All Wheel Drive Market by System (Automatic, Manual), Vehicle Type (Passenger & Commercial Vehicle), EV Type (BEV, PHEV), Component (Power Transfer Unit, Differential, Propeller Shaft, Transfer Case, Final Drive Unit) and Region - Global Forecast to 2027

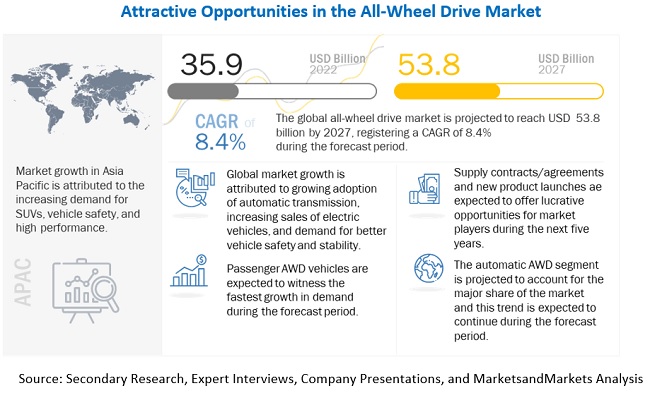

The global all wheel drive market size was estimated at USD 35.9 billion in 2022 and is anticipated to reach USD 53.8 billion by 2027, at a CAGR of 8.4%. Growing demand for SUVs, premium cars and, improved vehicle safety, stability, & enhanced driving dynamics are driving the demand for all wheel drive systems around the globe. The emission regulations and high fuel consumption are major challenges for all wheel drive system manufacturers.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increasing demand for improved vehicle safety, stability, & enhanced driving dynamics

According to the WHO Global Status Report on Road Safety, more than 1.24 million deaths occurred due to road accidents in 2010 globally. The increasing rate of accidents has incentivized countries to implement stringent vehicle safety norms. The European Union and the U.S. government are leaders, in terms of vehicle safety norms. As a result, OEMs are introducing vehicles with in-built safety features that control vehicle stability, safety, and provide enhanced driving dynamics. The all wheel drive(AWD) systems as compared to RWD or FWD systems add to the vehicle stability with better traction providing the capability to the automobile. Thus, in the developed regions such as Europe and North America, the demand for these multi-wheel drive systems is on the rise, however, in the emerging markets such as Asia-Pacific and the rest of the world, this growth is steady given the lack of any such safety regulations.

RESTRAINT: High cost of the all wheel drive system compared to 4WD and 2WD

The all wheel drive system is more expensive than the conventional two-wheel (FWD or RWD drive systems) drive vehicles. The cost of the AWD and 4x4 systems can range from $1,000 to $4,000, which depends on the type of the systems and components involved. Thus, this poses a restraint over the all-wheel drive market of the system, as it increases the overall cost of the vehicle. Even though the vehicles with AWD or 4WD systems offer better resale values, the initial cost of the vehicle is high. In addition to the high initial cost of the system, the AWD system is also expensive in terms of maintenance, since all the four tyres need to be changed together at once. Moreover, vehicles installed with the AWD or 4WD system do not offer great performance with normal or summer tires. These systems require all-season tires, which are costlier than the conventional tires meant for in-city driving. The use of differential in the multi-wheel drive system results in the extra cost of differential oil that is required for maintenance. The differential oil is not changed as frequently as engine oil; however, it still adds a cost of $30–$50 to the buyer’s pocket. Considering these factors, the associated cost of the vehicle with the AWD or 4WD systems is much higher than that of the conventional two-wheel (front or rear-wheel drive) drive vehicles. This can act as a restraint on the growth of all wheel drive systems.

OPPORTUNITY:Automatic AWD system

The automatic AWD system acts as a combination of all present systems such as 2WD and manual AWD. Functions of the present-day AWD-Disconnect system include detection of the need for AWD, detection of steering angle for the distribution of torque in a required ratio for turning wheels, using the electronic power steering for better angle detection, proper distribution of torque between the front and rear wheels separately, and so on. The system developed by Honda Motor Company can provide better performance and can respond to driver input and improves vehicle stability. It also combines front-rear torque distribution control with independently regulated torque distribution to the left and right rear wheels. This leads to the free distribution of the optimum amount of torque to all four wheels based on driving conditions. The key challenge in the development of such systems would be their compatibility with the hybrid or plug-in hybrid vehicles. Additionally, the cost of the new automatic AWD and its influence on the fuel efficiency of the vehicle would be the deciding factor in the demand for such systems.

CHALLENGE: Lack of awareness among consumers about the multi-wheel drive systems in developing nations

In the developed regions such as Europe and North America, due to bad weather conditions such as snowfall and heavy rains, the terrains become slippery and unfavourable for safe driving. This favours the incorporation of the AWD or 4WD system in the vehicle. However, in the Asia Pacific region, consumers are less aware of the advantages of this system, due to low exposure to such extreme weather conditions. Consumers own vehicles equipped with AWD systems or 4x4 systems but do not use them to their complete potential, given the lack of knowledge about the benefits offered by such systems. North America and Europe’s automobile markets are mature and people are aware of the latest trends whereas, in the Asia Pacific, the automobile market is still developing.

