VVT & Start-Stop System Market by Technology (Cam-phasing, Cam-phasing Plus Changing, BAS, Enhanced Starter, Direct Starter, ISG), Phaser Type (Hydraulic, Electronic), Valvetrain (SOHC and DOHC), Fuel type, Vehicle, and Region - Global Forecast to 2027

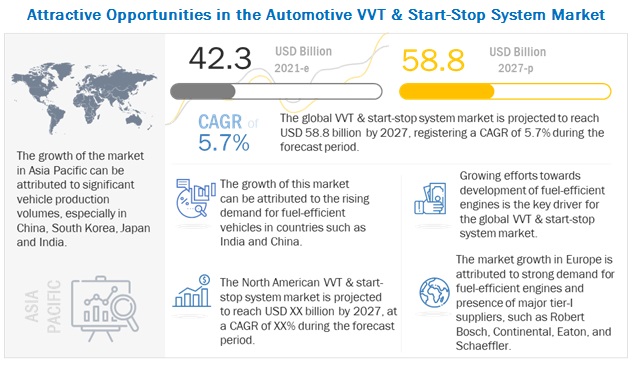

[332 Pages Report] The global automotive VVT & start-stop system market is projected to grow at a CAGR of 5.7%, reaching USD 58.8 billion by 2027 from an estimated USD 42.3 billion in 2021. The key factors that drive the market for VVT & start-stop systems are the demand for improving fuel efficiency and performance, stringent emission norms, and the increasing hybridization of vehicles.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Automotive VVT & start-stop system market:

The production and sales of new vehicles had come to a halt across the globe as the whole ecosystem had been disrupted in the initial outbreak of COVID 19. OEMs had to wait until lockdowns were lifted to resume production, which affected their businesses. Hence, vehicle manufacturers had to adjust the production volume. Also, component manufacturing was suspended, and small Tier II and Tier III manufacturers faced liquidity issues. The automotive industry is highly capital-intensive and relies on frequent financing to continue operations. Thus, the production suspension during the initial months of the outbreak and lower demand had an unprecedented impact on vehicle & component manufacturers in the initial months of the pandemic.

Due to the COVID-19 pandemic, many countries had imposed a complete lockdown of more than two months, which, in turn, has impacted vehicle production. Manufacturing units around the world were shut down, and vehicle sales have taken a huge hit. However, the majority of the automakers resumed vehicle production with limited production and necessary measures.

Market Dynamics:

Driver: Rise in hybridization of vehicles

The primary source of vehicle propulsion is the ICE, which is powered by fuels such as gasoline, diesel, ethanol, and Compressed Natural Gas (CNG). The need for emissions reduction, air quality improvement, and energy security drives the demand for hybrid vehicles. This hybridization of vehicles impacts the powertrain and the power supply system, as well as the vehicle control systems. Hybrid vehicles have the setup required for VVT & start-stop systems. The setup includes a starter, alternator, battery, and electronic control unit (ECU). Moreover, Hybrid vehicles and CNG vehicles are among the most promising vehicle types for low emissions. Consistent growth in these segments would ensure consistent demand for fuel-efficient components/systems, such as VVT & start-stop systems. Thus, despite rapid growth in electric vehicles, the VVT & start-stop system market would continue to demonstrate steady growth on account of the growing demand for hybrid and other alternate fuel ICE vehicles. Hence, the growing demand for hybrid vehicles is expected to boost the production of VVT & start-stop systems.

Restraint: Technology upgrades over time

VVT systems simply change the timing of the valve events without significantly altering the lift, which is the most basic function in order to achieve the engine controls. With the current trend of high-performance and fuel economy, the VVT market is firmly on the growth path. However, with the fuel economy standards and emission regulations set to become even more stringent, this will become increasingly challenging for a conventional VVT system to deliver the required level of performance and economy on a stand-alone basis. The need for updated VVT is being felt across the industry. While new and advanced technologies have been invented, they are still quite far away from reaching the implementation stage. For instance, Variable Valve Actuation (VVA) systems are cam-less systems that offer flexibility to the engine’s valve train by enabling variable valve event timing, duration, and/or lift. The introduction of such advanced technologies may restrict the market for conventional VVT systems in the future.

Opportunity:Increased inclusion of start-stop technology in vehicles

Engine start-stop helps to achieve fuel economy standards in conventional or hybrid-electric vehicles. The rise in hybrid vehicles production, government incentives for promoting the purchase of hybrid vehicles, and the increasing adoption of hybrid vehicles have boosted the demand for start-stop systems. OEMs are now focusing on adopting ultracapacitors for engine start-stop. For example, Continental Automotive Systems’ Maxwell Technologies delivered the voltage stabilization system (VSS) as a standard feature in 2016 Cadillac ATS, CTS sedans, and ATS coupes (excluding the ATS-V, CTS-V, and CT6 models). In 2015, General Motors became the first North American automotive OEM to integrate the Continental ultracapacitor-based VSS in car models with a start-stop function.

Challenge: High maintenance cost and limited aftermarket supplies of VVT & start-stop systems

High maintenance cost is the major challenge faced by the users of VVT & start-stop systems. These systems are part of an engine’s essential components that require adequate lubrication and proper maintenance. The replacement of the VVT solenoid costs 120–500 USD. The start-stop system also utilizes a lot of vehicle battery power for engine ignition and to power the starter motor. This drains the battery several dozen times a day, which increases the need for the maintenance of the system and batteries. Also, VVT & start-stop systems have a very high shelf life and are less prone to a replacement, unless factors such as adulterated fuel or those related to irregular maintenance of the vehicle come into play. This affects the aftermarket for these systems and restricts the market only to OEMs.

The most-efficient start-stop technologies include BAS and ISG. The BAS system consists mainly of an Absorbent Glass Mat (AGM) battery, an Engine Management System (EMS), and various sensors. The ISG system consists of a Low Voltage (LV) battery, a High Voltage (HV) battery, an ISG, an EMS, an Input Power Unit (IPU), and various sensors. The components and the system as a whole in these technologies are more expensive compared with the enhanced starter and direct starter-based start-stop technologies.

By vehicle type, passenger car is expected to be the largest in VVT & start-stop system market during the forecast period

The adoption of the VVT & start-stop systems is expected to be faster in passenger cars than in LCVs and HCVs. Another factor contributing to the growth of the passenger car segment is the increasing purchasing power in the developing regions. Initially, VVT & start-stop system systems are expected to be incorporated into mild-hybrid and premium passenger cars. Due to fierce competition in the premium car segment, luxury carmakers such as Audi, BMW, Mercedes Benz, and others have increased their focus towards fuel efficiency and advanced technologies supported by electric cam phasers and start-stop systems. Existing regulations regarding VVT & start-stop system systems in Europe would be a major factor for the growth of the market in the region.

By VVT technology, cam-phasing is expected to hold the largest market during the forecast period

The adoption of the cam-phasing VVT technology is majorly influenced by its use in passenger cars. Also, the low cost of cam-phasing VVT system is a major reason for its high demand in the Asia Pacific region. Cam-phasing needs only one hydraulic phasing actuator, unlike other systems that employ individual mechanisms for every cylinder. Such simple application encourages OEMs to adopt cam-phasing technology.

