Vehicle Emission Standards & Impact Analysis – by Emission Regulations (Vehicle Type (Light Duty, Heavy Duty), Fuel Type (Gasoline, Diesel), Region (Europe, Asia-Oceania, North America, Row), and Automotive Regulatory Bodies) - Global Analysis and Forecast to 2020

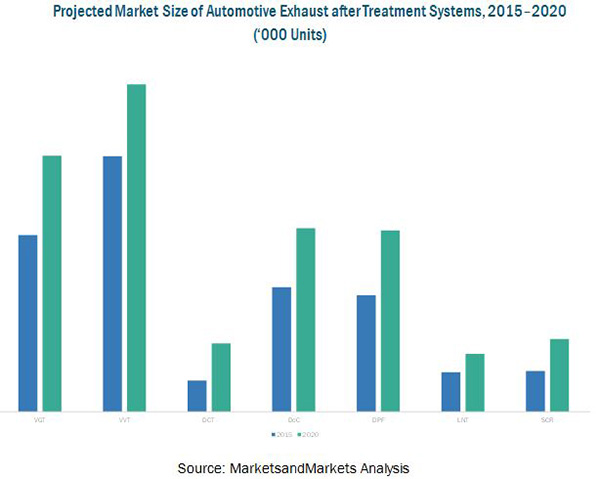

[79 Pages Report] Vehicle emission regulations are a set of guidelines/protocols for automotive component/vehicle design, manufacturing equipment, and exhaust aftertreatment system manufacture. The primary objective of these regulations is to minimize vehicle exhaust emissions. The automotive exhaust aftertreatment systems market, by volume, is projected to grow at a CAGR of 7.87% from 2015 to 2020. This growth can be attributed to the impact of current and pending emission regulations across the globe.

Exhaust aftertreatment systems play a key role in regulating exhaust emissions. Aftertreatment systems are mainly incorporated in vehicles with diesel engines. Diesel-propelled vehicles generate more harmful exhaust gases than those using gasoline, as gasoline has less impurities than diesel. The different diesel aftertreatment systems that have been considered in the study are the diesel particulate filter (DPF), which traps particulate matter present in the exhaust gas and collects the resultant soot; diesel oxidation catalyst (DOC), which breaks down carbon monoxide and hydrocarbons into carbon dioxide and water; lean NOx trap (LNT), which reduces the NO and NOx emissions generated during the lean burning of fuel; selective catalytic reduction (SCR), which breaks down harmful exhaust gases with the help of ceramic brick and precious metals such as platinum, palladium, and rhodium, which act as catalysts; variable valve timing (VVT), which alters the valve timing and lift event of valves; dual clutch transmission (DCT), which houses two separate clutches—one for odd and one for even gear sets—and eliminates the need for the torque converter; and variable geometry turbocharger (VGT), which helps reduce emissions and increases efficiency by allowing the effective aspect ratio (A:R) of the turbo to be altered as conditions change.

The research methodology used in the report involves various secondary sources, including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the automotive exhaust aftertreatment systems market.

The research design comprises current automotive emission regulations enforced in different regions and countries, along with planned automotive emission regulations and their potential impact on the overall automotive industry and its stakeholders.

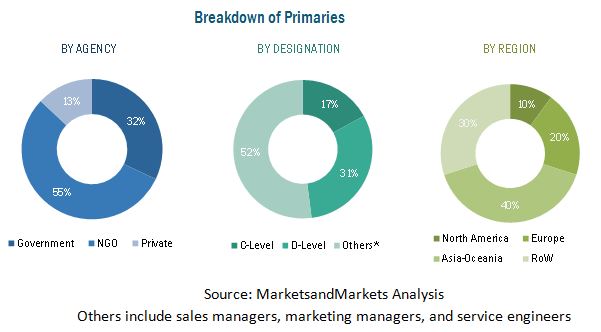

Regions covered include Asia-Pacific, Europe, North America, and the Rest of the World. Information regarding the current and planned regulations has been gathered from various secondary and primary sources, and their impact on the automotive value chain has been identified through extensive primary and secondary research. Primary research interviews have been conducted with key opinion leaders in the automotive industry such as CEOs, directors, industry experts, and other executives, regulatory bodies, and agencies to validate findings from the study.

