Aseptic Processing Market by Equipment (Processing and Packaging), Application (Bakery & Confectionery, Dairy & Beverages, Poultry, Seafood & Meat, Convenience Food, Fruits & Vegetables, and Industrial), Packaging, and Region - Global Forecast to 2022

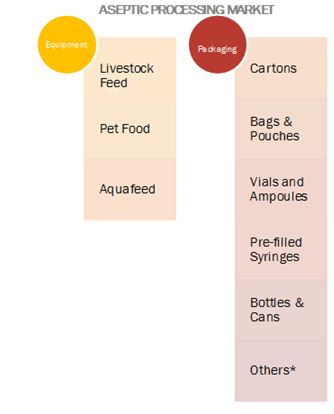

[192 Pages Report] The global aseptic processing market is classified into two studies, namely, packaging and equipment. The aseptic processing equipment market was valued at USD 9.52 billion in 2015 and is projected to reach a value of 12.24 billion by 2022. However, the packaging market was valued at USD 38.06 billion in 2015 and is projected to reach USD 77.25 billion by 2022, growing at a CAGR of 10.6% from 2017 to 2022.

The basic objective of the report is to define, segment, and project the global market size of the aseptic processing market on the basis of equipment, application, packaging, and region. It also helps to understand the structure of the market by identifying various segments. The other objectives of the report include analyzing the opportunities in the market for stakeholders, providing a competitive landscape of the market trends, and projecting the size of the market and its submarkets in terms of value (USD Million).

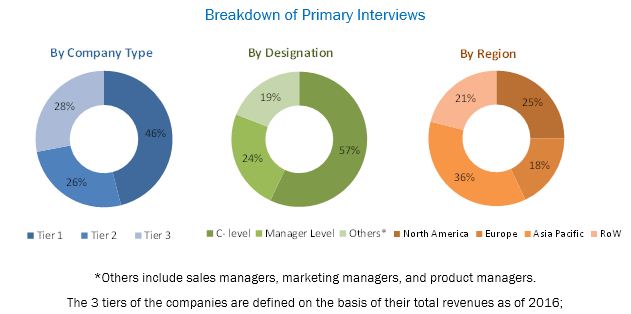

This research study involved the extensive use of secondary sources, which included directories and databases—such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the aseptic processing market. The primary sources include industry experts from the core and related industries and preferred suppliers, dealers, manufacturers, alliances, and standards & certification organizations from companies as well as organizations related to all the segments of this industry’s value chain. In-depth interviews are conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess growth prospects. The following figure depicts the market research methodology applied in drafting this report on the aseptic processing market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the aseptic processing market are the equipment manufacturers, aseptic packaging manufacturers, raw material suppliers, traders and distributors of aseptic packaging products, and regulatory bodies. The key players that are profiled in the report include Robert Bosch GmbH (Germany), E.I. Du Pont De Nemours and Company (US), Tetra Laval International S.A. (Switzerland), SPX FLOW, Inc. (US), IMA S.p.A (Italy), Becton, Dickinson and Co (US), Amcor Limited (Australia), GEA Group (Germany), Greatview Aseptic Packaging Co., Ltd (China), and JBT Corporation (US).

This aseptic processing market report is targeted at the existing players in the industry, which include the following:

- Aseptic packaging manufacturers

- Regulatory bodies

- Intermediary suppliers

- End Users

“The study answers several questions for the stakeholders; primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.”

Scope Of The Aseptic Processing Market Report

The aseptic processing market is segmented into two parts:

Equipment Market

On the basis of type, aseptic processing market has been segmented as follows:

- Processing

- Packaging

On the basis of application, the aseptic processing market has been segmented as follows:

-

Food & beverages

- Bakery & Confectionery

- Dairy and beverages

- Poultry, seafood, and meat products

- Convenience food

- Fruits & vegetables

-

Industrial

- Pharmaceuticals

- Cosmetics

On the basis of region, the aseptic processing market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Packaging Market

On the basis of type, the aseptic processing market has been segmented as follows:

- Cartons

- Bags & pouches

- Vials & ampoules

- Pre-filled syringes

- Bottles & cans

- Others (trays, bag-in-box packaging, cups, and containers)

On the basis of application, the aseptic processing market has been segmented as follows:

-

Food

- Convenience food

- Meat & seafood

- Fruits & vegetables

-

Beverages

- Milk & dairy products

- Fruit juices

- Pharmaceuticals

- Others (Personal care products)

On the basis of Material, the aseptic processing market has been segmented as follows:

- Paper & paperboard

- Plastic

- Metal

- Glass & wood

On the basis of region, the aseptic processing market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given aseptic processing market data, MarketsandMarkets offers customizations according to a company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Application Analysis

- Application analysis, which gives a detailed analysis of other applications of aseptic processing

Regional Analysis

- Further breakdown of the Rest of World aseptic processing market into Latin American countries

- Further breakdown of the Rest of Asia-Pacific market into key contributing countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Increasing urban population, demand for pharmaceutical supplies & rising demand for convenience products stimulate the aseptic processing demand to cross the mark of USD 89.5 billion for aseptic packaging and aseptic equipment markets combined, by 2022

The aseptic processing market is classified in two parts, namely, packaging market and equipment market. The global market size is projected to reach USD 89.5 million by 2022, largely owing to its varied functions and end uses such as food & beverages, pharmaceuticals, and cosmetics. Increasing disposable income of people in developing countries, increasing preference for eco-friendly packages, and improved equipment and technologies in the packaging industry are some of the drivers for the growth of the market. Varying environmental mandates across different regions are major challenges faced by manufacturers in this market. The need for superior understanding of the technology used in aseptic packaging compared to other packaging technologies is another restraining factor.

The high capital requirement for specialized aseptic equipment and need for higher technological understanding act as major restraints for the market

Technological knowledge required to set up a plant for packaging products aseptically is another restraint of the aseptic processing market. A lot of knowledge is required for establishing an aseptic processing plant as this is a crucial process that needs a cautious approach at every step of the way. Hence, manufacturers feel reluctant to step into the aseptic processing business as it requires in-depth knowledge. This aspect of aseptic processing becomes an obstruction in the expansion of the market. However, technological developments are helping this market to simplify operational procedures without human interference, but this would be available at a very high cost.

Aseptic Processing Market Dynamics

Leading aseptic equipment manufacturers are developing innovative solutions to drive the industry growth

Packaging Market: New advances making aseptic packaging more popular

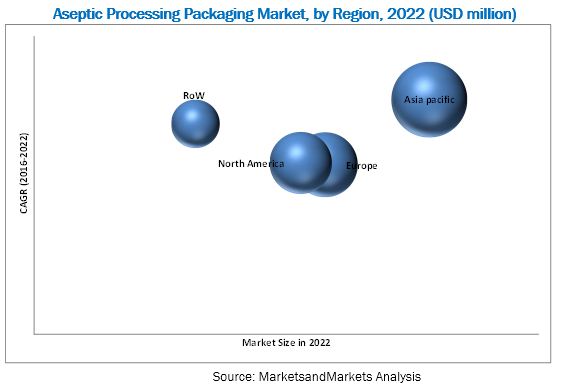

The global aseptic packaging market, in terms of value, is projected to reach USD 77.3 billion by 2022, at a CAGR of 10.6% from 2017. The packaging market comprises segments such as cartons, bottles & cans, vials & ampoules, bags & pouches, pre-filled syringes, and others. In terms of value, the cartons segment accounted for the largest share in 2015. The main factor that led to the growth of this segment is the increasing demand for convenience and high-quality products in the beverages sector. Due to advancements and inventions of new drugs in the pharmaceutical sector, there is an increase in the demand for vials & ampoules, which also contributes to the growth of the aseptic packaging market.

Although several new packaging designs and shapes have recently entered the market, aseptic carton manufacturers typically conform to the largely preferred block shape, which is favored as it permits easy stacking for more efficient storage. The carton packaging market is estimated to grow due to the demand from milk and dairy product packaging and juice packaging sectors. Also, the demand for ready-to-go and ready-to-serve products has influenced the demand in this market, particularly in the Asia Pacific region.

