Video Management System Market by Component (Solutions, Services), Technology (Analog-based VMS, IP-based VMS), Deployment Mode (On-Premises, Cloud), Organization Size (Large Enterprises, SMEs), Application, Vertical, & Region - Global Forecast to 2027

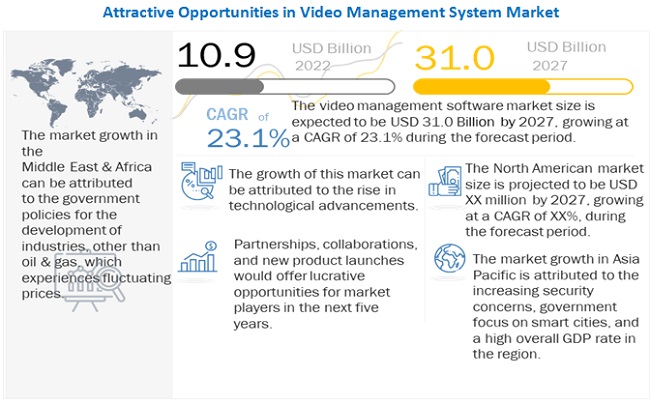

[304 Pages Report] The video management system market size is expected to grow USD 10.9 billion in 2022 to USD 31.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 23.1% during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The outbreak of COVID-19 has significantly impacted operations in a few key verticals, such as manufacturing and automotive, IT, transportation and logistics, healthcare and Lifesciences, and retail, are moderately impacted a few sectors, such as energy & utilities, government, education, and BFSI. Hence, the impact of this factor on the market is expected to be moderate across global sectors.

Market Dynamics

Driver: Increasing security surveillance

Security agencies maintain to be restrained about revealing the scale of their surveillance operations to public analysis. There is no doubt that giving authorities greater surveillance tools helps prevent certain kinds of crime, but there also is the possibility of abuses or that the rights of citizens could be compromised. Over the last two decades, several large terror attacks have led to a discussion of the use of different surveillance technologies. The use of novel technologies for pre-emptive security and surveillance has been discussed and criticized academically, but few studies have addressed the public. Studies that target the public tend to assume an oversimplified trade-off between privacy and security. The evolving trend in the domain of security and surveillance suggests an increased reliance on tech-powered innovations. Another manifestation of the increased concerns towards security and surveillance is the increase in demand for CCTV cameras. Leading companies are offering a wide range of devices, including 8-megapixel CCTV cameras. The massive range of CCTV security and surveillance cameras further includes IP-powered cams and those with night vision or colored night vision. This is boosting the video management software market.

Restraint: High risks of content duplicity

With the rapid development of technology, especially with the maturity of video management, more and more companies are selecting video management software to provide dedicated storage, disruption-free streaming, and enhanced security surveillance to their customers. Video management service providers are under pressure to produce a profit as content development costs rise. Companies are oblivious to many stages of video content delivery, causing them to spend more than necessary on video capturing. Video content duplication has been a popular method in content creation across the world. Such issues also raise the overall cost structure. The threat of video content commodification is always present for video management distributors.

Opportunity: Rise in demand for live and recorded videos

A video management software utilizes analytic data from cameras in a retail environment and displays it to help in making decisions on where to locate items on the store. It can also be used with artificial intelligence (AI) facial recognition technology to identify known offenders. It can also be used in concerts with access control to help fortify entry procedures or alert users of possible events. Large corporations and educational institutions use it widely for a variety of purposes, including corporate training, executive communication, event broadcasting, and knowledge management. Video content management (VCM) solutions offer a low-cost infrastructure for addressing video buffering issues. VCM frequently distributes captured videos in segments. With cache proxies installed throughout the WANs, this helps the video material sink well.

Challenge: Growing risk of video content security

There is a risk of cyber assaults and recording delays as the use of video management solution grows. The safety of video content has become increasingly important. Video management solutions providers need to develop and provide video management solutions for end users. Video management service providers are concerned about the security and privacy of video content shared across numerous platforms. To address these issues, businesses must restructure their plans for using enterprise video settings before implementing them.

By Component, the services segment to have a higher growth during the forecast period

The VMS industry is divided into two categories based on services: professional services and managed services . Education, training and certification services, consulting services, planning, implementation and management services, and support and maintenance services are all included in the professional services section. As most of the end users lack the technical competence required to store and handle video data, professional service providers offer solutions to this problem. Managed services are those provided by third-party vendors; they help manage an enterprises operating difficulties. The overall services segment has a major influence on the VMS market. It helps in reducing costs, increasing the overall revenue, and improving performance.

By deployment mode, the cloud segment to dominate the market during the forecast period

Cloud deployment allows for offloading some management duties and maintenance costs to the service provider. The cloud deployment model identifies the specific type of cloud environment based on ownership, scale, and access, as well as the clouds nature and purpose. The location of the servers that users utilize and control are defined by a cloud deployment model. VMS solutions are accessed via the Internet and hosted by third-party VMS providers. The video recording, controlling, and video management are performed by the cloud. Cloud-based VMS solutions are more in demand due to their scalability, lower CAPEX, and pay-as-you-go model. SMEs are the key adopters of cloud-based VMS solutions, as it is very cost-effective for them. Apart from this, cloud-based VMS solutions have several benefits, such as no need for on-site servers, rapid deployment of solutions without configuration, and easy access through the Internet. Cloud-based VMS solutions have been majorly adopted by retail, residential, small offices, and logistics customers.

