Off-Highway Vehicle Engine Market by Power Output (HP) (Construction: <100, 101-200, 201-400, >400; Agriculture: <30, 31-50, 51-80, 81-140, >140), Capacity (<5L, 5.1L-10L, >10L), Fuel Type (Diesel, Gasoline & Others), & by Region - Forecast to 2020

[146 Pages Report] The off-highway vehicle engine market is mainly driven by the stringent emission norms, increasing mechanization in agriculture industry, and growing infrastructure activities across the globe. The global off-highway vehicle engine market is estimated to be USD 26.9 billion in 2015 and is projected to grow at the CAGR of 7.65% from 2015 to 2020.

Off-highway engines are designed and developed for vehicles intended for operation on rough terrain or for off-highway activities, especially for construction & mining and agriculture. The continuous growth in socio-economic conditions has fueled the growth of construction and agriculture industry across the globe. The global off-highway vehicle engine market is being driven by the rising mechanization in agriculture, growth of construction industry especially in Asia-Oceania and rapid urbanization around the world. The base year considered for the study is 2014, and the forecast has been provided for the period between 2015 and 2020.

Market Dynamics of Engine Market

Drivers

- Rising Mechanization in Agriculture

- Growth of Infrastructure Activities

Restraints

- Heavy Investments, High Manufacturing, Operating, & Maintenance Cost

Opportunities

- Market Consolidation

- Renting or Leasing of Equipment

- Off-Highway Engines Powered by Alternate Fuels

Challenges

- Stringent Emission Norms

Increase in mechanization drives the agriculture tractors demand positively impacting the off-highway engines market

The agriculture tractor engine market is dominated by the <5L engine as majority of the agriculture tractors uses <5L engines. The major markets for agriculture tractor are China, India, and Indonesia where light or medium duty tractors are primarily used which are equipped with <5L engines. This is due to the size of the farm lands per farmer in this region is small as compared to the North American and European farm lands. The farmers in country like India have small farm lands where they either use cattle to plough farms or uses light duty tractors. Therefore, as demand for light or medium duty tractors is highest in high-volume markets such as India and China, the demand for <5L engines is the largest globally

The following are the major objectives of the study.

- To define, describe, and forecast the global off-highway engine market on the basis of power output, engine capacity, fuel type, end user and region

- To provide a detailed information regarding major factors influencing growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro-markets with respect to individual growth trends, future prospects, and contribution to the total market

- To identify opportunities offered by various segments of the market to stakeholders

- To project the market for off-highway vehicle engines for the four key regions, namely, Asia- Oceania, Europe, North America, and RoW (Rest of the world) in terms of volume (million units) and value (USD million)

- To strategically profile key players and comprehensively analyze their core competencies such as technology and cost

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other industry activities carried out by key industry participants

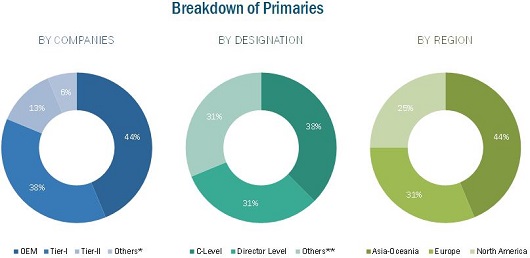

During this research study, major players operating in the off-highway engines market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The off-highway vehicle engine ecosystem consists of engine manufacturers such as Caterpillar Inc. (U.S.), Cummins Inc. (U.S.), Deutz AG (Germany), and Kubota Corporation (Japan), the construction equipment manufacturers such as J. C. Bamford Excavators Ltd. (U.K.), Deere and Company (U.S.) and Hitachi Construction Machinery Co. Ltd. (Japan), agricultural tractor manufacturers such as AGCO Corporation (U.S.), Mahindra and Mahindra Ltd. (India) and Massey Ferguson Ltd (U.S.).

Major Development in Engine Market

- In November 2015, MTU showcased its new range of agricultural engines complying with EU Stage V emissions regulations at 2015 Agritechnica agricultural machinery and equipment exhibition in Hanover, Germany. MTU also showcased its exhaust gas after-treatment systems for projected Tier 4 Final/Stage IV emissions regulations.