“Asia Pacific is expected to be the largest market during the forecast period.”

Asia Pacific is the largest market for VVT & start-stop system systems because of the increasing automotive production in Japan, China, and India. The region has the largest share of VVT systems globally due to the increased manufacturing of vehicles equipped with VVT systems. India is growing at a very high pace due to increased preference for diesel-powered vehicles, which has resulted in the demand for VVT system for diesel engines in the country. In addition, improving socio-economic conditions in Asian countries such as India, Thailand, and Indonesia have resulted in the growth of premium segment passenger cars. This has accelerated the market for VVT & start-stop system in these countries. Many automotive manufacturers are focusing on the Asia Pacific region owing to various benefits such as easy availability of economic labor, access to advanced machines, lenient regulations for environment & safety, increased FDI for the automotive industry in countries like India, South Korea, and China, and the growing demand for vehicles.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The global VVT & start-stop system market is dominated by key manufacturers such as Continental AG (Germany), DENSO Corporation (Japan), BorgWarner, Inc. (US), Robert Bosch GmbH (Germany), Aisin Seiki Co., Ltd. (Japan), and Hitachi, Ltd. (Japan). These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive solenoid market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2027 |

|

Forecast units |

Volume (‘000 units) and Value (USD Million) |

|

Segments covered |

Technology, Vehicle Type, Valvetrain, Fuel Type, Phaser Type, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Rest of the World |

|

Companies Covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo (France), DENSO Corporation (Japan), BorgWarner, Inc. (US), Hitachi, Ltd. (Japan), Aisin Seiki Co. Ltd. (Japan), and many others. |

This research report categorizes the VVT & start-stop system market based on fuel type, phaser type, valvetrain, technology, vehicle type, hybrid vehicle, and region.

Based on fuel type, the VVT system market has been segmented as follows:

- Gasoline

- Diesel

Based on phaser type, the VVT system market has been segmented as follows:

- Hydraulic Cam Phaser

- Electronic Cam Phaser

Based on valvetrain, the VVT system market has been segmented as follows:

- Dual Over Head Cam (DOHC)

- Single Over Head Cam (SOHC)

Based on technology, the VVT system market has been segmented as follows:

- Cam-Phasing

- Cam-Phasing Plus Changing

Based on technology, the start-stop system market has been segmented as follows:

- Belt-driven alternator starter

- Direct starter

- Enhanced starter

- Integrated starter generator

Based on vehicle type, the VVT & Start-Stop system market has been segmented as follows:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Based on region, the VVT & start-stop system market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Turkey

- Rest of Europe

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

Rest of the World

- Iran

- South Africa

- Others

Recent Developments

- In April 2021, Robert Bosch GmbH formed a joint venture with Qingling Motors and established Bosch Hydrogen Powertrain Systems (Chongqing) Co., Ltd. in China. The purpose of the joint venture is to provide fuel cells to all the vehicle manufacturers in China.

- In September 2021, Continental AG entered into a joint venture agreement with Horizon Robotics to accelerate the commercialization of automotive artificial intelligence technology in the Chinese market.

- In October 2020, BorgWarner, Inc. acquired Delphi Technologies to strengthen its capability, scale, and Electronics and Power Electronics Products portfolio. The company also expects to increase its strength in commercial vehicle and aftermarket businesses.

- In June 2019, Aisin Seiki Co., Ltd. entered into a joint venture agreement with Leon Import S.A., a Panama-based aftermarket import company, and formed a new company, i.e., Aisin Sales Latin America, S.A. to serve the Central and South American market as well as the Caribbean market.

- In October 2019, Valeo collaborated with Dana Incorporated with a focus to develop end-to-end 48V hybrid and electric vehicle systems. The company is expected to strengthen its position in low-voltage electrification through this collaboration.

Frequently Asked Questions (FAQ):

What is the current size of the global VVT & start-stop system market?

The global VVT & start-stop system market is estimated to be USD 42.3 billion in 2021 and projected to reach USD 58.8 billion by 2027, at a CAGR of 5.7%

Who are the winners in the global VVT & start-stop system market?

The VVT & start-stop system market is dominated by global players such as Robert Bosch GmbH, BorgWarner Inc, Hitachi, Ltd., Mikuni Corporation, and Magna International Inc. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the rapidly growing VVT & start-stop system market.

What is the Covid-19 impact on vehicle & component manufacturers?

Most automotive manufacturers and component suppliers incurred losses due to sales reduction during the pandemic in the initial months. The sales recovered in the latter months as demand for vehicles surged in the following months, however overall the companies suffered varying amount of losses.

What are the new market trends impacting the growth of the VVT & start-stop system market?

Growing demand for electric cam phasers,increased inclusion of start-stop technology in vehicles and growing use of VVT systems in high-end motorcycles are some of the major trends affecting this market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 VVT & START-STOP SYSTEM MARKET SEGMENTATION

1.3.2 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR THE STUDY OF MARKET

1.3.3 YEARS CONSIDERED

1.4 PACKAGE SIZE

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.1.2.1 List of primary participants

2.1.3 KEY DATA FROM PRIMARY SOURCES

TABLE 2 PRIMARY DATA SOURCES

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 VVT & START-STOP SYSTEM MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 7 VVT SYSTEM MARKET SIZE ESTIMATION APPROACH

FIGURE 8 START-STOP SYSTEM MARKET SIZE ESTIMATION APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 10 MARKET: RESEARCH DESIGN & METHODOLOGY

FIGURE 11 MARKET: RESEARCH METHODOLOGY ILLUSTRATION OF BORGWARNER REVENUE ESTIMATION

FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 13 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 14 VVT & START-STOP SYSTEM MARKET: MARKET OVERVIEW

FIGURE 15 MARKET, BY REGION

FIGURE 16 MARKET, BY VEHICLE TYPE, 2021 VS. 2027 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 VVT & START-STOP SYSTEM MARKET TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD (2021–2027)

FIGURE 17 INCREASING DEMAND FOR FUEL-EFFICIENT VEHICLES LIKELY TO BOOST MARKET GROWTH

4.2 ASIA PACIFIC ESTIMATED TO LEAD GLOBAL MARKET IN 2021

FIGURE 18 MARKET SHARE, BY REGION, 2021

4.3 VVT SYSTEM MARKET, BY TECHNOLOGY

FIGURE 19 CAM-PHASING SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 START-STOP SYSTEM MARKET, BY TECHNOLOGY

FIGURE 20 DIRECT STARTER SEGMENT ESTIMATED TO LEAD START-STOP SYSTEM MARKET DURING FORECAST PERIOD

4.5 VVT SYSTEM MARKET, BY VALVETRAIN

FIGURE 21 DOHC SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE FROM 2021 TO 2027

4.6 VVT SYSTEM MARKET, BY PHASER TYPE

FIGURE 22 HYDRAULIC CAM PHASER SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE FROM 2021 TO 2027

4.7 VVT SYSTEM MARKET, BY FUEL TYPE

FIGURE 23 GASOLINE SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE IN 2021

