Mobile Biometrics Market by Component (Fingerprint Readers, Scanners, Cameras, Software), Authentication Mode (Single factor (Fingerprint, Voice, Face, Iris, Vein, & Retina Scan) and Multifactor), Industry, and Geography - Global Forecast to 2022

The mobile biometrics market is expected to grow from USD 4.03 Billion in 2015 to USD 49.33 Billion by 2022, at a CAGR of 29.3% between 2016 and 2022. The industrial consensus on developing intelligence in mobile devices drives the use of biometric technology. In the last few years, most of the smart phone companies have launched biometrics-enabled phones. While the focus is currently on fingerprint recognition technology, the market is trending toward advanced biometric technologies such as face, voice, iris, and others.

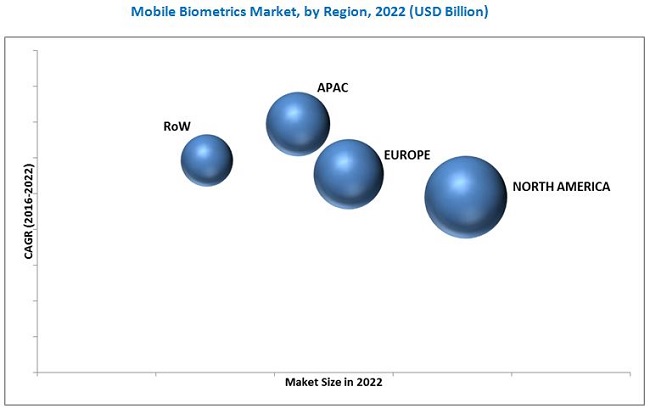

This report aims at estimating the current market size and future growth prospects of the mobile biometrics market on the basis of component, authentication mode, industry, and geography. The base year considered for this study is 2015 and the market forecast is given for the period between 2016 and 2022. The key drivers for the growth of this market are government initiatives for the adoption of biometrics, increase in mobile transactions, introduction of e-passports, and increasing number of smartphone vendors opting for biometric features. In mature markets such as North America and Europe, the adoption rate of mobile biometric is steady compared to that in emerging markets such as APAC and RoW. The large-scale adoption of mobile biometrics in these regions is attributed to the growing influx of mobile devices and the increasing number of mobile transactions.

The mobile biometrics market is expected to grow from USD 4.03 Billion in 2015 to USD 49.33 Billion by 2022, at a CAGR of 29.3% between 2016 and 2022. The increased security breaches and the rising threats to the public and private properties have led to the need for mobile biometrics. One of the areas where mobile biometrics can provide substantial support is eliminating fraudulent multiple identities or preventing identity frauds.

The mobile biometrics market has been segmented on the basis of components, authentication modes, industries, and geography. The single-factor authentication mode is expected to lead the market during the forecast period, while multi-factor authentication in biometrics is an emerging trend in this market. The growth of the market is primarily driven by factors such as government initiatives, increasing use of biometrics in smartphones, e-passports, and use of biometrics technology in crime identification & banking.

Fingerprint recognition is the leading single-factor authentication method and is expected to lead the market during the forecast period as it is the cheapest and most widely used method across all industries.

The consumer electronics industry led the mobile biometrics market in 2015. The finance and banking industry is expected to grow at a prominent growth rate during the forecast period. The increasing size of mobile transactions and the growing e-commerce supports the growth of mobile biometrics in these industries.

Economy modernization initiatives in emerging countries and government support are the major factors contributing to the growth in APAC. In addition to this, the governments of several Asian countries actively promote and adopt biometric technologies. India has introduced projects such as smart cities, e-governance, and digital India, where mobile biometrics technology is expected to play a big role. China introduced the new China Resident Identity Card Law. Considering these developments, the mobile biometrics market is expected to flourish in APAC in the coming years

The fear of privacy & data breach and high initial setup cost are the major restraints for this market. There are also possibilities of biometric databases being tampered with. Furthermore, the high initial setup costs further restrain the growth of the market.

