Vision Positioning System Market by Component (Sensors, Camera Systems, Markers), Location (Indoor Positioning, Outdoor Positioning), Solution, Platform, Application (Commercial, Defense), and Region - Global Forecast to 2022

[185 Pages Report] The vision positioning system market is projected to grow from USD 5.58 Billion in 2017 to USD 9.25 Billion in 2022, at a CAGR of 10.65% during the forecast period. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

The vision positioning system market is projected to grow from USD 5.58 Billion in 2017 to USD 9.25 Billion by 2022, at a CAGR of 10.65% during the forecast period. Vision positioning systems provide real-time information about the surroundings in which they are installed. Factors such as growth in usage of indoor and outdoor positioning system as well as increasing industrial automation for efficiency and lower operating expenses are driving the growth of the market.

Vision positioning systems consists of various components such as sensors, camera systems, markers, and other electronic components. These components are used to carry out various tasks. Camera systems is the largest and fastest-growing component subsegment of the market.

The market is segmented based on location of implementation into indoor and outdoor environment. Indoor systems are used in factories, indoor warehousing, and indoor navigation, among others. Outdoor systems are used for outdoor mapping, warehousing in container depots, drones, and military robotics. Indoor segment is the largest segment for market, by location.

Based on application, the market has been segmented into commercial and defense. The commercial segment is projected to grow at the highest CAGR during the forecast period of 2017 to 2022. The demand from commercial applications is due to the rise in industrial automation in logistics & warehouse management. Other commercial applications include healthcare and navigation in retail stores. Drone based vision positioning systems are increasingly being used in media & entertainment and security applications.

Vision positioning systems are installed on UAV drones, automated guided vehicles, robotics, automated undersea vehicles, space vehicles, and other platforms. The robotics and automated guided vehicles segment is the largest platform segment of the vision positioning system market. In this platform, vision positioning systems are extensively used in manufacturing and warehouse management. The UAV drones are used for surveillance and location mapping. Drones are also used extensively in commercial and defense applications. Autonomous undersea vehicles are an emerging platform for vision positioning systems. They are used for deep sea exploration and surveillance to depths where manned vehicles are dangerous to operate or unable to operate due to design limitations. UAV drone is the largest platform for vision positioning systems.

Based on solution, the vision positioning system market is segmented into tracking, navigation, analytics, industrial solutions, and others. Industrial solutions is the largest solution segment for vision positioning systems due to the rapid growth in industrial automation. Analytics and navigation solutions are widely used in healthcare and retail sectors to manage these places using big data.

Government regulations are a hurdle for use of drone platforms in civilian aerospace. Their widespread usage has led to privacy, security, and safety related issues. Many countries have banned usage of drones without registration.

Key players profiled in the vision positioning system market report are DJI (China), ABB (Switzerland), Sick AG (Germany), Cognex Corporation (U.S.), Omron Corporation (Japan), FANUC Corporation (Japan), Seegrid Corporation (U.S.), and Senion AB (Sweden), among others. Contracts is the major growth strategy adopted by the top market players to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Developing Economies to Offer Several Untapped Opportunities