4.8 VVT SYSTEM MARKET, BY VEHICLE TYPE

FIGURE 24 PASSENGER CAR SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF VVT SYSTEM MARKET IN 2021

4.9 START-STOP SYSTEM MARKET, BY VEHICLE TYPE

FIGURE 25 PASSENGER CAR SEGMENT PROJECTED TO DOMINATE START-STOP SYSTEM MARKET FROM 2021 TO 2027

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 26 VVT & START-STOP SYSTEM MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for fuel-efficient vehicles

TABLE 3 ESTIMATED ANNUAL BENEFITS OF VVT SYSTEM ON VEHICLE FUEL ECONOMY

5.2.1.2 Rise in hybridization of vehicles

FIGURE 27 EUROPE NEW CNG POWERED PASSENGER CAR & VAN REGISTRATION

5.2.1.3 Steady growth in ICE vehicle demand

TABLE 4 INTERNAL COMBUSTION ENGINE (ICE) VEHICLE PRODUCTION, BY COUNTRY, 2019 - 2021(E)

TABLE 5 PLUG-IN HYBRID VEHICLE (PHEV) SALES, 2019, 2020 & 2021(E)

FIGURE 28 EUROPE NEW PASSENGER CAR & VAN REGISTRATIONS IN EUROPE, BY FUEL TYPE

5.2.1.4 Stringent emission norms

TABLE 6 PASSENGER CAR MANUFACTURERS: CO2 EMISSIONS STATUS AND FUTURE TARGETS

TABLE 7 LIGHT COMMERCIAL VEHICLE MANUFACTURERS: CO2 EMISSIONS STATUS AND FUTURE TARGETS

TABLE 8 COUNTRY WISE CO2 STATUS AND FUTURE TARGETS

5.2.2 RESTRAINTS

5.2.2.1 Wear of engines due to increase in start-stop cycles

5.2.2.2 Technology upgrades over time

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for electric cam phasers

TABLE 9 ACRONYMS USED BY MANUFACTURERS FOR VVT SYSTEM

5.2.3.2 Increased inclusion of start-stop technology in vehicles

5.2.3.3 Growing use of VVT systems in high-end motorcycles

TABLE 10 TWO-WHEELER MODELS USING VVT & START-STOP SYSTEM

5.2.4 CHALLENGES

5.2.4.1 High maintenance cost and limited aftermarket supplies of VVT & start-stop systems

TABLE 11 VARIABLE VALVE TIMING (VVT) SOLENOID REPLACEMENT COST

5.2.4.2 Difficulty in procuring complex internal components

5.2.5 IMPACT OF MARKET DYNAMICS

TABLE 12 VVT & START-STOP SYSTEM MARKET: IMPACT OF MARKET DYNAMICS

5.3 TRENDS AND DISRUPTIONS IN MARKET

5.4 COVID-19 HEALTH ASSESSMENT

FIGURE 29 COVID-19: GLOBAL PROPAGATION

FIGURE 30 COVID-19 PROPAGATION: SELECT COUNTRIES

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 31 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 32 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 33 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

5.6 MARKET: COVID-19 IMPACT

5.6.1 IMPACT ON VVT & START-STOP SYSTEM SALES

5.6.2 IMPACT ON VEHICLE SALES

5.7 MARKET, SCENARIOS (2021–2027)

FIGURE 34 MARKET– FUTURE TRENDS & SCENARIOS, 2018–2027 (USD MILLION)

5.7.1 MARKET, MOST LIKELY SCENARIO

TABLE 13 MARKET (MOST LIKELY), BY REGION, 2021–2027 (USD MILLION)

5.7.2 MARKET, OPTIMISTIC SCENARIO

TABLE 14 MARKET (OPTIMISTIC), BY REGION, 2021–2027 (USD MILLION)

5.7.3 MARKET, PESSIMISTIC SCENARIO

TABLE 15 MARKET (PESSIMISTIC), BY REGION, 2021–2027 (USD MILLION)

6 INDUSTRY TRENDS (Page No. - 81)

6.1 INTRODUCTION

6.2 TECHNOLOGICAL OVERVIEW

6.2.1 HIGHLY ADOPTED VALVE TECHNOLOGIES IN ENGINES

FIGURE 35 BMW VALVETRONIC

6.2.2 ULTRACAPACITORS

FIGURE 36 HYBRID SYSTEM WITH ULTRACAPACITORS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 37 SIGNIFICANT INTEGRATION BETWEEN VVT & START-STOP SYSTEM AND COMPONENT MANUFACTURERS

6.4 PORTER’S FIVE FORCES

TABLE 16 IMPACT OF PORTER’S FIVE FORCES ON VVT & START-STOP SYSTEM MARKET

FIGURE 38 PORTER'S FIVE FORCES ANALYSIS: MARKET

6.4.1 INTENSITY OF COMPETITIVE RIVALRY

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF BUYERS

6.4.4 BARGAINING POWER OF SUPPLIERS

6.4.5 THREAT OF NEW ENTRANTS

6.5 MARKET ECOSYSTEM

FIGURE 39 MARKET: ECOSYSTEM ANALYSIS

TABLE 17 ROLE OF COMPANIES IN VVT & START-STOP SYSTEM ECOSYSTEM

6.6 REGULATORY OVERVIEW

TABLE 18 EMISSION REGULATIONS

FIGURE 40 CHINA 6A PASSENGER CAR EMISSION LIMITS FROM 1ST JANUARY 2021

FIGURE 41 CHINA 6B PASSENGER CAR EMISSION LIMITS FROM 1ST JULY 2023

TABLE 19 COMPARISON BETWEEN EURO6 AND BS6

6.7 PATENT ANALYSIS

TABLE 20 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

6.8 CASE STUDY

6.8.1 DORMAN PRODUCTS DEVELOPED OE FIX VVT SOLENOIDS

6.8.2 DORMAN PRODUCTS DEVELOPED AND PATENTED NEW CAM PHASERS WITH A STRONGER ALLOY LOCKING PLATE

6.8.3 HOLLINGSWORTH & VOSE DEVELOPED H&V ABSORPTION GLASS MAT (AGM) BATTERY SEPARATORS FOR AUTOMOTIVE START-STOP ENGINES

7 VVT SYSTEM MARKET, BY TECHNOLOGY (Page No. - 93)

7.1 INTRODUCTION

7.2 OPERATIONAL DATA

TABLE 21 VVT TECHNOLOGIES USED BY VARIOUS COMPANIES

FIGURE 42 VVT SYSTEM MARKET, BY TECHNOLOGY, 2021 VS. 2027 (USD MILLION)

TABLE 22 VVT SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (’000 UNITS)

TABLE 23 VVT SYSTEM MARKET, BY TECHNOLOGY, 2021–2027 (’000 UNITS)

TABLE 24 VVT SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 25 VVT SYSTEM MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

7.3 RESEARCH METHODOLOGY

7.4 ASSUMPTIONS

TABLE 26 ASSUMPTIONS: BY TECHNOLOGY

7.5 CAM-PHASING

7.5.1 EASY IMPLEMENTATION AND LOW COST WILL DRIVE ADOPTION OF CAM-PHASING TECHNOLOGY

TABLE 27 CAM-PHASING VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 28 CAM-PHASING VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 29 CAM-PHASING VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 CAM-PHASING VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

