Vehicle Control Unit Market by Vehicle Type, Component (Hardware & Software), Propulsion Type, Voltage (12/24V & 36/48V), Capacity (16, 32, & 64-bit), Electric Two-Wheeler, Communication Technology, Function, and Region - Global Forecast to 2027

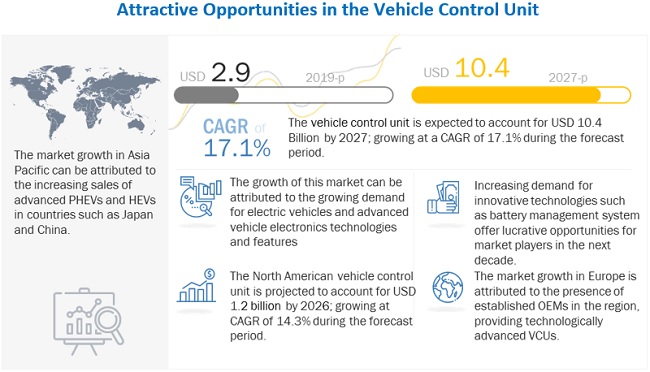

[152 Pages Report] The global vehicle control unit market is projected to reach USD 10.4 billion by 2027 from an estimated USD 2.9 billion in 2019, at a CAGR of 17.1%. Increasing emphasis on advanced and innovative vehicle electronics technologies in electric vehicles and electrification of automotive parts will create opportunities for OEMs to expand their revenue stream and geographical presence.

The market in Asia Pacific is projected to experience steady growth owing to the high demand for electric vehicles, while the European market is the second-fastest-growing market due to the presence of established companies and high adoption rate of electric vehicles. However, VCUs are yet to get standardized in terms of hardware and software so that they will be able to fit into any vehicle system. As of now, every company has VCUs with its software and hardware architecture. This would change the VCU market scenario in the future, as software with innovative technologies might get expensive, and hardware is expected to become cheaper due to the standardization.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growing trend of electric vehicles

One of the most important factors driving the vehicle control unit market is the increasing demand for electric vehicles. Electric vehicles have integrated electronics vehicle systems that require a supervisory controller to coordinate with all the ECUs located in the vehicle. VCUs balance, control, and optimize the integrated system of vehicles which enhances overall functionality. VCU helps electric vehicles in analyzing the battery health and charging conditions and provides powertrain solutions. Thus, inclination of the automotive industry toward electric vehicles will boost the market in the future.

Restraint: High investments required

The biggest hurdle in the growth of the vehicle control unit market would be the investments required to develop a VCU or the cost of VCU. VCUs are technologically advanced, which makes them expensive. Any VCU requires a number of test runs in its R&D phase. Also, each VCU supplier is developing its own unique VCU hardware and software solutions. Thus, they are costlier than any mechanical parts. Established vehicle manufacturers are spending a lot of time and money to develop VCUs that can be incorporated in their own vehicles. These embedded vehicle control solutions are complex in nature to customize as per the requirement in terms of software, as the entire vehicle is controlled through them. Companies providing such software, hardware, and vehicle electronics need to compensate for the cost of development, thereby making VCUs expensive.

Opportunity: Increasing demand for innovative technologies

The introduction of autonomous vehicles has resulted in the development of software technologies. Several other features have been added to the automotive cockpit. These include battery management system, advanced gesture controls, reconfigurable instrument cluster, and charging indicator. Most of the ultra-premium and premium vehicles have two or more unique displays that provide information about HVAC, parking, infotainment, and vehicle diagnostics. The increased incorporation of such features is expected to drive the market for vehicle control units in the future. The trend is more evident in developed economies where purchasing power is higher. Therefore, electronic systems are increasingly incorporated to provide better safety, comfort, and convenience. With the interconnected functions in vehicles, powerful VCUs would be required in compact size.

Challenge: Possibility of complete failure

Although VCU optimizes and controls the overall vehicle system, there is a constant threat of complete failure of the system. Any glitch in the system, whether it is hardware or software, and the whole system might crash or fail. There are many factors that might affect the VCU operation, such as working and environmental conditions. As it is an embedded electronics unit, it is not as robust and sturdy as any mechanical component. Also, a VCU is connected and dependent on the number of sensors located in different parts of the vehicle. A single bug or defect in any sensor would affect the operation of VCU, which might impact the whole vehicle, leading to accidents. Avoiding such scenarios is the biggest challenge the VCU market would face in the future.