4.2 Vision Positioning System Market, By Component

4.3 Market, By Location

4.4 Market, By Solution

4.5 Market, By Platform

4.6 Market, By Application

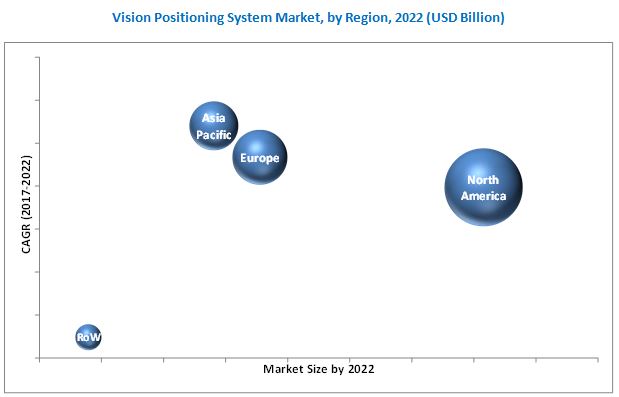

4.7 Market, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By Location

5.2.3 By Solution

5.2.4 By Platform

5.2.5 By Application

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Industrial Automation

5.3.1.2 Increasing Usage of Smart Robotics in Commercial and Defense Applications

5.3.1.3 Increasing Use of UAVs (Unmanned Aerial Vehicles) for Industrial as Well as Defense Purposes

5.3.2 Restraints

5.3.2.1 Government Regulations on Drone Usage

5.3.3 Opportunities

5.3.3.1 Rise in Demand for Sensors Equipped With Artificial Intelligence

5.3.4 Challenges

5.3.4.1 High Maintenance Cost

5.3.4.2 Need for Secure and Reliable Communication Infrastructure

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Technology Trends

6.2.1 Robotic Vision Positioning System

6.2.2 Ultra-Wide Band Navigation

6.2.3 Drone Based Vision Positioning System

6.2.4 Simultaneous Location and Mapping

6.2.5 Visible Light Communication

6.3 Key Technological Innovations By Leading Players

6.4 Innovation and Patent Registration

7 Vision Positioning System Market, By Component (Page No. - 52)

7.1 Introduction

7.2 Sensors

7.3 Camera Systems

7.4 Markers

7.5 Others

8 Vision Positioning System Market, By Location (Page No. - 58)

8.1 Introduction

8.2 Indoor Positioning System

8.3 Outdoor Positioning System

9 Vision Positioning System Market, By Solution (Page No. - 62)

9.1 Introduction

9.2 Navigation

9.3 Analytics

9.4 Tracking

9.5 Industrial Solutions

9.6 Others

10 Vision Positioning System Market, By Platform (Page No. - 68)

10.1 Introduction

10.2 Unmanned Aerial Vehicle/Drones

10.3 Automated Guided Vehicle

10.4 Robotics

10.5 Space Vehicle

10.6 Autonomous Undersea Vehicle

10.7 Others

11 Vision Positioning System Market, By Application (Page No. - 74)

11.1 Introduction

11.2 Commercial Application

11.3 Defense Application

12 Vision Positioning System Market, By Region (Page No. - 78)

12.1 Introduction

12.2 North America

12.2.1 By Component

12.2.2 By Location

12.2.3 By Solution

12.2.4 By Platform

12.2.5 By Application

12.2.6 By Country

12.2.6.1 U.S.

12.2.6.1.1 By Component

12.2.6.1.2 By Location

12.2.6.1.3 By Solution

12.2.6.1.4 By Platform

12.2.6.1.5 By Application

12.2.6.2 Canada

12.2.6.2.1 By Component

12.2.6.2.2 By Location

12.2.6.2.3 By Solution

12.2.6.2.4 By Platform

12.2.6.2.5 By Application

12.3 Europe

12.3.1 By Component

12.3.2 By Location

12.3.3 By Solution

12.3.4 By Platform

12.3.5 By Application

12.3.6 By Country

12.3.6.1 U.K.

12.3.6.1.1 By Component

12.3.6.1.2 By Location

12.3.6.1.3 By Solution

12.3.6.1.4 By Platform

12.3.6.1.5 By Application

12.3.6.2 France

12.3.6.2.1 By Component

12.3.6.2.2 By Location

12.3.6.2.3 By Solution

12.3.6.2.4 By Platform

12.3.6.2.5 By Application

12.3.6.3 Germany

12.3.6.3.1 By Component

12.3.6.3.2 By Location

12.3.6.3.3 By Solution

12.3.6.3.4 By Platform

12.3.6.3.5 By Application

12.3.6.4 Russia

12.3.6.4.1 By Component

12.3.6.4.2 By Location

12.3.6.4.3 By Solution

12.3.6.4.4 By Platform

12.3.6.4.5 By Application

12.3.6.5 Italy

12.3.6.5.1 By Component