The figure provided below illustrates the break-up of the profile of industry experts who participated in primary discussions.

The ecosystem of the automotive exhaust aftertreatment systems industry consists of research institutes such as the Automotive Research Association of India (ARAI), European Automotive Research Partners Association (EARPA), and the United States Council for Automotive Research (USCAR), and regional automobile associations such as China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), and the European Automobile Manufacturers Association (ACEA).

Target Audience

- Manufacturers of automotive exhaust aftertreatment systems

- Dealers and distributors of automotive exhaust aftertreatment systems

- Industry associations

- Investment firms

- Equity research firms

- Private equity firms

- Governments and regulatory authorities

Scope of the Report

- By Emission Regulation (Light-Duty and Heavy-Duty)

- By Fuel Type (Gasoline and Diesel)

- Impact Analysis

- By Region (North America, Asia-Pacific, Europe, and RoW)

Available Customizations

With the given market data, MarketsandMarkets can provide market data for the below categories:

- Further analysis of countries from the rest of Europe and rest of Asia-Oceania

The automotive exhaust aftertreatment systems market is estimated to be 141,366.05 Thousand units in 2015, and is projected to reach 206,430 Thousand units by 2020, growing at a CAGR of 7.87% during the forecast period. The automotive exhaust aftertreatment systems market has witnessed considerable growth in countries such as the U.S., China, India, and Mexico, owing to progressively stringent safety norms and increasing vehicle production. Stakeholders that would be affected by stringent emission regulations include vehicle manufacturers, component manufacturers, consumers, downstream stakeholders, and government regulatory bodies. The parameters that determine the exhaust emissions from vehicles are vehicular technology, quality of fuel, inspection and maintenance of the vehicle, and traffic management. Upcoming stringent automotive regulations are expected to create a strong link between the automotive industry and its stakeholders.

Asia-Oceania is projected to be the largest market for automotive exhaust aftertreatment systems during the forecast period. Regulatory bodies in India, Japan, and South Korea have increased the stringency of their emission norms/regulations to match those of Europe and the U.S. India skipping directly to BS VI emissions norms in 2020 would increase the demand for exhaust aftertreatment systems.

The North American automotive exhaust aftertreatment systems market is projected to grow at the highest CAGR from 2015 to 2020, as a result of stringent emission norms and high demand for low-emission vehicles, especially from the U.S. and Canada. Several OEMs are investing in the region, prompted by factors such as rigid emission regulations in the state of California and the high demand for ultra-low and super ultra-low emission vehicles. OEMs such as Toyota (Japan), Hyundai Motor Company (South Korea), and Honda Motor Company (Japan) are present in the region.

The market for automotive exhaust aftertreatment systems is mainly driven by emission regulations that mandate the installation of exhaust aftertreatment systems in vehicles. The automotive exhaust aftertreatment systems market has witnessed consistent growth, owing to stringent emission regulations across the globe. Exhaust aftertreatment system manufacturers are developing new and advanced exhaust aftertreatment technologies to comply with the emission regulations set by government regulatory bodies. Additionally, vehicle manufacturers are working on developing new design platforms to reduce the amount of pollutants emitted by vehicles.