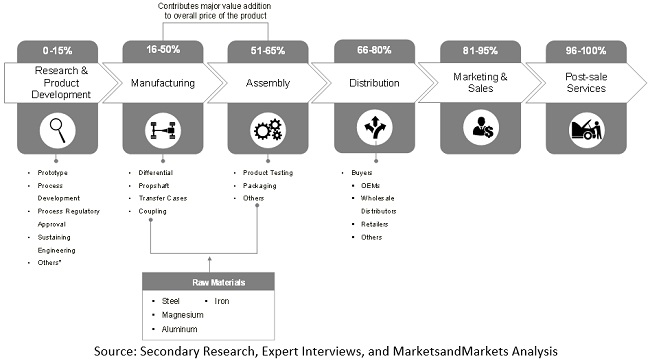

Supply Chain Analysis

The passenger car segment would lead the all wheel drive market during the forecast period, by vehicle type

Due to higher cost AWD systems were only popular with high-end (premium) passenger cars and SUVs. However, advancements in technology and increasing demand for a safe drive system for all climatic and road conditions have incentivized manufacturers to introduce the AWD drive system, which is cost-effective and can be available across all vehicle segments. Given this ‘buyer-driven demand’, OEMs have started introducing passenger cars and compact utility vehicles incorporated with automatic or manual AWD systems globally, without much addition to the overall cost of the vehicle. Looking at the advantages, these systems are also being introduced in the light commercial and heavy commercial vehicles. Growing demand for these systems has been observed in western countries as well as in the developing countries of Asia Pacific.

The automatic AWD segment would witness significantly faster growth than manual AWD during the forecast period

Manual and automatic AWD systems offer better traction, stability, torque, steering, and even distribution of weight. Safety standards, extreme weather conditions, and consumer preference for safety features are the key reasons for the growth of the AWD systems market in Europe and North America. The flaws associated with manual AWD systems such as high fuel consumption issues and high maintenance have been resolved to a certain extent by the introduction of intelligent AWD or disconnect and decoupling AWD systems. Thus, the market share of automatic AWD systems is set to surpass that of manual AWD systems. The RoW region comprises many developing economies such as Brazil and South Africa, with increasing purchasing power, customer preference for safety features, and road conditions being the factors driving the demand for automatic AWD systems.

Differentials would lead the all wheel drive components market

Automatic all wheel drive vehicles use a differential to maximize traction when needed. As the wheels begin to slip, more power is automatically directed to the wheels where there is no slippage. The driver in no way can switch from an all wheel drive mode into any other drive mode. However, the fuel efficiency provided by this system is comparatively lesser than that of 4WD, FWD or RWD systems. Thus, to overcome this problem, there is a disconnecting AWD system, which activates or deactivates the AWD system. The differential undergoes constant wear and tear due to its operations that cause overheating. There have been recent developments in the design that allows superior performance even in high-performance settings. For example, Torque Vectoring Differential (TVD) is an advanced electronic differential that regulates the torque distribution to the individual wheel, reducing the power loss and overheating.

BEV segment would hold the largest all wheel drive market share during the forecast period

Factors such as an increase in passenger safety regulations, straightforward design of EV AWD systems, and the need for higher performance are driving demand for AWD systems in BEVs. Moreover, BEVs are equipped with sophisticated computer systems and sensors, which reduce the cost incurred on auxiliary electronics systems. In an electric car, batteries are the most expensive component, and adding a second motor up front to deliver All Wheel drive is likely to make All Wheel-drive BEVs more affordable. Developments in AWD technologies would drive the market. For instance, in April 2022, Toyota launched the all-electric Toyota bZ4X SUV with AWD capability and X-MODE system. Another impressive feature of the AWD system is Grip-Control, a low-speed system that leverages motor drive power modulation to achieve capable off-road performance during turns.

Increasing demand for better performance and fuel efficiency is contributing would lead to higher growth rate of growth of eLSD differential

eLSD (Electric Limited Slip Differential) provides better handling in off-roading activities. Factors such as better fuel efficiency, lower probability of failure, and improved traction while cornering than LSD has resulted in higher growth in the adoption of electronic limited-slip differential.

Various OEMs are focusing on developing advanced electronic limited-slip differential for better efficiency and performance. For instance, in 2020, Eaton introduced InfiniTrac, an electronically controlled, hydraulically actuated, variable-bias limited-slip differential that delivers optimized vehicle performance at any speed and traction condition. This enhances vehicle stability control by redirecting power to the wheels with traction.