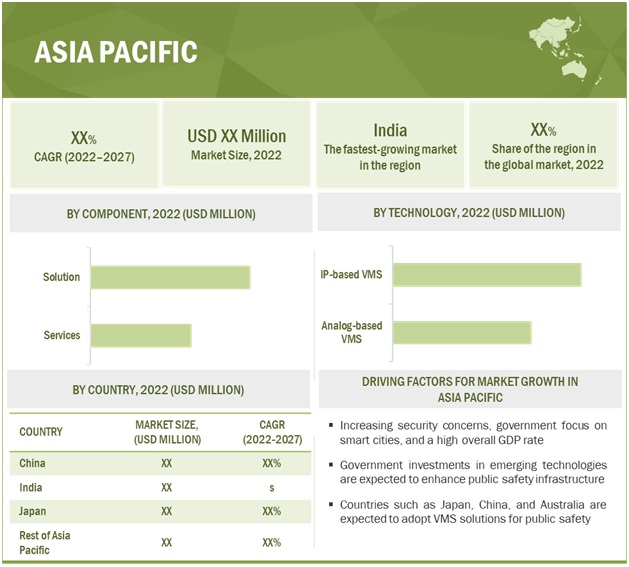

APAC to grow at the second-highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the video management software market owing to heavy investments in infrastructure and smart city projects. The use of security cameras in the region is expected to increase owing to the massive deployment of city surveillance networks in China to monitor millions of citizens across the country. The increasing urbanization in the region has led to the development of new cities, manufacturing industries, and retail industries. The rising penetration of surveillance cameras in small and medium-sized enterprises, hospitality businesses, airports, ATMs, banks, residential buildings, and religious places, among others, is also expected to drive the video management software market. Major players in the region include Dahua Technology (China), Hikvision (China), and Hanwha Techwin (South Korea).

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players video management system market. It profiles major vendors in the market. The major vendors in the market include Bosch (Germany), Hanwha Techwin Co (South Korea), Honeywell International (US), Schneider Electric (France), Axis Communications (Sweden), Johnson Controls International (Ireland), Hikvision Digital (China), Netapp (US), Dahua Technology (China), Kedacom (China), Verint Systems (US), Mindtree (India), Axxonsoft (US), eInfochips (US), Avigilon Corporation (Canada), Panasonic i-PRO Sensing Solutions (US), Panopto (US), Backstreet Surveillance (US), Eagle Eye (US), Arcules (US), Rhombus (US), ButterflyMX (US), Qumulex (US), Hakimo (US), Sighthound (UK), Camcloud (Canada), Pelco (US), Genetec (Canada), Verkada (US), Milestone Systems (Denmark), identiv (US), March Networks (Canada), IndigoVision (US), Qognify (US), Senstar (Canada), Exacq technologies (US), and American Dynamics (US). These players have adopted various strategies to grow in the global offering market. The study includes an in-depth competitive analysis of these key players in the offering video management system market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, technology, deployment mode, organization size, application, vertical, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Bosch (Germany), Hanwha Techwin Co (South Korea), Honeywell International (US), Schneider Electric (France), Axis Communications (Sweden), Johnson Controls International (Ireland), Hikvision Digital (China), Netapp (US), Dahua Technology (China), Kedacom (China), Verint Systems (US), Mindtree (India), Axxonsoft (US), eInfochips (US), Avigilon Corporation (Canada), Panasonic i-PRO Sensing Solutions (US), Panopto (US), Backstreet Surveillance (US), Eagle Eye (US), Arcules (US), Rhombus (US), ButterflyMX (US), Qumulex (US), Hakimo (US), Sighthound (UK), Camcloud (Canada), Pelco (US), Genetec (Canada), Verkada (US), Milestone Systems (Denmark), identiv (US), March Networks (Canada), IndigoVision (US), Qognify (US), Senstar (Canada), Exacq technologies (US), and American Dynamics (US. |

This research report categorizes the video management software market to forecast revenues and analyze trends in each of the following subsegments:

Video Management System Market By Component:

- Solution

- Services

- Professional Services

- Managed Services

By Technology:

- Analog-based VMS

- IP-based VMS

Video Management System Market By Deployment Type:

- On-Premises

- Cloud

By Organization Size:

- Large enterprises

- SMEs

Video Management System Market By Application:

- Mobile Application

- Intelligent Streaming

- Security and Surveillance

- Storage Management

- Video Intelligent

- Data Integration

- Case Management

- Advanced Video Management

- Custom Application Management

- Navigation Management

By Vertical:

- BFSI

- Healthcare and Lifesciences

- Retail

- IT

- Manufacturing and Automotive

- Tourism and Hospitality

- Government and Public Sector

- Education

- Media and Entertainment

- Transportation and Logistics

- Others

Video Management System Market By Region:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Middle East and Africa

- Middle East

- Africa

- Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments in Video Management System Market:

- In July 2021, Bosch announced the launch of its new FLEXIDOME panoramic 5100i camera range, which includes indoor and outdoor IR models offering 6- or 12- megapixel resolution with a stereographic fish-eye lens. The cameras also feature a built-in microphone array.

