UHT Processing Market by Mode of Operation (Direct, Indirect), End-Product Form (Liquid and Semi Liquid), Application (Milk, Dairy Desserts, Juices, Soups, Dairy Alternatives), and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027

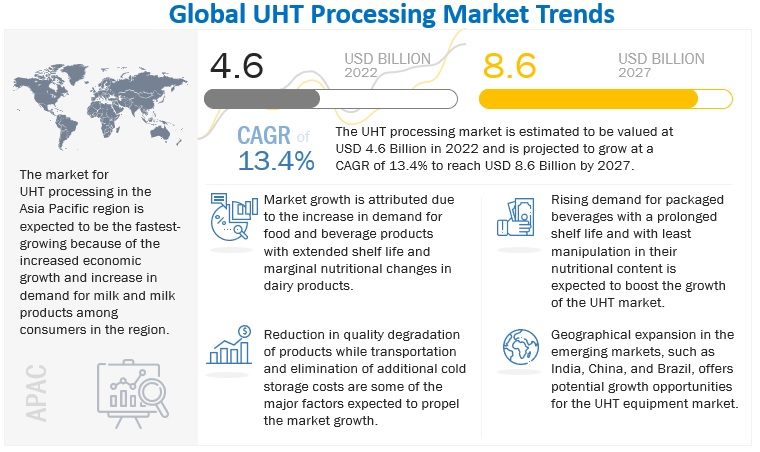

The market for UHT Processing is estimated at USD 4.6 billion in 2022; it is projected to grow at a CAGR of 13.4% to reach USD 8.6 billion by 2027. Ultra-Heat Treatment is a modern technique of extending shelf life of products. The UHT process requires a minimum temperature of rapid heating to 135oC and followed by rapid cooling. UHT processing will extend the shelf life of the product, and many industries adopt for UHT processing and aseptic packaging as the product can be stored for up to 90 days and more, without any chilled condition.

To know about the assumptions considered for the study, Request for Free Sample Report

UHT Processing Market Dynamics

Driver: Increasing demand for food & beverage products with an extended shelf life

Food waste is a worldwide problem. According to United Nations, 2021, Between harvest and retail, around 14% of the food produced globally is lost, and an estimated 17% of the total amount of food produced is wasted (11 percent in households, 5 percent in the food service and 2 percent in retail). A significant part of food loss or waste is due to improper storage. Each food item has a different shelf life, which is greatly influenced by the way that food is stored. The shelf life of food is greatly influenced by the storage temperature, oxygen and moisture exposure, and storage container. Dairy products make up a major category of food waste and food loss. In dairy products, milk accounts for a large percentage of food waste According to a 2018 study conducted at Edinburgh University for The Guardian, one in six pints of milk produced globally is lost or wasted, a total of about 128 million tons of milk each year. Each year, 116 tons of dairy products are lost or discarded globally, with production, distribution, and spoilage accounting for over half of this waste before the product even reaches the store. Dairy makes for one-fifth of all food waste in the UK, with households accounting for 90% of waste. The shelf life of raw milk is only 2 to 3 days because it contains bacteria. Various methods for extending the shelf life of milk have been discovered over the last few decades. According to article published in Quartz, 2018 following are various types of processes to extend the milk life: Pasteurized processing, filtered processing Ultra-high temperature processing. Frozen processing Evaporated/Condensed processing, Dried processing. Of these, ultra-high temperature (UHT) milk has the highest shelf life. UHT milk has a 12-month shelf life when kept at ambient temperature. According to Euromonitor International, around 34 percent of liquid milk consumption today is shelf-stable or UHT milk

Due to higher temperatures, higher humidity, and a lack of resources, processing milk and other liquid and non-liquid products is more difficult in tropical countries such as India, Australia, Africa, and South America than it is in temperate climates with a well-established cold chain infrastructure. As a result, cheese ripens too quickly and milk and other liquid products experience spoilage at a higher rate since it is frequently impossible to maintain sufficient cooling temperatures. The concept of extended shelf life milk, also known as ESL milk, was developed in response to consumer demand for products with longer shelf life – and wider distribution of chilled milk products. This concept has begun to play a significant role in the dynamics of the dairy industry along with the quick development of new processing and packaging concepts.

Liquid and semi-liquid food and beverage products, which are desired for their extended shelf life, can be successfully treated with UHT to remove microbial contamination. This characteristic of UHT-treated products continues to be advantageous for developing nations that are close to the equator or have a tropical climate by aiding them in reducing logistical and refrigeration costs.