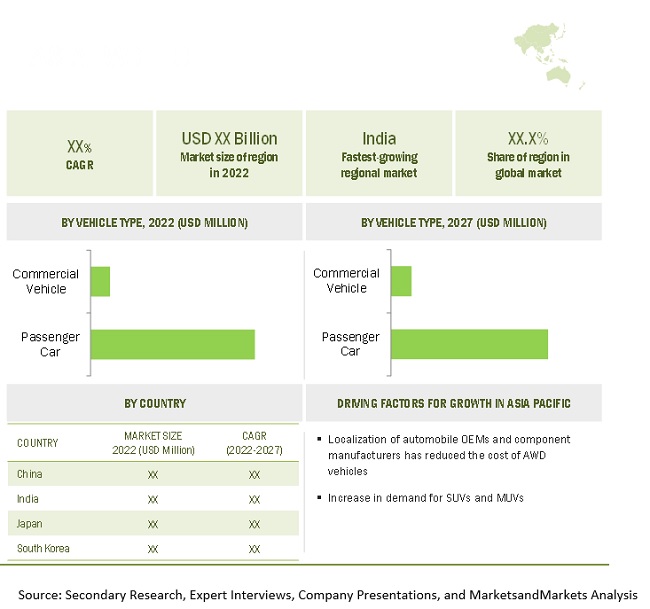

Asia Pacific is projected to be the largest market by 2027

The Asia Pacific region is one of the largest production and manufacturing hubs in the world. India and China have emerged as manufacturing hubs in the region, and their revenue from the automobile sector accounted for 7.1% and 2.3%, respectively, in 2021. The road networks of China and India are among the largest in the world. In 2019, according to the Road Chronicle, China and India were constructing roads at a rate of 47 km and 29 km per day, respectively. SUVs(Sports Utility Vehicles0 are the most popular vehicle in China and India, whereas sedans and MUVs(Multi Utility Vehicles) are popular in Japan and South Korea. Due to the increased demand for such AWD vehicles, the requirement for AWD systems is increasing.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players & Start-ups

The globally established players lead the all wheel drive market. These are - ZF Friedrichshafen AG (Germany), Continental AG (Germany), Magna International Inc. (Canada), BorgWarner Inc. (US), and JTEKT Corporation (Japan). These companies have developed new products; adopted expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing AWD market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By System Type, By Vehicle Type, By EV type, By Component, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America and Rest of the World |

|

Companies covered |

ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), BorgWarner Inc. (U.S.), Continental AG (Germany), and JTEKT Corporation (Japan) |

The study categorizes the all wheel drive market based on system type, vehicle type, EV type, component type, regional and global level.

Market, by System Type

- Automatic AWD

- Manual AWD

Market, by Vehicle Type

- Passenger Car

- Commercial Vehicle

Market, by EV type

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

Market, by Component

- Differential

- Transfer case

- Propeller shaft

- Power Transfer Unit

- Final Drive Unit

Market, by Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In March 2022, BorgWarner Inc. signed a supply contract with Hyundai. Under the contract, BorgWarner Inc. will supply an integrated drive module (iDM) for Hyundai’s upcoming A-segment electric vehicle production.

- In November 2021, American Axle & Manufacturing Inc. announced the manufacturing and assembling of 3-in-1 electric drive technology for REE Automotive Ltd. The electric drive units will be developed at American Axle & Manufacturing Inc.’s Advanced Technology and Development Center in Detroit with full volume production expected by 2024.

- In October 2020, Magna International Inc. signed its first EV component manufacturing deal with an EV startup. Fisker Inc. The California-based EV startup will utilize Magna’s automotive components to build its Ocean SUV.

- In June 2020, JTEKT Corporation and Plug and Play LLC, (known as a global innovation platform) signed an agreement to work on supporting and nurturing startups together with major global companies.

Frequently Asked Questions (FAQ):

How big is the all wheel drive market ?

The global all wheel drive market size is projected to grow from USD 35.9 billion in 2022 to USD 53.8 billion by 2027, at a CAGR of 8.4%.

Can you tell us who are the leading global all wheel drive manufacturers and what are strategies they have adopted?

- The global all wheel drive market is dominated by players such as ZF Friedrichshafen AG (Germany), Continental AG (Germany), Magna International Inc. (Canada), BorgWarner Inc. (US), and JTEKT Corporation (Japan).

- These companies invest heavily in product development and improvement. Further, expansion strategies such as collaborations, partnerships, mergers & acquisitions are prominently used to consolidate their position.

How does the demand for all wheel drive systems vary by region?

The global demand for all wheel drive has some variation as per the region as well as the vehicles used in the region. Further, car ownership and standard of living contribute to a preference for the type of AWD system used. For instance, the Asia Pacific region is estimated to be the largest market for passenger car AWD during the forecast period. Hence, an increase in sales of vehicles directly impact the demand for all wheel drive in the region. Whereas, the North American region has a high demand for automatic AWD therefore, the demand for system type of AWD changes with different regions.

Which Electric Vehicles (EV) use AWD at present? How the demand would shift in future?

- The BEV (Battery Electric Vehicle) uses the AWD system extensively due to its advantages such as better handling and vehicle safety.

- The PHEV (Plugin Hybrid-electric Vehicle) currently have less penetration of the AWD system. But in future due to their higher fuel efficiency, Automobile OEMs can offer PHEV models with standard AWD systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: ALL WHEEL DRIVE MARKET

FIGURE 2 ALL WHEEL DRIVE SYSTEM MARKET, BY REGION

1.4 INCLUSIONS & EXCLUSIONS

TABLE 1 SEGMENT-WISE INCLUSIONS & EXCLUSIONS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

FIGURE 4 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR BASE DATA

2.2.2 KEY SECONDARY SOURCES FOR AWD MARKET

2.2.3 DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4.1 BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 9 AWD MARKET: RESEARCH DESIGN & METHODOLOGY

2.5 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDE

2.6 FACTOR ANALYSIS

2.7 DATA TRIANGULATION

2.8 LIMITATIONS

2.9 ASSUMPTIONS

TABLE 2 ASSUMPTIONS: RISK ASSESSMENT AND RANGES

2.1 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 PRE- AND POST-COVID-19 SCENARIO

FIGURE 10 PRE- & POST-COVID-19 SCENARIO: ALL WHEEL DRIVE MARKET, 2018-2027 (USD MILLION)

TABLE 3 ALL WHEEL DRIVE: PRE- VS. POST-COVID-19 SCENARIO, 2020–2027 (USD MILLION)