- In April 2021, Bosch introduced its new FLEXIDOME multi 7000i camera family offering IR and non-IR models that provide 12- or 20- megapixel resolution to deliver highly detailed multidirectional overviews.

- In April 2021, Axis Communications announced that it is selling its subsidiary Citilog (France) to TagMaster (Sweden), an application-driven technology company with business areas, including traffic solutions and rail solutions. The transaction is expected to close on April 30, wherein Axis is expected to continue to cooperate with Citilog and TagMaster as partners.

- In February 2021, Honeywell announced the expansion of the capabilities of its MAXPRO Cloud portfolio with the launch of the MPA1 and MPA2 access control panels that offer cloud, web-based, or on-premises hosting options. This development is expected to improve productivity, reduce the cost of ownership, and enhance security and control over the business

- In January 2021, Hanwha Techwin announced the launch of six new PTZ PLUS cameras in compact and lightweight design, which are 65% lighter than conventional PTZ cameras.

Frequently Asked Questions (FAQ):

How is the video management system market expected to grow in the next five years?

According to MarketsandMarkets, the video management system market size is expected to grow USD 10.9 billion in 2022 to USD 31.0 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 23.1% during the forecast period.

Which region has the largest market share in the video management system market?

Asia Pacific is estimated to hold the largest market share in video management system market in 2022. Asia Pacific is one of the technologically advanced markets in the world. It drives the large-scale implementation video management system market in the China.

What are the major factors driving video management system market?

The major drivers video management system market are increasing security surveillance and increasing demand for high quality videos.

Who are the major vendors in video management system market?

Major vendors in video management system market include Bosch (Germany), Hanwha Techwin Co (South Korea), Honeywell International (US), Schneider Electric (France), Axis Communications (Sweden), Johnson Controls International (Ireland), Hikvision Digital (China), Netapp (US), Dahua Technology (China), Kedacom (China), Verint Systems (US), Mindtree (India), Axxonsoft (US), eInfochips (US), Avigilon Corporation (Canada), Panasonic i-PRO Sensing Solutions (US), Panopto (US), Backstreet Surveillance (US), Eagle Eye (US), Arcules (US), Rhombus (US), ButterflyMX (US), Qumulex (US), Hakimo (US), Sighthound (UK), Camcloud (Canada), Pelco (US), Genetec (Canada), Verkada (US), Milestone Systems (Denmark), identiv (US), March Networks (Canada), IndigoVision (US), Qognify (US), Senstar (Canada), Exacq technologies (US), and American Dynamics (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 20182021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 VIDEO MANAGEMENT SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

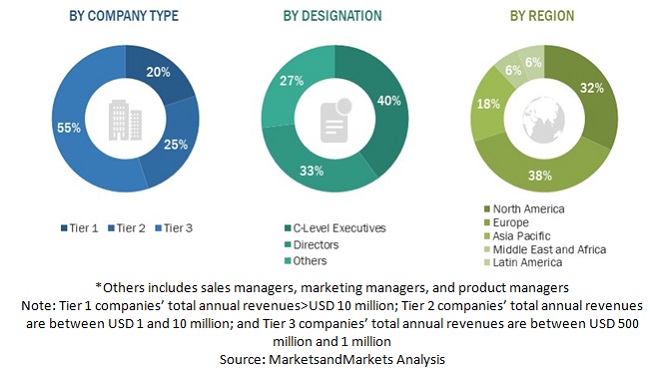

FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 VIDEO MANAGEMENT SOFTWARE MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH: SUPPLY-SIDE ANALYSIS (1/2)

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH: SUPPLY-SIDE ANALYSIS (2/2)

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS): MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

TABLE 3 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 VIDEO MANAGEMENT SOFTWARE MARKET, 20202027

FIGURE 8 LEADING SEGMENTS IN MARKET IN 2022

FIGURE 9 MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

FIGURE 10 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

4.2 MARKET, BY DEPLOYMENT MODE

FIGURE 12 ON-PREMISES SEGMENT TO LEAD MARKET

4.3 NORTH AMERICAN MARKET, BY COMPONENT AND COUNTRY (2022)

FIGURE 13 SOLUTION SEGMENT AND US TO ACCOUNT FOR HIGHEST MARKET SHARES IN NORTH AMERICA

4.4 ASIA PACIFIC VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT AND COUNTRY (2022)

FIGURE 14 SOLUTION SEGMENT AND CHINA TO ACCOUNT FOR HIGHEST MARKET SHARES IN ASIA PACIFIC

4.5 MARKET, BY COUNTRY

FIGURE 15 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN VIDEO MANAGEMENT SOFTWARE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing security surveillance

5.2.1.2 Rise in technological advancements

5.2.1.3 Increasing demand for high-quality videos

5.2.2 RESTRAINTS

5.2.2.1 High risk of content duplicity

FIGURE 17 RISING PERCENTAGE OF THEFT AND FRAUD, 20162021

5.2.2.2 Network connectivity and infrastructure issues

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for live and recorded videos