12.3.6.5.2 By Location

12.3.6.5.3 By Solution

12.3.6.5.4 By Platform

12.3.6.5.5 By Application

12.4 Asia-Pacific

12.4.1 By Component

12.4.2 By Location

12.4.3 By Solution

12.4.4 By Platform

12.4.5 By Application

12.4.6 By Country

12.4.6.1 China

12.4.6.1.1 By Component

12.4.6.1.2 By Location

12.4.6.1.3 By Solution

12.4.6.1.4 By Platform

12.4.6.1.5 By Application

12.4.6.2 India

12.4.6.2.1 By Component

12.4.6.2.2 By Location

12.4.6.2.3 By Solution

12.4.6.2.4 By Platform

12.4.6.2.5 By Application

12.4.6.3 Japan

12.4.6.3.1 By Component

12.4.6.3.2 By Location

12.4.6.3.3 By Solution

12.4.6.3.4 By Platform

12.4.6.3.5 By Application

12.5 Middle East

12.5.1 Introduction

12.5.2 By Component

12.5.3 By Location

12.5.4 By Solution

12.5.5 By Platform

12.5.6 By Application

12.5.7 By Country

12.5.7.1 UAE

12.5.7.1.1 By Component

12.5.7.1.2 By Location

12.5.7.1.3 By Solution

12.5.7.1.4 By Platform

12.5.7.1.5 By Application

12.5.7.2 Saudi Arabia

12.5.7.2.1 By Component

12.5.7.2.2 By Location

12.5.7.2.3 By Solution

12.5.7.2.4 By Platform

12.5.7.2.5 By Application

12.5.7.3 Israel

12.5.7.3.1 By Component

12.5.7.3.2 By Location

12.5.7.3.3 By Solution

12.5.7.3.4 By Platform

12.5.7.3.5 By Application

12.6 Rest of the World (RoW)

12.6.1 By Component

12.6.2 By Location

12.6.3 By Solution

12.6.4 By Platform

12.6.5 By Application

12.6.6 By Country

12.6.6.1 South Africa

12.6.6.1.1 By Component

12.6.6.1.2 By Location

12.6.6.1.3 By Solution

12.6.6.1.4 By Platform

12.6.6.1.5 By Application

12.6.6.2 Brazil

12.6.6.2.1 By Component

12.6.6.2.2 By Location

12.6.6.2.3 By Solution

12.6.6.2.4 By Platform

12.6.6.2.5 By Application

13 Competitive Landscape (Page No. - 141)

13.1 Dive Overview

13.1.1 Dynamic

13.1.2 Innovators

13.1.3 Vanguards

13.1.4 Emerging

13.2 Competitive Benchmarking

13.2.1 Product Offerings

13.2.2 Business Strategies

14 Company Profiles (Page No. - 145)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 DJI

14.2 Parrot SA

14.3 ABB

14.4 Sick AG

14.5 Cognex Corporation

14.6 Omron Corporation

14.7 Pepperl+Fuchs

14.8 Fanuc Corporation

14.9 Infsoft GmbH

14.10 Seegrid

14.11 Senion AB

14.12 Adtech (Shenzhen) Technology Co., Ltd.

14.13 Locata Corporation Pty. Limited

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

15 Appendix (Page No. - 177)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customization

15.5 Related Reports

15.6 Author Details

List of Tables (138 Tables)

Table 1 Market Segmentation, By Component

Table 2 Market Segmentation, By Location

Table 3 Market Segmentation, By Solution

Table 4 Market Segmentation, By Platform

Table 5 Market Segmentation, By Application

Table 6 Geographic Analysis of the Vision Positioning Systems Market

Table 7 Key Technological Innovations By Leading Players

Table 8 Innovation & Patent Registration (2013-2016)

Table 9 Market Size, By Component, 2015-2022 (USD Million)

Table 10 Market Size for Sensors, By Region, 2015-2022 (USD Million)

Table 11 Market Size for Camera System, By Region, 2015-2022 (USD Million)

Table 12 Market Size for Markers, By Region, 2015-2022 (USD Million)

Table 13 Market Size for Others, By Region, 2015-2022 (USD Million)

Table 14 Market Size, By Location, 2015-2022 (USD Million)