Passenger car segment is expected to be largest market during the forecast period

Passenger car is expected to be the largest market by vehicle type during the forecast period. The passenger car segment is the largest VCU market, by vehicle type, and includes sedans, hatchbacks, station wagons, sports utility vehicles (SUVs), multi-utility vehicles (MUVs), and other car types. Electric passenger car is the fastest growing segment in the EV market and is expected to witness significant growth during the forecast period. The availability of a wide range of models, upgraded technology, increasing customer awareness, and availability of subsidies and tax rebates are the major factors driving the market. Earlier, electric passenger cars were introduced with basic functionalities and features. However, with technological advancements in vehicle electronics and increasing demand for features and functions, OEMs have started providing electric vehicles with advanced functions such as toque coordination, infotainment and body control functions, charging control, battery management system, ADAS, predictive vehicle technology, and engine and powertrain functions. Many globally established companies such as Robert Bosch, Continental, and Texas Instruments have been focusing on developing advanced VCUs for performance electric cars that can execute various interconnected functions in vehicles.

Software segment is estimated to be the fastest-growing market during the forecast period

Software segment is estimated to be the largest market during the forecast period. VCU software guides or instructs the VCU hardware to manage, monitor, and perform certain tasks in the vehicle. A highly configured software is as important as a perfectly embedded hardware for optimum performance of any VCU. Unlike hardware, software is easy to update through computer programming. Software can be reprogrammed over-the-air (OTA) using SOTA and FOTA protocols. Therefore, VCU software is very flexible and can be fitted into any vehicle system with the help of required programming. Currently, all VCU providers in the market are using their own basic software in their VCUs. However, these software can be reprogrammed easily using platforms such as MATLAB and Simulink. With continuous advancements in software technologies and hardware standardization in the future, software prices are expected to increase with time. Asia Pacific is set to be the largest market for VCU software segment due to the exponential growth in electric vehicles sales, especially in China and Japan. OEMs have been rolling out new OTA software updates in these vehicles and developing new software technologies for vehicle electronics, resulting in the increased price of VCU software. The software segment would dominate the VCU market during the forecast period as different companies have adopted different software technologies.

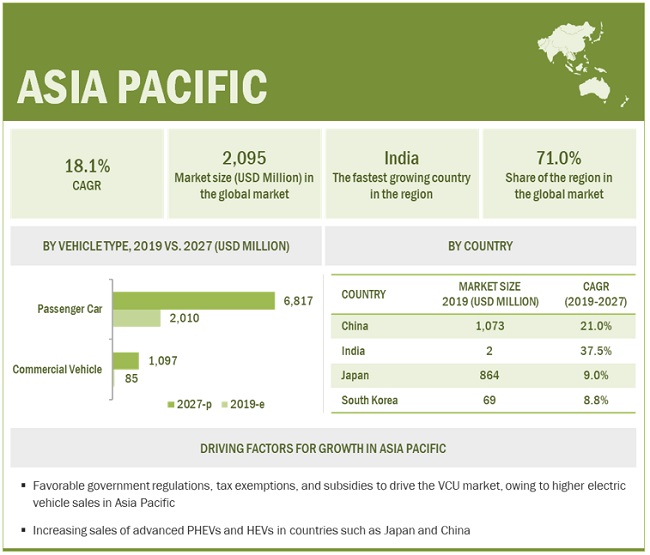

Asia Pacific is expected to be the largest market during the forecast period

Asia Pacific is expected to be the fastest-growing and the largest vehicle control unit market during the forecast period. The market growth in the region can also be attributed to the rising demand for autonomous driving functions in BEVs, HEVs, and PHEVs. Also, Asia Pacific is home to many OEMs that are focusing on vehicle electronics technologies through R&D, especially in Japan and China. Japan plays a vital role in automotive technologies in Asia Pacific. It is the largest market for technologically advanced vehicles with advanced automotive electronics.

