Exhaust Sensor Market for Automotive by Sensor Type (Exhaust Temperature & Pressure, O2, NOx, Particulate Matter, Engine Coolant Temperature, & MAP/MAF Sensor), Fuel Type (Gasoline & Diesel), Vehicle Type, & by Region - Industry Trends & Forecast to 2020

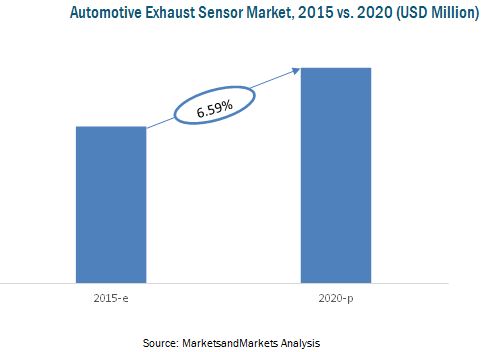

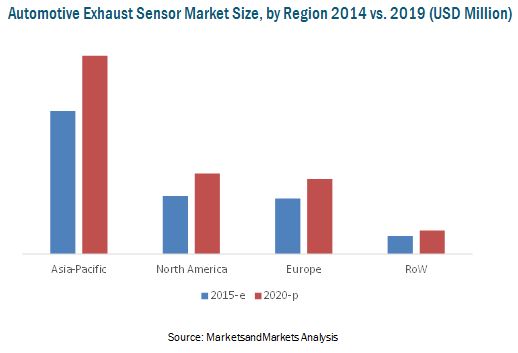

Sensors are an integral part of automobiles and play a key role in driving efficiency, safety, comfort, and emission control. They have various automotive applications, right from the engine to the exhaust system. The growth of automotive sensors can be directly attributed to the increasing use of electronics in the automotive industry for safety, driving control, emission control, and luxury. Emission sensors are a commercially attractive segment of the overall automotive sensors market and are estimated to grow at a CAGR of 6.59% from 2015 to 2020. Asia-Oceania is estimated to be the largest market for exhaust sensors. The region comprises countries such as China and India, which together account for two-thirds of the global population. A large chunk of the population in the region constitutes urban-based working youth with high disposable income. This is driving the demand for vehicles in the region. Europe is also an attractive market for emission sensors, owing to its stringent Euro norms. The market is estimated to account for a share, by value, of 20.2% of the global exhaust sensor market in 2015. It is projected to grow at a CAGR of 6.23% during the forecast period. Germany, the U.K., and France are the key contributors to the European market. Several automotive companies are expanding their after-treatment device facilities in Europe, owing to its stringent emission norms.

According to MarketsandMarkets analysis, the global medium commercial vehicle (MCV) and heavy commercial vehicle (HCV) markets are estimated to stabilize between 2014 and 2024 after a volatile period from 2004 to 2013. Country-wise growth for these commercial vehicles suggest 1%2% growth for China and Brazil, a staggering 7%8% growth for India, and around 6% growth for Europe. The high demand for commercial vehicles is projected to boost the market for diesel vehicles, which in turn, would boost the global market for exhaust sensors. The stringent emission regulations that limit the particulate matter in diesel vehicles are boosting the particulate matter sensor market, which is poised to grow at an impressive CAGR of 10.10%.

This report classifies and defines the automotive emission sensor market size, in terms of volume and value. It provides a comprehensive analysis and insights (both, qualitative and quantitative) into the automotive exhaust sensor market, while highlighting the potential growth opportunities in coming years. It reviews the market drivers, restraints, growth indicators, challenges, market dynamics, competitive landscape, and other key aspects with respect to automotive particulate matter sensor products. The report also covers who supplies whom data for all the key market players and the product life cycle for each sensor type.

This report segments the automotive exhaust sensor market as follows

- By Sensor Type

- Exhaust temperature and pressure sensor

- Oxygen sensor

- NOx sensor

- Particulate matter sensor

- Engine coolant temperature sensor

- MAP/MAF sensor

- By Vehicle Type

- Passenger car

- LCV

- HCV

- By Region

- North America

- Asia-Oceania

- Europe

- RoW

The key players in the automotive emission sensor market have also been identified and profiled.