FIGURE 18 ADOPTION OF VIDEO SURVEILLANCE ACROSS REGIONS

5.2.3.2 Growth in demand for real-time video services

5.2.4 CHALLENGES

5.2.4.1 Security risks of video content

5.2.4.2 Poor internet speed

FIGURE 19 CYBER CRIME COMPLAINTS, 20162021

5.3 INDUSTRY TRENDS

5.3.1 VALUE CHAIN

FIGURE 20 VIDEO MANAGEMENT SOFTWARE MARKET: ECOSYSTEM

5.3.2 ECOSYSTEM

TABLE 4 MARKET: ECOSYSTEM

5.4 PORTERS FIVE FORCES MODEL

TABLE 5 MARKET: PORTERS FIVE FORCES MODEL

FIGURE 21 MARKET: PORTERS FIVE FORCES MODEL

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF BUYERS

5.4.4 BARGAINING POWER OF SUPPLIERS

5.4.5 COMPETITIVE RIVALRY

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.5.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE

5.6.2 MACHINE LEARNING

5.6.3 VIDEO ANALYTICS

5.6.4 CLOUD COMPUTING

5.6.5 EDGE COMPUTING

5.6.6 INTERNET OF THINGS (IOT)

5.7 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 24 REVENUE SHIFT FOR VIDEO MANAGEMENT SOFTWARE MARKET

5.7.1 PATENT ANALYSIS

FIGURE 25 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 8 TOP 20 PATENT OWNERS

FIGURE 26 NUMBER OF PATENTS GRANTED DURING 2012-2021

5.7.2 PRICING ANALYSIS

TABLE 9 PRICING MODELS AND INDICATIVE PRICE POINT

5.8 USE CASES

5.8.1 USER-FRIENDLY SOLUTION SLASHES TIME SPENT ON VIDEO CREATION

5.8.2 EASILY ACCESSIBLE AND SIMPLIFIED REMOTE MONITORING OF REAL-TIME ACTIVITIES

5.8.3 NEMOURS CHILDRENS HOSPITAL INTEGRATES AXIS CAMERAS

5.9 KEY CONFERENCES & EVENTS IN 2022

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 TARIFF AND REGULATORY IMPACT

5.10.1 SOC2

5.10.2 DIGITAL MILLENNIUM COPYRIGHT ACT

5.10.3 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.10.4 NORTH AMERICA

5.10.5 EUROPE

5.10.6 ASIA PACIFIC

5.10.7 MIDDLE EAST & AFRICA

5.10.8 LATIN AMERICA

5.11 COVID-19-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.11.1 OVERVIEW

5.11.2 DRIVERS AND OPPORTUNITIES

5.11.3 RESTRAINTS AND CHALLENGES

5.11.4 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 VIDEO MANAGEMENT SOFTWARE MARKET, BY COMPONENT (Page No. - 76)

6.1 INTRODUCTION

6.1.1 MARKET, BY COMPONENT: COVID19 IMPACT

6.1.2 MARKET, BY COMPONENT: DRIVERS

FIGURE 27 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

6.2 SOLUTION

TABLE 14 SOLUTION: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 15 SOLUTION: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

6.3 SERVICES

FIGURE 28 PROFESSIONAL SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 SERVICES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

TABLE 18 MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 19 MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

TABLE 20 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

6.3.2 MANAGED SERVICES

TABLE 22 MANAGED SERVICES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 23 MANAGED SERVICES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

7 VIDEO MANAGEMENT SOFTWARE MARKET, BY TECHNOLOGY (Page No. - 84)

7.1 INTRODUCTION

7.1.1 MARKET, BY TECHNOLOGY: COVID-19 IMPACT

7.1.2 MARKET, BY TECHNOLOGY: DRIVERS

FIGURE 29 IP-BASED SEGMENT TO RECORD HIGHER CAGR

TABLE 24 MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 25 MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

7.2 ANALOG-BASED VMS

TABLE 26 ANALOG-BASED MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 27 ANALOG-BASED MARKET SIZE, BY REGION, 20222027 (USD MILLION)

7.3 IP-BASED VMS

TABLE 28 IP-BASED MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 29 IP-BASED MARKET SIZE, BY REGION, 20222027 (USD MILLION)

8 VIDEO MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE (Page No. - 89)

8.1 INTRODUCTION

8.1.1 MARKET, BY DEPLOYMENT MODE: COVID-19 IMPACT

8.1.2 MARKET, BY DEPLOYMENT MODE: DRIVERS

FIGURE 30 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 30 MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 31 MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

8.2 CLOUD

TABLE 32 CLOUD: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

8.3 ON-PREMISES

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

9 VIDEO MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 94)

9.1 INTRODUCTION

9.1.1 MARKET, BY ORGANIZATION SIZE: COVID-19 IMPACT

9.1.2 MARKET, BY ORGANIZATION SIZE: DRIVERS

FIGURE 31 LARGE ENTERPRISES SEGMENT TO LEAD MARKET

TABLE 36 MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 37 MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

9.2 LARGE ENTERPRISES

TABLE 38 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 39 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

TABLE 40 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10 VIDEO MANAGEMENT SOFTWARE MARKET, BY APPLICATION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 32 STORAGE MANAGEMENT AND DATA INTEGRATION SEGMENTS TO GROW AT HIGH CAGR

TABLE 42 MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 43 MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