Table 15 Market Size for Indoor Positioning System, By Region, 2015-2022 (USD Million)

Table 16 Market Size for Outdoor Positioning System, By Region, 2015-2022 (USD Million)

Table 17 Market Size, By Solution, 2015-2022 (USD Million)

Table 18 Market Size for Navigation, By Region, 2015-2022 (USD Million)

Table 19 Market Size for Analytics, By Region, 2015-2022 (USD Million)

Table 20 Market Size for Tracking, By Region, 2015-2022 (USD Million)

Table 21 Market Size for Industrial Solutions, By Region, 2015-2022 (USD Million)

Table 22 Market Size for Others, By Region, 2015-2022 (USD Million)

Table 23 Market Size, By Platform, 2015-2022 (USD Million)

Table 24 Vision Positioning Systems Market Size for Unmanned Aerial Vehicle/Drone, By Region, 2015-2022 (USD Million)

Table 25 Market Size for Automated Guided Vehicle, By Region, 2015-2022 (USD Million)

Table 26 Market Size for Robotics, By Region, 2015-2022 (USD Million)

Table 27 Market Size for Space Vehicle, By Region, 2015-2022 (USD Million)

Table 28 Market Size for Autonomous Undersea Vehicle, By Region, 2015-2022 (USD Million)

Table 29 Market Size for Others, By Region, 2015-2022 (USD Million)

Table 30 Market Size, By Application, 2015-2022 (USD Million)

Table 31 Market Size for Commercial, By Region, 2015-2022 (USD Million)

Table 32 Market Size for Defense, By Region, 2015-2022 (USD Million)

Table 33 Market Size, By Region, 2015-2022 (USD Million)

Table 34 North America: Market Size, By Component, 2015-2022 (USD Million)

Table 35 North America: Market Size, By Location, 2015-2022 (USD Million)

Table 36 North America: Market Size, By Solution, 2015-2022 (USD Million)

Table 37 North America: Market Size, By Platform, 2015-2022 (USD Million)

Table 38 North America: Market Size, By Application, 2015-2022 (USD Million)

Table 39 North America: Market Size, By Country, 2015-2022 (USD Million)

Table 40 U.S.: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 41 U.S.: Market Size, By Location, 2015-2022 (USD Million)

Table 42 U.S.: Market Size, By Solution, 2015-2022 (USD Million)

Table 43 U.S.: Market Size, By Platform, 2015-2022 (USD Million)

Table 44 U.S.: Market Size, By Application, 2015-2022 (USD Million)

Table 45 Canada: Market Size, By Component, 2015-2022 (USD Million)

Table 46 Canada: Market Size, By Location, 2015-2022 (USD Million)

Table 47 Canada: Market Size, By Solution, 2015-2022 (USD Million)

Table 48 Canada: Market Size, By Platform, 2015-2022 (USD Million)

Table 49 Canada: Market Size, By Application, 2015-2022 (USD Million)

Table 50 Europe: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 51 Europe: Market Size, By Location, 2015-2022 (USD Million)

Table 52 Europe: Market Size, By Solution, 2015-2022 (USD Million)

Table 53 Europe: Market Size, By Platform, 2015-2022 (USD Million)

Table 54 Europe: Market Size, By Application, 2015-2022 (USD Million)

Table 55 Europe: Market Size, By Country, 2015-2022 (USD Million)

Table 56 U.K.: Market Size, By Component, 2015-2022 (USD Million)

Table 57 U.K.: Market Size, By Location, 2015-2022 (USD Million)

Table 58 U.K.: Market Size, By Solution, 2015-2022 (USD Million)

Table 59 U.K.: Market Size, By Platform, 2015-2022 (USD Million)

Table 60 U.K.: Market Size, By Application, 2015-2022 (USD Million)

Table 61 France: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 62 France: Market Size, By Location, 2015-2022 (USD Million)

Table 63 France: Market Size, By Solution, 2015-2022 (USD Million)

Table 64 France: Market Size, By Platform, 2015-2022 (USD Million)

Table 65 France: Market Size, By Application, 2015-2022 (USD Million)