7.6 CAM-PHASING PLUS CHANGING

7.6.1 IMPROVED TORQUE DELIVERY TO SIGNIFICANTLY INCREASE ADOPTION OF CAM-PHASING PLUS CHANGING

TABLE 31 CAM-PHASING PLUS CHANGING VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 32 CAM-PHASING PLUS CHANGING VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 33 CAM-PHASING PLUS CHANGING VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 34 CAM-PHASING PLUS CHANGING VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

7.7 KEY PRIMARY INSIGHTS

8 VVT SYSTEM MARKET, BY VALVETRAIN (Page No. - 101)

8.1 INTRODUCTION

FIGURE 43 SOHC VS DOHC ASSEMBLY

8.2 OPERATIONAL DATA

TABLE 35 CO2 EMISSIONS STATUS OF VARIOUS COMPANIES FOR PASSENGER CARS

TABLE 36 CO2 EMISSIONS STATUS OF VARIOUS COMPANIES FOR COMMERCIAL VEHICLES

FIGURE 44 VVT SYSTEM MARKET, BY VALVETRAIN, 2021 VS. 2027 (USD MILLION)

TABLE 37 VVT SYSTEM MARKET, BY VALVETRAIN, 2018–2020 (’000 UNITS)

TABLE 38 VVT SYSTEM MARKET, BY VALVETRAIN , 2021–2027 (’000 UNITS)

TABLE 39 VVT SYSTEM MARKET, BY VALVETRAIN, 2018–2020 (USD MILLION)

TABLE 40 VVT SYSTEM MARKET, BY VALVETRAIN , 2021–2027 (USD MILLION)

8.3 RESEARCH METHODOLOGY

8.4 ASSUMPTIONS

TABLE 41 ASSUMPTIONS: BY VALVETRAIN

8.5 SINGLE OVERHEAD CAMSHAFT (SOHC)

8.5.1 DEMAND FOR HIGHER ENGINE SPEED WITH LIGHTER VALVETRAIN TO DRIVE MARKET FOR SOHC

TABLE 42 SOHC VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 43 SOHC VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 44 SOHC VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 SOHC VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

8.6 DUAL OVERHEAD CAMSHAFT (DOHC)

8.6.1 DOHC DEVELOPS HIGHER PEAK TORQUE AND HORSEPOWER, WHICH INCREASES ITS DEMAND

TABLE 46 DOHC VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 47 DOHC VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 48 DOHC VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 49 DOHC VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

8.7 KEY PRIMARY INSIGHTS

9 VVT SYSTEM MARKET, BY FUEL TYPE (Page No. - 111)

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

TABLE 50 GLOBAL GASOLINE VEHICLE PENETRATION, BY REGION (%)

TABLE 51 GLOBAL DIESEL VEHICLE PENETRATION, BY REGION (%)

FIGURE 45 VVT SYSTEM MARKET, BY FUEL TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 52 VVT SYSTEM MARKET, BY FUEL TYPE, 2018–2020 (’000 UNITS)

TABLE 53 VVT SYSTEM MARKET, BY FUEL TYPE, 2021–2027 (’000 UNITS)

TABLE 54 VVT SYSTEM MARKET, BY FUEL TYPE, 2018–2020 (USD MILLION)

TABLE 55 VVT SYSTEM MARKET, BY FUEL TYPE , 2021–2027 (USD MILLION)

9.3 RESEARCH METHODOLOGY

9.4 ASSUMPTIONS

TABLE 56 ASSUMPTIONS: BY FUEL TYPE

9.5 DIESEL VVT SYSTEM

9.5.1 HIGH POWER & IMPROVED DIESEL ENGINE VERSIONS EQUIPPED WITH VVT SYSTEMS ARE EXPECTED TO GAIN POPULARITY IN COMMERCIAL VEHICLE SEGMENT

TABLE 57 DIESEL VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 58 DIESEL VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 59 DIESEL VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 DIESEL VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

9.6 GASOLINE VVT SYSTEM

9.6.1 CONSISTENT DEVELOPMENT TOWARDS FUEL-EFFICIENT ENGINES TO BOOST GASOLINE VVT SYSTEM MARKET

TABLE 61 GASOLINE VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 62 GASOLINE VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 63 GASOLINE VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 GASOLINE VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

9.7 KEY PRIMARY INSIGHTS

10 VVT SYSTEM MARKET, BY VEHICLE TYPE (Page No. - 120)

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

TABLE 65 LIGHT COMMERCIAL VEHICLE PRODUCTION, BY COUNTRY, 2017–2020 (THOUSAND UNITS)

TABLE 66 HEAVY COMMERCIAL VEHICLE PRODUCTION, BY COUNTRY, 2018–2020 (THOUSAND UNITS)

FIGURE 46 VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 67 VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 68 VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 69 VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 70 VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

10.3 RESEARCH METHODOLOGY

10.4 ASSUMPTIONS

TABLE 71 ASSUMPTIONS: BY VEHICLE TYPE

10.5 PASSENGER CAR

10.5.1 INCORPORATION OF FUEL-EFFICIENT FEATURES TO BOOST ADOPTION OF VVT SYSTEMS IN PASSENGER CARS

TABLE 72 PASSENGER CAR VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 73 PASSENGER CAR VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 74 PASSENGER CAR VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 75 PASSENGER CAR VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

10.6 LIGHT COMMERCIAL VEHICLE

10.6.1 IMPROVED TORQUE DELIVERY THAT INCREASES ENGINE OUTPUT WILL SIGNIFICANTLY INCREASE ADOPTION OF VVT SYSTEMS IN LCVS

TABLE 76 LIGHT COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 77 LIGHT COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 78 LIGHT COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 79 LIGHT COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

10.7 HEAVY COMMERCIAL VEHICLE

10.7.1 HIGH DEMAND FOR HCVS FOR HEAVY LOAD TRANSFERS WILL DRIVE MARKET

TABLE 80 HEAVY COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 81 HEAVY COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 82 HEAVY COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 83 HEAVY COMMERCIAL VEHICLE VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

10.8 KEY PRIMARY INSIGHTS

11 VVT SYSTEM MARKET, BY PHASER TYPE (Page No. - 131)

11.1 INTRODUCTION

11.2 OPERATIONAL DATA

TABLE 84 PLUG-IN HYBRID VEHICLE (PHEV) SALES, BY COUNTRY, 2019 VS. 2020 (THOUSAND UNITS)

FIGURE 47 VVT SYSTEM MARKET, BY PHASER TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 85 VVT SYSTEM MARKET, BY PHASER TYPE, 2018–2020 (’000 UNITS)

TABLE 86 VVT SYSTEM MARKET, BY PHASER TYPE , 2021–2027 (’000 UNITS)

TABLE 87 VVT SYSTEM MARKET, BY PHASER TYPE, 2018–2020 (USD MILLION)

TABLE 88 VVT SYSTEM MARKET, BY PHASER TYPE , 2021–2027 (USD MILLION)