Target Audience

- Automotive exhaust manufacturers

- Automotive sensor manufacturers

- Automotive engine management system manufacturers

- Equipment service providers

- Governments and research organizations

- Consulting companies in the automotive sector

- Manufacturers of Emission Controls Association (MECA)

- AECC (Association of Emission Control By Catalyst)

- Emission Control Technology Association

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

The following customization options are available for the report:

- Off-Highway Exhaust Sensor Market

- Exhaust gas temperature sensor

- Exhaust gas pressure sensor

- Oxygen/lambda sensor

- NOx sensor

- Particulate matter sensor

- MAP/MAF sensor

- Particulate Matter Sensor Market, By Technology

- Accumulative electrode PM sensor

- Electrostatic charge PM sensor

- Radio frequency PM sensor

The automotive exhaust sensor market is projected to reach USD 35,714.7 Million by 2020 from USD 25,961.8 Million in 2015. Asia-Oceania accounts for the largest market share in the automotive emission sensor market. This can be attributed to the growing demand for vehicles, increasing penetration of diesel vehicles, and upcoming emissions norms in the region. China is the largest market for automotive exhaust sensors in Asia-Oceania. The high pollution levels in the country have contributed to thousands of deaths annually. Automobiles are chiefly responsible for pollution in China. The country therefore presents considerable growth opportunities for emission sensors. The Chinese emission sensor market is set to grow at a CAGR of 8.23% from 2015 to 2020. North America is the second-largest market for exhaust sensors, with an estimated size, by volume, of 134,395.0 thousand units in 2015. It is projected to grow to 177,055.7 thousand units by 2020. The region exhibits a strong inclination towards gasoline-powered vehicles due to its strict CAFΙ emission standards.

The market for exhaust sensors in Europe and North America has reached the maturation phase and is stable owing to a slump in production and increasing competition from emerging economies in Asia-Oceania and RoW. However, with the implementation of Euro VI norms by 2017, the demand for exhaust sensors is expected to grow. Moreover, limits are now being set for particulate matter emission from vehicles. Gasoline vehicles will therefore soon be equipped with particulate filters; this would propel the growth of the particulate matter sensor market.

The key sensors considered for the study are oxygen sensors, NOx sensors, exhaust temperature and pressure sensors, particulate matter sensors, and MAP/MAF sensors. The market for particulate matter sensors is estimated to grow at the highest CAGR of 10.10%, owing to emission norms that restrict particulate matter emission in diesel vehicles.

Key drivers for the automotive exhaust sensor market are stringent emission standards and norms and the increasing penetration of diesel vehicles in developed nations. However, factors such as the increasing demand for electric vehicles may limit the growth of the market.

The global automotive emission sensor market is dominated by major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (U.S.), Sensata Technologies Holding N.V. (Netherlands), Delphi Automotive (U.K.), and Hitachi Automotive Systems (Japan).

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.2.1 Key Industry Insights

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Impact of Gross Domestic Product on Commercial Vehicle Sales

2.4.2.2 Urbanization vs. Passenger Cars Per 1,000 People

2.4.2.3 Infrastructure: Roadways

2.4.3 Supply-Side Analysis

2.4.3.1 Increasing Vehicle Production in Developing Countries

2.4.4 Technological Advancements

2.4.5 Influence of Other Factors

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Opportunities in the Automotive Emission Sensor Market

4.2 Global Automotive Emission Sensor Market, By Fuel & Sensor Type

4.3 Global Automotive Emission Sensor Market, By Vehicle Type

4.4 Global Automotive Emission Sensor Market Product Life Cycle

4.5 Who Supplies to Whom

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automotive Emission Sensor Market, By Type

5.2.2 Automotive Emission Sensor Market, By Fuel Type

5.2.3 Automotive Emission Sensor Market, By Vehicle Type

5.2.4 Automotive Emission Sensor Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Stringent Emission Standards and Norms

