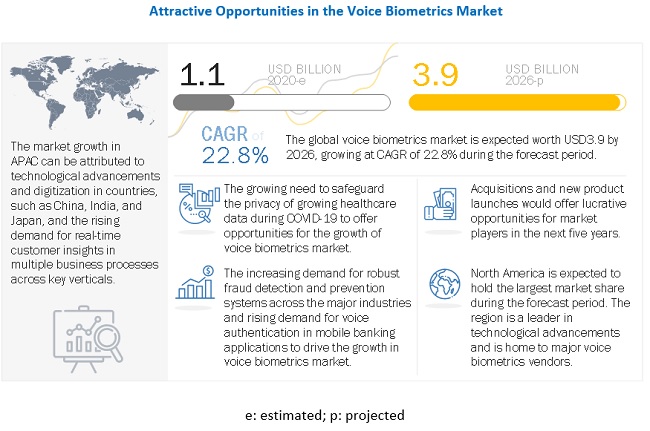

The global Voice Biometrics Market size as per revenue was surpassed $1.1 billion in 2020 and is anticipated to exhibits a CAGR of 22.8% to rise over $3.9 billion by the end of 2026. Factors such as the increasing demand for robust fraud detection and prevention systems across the Banking, Financial Services, and Insurance (BFSI) industry and the need for reducing authentication and identification costs are driving the adoption of voice biometrics solutions across the world.

Fraudulent activities have increased alarmingly with the advent of digitalization across the banking industry. Through high-profile data thefts, fraudsters with access to banking credentials may gain access to customers’ bank accounts, thus creating the need for second or third-level security in the whole financial authentication system. Voice biometrics caters to such needs of banks and financial agencies by smartly identifying a user based on his/her voiceprint.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The voice biometrics market is expected to witness a minor slowdown in 2020 due to the global lockdown. The COVID-19 pandemic has increased the churn rate and shuddered almost every industry. The lockdown is impacting global manufacturing, and supply chains and logistics as the continuity of operations for various sectors are badly impacted. The sectors facing the greatest drawbacks are manufacturing, transportation and logistics, and retail and consumer goods. The availability of the essential items has been impacted due to the lack of manpower to work on production lines, supply chains, and transportation, although the essential items are exempted from the lockdown. The condition is expected to come under control by early 2021, while the demand for voice biometrics solutions and services is expected to increase, which is due to the increased demand for enhanced customer experience and build a personalized relationship with the prospects. Several verticals are already planning to deploy a diverse array of voice biometrics solutions and services to enable digital transformation initiatives that address mission-critical processes, improve operations, and authenticate user’s identification. The reduction in operational costs, better customer experiences, fraud detection and prevention, enhanced authentication processes and operations, and improved real-time decision-making are the key business and operational priorities that are expected to drive the adoption of the voice identification market.

Voice Biometrics Market Growth Dynamics

Driver: Increasing demand for robust fraud detection and prevention systems across major industries

Fraudulent activities have increased at an alarming rate with the advent of digitalization across the banking industry. Through high-profile data thefts, fraudsters with access to banking credentials may gain access to customers’ bank accounts, creating the need for a second or third level of security in the whole financial authentication system. Voice biometrics solutions cater to such needs of banks and financial agencies by smartly identifying a user based on his/her voiceprint. Unlike traditional text passwords and pins, voiceprints are unique to every individual. Featured with automated calibration, active and passive authentication, liveliness detection, and panic detection, voice biometrics eases user identification and authentication and also improves the Know Your Customer (KYC) management. For instance, Barclays authenticates the caller’s identity with the phrase “My voice is my password,” which has reduced their user verification time by 20 seconds. Similarly, large banks, including HSBC, Wells Fargo, Santander Bank, N. A., and Tangerine Bank, have also adopted voice recognition to speed up the identity verification process at their bank call centers.

Restraint: Security and privacy issues due to advanced technologies

Voice biometrics presents a major privacy problem as samples are being stored locally and are used for purposes other than the primary reason of the collection. Any basic application that is enabled with voice technology may cause fraudsters and hackers to breach the system and steal the voice sample easily. With access to all the customer/user information, fraudsters can easily access any user’s bank accounts and steal money. Further, intelligence agencies with access to this user data might be used by nosy governments to perform global surveillance, which automatically brings in privacy issues. Stolen data can also be used as a masquerade by terrorists and criminals to mislead legal entities. To eliminate such risks, various governments are taking the necessary initiatives for standardizing the use of biometrics across industries; hence, security and privacy concerns are expected to diminish in the near future. The lack of accuracy in voice biometrics solutions can also be one of the reasons why users still do not talk to their personal computers or do not use only voice for giving commands on their smartphones and prefer to type rather than getting false rejections again and again, as the process can be frustrating and time-consuming. Although researchers are trying to make a voice biometrics solution using the neural networks approach that can identify such problems and rectify them on its own, they are not completely successful in this field.