Equipment Market: Innovations in packaging equipment are revolutionary

The market for equipment is also positively affected by technological advancements with the introduction of innovative robotic technologies, with greater efficiencies and accuracy, reducing the need for manpower, subsequently reducing the overall cost. The aseptic processing market is segmented into processing and packaging. The year-on-year growth of the packaging segment is estimated to be higher, well above the average growth of the equipment market, owing to the increasing demand for packaging of convenience and packaged food, and pre-cut vegetables. Also, the growing importance of packaging machines and demand for integrated filling machines, owing to the growth in health awareness, high availability, and increase in its usage as convenience food, are expected to drive the market for packaging machines/equipment at a higher rate. Hence, the market for packaging equipment is projected to sustain a higher growth rate through 2022, as compared to processing equipment.

Equipment Market: Innovations in packaging equipment are revolutionary

The market for equipment is also positively affected by technological advancements with the introduction of innovative robotic technologies, with greater efficiencies and accuracy, reducing the need for manpower, subsequently reducing the overall cost. The market is segmented into processing and packaging. The year-on-year growth of the packaging segment is estimated to be higher, well above the average growth of the equipment market, owing to the increasing demand for packaging of convenience and packaged food, and pre-cut vegetables. Also, the growing importance of packaging machines and demand for integrated filling machines, owing to the growth in health awareness, high availability, and increase in its usage as convenience food, are expected to drive the market for packaging machines/equipment at a higher rate. Hence, the market for packaging equipment is projected to sustain a higher growth rate through 2022, as compared to processing equipment.

Food & Beverages: Rising importance of shelf-life extension fueling growth

Aseptic processing of food & beverages is a commercial sterilization process of food & beverage products such as dairy & soy drinks, vegetables & fruit juices, creams, and smoothies. Aseptic processing and packaging is done for preserving and extending the shelf life of food & beverage products. The aseptic processing market is highly driven by government laws and regulations. In the current scenario, governments are equally concerned about the health and hygiene of the population; be it developed or developing nations. With the growth in economies, people are shifting toward convenience food & beverages. This is benefitting the packaged food & beverage market; however, the cause for concern here is about safety. Therefore, manufacturers adopted aseptic processing to enhance the safety factor and extended the shelf life (ESL) of products. Rising importance of shelf-life extension and increasing inclination of manufacturers toward aseptic processing are expected to lead to market growth.

Industrial: High number of applications

The equipment is also used in industries such as pharmaceutical, cosmetic, and personal care. Equipment are utilized by manufacturers of creams, lotions, balms, oral hygiene products, cosmetics, fragrances, and toiletries such as soaps, shampoos, and body shower gels. Drugs need to be processed and packaged in a very sterile environment. The processing and packaging of pharma products undergo various inspections, quality checks, while also adhering to regulatory compliances with regard to the drug content and the material used in packaging. Although the market for equipment in cosmetics is small, it is projected to register growth in the future. There is a continuous need for innovation in the cosmetic packaging and machinery industry for the players to gain a competitive advantage over the other players. Thus, substantial demand from the cosmetic and personal care sectors is expected to fuel the growth of the aseptic packaging market, consequently driving the equipment market.

Key questions

- What are the upcoming technologies, substitutes, and trends that will have a significant impact on the market in the future?

- Packaging equipment are getting traction in the market; how will this impact the application industries in next five years?

- What will be the prominent revenue-generating pockets for the market in the next five years?

- Most suppliers have opted for expansions & acquisitions as key strategies as seen from the recent developments. Where will it take the industry in the mid to long term?