5.3.1.2 Increasing Penetration of Diesel Engine Vehicles in Developed Nations

5.3.2 Restraints

5.3.2.1 Increasing Demand for Battery Electric Vehicles

5.3.2.2 Increased Complexity & Electronics in Vehicle

5.3.3 Opportunities

5.3.3.1 Introduction of Gasoline Particulate Filters & Urea Injection in Euro Vi

5.3.3.2 Radio Frequency Particulate Matter Sensor

5.3.4 Challenge

5.3.4.1 Increasing Life Expectancy of Emission Sensors

5.4 Value Chain Analysis

5.5 Porters Five Forces Analysis

5.5.1 Threat of New Entrants

5.5.2 Threat of Substitutes

5.5.3 Bargaining Power of Suppliers

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

6 Automotive Emission Sensor Market Analysis, By Fuel Type (Page No. - 57)

6.1 Introduction

6.2 Gasoline Fuel

6.2.1 By Region

6.2.2 By Vehicle Type

6.3 Diesel Fuel

6.3.1 By Region

6.3.2 By Vehicle Type

7 Automotive Emission Sensor Market, By Sensor Type (Page No. - 65)

7.1 Introduction

7.2 Exhaust Gas Pressure Sensor

7.2.1 By Region & Vehicle Type

7.3 Exhaust Gas Temperature Sensor

7.3.1 By Region & Vehicle Type

7.4 Particulate Matter Sensor

7.4.1 Differential Pressure Sensor

7.4.2 Radio Frequency Particulate Matter Sensor

7.4.3 Accumulative Electrode Particulate Matter Sensor/Electrostatic Charge Particulate Matter Sensor

7.4.4 By Region & Vehicle Type

7.5 Oxygen/Lambda Sensor

7.5.1 By Region & Vehicle Type

7.6 NOX Sensor

7.6.1 By Region & Vehicle Type

7.7 Engine Coolant Temperature Sensor

7.7.1 By Region & Vehicle Type

7.8 MAP/MAF Sensor

7.8.1 By Region & Vehicle Type

8 Automotive Emission Sensor Market Analysis, By Region (Page No. - 88)

8.1 Introduction

8.1.1 Asia-Oceania

8.1.2 By Country

8.1.3 China

8.1.3.1 By Type

8.1.4 Japan

8.1.4.1 By Type

8.1.5 India

8.1.5.1 By Type

8.1.6 South Korea

8.1.6.1 By Type

8.1.7 Pest Analysis

8.1.7.1 Political Factors

8.1.7.2 Economic Factors

8.1.7.3 Social Factors

8.1.7.4 Technological Factors

8.2 Europe

8.2.1 By Country

8.2.2 Germany

8.2.2.1 By Type

8.2.3 France

8.2.3.1 By Type

8.2.4 U.K.

8.2.4.1 By Type

8.2.5 Spain

8.2.5.1 By Type

8.2.6 Pest Analysis

8.2.6.1 Political Factors

8.2.6.2 Economic Factors

8.2.6.3 Social Factors

8.2.6.4 Technological Factors

8.3 North America

8.3.1 By Country

8.3.2 U.S.

8.3.2.1 By Type

8.3.3 Canada

8.3.3.1 By Type

8.3.4 Mexico

8.3.4.1 By Type

8.3.5 Pest Analysis

8.3.5.1 Political Factors

8.3.5.2 Economic Factors

8.3.5.3 Social Factors

8.3.5.4 Technological Factors

8.4 Rest of the World

8.4.1 By Country

8.4.2 Brazil

8.4.2.1 By Type

8.4.3 Russia

8.4.3.1 By Type

9 Emission Regulations & Role of On-Board Diagnostics in Emission Control (Page No. - 118)

9.1 Introduction

9.2 U.S.

9.3 European Union

9.4 China

9.5 India

9.6 On-Board Diagnostics

9.6.1 Diagnostic Trouble Code

9.6.1.1 Elements of A Diagnostic Trouble Code

9.6.1.2 Decoding A Diagnostic Trouble Code

9.6.2 On-Board Diagnostics Thresholds

10 Competitive Landscape (Page No. - 131)

10.1 Market Share Analysis: Automotive Emission Sensor Market

10.2 Competitive Situation and Trends

10.3 New Product Launches

10.4 Expansions

10.5 Mergers & Acquisitions

10.6 AGreements/Joint Ventures/Supply Contracts/Partnerships

11 Company Profiles (Page No. - 138)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Robert Bosch GmbH