10.1.1 MARKET, BY APPLICATION: COVID-19 IMPACT

10.1.2 MARKET, BY APPLICATION: DRIVERS

10.2 MOBILE APPLICATION

TABLE 44 MOBILE APPLICATION: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 45 MOBILE APPLICATION: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.3 INTELLIGENT STREAMING

TABLE 46 INTELLIGENT STREAMING: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 47 INTELLIGENT STREAMING: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.4 SECURITY AND SURVEILLANCE

TABLE 48 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 49 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.5 STORAGE MANAGEMENT

TABLE 50 STORAGE MANAGEMENT: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 51 STORAGE MANAGEMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.6 VIDEO INTELLIGENCE

TABLE 52 VIDEO INTELLIGENCE: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 53 VIDEO INTELLIGENCE: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.7 DATA INTEGRATION

TABLE 54 DATA INTEGRATION: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 55 DATA INTEGRATION: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.8 CASE MANAGEMENT

TABLE 56 CASE MANAGEMENT: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 57 CASE MANAGEMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.9 ADVANCED VIDEO MANAGEMENT

TABLE 58 ADVANCED VIDEO MANAGEMENT: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 59 ADVANCED VIDEO MANAGEMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.10 CUSTOM APPLICATION MANAGEMENT

TABLE 60 CUSTOM APPLICATION MANAGEMENT: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 61 CUSTOM APPLICATION MANAGEMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

10.11 NAVIGATION MANAGEMENT

TABLE 62 NAVIGATION MANAGEMENT: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 63 NAVIGATION MANAGEMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11 VIDEO MANAGEMENT SOFTWARE MARKET, BY VERTICAL (Page No. - 113)

11.1 INTRODUCTION

11.1.1 MARKET, BY VERTICAL: COVID-19 IMPACT

11.1.2 MARKET, BY VERTICAL: DRIVERS

FIGURE 33 TRANSPORTATION & LOGISTICS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 65 MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

TABLE 66 BFSI: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 67 BFSI: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.3 HEALTHCARE & LIFE SCIENCES

TABLE 68 HEALTHCARE & LIFE SCIENCES: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 69 HEALTHCARE & LIFE SCIENCES: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.4 RETAIL

TABLE 70 RETAIL: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 71 RETAIL: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.5 INFORMATION TECHNOLOGY (IT)

TABLE 72 IT: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 73 IT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.6 MANUFACTURING & AUTOMOTIVE

TABLE 74 MANUFACTURING & AUTOMOTIVE: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 75 MANUFACTURING & AUTOMOTIVE: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.7 TOURISM & HOSPITALITY

TABLE 76 TOURISM & HOSPITALITY: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 77 TOURISM & HOSPITALITY: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.8 GOVERNMENT & PUBLIC SECTOR

TABLE 78 GOVERNMENT & PUBLIC SECTOR: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 79 GOVERNMENT & PUBLIC SECTOR: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.9 EDUCATION

TABLE 80 EDUCATION: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 81 EDUCATION: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.10 MEDIA & ENTERTAINMENT

TABLE 82 MEDIA & ENTERTAINMENT: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 83 MEDIA & ENTERTAINMENT: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.11 TRANSPORTATION & LOGISTICS

TABLE 84 TRANSPORTATION & LOGISTICS: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 85 TRANSPORTATION & LOGISTICS: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

11.12 OTHER VERTICALS

TABLE 86 OTHER VERTICALS: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 87 OTHER VERTICALS: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

12 VIDEO MANAGEMENT SOFTWARE MARKET, BY REGION (Page No. - 128)

12.1 INTRODUCTION

12.1.1 COVID-19 IMPACT

FIGURE 34 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

TABLE 88 MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 89 MARKET SIZE, BY REGION, 20222027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: REGULATIONS

12.2.2.1 Health Insurance Portability and Accountability Act (HIPAA)

12.2.2.2 California Consumer Privacy Act (CCPA)

12.2.2.3 Federal Information Security Management Act (FISMA)

12.2.2.4 Federal Information Processing Standards (FIPS)

FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 95 NORTH AMERICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 102 NORTH AMERICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20162021 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20222027 (USD MILLION)

12.2.3 UNITED STATES (US)

12.2.3.1 Increased need for higher security in public places to drive market

TABLE 106 UNITED STATES: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 110 UNITED STATES: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 112 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 113 UNITED STATES: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 114 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 115 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 116 UNITED STATES: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 117 UNITED STATES: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 118 UNITED STATES: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 119 UNITED STATES: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

12.2.4 CANADA

12.2.4.1 Public-private partnerships to boost market

TABLE 120 CANADA: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 121 CANADA: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 122 CANADA: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 123 CANADA: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 124 CANADA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 125 CANADA: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 126 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 127 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 128 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 129 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 130 CANADA: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 131 CANADA: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 132 CANADA: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 133 CANADA: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: REGULATIONS

12.3.2.1 European Market Infrastructure Regulation (EMIR)

12.3.2.2 General Data Protection Regulation (GDPR)

12.3.2.3 European Committee for Standardization (CEN)

12.3.2.4 European Technical Standards Institute (ETSI)

TABLE 134 EUROPE: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 135 EUROPE: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 136 EUROPE: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 138 EUROPE: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 140 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 142 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 143 EUROPE: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 144 EUROPE: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY COUNTRY, 20162021 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE, BY COUNTRY, 20222027 (USD MILLION)