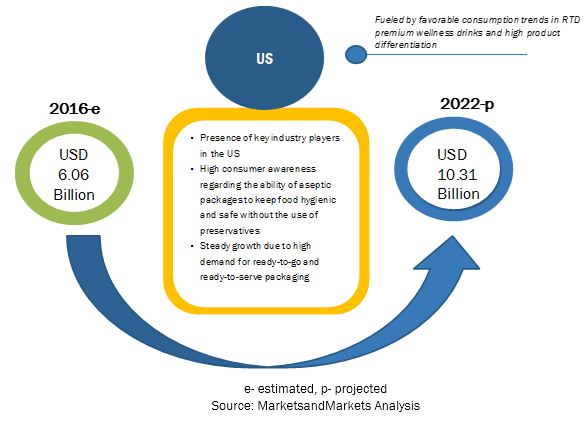

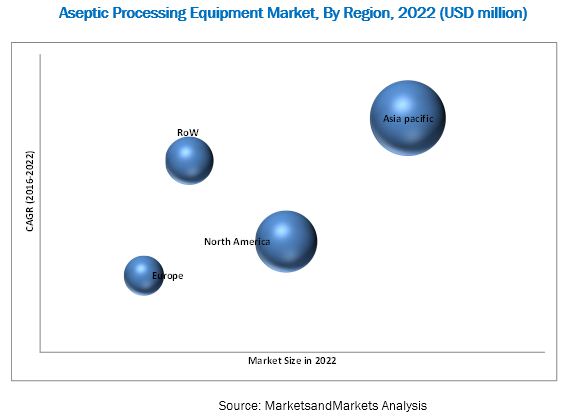

The global aseptic processing market is classified into two parts, namely, the packaging market and equipment market. The aseptic processing equipment market is estimated to account for USD 10.17 billion in 2017 and is projected to reach USD 12.24 billion by 2022, growing at a CAGR of 3.8% during the forecast period. However, the aseptic packaging market was estimated at USD 38.06 billion and is projected to reach USD 77.25 billion by 2022, growing at a CAGR of 10.6% during the forecast period. Increasing urban population and growing demand for pharmaceutical supplies and convenience products are the factors driving the growth of the global aseptic processing market. With the increasing demand for convenience and quality food products, people are opting for packaged food products, which creates profitable opportunities for aseptic packaging and equipment manufacturers.

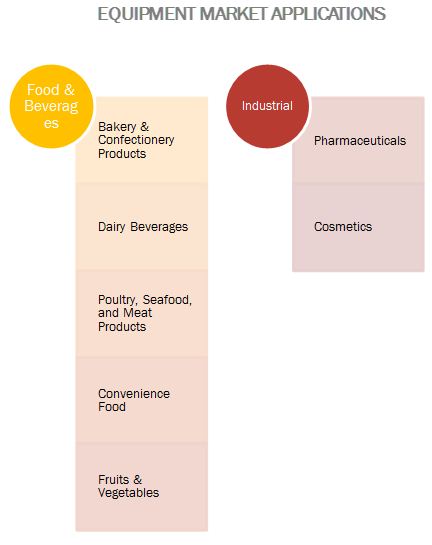

The segments considered for the aseptic processing equipment market are type, application, and region. Based on type, the aseptic processing equipment market is segmented into processing and packaging equipment. The packaging segment dominated the market in 2016, due to the rising demand for packaging machines and integrated filling machines. In addition, increasing health awareness, high availability, and a surge in its use as a convenience food are factors contributing toward the growth of this segment, which, in turn, is significantly driving the market for equipment.

Based on the application, the equipment market is segmented into food & beverages and industrial applications. The food & beverages application segment is further subsegmented as bakery & confectionery, dairy & beverages, poultry, seafood & meat products, convenience food, fruit & vegetable ingredients, and others. The industrial applications are subsegmented as pharmaceuticals and cosmetics. The food & beverage segment dominated the equipment segment, due to an extensive demand for packaging technology in different beverage applications.

The segments considered for the packaging market are type, application, material, and region. Based on type, the packaging market is segmented into cartons, bottles & cans, bags & pouches, vials & ampoules, pre-filled syringes, and others. The bottles & cans segment dominated the market in 2016, due to the increased demand for beverage products, especially from the dairy and juice packaging market.