- In June 2014, Deutz AG opened a sales office in Shanghai (China) to consolidate its sales activities in the country. The office employs sales staff as well as application engineers and service engineers to further expand customer support.

- In April 2015, Weichai Power (China) and Caterpillar (Qingzhou) Co., Ltd. (China) entered into strategic cooperation agreement for the supply of Weichai engines for construction machineries manufactured by Caterpillar for three years.

Target Audience of Engine Market

- Engine manufacturers

- Construction equipment manufacturers

- Agricultural tractor manufacturers

- Investment firms

- Equity research firms

- Private equity firms

Scope of the Engine Market Report

- By power output (Construction: <100HP, 101-200HP, 201-400HP, and >400HP; Agriculture: <30HP, 31-50HP, 51-80HP, 81-140HP, and >140HP)

- By engine capacity (<5L, 5-10L and >10L)

- By fuel type (Diesel and Gasoline & others)

- By region (Asia-Oceania, North America, Europe, and RoW)

Critical questions the report answers:

- Which new regions, engines manufacturers are exploring for potential business avenues?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

- How will the new advancement affect the off-highway engines market?

Available Customizations of Engine Market

- Off-highway engine market, by application (Industrial, Marine, Forestry and Mining)

- Further breakdown of Rest of Asia-Oceania off-highway engine market into country level markets such as Indonesia, Malaysia, Thailand and Australia

- Further breakdown of Rest of Europe off-highway engine market into country level markets such as Italy, Spain, Poland and Sweden

The off-highway vehicle engine market size is projected to grow at a promising CAGR of 7.65% during the forecast period, to reach $38.93 billion by 2020. Rising mechanization in agriculture and growth in infrastructure activities are some of the drivers fueling growth in sales of off-highway vehicle engine globally.

The off-highway engines are those engines that are used in applications that are intended to work on the rough terrain or off-highway activities such as construction, mining and agriculture, among others. The engines used for off-highway applications are generally diesel-powered owing to the power requirements. The increasing stringency of emission norms have led to several technological advancements in off-highway industry. For instance, major players such as Cummins Inc. (U.S.) and Deere and Company (U.S.) have introduced engines that run on natural gas and gasoline. Alternate fuel engines have also been introduced but have limited applications such as lawn movers and stationary equipment.

The study segments off-highway engine market report by power output (Construction & mining: <100HP, 101-200HP, 201-400HP and >400HP; Agriculture: <30HP, 31-50HP, 51-80HP, 81-140HP, and >140HP), by engine capacity (<5 liter, 5.1-10.0 liter, and >10 liter), fuel type (diesel, gasoline & others), and by region (Asia-Oceania, Europe, North America, and RoW).

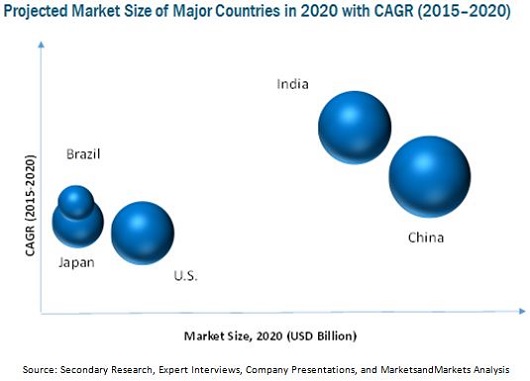

The Asia-Oceania region includes emerging economies such as India, China, Indonesia, and Thailand among others. The increase in the infrastructure activities such as housing, power projects, road construction, and airports among others is enhancing the demand for construction equipment, which in turn increasing the market for off-highway vehicle engines. Apart from construction industry, growth in agriculture industry is also enhancing the market for off-highway engines. Due to the increase in the mechanization of agriculture industry the demand for agriculture tractors is on the rise, which is ultimately increasing the demand for agriculture tractor engines in Asia-Oceania region. Asia-Oceania region is the highest growing off-highway vehicle engine market, growing at a CAGR of 8.45% from 2015 to 2020.