The report profiles the major players in the mobile market, along with their SWOT analysis. The market has witnessed a series of new product launches, along with investments and collaborations among the industry players across the value chain. The major players operating in the mobile biometrics market are Apple Inc. (U.S.) Nuance Communications, Inc. (U.S.), Safran SA (France), NEC Corporation (Japan), 3M Cogent, Inc. (U.S.), and Precise Biometrics (Sweden), and M2SYS Technology (U.S.). Some of the other emerging players that have shown prominent growth are Crossmatch (U.S.) BIO-key (U.S.), Aware Inc. (U.S.), Applied Recognition, Inc. (Canada), EyeVerify, Inc. (U.S.), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

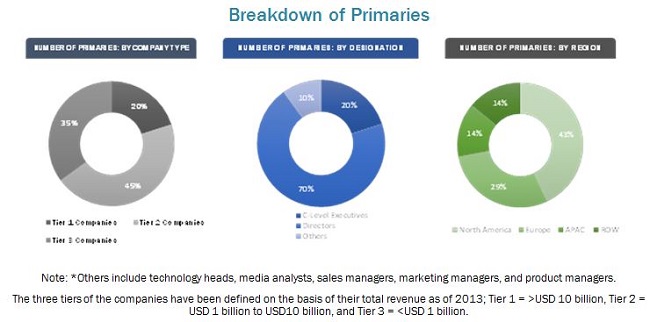

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Global Mobile Biometrics Market