3.2 REPORT SUMMARY

FIGURE 11 ALL WHEEL DRIVE: MARKET OUTLOOK

FIGURE 12 AUTOMOTIVE AWD MARKET, 2022 VS 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN AWD MARKET

FIGURE 13 RISING DEMAND FOR SUVS AND NEED FOR IMPROVED VEHICLE SAFETY, STABILITY, & ENHANCED DRIVING DYNAMICS EXPECTED TO DRIVE MARKET

4.2 MARKET, BY VEHICLE TYPE

FIGURE 14 COMMERCIAL VEHICLE SEGMENT PROJECTED TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD (USD MILLION)

4.3 MARKET, BY SYSTEM TYPE

FIGURE 15 AUTOMATIC SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027 (USD MILLION)

4.4 MARKET, BY COMPONENT

FIGURE 16 DIFFERENTIAL SEGMENT TO LEAD DURING FORECAST PERIOD (USD MILLION)

4.5 MARKET, BY REGION

FIGURE 17 ASIA PACIFIC PROJECTED TO LEAD MARKET DURING FORECAST PERIOD (USD MILLION)

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: AWD MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing global demand for SUVs

TABLE 4 KEY OEMS & THEIR SUVS WITH AWD & 4WD SYSTEMS

5.2.1.2 Unfavorable terrain for safe driving

5.2.1.3 Increasing demand for improved vehicle safety, stability, and enhanced driving dynamics

5.2.2 RESTRAINTS

5.2.2.1 Stringent fuel economy standards

5.2.2.2 High cost of AWD system

5.2.3 OPPORTUNITIES

5.2.3.1 Automatic AWD

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about AWD among consumers in emerging economies

5.3 ALL WHEEL DRIVE MARKET SCENARIO

FIGURE 19 AWD MARKET SCENARIO, 2018–2027 (USD MILLION)

5.3.1 MOST LIKELY/REALISTIC SCENARIO

TABLE 5 REALISTIC SCENARIO - AWD MARKET, BY REGION, 2021–2027 (USD MILLION)

5.3.2 HIGH COVID-19 IMPACT SCENARIO

TABLE 6 HIGH COVID-19 IMPACT SCENARIO - AWD MARKET, BY REGION, 2021–2027 (USD MILLION)

5.3.3 LOW COVID-19 IMPACT SCENARIO

TABLE 7 LOW COVID-19 IMPACT SCENARIO - AWD MARKET, BY REGION, 2021–2027 (USD MILLION)

5.4 REVENUE SHIFT DRIVING MARKET GROWTH

FIGURE 20 AWD MARKET: REVENUE SHIFT DRIVING MARKET GROWTH

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 8 AWD MARKET: GLOBAL OEM AVERAGE PRICING ANALYSIS (USD), 2022

5.6 TECHNOLOGY ANALYSIS

5.6.1 OVERVIEW

FIGURE 21 FRONT VS. REAR TWO WHEEL DRIVE LAYOUT

5.7 AUTOMATIC VS MANUAL ALL WHEEL DRIVE SYSTEMS

5.7.1 AUTOMATIC ALL WHEEL DRIVE (AWD) SYSTEMS

FIGURE 22 AUTOMATIC ALL WHEEL DRIVE (AWD) LAYOUT

5.7.2 MANUAL ALL WHEEL DRIVE (4WD) SYSTEMS

FIGURE 23 MANUAL AWD (4WD) LAYOUT

5.8 MARKET ECOSYSTEM

TABLE 9 ALL WHEEL DRIVE: MARKET ECOSYSTEM

5.9 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: ALL WHEEL DRIVE SYSTEM MARKET

5.10 PATENT ANALYSIS

5.11 CASE STUDY

5.11.1 USE CASE 1: TOYOTA RAV4

5.11.2 USE CASE 2: HONDA CR-V

5.11.3 USE CASE 3: SUBARU WRX

5.12 REGULATORY LANDSCAPE

TABLE 10 NORTH AMERICA: ALL WHEEL DRIVE REGULATIONS

TABLE 11 EUROPE: ALL WHEEL DRIVE REGULATIONS

TABLE 12 ASIA PACIFIC: ALL WHEEL DRIVE REGULATIONS

5.13 REGULATORY BODIES/KEY AGENCIES/OTHER ORGANIZATIONS

5.13.1 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.3 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14 KEY CONFERENCES

5.14.1 ALL WHEEL DRIVE MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

5.15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: ALL WHEEL DRIVE SYSTEM MARKET

5.15.1 THREAT OF NEW ENTRANTS

5.15.2 THREAT OF SUBSTITUTES

5.15.3 BARGAINING POWER OF SUPPLIERS

5.15.4 BARGAINING POWER OF BUYERS

5.15.5 INTENSITY OF COMPETITIVE RIVALRY

6 ALL WHEEL DRIVE SYSTEM MARKET, BY SYSTEM TYPE (Page No. - 76)

6.1 INTRODUCTION

6.2 RESEARCH METHODOLOGY

FIGURE 26 ALL WHEEL DRIVE MARKET, BY SYSTEM TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 13 MARKET: BY SYSTEM TYPE, 2018–2021 (‘000 UNITS)

TABLE 14 MARKET: BY SYSTEM TYPE, 2022–2027 (‘000 UNITS)

TABLE 15 MARKET; BY SYSTEM TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET; BY SYSTEM TYPE, 2022–2027 (USD MILLION)

