Electronic Flight Instrument System (EFIS) Market by Sub-System (Display Systems, Processing Systems, Control Panel), Platform (General Aviation, Commercial Aviation, Military Aviation), Application, Fit and Region - Global Forecast to 2027

Updated on : Oct 22, 2024

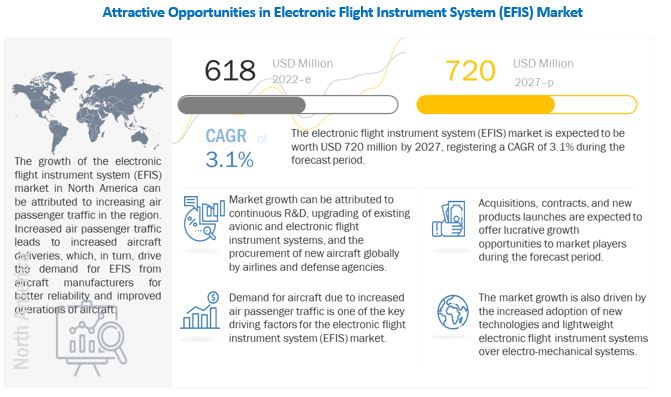

An EFIS is a digital substitute for the conventional mechanical gauges and instruments that are installed in the cockpit to analyze and display various operational parameters of an aircraft. The electronic flight instrument system (EFIS) market size is projected to grow from USD 618 million in 2022 to USD 720 million by 2027, at a CAGR of 3.1% from 2022 to 2027. The adoption of EFIS is driven by the demand for integration of sophisticated avionics onboard modern aircraft as a replacement to the cumbersome electromechanical gauges and indicators, thereby saving weight and reducing operational and maintenance costs for end users.

To know about the assumptions considered for the study, Request for Free Sample Report

Electronic Flight Instrument System (EFIS) Market Dynamics:

Driver: Increasing use of sophisticated avionics with minimal weight profile

The older generation aircraft used bulky electromechanical gauges and indicators to display the performance parameters of the aircraft. However, their low reliability and bulkiness resulted in their subsequent and gradual replacement by EFIS technology. EFIS provides multi-function capabilities by overcoming the physical limitations of traditional instruments. Modern EFIS offers high-quality infographics to monitor several aircraft systems, such as GPS, EVS, terrain avoidance information, and weather information on a single screen. EFIS displays all the information in the form of numbers, track, bearing, desired track, distance, and various other essential features, allowing the user to take instant decisions by eliminating the element of the user processing the data to obtain critical information.

Business and general aviation aircraft electronics are becoming increasingly more connected and digital within smaller modular form factors. Several manufacturers are investing significant resources towards the R&D of new sophisticated avionics and electronic flight instrument systems. For instance, in October 2021, Universal Avionics (US) introduced its new Flight Partner and Flight Review applications at the 2021 National Business Aviation Association (NBAA) conference. Similarly, in March 2022, Thommen Aircraft, a Switzerland-based avionics manufacturer, unveiled its new display replacement services targeted at replacing the legacy cathode-ray tube (CRT) and first-generation liquid crystal display (LCD) units in the cockpit of general aviation aircraft. Such developments are anticipated to increase the adoption of modern EFIS and drive both line-fit and retrofit aspects of the market during the forecast period.

Restraint: Stringent design regulations pertaining to EFIS

EFIS is a vital part of the flight deck and, hence, the safety of the crew and passengers is dependent on the proper functioning of the system and its subcomponents. Thus, the EFIS is required to be designed as per the guidelines formulated by aviation regulatory authorities and its performance and accuracy are required to be validated prior to obtaining installation type certification. For instance, as per the US Code of Federal Regulations (FCR), to obtain operational credit, EFIS must meet several requirements, pertaining to information provided and instruments used in the system. The US Federal Aviation Administration (FAA) states that for displaying the Primary Flight Information (PFI), there should be at least two independent displays to provide information pertaining to the attitude, airspeed, altitude, and heading (direction) to the pilot, and these displays must be arranged in the basic T arrangement, and the horizon reference line should be at least 3.25 inches wide for integrated displays. Thus, the process of certification is stringent and hence requires a significant R&D expenditure to design a system in compliance with all existing regulations to be deemed fit for installation onboard different aircraft models. The lengthy and capital-intensive process involved in the appropriate certification of EFIS may restrain the growth of the Electronic Flight Instrument System Industry in the near future.