Opportunity: Need to safeguard the privacy of growing healthcare data during COVID-19

While dealing with fraud risks, healthcare firms are often ignored, and breaches to hack medical information are costlier, lethal, and are becoming increasingly prevalent. However, regulatory pressures and compliance guidelines require healthcare providers to handle patient information with utmost privacy and care properly. Voice biometrics solutions prevent the theft of medical information and maintain the privacy of healthcare data through a robust and convenient authentication experience for physicians, doctors, and patients. While complying with the privacy regulations, these solutions ensure patient confidentiality and can be used by patients to access insurance portals and validate received care. This also ensures fraud and data theft prevention through encrypted information exchange.

Challenge: Lack of accuracy in authenticating users

Although the current voice biometrics solutions offer exceptional benefits, a lack of accuracy due to various issues still exists. These issues include poor-quality voice samples; background noise interferences while interacting with the IVR or call system; inconsistency in the speaker's voice due to illness, and mood changes over time, as well as changes in the voice technology, such as speakers and recorders. Similarly, passphrases used by users for authentication purposes can be acquired by vishing to attempt an attack on a voice biometric system securing access to an IVR, all of which create reluctance among organizations to adopt voice biometrics as an authentication or verification system. By whitelisting voiceprints and blacklisting fraudulent voices to compare and authenticate valid users, most of the voice biometrics vendors are constantly improvising their solutions. However, in the current conditions, lack of accuracy is still expected to become one of the biggest challenges in the voice biometrics market.

Among verticals, the healthcare and life sciences segment to grow at the highest CAGR during the forecast period

The voice biometrics market is segmented into the various verticals, particularly verticals, such as BFSI, retail and eCommerce, government and defense, IT and telecom, healthcare and life sciences, transportation and logistics, travel and hospitality, energy and utilities, and others (manufacturing, education, and media and entertainment). The market size of the healthcare and life sciences vertical is expected to grow at the highest CAGR during the forecast period. Mandatory protection of sensitive data to boost the adoption of voice biometrics solutions in the healthcare and life sciences vertical.

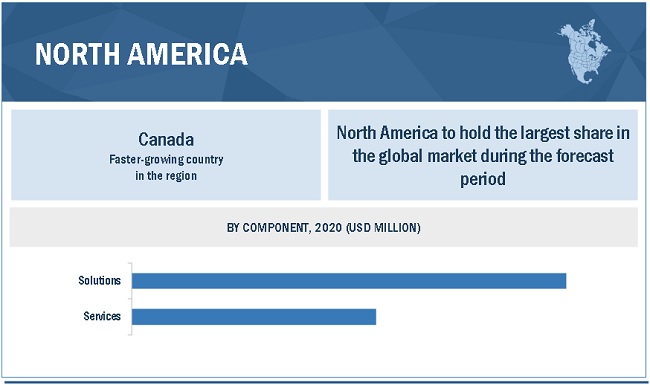

APAC to grow at a higher CAGR during the forecast period

The voice biometrics market has been segmented into five regions: North America, Europe, APAC, MEA, and Latin America. Among these regions, North America is projected to hold the largest market size during the forecast period. APAC is expected to grow at the highest CAGR during the forecast period. The increasing demand for enhanced security for preventing criminal activities from enhancing the market growth in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Major Companies in Voice Biometrics Market

The voice biometrics market vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the key players operating in the voice biometrics market include Nuance (US), NICE (Israel), Verint (US), Pindrop (US), LexisNexis Risk Solutions (US), Phonexia (Czech Republic), VBG (US), Aculab (UK), Auraya (Australia), OneVault (South Africa), Aware (US), SpeechPro (US), LumenVox (US), Uniphore (India), SESTEK (Turkey), VoicePIN (Poland), QSS Technosoft (India), Voxta (India) Interactions (US), ID R&D (US), Kaizen Secure Voiz (US), HYPR (US), Element (US), Trust Stamp (US), and AnyVision (Israel). The study includes an in-depth competitive analysis of these key players in the voice biometrics market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

USD 1.1 billion |

|

Revenue forecast for 2026 |

USD 3.9 billion |

|

Growth Rate |

22.8% CAGR |

|

Forecast units |

USD Billion |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Component, Type, Authenicatin Process, Oragnisation Size, Deployment Mode, Application, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Nuance (US), NICE (Israel), Verint (US), Pindrop (US), LexisNexis Risk Solutions (US), Phonexia (Czech Republic), VBG (US), Aculab (UK), Auraya (Australia), OneVault (South Africa) and many more |

This research report categorizes the voice biometrics market based on component, type, application, deployment mode, organization size, vertical, and region.