6.3 MANUAL AWD

6.3.1 GROWING ADOPTION OF AUTOMATIC AWD TO NEGATIVELY IMPACT SEGMENT

TABLE 17 MANUAL AWD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 18 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 19 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 AUTOMATIC AWD

6.4.1 GROWING DEMAND FOR VEHICLE STABILITY AND SAFETY TO DRIVE SEGMENT

TABLE 21 AUTOMATIC AWD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 22 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 23 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24

MARKET, BY REGION, 2022–2027 (USD MILLION)

7 ALL WHEEL DRIVE SYSTEM MARKET, BY VEHICLE TYPE (Page No. - 83)

7.1 INTRODUCTION

7.2 RESEARCH METHODOLOGY

FIGURE 27 ALL WHEEL DRIVE MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 25 MARKET, BY VEHICLE TYPE, 2018–2021 (’000 UNITS)

TABLE 26 MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 27 MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

7.3 PASSENGER CARS

7.3.1 HIGHER CAR OWNERSHIP RATE IN EMERGING ECONOMIES TO DRIVE SEGMENT

TABLE 29 PASSENGER CAR MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 30 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 31 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 COMMERCIAL VEHICLE

7.4.1 THRIVING EUROPEAN MARKET TO DRIVE SEGMENT

TABLE 33 COMMERCIAL VEHICLE MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 34 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 35 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 MARKET, BY REGION, 2022–2027 (USD MILLION)

8 ELECTRIC VEHICLE ALL WHEEL DRIVE SYSTEM MARKET, BY TYPE (Page No. - 90)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

FIGURE 28 ELECTRIC VEHICLE AWD MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 37 ALL WHEEL DRIVE MARKET, BY VEHICLE TYPE, 2018–2021 (UNITS)

TABLE 38 MARKET, BY VEHICLE TYPE, 2022–2027 (UNITS)

TABLE 39ALL WHEEL DRIVE MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 40 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

8.2 BEV

8.2.1 DEVELOPMENTS IN AWD TECHNOLOGY AND VARIOUS BEV LAUNCHES TO DRIVE SEGMENT

TABLE 41 BEV MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 42 BEV MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 43 BEV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 BEV MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PHEV

8.3.1 NEED FOR LOWER OPERATING COST AND HIGHER PERFORMANCE TO DRIVE SEGMENT

TABLE 45 PHEV MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 46 PHEV MARKET, BY REGION,2022–2027 (UNITS)

TABLE 47 PHEV MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 PHEV MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ALL WHEEL DRIVE SYSTEM MARKET, BY COMPONENT (Page No. - 96)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

FIGURE 29 ALL WHEEL DRIVE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 49 MARKET: BY COMPONENT, 2018–2021 (‘000 UNITS)

TABLE 50 MARKET: BY COMPONENT, 2022–2027 (‘000 UNITS)

TABLE 51 MARKET: BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 52 MARKET: BY COMPONENT, 2022–2027 (USD MILLION)

9.2 DIFFERENTIAL

9.2.1 FALLING DIFFERENTIAL PRICES AND DEVELOPMENTS IN DESIGN TO DRIVE SEGMENT

TABLE 53 ALL WHEEL DRIVE DIFFERENTIAL MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 54 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 55 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 TRANSFER CASE

9.3.1 GROWING DEMAND FOR MODERN AUTOMATIC VEHICLES TO DRIVE SEGMENT

TABLE 57 ALL WHEEL DRIVE TRANSFER CASE MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 58 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 59 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 PROPELLER SHAFT

9.4.1 R&D IN LIGHTWEIGHT HYBRID MATERIALS TO REDUCE WEIGHT TO DRIVE SEGMENT

TABLE 61 ALL WHEEL DRIVE PROPELLER SHAFT MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 62 ALL WHEEL DRIVE MARKET, BY REGION,2022–2027 (‘000 UNITS)

TABLE 63 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 POWER TRANSFER UNIT (PTU)

9.5.1 POPULARITY OF FWD TO DRIVE SEGMENT

TABLE 65 ALL WHEEL DRIVE POWER TRANSFER UNIT MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 66 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 67 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 FINAL DRIVE UNIT (FDU)

9.6.1 GROWING PENETRATION OF AWD TO DRIVE SEGMENT

TABLE 69 ALL WHEEL DRIVE FINAL DRIVE UNIT MARKET, BY REGION,2018–2021 (‘000 UNITS)

TABLE 70 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 71 MARKET, BY REGION,2018–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION,2022–2027 (USD MILLION)

10 ALL WHEEL DRIVE SYSTEM MARKET, BY DIFFERENTIAL TYPE (Page No. - 107)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 30 ALL WHEEL DRIVE MARKET, BY DIFFERENTIAL TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 73 MARKET, BY DIFFERENTIAL TYPE, 2018–2021 (‘000 UNITS)

TABLE 74 MARKET, BY DIFFERENTIAL TYPE, 2022–2027 (‘000 UNITS)

TABLE 75 MARKET, BY DIFFERENTIAL TYPE, 2018–2021 (USD MILLION)

TABLE 76 MARKET, BY DIFFERENTIAL TYPE, 2022–2027 (USD MILLION)

10.2 LIMITED-SLIP DIFFERENTIAL

10.2.1 GROWING AVAILABILITY OF LSD FEATURES IN VARIOUS MODELS DRIVES DEMAND

TABLE 77 LSD: AWD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 78 LSD: AWD MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 79 LSD: AWD MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 LSD: AWD MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 OPEN DIFFERENTIAL