Increase in mechanization and demand for powered engines to drive the overall market

<5 Liter engines

The off-highway vehicle engine market for engine capacity segment is estimated to be dominated by the <5 Liter engines from 2015 to 2020. The <5L engines are prominently used in agriculture tractors and construction equipment. In agriculture tractors, China and India are the largest market, where light and medium duty tractors holds the maximum share which are equipped with <5L engines. In Asia-Oceania region farm lands are smaller in size where farmers uses cattle to plough the farms or light or medium duty tractors. For construction equipment, <5L engines are the highest growing market. This is due to the increase in the demand for backhoe loaders and mini excavators which are equipped with <5L engines.

Agriculture Tractor

The agriculture tractor market for power output segment is led by 51-80 HP engines for the forecast period. The demand for 51-80 HP engines is largest because of the high demand for medium duty tractors in Asia-Oceania region which is holds the majority share of the overall agriculture tractor market. Whereas, in North America and Europe, the demand for heavy duty tractors is high therefore the market for 81-140 HP and >140 HP engines is more in these regions. The demand for 101-200 HP engines of construction equipment engines is largest globally. This is due to the increase in the demand for excavators, loaders, and dozers equipped with these engines is highest globally.

Critical questions the report answers:

- Which new regions, engines manufacturers are exploring for potential business avenues?

- Which are the key players in the market and how intense is the competition?

- Where will all these developments take the industry in the mid to long term?

- How will the new advancement affect the off-highway engines market?

The major restraint considered in the study is high manufacturing, operating, and maintenance cost of off-highway vehicle engines. Machinery used in construction and agriculture industry have high operating cost as most of the times power requirements are high that results in high fuel consumption. The maintenance and repair cost associated with these equipment are also high. These factors could negatively affect the demand for agriculture and construction machinery which in turn restraints the market for engines required for these applications

The off-highway vehicle engine ecosystem consists of engine manufacturers such as Caterpillar Inc. (U.S.), Cummins Inc. (U.S.), Deutz AG (Germany), and Kubota Corporation (Japan), the construction equipment manufacturers such as J. C. Bamford Excavators Ltd. (U.K.), Deere and Company (U.S.) and Hitachi Construction Machinery Co. Ltd. (Japan), agricultural tractor manufacturers such as AGCO Corporation (U.S.), Mahindra and Mahindra Ltd. (India) and Massey Ferguson Ltd (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitation

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Increasing Population Across the Globe

2.4.2.2 Impact of GDP on Construction & Mining and Agriculture Equipment Sales

2.4.3 Supply Side Analysis

2.4.3.1 Influence of Other Factors Such as Environmental Regulations

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Engine Market for Off-Highway Vehicles, By Region, 2015-E

4.2 Engine Market for Off-Highway Vehicles Growth, By Country, 2015–2020

4.3 Construction & Mining Equipment Engine Market, By Engine Capacity & Region, 2015-E

4.4 Construction & Mining Equipment Engine Market, By Power Output, 2015–2020 (USD Billion)

4.5 Agriculture Tractor Engine Market, By Power Output, 2015-E (USD Billion)

4.6 Agriculture Tractor Engine Market, By Engine Capacity, 2015–2020

4.7 Off-Highway Vehicle Engine Market, By Country, 2015–2020

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rising Mechanization in Agriculture