Products that have undergone UHT treatment are aseptically packaged, so there is no need to boil them before consumption. These factors have led the UHT processing industry to expand rapidly in both developed and developing nations. In households without access to refrigeration or with insufficient space for chilling, UHT-treated products are frequently used. UHT processed products have been successful in rural, drought-stricken areas with little or no food mobility

Restraint: High capital investment

For the procurement and installation of UHT processing equipment, food and beverage processing enterprises must make a significant capital expenditure. The operational margins and profits of food and beverage processors and manufacturers are impacted by the high installation costs and frequent maintenance associated with certain processing equipment types. Manufacturers avoid installing UHT processing equipment in favour of more cost - effective option. In compared to UHT plants, processing equipment like pasteurizer units require lower capital investment and require less annual maintenance.

Since specialised equipment is needed for both treating the desired products and manufacturing different packages out of diverse raw materials, the initial capital investment needed for UHT processing equipment is high. For the UHT treatment of various products, several types of flash cooling machines, cleaning machines, heaters, homogenizers, and pressurizers are required. This necessitates significant investments, which discourage manufacturers from starting their own UHT processing plants and limit the market for UHT processing.

Opportunity: Emerging markets in Asia Pacific, African, and South American countries

Global population growth is increasing the pressure on developers to manufacture, extract, and maintain limited resources. Low-income customers are being impacted by increased food prices as a result of high energy and raw material costs. Water scarcity is adding the pressure on food supplies, especially in Northern Asia and Africa. Therefore, improvements in science and technology considerably contribute to the expansion of food and beverage shelf life. The market size for the product is also expanding, notably in nations like Zambia, Botswana, and Namibia, where the demand for selling UHT processing equipment to the smallest food and beverage manufacturers is also increasing

Urbanization and globalisation have grown throughout time, increasing literacy and exposure to industrialised nations through foreign media, overseas employment opportunities, and travel. This has brought about a change in the mindset and preferences of urban people in developing countries. The prevalence of nuclear double-income families, particularly in urban areas, is a trend that is influencing these shifting lifestyles. The demand for ready-to-cook and ready-to-eat food has expanded as a result of busy lifestyles and shifting consumption habits. This has raised brand awareness and, in turn, increased use of UHT processing equipment.

Challenge: High product quality requirement for UHT treatment

has alcohol stability of less than 75%, and was stored for longer than a week at low temperatures.

Superior quality products are needed for UHT treatment. For instance, high quality milk is required to withstand high heat treatment when milk is exposed to UHT. For example, it is imperative that raw milk proteins do not result in thermal instability. When treated with high heat, low-quality raw milk degrades both the ability to be processed and the quality of the finished product. Milk with a pH below 6.65 at 20°C has less thermal stability, which affects processing, makes cleaning more difficult, and promotes protein sedimentation in storage containers. Consequently, the required milk quality continues to be a key factor.

If milk was stored at low temperatures for more than a week and has a pH level of less than 6.65, alcohol stability of less than 75%, it is not considered suitable for UHT treatment.

The indirect segment dominated the market and is projected to have higher growth rate during the forecast period of UHT Processing market.

indirect heating UHT systems are reduced energy consumption, long runtimes, and straightforward cleaning. Indirect type heat exchangers use regenerative type of process, which saves more energy. For these factors companies prefer indirect type heat exchangers.

The liquid segment dominated the UHT processing market, with highest market share during the forecast period of UHT Processing market.

As liquid products have low viscosity, they can pass easily through the heat exchangers. The process control such as flow rates can be handled easily for a liquid product to maintain the product temperature. Products such as milk, cream, ice cream mixes, beverages, beer, beer wort, beverages with pulp, and purees are commonly processed using UHT treatment. Thus, their market share is higher during the forecast period of UHT Processing market.

Milk and dairy desserts were the major applications in the UHT processing market, combined having majority of the market share in the by application segment.

Milk and milk products is the most commonly processed product for UHT treatment, as milk is highly perishable and has high demand. Temporary surpluses due to seasonal variations can be covered by subjecting milk to UHT treatment and can be stored for off season. Thus UHT processing can help industries to stabilize their demand and supply chain in all seasons.

To know about the assumptions considered for the study, download the pdf brochure