11.3 ASSUMPTIONS

TABLE 89 ASSUMPTIONS, BY PHASER TYPE

11.4 RESEARCH METHODOLOGY

11.5 HYDRAULIC CAM PHASER

11.5.1 USAGE OF GASOLINE AND DIESEL ENGINES IN AUTOMOTIVE INDUSTRY TO INCREASE DEMAND FOR HYDRAULIC CAM PHASERS

TABLE 90 HYDRAULIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 91 HYDRAULIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 92 HYDRAULIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 93 HYDRAULIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

11.6 ELECTRONIC CAM PHASER

11.6.1 HIGH PHASING SPEEDS PROVIDED BY ELECTRONIC CAM PHASERS WILL DRIVE GROWTH

TABLE 94 ELECTRONIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 95 ELECTRONIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 96 ELECTRONIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 97 ELECTRONIC CAM PHASER VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

11.7 KEY PRIMARY INSIGHTS

12 START-STOP SYSTEM MARKET, BY TECHNOLOGY (Page No. - 139)

12.1 INTRODUCTION

FIGURE 48 START-STOP SYSTEM MARKET, BY TECHNOLOGY, 2021 VS. 2027 (USD MILLION)

TABLE 98 START-STOP SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (’000 UNITS)

TABLE 99 START-STOP SYSTEM MARKET, BY TECHNOLOGY, 2021–2027 (’000 UNITS)

TABLE 100 START-STOP SYSTEM MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 101 START-STOP SYSTEM MARKET, BY TECHNOLOGY, 2021–2027 (USD MILLION)

12.2 RESEARCH METHODOLOGY

12.3 ASSUMPTIONS

TABLE 102 ASSUMPTIONS, BY TECHNOLOGY (START-STOP SYSTEM)

12.4 BELT-DRIVEN ALTERNATOR STARTER (BAS)

12.4.1 BAS REPLACES NEED FOR ALTERNATOR AND STARTER IN VEHICLES

TABLE 103 BELT-DRIVEN ALTERNATOR STARTER (BAS) START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 104 BELT-DRIVEN ALTERNATOR STARTER (BAS) START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 105 BELT-DRIVEN ALTERNATOR STARTER (BAS) START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 106 BELT-DRIVEN ALTERNATOR STARTER (BAS) START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

12.5 ENHANCED STARTER

12.5.1 COST ADVANTAGE WILL DRIVE DEMAND FOR ENHANCED STARTERS

TABLE 107 ENHANCED STARTER START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 108 ENHANCED STARTER START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 109 ENHANCED STARTER START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 110 ENHANCED STARTER START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

12.6 DIRECT STARTER

12.6.1 HIGH EFFICIENCY AND FUEL-SAVING CHARACTERISTICS EXPECTED TO BOOST DEMAND FOR DIRECT STARTERS

TABLE 111 DIRECT STARTER START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 112 DIRECT STARTER START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 113 DIRECT STARTER START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 114 DIRECT STARTER START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

12.7 INTEGRATED STARTER GENERATOR (ISG)

12.7.1 ISG ALLOWS GREATER ELECTRICAL GENERATION CAPACITY AND EMISSIONS BENEFITS

TABLE 115 INTEGRATED STARTER GENERATOR START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 116 INTEGRATED STARTER GENERATOR START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 117 INTEGRATED STARTER GENERATOR START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 118 INTEGRATED STARTER GENERATOR START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

12.8 KEY PRIMARY INSIGHTS

13 START-STOP SYSTEM MARKET, BY VEHICLE TYPE (Page No. - 151)

13.1 INTRODUCTION

13.2 OPERATIONAL DATA

TABLE 119 GLOBAL VEHICLE PRODUCTION (THOUSAND UNITS)

FIGURE 49 START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021 VS. 2027 (USD MILLION)

TABLE 120 START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 121 START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 122 START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 123 START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

13.3 ASSUMPTIONS

TABLE 124 ASSUMPTIONS, BY VEHICLE TYPE (START-STOP SYSTEM)

13.4 RESEARCH METHODOLOGY

13.5 PASSENGER CAR

13.5.1 HIGH PRODUCTION OF PASSENGER CARS AND NEED FOR POLLUTION CONTROL IN CITIES TO DRIVE ADOPTION OF START-STOP SYSTEMS

TABLE 125 PASSENGER CAR START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 126 PASSENGER CAR START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 127 PASSENGER CAR START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 128 PASSENGER CAR START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

13.6 LIGHT COMMERCIAL VEHICLE

13.6.1 NORTH AMERICA DOMINATES LCV SEGMENT DUE TO LARGE PRODUCTION OF LIGHT COMMERCIAL VEHICLES AND RISING PENETRATION OF START-STOP SYSTEMS

TABLE 129 LIGHT COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 130 LIGHT COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 131 LIGHT COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 132 LIGHT COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

13.7 HEAVY COMMERCIAL VEHICLE

13.7.1 DEVELOPMENT OF HIGH-PERFORMANCE TRUCKS IN EUROPE WILL DRIVE DEMAND FOR START-STOP SYSTEMS

TABLE 133 HEAVY COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 134 HEAVY COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 135 HEAVY COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 136 HEAVY COMMERCIAL VEHICLE START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

13.8 KEY PRIMARY INSIGHTS

14 VVT & START-STOP SYSTEM MARKET, BY REGION (Page No. - 161)

14.1 INTRODUCTION

FIGURE 50 MARKET, BY REGION, 2021 VS. 2027 (USD MILLION)

TABLE 137 MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 138 MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 139 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 140 MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 141 VVT SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 142 VVT SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 143 VVT SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 144 VVT SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 145 START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (’000 UNITS)

TABLE 146 START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (’000 UNITS)

TABLE 147 START-STOP SYSTEM MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 148 START-STOP SYSTEM MARKET, BY REGION, 2021–2027 (USD MILLION)

14.2 ASIA PACIFIC

FIGURE 51 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 150 ASIA PACIFIC VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 151 ASIA PACIFIC VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 154 ASIA PACIFIC START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 155 ASIA PACIFIC START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.2.1 CHINA

14.2.1.1 Focus on fuel efficiency in road transport will drive VVT system market growth in China

TABLE 157 CHINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 158 CHINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 159 CHINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 160 CHINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 161 CHINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 162 CHINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 163 CHINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 164 CHINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.2.2 INDIA

14.2.2.1 Rapid industrialization and urbanization in India will boost investment in fuel-saving technologies

TABLE 165 INDIA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 166 INDIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 167 INDIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 168 INDIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 169 INDIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 170 INDIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 171 INDIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 172 INDIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 173 INDIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.2.3 JAPAN

14.2.3.1 High adoption of advanced technologies expected to drive VVT & start-stop system market

TABLE 174 JAPAN VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 175 JAPAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 176 JAPAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 177 JAPAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 178 JAPAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 179 JAPAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 180 JAPAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 181 JAPAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 182 JAPAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.2.4 SOUTH KOREA

14.2.4.1 GHG emission standards set by the country will boost market

TABLE 183 SOUTH KOREA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 184 SOUTH KOREA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 185 SOUTH KOREA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 186 SOUTH KOREA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 187 SOUTH KOREA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 188 SOUTH KOREA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 189 SOUTH KOREA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 190 SOUTH KOREA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 191 SOUTH KOREA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.2.5 THAILAND