5.3.1.2 Growth of Infrastructure Activities

5.3.2 Restraint

5.3.2.1 Heavy Investments, High Manufacturing, Operating, & Maintenance Cost

5.3.3 Opportunities

5.3.3.1 Market Consolidation

5.3.3.2 Renting Or Leasing of Equipment

5.3.3.3 Off-Highway Engines Powered By Alternate Fuels

5.3.4 Challenges

5.3.4.1 Stringent Emission Norms

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Product Flow Diagram

6 Technical Overview (Page No. - 50)

6.1 Emission Regulations for Off-Highway Engines

6.1.1 Tier-IV/ Stage-IV

6.1.2 Tier 3/ Stage III Norms

6.2 Upgrades in Engine Technology

6.2.1 Tier-IV Engine Families From Key Manufacturers

6.2.2 Electronic Fuel Injection

6.2.3 Two Stage Turbochargers

6.2.4 Cooled Egr

6.2.5 Selective Catalytic Reduction (SCR)

6.3 Fuel Quality Requirements

6.4 Upgrades in Materials Used for Off-Highway Engines

7 Engine Market for Off-Highway Vehicles, By Power Output (Page No. - 60)

7.1 Introduction

7.2 Construction & Mining Equipment Engines Market, By Power Output

7.2.1 Market for <100 HP Engines, By Region

7.2.2 Market for 101-200 HP Engines, By Region

7.2.3 Market for 201-400 HP Engines, By Region

7.2.4 Market for >400 HP Engines, By Region

7.3 Agriculture Tractor Engines Market, By Power Output

7.3.1 Market for <30 HP Engines, By Region

7.3.2 Market for 31-50 HP Engines, By Region

7.3.3 Market for 51-80 HP Engines, By Region

7.3.4 Market for 81-140 HP Engines, By Region

7.3.5 Market for >140 HP Engines, By Region

8 Engine Market for Off-Highway Vehicles, By Engine Capacity (Page No. - 73)

8.1 Introduction

8.2 Construction & Mining Equipment Engines Market, By Engine Capacity

8.2.1 Market for <5l Engines, By Region

8.2.2 Market for 5l-10l Engines, By Region

8.2.3 Market for >10l Engines, By Region

8.3 Agriculture Tractor Engines Market, By Engine Capacity

8.3.1 Market for <5l Engines, By Region

8.3.2 Market for 5l-10l Engines, By Region

8.3.3 Market for >10l Engines, By Region

9 Engine Market for Off-Highway Vehicles, By Fuel Type (Page No. - 82)

9.1 Introduction

9.2 Construction & Mining Equipment Engine Market, By Fuel Type

9.3 Agriculture Tractor Engine Market, By Fuel Type

10 Engine Market for Off-Highway Vehicles, By Region (Page No. - 86)

10.1 Introduction

10.2 Engine Market for Off-Highway Vehicles, By Region

10.2.1 Asia-Oceania

10.2.1.1 Pest Analysis

10.2.1.1.1 Political Factors

10.2.1.1.2 Economic Factors

10.2.1.1.3 Social Factors

10.2.1.1.4 Technological Factors

10.2.1.2 Asia-Oceania Engine Market for Off-Highway Vehicles, By Country

10.2.1.2.1 China Engine Market for Off-Highway Vehicles, By End User

10.2.1.2.2 Japan Engine Market for Off-Highway Vehicles, By End User

10.2.1.2.3 India Engine Market for Off-Highway Vehicles, By End User

10.2.2 North America

10.2.2.1 Pest Analysis

10.2.2.1.1 Political Factors

10.2.2.1.2 Economic Factors

10.2.2.1.3 Social Factors

10.2.2.1.4 Technological Factors

10.2.2.2 North America Engine Market for Off-Highway Vehicles, By Country

10.2.2.2.1 U.S. Engine Market for Off-Highway Vehicles, By End User

10.2.2.2.2 Canada Engine Market for Off-Highway Vehicles, By End User

10.2.2.2.3 Mexico Engine Market for Off-Highway Vehicles, By End User

10.2.3 Europe

10.2.3.1 Pest Analysis

10.2.3.1.1 Political Factors

10.2.3.1.2 Economic Factors

10.2.3.1.3 Social Factors

10.2.3.1.4 Technological Factors

10.2.3.2 Europe Engine Market for Off-Highway Vehicles, By Country

10.2.3.2.1 Germany Engine Market for Off-Highway Vehicles, By End User

10.2.3.2.2 U.K. Engine Market for Off-Highway Vehicles, By End User

10.2.3.2.3 France Engine Market for Off-Highway Vehicles, By End User

10.2.4 RoW

10.2.4.1 Pest Analysis

10.2.4.1.1 Political Factors

10.2.4.1.2 Economic Factors

10.2.4.1.3 Social Factors

10.2.4.1.4 Technological Factors

10.2.4.2 RoW Engine Market for Off-Highway Vehicles, By Country

10.2.4.2.1 Brazil Engine Market for Off-Highway Vehicles, By End User

10.2.4.2.2 Russia Engine Market for Off-Highway Vehicles, By End User

11 Competitive Landscape (Page No. - 108)

11.1 Competitive Situation & Trends

11.2 Battle for Market Share: New Product Launch Was the Key Strategy

11.3 New Product Launches