Voice Biometrics Market By component:

-

Solutions

- Software

- Platform

-

Services

-

Professional Services

- Consulting

- System Integration and Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

Voice Biometrics Market By type:

- Active Voice Biometrics

- Passive Voice Biometrics

Voice Biometrics Market By authentication process:

- Automated IVR

- Agent-Assisted

- Mobile Applications

- Employee Authentication

Voice Biometrics Market By deployment mode:

- On-premises

- Cloud

Voice Biometrics Market By organization size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Voice Biometrics Market By appliction:

- Authentication and Customer Verification

- Forensic Voice Analysis and Criminal Investigation

- Fraud Detection and Prevention

- Risk and Emergency Management

- Transaction Processing

- Access Control

- Workforce Management

- Others (Speech Therapy, Vocal Passphrase, and Personalized User Experience).

Voice Biometrics Market By vertical:

- BFSI

- Retail and Ecommerce

- Government and Defense,

- IT And Telecom

- Healthcare and Life Sciences

- Transportation and Logistics

- Travel and Hospitality

- Energy and Utilities

- Others (Manufacturing, Education, and Media and Entertainment).

Voice Biometrics Market By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- India

- Japan

- Rest of APAC

-

MEA

- South Africa

- UAE

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2021, Nuance launched Omnichannel Patient Engagement Virtual Assistant Platform to power healthcare's 'Digital Front Door.' Nuance's omnichannel patient engagement platform represents a new integrated philosophy for enabling healthcare's digital front door and a well-thought-out, well-implemented, and highly practical solution for delivering an enhanced level of digital services to patients.

- In February 2021, Onevault extended its footprint into Pakistan. Partnering with ConnectDotNet, Onevault will provide the Pakistan market with the biometric technology and solutions that are ideally suited for the array of market requirements.

- In November 2020, NICE unveiled ENLIGHTEN Fraud Prevention, an innovative new solution for automatic and continuous fraudster detection and exposure. Bringing together NICE ENLIGHTEN's comprehensive Customer Engagement AI platform with the company’s voice biometrics capabilities, the solution continuously scans millions of calls to accurately pinpoint suspicious behavior and uncover previously unidentified fraudsters.

- In July 2019, Auraya launched EVA for Amazon Connect. EVA enabled organizations to deliver a better customer experience for authenticating customer identity on telephony and digital channels. It allows customers to verify their identity quickly and conveniently without needing to remember passwords, PINs, or needing to provide sensitive private information.

- In May 2020, Nuance partnered with National Australia Bank. National Australia Bank (NAB) is leveraging the biometrics solution for authenticating customers and enabling fraud detection processes. Nuance biometrics and security solutions power NAB's VoiceID service that authenticates NAB customers' voices in seconds, helping prevent fraudsters from accessing bank accounts using a customer's credentials or information.

- April 2020, OneVault signed an agreement with the South African Fraud Prevention Service (SAFPS) to deliver a biometric fraud detection solution for call centers and establish a centralized fraud database in the country.

Frequently Asked Questions (FAQ):

How big is the voice biometrics market?

What is growth rate of the voice biometrics market?

What are the applications in voice biometrics market?

Who are the key players in voice biometrics market?

Who will be the leading hub for voice biometrics market?

What is the voice biometrics market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 6 VOICE BIOMETRICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS AND SERVICES OF THE VOICE BIOMETRICS MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF VOICE BIOMETRICS MARKET THROUGH OVERALL VOICE BIOMETRICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 4 GLOBAL VOICE BIOMETRICS MARKET SIZE AND GROWTH RATE, 2015–2019 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2020–2026 (USD MILLION, Y-O-Y %)

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2020

FIGURE 17 SOFTWARE SEGMENT TO HOLD A LARGER MARKET SHARE IN THE MARKET IN 2020

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2020

FIGURE 19 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SHARE IN THE MARKET IN 2020

FIGURE 20 PASSIVE SEGMENT TO HOLD A HIGHER MARKET SIZE IN THE MARKET IN 2020

FIGURE 21 AGENT ASSISTED SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 22 AUTHENTICATION AND CUSTOMER VERIFICATION APPLICATION SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2020

FIGURE 23 CLOUD SEGMENT TO HOLD A LARGER MARKET SHARE IN 2020

FIGURE 24 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2020

FIGURE 25 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SHARE IN 2020

FIGURE 26 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE VOICE BIOMETRICS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN THE VOICE BIOMETRICS MARKET