4.2 Market, By Authentication Mode (2016–2022)

4.3 Market, By Single Factor Authentication Method

4.4 Regional and Industrial Snapshot of Market

4.5 Mobile Biometrics Makret: Regional Outlook

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Market, By Component

5.2.2 Market, By Authentication Mode

5.2.3 Market, By Industry

5.2.4 Market, By Geography

5.3 Market Dynamics: Mobile Biometrics Market

5.3.1 Drivers

5.3.1.1 Government Initiatives to Promote the Adoption of Biometrics

5.3.1.2 Rising Trend of Mobile Transactions

5.3.1.3 Growing Adoption of Biometric Features in Smartphones

5.3.1.4 Large Scale Adoption of Electronic Verification Systems Fueled Growth in Mobile Biometric Industry

5.3.1.5 Increased Usage of Mobile Biometrics Technology in Crime Identification

5.3.2 Restraints

5.3.2.1 Concern Regarding Privacy and Data Breach

5.3.3 Opportunities

5.3.3.1 Application of Mobile Biometrics in E-Commerce and Online Gaming

5.3.4 Challenges

5.3.4.1 Protection of Biometric Data

5.3.4.2 Cost Involved in the Deployment of Mobile Biometrics Systems

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis for the Market

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Intensity of Rivalry

7 Mobile Biometrics Market, By Component (Page No. - 47)

7.1 Introduction

7.2 Hardware Component

7.2.1 Fingerprint Readers

7.2.2 Scanners

7.2.3 Cameras

7.2.4 Others

7.3 Software

8 Mobile Biometrics Market, By Authentication Mode (Page No. - 51)

8.1 Introduction

8.2 Single-Factor Authentication

8.2.1 Fingerprint Recognition

8.2.2 Voice Recognition

8.2.3 Facial Recognition

8.2.4 Iris Recognition

8.2.5 Vein Recognition

8.2.6 Retina Scan System

8.2.7 Others

8.3 Multi-Factor Authentication

9 Mobile Biometrics Market, By Industry (Page No. - 66)

9.1 Introduction

9.2 Consumer Electronics

9.3 Healthcare

9.4 Finance & Banking

9.5 Travel & Immigration

9.6 Government/Law Enforcement & Forensic

9.7 Military & Defense

9.8 Others

10 Geographic Analysis (Page No. - 81)

10.1 Introduction

10.2 North America

10.2.1 The Strong Economy and Government Inclination Toward Biometrics is the Major Driving Factor

10.2.2 U.S.

10.2.2.1 The Presence of Key Players in the U.S. is the Major Driver for the Market

10.2.3 Canada

10.2.3.1 Inclination of the Banking and Financial Sector Toward Adopting Mobile Biometrics

10.2.4 Mexico

10.2.4.1 Biometrics Technologies Such as Face and Voice Recognition Gaining Traction in Mexico

10.3 Europe

10.3.1 Brexit Offers A Key Opportunity for Mobile Biometrics Device Manufacturers in Europe

10.3.2 Germany

10.3.2.1 Widespread Adoption and Association of German Federal Office With Fido Alliance Driving the Market in Germany

10.3.3 France

10.3.3.1 Border Management and Travel & Immigration Industry to Drive the French Mobile Biometrics Market

10.3.4 U.K.

10.3.4.1 The U.K.’S Exit From the European Union Offers A Lucrative Opportunities

10.3.5 Italy

10.3.5.1 Security Upgradation in Italy and Untapped Market Opportunities Supporting the Growth of the Market

10.3.6 Rest of Europe

10.4 Asia-Pacific

10.4.1 Large Population, High Demand for Consumer Electronics, and Presence of Emerging Countries are the Key Drivers

10.4.2 China

10.4.2.1 Growing Using of Facial Recognition and E-Passports are Major Factors Driving the Chinese Market

10.4.3 Japan

10.4.3.1 Technological Advancement and Presence of Key Players Makes Japan A Prominent Market in APAC

10.4.4 South Korea

10.4.4.1 Concentration of Major Consumer Electronics Companies in South Korea has Strengthened the Market

10.4.5 India

10.4.5.1 Fastest-Growing Economy, Rising Population, and Government Initiatives for Adoption of Biometric Technologies

10.4.5.2 Rest of APAC

10.5 Rest of the World

10.5.1 Security Threats in the Middle East and Government Initiatives to Strengthen the Market

10.5.2 Latin America

10.5.3 Middle East & Africa

11 Competitive Landscape (Page No. - 98)

11.1 Overview

11.2 Market Ranking Analysis of Mobile Biometric Market

11.2.1 Key Players, 2015

11.3 Competitive Scenario and Trends

11.3.1 New Product Launches

11.3.2 Partnerships and Agreements

11.3.3 Contracts, Expansion, Patents, and Funding

11.3.4 Others

12 Company Profiles (Page No. - 103)

12.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.2 Apple Inc

12.3 Safran SA

12.4 Nuance Communication, Inc.

12.5 NEC Corporation

12.6 Precise Biometrics AB

12.7 3M Cogent, Inc.

12.8 Bio-Key

12.9 Fujitsu Ltd.

12.10 Honeywell International Inc.

12.11 Imageware Systems, Inc.

12.12 Applied Recognition, Inc.

12.13 Bioenable Technologies Pvt. Ltd.

12.14 Cognitec Systems GmbH

12.15 Eyeverify Inc.

12.16 Fulcrum Biometrics, LLC.

12.17 M2sys Technology

12.18 Neurotechnology

12.19 Voicepin.Com Sp Z O. O.

12.20 Voicevault, Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 136)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.5 Available Customizations

13.6 Related Reports

List of Tables (61 Tables)

Table 1 Mobile Biometrics Market, By Component, 2014–2022 (USD Million)

Table 2 Market for Hardware Component, By Device, 2014–2022 (USD Million)

Table 3 Market, By Authentication Mode, 2014–2022 (USD Million)

Table 4 Market for Single-Factor Authentication Mode, By Region, 2014–2022 (USD Million)

Table 5 Market for Single-Factor Authentication Mode, By Industry, 2014–2022 (USD Million)

Table 6 Market for Single-Factor Authentication Mode, By Authentication Method, 2014–2022 (USD Million)

Table 7 Market for Fingerprint Recognition, By Region, 2014–2022 (USD Million)

Table 8 Market for Fingerprint Recognition, By Industry, 2014–2022 (USD Million)

Table 9 Market for Voice Recognition, By Region, 2014–2022 (USD Million)

Table 10 Market for Voice Recognition, By Industry, 2014–2022 (USD Million)

Table 11 Market for Facial Recognition, By Region, 2014–2022 (USD Million)

Table 12 Market for Facial Recognition, By Industry, 2014–2022 (USD Million)

Table 13 Market for Iris Recognition Market, By Region, 2014–2022 (USD Million)

Table 14 Market for Iris Recognition, By Industry, 2014–2022 (USD Million)

Table 15 Mobile Biometrics Market for Vein Recognition, By Region, 2014–2022 (USD Million)

Table 16 Market for Vein Recognition, By Industry, 2014–2022 (USD Million)

Table 17 Market for Retina Scan System, By Region, 2014–2022 (USD Million)

Table 18 Market for Retina Scan System, By Industry, 2014–2022 (USD Million)

Table 19 Market for Other Authentication Methods, By Region, 2014–2022 (USD Million)

Table 20 Market for Other Authentication Methods, By Industry, 2014–2022 (USD Million)

Table 21 Market for Multi-Factor Authentication, By Region, 2014–2022 (USD Million)

Table 22 Market for Multi-Factor Authentication Mode, By Industry, 2014–2022 (USD Million)

Table 23 Market, By Industry, 2014–2022 (USD Million)

Table 24 Market in Consumer Electronics, By Authentication Mode, 2014–2022 (USD Million)

Table 25 Market in Consumer Electronics, By Region, 2014–2022 (USD Million)

Table 26 Market in Consumer Electronics, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 27 Market in Healthcare, By Authentication Mode, 2014–2022 (USD Million)