Table of Contents

1 Introduction (Page No. - 7)

1.1 Objectives of the Study

1.2 Markets Scope

1.2.1 Markets Covered

1.3 Stakeholders

2 Research Methodology (Page No. - 9)

2.1 Research Data

2.2 Secondary Data

2.3 Key Data From Secondary Sources

2.4 Primary Data

2.4.1 Research Techniques & Data Collection Methods

2.4.2 Primary Participants

2.5 Factor Analysis

2.5.1 Introduction

2.5.2 Factors Considered for Increasing Emission Regulations

2.5.2.1 Increasing Vehicle Population vs Vehicular Emissions

2.5.2.2 Increasing Demand for Electric and Hybrid Electric Vehicles

2.5.2.3 Increasing Urbanization vs Passenger Car Per Thousand People

2.5.2.4 Technological Advancements

2.5.2.5 Influence of Other Factors

2.6 Assumptions

3 Stakeholders (Page No. - 19)

3.1 Vehicle Manufacturers

3.2 Component Manufacturers

3.3 Consumers

3.4 Downstream Stakeholders

3.5 Government Regulatory Authorities

4 Existing Vehicle Emission Regulations, By Region & Vehicle Type (Page No. - 26)

4.1 Europe

4.1.1 Europe Emission Regulations for Passenger Cars and Light-Duty Vehicles

4.1.1.1 Applicability

4.1.1.2 Fuels

4.1.1.3 Emission Testing

4.1.2 Europe 28 Emission Regulations for Heavy-Duty Vehicles

4.2 Asia-Oceania

4.2.1 India

4.2.2 China

4.2.2.1 Beijing Requirements

4.2.3 South Korea

4.2.4 Japan

4.3 North America

4.3.1 U.S.

4.3.1.1 U.S. Federal Standards

4.3.2 California Standards

4.3.2.1 Sftp Emission Standards

4.3.2.2 Tier 2 Emission Standards

4.3.2.3 Tier 3 Emission Standards

4.3.2.4 California Emission Standards

4.3.3 Canada

4.3.3.1 Tier 1 Standards

4.3.3.2 Tier 2 Standards

4.3.4 Mexico

4.3.5 Brazil

4.3.6 Russia

5 Impact Analysis (Page No. - 58)

5.1 Impact of Emission Regulations & Emission Reduction Technologies in Asia-Oceania

5.1.1 Impact Analysis of Emission Regulations in India

5.1.2 Impact Analysis of Emission Regulations in China

5.1.3 Impact Analysis of Emission Regulations in Japan

5.1.4 Impact Analysis of Emission Regulations in South Korea

5.2 Impact of Emission Regulations & Emission Reduction Technologies in Europe

5.3 Impact of Emission Regulations & Emission Reduction Technologies in North America

5.3.1 Impact Analysis of Emission Regulations in the U.S.

5.3.2 Impact Analysis of Emission Regulations in Canada

5.3.3 Impact Analysis of Emission Regulations in Mexico

5.4 Impact of Emission Regulations & Emission Reduction Technologies in RoW

5.4.1 Impact Analysis of Emission Regulations in Brazil

5.4.2 Impact Analysis of Emission Regulations in Russia

5.5 Impact of Emission Regulations on Automotive Stakeholders

5.5.1 Impact on OEMs & Tier-1 Manufacturers

5.5.2 Impact on Consumers

6 Automotive Regulatory Bodies, By Region (Page No. - 69)

6.1 Introduction

6.2 North America

6.2.1 U.S.

6.2.2 Canada

6.2.3 Mexico

6.3 Europe

6.4 Asia-Pacific

6.4.1 India

6.4.2 Japan

6.4.3 China

6.4.4 South Korea

6.5 Rest of the World

6.5.1 Brazil

6.5.2 Russia

7 Appendix (Page No. - 77)

7.1 Insights From Industry Experts

7.2 Discussion Guide

7.3 Introducing RT: Real Time Market Intelligence

7.4 Available Customizations

7.4.1 Regional Analysis

7.4.2 Company Information

7.5 Related Reports

List of Tables (53 Tables)

Table 1 EU Emission Regulations for Passenger Cars With Positive Ignition Engines

Table 2 EU Emission Regulations for Passenger Cars With Compression Ignition

Table 3 EU Emission Standards for Light Commercial Vehicles (Gasoline)

Table 4 EU Emission Standards for Light Commercial Vehicles (Diesel)

Table 5 EU Emission Standards for Heavy Commercial Vehicles in Steady State Testing

Table 6 EU Emission Standards for Heavy Commercial Vehicles in Transient Testing

Table 7 Indian Emission Standards (4–Wheel Vehicles)

Table 8 Emission Standards for Passenger Cars (Gasoline Vehicles)

Table 9 Emission Standards for Passenger Cars (Diesel)

Table 10 Emissions Standards for Heavy Commercial Vehicles (GVW > 3,500 Kg)

Table 11 Implementation Date of Emission Standards for Passenger Cars and Light Duty Trucks

Table 12 Emission Standards in China for Passenger Cars and Light-Duty Vehicles (Gasoline)

Table 13 Emission Standards in China for Passenger Cars and Light-Duty Vehicles (Diesel)