FIGURE 27 INCREASING DEMAND FOR ROBUST FRAUD DETECTION AND PREVENTION SYSTEMS ACROSS THE MAJOR INDUSTRIES TO DRIVE THE GROWTH OF MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 28 ACCESS CONTROL APPLICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET: BY COMPONENT AND TOP THREE VERTICAL

FIGURE 29 SOLUTIONS SEGMENT AND BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL SEGMENT TO HOLD LARGE MARKET SHARES IN 2020

4.4 MARKET: BY REGION

FIGURE 30 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 VOICE BIOMETRICS: ARCHITECTURE

FIGURE 31 VOICE BIOMETRICS MARKET ARCHITECTURE

5.3 MARKET DYNAMICS

FIGURE 32 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.3.1 DRIVERS

5.3.1.1 Increasing demand for robust fraud detection and prevention systems across major industries

5.3.1.2 Growing need to reduce authentication and identification costs

5.3.1.3 Rising demand for voice authentication in mobile banking applications

5.3.2 RESTRAINTS

5.3.2.1 Security and privacy issues due to advanced technologies

5.3.2.2 Low cybersecurity budgets coupled with high installation costs

5.3.3 OPPORTUNITIES

5.3.3.1 Advent of advanced technologies such as AI and DNN

5.3.3.2 Need to safeguard the privacy of growing healthcare data during COVID-19

5.3.4 CHALLENGES

5.3.4.1 Lack of accuracy in authenticating users

5.3.4.2 Increased errors with changes in quality of voice samples due to fluctuations in the physical or physiological state

5.3.5 CUMULATIVE GROWTH ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 33 VALUE CHAIN ANALYSIS

5.5 VOICE BIOMETRICS: ECOSYSTEM

FIGURE 34 ECOSYSTEM OF VOICE BIOMETRICS MARKET

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 35 NUMBER OF PATENTS GRANTED EACH YEAR, 2010-2020

5.6.3.1 Top applicants

FIGURE 36 TOP 10 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010-2020

TABLE 7 TOP 15 PATENT OWNERS (US) IN THE VOICE BIOMETRICS MARKET, 2010-2020

5.7 CASE STUDY ANALYSIS

5.7.1 ACEABLE DEPLOYED VOICEVAULT VOICE BIOMETRICS SOLUTION TO STREAMLINES ITS CUSTOMER FACING AND BACK END PROCESS

5.7.2 I-TEL A PUBLIC COMPANY’S CUSTOMER IMPLEMENTED ACULAB VOICE BIOMETRICS SOLUTION VIOSENTRY TO AUTHENTICATE VOICE PROCESS WITH EASE AND SIMPLICITY

5.7.3 ROYAL BANK OF SCOTLAND DETECTED FRAUD WITH VOICE BIOMETRICS SOLUTIONS FROM NUANCE

5.7.4 A DOMESTIC BANK IN VIETNAM CHOSE NICE RTA SOLUTION TO PREVENT FRAUD AND DELIVER BETTER SERVICE TO THE CUSTOMERS

5.7.5 A LEADING COMMUNICATION FIRM DEPLOYED ACULAB VOICE BIOMETRICS SOLUTION TO MITIGATE FRAUD AND SAVE COSTS

5.7.6 A LEADING TECHNOLOGY SERVICE PROVIDER IMPLEMENTED ACULAB VOICE BIOMETRICS SOLUTION TO AUTOMATE THE PASSWORD RESET PROCESS

5.8 PRICING MODEL ANALYSIS

5.9 VOICE BIOMETRICS MARKET: COVID-19 IMPACT

FIGURE 37 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.10 REGULATORY LANDSCAPE

5.10.1 GENERAL DATA PROTECTION REGULATION

5.10.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.10.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.10.4 FINANCIAL INDUSTRY REGULATORY AUTHORITY

5.10.5 SERVICE ORGANIZATIONAL CONTROL 2

5.10.6 MARKETS IN FINANCIAL INSTRUMENTS DIRECTIVE II

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 38 PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 SCENARIO

TABLE 8 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE VOICE BIOMETRICS MARKET

5.13 TECHNOLOGY ANALYSIS

5.13.1 MACHINE LEARNING AND VOICE BIOMETRICS

5.13.2 ARTIFICIAL INTELLIGENCE AND VOICE BIOMETRICS

5.13.3 AIOPS AND VOICE BIOMETRICS

6 VOICE BIOMETRICS MARKET, BY COMPONENT (Page No. - 85)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

6.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 39 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 9 MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 40 PLATFORM SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 13 SOLUTION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 14 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.1 SOFTWARE

TABLE 15 SOFTWARE: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 16 SOFTWARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 PLATFORM