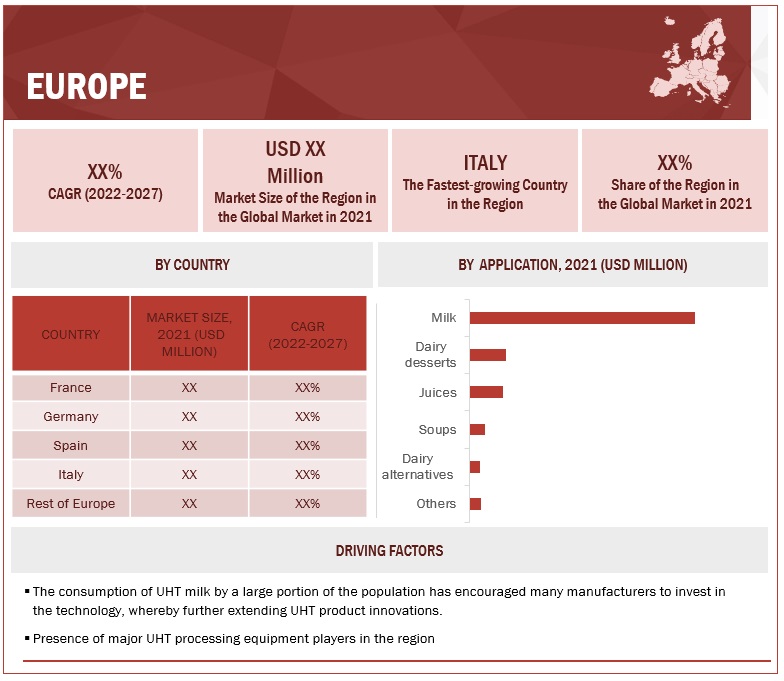

Europe was the most prominent region for the UHT processing market, occupying majority of the market share in the region segment of UHT Processing market.

UHT milk is also one of the most preferred choices of processed milk form in the European countries, due to several advantages associated with it. Europe is also home for large dairy corporations such as Lactalis, Danone, Savencia, and others. These companies prefer Hi-tech technology with higher efficiency. Thus the market for UHT processing equipment manufacturers in these region is accounted high.

Key Market Players

The key players in this market Tetra Laval (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), SPX Flow (Us), Elecster Oyj (Finland), Shanghai Triowin Intelligent Machinery Co., Ltd (China), Microthermics, Inc (US), Reda S.P.A. (Italy), Shanghai Jimei Food Machinery Co. Ltd (China), Proxes Gmbh (Germany), Goma (India), JBT (Us), Neologic Engineers Private Limited (India), Highland Equipment Inc. (Canada), Krones Ag (Germany). These Companies are focusing developing technology and efficiency to provide their customers a hi-tech processing equipment’s. The companies are also focusing on providing after sale maintenance and spare part services. These companies have a strong presence in North America, Asia Pacific and Europe.

Scope of the report

|

Report Metrics |

Details |

| Market size estimation | 2022–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD) |

| Segments covered | By mode of operations, By end product form, By applications, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America and RoW |

| Companies studied | SGS SA (Switzerland), Eurofins Scientific (Luxembourg), Intertek Group plc (UK), Bureau Veritas (France), ALS Limited (Australia), |

This research report categorizes the UHT Processing market based on By food tested, By target tested, By technology and Region

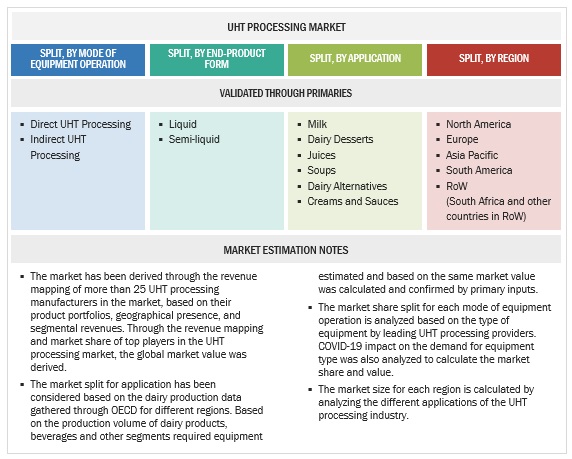

Based on mode of operations, the UHT Processing market has been segmented as follows:

- Direct UHT processing

- Indirect UHT processing

Based on end product form, the UHT Processing market has been segmented as follows:

- Liquid

- Semi-liquid

Based on applications, the UHT Processing market has been segmented as follows:

- Milk

- Dairy desserts

- Juices

- Soups

- Dairy alternatives

- Other applications (cream and sauces)

Based on the Region, the UHT Processing market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Middle East & Africa)

Frequently Asked Questions (FAQ):

Who are some of the key players operating in the UHT Processing market and how intense is the competition?

The key players in this market include Tetra Laval (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), SPX Flow (Us), Elecster Oyj (Finland), Shanghai Triowin Intelligent Machinery Co., Ltd (China), Microthermics, Inc (US), Reda S.P.A. (Italy), Shanghai Jimei Food Machinery Co. Ltd (China), Proxes Gmbh (Germany), Goma (India), JBT (Us), Neologic Engineers Private Limited (India), Highland Equipment Inc. (Canada), Krones Ag (Germany). These Companies are focusing developing technology and efficiency to provide their customers a hi-tech processing equipment’s. The companies are also focusing on providing after sale maintenance and spare part services. These companies have a strong presence in North America, Asia Pacific and Europe.