10.3.1 GROWING POPULARITY OF ELSD, LSD FOR BETTER PERFORMANCE IMPACTS MARKET SHARE

TABLE 81 OPEN DIFFERENTIAL: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 82 OPEN DIFFERENTIAL: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 83 OPEN DIFFERENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 OPEN DIFFERENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 LOCKING DIFFERENTIAL

10.4.1 INCREASING MARKET FOR COMMERCIAL AWD VEHICLES BOOSTS SEGMENT

TABLE 85 LOCKING DIFFERENTIAL: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 86 LOCKING DIFFERENTIAL: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 87 LOCKING DIFFERENTIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 LOCKING DIFFERENTIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 ELECTRONIC LIMITED-SLIP DIFFERENTIAL

10.5.1 INCREASING FOCUS ON DEVELOPING ADVANCED ELSD FOR BETTER PERFORMANCE

TABLE 89 ELSD: MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 90 ELSD: MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 91 ELSD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 ELSD: MARKET, BY REGION, 2022–2027 ( USD MILLION)

11 ALL WHEEL DRIVE TORQUE VECTORING SYSTEM MARKET, BY TYPE (Page No. - 117)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS/LIMITATIONS

FIGURE 31 ALL WHEEL DRIVE TORQUE VECTORING SYSTEM MARKET, BY TYPE, 2022 VS. 2027 (‘000 UNITS)

TABLE 93 TORQUE VECTORING SYSTEM: AWD MARKET, BY TYPE, 2018–2021 (‘000 UNITS)

TABLE 94 TORQUE VECTORING SYSTEM: AWD MARKET, BY TYPE, 2022–2027 (‘000 UNITS)

11.2 ACTIVE TORQUE VECTORING SYSTEM

11.2.1 LOWER COST AND SIMPLER DESIGN TO DRIVE SEGMENT

TABLE 95 ACTIVE TORQUE VECTORING SYSTEM: AWD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 96 ACTIVE TORQUE VECTORING SYSTEM: AWD MARKET, BY REGION, 2022–2027 (‘000 UNITS)

11.3 PASSIVE TORQUE VECTORING SYSTEM

11.3.1 SIMPLE IMPLEMENTATION AND LOW WEIGHT TO DRIVE SEGMENT

TABLE 97 PASSIVE TORQUE VECTORING SYSTEM: AWD MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 98 PASSIVE TORQUE VECTORING SYSTEM: AWD MARKET, BY REGION, BY REGION,2022–2027 (‘000 UNITS)

12 ALL WHEEL DRIVE SYSTEM MARKET, BY REGION (Page No. - 122)

12.1 INTRODUCTION

12.2 RESEARCH METHODOLOGY

FIGURE 32 ALL WHEEL DRIVE MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 99 MARKET, BY REGION, 2018–2021 (‘000 UNITS)

TABLE 100 MARKET, BY REGION, 2022–2027 (‘000 UNITS)

TABLE 101 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: AWD MARKET SNAPSHOT

TABLE 103 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 CHINA

12.3.1.1 Growth in SUV sales and stringent vehicle safety norms to drive market

TABLE 107 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 108 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 109 CHINA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 110 CHINA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.2 INDIA

12.3.2.1 Growth in adoption of AWD in passenger cars to drive market

TABLE 111 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 112 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 113 INDIA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 114 INDIA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.3 JAPAN

12.3.3.1 Growing sales of sedans and luxury cars to drive market

TABLE 115 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 116 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 117 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.3.4 SOUTH KOREA

12.3.4.1 Growing demand for SUVs to drive market

TABLE 119 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 120 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 121 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 122 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4 NORTH AMERICA

FIGURE 34 NORTH AMERICA: AWD MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 124 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 125 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 US

12.4.1.1 Increasing demand for SUVs, LCVs, and luxury cars to drive market

TABLE 127 US: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 128 US: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 129 US: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 130 US: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.2 CANADA

12.4.2.1 High penetration of AWD to drive market

TABLE 131 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 132 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 133 CANADA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 134 CANADA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.4.3 MEXICO

12.4.3.1 Entry of various OEMs to drive market

TABLE 135 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 136 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 137 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 138 MEXICO: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5 EUROPE

FIGURE 35 EUROPE: AWD MARKET, BY COUNTRY, 2022 VS 2027 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 140 EUROPE: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 141 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 FRANCE

12.5.1.1 Increasing sales of SUVs and demand for safety to drive market

TABLE 143 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 144 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 145 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 146 FRANCE: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.2 GERMANY

12.5.2.1 Increasing exports of LCVs and passenger cars to drive market

TABLE 147 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 148 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 149 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.3 ITALY

12.5.3.1 Presence of supercar manufacturers and demand for high-performance vehicles to drive market

TABLE 151 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 152 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 153 ITALY: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 154 ITALY: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.4 SPAIN

12.5.4.1 Shifting momentum toward automatic transmission to drive market

TABLE 155 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 156 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 157 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 158 SPAIN: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.5.5 UK

12.5.5.1 Localization of automakers and increasing popularity of AWD to drive market

TABLE 159 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 160 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 161 UK: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 162 UK: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD (ROW)

FIGURE 36 ROW: AWD MARKET, BY COUNTRY, 2022 VS 2027 (USD MILLION)

TABLE 163 ROW: MARKET, BY COUNTRY, 2018–2021 (‘000 UNITS)