Table 14 Implementation Date of Emission Standards for Heavy-Duty Vehicles

Table 15 WHTC Cycle Emission Limits for China Iv and V

Table 16 Emissions Standards in China for Heavy-Duty Vehicles

Table 17 Emission Regulation in South Korea for Diesel Passenger Cars

Table 18 Emission Regulations for Light-Duty Diesel Vehicles

Table 19 Emission Regulations for Heavy-Duty Diesel Vehicles

Table 20 Emission Regulation for Gasoline Passenger Cars

Table 21 Emission Regulation for Diesel Passenger Cars

Table 22 Emission Regulations for Diesel Light Commercial Vehicles

Table 23 Emission Regulations for Gasoline and LPG Light Commercial Vehicles

Table 24 Emission Regulation for Diesel Heavy Commercial Vehicles

Table 25 Emission Regulations for Gasoline Heavy Commercial Vehicles

Table 26 Tier 1 Ftp (Federal Test Procedure) Standards for Passenger Cars and Light-Duty Trucks

Table 27 Tier 1 Sftp Standards for Passenger and Light-Duty Trucks

Table 28 Vehicle Categories Used in EPA Tier 2 Standards

Table 29 Tier 2 Emission Standards for Passenger Cars and Light-Duty Trucks

Table 30 Tier 3 Emission Standards for Passenger Cars and Light-Duty Trucks

Table 31 Lev Iii Emission Standards for Light and Medium Duty Vehicles

Table 32 U.S. EPA & California Emission Standards for Heavy-Duty Vehicles

Table 33 Tier 2 Bins, Maximum Allowed Grams Per Mile

Table 34 Emission Standards for Passenger Cars and Light-Duty Vehicle Based on U.S. EPA Standards

Table 35 Vehicle Emission Regulations for Passenger Cars and Light-Duty Vehicle Based on European Standards

Table 36 Vehicle Emission Standards for Heavy-Duty Gasoline Vehicles

Table 37 Vehicle Emission Standards for Heavy-Duty Diesel Vehicles

Table 38 Emission Standards for Passenger Cars

Table 39 Emission Standards for Light Commercial Vehicles

Table 40 Emission Standards for Heavy-Duty Vehicles

Table 41 Emission Standards in Russia for Passenger Cars & Light-Duty Vehicles

Table 42 Emission Standards in Russia for Heavy-Duty Vehicles

Table 43 Major Upcoming Regulations for Vehicle Emissions

Table 44 India: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 45 China: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 46 Japan: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 47 South Korea: Emission Reduction Market, By Technology Type, 2015–2020(‘000 Units)

Table 48 Europe: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 49 U.S.: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 50 Canada: Emission Reduction Market, By Technology Type, 2015–2020 (‘000 Units)

Table 51 Mexico: Emission Reduction Market, By Technology Type (‘000 Units)

Table 52 Brazil: Emission Reduction Market, By Technology Type (‘000 Units)

Table 53 Russia: Emission Reduction Market, By Technology Type (‘000 Units)

List of Figures (24 Figures)

Figure 1 Global Emission Regulations: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Significant Growth in Vehicle Production and Emissions Across the Europe

Figure 6 Significant Growth in Vehicle Production Across U.S. and Canada

Figure 7 Passenger Cars Per Capita vs Urban Population %, By Country, 2010–2011

Figure 8 Stakeholders Related to Automotive Emissions

Figure 9 Steps Taken By Vehicle Manufacturers to Reduce Emissions

Figure 10 Components Manufactured By Suppliers to Curb Emissions

Figure 11 Electric Vehicles vs Conventional Vehicles

Figure 12 Downstream Stakeholders Affected By Emission Regulations

Figure 13 Impact of Emission Regulations on OEMs & Tier-1 Manufacturers

Figure 14 Impact of Emission Regulations on Consumers

Figure 15 U.S. Emission Regulations Roadmap

Figure 16 Canadian Emission Regulations Roadmap

Figure 17 Mexican Emission Regulations Roadmap

Figure 18 European Emission Regulations Roadmap

Figure 19 Indian Emission Regulations Roadmap

Figure 20 Japanese Emission Regulations Roadmap

Figure 21 Chinese Emission Regulations Roadmap

Figure 22 South Korean Emission Regulations Roadmap

Figure 23 Brazilian Emission Regulations Roadmap

Figure 24 Russian Emission Regulations Roadmap

Growth opportunities and latent adjacency in Vehicle Emission Standards & Impact Analysis