Based on application, the aseptic processing market is segmented into food, beverages, pharmaceutical, and other applications. The market is dominated the by the beverage segment, which is driven by the extensive use of cartons and bottles in the milk and juice production markets. Based on material, the market is segmented into paper & paperboard, plastic, metal, glass, and wood. The paper & paperboard segment is projected to dominate the market during the forecast period

Asia Pacific is projected to be the fastest-growing market for aseptic packaging during the forecast period. The growth of the aseptic packaging market in the region is attributed to the increased demand for pharmaceutical and convenience products in countries such as China and India, which in turn increases the consumption of aseptic packages for food, beverage, and pharmaceutical applications in the region. Due to the increasing demand for aseptic processing solutions in the developed markets such as North America and Europe, the market is projected to witness a relatively slow growth during the forecast period.

High initial capital investments and the growing requirements for skilled labors for a better understanding of the technologies are the major factors inhibiting the growth of the global aseptic processing market. The increasing demand for pharmaceutical supplies, change in the mindset of consumers toward the use of food preservatives, growth of the dairy beverage market, and a surge in demand for convenience and quality food products are the primary factors driving the global market. Key players such as Robert Bosch GmbH (Germany), E.I. Du Pont De Nemours and Company (US), Tetra Laval International S.A. (Switzerland), SPX FLOW, Inc. (US), IMA S.p.A (Italy) are actively strategizing their growth plans to expand in the aseptic processing market. These companies have a strong presence in Europe and North America and manufacturing facilities as well as a strong distribution network across these regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Segmentation of Submarkets for Aseptic Processing

1.4.1 Packaging

1.4.2 Equipment

1.5 Periodization Considered for the Study

1.6 Currency Considered

1.7 Units Considered

1.8 Stakeholders

1.9 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Outlook of Aseptic Processing Market

4.2 Attractive Opportunities in Packaging Market

4.3 Beverages Segment Dominated the Packaging Market in 2015

4.4 Asia-Pacific: Fastest-Growing Equipment Market

4.5 Aseptic Packaging Market: Developed vs Developing Nations, 2017–2022 (USD Million)

4.6 Life Cycle Analysis, By Region

4.7 Year on Year Growth Outlook: Equipment Market

5 Aseptic Processing Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution

5.3 Macroindicators

5.3.1 Increasing Urban Population

5.3.2 Growth of the Parent Industry (Packaging)

5.4 Market Segmentation

5.4.1 Packaging Market

5.4.1.1 By Material

5.4.1.2 By Type

5.4.1.3 By Application

5.4.1.4 By Region

5.4.2 Equipment Market

5.4.2.1 By Type

5.4.2.2 By Application

5.4.2.3 By Region

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Growing Demand for Pharmaceutical Supplies