TABLE 164 ROW: MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

TABLE 165 ROW: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.1 SOUTH AFRICA

12.6.1.1 Presence of luxury car manufacturers to drive market

TABLE 167 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 168 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 169 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 170 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Growing high-performance vehicle sales to drive market

TABLE 171 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (‘000 UNITS)

TABLE 172 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (‘000 UNITS)

TABLE 173 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 174 BRAZIL: MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

13 RECOMMENDATIONS FROM MARKETSANDMARKETS (Page No. - 149)

13.1 ASIA PACIFIC: POTENTIAL MARKET FOR ALL WHEEL DRIVE SYSTEM MANUFACTURERS

13.2 AUTOMATIC AWD SYSTEMS WILL RESULT IN HIGHER GROWTH OF AWD MARKET

13.3 CONCLUSION

14 COMPETITIVE LANDSCAPE (Page No. - 151)

14.1 OVERVIEW

14.2 ALL WHEEL DRIVE MARKET SHARE ANALYSIS, 2021

TABLE 175 MARKET SHARE ANALYSIS FOR AWD MARKET, 2021

FIGURE 37 ALL WHEEL DRIVE SYSTEM MARKET SHARE, 2021

14.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

14.4 COMPETITIVE EVALUATION QUADRANT

14.4.1 TERMINOLOGY

14.4.2 STARS

14.4.3 EMERGING LEADERS

14.4.4 PERVASIVE COMPANIES

14.4.5 PARTICIPANTS

TABLE 176 AWD MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 177 AWD MARKET: COMPANY APPLICATION FOOTPRINT, 2021

TABLE 178 AWD MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 38 ALL WHEEL DRIVE MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

14.5 COMPETITIVE SCENARIO

14.5.1 DEALS

TABLE 179 DEALS, 2019–2022

14.5.2 EXPANSIONS

TABLE 180 EXPANSIONS, 2019–2022

14.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2022

TABLE 181 COMPANIES ADOPTED EXPANSIONS AS KEY GROWTH STRATEGIES, 2018–2022

15 COMPANY PROFILES (Page No. - 163)

(Business overview, Products offered, Recent Developments, MNM view)*

15.1 ZF FRIEDRICHSHAFEN AG

TABLE 182 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

FIGURE 39 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 183 ZF FRIEDRICHSHAFEN AG: DEAL

15.2 CONTINENTAL AG

TABLE 184 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 40 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 185 CONTINENTAL AG: EXPANSION

15.3 MAGNA INTERNATIONAL INC.

TABLE 186 MAGNA INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 41 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 187 MAGNA INTERNATIONAL INC.: EXPANSION

TABLE 188 MAGNA INTERNATIONAL INC.: DEALS

15.4 BORGWARNER INC.

TABLE 189 BORGWARNER INC.: BUSINESS OVERVIEW

FIGURE 42 BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 190 BORGWARNER INC.: DEALS

15.5 JTEKT CORPORATION

TABLE 191 JTEKT CORPORATION: BUSINESS OVERVIEW

FIGURE 43 JTEKT CORPORATION: COMPANY SNAPSHOT

TABLE 192 JTEKT CORPORATION: DEALS

15.6 AMERICAN AXLE & MANUFACTURING INC.

TABLE 193 AMERICAN AXLE & MANUFACTURING INC.: BUSINESS OVERVIEW

FIGURE 44 AMERICAN AXLE & MANUFACTURING INC.: COMPANY SNAPSHOT

TABLE 194 AMERICAN AXLE & MANUFACTURING INC.: DEALS

TABLE 195 AMERICAN AXLE & MANUFACTURING, INC.: EXPANSION

15.7 EATON CORPORATION PLC

TABLE 196 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 45 EATON CORPORATION PLC: COMPANY SNAPSHOT

15.8 GKN PLC

TABLE 197 GKN PLC: BUSINESS OVERVIEW

15.9 DANA HOLDING CORPORATION

TABLE 198 DANA HOLDING CORPORATION: BUSINESS OVERVIEW

FIGURE 46 DANA HOLDING CORPORATION: COMPANY SNAPSHOT

TABLE 199 DANA HOLDING CORPORATION: EXPANSION

15.10 ROBERT BOSCH GMBH

TABLE 200 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 47 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 201 ROBERT BOSCH GMBH: EXPANSION

15.11 ADDITIONAL COMPANIES/PLAYERS

15.11.1 HALDEX

TABLE 202 HALDEX: COMPANY OVERVIEW

15.11.2 HONDA MOTOR CO., LTD

15.11.3 MERITOR, INC

TABLE 203 MERITOR, INC: COMPANY OVERVIEW

15.11.4 MITSUBISHI MOTORS CORPORATION

TABLE 204 MITSUBISHI MOTORS CORPORATION: COMPANY OVERVIEW

15.11.5 SUBARU CORPORATION

TABLE 205 SUBARU CORPORATION: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 201)

16.1 CURRENCY & PRICING

16.2 KEY INSIGHTS FROM INDUSTRY EXPERTS

16.3 DISCUSSION GUIDE

16.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.5 AVAILABLE CUSTOMIZATION