China’s rapidly growing electric vehicle sales and strong R&D in the automotive sector is driving the vehicle control unit market in the country. With favourable government regulations for electric vehicles, India can be a great potential market for vehicle control units. As of now, very few electric vehicles have been introduced in the Indian market. However, electric vehicle sales in India would grow with time, resulting in the growth of market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global vehicle control unit market is dominated by major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Texas Instruments (US), Mitsubishi Electric Corporation (Japan), and STMicroelectronics (Switzerland). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units), Value (USD Million) |

|

Segments covered |

Vehicle Type, Propulsion Type, Voltage Type, Capacity Type, Electric two-wheeler type, Function, Communication Technology Type, and Region |

|

Geographies covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), Texas Instruments (US), Mitsubishi Electric Corporation (Japan), and STMicroelectronics (Switzerland). |

This research report categorizes the given market based on Vehicle Type, Propulsion Type, Voltage Type, Capacity Type, Electric two-wheeler type, Function, Communication Technology Type, and Region.

Based on Vehicle Type, it has been segmented as follows:

- Commercial Vehicle

- Passenger car

Based on the Propulsion Type, the given market has been segmented as follows:

- BEV

- HEV

- PHEV

Based on the Voltage Type, the market has been segmented as follows:

- 12/24V

- 36/48V

Based on Capacity, the market has been segmented as follows:

- 16-bit

- 32-bit

- 64-bit

Based on Offering Type, the market has been segmented as follows:

- Hardware

- Software

Based on the Electric Two-wheeler Type, the market has been segmented as follows:

- E-Scooter/Moped

- E-Motorcycle

Based on the Off-highway Electric Vehicle type, the market has been segmented as follows:

- Construction

- Mining

- Agriculture

Based on Function (Qualitative), the market has been segmented as follows:

- Autonomous Driving/ADAS

- Predictive Technology

Based on the Communication Type (Qualitative), the market has been segmented as follows:

- CAN

- LIN

- FlexRay

- Ethernet

Based on the Region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

-

Europe

- Austria

- Denmark

- France

- Germany

- Netherlands

- Norway

- Spain

- Sweden

- Switzerland

Recent Developments

- In June 2019, Texas Instruments introduced an automotive system based chip that was the industry’s first to integrate a controller and transceiver for Controller Area Network with Flexible Data Rate (CAN FD). Designed to meet the high-bandwidth and data-rate flexibility needs of in-vehicle networks, the TCAN4550-Q1 uses the Serial Peripheral Interface (SPI) bus of almost any microcontroller to implement, with minimal hardware changes, a CAN FD interface or increase the amount of CAN FD bus ports in a system.

- In February 2019, Mitsubishi announced that it has developed what is believed to be the world's smallest power unit for a two-motor hybrid electric vehicle (two inverters and one converter), measuring just 2.7 liters in volume, offering a world-leading 150 kVA/l power density. The motor also boasts top-class output-power density of 23 kW/l.

- In January 2018, Continental introduced the new Safety Domain Control Unit (SDCU) as a backup to the Automated Driving System. It is an additional level of safety on the central control unit and the Assisted & Automated Driving Control Unit. With the implementation of the SDCU, vehicles can still be brought to a safe stop if the main automation functionality fails.

Frequently Asked Questions (FAQ):

What is the current size of the global vehicle control unit market?

The vehicle control unit market is projected to reach USD 10.4 billion by 2027 from an estimated USD 2.9 billion in 2019, at a CAGR of 17.1%.

Who are the winners in the global vehicle control unit market?

The global vehicle control unit market is dominated by major players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Texas Instruments (US), Mitsubishi Electric Corporation (Japan), and STMicroelectronics (Switzerland). These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range in this market. These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Which region will have the fastest-growing market for vehicle control unit?

Asia Pacific is expected to be the fastest-growing and the largest vehicle control unit market in the world. The market growth in the region can be attributed to the large electric vehicle sales volume in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Product Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Vehicle Control Unit Market

4.2 Asia Pacific to Lead the Market

4.3 Market in Asia Pacific, By Offering Type and Country

4.4 Market, By Vehicle Type

4.5 Market, By Propulsion Type

4.6 Market, By Capacity Type

4.7 Market, By Voltage Type

4.8 Market, By Electric Two-Wheeler Type

4.9 Market, By Off-Highway Electric Vehicle Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Trend of Electric Vehicles