11.3 Continental AG

11.4 Delphi Automotive PLC

11.5 Denso Corporation

11.6 Sensata Technologies Holding NV

11.7 Hella KGAA Hueck & Co.

11.8 Hitachi Ltd.

11.9 Infineon Technologies AG

11.10 NGK Spark Plug Co., Ltd

11.11 Stoneridge, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 167)

12.1 Key Industry Insights

12.2 Discussion Guide

12.3 Other Developments

12.3.1 Expansions

12.3.2 New Product Development

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (77 Tables)

Table 1 Overview of Emission & Fuel Economy Regulation Specifications for Passenger Cars

Table 2 Drivers: Impact Analysis

Table 3 Restraints: Impact Analysis

Table 4 Opportunities: Impact Analysis

Table 5 Challenge: Impact Analysis

Table 6 Automotive Emission Sensor Market Size, By Fuel Type,20132020 (000 Units)

Table 7 Automotive Emission Sensor Market Size, By Fuel Type,20132020 (USD Million)

Table 8 Gasoline Emission Sensor Market Size, By Region, 20132020 (000 Units)

Table 9 Gasoline Emission Sensor Market Size, By Region,20132020 (USD Million)

Table 10 Gasoline Emission Sensor Market Size, By Vehicle Type,20132020 (000 Units)

Table 11 Gasoline Emission Sensor Market Size, By Vehicle Type,20132020 (USD Million)

Table 12 Diesel Emission Sensor Market Size, By Region, 20132020 (000 Units)

Table 13 Diesel Emission Sensor Market Size, By Region, 20132020 (USD Million)

Table 14 Diesel Emission Sensor Market Size, By Vehicle Type,20132020 (000 Units)

Table 15 Diesel Emission Sensor Market Size, By Vehicle Type,20132020 (USD Million)

Table 16 Automotive Emission Sensor Market Size, By Sensor Type,20132020 (000 Units)

Table 17 Automotive Emission Sensor Market Size, By Sensor Type,20132020 (USD Million)

Table 18 Exhaust Gas Pressure Sensor Market Size, By Region & Vehicle Type, 20132020 (000 Units)

Table 19 Exhaust Gas Pressure Sensor Market Size, By Region & Vehicle Type, 20132020 (USD Million)

Table 20 Exhaust Gas Temperature Sensor Market Size, By Region & Vehicle Type, 20132020 (000 Units)

Table 21 Exhaust Gas Temperature Sensor Market Size, By Region & Vehicle Type, 20132020 (USD Million)

Table 22 Particulate Matter Sensor Market Size, By Region & Vehicle Type,20132020 (000 Units)

Table 23 Particulate Matter Sensor Market Size, By Region & Vehicle Type,20132020 (USD Million)

Table 24 Oxygen/Lambda Sensor Market Size, By Region & Vehicle Type,20132020 (000 Units)

Table 25 Oxygen/Lambda Sensor Market Size, By Region & Vehicle Type,20132020 (USD Million)

Table 26 NOX Sensor Market Size, By Region & Vehicle Type, 20132020 (000 Units)

Table 27 NOX Sensor Market Size, By Region & Vehicle Type,20132020 (USD Million)

Table 28 Engine Coolant Temperature Sensor Market Size, By Region & Vehicle Type, 20132020 (000 Units)

Table 29 Engine Coolant Temperature Sensor Market Size, By Region & Vehicle Type, 20132020 (USD Million)

Table 30 MAP/MAF Sensor Market Size, By Region & Vehicle Type,20132020 (000 Units)

Table 31 MAP/MAF Sensor Market Size, By Region & Vehicle Type,20132020 (USD Million)

Table 32 Automotive Emission Sensor Market Size, By Region,20132020 (000 Units)

Table 33 Automotive Emission Sensor Market Size, By Region,20132020 (USD Million)

Table 34 Asia-Oceania: Automotive Emission Sensor Market Size, By Country,20132020 (000 Units)