TABLE 17 PLATFORM: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 18 PLATFORM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 41 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 19 MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 20 MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 42 CONSULTING SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 21 MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 22 MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 23 PROFESSIONAL SERVICES: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 24 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.1 Consulting

TABLE 25 CONSULTING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 26 CONSULTING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.2 System integration and implementation

TABLE 27 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 28 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1.3 Support and maintenance

TABLE 29 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 30 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 31 MANAGED SERVICE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 32 MANAGED SERVICE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 VOICE BIOMETRICS MARKET, BY TYPE (Page No. - 100)

7.1 INTRODUCTION

7.1.1 TYPES: COVID-19 IMPACT

7.1.2 TYPES: MARKET DRIVERS

FIGURE 43 PASSIVE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 33 MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 34 MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

7.2 ACTIVE VOICE BIOMETRICS

TABLE 35 ACTIVE VOICE BIOMETRICS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 36 ACTIVE VOICE BIOMETRICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 PASSIVE VOICE BIOMETRICS

TABLE 37 PASSIVE VOICE BIOMETRICS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 38 PASSIVE VOICE BIOMETRICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 VOICE BIOMETRICS MARKET, BY AUTHENTICATION PROCESS (Page No. - 105)

8.1 INTRODUCTION

8.1.1 AUTHENTICATION PROCESS: COVID-19 IMPACT

8.1.2 AUTHENTICATION PROCESS: MARKET DRIVERS

FIGURE 44 MOBILE APPLICATIONS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 39 MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 40 MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

8.2 AUTOMATED IVR

TABLE 41 AUTOMATED IVR: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 42 AUTOMATED IVR: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 AGENT ASSISTED

TABLE 43 AGENT ASSISTED: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 44 AGENT ASSISTED: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.4 MOBILE APPLICATIONS

TABLE 45 MOBILE APPLICATIONS: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 46 MOBILE APPLICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.5 EMPLOYEE AUTHENTICATION

TABLE 47 EMPLOYEE AUTHENTICATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 48 EMPLOYEE AUTHENTICATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 VOICE BIOMETRICS MARKET, BY APPLICATION (Page No. - 112)

9.1 INTRODUCTION

9.1.1 APPLICATIONS: COVID-19 IMPACT

9.1.2 APPLICATIONS: MARKET DRIVERS

FIGURE 45 TRANSACTION PROCESSING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 49 MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 50 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.2 AUTHENTICATION AND CUSTOMER VERIFICATION

TABLE 51 AUTHENTICATION AND CUSTOMER VERIFICATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 52 AUTHENTICATION AND CUSTOMER VERIFICATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 FORENSIC VOICE ANALYSIS AND CRIMINAL INVESTIGATION

TABLE 53 FORENSIC VOICE ANALYSIS AND CRIMINAL INVESTIGATION: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 54 FORENSIC VOICE ANALYSIS AND CRIMINAL INVESTIGATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 FRAUD DETECTION AND PREVENTION

TABLE 55 FRAUD DETECTION AND PREVENTION: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 56 FRAUD DETECTION AND PREVENTION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 RISK AND EMERGENCY MANAGEMENT

TABLE 57 RISK AND EMERGENCY MANAGEMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 58 RISK AND EMERGENCY MANAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 TRANSACTION PROCESSING

TABLE 59 TRANSACTION PROCESSING: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 60 TRANSACTION PROCESSING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 ACCESS CONTROL

TABLE 61 ACCESS CONTROL: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 62 ACCESS CONTROL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.8 WORKFORCE MANAGEMENT

TABLE 63 WORKFORCE MANAGEMENT: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 64 WORKFORCE MANAGEMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.9 OTHER APPLICATIONS

TABLE 65 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 66 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 VOICE BIOMETRICS MARKET, BY ORGANIZATION SIZE (Page No. - 124)

10.1 INTRODUCTION

10.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

10.1.2 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 46 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 67 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 68 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 69 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 70 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.3 LARGE ENTERPRISES

TABLE 71 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 72 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11 VOICE BIOMETRICS MARKET, BY DEPLOYMENT MODE (Page No. - 129)

11.1 INTRODUCTION

11.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

11.1.2 DEPLOYMENT MODES: MARKET DRIVERS

FIGURE 47 ON-PREMISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 73 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 74 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

11.2 CLOUD

TABLE 75 CLOUD: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 76 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.3 ON-PREMISES

TABLE 77 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 78 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12 VOICE BIOMETRICS MARKET, BY VERTICAL (Page No. - 134)