Table 66 Germany: Market Size, By Component, 2015-2022 (USD Million)

Table 67 Germany: Market Size, By Location, 2015-2022 (USD Million)

Table 68 Germany: Market Size, By Solution, 2015-2022 (USD Million)

Table 69 Germany: Market Size, By Platform, 2015-2022 (USD Million)

Table 70 Germany: Market Size, By Application, 2015-2022 (USD Million)

Table 71 Russia: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 72 Russia: Market Size, By Location, 2015-2022 (USD Million)

Table 73 Russia: Market Size, By Solution, 2015-2022 (USD Million)

Table 74 Russia: Market Size, By Platform, 2015-2022 (USD Million)

Table 75 Russia: Market Size, By Application, 2015-2022 (USD Million)

Table 76 Italy: Market Size, By Component, 2015-2022 (USD Million)

Table 77 Italy: Market Size, By Location, 2015-2022 (USD Million)

Table 78 Italy: Market Size, By Solution, 2015-2022 (USD Million)

Table 79 Italy: Market Size, By Platform, 2015-2022 (USD Million)

Table 80 Italy: Market Size, By Application, 2015-2022 (USD Million)

Table 81 Asia-Pacific: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 82 Asia-Pacific: Market Size, By Location, 2015-2022 (USD Million)

Table 83 Asia-Pacific: Market Size, By Solution, 2015-2022 (USD Million)

Table 84 Asia-Pacific: Market Size, By Platform, 2015-2022 (USD Million)

Table 85 Asia-Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 86 Asia-Pacific: Market Size, By Country, 2015-2022 (USD Million)

Table 87 China: Market Size, By Component, 2015-2022 (USD Million)

Table 88 China: Market Size, By Location, 2015-2022 (USD Million)

Table 89 China: Market Size, By Solution, 2015-2022 (USD Million)

Table 90 China: Market Size, By Platform, 2015-2022 (USD Million)

Table 91 China: Market Size, By Application, 2015-2022 (USD Million)

Table 92 India: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 93 India: Market Size, By Location, 2015-2022 (USD Million)

Table 94 India: Market Size, By Solution, 2015-2022 (USD Million)

Table 95 India: Market Size, By Platform, 2015-2022 (USD Million)

Table 96 India: Market Size, By Application, 2015-2022 (USD Million)

Table 97 Japan: Market Size, By Component, 2015-2022 (USD Million)

Table 98 Japan: Market Size, By Location, 2015-2022 (USD Million)

Table 99 Japan: Market Size, By Solution, 2015-2022 (USD Million)

Table 100 Japan: Market Size, By Platform, 2015-2022 (USD Million)

Table 101 Japan: Market Size, By Application, 2015-2022 (USD Million)

Table 102 Middle East: Market Size, By Component, 2015-2022 (USD Million)

Table 103 Middle East: Market Size, By Location, 2015-2022 (USD Million)

Table 104 Middle East: Market Size, By Solution, 2015-2022 (USD Million)

Table 105 Middle East: Market Size, By Platform, 2015-2022 (USD Million)

Table 106 Middle East: Market Size, By Application, 2015-2022 (USD Million)

Table 107 Middle East: Market Size, By Country, 2015-2022 (USD Million)

Table 108 UAE: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 109 UAE: Market Size, By Location, 2015-2022 (USD Million)

Table 110 UAE: Market Size, By Solution, 2015-2022 (USD Million)

Table 111 UAE: Market Size, By Platform, 2015-2022 (USD Million)

Table 112 UAE: Market Size, By Application, 2015-2022 (USD Million)

Table 113 Saudi Arabia: Market Size, By Component, 2015-2022 (USD Million)

Table 114 Saudi Arabia: Market Size, By Location, 2015-2022 (USD Million)

Table 115 Saudi Arabia: Market Size, By Solution, 2015-2022 (USD Million)

Table 116 Saudi Arabia: Market Size, By Platform, 2015-2022 (USD Million)

Table 117 Saudi Arabia: Market Size, By Application, 2015-2022 (USD Million)