Opportunity: Planned fleet modernization programs

EFIS retrofits are a comprehensive set of capabilities that can resemble those of a new factory aircraft to improve safety and efficiency, reduce maintenance costs, and enhance the reliability of an aircraft. A cockpit can be retrofitted entirely to install all digital glass instrumentation or upgrade communications, navigation, surveillance, and air-traffic management capabilities. Several airline operators consider retrofit options to boost the value of existing assets, extend the avionics lifecycle, and enhance overall aircraft performance. Hence, major avionics manufacturers are working with aviation service companies to integrate and install systems that can meet the demand of upcoming modern avionics enabled with advanced functionalities. Several contracts are being awarded to satiate the demand for new avionics and EFIS as part of the fleet modernization initiatives planned by operators. For instance, in June 2019, L3Harris Technologies (US) was awarded a USD 500 million contract for major avionics upgrade of 176 Lockheed Martin C-130H tactical transports flown by the US Air National Guard and US Air Force Reserve Command. Several similar contracts are also underway or are anticipated to be formalized in different parts of the globe, thereby creating numerous opportunities for EFIS installations and upgrades during the forecast period.

Challenge: High system complexity requiring proper pilot training for optimum usage

An EFIS consists of several subsystems and the data from several embedded sensors is displayed to the pilot using the different display systems installed onboard. However, these display systems are complex and vulnerable to signal errors. The complex nature of the system has a negative impact on situational awareness and pilot workload as the pilot is then required to manage several goals, tasks, and split-second decisions. There have been several instances where pilots have been confused by computer-generated messages. For example, in Aero Peru Flight 603, the pilots of the B757 received contradictory messages with most of the instruments inoperable, which ultimately resulted in a mid-air collision.

The US National Transport Safety Board has made six recommendations to the Federal Aviation Administration (US) to address the problem of lack of situational awareness in pilots. All the six recommendations are related to appropriate training for pilots, which includes the revision of knowledge tests for pilots to include electronic flight instrument system operations and malfunctions, the development and publication of guidance for a new generation of EFIS simulators and increasing awareness of voluntary services provided when there is any difficulty in the reporting of equipment malfunctions. Though airlines have incorporated extensive training procedures for the pilots, the margin of computational error remains in certain extreme cases and the system may malfunction abruptly, thereby increasing the workload and stress for pilots.

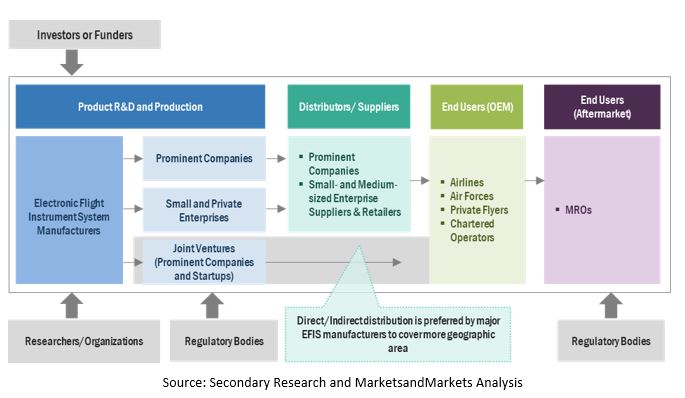

Electronic Flight Instrument System (EFIS) Market Ecosystem

Prominent companies that provide EFIS, private and small enterprises, distributors/suppliers/retailers, and end customers (airlines, air forces, and MROs) are the key stakeholders in the EFIS market ecosystem. Investors, funders, academic researchers, distributors, service providers, and defense procurement authorities are the major influencers in the EFIS market.

The flight attitude segment is estimated to account for the largest share of the EFIS market during the forecast period

Based on application, the EFIS market is segmented into flight attitude, navigation, information management, and engine monitoring. The flight attitude segment is estimated to lead the EFIS market during the forecast period due to the enhancement of the existing aircraft fleet by major airline players with the latest electronic equipment for better safety and fuel efficiency.