14.2.5.1 Favorable government tax policies to encourage foreign investments will drive market

TABLE 192 THAILAND VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 193 THAILAND VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 194 THAILAND VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 195 THAILAND VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 196 THAILAND VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 197 THAILAND START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 198 THAILAND START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 199 THAILAND START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 200 THAILAND START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.2.6 REST OF ASIA PACIFIC

14.2.6.1 OEMs’ focus on expansion in Rest of Asia Pacific will drive market

TABLE 201 REST OF ASIA PACIFIC VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 202 REST OF ASIA PACIFIC VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 203 REST OF ASIA PACIFIC VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 204 REST OF ASIA PACIFIC VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 205 REST OF ASIA PACIFIC VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 207 REST OF ASIA PACIFIC START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 208 REST OF ASIA PACIFIC START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 209 REST OF ASIA PACIFIC START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3 EUROPE

TABLE 210 EUROPE: CO2 EMISSIONS BY VEHICLE MANUFACTURERS

FIGURE 52 EUROPE: VVT & START-STOP SYSTEM MARKET SNAPSHOT

TABLE 211 EUROPE VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 212 EUROPE VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 213 EUROPE VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 214 EUROPE VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 215 EUROPE START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 216 EUROPE START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 217 EUROPE START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 218 EUROPE START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Engine downsizing trend and growing demand for fuel-efficient vehicles will drive demand

TABLE 219 GERMANY VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 220 GERMANY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 221 GERMANY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 222 GERMANY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 223 GERMANY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 224 GERMANY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 225 GERMANY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 226 GERMANY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 227 GERMANY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.2 FRANCE

14.3.2.1 Increasing demand for premium passenger cars will boost market

TABLE 228 FRANCE VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 229 FRANCE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 230 FRANCE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 231 FRANCE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 232 FRANCE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 233 FRANCE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 234 FRANCE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 235 FRANCE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 236 FRANCE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.3 UK

14.3.3.1 Advancements in premium passenger car segment to boost demand for VVT & start-stop systems

TABLE 237 UK VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 238 UK VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 239 UK VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 240 UK VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 241 UK VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 242 UK START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 243 UK START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 244 UK START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 245 UK START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.4 SPAIN

14.3.4.1 Increasing passenger vehicle production & export will boost demand for engine technologies in Spain

TABLE 246 SPAIN VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 247 SPAIN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 248 SPAIN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 249 SPAIN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 250 SPAIN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 251 SPAIN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 252 SPAIN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 253 SPAIN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 254 SPAIN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.5 RUSSIA

14.3.5.1 Automotive manufacturing plant expansions will drive demand for VVT & start-stop systems

TABLE 255 RUSSIA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 256 RUSSIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 257 RUSSIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 258 RUSSIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 259 RUSSIA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 260 RUSSIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 261 RUSSIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 262 RUSSIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 263 RUSSIA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.6 TURKEY

14.3.6.1 Efficient ecosystem of OEMs and component suppliers would drive market for VVT & start-stop systems in Turkey

TABLE 264 TURKEY VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 265 TURKEY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 266 TURKEY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 267 TURKEY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 268 TURKEY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 269 TURKEY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 270 TURKEY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 271 TURKEY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 272 TURKEY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.7 ITALY

14.3.7.1 Government collaborations and strategies will impact market positively

TABLE 273 ITALY VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 274 ITALY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 275 ITALY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 276 ITALY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 277 ITALY VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 278 ITALY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 279 ITALY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 280 ITALY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 281 ITALY START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.3.8 REST OF EUROPE

14.3.8.1 Increasing passenger car production will drive demand

TABLE 282 REST OF EUROPE VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 283 REST OF EUROPE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 284 REST OF EUROPE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 285 REST OF EUROPE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 286 REST OF EUROPE VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 287 REST OF EUROPE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 288 REST OF EUROPE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 289 REST OF EUROPE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 290 REST OF EUROPE START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.4 NORTH AMERICA

TABLE 291 NORTH AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 292 NORTH AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 293 NORTH AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 294 NORTH AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 295 NORTH AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 296 NORTH AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 297 NORTH AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 298 NORTH AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.4.1 US

14.4.1.1 Increasing technological developments in engines will impact market positively

TABLE 299 US VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 300 US VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 301 US VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 302 US VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 303 US VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 304 US START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 305 US START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 306 US START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 307 US START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.4.2 CANADA

14.4.2.1 Upcoming fuel efficiency regulations will boost demand for VVT systems

TABLE 308 CANADA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 309 CANADA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 310 CANADA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 311 CANADA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 312 CANADA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 313 CANADA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 314 CANADA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 315 CANADA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 316 CANADA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.4.3 MEXICO

14.4.3.1 Increased demand for turbocharged and direct-injection engines will boost VVT system market in Mexico

TABLE 317 MEXICO VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 318 MEXICO VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 319 MEXICO VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 320 MEXICO VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 321 MEXICO VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 322 MEXICO START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 323 MEXICO START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 324 MEXICO START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 325 MEXICO START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.5 LATIN AMERICA

TABLE 326 LATIN AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 327 LATIN AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 328 LATIN AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 329 LATIN AMERICA VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 330 LATIN AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 331 LATIN AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 332 LATIN AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 333 LATIN AMERICA START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.5.1 BRAZIL

14.5.1.1 Government support and quotas on imports will drive market growth

TABLE 334 BRAZIL VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 335 BRAZIL VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 336 BRAZIL VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 337 BRAZIL VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 338 BRAZIL VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 339 BRAZIL START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 340 BRAZIL START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 341 BRAZIL START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 342 BRAZIL START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.5.2 ARGENTINA

14.5.2.1 Increasing production of passenger cars will drive VVT system demand

TABLE 343 ARGENTINA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 344 ARGENTINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 345 ARGENTINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 346 ARGENTINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 347 ARGENTINA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 348 ARGENTINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 349 ARGENTINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 350 ARGENTINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 351 ARGENTINA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.5.3 REST OF LATAM

14.5.3.1 Increasing demand for engine downsizing will impact market positively

TABLE 352 REST OF LATAM VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 353 REST OF LATAM VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 354 REST OF LATAM VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 355 REST OF LATAM VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 356 REST OF LATAM VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 357 REST OF LATAM START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 358 REST OF LATAM START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 359 REST OF LATAM START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 360 REST OF LATAM START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.6 REST OF THE WORLD (ROW)

TABLE 361 ROW VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 362 ROW VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 363 ROW VVT SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 364 ROW VVT SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 365 ROW START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (’000 UNITS)

TABLE 366 ROW START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (’000 UNITS)

TABLE 367 ROW START-STOP SYSTEM MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 368 ROW START-STOP SYSTEM MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

14.6.1 IRAN

14.6.1.1 Partnerships with global OEMs will drive demand for VVT systems

TABLE 369 IRAN VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 370 IRAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 371 IRAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 372 IRAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 373 IRAN VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 374 IRAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 375 IRAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 376 IRAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 377 IRAN START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.6.2 SOUTH AFRICA