5.2.1.2 Increasing Demand for Automation in Vehicles and Electrification of Automotive Parts

5.2.2 Restraints

5.2.2.1 High Investments Required

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Innovative Technologies

5.2.3.2 Customizable and Standardized VCU Software

5.2.4 Challenges

5.2.4.1 Possibility of Complete Failure

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Technology Analysis

6.3 VCU-S and VCU-P

6.4 Programmable and Flexible VCU

6.5 Porter’s Five Forces Model Analysis

7 Vehicle Control Unit Market, By Vehicle Type (Page No. - 44)

7.1 Introduction

7.2 Research Methodology

7.3 Commercial Vehicle

7.3.1 Electrification of Public Transport to Boost the Vehicle Control Unit Market

7.4 Passenger Car

7.4.1 Increasing Demand for Advanced Drive Unit Functions and Features to Drive the Passenger Car Segment

7.5 Key Primary Insights

8 Vehicle Control Unit Market, By Propulsion Type (Page No. - 50)

8.1 Introduction

8.2 Research Methodology

8.3 BEV

8.3.1 BEV Segment to Dominate the Asia Pacific Region

8.4 HEV

8.4.1 Advanced VCU Would Improve Overall HEV Functionality

8.5 PHEV

8.6 Key Primary Insights

9 Vehicle Control Unit Market, By Capacity Type (Page No. - 57)

9.1 Introduction

9.2 Research Methodology

9.3 16-Bit

9.3.1 16-Bit VCU Segment Would Get Replaced By Higher Capacity VCU in the Future

9.4 32-Bit

9.4.1 VCU Market is Dominated By 32-Bit VCU Segment

9.5 64-Bit

9.5.1 Innovation in Technologies Will Boost the Demand for 64-Bit VCU in the Future

9.6 Key Primary Insights

10 Vehicle Control Unit Market, By Voltage Type (Page No. - 63)

10.1 Introduction

10.2 Research Methodology

10.3 12/24V

10.3.1 12/24V is Dominating the Current VCU Market

10.4 36/48V

10.4.1 36/48V Segment to Grow Much Faster in Future

10.5 Key Primary Insights

11 Vehicle Control Unit Market, By Offering Type (Page No. - 67)

11.1 Introduction

11.2 Research Methodology

11.3 Hardware

11.3.1 VCU Hardware Segment to Get Standardized With Time

11.4 Software

11.4.1 Continuous Advancements in Software Technologies to Boost the Segment in Future

11.5 Key Primary Insights

12 Vehicle Control Unit Market, By Electric Two-Wheeler (Page No. - 72)

12.1 Introduction

12.2 Research Methodology

12.3 E-Scooter/Moped

12.3.1 Rising Demand for Advanced Features and Functions in E-Scooters/Mopeds to Boost the VCU Market in the Future

12.4 E-Motorcycle

12.4.1 Increasing Demand for High Performance Electric Two-Wheelers to Drive the VCU Market for E-Motorcycles

12.5 Key Primary Insights

13 Vehicle Control Unit Market, By Off-Highway Electric Vehicle Type (Page No. - 77)

13.1 Introduction

13.2 Research Methodology

13.3 Mining

13.3.1 Asia Pacific is Projected to Be the Fastest Growing Market Due to Growing Mining Activities in the Region

13.4 Construction

13.4.1 Europe is Expected to Be the Largest Market Due to Rapid Infrastructural Advancements

13.5 Agriculture

13.5.1 Europe is Projected to Be the Fastest Growing Market Due to Its Growing Agriculture Sector

13.6 Key Primary Insights

14 Vehicle Control Unit Market, By Communication Technology (Page No. - 83)

14.1 Introduction

14.2 CAN (Controller Area Network)

14.3 LIN (Local Interconnect Network)

14.4 Flexray

14.5 Ethernet

14.6 Vehicle Control Unit Technical Specification Comparison (Major Players)

15 Vehicle Control Unit Market, By Function (Page No. - 87)

15.1 Introduction

15.2 Autonomous Driving/ADAS

15.3 Predictive Technology

16 Vehicle Control Unit Market, By Region (Page No. - 89)

16.1 Introduction

16.2 Asia Pacific

16.2.1 China

16.2.1.1 Chinese VCU Market is Dominated By BEV Segment

16.2.2 Japan

16.2.2.1 Japan has Many Renowned Oems Providing Advanced Vehicle Electronics Technologies

16.2.3 India

16.2.3.1 India to Witness Rapid Growth in VCU Market