16.5.1 ALL WHEEL DRIVE MARKET, BY VEHICLE TYPE & SYSTEM TYPE

16.5.1.1 Passenger Cars

16.5.1.1.1 Automatic AWD

16.5.1.1.2 Manual AWD

16.5.1.2 Commercial Vehicles

16.5.1.2.1 Automatic AWD

16.5.1.2.2 Manual AWD

16.5.2 MARKET, BY COUNTRY & SYSTEM TYPE

16.5.2.1 Asia Pacific

16.5.2.1.1 Automatic AWD

16.5.2.1.2 Manual AWD

16.5.2.2 Europe

16.5.2.2.1 Automatic AWD

16.5.2.2.2 Manual AWD

16.5.2.3 North America

16.5.2.3.1 Automatic AWD

16.5.2.3.2 Manual AWD

16.5.2.4 RoW

16.5.2.4.1 Automatic AWD

16.5.2.4.2 Manual AWD

16.6 RELATED REPORTS

16.7 AUTHOR DETAILS

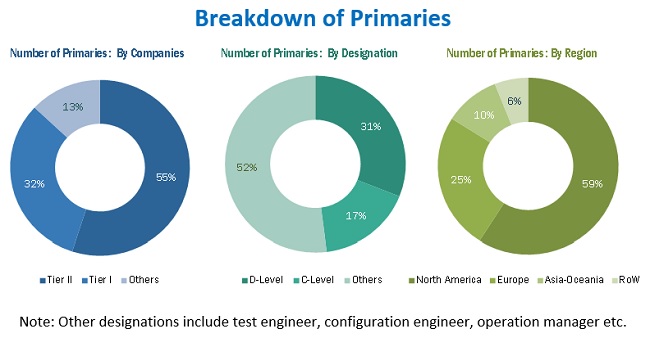

The study involved four major activities in estimating the current size of the all wheel drive market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and industry associations. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the AWD market through secondary research. Several primary interviews have been conducted with market experts from both, demand- (automobile manufacturers) and supply-side (AWD system manufacturers) across major regions, namely, North America, Europe, Asia Pacific, and RoW. Approximately 55%, 32% and 13% of primary interviews were conducted with the Tier-II, Tier-I and others respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the primary research, we have strived to cover various departments within organizations, such as sales, operations, and administration, to enable a holistic approach in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings through the primaries conducted by us. This, along with the opinions of in-house subject matter experts, led us to the findings which have been delineated in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

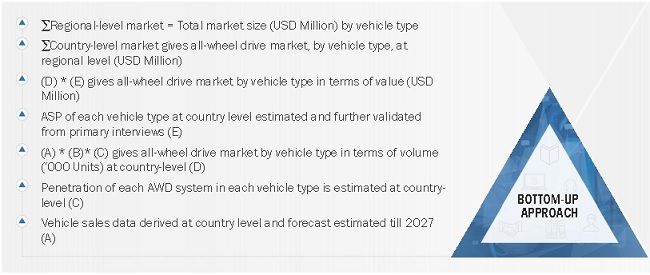

The bottom-up approach has been used to estimate and validate the size of the global market. To find the market for automotive all Wheel drive systems by vehicle type, the automatic and manual AWD market is divided into three vehicle types—passenger car, LCV, and HCV. The penetration of these technologies is derived by estimating model-wise data for the automatic and manual AWD and their production in each vehicle segment. The data is correlated with a correction factor to compensate for the trim-level discrepancies (as these all Wheel drive systems are not offered in every trim of a model).

To find the regional market for automotive all Wheel drive systems, the bottom-up approach is used to derive the country-wise demand for the automatic and manual AWD. As mentioned in the vehicle type segment, the model-wise production of each vehicle segment is derived for estimating the penetration of automatic and manual AWD. The same penetration is further drilled to country-level penetration of each system in respective vehicle segments.

To find the market for automotive all Wheel drive systems by their system type, top-down approach is used- estimations are collated to arrive at the country-level demand for automatic as well as manual AWD. The pricing for all these segments is calculated by multiplying the average price of an automatic or manual AWD per vehicle segment, varied across countries.

AWD Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides

Report Objectives

- To define, segment, analyze, and forecast (2022–2027) the all Wheel drive market size in terms of volume (units) and value (USD Millions) based on:

- By system type (automatic and manual)

- By vehicle type (commercial cars and passenger cars)

- By EV type (battery electric vehicles and plug-in hybrid vehicles)

- By component (differential, transfer case, propeller shaft, power transfer unit and final drive unit)

- Region (Asia Pacific, Europe, North America, and Rest of the World)

- To analyze the impact of COVID-19 on the AWD market (pre-COVID-19 vs. post-COVID-19)

- To analyze the most likely, low-impact, and high-impact scenarios of COVID-19 on the market

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the AWD market

- To study the following with respect to the market

- Revenue Shift Driving Market Growth

- Pricing Analysis

- Technology Analysis

- Ecosystem

- Value Chain

- Patent Analysis

- Regulatory Landscape

- Porter’s Five Forces Analysis

- To estimate the following with respect to the market

- Average Selling Price Analysis

- Market Share Analysis

- COVID-19 Market Scenario Analysis

- To analyze the market ranking of key players operating in the all wheel drive system market

- To analyze the competitive landscape and prepare a competitive leadership mapping/market quadrant for the global players operating in the market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the AWD market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

All Wheel Drive Market, By Country & System Type

-

Asia Pacific

- Automatic AWD

- Manual AWD

-

Europe

- Automatic AWD

- Manual AWD

-

North America

- Automatic AWD

- Manual AWD

-

RoW

- Automatic AWD

- Manual AWD

Note: The segment would be further segmented by region

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in All Wheel Drive Market