Table 35 Asia-Oceania: Automotive Emission Sensor Market Size, By Country,20132020 (USD Million)

Table 36 China: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 37 China: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 38 Japan: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 39 Japan: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 40 India: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 41 India: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 42 South Korea: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 43 South Korea: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 44 Europe: Automotive Emission Sensor Market Size, By Country,20132020 (000 Units)

Table 45 Europe: Automotive Emission Sensor Market Size, By Country,20132020 (USD Million)

Table 46 Germany: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 47 Germany: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 48 France: Automotive Emission Sensor Market Size, By Type,20132020 ( 000 Units)

Table 49 France: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 50 U.K.: Automotive Emission Sensor Market Size, By Type,20132020 ( 000 Units)

Table 51 U.K.: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 52 Spain: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 53 Spain: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 54 North America: Automotive Emission Sensor Market Size, By Country, 20132020 ( 000 Units)

Table 55 North America: Automotive Emission Sensor Market Size, By Country, 20132020 (USD Million)

Table 56 U.S.: Automotive Emission Sensor Market Size, By Type,20132020 ( 000 Units)

Table 57 U.S.: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 58 Canada: Automotive Emission Sensor Market Size, By Type,20132020 ( 000 Units)

Table 59 Canada: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 60 Mexico: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 61 Mexico: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 62 RoW: Automotive Emission Sensor Market Size, By Country,20132020 (000 Units)

Table 63 RoW: Automotive Emission Sensor Market Size, By Country,20132020 (USD Million)

Table 64 Brazil: Automotive Emission Sensor Market Size, By Type,20132020 ( 000 Units)

Table 65 Brazil: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 66 Russia: Automotive Emission Sensor Market Size, By Type,20132020 (000 Units)

Table 67 Russia: Automotive Emission Sensor Market Size, By Type,20132020 (USD Million)

Table 68 Components & Systems Monitored By OBD-II

Table 69 OBD-II D Connector Terminal Assignment

Table 70 OBD-II Diagnostic Trouble Code Legend

Table 71 Revised Proposals for Final On-Board DiagnosticsThresholds for Euro 6

Table 72 New Product Launches, 20112015

Table 73 Expansions, 20102015

Table 74 Mergers & Acquisitions, 20102015

Table 75 Agreements/Joint Ventures/Supply Contracts/Partnerships, 20102015

Table 76 Expansions, 2010-2014

Table 77 New Product Development, 2011-2012

List of Figures (73 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation,& Region

Figure 4 Gross Domestic Product vs. Commercial Vehicle Sales

Figure 5 Urbanization vs. Passenger Cars Per 1,000 People

Figure 6 Road Network vs. Total Vehicle Sales

Figure 7 Vehicle Production, 20092014

Figure 8 Micro and Macro Factor Analysis

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Automotive Emission Sensor Market, By Value, 2015 vs. 2020

Figure 11 Increasing Diesel Penetration in Developed Countries PushingThe Demand for Automotive Emission Sensors

Figure 12 Oxygen/Lambda Sensor: the Largest Contributor to the Automotive Emission Sensors Market

Figure 13 Asia-Oceania is Projected to Be the Fastest Growing Market for Emission Sensors

Figure 14 Advance Particulate Matter Sensor Offers Lucrative Opportunities for the Manufacturers in the Automotive Emission Sensors Market

Figure 15 Particulate Matter Sensor in Diesel Engine Vehicles is Projected to Grow at the Fastest Cagr During the Forecast Period

Figure 16 Passenger Cars Leads the Global Automotive Emission Sensor Market During the Forecast Period

Figure 17 Particulate Matter Sensors: an Attractive Market to Invest

Figure 18 Market Segmentation, By Type

Figure 19 Growing Penetration of Diesel Engine Vehicles in Developed Nations Would Drive the Market for Automotive Emission Sensors in the Future

Figure 20 Gasoline vs. Diesel Fuel Shares Across Various Countries

Figure 21 Electric Vehicle Sales, 20122014

Figure 22 Growth of the Automotive Emission Sensor Market During 2013-2020

Figure 23 Value Chain Analysis: Major Value is Added During Manufacturing and Assembly Phases