11.4 Expansions

11.5 Agreements/Joint Ventures/ Supply Contracts/ Partnerships

12 Company Profiles (Page No. - 115)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Caterpillar Inc.

12.3 Cummins Inc.

12.4 Deere & Company

12.5 Kubota Corporation

12.6 Deutz AG

12.7 Scania AB

12.8 Weichai Power Co. Ltd.

12.9 MTU Friedrichshafen GmbH

12.10 Volvo CE

12.11 Yanmar Co. Ltd.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 140)

13.1 Insights of Industry Experts

13.2 Other Developments

13.3 Discussion Guide

13.4 Available Customizations

13.4.1 Further Breakdown of Engine Market for Off-Highway Vehicles, By Other Applications

13.4.2 Regional Analysis

13.4.3 Model Mapping for Off-Highway Engines

13.4.4 Off-Highway Electric Vehicles Market

13.5 Introducing RT: Real Time Market Intelligence

13.6 Related Report

List of Tables (88 Tables)

Table 1 Economic Factors

Table 2 U.S. Tier-IV Off-Highway Final Regulations

Table 3 EU Stage-IV Off-Highway Regulations

Table 4 U.S. Tier 3 Off-Highway Regulations

Table 5 EU Stage III A Off-Highway Regulations

Table 6 EU Stage III B Off-Highway Regulations

Table 7 Cummins Inc. Tier 4 Engine Families

Table 8 Caterpillar Inc. Tier 4 Engine Families

Table 9 John Deere Tier 4 Engine Families

Table 10 Deutz AG Tier 4 Engine Families

Table 11 Perkins Engines Co. Ltd. Tier 4 Engine Families

Table 12 Construction & Mining Equipment Engine Market Size, By Power Output, 2013–2020 (‘000 Units)

Table 13 Construction & Mining Equipment Engine Market Size, By Power Output, 2013–2020 (USD Million)

Table 14 Construction & Mining Equipment <100 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 15 Construction & Mining Equipment <100 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 16 Construction & Mining Equipment 101-200 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 17 Construction & Mining Equipment 101-200 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 18 Construction & Mining Equipment 201-400 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 19 Construction & Mining Equipment 201-400 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 20 Construction & Mining Equipment >400 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 21 Construction & Mining Equipment >400 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 22 Agriculture Tractor Engine Market Size, By Power Output, 2013–2020 (‘000 Units)

Table 23 Agriculture Tractor Engine Market Size, By Power Output, 2013–2020 (USD Million)

Table 24 Agriculture Tractor <30 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 25 Agriculture Tractor <30 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 26 Agriculture Tractor 31-50 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 27 Agriculture Tractor 31-50 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 28 Agriculture Tractor 51-80 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 29 Agriculture Tractor 51-80 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 30 Agriculture Tractor 81-140 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 31 Agriculture Tractor 81-140 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 32 Agriculture Tractor >140 HP Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 33 Agriculture Tractor >140 HP Engine Market Size, By Region, 2013–2020 (USD Million)

Table 34 Construction & Mining Equipment Engine Market Size, By Capacity, 2013–2020 (‘000 Units)

Table 35 Construction & Mining Equipment Engine Market Size, Capacity, 2013–2020 (USD Million)

Table 36 Construction & Mining Equipment <5l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 37 Construction & Mining Equipment <5l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 38 Construction & Mining Equipment 5l-10l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 39 Construction & Mining Equipment 5l-10l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 40 Construction & Mining Equipment >10l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 41 Construction & Mining Equipment >10l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 42 Agriculture Tractor Engine Market Size, By Capacity, 2013–2020 (‘000 Units)