Table 28 Market in Healthcare, By Single-Factor Authentication Method, 2014–2022

Table 29 Market in Healthcare, By Region, 2014–2022

Table 30 Mobile Biometrics Market for Finance & Banking, By Authentication Mode, 2014–2022 (USD Million)

Table 31 Market for Finance & Banking, By Single Factor Authentication Method, 2014–2022 (USD Million)

Table 32 Market in Finance & Banking, By Region, 2014–2022 (USD Million)

Table 33 Market for Travel & Immigration, By Authentication Mode, 2014–2022 (USD Million)

Table 34 Market for Travel & Immigration, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 35 Market for Travel & Immigration, By Region, 2014–2022 (USD Million)

Table 36 Market in Government, By Authentication Mode, 2014–2022 (USD Million)

Table 37 Market in Government, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 38 Mobile Biometric Market in Government, By Region, 2014–2022 (USD Million)

Table 39 Market in Military & Defense, By Authentication Mode, 2014–2022 (USD Million)

Table 40 Market in Military & Defense, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 41 Market in Military & Defense, By Region, 2014–2022 (USD Million)

Table 42 Market in Other Industries, By Authentication Mode, 2014–2022 (USD Million)

Table 43 Market in Other Industries, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 44 Market for Other Industries, By Region, 2014–2022 (USD Million)

Table 45 Market, By Region, 2014–2022 (USD Million)

Table 46 Market in North America, By Country, 2014–2022 (USD Million)

Table 47 Market in North America, By Industry, 2014–2022 (USD Million)

Table 48 Market in North America, By Authentication Mode, 2014–2022 (USD Million)

Table 49 Market in North America, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 50 Market in Europe, By Country, 2014–2022 (USD Million)

Table 51 Market in Europe, By Industry, 2014–2022 (USD Million)

Table 52 Market in Europe, By Authentication Mode, 2014–2022 (USD Million)

Table 53 Market in Europe, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 54 Market in APAC, By Country, 2014–2022 (USD Million)

Table 55 Market in APAC, By Industry, 2014–2022 (USD Million)

Table 56 Market in APAC, By Authentication Mode, 2014–2022 (USD Million)

Table 57 Market in APAC, By Single-Factor Authentication Method, 2014–2022 (USD Million)

Table 58 Market in RoW, By Region, 2014–2022 (USD Million)

Table 59 Marketin RoW, By Industry, 2014–2022 (USD Million)

Table 60 Market in RoW, By Authentication Mode, 2014–2022 (USD Million)

Table 61 Market in RoW, By Single-Factor Authentication Method, 2014–2022 (USD Million)

List of Figures (60 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Mobile Biometrics Market: Data Triangulation Approach

Figure 5 Market, 2014–2022

Figure 6 Market Snapshot (2016 vs 2022), Single-Factor Authentication Expected to Dominate the Market During the Forecast Period

Figure 7 Fingerprint Recognition Would Be the Leading Single-Factor Authentication Method During the Forecast Period

Figure 8 Healthcare Industry Presents Lucrative Opportunities in Mobile Biometric Market During the Forecast Period

Figure 9 APAC is Expected to Show Prominent Growth During the Forecast Period

Figure 10 Adoption By Governments and Growing Integration of Biometrics in Mobile Devices are the Key Drivers

Figure 11 Multi-Factor Authentication Mode Expected to Grow at the Highest Rate During the Forecast Period

Figure 12 Fingerprint Recognition Method is Expected to Dominate the Single Factor Authentication Method During the Forecast Period

Figure 13 Consumer Electronics Was the Leading Industry in 2015

Figure 14 APAC is Expected to Grow at the Highest Rate During the Forecast Period

Figure 15 Adoption By the Governments and the Rising Trend of Mobile Transactions are the Key Drivers for the Market

Figure 16 Worldwide Mobile Payments, 2015–2018 (USD Billion)

Figure 17 Value Chain Analysis of Market : Major Value is Added By Component and Biometrics Manufacturers

Figure 18 Porter’s Five Forces Analysis for the Mobile Biometrics Market (2015)

Figure 19 Porter’s Five Forces Impact Analysis for Mobile Biometrics Market, 2015

Figure 20 Bargaining Power of Suppliers, 2015

Figure 21 Bargaining Power of Buyers, 2015

Figure 22 Threat of Substitutes, 2015

Figure 23 Threat of New Entrants, 2015

Figure 24 Intensity of Rivalry, 2015

Figure 25 Mobile Biometrics Market, By Component

Figure 26 Cameras Expected to Witness the Highest Growth Rate in the Market During the Forecast Period