16.2.4 South Korea

16.2.4.1 South Korea has High Adoption Rate for Hybrid Electric Vehicles

16.3 Europe

16.3.1 France

16.3.1.1 French Government Offering Purchase Grants for EV Will Boost the VCU Demand

16.3.2 Germany

16.3.2.1 Leading Players From the Country to Provide Advanced VCU

16.3.3 Spain

16.3.3.1 Increasing Investments in BEV and HEV By Government to Boost the Market

16.3.4 Austria

16.3.4.1 Ev Infrastructure in Austria to Drive VCU Market

16.3.5 Norway

16.3.5.1 Significant Share of PHEV to Boost VCU Market in Norway

16.3.6 Sweden

16.3.6.1 Higher EV Adoption Rate to Boost Swedish VCU Market

16.3.7 Switzerland

16.3.7.1 Favourable Government Regulations to Drive VCU Market

16.3.8 Netherlands

16.3.8.1 Electrification to Boost the VCU Market

16.3.9 Denmark

16.3.9.1 HEV Segment to Lead the Danish VCU Market

16.4 North America

16.4.1 US

16.4.1.1 Advancements in Vehicle Electronics to Boost the VCU Market

16.4.2 Canada

16.4.2.1 Increased HEV Sales to Drive the VCU Market

17 Competitive Landscape (Page No. - 113)

17.1 Overview

17.2 Market Ranking Analysis

17.3 Competitive Scenario

17.3.1 New Product Developments

17.3.2 Partnerships/Supply Contracts/Collaborations/ Joint Ventures/License Agreements

17.3.3 Expansions

17.4 Competitive Leadership Mapping

17.4.1 Visionary Leaders

17.4.2 Innovators

17.4.3 Dynamic Differentiators

17.4.4 Emerging Companies

18 Company Profiles (Page No. - 122)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

18.1 Robert Bosch GmbH

18.2 Continental AG

18.3 Texas Instruments

18.4 Mitsubishi Electric Corporation

18.5 STMicroelectronics

18.6 Autonomous Solutions, Inc.

18.7 Iet Spa

18.8 Pi Innovo

18.9 Embitel

18.1 Rimac Automobili

18.11 Pues Corporation

18.12 Aim Technologies

18.13 Other Key Players

18.13.1 North America

18.13.1.1 Ecotrons LLC

18.13.1.2 Thunderstruck Motors LLC

18.13.2 Asia

18.13.2.1 Hirain Technologies Co., Ltd.

18.13.2.2 Anandalal Electric

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

19 Appendix (Page No. - 146)

19.1 Key Insights of Industry Experts

19.2 Discussion Guide

19.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

19.4 Available Customizations

19.5 Related Reports

19.6 Author Details

List of Tables (77 Tables)

Table 1 Currency Exchange Rates (Per USD)

Table 2 Impact of Market Dynamics

Table 3 Vehicle Control Unit Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 4 Market, By Vehicle Type, 2017–2027 (USD Million)

Table 5 Commercial Vehicle: Market, By Region, 2017–2027 (Thousand Units)

Table 6 Commercial Vehicle: Market, By Region, 2017–2027 (USD Million)

Table 7 Passenger Car: Market, By Region, 2017–2027 (Thousand Units)

Table 8 Passenger Car: Market, By Region, 2017–2027 (USD Million)

Table 9 Market Size, By Propulsion Type, 2017–2027 (Thousand Units)

Table 10 Market Size, By Propulsion Type, 2017–2027 (USD Million)

Table 11 BEV: Market, By Region, 2017–2027 (Thousand Units)

Table 12 BEV: Market, By Region, 2017–2027 (USD Million)

Table 13 HEV: Market, By Region, 2017–2027 (Thousand Units)

Table 14 HEV: Market, By Region, 2017–2027 (USD Million)

Table 15 PHEV: Market, By Region, 2019–2027 (Thousand Units)

Table 16 PHEV: Market, By Region, 2019–2027 (USD Million)

Table 17 Vehicle Control Unit Market, By Capacity Type, 2017–2027 (Thousand Units)

Table 18 16-Bit: Market, By Region, 2017–2027 (Thousand Units)

Table 19 32-Bit: Market, By Region, 2017–2027 (Thousand Units)

Table 20 64-Bit: Market, By Region, 2019–2027 (Thousand Units)

Table 21 Market, By Voltage, 2017–2027 (Thousand Units)

Table 22 12/24V: Market, By Region, 2017–2027 (Thousand Units)

Table 23 36/48V: Market, By Region, 2017–2027 (Thousand Units)

Table 24 Market, By Offering Type, 2017–2027 (USD Million)