14.6.2.1 Strategy to partner with foreign companies will drive VVT system market in South Africa

TABLE 378 SOUTH AFRICA VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 379 SOUTH AFRICA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 380 SOUTH AFRICA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 381 SOUTH AFRICA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 382 SOUTH AFRICA VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 383 SOUTH AFRICA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 384 SOUTH AFRICA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 385 SOUTH AFRICA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 386 SOUTH AFRICA START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

14.6.3 OTHERS

14.6.3.1 Government initiatives will drive demand for VVT & start-stop systems

TABLE 387 OTHERS VEHICLE PRODUCTION DATA (THOUSAND UNITS)

TABLE 388 OTHERS VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 389 OTHERS VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 390 OTHERS VVT SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 391 OTHERS VVT SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

TABLE 392 OTHERS START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (’000 UNITS)

TABLE 393 OTHERS START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (’000 UNITS)

TABLE 394 OTHERS START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2018–2020 (USD MILLION)

TABLE 395 OTHERS START-STOP SYSTEM MARKET, BY VEHICLE TYPE, 2021–2027 (USD MILLION)

15 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 248)

15.1 ASIA PACIFIC WILL BE MAJOR MARKET FOR VVT & START-STOP SYSTEMS

15.2 INCREASING FOCUS ON PASSENGER CARS WILL DRIVE DEMAND FOR VVT & START-STOP SYSTEMS

15.3 CONCLUSION

16 COMPETITIVE LANDSCAPE (Page No. - 250)

16.1 OVERVIEW

TABLE 396 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN VVT & START-STOP SYSTEM MARKET

16.2 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 53 TOP PUBLIC/LISTED PLAYERS DOMINATED MARKET DURING LAST THREE YEARS

16.3 MARKET RANKING ANALYSIS

FIGURE 54 MARKET: MARKET RANKING ANALYSIS

16.4 COMPETITIVE LEADERSHIP MAPPING FOR MARKET

16.4.1 STAR

16.4.2 PERVASIVE

16.4.3 EMERGING LEADER

16.4.4 PARTICIPANT

FIGURE 55 VVT SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2021

16.5 COMPANY EVALUATION QUADRANT

TABLE 397 COMPANY REGION FOOTPRINT

TABLE 398 COMPANY VEHICLE TYPE FOOTPRINT (14 COMPANIES)

TABLE 399 COMPANY APPLICATION & GEOGRAPHIC FOOTPRINT

FIGURE 56 START-STOP SYSTEM MARKET: COMPANY EVALUATION MATRIX, 2021

16.6 COMPANY EVALUATION QUADRANT

TABLE 400 COMPANY REGION FOOTPRINT

TABLE 401 COMPANY VEHICLE TYPE FOOTPRINT (14 COMPANIES)

TABLE 402 COMPANY APPLICATION & GEOGRAPHIC FOOTPRINT

16.7 COMPETITIVE SCENARIO AND TRENDS

16.7.1 PRODUCT LAUNCHES

TABLE 403 VVT & START-STOP SYSTEM MARKET: PRODUCT LAUNCHES, 2018–2021

16.7.2 DEALS

TABLE 404 MARKET: DEALS, 2018–2021

16.7.3 OTHERS

TABLE 405 MARKET: OTHERS, 2018–2021

16.8 WINNERS VS. TAIL-ENDERS

TABLE 406 WINNERS VS. TAIL-ENDERS

17 COMPANY PROFILES (Page No. - 274)

17.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

17.1.1 ROBERT BOSCH GMBH

TABLE 407 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

FIGURE 57 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 408 ROBERT BOSCH GMBH: PRODUCTS OFFERED

TABLE 409 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

TABLE 410 ROBERT BOSCH GMBH: DEALS

TABLE 411 ROBERT BOSCH GMBH: OTHERS

17.1.2 CONTINENTAL AG

TABLE 412 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 58 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 413 CONTINENTAL AG: BUSINESS SEGMENTS

TABLE 414 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 415 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 416 CONTINENTAL AG: DEALS

TABLE 417 CONTINENTAL AG: OTHERS

17.1.3 BORGWARNER, INC.

TABLE 418 BORGWARNER, INC.: BUSINESS OVERVIEW

FIGURE 59 BORGWARNER, INC.: MAJOR CLIENTS

FIGURE 60 BORGWARNER, INC.: COMPANY SNAPSHOT

TABLE 419 BORGWARNER, INC.: PRODUCTS OFFERED

TABLE 420 BORGWARNER INC: NEW PRODUCT DEVELOPMENTS

TABLE 421 BORGWARNER, INC.: DEALS

TABLE 422 BORGWARNER, INC.: OTHERS

17.1.4 AISIN SEIKI CO., LTD.

TABLE 423 AISIN SEIKI CO., LTD.: BUSINESS OVERVIEW

FIGURE 61 AISIN SEIKI CO., LTD.: COMPANY SNAPSHOT

TABLE 424 AISIN SEIKI CO., LTD.: PRODUCTS OFFERED

TABLE 425 AISIN SEIKI CO., LTD.: NEW PRODUCT DEVELOPMENTS

TABLE 426 AISIN SEIKI CO., LTD.: DEALS

TABLE 427 AISIN SEIKI CO., LTD.: OTHERS

17.1.5 VALEO

TABLE 428 VALEO: BUSINESS OVERVIEW

FIGURE 62 VALEO: COMPANY SNAPSHOT

TABLE 429 VALEO: PRODUCTS OFFERED

TABLE 430 VALEO: DEALS

17.1.6 DENSO CORPORATION

TABLE 431 DENSO CORPORATION: BUSINESS OVERVIEW

FIGURE 63 DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 432 DENSO CORPORATION: PRODUCTS OFFERED

TABLE 433 DENSO CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 434 DENSO CORPORATION: DEALS

TABLE 435 DENSO CORPORATION: OTHERS

17.1.7 HITACHI, LTD.

TABLE 436 HITACHI, LTD.: BUSINESS OVERVIEW

FIGURE 64 HITACHI, LTD.: COMPANY SNAPSHOT

TABLE 437 HITACHI, LTD.: PRODUCTS OFFERED

TABLE 438 HITACHI, LTD.: DEALS

TABLE 439 HITACHI, LTD.: OTHERS

17.1.8 SCHAEFFLER AG

TABLE 440 SCHAEFFLER AG: BUSINESS OVERVIEW

FIGURE 65 SCHAEFFLER AG: COMPANY SNAPSHOT

TABLE 441 SCHAEFFLER AG: PRODUCTS OFFERED

TABLE 442 SCHAEFFLER AG: NEW PRODUCT DEVELOPMENTS

TABLE 443 SCHAEFFLER AG: DEALS

TABLE 444 SCHAEFFLER AG: OTHERS

17.1.9 EATON CORPORATION PLC

TABLE 445 EATON CORPORATION PLC: BUSINESS OVERVIEW

FIGURE 66 EATON CORPORATION PLC: COMPANY SNAPSHOT

TABLE 446 EATON CORPORATION PLC: PRODUCTS OFFERED

TABLE 447 EATON CORPORATION PLC: NEW PRODUCT DEVELOPMENTS

TABLE 448 EATON CORPORATION PLC: DEALS

17.1.10 MITSUBISHI ELECTRIC CORPORATION

TABLE 449 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 67 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 450 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