Commercial aviation segment projected to lead EFIS market during forecast period

Based on platform, the electronic flight instrument system (EFIS) market has been segmented into commercial aviation, military aviation, and general aviation. The growth in air passenger traffic and an increase in the number of aircraft orders across the globe are expected to propel the demand for all types of EFIS components as they are essential for the smooth operations of different types of aircraft. Thus, the increasing air passenger traffic, especially in emerging economies, is driving the growth of the commercial aviation segment of the EFIS market across the globe.

Line-fit segment is expected to account for the largest share in 2022

Based on fit, the electronic flight instrument system (EFIS) market has been segmented into line-fit and retrofit. Line-fit is the direct installation of EFIS into the aircraft cockpit by aircraft OEMs, while retrofit refers to the modernization of cockpits of active aircraft fleet with EFIS through MRO channels. Since the number of aircraft with provisions for EFIS installation in the active fleet is limited to just commercial and military aviation as a large part of the older generation light aircraft did not have the necessary wiring and electrical design for EFIS upgrade, the line-fit segment is projected to account for a larger market share throughout the forecast period.

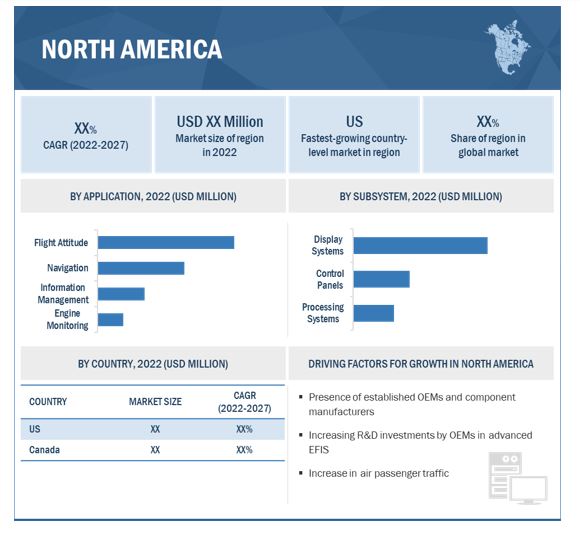

North America is projected to account for the largest share in 2022

North America accounted for the largest market share in 2022 due to significant R&D investments by domestic players in advanced electronic flight instrument systems and rising demand for lightweight and simple-to-install systems. In the last five years, the US’ aerospace and aviation sector has increased its spending owing to the US government’s focus on the safety of air passengers. The US is likewise investing in the advancement of EFIS. Major US-based market players, such as Boeing, Lockheed Martin, Northrop Grumman, and Piper Aircraft Inc. are significantly investing in the development of advanced avionics as well as EFIS. These factors contribute to the growth of the EFIS market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Electronic Flight Instrument Companies - Key Market Players

The electronic flight instrument system (EFIS) companies are dominated by a few globally established players such as Honeywell International Inc. (US), Raytheon Technologies Corporation (US), General Electric Company (US), Thales SA (France), BAE Systems PLC (UK), and Meggitt PLC (UK).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, Subsystem, Application, Fit, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Honeywell International Inc. (US), Raytheon Technologies Corporation (US), General Electric Company (US), Thales SA (France), BAE Systems PLC (UK), and Meggitt PLC (UK), among others |

This research report categorizes the Electronic Flight Instrument System (EFIS) Market based on Platform, Subsystem, Application, Fit, and Region.

Electronic Flight Instrument System (EFIS) Market, By Platform

- Commercial Aviation

- Military Aviation

- General Aviation

Electronic Flight Instrument System (EFIS) Market, By Subsystem

- Display Systems

- Processing Systems

- Control Panel

Electronic Flight Instrument System (EFIS) Market, By Application

- Flight Attitude

- Navigation

- Information Management

- Engine Monitoring

Electronic Flight Instrument System (EFIS) Market, By Fit

- Line-fit

- Retrofit

Electronic Flight Instrument System (EFIS) Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In June 2022, Collins Aerospace, a part of Raytheon Technologies Corporation (US) introduced FlightHub, a scalable solution that can be integrated with the Flight Profile Optimization tool to provide real-time route suggestions and save fuel and time while reducing CO2 emissions.