Table 25 Hardware: Market, By Region, 2017–2027 (USD Million)

Table 26 Software: Market, By Region, 2017–2027 (USD Million)

Table 27 Market, By Electric Two-Wheeler, 2017–2027 (Units)

Table 28 Market, By Electric Two-Wheeler, 2017–2027 (USD Thousand)

Table 29 E-Scooter/Moped: Market, By Region, 2017–2027 (Units)

Table 30 E-Scooter/Moped: Market, By Region, 2017–2027 (USD Thousand)

Table 31 E-Motorcycle: Market, By Region, 2017–2027 (Units)

Table 32 E-Motorcycle: Market, By Region, 2017–2027 (USD Thousand)

Table 33 Vehicle Control Unit Market, By Off-Highway Electric Vehicle Type, 2017–2027 (Units)

Table 34 Mining: Market, By Region, 2017–2027 (Units)

Table 35 Construction: Market, By Region, 2017–2027 (Units)

Table 36 Agriculture: Market, By Region, 2017–2027 (Units)

Table 37 Market, By Region, 2017–2027 (Thousand Units)

Table 38 Market, By Region, 2017–2027 (USD Million)

Table 39 Asia Pacific: Market, By Country, 2017–2027 (Thousand Units)

Table 40 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 41 China: Market, By Propulsion Type, 2017–2027 (Units)

Table 42 China: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 43 Japan: Market, By Propulsion Type, 2017–2027 (Units)

Table 44 Japan: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 45 India: Market, By Propulsion Type, 2017–2027 (Units)

Table 46 India: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 47 South Korea: Vehicle Control Unit Market, By Propulsion Type, 2017–2027 (Units)

Table 48 South Korea: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 49 Europe: Market, By Country, 2017–2027 (Thousand Units)

Table 50 Europe: Market, By Country, 2017–2027 (USD Million)

Table 51 France: Market, By Propulsion Type, 2017–2027 (Units)

Table 52 France: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 53 Germany: Market, By Propulsion Type, 2017–2027 (Units)

Table 54 Germany: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 55 Spain: Market, By Propulsion Type, 2017–2027 (Units)

Table 56 Spain: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 57 Austria: Market, By Propulsion Type, 2017–2027 (Units)

Table 58 Austria: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 59 Norway: Market, By Propulsion Type, 2017–2027 (Units)

Table 60 Norway: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 61 Sweden: Market, By Propulsion Type, 2017–2027 (Units)

Table 62 Sweden: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 63 Switzerland: Market, By Propulsion Type, 2017–2027 (Units)

Table 64 Switzerland: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 65 Netherlands: Market, By Propulsion Type, 2017–2027 (Units)

Table 66 Netherlands: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 67 Denmark: Market, By Propulsion Type, 2017–2027 (Units)

Table 68 Denmark: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 69 North America: Market, By Country, 2017–2027 (Thousand Units)

Table 70 North America: Market, By Country, 2017–2027 (USD Million)

Table 71 US: Vehicle Control Unit Market, By Propulsion Type, 2017–2027 (Units)

Table 72 US: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 73 Canada: Market, By Propulsion Type, 2017–2027 (Units)

Table 74 Canada: Market, By Propulsion Type, 2017–2027 (USD Thousand)

Table 75 New Product Developments, 2017–2019

Table 76 Partnerships/Supply Contracts/Collaborations/Joint Ventures/ Agreements, 2017–2019

Table 77 Expansions, 2017–2019

List of Figures (51 Figures)

Figure 1 Vehicle Control Unit Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology for the Market: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market: Market Dynamics

Figure 9 Market, By Region, 2019–2027 (USD Million)

Figure 10 Software Segment Held the Largest Share in the Market in 2019

Figure 11 Increasing Demand for Advanced Vehicle Electronics Technologies and Features is Driving the Market, 2019–2027 (USD Billion)

Figure 12 Market, By Value, By Region, 2027,

Figure 13 Software Segment to Account for the Largest Share in Asia Pacific Market, By Value, 2019

Figure 14 Passenger Car Segment Expected to Dominate During the Forecast Period

Figure 15 BEV Segment is Expected to Dominate During the Forecast Period

Figure 16 32-Bit Segment Expected to Dominate During the Forecast Period

Figure 17 36/48V Segment Expected to Grow Faster During the Forecast Period

Figure 18 E-Motorcycle Segment Expected to Dominate During the Forecast Period

Figure 19 Mining Segment Expected to Grow Faster During the Forecast Period

Figure 20 Vehicle Control Unit Market: Market Dynamics

Figure 21 Commercial Vehicle Segment to Grow at A Higher CAGR During the Forecast Period, 2019–2027 (USD Million)