Table 43 Agriculture Tractor Engine Market Size, By Capacity, 2013–2020 (USD Million)

Table 44 Agriculture Tractor <5l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 45 Agriculture Tractor <5l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 46 Agriculture Tractor 5l-10l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 47 Agriculture Tractor 5l-10l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 48 Agriculture Tractor >10l Engine Market Size, By Region, 2013–2020 (‘000 Units)

Table 49 Agriculture Tractor >10l Engine Market Size, By Region, 2013–2020 (USD Million)

Table 50 Construction & Mining Equipment Engine Market Size, By Fuel Type, 2013–2020 (‘000 Units)

Table 51 Construction & Mining Equipment Engine Market Size, By Fuel Type, 2013–2020 (USD Million)

Table 52 Agriculture Tractor Engine Market Size, By Fuel Type, 2013–2020 (‘000 Units)

Table 53 Agriculture Tractor Engine Market Size, By Fuel Type, 2013–2020 (USD Million)

Table 54 Engine Market for Off-Highway Vehicles Size, By Region, 2013–2020 (‘000 Units)

Table 55 Engine Market for Off-Highway Vehicles Size, By Region, 2013–2020 (USD Million)

Table 56 Asia-Oceania: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (‘000 Units)

Table 57 Asia-Oceania: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (USD Million)

Table 58 China: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 59 China: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 60 Japan: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 61 Japan: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 62 India: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 63 India: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 64 North America: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (‘000 Units)

Table 65 North America: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (USD Million)

Table 66 U.S.: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 67 U.S.: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 68 Canada: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 69 Canada: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 70 Mexico: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 71 Mexico: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 72 Europe: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (‘000 Units)

Table 73 Europe: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (USD Million)

Table 74 Germany: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 75 Germany: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 76 U.K.: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 77 U.K.: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 78 France: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 79 France: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 80 RoW: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (‘000 Units)

Table 81 RoW: Engine Market for Off-Highway Vehicles Size, By Country, 2013–2020 (USD Million)

Table 82 Brazil: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (‘000 Units)

Table 83 Brazil: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 84 Russia: Engine Market for Off-Highway Vehicles, By End User, 2013–2020 (‘000 Units)

Table 85 Russia: Engine Market for Off-Highway Vehicles Size, By End User, 2013–2020 (USD Million)

Table 86 New Product Launches, 2014–2015

Table 87 Expansions, 2011–2015

Table 88 Agreements/Joint Ventures/Supply Contracts/Partnerships , 2012–2015

List of Figures (62 Figures)

Figure 1 Global Off-Highway Engine Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Companies, Designation, & Region

Figure 5 Significant Growth in Global Population (Million), 2004–2014

Figure 6 Value Added By Agriculture Industry as A Percentage of GDP, 2014

Figure 7 Gross Domestic Product vs Construction & Mining Equipment Sales, 2013-2014

Figure 8 U.S. Fuel Price Comparison, 2000-2015

Figure 9 Engine Market for Off-Highway Vehicles, By Engine Capacity: Bottom-Up Approach

Figure 10 Engine Market for Off-Highway Vehicles, By Power Output: Top Down Approach

Figure 11 Asia-Oceania Projected to Be the Largest Market for Off-Highway Engines, 2015–2020

Figure 12 101-400hp Engine Segments Estimated to Dominate the Construction & Mining Equipment Engines, 2015

Figure 13 <5l Engines: Largest Share in Engine Market for Off-Highway Vehicles, 2015

Figure 14 Diesel Fuel Segment Dominates the Off-Highway Engine Market in 2015

Figure 15 China: the Largest Market for Off-Highway Vehicle Engine From 2015 to 2020 (USD Billion)

Figure 16 Asia-Oceania Estimated to Dominate the Engine Market for Off-Highway Vehicles, By Value, 2015-E

Figure 17 India: Highest Growing Engine Market for Off-Highway Vehicles From 2015 to 2020, By Value

Figure 18 Asia-Oceania to Dominate the Global Construction & Mining Equipment Engine Market, 2015