12.1 INTRODUCTION

12.1.1 VERTICALS: COVID-19 IMPACT

12.1.2 VERTICALS: MARKET DRIVERS

FIGURE 48 HEALTHCARE AND LIFE SCIENCES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 79 MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 80 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 81 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 82 BANKING, FINANCIAL SERVICES, AND INSURANCE SEGMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.3 RETAIL AND ECOMMERCE

TABLE 83 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 84 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.4 IT AND TELECOM

TABLE 85 IT AND TELECOM: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 86 IT AND TELECOM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.5 GOVERNMENT AND DEFENSE

TABLE 87 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 88 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.6 HEALTHCARE AND LIFE SCIENCES

TABLE 89 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 90 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.7 TRAVEL AND HOSPITALITY

TABLE 91 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 92 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.8 TRANSPORTATION AND LOGISTICS

TABLE 93 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 94 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.9 ENERGY AND UTILITIES

TABLE 95 ENERGY AND UTILITIES: VOICE BIOMETRICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 96 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.10 OTHER VERTICALS

TABLE 97 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 98 OTHER VERTICALS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

13 VOICE BIOMETRICS MARKET, BY REGION (Page No. - 147)

13.1 INTRODUCTION

FIGURE 49 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 50 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING THE FORECAST PERIOD

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 NORTH AMERICA: COVID-19 IMPACT

13.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

13.2.4 UNITED STATES SECURITIES AND EXCHANGE COMMISSION

13.2.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

13.2.6 CALIFORNIA CONSUMER PRIVACY ACT

13.2.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

FIGURE 51 NORTH AMERICA MARKET SNAPSHOT

TABLE 99 NORTH AMERICA: VOICE BIOMETRICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 110 NORTH AMERICA: VOICE BIOMETRICS MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.2.8 UNITED STATES

13.2.9 CANADA

13.3 EUROPE

13.3.1 EUROPE: MARKET DRIVERS

13.3.2 EUROPE: COVID-19 IMPACT

13.3.3 EUROPE: REGULATORY IMPLICATIONS

13.3.4 EUROPEAN ASSOCIATION FOR BIOMETRICS

13.3.5 GENERAL DATA PROTECTION REGULATION

TABLE 121 EUROPE: VOICE BIOMETRICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

TABLE 133 EUROPE: VOICE BIOMETRICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.3.6 UNITED KINGDOM

13.3.7 GERMANY

13.3.8 FRANCE

13.3.9 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: MARKET DRIVERS

13.4.2 ASIA PACIFIC: COVID-19 IMPACT

13.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

13.4.4 PERSONAL DATA PROTECTION ACT

13.4.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

FIGURE 52 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 143 ASIA PACIFIC: VOICE BIOMETRICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: VOICE BIOMETRICS SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 156 ASIA PACIFIC: VOICE BIOMETRICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.4.6 CHINA

13.4.7 INDIA

13.4.8 JAPAN

13.4.9 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: VOICE BIOMETRIC MARKET DRIVERS

13.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

13.5.3 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

13.5.4 PERSONAL DATA PROTECTION LAW

TABLE 165 MIDDLE EAST AND AFRICA: VOICE BIOMETRICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: VOICE BIOMETRICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.5.5 SOUTH AFRICA

13.5.6 UNITED ARAB EMIRATES

13.5.7 KINGDOM OF SAUDI ARABIA

13.5.8 REST OF MIDDLE EAST AND AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: COVID-19

13.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

13.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

TABLE 187 LATIN AMERICA: VOICE BIOMETRICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 189 LATIN AMERICA: VOICE BIOMETRICS SIZE, BY SOLUTION, 2015–2019 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2019 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2015–2019 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2020–2026 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY AUTHENTICATION PROCESS, 2015–2019 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY AUTHENTICATION PROCESS, 2020–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: VOICE BIOMETRICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

13.6.5 BRAZIL

13.6.6 MEXICO

13.6.7 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 201)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 53 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS AND EXPANSIONS FROM 2018 TO 2020

14.3 MARKET SHARE, 2020

FIGURE 54 NUANCE LED THE VOICE BIOMETRICS MARKET IN 2020

14.4 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 55 REVENUE ANALYSIS OF KEY MARKET PLAYERS

14.5 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

14.5.1 STAR

14.5.2 EMERGING LEADERS

14.5.3 PERVASIVE

14.5.4 PARTICIPANTS

FIGURE 56 MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

14.6 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 57 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