Table 118 Israel: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 119 Israel: Market Size, By Location, 2015-2022 (USD Million)

Table 120 Israel: Market Size, By Solution, 2015-2022 (USD Million)

Table 121 Israel: Market Size, By Platform, 2015-2022 (USD Million)

Table 122 Israel: Market Size, By Application, 2015-2022 (USD Million)

Table 123 RoW: Market Size, By Component, 2015-2022 (USD Million)

Table 124 RoW: Market Size, By Location, 2015-2022 (USD Million)

Table 125 RoW: Market Size, By Solution, 2015-2022 (USD Million)

Table 126 RoW: Market Size, By Platform, 2015-2022 (USD Million)

Table 127 RoW: Market Size, By Application, 2015-2022 (USD Million)

Table 128 RoW: Market Size, By Country, 2015-2022 (USD Million)

Table 129 South Africa: Vision Positioning Systems Market Size, By Component, 2015-2022 (USD Million)

Table 130 South Africa: Market Size, By Location, 2015-2022 (USD Million)

Table 131 South Africa: Market Size, By Solution, 2015-2022 (USD Million)

Table 132 South Africa: Market Size, By Platform, 2015-2022 (USD Million)

Table 133 South Africa: Market Size, By Application, 2015-2022 (USD Million)

Table 134 Brazil: Market Size, By Component, 2015-2022 (USD Million)

Table 135 Brazil: Market Size, By Location, 2015-2022 (USD Million)

Table 136 Brazil: Market Size, By Solution, 2015-2022 (USD Million)

Table 137 Brazil: Market Size, By Platform, 2015-2022 (USD Million)

Table 138 Brazil: Market Size, By Application, 2015-2022 (USD Million)

List of Figures (49 Figures)

Figure 1 Vision Positioning System

Figure 2 Research Process Flow

Figure 3 Research Design

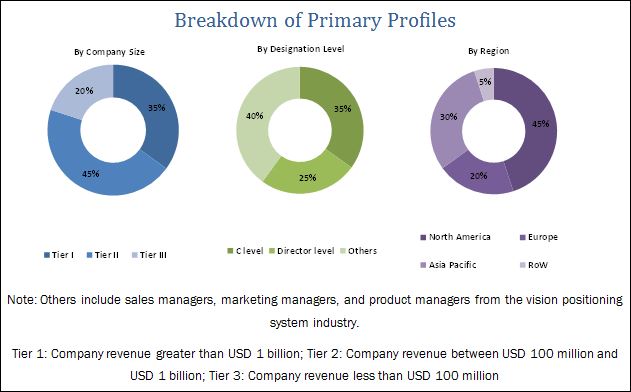

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Market, By Region, 2017 & 2022 (USD Billion)

Figure 10 Market, By Location, 2017 & 2022 (USD Billion)

Figure 11 Market, By Solution, 2017 & 2022 (USD Billion)

Figure 12 Market, By Region, 2017

Figure 13 Contract Was the Major Strategy Adopted By the Key Players in the Vision Positioning Systems Market From January 2011 to April 2017

Figure 14 Attractive Market Opportunities in the Market, 2017-2022

Figure 15 Camera Systems Segment to Lead the Market During the Forecast Period, 2017-2022

Figure 16 Indoor Positioning System Segment Estimated to Account for the Largest Market Size in 2017

Figure 17 Industrial Solutions Segment to Lead the During Forecast Period

Figure 18 Unmanned Aerial Vehicle Segment Estimated to Account for the Largest Market Size in 2017

Figure 19 Commercial Application Segment Estimated to Lead the Market in 2017

Figure 20 North America to Dominate the Market in 2017

Figure 21 Market Segmentation, By Component

Figure 22 Market Segmentation, By Location

Figure 23 Market Segmentation, By Solution

Figure 24 Market Segmentation, By Platform

Figure 25 Market Segmentation, By Application

Figure 26 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 27 Smart Robotics End Users