12.3.3 UNITED KINGDOM (UK)

12.3.3.1 Adoption of intelligent video management systems across various verticals to drive market

TABLE 150 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 151 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 152 UNITED KINGDOM: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 153 UNITED KINGDOM: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 154 UNITED KINGDOM: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 155 UNITED KINGDOM: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 156 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 157 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 158 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 163 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Need for stringent security due to increase in crimes to propel market

12.3.5 GERMANY

12.3.5.1 Increased adoption of video management software across various verticals to favor market growth

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: VIDEO MANAGEMENT SOFTWARE MARKET DRIVERS

12.4.2 ASIA PACIFIC: REGULATIONS

12.4.2.1 Privacy Commissioner for Personal Data (PCPD)

12.4.2.2 Act on the Protection of Personal Information (APPI)

12.4.2.3 Critical Information Infrastructure (CII)

12.4.2.4 International Organization for Standardization (ISO) 27001

12.4.2.5 Personal Data Protection Act (PDPA)

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 170 ASIA PACIFIC: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20162021 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20222027 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Huge investments by government in infrastructure and public security projects to favor market growth

TABLE 180 CHINA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 181 CHINA: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 182 CHINA: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 183 CHINA: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 184 CHINA: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 187 CHINA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 188 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 189 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 190 CHINA: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 191 CHINA: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 192 CHINA: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 193 CHINA: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

12.4.4 INDIA

12.4.4.1 Rapid growth in technology innovations and government initiatives to be market driver

12.4.5 JAPAN

12.4.5.1 Rapid deployment of advanced security systems across public infrastructure to drive market

12.4.6 REST OF ASIA PACIFIC

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: VIDEO MANAGEMENT SOFTWARE MARKET DRIVERS

12.5.2 MIDDLE EAST & AFRICA: REGULATIONS

12.5.2.1 Israeli Privacy Protection Regulations (Data Security), 57772017

12.5.2.2 Cloud Computing Framework (CCF)

12.5.2.3 GDPR Applicability in KSA

12.5.2.4 Protection of Personal Information (POPI) Act

TABLE 194 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 20162021 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET SIZE, BY REGION, 20222027 (USD MILLION)

12.5.3 MIDDLE EAST

12.5.3.1 Initiatives by governments to drive market

TABLE 210 MIDDLE EAST: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 211 MIDDLE EAST: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 212 MIDDLE EAST: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 213 MIDDLE EAST: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 214 MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 215 MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 216 MIDDLE EAST: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 217 MIDDLE EAST: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 218 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 219 MIDDLE EAST: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 220 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 221 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 222 MIDDLE EAST: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 223 MIDDLE EAST: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

12.5.4 AFRICA

12.5.4.1 Governments initiatives and investments to spur market growth

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: MARKET DRIVERS

12.6.2 LATIN AMERICA: REGULATIONS

12.6.2.1 Brazil Data Protection Law

12.6.2.2 Federal Law on Protection of Personal Data Held by Individuals

TABLE 224 LATIN AMERICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 20162021 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 20222027 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET SIZE, BY SERVICES, 20162021 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET SIZE, BY SERVICES, 20222027 (USD MILLION)

TABLE 228 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 20162021 (USD MILLION)

TABLE 229 LATIN AMERICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY TECHNOLOGY, 20222027 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20162021 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 20222027 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20162021 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 20222027 (USD MILLION)

TABLE 234 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 20162021 (USD MILLION)

TABLE 235 LATIN AMERICA: VIDEO MANAGEMENT SOFTWARE MARKET SIZE, BY APPLICATION, 20222027 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20162021 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 20222027 (USD MILLION)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20162021 (USD MILLION)

TABLE 239 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 20222027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 Governments investments in video surveillance to support market growth

12.6.4 BRAZIL

12.6.4.1 Governments strong focus on public safety to drive market

12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 199)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 37 MARKET EVALUATION FRAMEWORK, 20192021

13.3 COMPETITIVE SCENARIO AND TRENDS

13.3.1 PRODUCT LAUNCHES

TABLE 240 VIDEO MANAGEMENT SOFTWARE MARKET: PRODUCT LAUNCHES, 2019-2021

13.3.2 DEALS

TABLE 241 MARKET: DEALS, 2019-2021

13.3.3 OTHERS

TABLE 242 MARKET: OTHER DEVELOPMENTS, 2019-2020

13.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 243 MARKET: DEGREE OF COMPETITION

FIGURE 38 MARKET SHARE ANALYSIS OF COMPANIES IN VIDEO MANAGEMENT SOFTWARE MARKET

13.5 HISTORICAL REVENUE ANALYSIS

FIGURE 39 HISTORICAL REVENUE ANALYSIS, 20172021

13.6 COMPANY EVALUATION MATRIX OVERVIEW

13.7 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 244 PRODUCT FOOTPRINT WEIGHTAGE