- In February 2022, Garmin Ltd. (US) introduced the TXi EIS for the Pilatus PC-12 aircraft. It is an advanced cockpit retrofit solution that comprises GFCTM-600 autopilot, G600 TXi primary flight display, GTN-Xi navigators, GTX-ADS-B transponder, GWX-weather radar, and other equipment.

- In May 2021, Garmin Ltd. (US) launched the G3000H Integrated Flight Deck that features WAAS/SBAS, ILS approach capabilities, VFR and IFR helicopter charts, and a Connext wireless connection.

Frequently Asked Questions (FAQs):

What is the current size of the Electronic Flight Instrument System (EFIS) Market?

The electronic flight instrument system (EFIS) market size is projected to grow from USD 618 million in 2022 to USD 720 million by 2027, at a CAGR of 3.1% from 2022 to 2027.

Who are the winners in the Electronic Flight Instrument System (EFIS) Market?

Major players operating in the electronic flight instrument system (EFIS) market are Honeywell International Inc. (US), Raytheon Technologies Corporation (US), General Electric Company (US), Thales SA (France), BAE Systems PLC (UK), and Meggitt PLC (UK).

What are some of the technological advancements in the market?

The EFIS market is being revolutionized by the advent of modern navigation and avionics technologies such as the Attitude Heading Reference System (AHRS), Traffic Alert and Collision Avoidance System (TCAS), and several other technologies, that are designed to elevate the level of safety in an aircraft while minimizing the chances of manual error by automating several of the aircraft control parameters, thereby reducing the stress of the pilots.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

TABLE 1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SEGMENT

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 PRIMARY SOURCES

2.3.1.1 Key data from primary sources

2.3.2 BREAKDOWN OF PRIMARIES

2.3.2.1 Breakdown of primary interviews: By company type, designation, and region

2.4 DEMAND AND SUPPLY-SIDE ANALYSIS

2.4.1 INTRODUCTION

2.4.2 DEMAND-SIDE INDICATORS

2.4.2.1 Increasing demand for aftermarket services

2.4.3 SUPPLY-SIDE INDICATORS

2.4.3.1 Advancements in EFIS technologies

2.5 RESEARCH APPROACH & METHODOLOGY

TABLE 3 SEGMENTS AND SUBSEGMENTS

2.6 MARKET SIZE ESTIMATION

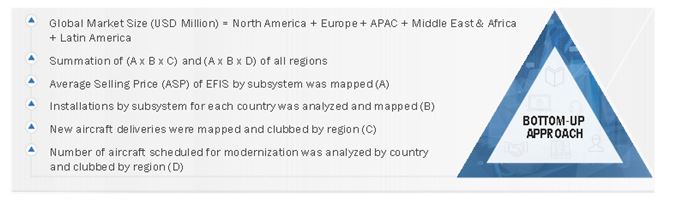

2.6.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

2.6.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

2.7 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.8 GROWTH RATE ASSUMPTIONS

2.9 ASSUMPTIONS

FIGURE 6 PARAMETRIC ASSUMPTIONS MADE FOR MARKET FORECAST

2.10 RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 BY APPLICATION, FLIGHT ATTITUDE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 8 BY SUB-SYSTEM, PROCESSING SYSTEMS SEGMENT PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

FIGURE 9 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

FIGURE 10 INCREASING DEMAND FOR ADVANCED LIGHTWEIGHT ELECTRONIC FLIGHT INSTRUMENT SYSTEMS TO DRIVE MARKET DURING FORECAST PERIOD

4.2 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM

FIGURE 11 DISPLAY SYSTEMS SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.3 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION

FIGURE 12 FLIGHT ATTITUDE SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.4 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM

FIGURE 13 COMMERCIAL AVIATION SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4.5 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT

FIGURE 14 LINE-FIT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing use of sophisticated avionics with minimal weight profile

5.2.1.2 Enhanced safety and situational awareness offered by EFIS

5.2.2 RESTRAINTS

5.2.2.1 Stringent design regulations pertaining to EFIS

5.2.2.2 High installation cost due to ongoing technological disruption

5.2.3 OPPORTUNITIES

5.2.3.1 Planned fleet modernization programs

5.2.4 CHALLENGES

5.2.4.1 High system complexity requiring proper pilot training for optimum usage

5.2.4.2 Electronic failures

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER

5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM MANUFACTURERS

FIGURE 16 REVENUE SHIFT IN ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

5.4 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE RANGE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET (BY SUBSYSTEM)