What kind of stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

The key stakeholders to UHT Processing market would be

- Manufacturers, dealers, suppliers of UHT equipment

- Processed milk manufacturers

- R&D institutes

- Technology providers

- UHT equipment importers and exporters

-

Intermediary suppliers

- Wholesalers

- Traders

- Research institutes and organizations

- Government bodies, venture capitalists, and private equity firms

Which is the largest-growing geography during the forecasted period in reed relay market?

The products required for UHT treatment must be of superior quality. For instance, when milk is exposed to UHT, it must be of high quality to sustain high heat treatment. For instance, it is also imperative that proteins in raw milk do not cause thermal instability. Raw milk of poor quality hurts both processability and the final product’s quality when treated with high heat. Milk with a pH below 6.65 at 20°C has reduced thermal stability and causes processing problems, difficulties with cleaning, and sedimentation of proteins at the bottom of the package during storage. Therefore, the quality of milk required remains an important criterion.

What are the key development strategies undertaken by companies in the UHT Processing market?

Strategies such as developing technology and efficiency to provide their customers a hi-tech processing equipment’s, expansion and development, are the key strategies being used by large players in order to achieve differential positioning in the global market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

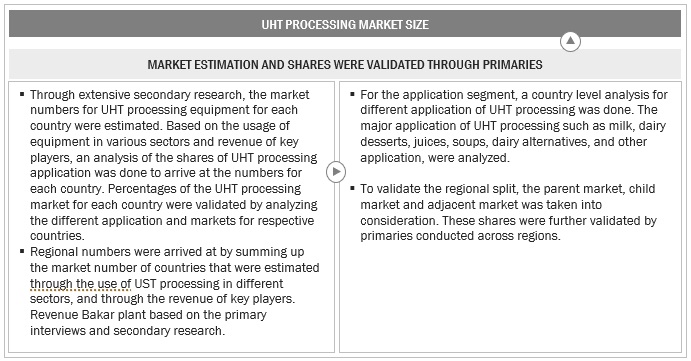

The study involved four major steps in estimating the size of the UHT Processing market. Exhaustive secondary research was done to collect information on the market, as well as the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for this study. The secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases. Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the market’s monetary chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

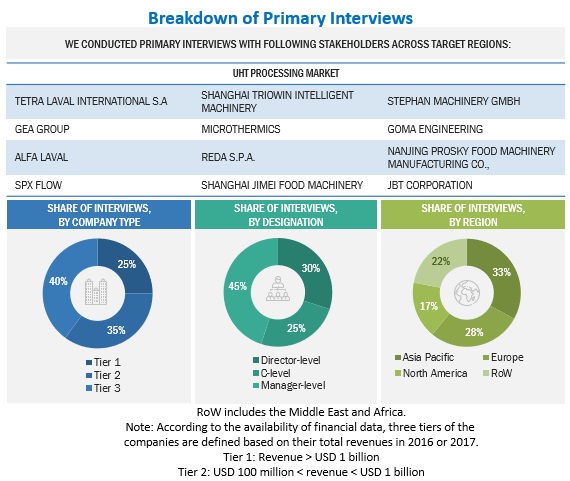

Primary Research

The market comprises several stakeholders in the supply chain, including suppliers, manufacturers, and end-product manufacturers. Various primary sources from both the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs of the companies and organizations, operating in the UHT processing market. The primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the UHT processing market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the UHT processing market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and markets were identified through extensive secondary research.

- The UHT processing value chain and market size in terms of value and volume have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the UHT processing market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Bottom-Up

In the bottom-up approach, UHT processing for mode of application, application, end-product form, and region were added to arrive at the global and regional market size and CAGR

- Based on the share of UHT processing for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach for applications at the country level, the global market for UHT processing was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated

- Other factors considered include demand for UHT-treated products, products with higher shelf- life, consumer awareness, functional trends, the adoption rate for UHT-processed products, patents registered, and organic & inorganic growth attempts

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

The following figure represents the overall market size estimation process employed for this study.

Market Size Estimation Methodology: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall UHT processing market and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the UHT processing market with respect to its mode of application, end-product form, application, and Region over a five-year period ranging from 2022 to 2027

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

Competitive Intelligence

- Identifying and profiling the key market players in the UHT processing market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the supply chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments in product innovations and technology in the UHT processing market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the company's specific scientific needs.

The following customization options are available for the report

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for UHT processing into the Netherlands and Greece

- Further breakdown of the Rest of Asia Pacific market for UHT processing into Vietnam, Thailand, and Malaysia

- Further breakdown of the Rest of South America market for UHT processing into Peru and Ecuador

- Further breakdown of other countries in the ROW market for UHT processing into Egypt, Israel, and Turkey

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in UHT Processing Market