Figure 27 Market, By Authentication Mode

Figure 28 Facial Recognition Market in Healthcare Expected to Grow at the Highest Rate During the Forecast Period

Figure 29 APAC is Expected to Grow at High Rate During the Forecast Period

Figure 30 Government and Finance & Banking Industries Expected to Show Prominent Growth for Multi-Factor Authentication During the Forecast Period

Figure 31 Mobile Biometrics Market, By Industry

Figure 32 Voice Recognition Expected to Grow at the Highest Rate in the Consumer Electronics Industry During the Forecast Period

Figure 33 APAC Expected to Grow at the Highest Rate in the Healthcare Industry During the Forecast Period

Figure 34 Fingerprint Recognition Expected to Witness Higher Adoption in the Government Industry During the Forecast Period

Figure 35 Fingerprint Recognition to Be the Widely Used Authentication Method in Military & Defense Industry Between 2016 and 2022

Figure 36 Mobile Biometric Market, By Geography

Figure 37 India and China to Witness the Highest Rate During the Forecast Period

Figure 38 APAC is Likely to Be an Attractive Destination for Market During the Forecast Period

Figure 39 North America: Geographic Snapshot

Figure 40 Europe: Geographical Snapshot

Figure 41 APAC: Geographic Snapshot

Figure 42 RoW: Geographic Snapshot

Figure 43 Market Evaluation Frame Work 2014-2016

Figure 44 Battle for Market Share: Partnerships, Collaborations, and Agrements Was the Key Strategy

Figure 45 Geographic Revenue Mix of Major Market Players

Figure 46 Apple Inc.: Company Snapshot

Figure 47 Apple, Inc. : SWOT Analysis

Figure 48 Safran SA: Company Snapshot

Figure 49 Safran SA: SWOT Analysis

Figure 50 Nuance Communications Inc. : Company Snapshot

Figure 51 Nuance Communication, Inc: SWOT Analysis

Figure 52 NEC Corporation: Company Snapshot

Figure 53 NEC Corporation: SWOT Analysis

Figure 54 Precise Biometrics AB : Company Snapshot

Figure 55 Precise Biometrics AB: SWOT Analysis

Figure 56 3M Congent: SWOT Analysis

Figure 57 Bio-Key: Company Snapshot

Figure 58 Fujitsu Ltd.: Company Snapshot

Figure 59 Honeywell International, Inc.: Company Snapshot

Figure 60 Imageware Systems, Inc. : Company Snapshot

The research methodology used to estimate and forecast the size of the mobile biometrics market begins with obtaining data of key companies through secondary sources such as like FIDO Alliance, European Association for Biometrics, The International Biometric Society, and others. The vendors’ offerings and their current product portfolios have also been considered for this study. The estimation has also been made by identifying biometric-enabled mobile devices, mobile transactions, and the size of biometric mobile applications. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting interviews with key experts such as CEOs, VPs, directors, product managers, and others. In addition, the market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and provide statistical analysis for all segments and subsegments. The breakdown of the profiles of primaries is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The mobile biometrics ecosystem comprises hardware suppliers, manufacturers, software companies, system integrators, and technology providers. The key players in the market are Apple Inc. (U.S.) Nuance Communications, Inc. (U.S.), Safran SA (France), NEC Corporation (Japan), 3M Cogent, Inc. (U.S.), and Precise Biometrics (Sweden), and M2SYS Technology (U.S.). Some of the other players that have shown prominent growth are Crossmatch (U.S.) BIO-key (U.S.), Aware Inc. (U.S.), Applied Recognition, Inc. (Canada), EyeVerify, Inc. (U.S.), and others

Key Target Audience

- Digital security consultants

- Biometric hardware providers, including regional equipment manufacturers, sensor manufacturers, battery manufacturers, and camera suppliers

- Software dealers & distributors

- Cloud service providers

- Biometrics associations and alliances

- Research institutions and organizations

- Market research & consulting firms

The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Scope of the Report

The mobile biometrics market, in this research report, has been segmented on the basis of:

Component:

- Fingerprint readers

- Scanners

- Cameras

Authentication Mode:

- Single-factor authentication

- Multi-factor authentication

Industry:

- Consumer electronics

- Healthcare

- Finance & banking

- Travel & immigration

- Government

- Military & defense

- Others

Geography:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of up to five additional market players

- Mobile biometrics market by matching capability (on server and on device)

Growth opportunities and latent adjacency in Mobile Biometrics Market