Figure 24 Porters Five Forces Analysis (2013): Automotive Emission Sensor Market

Figure 25 Automotive Emission Sensor Growth, 20152020

Figure 26 Increasing Light Passenger Vehicle Production and Sales is Boosting the Growth of the PM Sensor Market

Figure 27 Automotive Emission Sensor Market By Region, 2015

Figure 28 Differential Pressure Sensor Schematic

Figure 29 Radio Frequency Particulate Matter Sensor Schematic

Figure 30 Accumulative Electrode Particulate Matter Sensor Schematic

Figure 31 Electrostatic Charge Particulate Matter Sensor Schematic

Figure 32 Automotive PM Sensor Schematic

Figure 33 China is the Fastest Growing Country in the Global Automotive Emission Sensor Market During the Forecast Period

Figure 34 China is Expected to Lead the Asia-Oceania Automotive Emission Sensor Market During the Forecast Period

Figure 35 U.S. Captures the Major Market Share in the North America Emission Sensor Market

Figure 36 U.S.: LEV II Emission Standards for Passenger Cars and Light-Duty Trucks

Figure 37 U.S.: LEV II Emission Standards for Medium-Duty Vehicles

Figure 38 U.S.: LEV III Emission Standards for Passenger Cars and Light-Duty Trucks

Figure 39 U.S.: HCV Emission Standards

Figure 40 European Union: Emission Standards for Passenger Car

Figure 41 European Union: Emission Standards for Light Commercial Vehicle

Figure 42 European Union: Emission Standards for Heavy Commercial Vehicle

Figure 43 China: Emission Standards for Passenger Car and Light Commercial Vehicle Powered With Gasoline Engine

Figure 44 China: Emission Standards for PC and Light Commercial Vehicle Powered With Diesel Engine

Figure 45 China: Emission Standards for Heavy Commercial Vehicle

Figure 46 India: Emission Standards for Light-Duty Vehicles

Figure 47 India: Emission Standards for Heavy-Duty Vehicles

Figure 48 Technological Roadmap

Figure 49 OBD-I & OBD-II: Features Comparison

Figure 50 Standard OBD-II Connector

Figure 51 Diagnostic Trouble Code Decoding

Figure 52 Companies Adopted Product Innovation as the Key Growth Strategy During 2013-2015

Figure 53 Automotive Emission Sensor Market Share, 2014

Figure 54 Market Evaluation Framework: Expansions Have Fueled the Demand for Emission Sensors

Figure 55 Continental AG and Sensata Technologies Grew at the Fastest Rate Between 2009 and 2013

Figure 56 Battle for Market Share: Expansion Was the Key Strategy

Figure 57 Region-Wise Revenue Mix of Key Players

Figure 58 Competitive Benchmarking of Key Players (20082013): Denso Corporation Proved to Be A Frontrunner With Its Wide & Robust Product Portfolio

Figure 59 Robert Bosch GmbH: Company Snapshot

Figure 60 Robert Bosch GmbH: SWOT Analysis

Figure 61 Continental AG: Company Snapshot

Figure 62 Continental AG: SWOT Analysis

Figure 63 Delphi Automotive PLC: Company Snapshot

Figure 64 Delphi Automotive PLC: SWOT Analysis

Figure 65 Denso Corporation: Company Snapshot

Figure 66 Denso Corporation: SWOT Analysis

Figure 67 Sensata Technologies Holding NV: Company Snapshot

Figure 68 Sensata Technologies Holdings NV: SWOT Analysis

Figure 69 Hella KGAA Hueck & Co: Company Snapshot

Figure 70 Hitachi Ltd.: Company Snapshot

Figure 71 Infineon Technologies AG: Company Snapshot

Figure 72 NGK Spark Plug Co. Ltd: Company Snapshot

Figure 73 Stoneridge, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Exhaust Sensor Market

Does this report cover a forecast for NOx sensors in units? Can you please send a sample that shows that this data is in? Thanks!

I am most interested in 02 Sensors and the market details and players within Russia, France and UK. This is for my Executive MBA Marketing Assignment. Thank you