13.7.1 STARS

13.7.2 EMERGING LEADERS

13.7.3 PERVASIVE PLAYERS

13.7.4 PARTICIPANTS

FIGURE 40 VIDEO MANAGEMENT SOFTWARE MARKET, COMPANY EVALUATION MATRIX, 2022

13.8 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

TABLE 245 COMPANY PRODUCT FOOTPRINT

TABLE 246 COMPANY COMPONENT FOOTPRINT

TABLE 247 COMPANY VERTICAL FOOTPRINT

TABLE 248 COMPANY REGION FOOTPRINT

13.9 MARKET RANKING ANALYSIS OF COMPANIES

FIGURE 41 RANKING OF KEY PLAYERS IN MARKET, 2022

13.10 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 42 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 249 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 DYNAMIC COMPANIES

13.10.4 STARTING BLOCKS

FIGURE 43 MARKET, STARTUP/SME EVALUATION MATRIX, 2022

13.11 COMPETITIVE BENCHMARKING FOR SMES/STARTUPS

TABLE 250 VIDEO MANAGEMENT SOFTWARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 251 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

14 COMPANY PROFILES (Page No. - 221)

14.1 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Recent Developments, MnM View)*

14.1.1 BOSCH

TABLE 252 BOSCH: COMPANY OVERVIEW

FIGURE 44 BOSCH: COMPANY SNAPSHOT

TABLE 253 BOSCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 254 BOSCH: PRODUCT LAUNCHES

14.1.2 HANWHA TECHWIN CO

TABLE 255 HANWHA TECHWIN CO: COMPANY OVERVIEW

FIGURE 45 HANWHA TECHWIN CO: COMPANY SNAPSHOT

TABLE 256 HANWHA TECHWIN CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 257 HANWHA TECHWIN CO: PRODUCT LAUNCHES

TABLE 258 HANWHA TECHWIN CO: OTHERS

14.1.3 HONEYWELL INTERNATIONAL

TABLE 259 HONEYWELL INTERNATIONAL: COMPANY OVERVIEW

FIGURE 46 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

TABLE 260 HONEYWELL INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 261 HONEYWELL INTERNATIONAL: PRODUCT LAUNCHES

14.1.4 SCHNEIDER ELECTRIC

TABLE 262 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

FIGURE 47 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 263 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.5 AXIS COMMUNICATIONS

TABLE 264 AXIS COMMUNICATIONS: COMPANY OVERVIEW

FIGURE 48 AXIS COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 265 AXIS COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 266 AXIS COMMUNICATIONS: PRODUCT LAUNCHES

TABLE 267 AXIS COMMUNICATIONS: DEALS

TABLE 268 AXIS COMMUNICATIONS: OTHERS

14.1.6 JOHNSON CONTROLS INTERNATIONAL

TABLE 269 JOHNSON CONTROLS INTERNATIONAL: COMPANY OVERVIEW

FIGURE 49 JOHNSON CONTROLS INTERNATIONAL: COMPANY SNAPSHOT

TABLE 270 JOHNSON CONTROLS INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 JOHNSON CONTROLS INTERNATIONAL: PRODUCT LAUNCHES

14.1.7 HIKVISION DIGITAL

TABLE 272 HIKVISION DIGITAL: COMPANY OVERVIEW

FIGURE 50 HIKVISION DIGITAL: COMPANY SNAPSHOT

TABLE 273 HIKVISION DIGITAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 274 HIKVISION DIGITAL: PRODUCT LAUNCHES

TABLE 275 HIKVISION DIGITAL: DEALS

14.1.8 NETAPP

TABLE 276 NETAPP: COMPANY OVERVIEW

FIGURE 51 NETAPP: COMPANY SNAPSHOT

TABLE 277 NETAPP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

14.1.9 DAHUA TECHNOLOGY

TABLE 278 DAHUA TECHNOLOGY: COMPANY OVERVIEW

FIGURE 52 DAHUA TECHNOLOGY: COMPANY SNAPSHOT

TABLE 279 DAHUA TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 280 DAHUA TECHNOLOGY: PRODUCT LAUNCHES

TABLE 281 DAHUA TECHNOLOGY: DEALS

14.1.10 PELCO

TABLE 282 PELCO: COMPANY OVERVIEW

TABLE 283 PELCO: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 284 PELCO: PRODUCT LAUNCH

TABLE 285 PELCO: DEALS

14.1.11 KEDACOM

TABLE 286 KEDACOM: COMPANY OVERVIEW

TABLE 287 KEDACOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 288 KEDACOM: PRODUCT LAUNCHES

14.1.12 VERINT SYSTEMS

14.1.13 MINDTREE

14.1.14 AXXONSOFT

14.1.15 GENETEC

14.1.16 VERKADA

14.1.17 MILESTONE SYSTEMS

14.1.18 IDENTIV

14.1.19 MARCH NETWORKS

14.1.20 INDIGOVISION

14.1.21 EINFOCHIPS

14.1.22 QOGNIFY

14.1.23 SENSTAR

14.1.24 AVIGILON CORPORATION

14.1.25 EXACQ TECHNOLOGIES

14.1.26 AMERICAN DYNAMICS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.2 STARTUPS

14.2.1 PANASONIC I-PRO SENSING SOLUTIONS

14.2.2 PANOPTO

14.2.3 BACKSTREET SURVEILLANCE

14.2.4 EAGLE EYE

14.2.5 ARCULES

14.2.6 RHOMBUS

14.2.7 BUTTERFLYMX

14.2.8 QUMULEX

14.2.9 HAKIMO

14.2.10 SIGHTHOUND

14.2.11 CAMCLOUD

15 APPENDIX (Page No. - 282)

15.1 ADJACENT/RELATED MARKETS

15.1.1 INTRODUCTION

15.1.2 LIMITATIONS

15.2 VIDEO STREAMING SOFTWARE MARKET

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Video Streaming Software Market, By Component