TABLE 451 MITSUBISHI ELECTRIC CORPORATION: DEALS

TABLE 452 MITSUBISHI ELECTRIC CORPORATION: OTHERS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

17.2 OTHER KEY PLAYERS

17.2.1 TENNECO INC.

TABLE 453 TENNECO INC.: BUSINESS OVERVIEW

17.2.2 HILITE INTERNATIONAL

TABLE 454 HILITE INTERNATIONAL: BUSINESS OVERVIEW

17.2.3 TOYOTA MOTOR CORPORATION

TABLE 455 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

17.2.4 EXEDY CORPORATION

TABLE 456 EXEDY CORPORATION: BUSINESS OVERVIEW

17.2.5 HONDA MOTOR CO., LTD.

TABLE 457 HONDA MOTOR CO., LTD.: BUSINESS OVERVIEW

17.2.6 HYUNDAI MOTOR COMPANY

TABLE 458 HYUNDAI MOTOR COMPANY: BUSINESS OVERVIEW

17.2.7 MIKUNI CORPORATION

TABLE 459 MIKUNI CORPORATION: BUSINESS OVERVIEW

17.2.8 BMW AG

TABLE 460 BMW AG: BUSINESS OVERVIEW

17.2.9 ZF FRIEDRICHSHAFEN AG

TABLE 461 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

17.2.10 PMG HOLDING GMBH

TABLE 462 PMG HOLDING GMBH: BUSINESS OVERVIEW

17.2.11 STELLANTIS NV

TABLE 463 STELLANTIS NV: BUSINESS OVERVIEW

17.2.12 MAGNA INTERNATIONAL INC.

TABLE 464 MAGNA INTERNATIONAL INC.: BUSINESS OVERVIEW

17.2.13 CLOYES GEAR & PRODUCTS, INC.

TABLE 465 CLOYES GEAR & PRODUCTS, INC.: BUSINESS OVERVIEW

17.2.14 GENERAL MOTORS

TABLE 466 GENERAL MOTORS: BUSINESS OVERVIEW

18 APPENDIX (Page No. - 324)

18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the VVT & start-stop system market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

Various secondary sources were used in the secondary research process to identify and collect information useful for an extensive commerial study of the global VVT & start-stop system market. These sources include company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository.

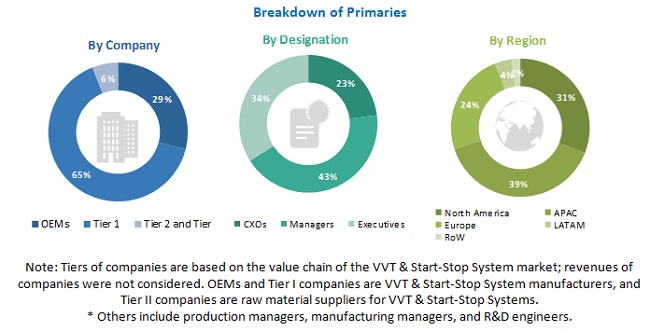

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the VVT & Start-Stop System market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (VVT & Start-Stop System and component manufacturers) across major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the VVT & Start-Stop System market. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and forecast the global VVT & start-stop system market based on technology, fuel type, phaser type, valvetrain, vehicle type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the VVT system market size, by technology (cam-phasing and cam-phasing plus changing)

- To segment and forecast the VVT system market size, by fuel type (gasoline VVT system and diesel VVT system)

- To segment and forecast the VVT system market size, by phaser type (hydraulic cam phaser and electronic cam phaser)

- To segment and forecast the VVT system market size, by valvetrain [dual overhead cam (DOHC) and single overhead cam (SOHC)]

- To segment and forecast the start-stop market size, by technology [belt-driven alternator starter (BAS), enhanced starter, direct starter, and integrated starter generator (ISG)]

- To segment and forecast the VVT & start-stop system market size, by vehicle type {passenger car and commercial vehicle [Light Commercial Vehicle (LCV) & Heavy Commercial Vehicle (HCV)]}

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, Latin America, and RoW

- To provide critical analysis of the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To analyze the competitive landscape of the market and the opportunities for stakeholders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To examine recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the VVT & start-stop system market

Start-stop technology & Its impact on VVT & Start-Stop System Market

Both start-stop technology and variable valve timing (VVT) have been linked to increased fuel efficiency in internal combustion engines. When the vehicle comes to a stop, start-stop technology automatically turns off the engine and restarts it when the driver releases the brake pedal or engages the clutch. In urban traffic, where vehicles frequently stop and start, this helps to reduce fuel consumption and emissions.

VVT, on the other hand, is a mechanism that allows for precise control of the intake and exhaust valves of the engine. This enables better control of the air-fuel mixture entering the engine, potentially leading to improved fuel efficiency, increased power output, and lower emissions.

By extending the reach of Start-stop technology companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Electric Vehicles: Start-stop systems can help to reduce energy consumption by shutting off the electric motor when the vehicle is stopped, and then quickly restarting it when the driver releases the brake pedal.

- Hybrid Vehicles: By combining start-stop technology with other features such as regenerative braking, hybrid vehicles can achieve even greater fuel efficiency.

- Heavy-Duty Vehicles: Start-stop systems can help to reduce fuel consumption and emissions in these vehicles, which are often used for commercial purposes.

- Connected Vehicles: As more vehicles become connected to the internet and to each other, start-stop technology may be used to enable new features and functionality.

- Autonomous Vehicles: By shutting off the engine when the vehicle is stopped or idle, autonomous vehicles could operate more efficiently and reduce their environmental impact.

The top players in the Start-stop technology Market are Johnson Controls, Robert Bosch GmbH, Continental AG, A123 Systems, Delphi Technologies, EnerSys, GS Yuasa Corporation, Exide Technologies.

Some of the key industries that are going to get impacted because in the future because of Powered Seats are,

- Battery Industry: The widespread adoption of start-stop technology has led to an increased demand for batteries with specific characteristics, such as higher power density and longer life.

- Energy Industry: Start-stop technology has the potential to reduce the demand for fossil fuels in the automotive industry, which could have a significant impact on the energy industry.

- Environmental Industry: The use of start-stop technology in vehicles can help to reduce emissions and improve air quality, which could have a positive impact on the environmental industry.

- Manufacturing Industry: The growth of start-stop technology is likely to drive innovation and competition in the manufacturing industry, as companies work to develop new solutions and components for start-stop systems.

- Consumer Electronics Industry: As more vehicles adopt start-stop technology, there may be increased demand for consumer electronics products that can interface with these systems.

Speak to our analyst today to know more about "Start-stop technology Market"

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

VVT & start-stop system market, by vehicle type, at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in VVT & Start-Stop System Market

It looks quite interesting. I would like to see the sample of this report. Kindly share the sample ASAP. Thanks

The numbers in the sample table for the volume of Stop-Start Systems do not make much sense - can you clarify? Are the comas in the wrong places?

More interested in the percentage of the VVT market that will be electronically actuated versus the Eaton mechanical valve systems.

Future design and production process of VVT systems; to identify possible future forged and machined products for my company. Forecast QTY´s for Europe, America and Asia.