14.7 BUSINESS STRATEGY EXCELLENCE

FIGURE 58 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

14.8 RANKING OF KEY MARKET PLAYERS IN THE VOICE BIOMETRICS MARKET, 2020

FIGURE 59 RANKING OF KEY PLAYERS, 2020

14.9 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT ANALYSIS

TABLE 209 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT

TABLE 210 COMPANY (MAJOR PLAYERS) APPLICATION FOOTPRINT –PART 1

TABLE 211 COMPANY (MAJOR PLAYERS) APPLICATION FOOTPRINT – PART 2

TABLE 212 COMPANY (MAJOR PLAYERS) VERTICAL FOOTPRINT – PART 1

TABLE 213 COMPANY (MAJOR PLAYERS) VERTICAL FOOTPRINT – PART 2

TABLE 214 COMPANY (MAJOR PLAYERS) REGION FOOTPRINT

14.10 STARTUP/SME EVALUATION MATRIX, 2020

14.10.1 PROGRESSIVE COMPANIES

14.10.2 RESPONSIVE COMPANIES

14.10.3 DYNAMIC COMPANIES

14.10.4 STARTING BLOCKS

FIGURE 60 VOICE BIOMETRICS MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

14.11 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 61 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN THE MARKET

14.12 BUSINESS STRATEGY EXCELLENCE

FIGURE 62 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN THE MARKET

14.13 COMPANY (STARTUP/ SMES) PRODUCT FOOTPRINT ANALYSIS

TABLE 215 COMPANY (STARTUP/ SMES) PRODUCT FOOTPRINT

TABLE 216 COMPANY (STARTUP/ SMES) APPLICATION FOOTPRINT – PART 1

TABLE 217 COMPANY (STARTUP/ SMES) APPLICATION FOOTPRINT

TABLE 218 COMPANY (STARTUP/ SMES) VERTICAL FOOTPRINT – PART 1

TABLE 219 COMPANY (STARTUP/ SMES) VERTICAL FOOTPRINT – PART 2

TABLE 220 COMPANY (STARTUP/ SMES) REGION FOOTPRINT

14.14 COMPETITIVE SCENARIO

14.14.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 221 PRODUCT LAUNCHES, 2019–2020

14.14.2 DEALS

TABLE 222 DEALS, 2019–2021

14.14.3 OTHERS

TABLE 223 OTHERS, 2018–2019

15 COMPANY PROFILES (Page No. - 225)

15.1 INTRODUCTION

(Business overview, Products offered, Recent developments, COVID-19 developments & MnM View)*

15.2 MAJOR PLAYERS

15.2.1 NUANCE

TABLE 224 NUANCE: BUSINESS OVERVIEW

FIGURE 63 NUANCE: FINANCIAL OVERVIEW

TABLE 225 NUANCE: PRODUCTS OFFERED

TABLE 226 NUANCE: VOICE BIOMETRICS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 227 NUANCE: MARKET: DEALS

15.2.2 NICE

TABLE 228 NICE: BUSINESS OVERVIEW

FIGURE 64 NICE: FINANCIAL OVERVIEW

TABLE 229 NICE: PRODUCTS OFFERED

TABLE 230 NICE: MARKET: SOLUTION LAUNCHES

TABLE 231 NICE: MARKET: DEALS

15.2.3 VERINT

TABLE 232 VERINT: BUSINESS OVERVIEW

FIGURE 65 VERINT: FINANCIAL OVERVIEW

TABLE 233 VERINT: PRODUCTS OFFERED

TABLE 234 VERINT: VOICE BIOMETRICS MARKET: SOLUTION LAUNCHES

TABLE 235 VERINT: MARKET: DEALS

15.2.4 PINDROP

TABLE 236 PINDROP: BUSINESS OVERVIEW

TABLE 237 PINDROP: PRODUCTS OFFERED

TABLE 238 PINDROP: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 239 PINDROP: MARKET: DEALS