TABLE 289 VIDEO STREAMING SOFTWARE MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 290 SOLUTIONS: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 291 SERVICES: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.2.2.2 Video Streaming Software Market, By Streaming type

TABLE 292 VIDEO STREAMING SOFTWARE MARKET SIZE, BY STREAMING TYPE, 20212026 (USD MILLION)

TABLE 293 LIVE STREAMING: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 294 VIDEO-ON-DEMAND STREAMING: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.2.2.3 Video Streaming Software Market, By Deployment Mode

TABLE 295 VIDEO STREAMING SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 296 ON-PREMISES: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

TABLE 297 CLOUD: VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.2.2.4 Video Streaming Software Market, By Vertical

TABLE 298 VIDEO STREAMING SOFTWARE MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

15.2.2.5 Video Streaming Software Market, By Region

TABLE 299 VIDEO STREAMING SOFTWARE MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.3 VIDEO ANALYTICS MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Video Analytics Market, By Component

TABLE 300 VIDEO ANALYTICS MARKET SIZE, BY COMPONENT, 20212026 (USD MILLION)

TABLE 301 SOFTWARE: VIDEO ANALYTICS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.3.2.2 Video Analytics Market, By Deployment Mode

TABLE 302 VIDEO ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 20212026 (USD MILLION)

TABLE 303 ON-PREMISES: VIDEO ANALYTICS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.3.2.3 Video Analytics Market, By Application

TABLE 304 VIDEO ANALYTICS MARKET SIZE, BY APPLICATION, 20212026 (USD MILLION)

15.3.2.4 Video Analytics Market, By Type

TABLE 305 VIDEO ANALYTICS MARKET SIZE, BY TYPE, 20212026 (USD MILLION)

15.3.2.5 Video Analytics Market, By Vertical

TABLE 306 VIDEO ANALYTICS MARKET SIZE, BY VERTICAL, 20212026 (USD MILLION)

15.3.2.6 Video Analytics Market, By Region

TABLE 307 VIDEO ANALYTICS MARKET SIZE, BY REGION, 20212026 (USD MILLION)

15.4 VIDEO SURVEILLANCE STORAGE MARKET

15.4.1 MARKET DEFINITION

15.4.2 MARKET OVERVIEW

15.4.2.1 Video Surveillance Storage Market, By Product

TABLE 308 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY PRODUCT, 20192025 (USD MILLION)

15.4.2.2 Video Surveillance Storage Market, By Storage Media

TABLE 309 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY STORAGE MEDIA, 20192025 (USD MILLION)

15.4.2.3 Video Surveillance Storage Market, By Deployment Mode

TABLE 310 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY DEPLOYMENT MODE, 20192025 (USD MILLION)

15.4.2.4 Video Surveillance Storage Market, By Enterprise Size

TABLE 311 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY ENTERPRISE SIZE, 20192025 (USD MILLION)

15.4.2.5 Video Surveillance Storage Market, By Application

15.4.2.6 Video Surveillance Storage Market, By Vertical

TABLE 312 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY VERTICAL, 20192025 (USD MILLION)

15.4.2.7 Video Surveillance Storage Market, By Region

TABLE 313 VIDEO SURVEILLANCE STORAGE MARKET SIZE, BY REGION, 20192025 (USD MILLION)

15.5 DISCUSSION GUIDE

15.6 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.7 AVAILABLE CUSTOMIZATIONS

15.8 RELATED REPORTS

15.9 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the video management software market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the video management software market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources; journals and various associations, have also been referred to for consolidating the report.

Secondary research was mainly used to obtain key information about industry insights, markets monetary chain, the overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the video management software market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing video management software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the video management software market. The first approach involved the estimation of the market size by summation of companies revenue generated through the video management software solutions and services. This entire procedure studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

The bottom-up procedure was employed to arrive at the overall size of the video management software market from the revenues of key players (companies) and their market shares. The calculation was done based on estimations, and by verifying key companies revenue through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of other individual segments (component, technology, deployment mode, organization size, application, vertical, and region) via the percentage splits of the markets segments from secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained. Market shares were then estimated for each company to verify revenue shares used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primary interviews, the exact values of the overall parent market size and its segments market size were determined and confirmed using this study.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes as explained abovethe market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global video management software market based on component (solution and services), technology, deployment mode, organization size, application, vertical, and region from 2016 to 2027, and analyze various macro and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key market players (such as top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the markets competitive landscape

- To track and analyze competitive developments, such as mergers & acquisitions (M&As), product developments, partnerships and collaborations, and research & development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Video Management System Market

Is the study will incorporate the latest impact of COVID-19 and recent research efforts/primary interviews? will the data captured be up-to-date and more relevant to your objectives? What are the key priorities areas across different Industry Verticals?