5.5 MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 17 MARKET ECOSYSTEM MAP: ELECTRONIC FLIGHT INSTRUMENT SYSTEM

TABLE 5 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

5.7 TECHNOLOGY ANALYSIS

5.7.1 AUTOMATIC DEPENDENT SURVEILLANCE–BROADCAST (ADS–B)

5.7.2 INTEGRATED MODULAR AVIONICS

5.8 CASE STUDY ANALYSIS

5.8.1 NEXT-GENERATION OPEN FLIGHT DECK

5.9 PORTER’S FIVE FORCES MODEL

FIGURE 19 PORTER’S FIVE FORCES MODEL ANALYSIS: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

TABLE 6 ELECTRONIC FLIGHT INSTRUMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 KEY STAKEHOLDERS & BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES (%)

5.10.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

TABLE 8 KEY BUYING CRITERIA FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM TECHNOLOGIES

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 9 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.12 TARIFF & REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 73)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS OF ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET

6.3 TECHNOLOGY TRENDS

6.3.1 ATTITUDE HEADING REFERENCE SYSTEM (AHRS)

6.3.2 TRAFFIC ALERT AND COLLISION AVOIDANCE SYSTEM (TCAS)

6.3.3 TERRAIN AWARENESS AND WARNING SYSTEM (TAWS)

6.3.4 ENHANCED VISION SYSTEM (EVS)

6.3.5 AUTOMATIC FLIGHT CONTROL SYSTEM (AFCS)

6.4 IMPACT OF MEGATRENDS

6.4.1 IMPLEMENTATION OF INDUSTRY 4.0

6.4.2 ADVANCEMENTS IN SUPPLY CHAIN FOR ELECTRONIC FLIGHT INSTRUMENT SYSTEM MANUFACTURING

6.5 PATENT ANALYSIS

TABLE 14 KEY PATENTS, 2018-2022

7 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION (Page No. - 78)

7.1 INTRODUCTION

FIGURE 23 BY APPLICATION, FLIGHT ATTITUDE SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 15 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 FLIGHT ATTITUDE

7.3 NAVIGATION

7.4 INFORMATION MANAGEMENT

7.5 ENGINE MONITORING

8 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM (Page No. - 81)

8.1 INTRODUCTION

FIGURE 24 BY PLATFORM, COMMERCIAL AVIATION SEGMENT PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 18 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

8.2 COMMERCIAL AVIATION

FIGURE 25 NARROWBODY AIRCRAFT SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

TABLE 19 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COMMERCIAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 20 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COMMERCIAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

8.2.1 NARROWBODY AIRCRAFT

8.2.1.1 Demand for narrow-body aircraft in short-haul travel to drive EFIS installations

8.2.2 WIDEBODY AIRCRAFT

8.2.2.1 Increase in passenger travel to drive demand for widebody aircraft

8.2.3 REGIONAL JETS

8.2.3.1 Increased use of fly-by-wire technology to fuel demand for regional jets worldwide

8.3 MILITARY AVIATION

FIGURE 26 COMBAT AIRCRAFT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 21 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY MILITARY AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 22 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY MILITARY AVIATION PLATFORM, 2022–2027 (USD MILLION)

8.3.1 COMBAT AIRCRAFT

8.3.1.1 Growing procurement of combat aircraft due to increasing geopolitical rift

8.3.2 MILITARY HELICOPTERS

8.3.2.1 Increasing use of helicopters in combat and search & rescue operations

8.3.3 TRAINING AIRCRAFT

8.3.3.1 Need for more pilots to drive demand for training aircraft

8.3.4 TRANSPORT AIRCRAFT

8.3.4.1 Increasing use of transport aircraft in military operations

8.3.5 SPECIAL MISSION AIRCRAFT

8.3.5.1 Evolving warfare techniques to drive demand

8.4 GENERAL AVIATION

FIGURE 27 CIVIL HELICOPTERS SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 23 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY GENERAL AVIATION PLATFORM, 2018–2021 (USD MILLION)