Figure 28 Growth of UAVs in Defense and Industry Applications

Figure 29 Camera System Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Indoor Positioning System Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 31 Analytics Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Unmanned Aerial Vehicles Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Commercial Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 34 North America Estimated to Account for the Largest Share of the Market in 2017

Figure 35 Global Market Size, By Region

Figure 36 North America Vision Positioning Systems Market Snapshot

Figure 37 U.S. Estimated to Account for the Largest Share of the North America Vision Positioning Systems Market in 2017

Figure 38 Europe: Market Snapshot

Figure 39 U.K. Estimated to Account for the Largest Share of the Europe Vision Positioning Systems Market in 2017

Figure 40 Russia Was the Third Largest Defense Spender in 2016 (USD Billion)

Figure 41 Asia-Pacific Vision Positioning Systems Market Snapshot

Figure 42 China Estimated to Account for the Largest Share of the Asia-Pacific Vision Positioning Systems Market in 2017

Figure 43 Dive-Vendor Comparison Matrix

Figure 44 ABB: Company Snapshot

Figure 45 Sick AG: Company Snapshot

Figure 46 Cognex Corporation: Company Snapshot

Figure 47 Omron Corporation: Company Snapshot

Figure 48 Pepperl+Fuchs: Company Snapshot

Figure 49 Fanuc Corporation: Company Snapshot

Objectives of the Study:

The report analyzes the market on the basis of component (sensors, camera systems, markers, and others), location (indoor positioning system and outdoor positioning system), solution (tracking, navigation, analytics, industrial solutions, and others), platform (unmanned aerial vehicle – drones, automated guided vehicle, robotics, autonomous undersea vehicles, space vehicles), and application (commercial and defense) and maps these segments and subsegments across major regions worldwide, namely, North America, Europe, Asia-Pacific, Middle East, and Rest of the World.

The report provides in-depth market intelligence regarding vision positioning system market dynamics and major factors that influence the growth of the market (drivers, restraints, opportunities, and industry-specific challenges), along with an analysis of micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

The report also covers competitive developments such as long-term contracts, joint ventures, mergers, new product launches and developments, and research & development activities in the vision positioning system market, in addition to business and corporate strategies adopted by the key players in the market.

Research Methodology:

Market size estimations for various segments and subsegments of the vision positioning system market were arrived at through extensive secondary research and government sources such as company website; corporate filings such as annual reports of the leading players, investor presentations, and financial statements; and trade, business, and professional associations such as Australian Association for Unmanned Systems and Unmanned Aerial Vehicle Systems Association, Los Angeles, among others. Furthermore, corroboration with primaries and further market triangulation with the help of statistical techniques using econometric tools was carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data is consolidated, and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the vision positioning system market comprises manufacturers, distributors, and end users. Key end users of the market are commercial and defense sectors. Key players in the market are DJI (China), Sick AG (Germany), ABB (Switzerland), Cognex Corporation (U.S.), and Omron Corporation (Japan) offering advanced technology systems, products, and services. These players are adopting strategies such as agreements and partnerships, new product developments, contracts, and business expansions to strengthen their position in the market.

Target Audience

- Armed Services

- Police Departments

- U.S. Universities

- Banks & Financial Institutions

- Private Companies

- Original Equipment Manufacturers (OEMs)

- Component Suppliers

Scope of the Report

This research report categorizes the vision positioning system market into the following segments and subsegments:

Vision Positioning System Market, By Component

- Sensors

- Camera Systems

- Markers

- Others

Vision Positioning System Market, By Location

- Indoor Positioning System

- Outdoor Positioning System

Vision Positioning System Market, By Solution

- Tracking

- Navigation

- Analytics

- Industrial Solutions

- Others

Vision Positioning System Market, By Platform

- Unmanned Aerial Vehicle - Drones

- Automated Guided Vehicles

- Robotics

- Space Vehicles

- Others

Vision Positioning System Market, By Application

- Commercial

- Defense

Vision Positioning System Market, By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- Rest of the World

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per specific needs of the company. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiles of additional market players (up to five)

- Geographic Analysis: Further breakdown of the Rest of the World market

Growth opportunities and latent adjacency in Vision Positioning System Market