Figure 22 Key Primary Insights

Figure 23 BEV Segment to Dominate the VCU Market in the Forecast

Figure 24 Key Primary Insights

Figure 25 32-Bit VCU is Capable of Performing Distinct Vehicle Electronics Functions

Figure 26 Key Primary Insights

Figure 27 36/48V Segment to Grow at A Higher CAGR Due to Increased Demand for Advanced VCU in Future, 2019–2027 (Thousand Units)

Figure 28 Key Primary Insights

Figure 29 Software Segment to Grow at A Higher CAGR During the Forecast Period, 2019–2027 (USD Million)

Figure 30 Key Primary Insights

Figure 31 Electric Motorcycle Segment to Grow at A Higher CAGR During the Forecast Period, 2019–2027 (USD Thousand)

Figure 32 Key Primary Insights

Figure 33 Market, By Off-Highway Electric Vehicle Type, 2019 vs. 2027

Figure 34 Key Primary Insights

Figure 35 Market, By Region, 2019 vs. 2027 (USD Million)

Figure 36 Asia Pacific: Market Snapshot

Figure 37 Europe: Market, By Country, 2019 vs. 2027 (USD Million)

Figure 38 North America: Market Snapshot

Figure 39 Key Developments By Leading Players, 2016–2019

Figure 40 Market Ranking 2018

Figure 41 Vehicle Control Unit Market: Competitive Leadership Mapping, 2019

Figure 42 Robert Bosch GmbH.: Company Snapshot

Figure 43 Robert Bosch GmbH: SWOT Analysis

Figure 44 Continental AG: Company Snapshot

Figure 45 Continental AG: SWOT Analysis

Figure 46 Texas Instruments: Company Snapshot

Figure 47 Texas Instruments: SWOT Analysis

Figure 48 Mitsubishi Electric Corporation: Company Snapshot

Figure 49 Mitsubishi Electric Corporation: SWOT Analysis

Figure 50 STMicroelectronics: Company Snapshot

Figure 51 STMicroelectronics: SWOT Analysis

The study involved four major activities in estimating the current market size of the vehicle control unit market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, publications of electric vehicle OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], control unit magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global vehicle control unit market.

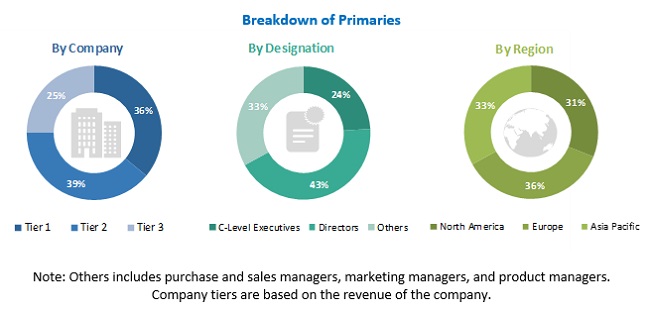

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across three major regions, namely, Asia Pacific, Europe, and North America. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation,

The top-down approach was used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global vehicle control unit market size in terms of volume and value.

- To define, describe, and forecast the global market based on propulsion type, vehicle type, capacity type, voltage type, component type, electric two-wheeler type, function, communication technology, and region

- To segment and forecast the market size by propulsion type {battery electric vehicle (BEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV)}

- To segment and forecast the market size by vehicle type (passenger car and commercial vehicle)

- To segment and forecast the market size by component type (hardware and software)

- To segment and forecast the market size by voltage type (12/24V and 36/48V)

- To segment and forecast the market size by capacity type (16, 32, and 64-bit)

- To segment and forecast the market size by electric two-wheeler type (E-scooter/moped and E-motorcycle)

- To segment and forecast the market size by function (qualitative)

- To segment and forecast the market size by communication technology type (Qualitative)

- To forecast the market size with respect to key regions, namely, North America, Europe, and Asia Pacific.

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Vehicle Control Unit Market, By Voltage type at country level

- Vehicle Control Unit Market, By Capacity at country level

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Vehicle Control Unit Market