TABLE 24 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY GENERAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

8.4.1 BUSINESS JETS

8.4.1.1 Growth of private aviation companies

8.4.2 COMMERCIAL HELICOPTERS

8.4.2.1 Increasing use in corporate and civil applications

8.4.3 LIGHT AIRCRAFT

8.4.3.1 Low cost of maintenance and operations to drive demand

9 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM (Page No. - 90)

9.1 INTRODUCTION

FIGURE 28 BY SUB-SYSTEM, DISPLAY SYSTEMS SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

TABLE 25 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 26 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

9.2 DISPLAY SYSTEMS

TABLE 27 DISPLAY SYSTEMS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 DISPLAY SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2.1 PRIMARY FLIGHT DISPLAY (PFD)

9.2.1.1 Rising system efficiency and increasing demand for advanced aircraft

9.2.2 MULTI-FUNCTION DISPLAY (MFD)

9.2.2.1 Enhanced product functionality due to technological innovations and advancements

9.2.3 NAVIGATION DISPLAY

9.2.3.1 Enhanced display systems with vertical flight profile addition

9.2.4 ENGINE INDICATING AND CREW ALERTING SYSTEM (EICAS)

9.2.4.1 Rising demand for lightweight and advanced components with various functionalities in modern aircraft

9.2.5 ELECTRONIC FLIGHT BAG (EFB)

9.2.5.1 Incorporation of EFB to reduce aircraft weight and real-time data sharing

9.2.6 CONTROL PANELS

TABLE 29 CONTROL PANELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 CONTROL PANELS MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.2.7 AUTOPILOT

9.2.7.1 Digital revolution in aviation sector to accelerate demand for autopilot control systems

9.2.8 RADIO

9.2.8.1 Consolidation of multi radios into one advanced radio control unit to drive market

9.2.9 INPUT SELECTOR

9.2.9.1 Integration of input selectors with advanced multi-functional displays

9.3 PROCESSING SYSTEMS

TABLE 31 PROCESSING SYSTEMS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 32 PROCESSING SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

9.3.1 AIR DATA COMPUTER

9.3.1.1 Integration of digital air data computers with modern aircraft

9.3.2 FLIGHT CONTROL COMPUTER

9.3.2.1 Increasing R&D activities to develop advanced flight control computers

9.3.3 NAVIGATION COMPUTER

9.3.3.1 Development of regional satellite navigation systems

10 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT (Page No. - 97)

10.1 INTRODUCTION

FIGURE 29 BY FIT, LINE-FIT SEGMENT PROJECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 33 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 34 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022–2027 (USD MILLION)

10.2 LINE-FIT

10.2.1 INCREASING AIRCRAFT DEMAND TO DRIVE SEGMENT

10.3 RETROFIT

10.3.1 EVOLVING SAFETY REGULATIONS TO DRIVE FLEET MODERNIZATION

11 REGIONAL ANALYSIS (Page No. - 100)

11.1 INTRODUCTION

FIGURE 30 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

TABLE 35 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 31 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

TABLE 37 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 40 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 42 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT 2022–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 44 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM 2022–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 46 NORTH AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

TABLE 47 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 49 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 50 US: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 ASSUMPTIONS

TABLE 51 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 53 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 54 CANADA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 32 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

TABLE 55 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 57 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 58 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

TABLE 59 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 60 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 61 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 62 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 63 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 INTRODUCTION

TABLE 65 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 66 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 67 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 68 UK: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 RESTRAINTS

TABLE 69 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 70 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 71 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 72 FRANCE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 High system complexity requiring proper pilot training for optimum usage

TABLE 73 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 76 GERMANY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3.5 ITALY

11.3.5.1 AVERAGE SELLING PRICE RANGE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET (BY SUBSYSTEM)

TABLE 77 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 79 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 80 ITALY: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3.6 RUSSIA

11.3.6.1 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET ECOSYSTEM

TABLE 81 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 84 RUSSIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 CASE STUDY ANALYSIS

TABLE 85 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 87 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 88 REST OF EUROPE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

TABLE 89 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 92 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

TABLE 93 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 94 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT 2022–2027 (USD MILLION)

TABLE 95 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 TARIFF & REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