15.2.5 LEXISNEXIS RISK SOLUTIONS

TABLE 240 LEXISNEXIS RISK SOLUTIONS: BUSINESS OVERVIEW

TABLE 241 LEXISNEXIS RISK SOLUTIONS: PRODUCTS OFFERED

TABLE 242 LEXISNEXIS RISK SOLUTIONS: VOICE BIOMETRICS MARKET: DEALS

15.2.6 PHONEXIA

TABLE 243 PHONEXIA: BUSINESS OVERVIEW

TABLE 244 PHONEXIA: PRODUCTS OFFERED

TABLE 245 PHONEXIA: MARKET: SOLUTION ENHANCEMENTS

15.2.7 VBG

TABLE 246 VBG: BUSINESS OVERVIEW

TABLE 247 VBG: PRODUCTS OFFERED

15.2.8 ACULAB

TABLE 248 ACULAB: BUSINESS OVERVIEW

TABLE 249 ACULAB: PRODUCTS OFFERED

TABLE 250 ACULAB: VOICE BIOMETRICS MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 251 ACULAB: MARKET: DEALS

15.2.9 AURAYA

TABLE 252 AURAYA: BUSINESS OVERVIEW

TABLE 253 AURAYA: PRODUCTS OFFERED

TABLE 254 AURAYA: MARKET: SOLUTION ENHANCEMENTS AND LAUNCHES

TABLE 255 AURAYA: MARKET: DEALS

15.2.10 ONEVAULT

TABLE 256 ONEVAULT: BUSINESS OVERVIEW

TABLE 257 ONEVAULT: PRODUCTS OFFERED

TABLE 258 ONEVAULT: MARKET: BUSINESS EXPANSION

TABLE 259 ONEVAULT: VOICE BIOMETRICS MARKET: DEALS

15.2.11 AWARE

15.2.12 SPEECHPRO

15.2.13 LUMENVOX

15.2.14 UNIPHORE

15.2.15 SESTEK

15.2.16 VOICEPIN

15.2.17 QSS TECHNOSOFT

15.2.18 VOXTA

15.2.19 INTERACTIONS

15.3 STARTUP/ SME PLAYERS

15.3.1 ID R&D

15.3.2 KAIZEN SECURE VOIZ

15.3.3 HYPR

15.3.4 ELEMENT

15.3.5 TRUST STAMP

15.3.6 ANYVISION

*Details on Business overview, Products offered, Recent developments, COVID-19 developments & MnM View might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 259)

16.1 INTRODUCTION

16.2 SPEECH ANALYTICS MARKET - GLOBAL FORECAST TO 2025

16.2.1 MARKET DEFINITION

16.2.2 MARKET OVERVIEW

16.2.2.1 Speech analytics market, by component

TABLE 260 SPEECH ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 261 SEECH ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

16.2.2.2 Speech analytics market, by deployment mode

TABLE 262 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 263 SPEECH ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

16.2.2.3 Speech analytics market, by organization size

TABLE 264 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 265 SPEECH ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

16.2.2.4 Customer analytics market, by application

TABLE 266 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION, 2014–2019 (USD MILLION)

TABLE 267 SPEECH ANALYTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

16.2.2.5 Speech analytics market, by vertical

TABLE 268 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 269 SPEECH ANALYTICS MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

16.2.2.6 Speech analytics market, by region

TABLE 270 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 271 SPEECH ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16.3 VOICE ANALYTICS MARKET - GLOBAL FORECAST TO 2024

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

16.3.2.1 Voice analytics market, by component

TABLE 272 VOICE ANALYTICS MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

16.3.2.2 Voice analytics market, by deployment mode

TABLE 273 VOICE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

16.3.2.3 Voice analytics market, by application

TABLE 274 VOICE ANALYTICS MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

16.3.2.4 Voice analytics market, by organization size

TABLE 275 VOICE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

16.3.2.5 Retail analytics market, by vertical

TABLE 276 VOICE ANALYTICS MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

16.3.2.6 Retail analytics market, by region

TABLE 277 VOICE ANALYTICS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

17 APPENDIX (Page No. - 269)

17.1 INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATIONS

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

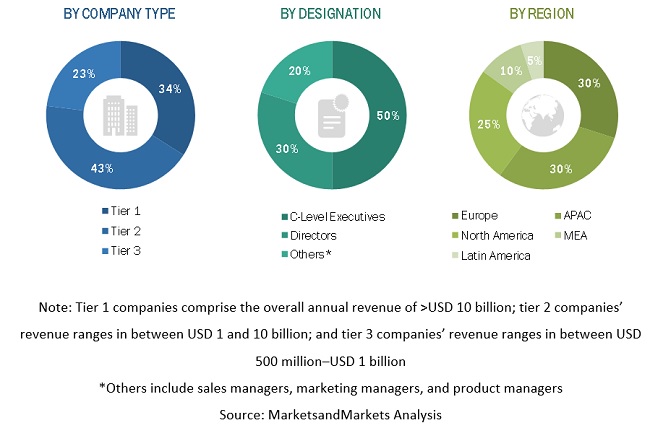

The study involved four major activities in estimating the current market size of voice biometrics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the voice biometrics market.

Secondary Research

In the secondary research process, various secondary sources, such as Information Discovery and Delivery, Journal of Data Mining and Knowledge Discovery, and Data Science Journal, have been referred to for identifying and collecting information for this study. Secondary sources included annual reports; press releases & investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from voice biometrics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Voice Biometrics Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the voice biometrics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the voice biometrics market. The bottom-up approach was used to arrive at the overall market size of the global voice biometrics market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the voice biometrics market by component (solutions and services), organization size, deployment mode, type, authentication process, application, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the voice biometrics market

- To analyze the impact of the COVID-19 pandemic on the voice biometrics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American voice biometrics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Voice Biometrics Market