Figure 19 Construction & Mining Equipment Engine Market, By Power Output: Snapshot, 2015

Figure 20 51-80 HP Engine: Highest Market Share in Agriculture Tractor Engine Market, By Value, 2015-E

Figure 21 <5l Engine: Largest Market in the Engine Capacity Segment of Agriculture Tractor Engine, 2015-2020

Figure 22 Top 4 Countries to Account for the Maximum Share in the Engine Market for Off-Highway Vehicles Size, By Value, 2015–2020

Figure 23 Engine Market for Off-Highway Vehicles Dynamics

Figure 24 Agriculture Tractor Sales, 2012–2013

Figure 25 Global Infrastructure Investment, 2013

Figure 26 Construction Spending in Asia-Oceania, 2013 (USD Billion)

Figure 27 U.S. EPA (Environmental Protection Agency) Emission Norms for Off-Highway Engines

Figure 28 EU Emission Norms for Off-Highway Engines

Figure 29 Engine Market for Off-Highway Vehicles: Porter’s Five Forces Analysis

Figure 30 Off-Highway Engine: Product Flow Diagram

Figure 31 Pm & NOX Reduction in Off-Highway Engines, 1996–2014

Figure 32 Technology Requirements for Tier-IV/ Stage-IV Engines

Figure 33 Working of SCR System

Figure 34 Sulfur Content Limits in Diesel, 2015

Figure 35 Construction & Mining Equipment Engine Market, By Power Output, 2015–2020 (USD Million)

Figure 36 Agriculture Tractor Engine Market, By Power Output, 2015–2020 (USD Million)

Figure 37 Construction & Mining Equipment Engine Market: <5l Engine is Projected to Grow at the Highest CAGR, 2015-2020 (USD Million)

Figure 38 Agriculture Tractor Engine Market: 5l-10l Engine is Projected to Grow at the Highest CAGR From 2015 to 2020 (USD Million)

Figure 39 Construction & Mining Equipment Engine Market: Diesel Engine is Projected to Be the Largest Market, 2015-2020 (USD Million)

Figure 40 Agriculture Tractor Engine Market: Diesel Engine is Projected to Be the Largest Market From 2015 to 2020 (USD Million)

Figure 41 Engine Market for Off-Highway Vehicles Outlook, By Country (USD Million)

Figure 42 Asia-Oceania: Engine Market for Off-Highway Vehicles Snapshot

Figure 43 North America: Engine Market for Off-Highway Vehicles Snapshot

Figure 44 Companies Adopted New Product Launch as the Key Growth Strategy, 2011-2015

Figure 45 Cummins Inc. Registered the Highest Growth Rate From 2010 to 2014

Figure 46 Top Players in Off-Highway Engine Market

Figure 47 Market Evaluation Framework: New Product Launch has Been Driving the Engine Market for Off-Highway Vehicles

Figure 48 Caterpillar Inc.: Company Snapshot

Figure 49 Caterpillar Inc.: SWOT Analysis

Figure 50 Cummins Inc.: Company Snapshot

Figure 51 Cummins Inc.: SWOT Analysis

Figure 52 Deere & Company: Company Snapshot

Figure 53 Deere & Company: SWOT Analysis

Figure 54 Kubota Corp.: Company Snapshot

Figure 55 Kubota Corporation: SWOT Analysis

Figure 56 Deutz AG: Company Snapshot

Figure 57 Deutz AG: SWOT Analysis

Figure 58 Scania AB: Company Snapshot

Figure 59 Weichai Power Co. Ltd.: Company Snapshot

Figure 60 MTU : Company Snapshot

Figure 61 Volvo CE: Company Snapshot

Figure 62 Yanmar Co. Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Off-Highway Vehicle Engine Market

The data which we are interested is 1. Engine manufacturing company 2. Manufacturing location. (Region, Country, Address.) 3. Engine segments 4. Monthly engine production rate (Capacity) 5. Engine Model including technical specifications (e.g no. of valves, no. of cylinder) 6. End user of engine. (Vehicle model in which those engine actually used)