TABLE 99 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 100 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 101 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 102 CHINA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 INTRODUCTION

TABLE 103 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 104 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 105 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 106 INDIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 TERRAIN AWARENESS AND WARNING SYSTEM (TAWS)

TABLE 107 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 108 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 110 JAPAN: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 PATENT ANALYSIS

TABLE 111 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 113 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 114 AUSTRALIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 116 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 117 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 118 SOUTH KOREA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.4.7.1 INTRODUCTION

TABLE 119 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 34 MIDDLE EAST & AFRICA: ELECTRONIC FLIGHT INSTRUMENT MARKET SNAPSHOT

TABLE 123 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY FIT, 2018–2021 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY FIT 2022–2027 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY PLATFORM 2022–2027 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY 2018–2021 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 SAUDI ARABIA

11.5.2.1 Growing procurement of combat aircraft due to increasing geopolitical rift

TABLE 133 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 135 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 136 SAUDI ARABIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5.3 UAE

11.5.3.1 Increasing use of transport aircraft in military operations

TABLE 137 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 139 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 140 UAE: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5.4 ISRAEL

11.5.4.1 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY GENERAL AVIATION PLATFORM, 2022–2027 (USD MILLION)

TABLE 141 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 142 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 144 ISRAEL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Low cost of maintenance and operations to drive demand

TABLE 145 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 147 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 148 SOUTH AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5.6 NIGERIA

11.5.6.1 DISPLAY SYSTEMS

TABLE 149 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 151 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 152 NIGERIA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.5.7 REST OF MIDDLE EAST & AFRICA

11.5.7.1 Enhanced product functionality due to technological innovations and advancements

TABLE 153 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 156 REST OF MIDDLE EAST AND AFRICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 35 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SNAPSHOT

TABLE 157 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 158 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM) MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 160 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

TABLE 161 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2018–2021 (USD MILLION)

TABLE 162 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT, 2022–2027 (USD MILLION)

TABLE 163 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2018–2021 (USD MILLION)

TABLE 164 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 165 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 AIR DATA COMPUTER

TABLE 167 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 168 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 169 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 170 BRAZIL: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY FIT

TABLE 171 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 172 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 173 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 174 MEXICO: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

11.6.4 REST OF LATIN AMERICA

11.6.4.1 INCREASING AIRCRAFT DEMAND TO DRIVE SEGMENT

TABLE 175 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 176 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 177 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2018–2021 (USD MILLION)

TABLE 178 REST OF LATIN AMERICA: ELECTRONIC FLIGHT INSTRUMENT SYSTEM MARKET SIZE, BY SUB-SYSTEM, 2022–2027 (USD MILLION)

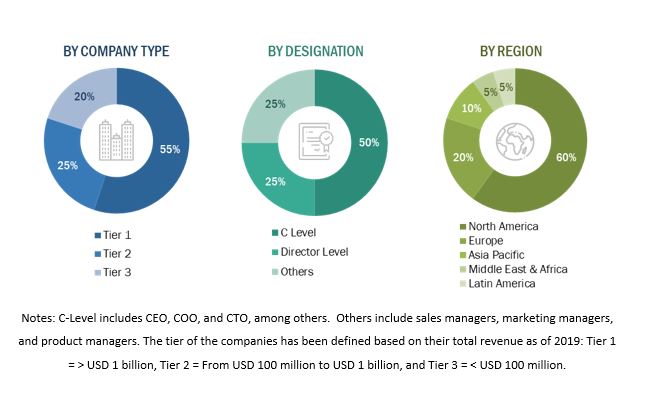

The study involved four major activities in estimating the current market size for the electronic flight instrument system (EFIS) market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

Primary Research

The electronic flight instrument system (EFIS) market comprises several stakeholders, such as raw material providers, EFIS manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in EFIS. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the electronic flight instrument system (EFIS) market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the electronic flight instrument system (EFIS) market from the demand for EFIS sub-systems by the end users in each country, and the average cost of integration for both line-fit and retrofit installation was multiplied by new aircraft deliveries and MRO fleet, respectively. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation procedure and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the electronic flight instrument system (EFIS) market.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the military wearables market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electronic Flight Instrument System (EFIS) Market