5.5.1.2 Changing Mindset of Consumers Toward the Usage of Food Preservatives

5.5.1.3 Growth of the Dairy Beverage Market

5.5.1.4 Growing Demand for Convenience and Quality Food Products

5.5.2 Restraints

5.5.2.1 Higher Initial Capital Investment Involved

5.5.2.2 Need for Higher Technological Understanding Than Other Packaging Forms

5.5.3 Opportunities

5.5.3.1 Improved Equipment and Technologies

5.5.3.2 Electronic Business Processing

5.5.3.3 Emerging Nutraceutical Market

5.5.3.4 Growth in the Usage of Self-Administered Drugs

5.5.4 Challenges

5.5.4.1 Varying Environmental Mandates Across Regions

5.5.4.2 Cost-To-Benefit Ratio A Concern to Small Manufacturers

5.5.4.3 Difficulty in the Management of the Packaging Supply Chain (Packaging)

5.6 Supply Chain

6 Packaging Market, By Type (Page No. - 54)

6.1 Introduction

6.2 Cartons

6.3 Bottles & Cans

6.4 Bags & Pouches

6.5 Vials & Ampoules

6.6 Pre-Filled Syringes

6.7 Other Types

7 Packaging Market, By Application (Page No. - 64)

7.1 Introduction

7.2 Food

7.3 Beverages

7.4 Pharmaceutical

7.5 Other Applications

8 Packaging Market, By Material (Page No. - 73)

8.1 Introduction

8.2 Paper & Paperboard

8.3 Plastic

8.4 Metal

8.5 Glass & Wood

9 Packaging Market, By Region (Page No. - 78)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Russia

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia

9.4.4 Japan

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World

9.5.1 Brazil

9.5.2 Argentina

9.5.3 South Africa

9.5.4 Others in RoW

10 Equipment Market, By Type (Page No. - 120)

10.1 Introduction

10.2 Processing Equipment

10.2.1 Centrifuges & Separation Equipment

10.2.2 Spray Dryers

10.2.3 Homogenizers

10.2.4 Heat Exchangers

10.2.5 Uht (Ultra High Temperature) Treatment

10.3 Packaging Equipment

10.3.1 Aseptic Filling Equipment

10.3.2 Aseptic Blowers

10.3.3 Aseptic Filling Valves

11 Equipment Market, By Application (Page No. - 127)

11.1 Introduction

11.2 Food & Beverages

11.2.1 Food & Beverages: Sub Application Market Segments

11.2.1.1 Bakery & Confectionary

11.2.1.2 Dairy & Beverages

11.2.1.3 Poultry, Sea-Foods, and Meat Products

11.2.1.4 Convenience Food

11.2.1.5 Fruits & Vegetables

11.3 Industrial: Sub Application Market Segments

11.3.1 Pharmaceuticals

11.3.2 Cosmetic

12 Equipment Market, By Region (Page No. - 134)

12.1 North America

12.2 Europe

12.3 Asia-Pacific

12.4 RoW: Market

13 Competitive Landscape (Page No. - 145)

13.1 Overview

13.2 Market Share Analysis

13.3 Competitive Situation & Trends

13.3.1 Mergers & Acquisitions

13.3.2 New Product Launches

13.3.3 Expansions & Investments

13.3.4 Joint Ventures & Agreements

14 Company Profiles (Page No. - 151)

14.1 Introduction

(Business Overview, Products Offered, Recent Developments, MNM View, SWOT Analysis, and Key Strategies)*

14.2 Robert Bosch GmbH

14.3 E.I. Du Pont De Nemours and Co.

14.4 Tetra Laval International S.A.

14.5 SPX Flow, Inc.

14.6 Industria Macchine Automatiche S.P.A.

14.7 Becton, Dickinson and Company

14.8 AMCOR Limited

14.9 GEA Group

14.10 Greatview Aseptic Packaging Co., Ltd.

14.11 JBT Corporation

*Details on Business Overview, Products Offered, Recent Developments, MNM View, SWOT Analysis, and Key Strategies might not be captured in case of unlisted companies.

15 Appendix (Page No. - 183)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (135 Tables)

Table 1 Packaging Market: Segments Defined

Table 2 Equipment Market: Segments Defined

Table 3 Asia-Pacific Urbanization Prospects

Table 4 Growth in Convenience, Pharmaceutical & Dairy Beverage Markets has Played A Major Role in Driving the Growth of the Aseptic Processing Market

Table 5 Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 6 Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 7 Cartons Market Size, By Region, 2015–2022 (USD Billion)

Table 8 Cartons Market Size, By Region, 2015–2022 (Billion Units)

Table 9 Bottles & Cans Market Size, By Region, 2015–2022 (USD Billion)

Table 10 Bottles & Cans Market Size, By Region, 2015–2022 (Billion Units)

Table 11 Bags & Pouches Market Size, By Region, 2015–2022 (USD Billion)

Table 12 Bags & Pouches Market Size, By Region, 2015–2022 (Billion Units)

Table 13 Vials & Ampoules Market Size, By Region, 2015–2022 (USD Billion)

Table 14 Vials & Ampoules Market Size, By Region, 2015–2022 (Billion Units)

Table 15 Pre-Filled Syringes Market Size, By Region, 2015–2022 (USD Billion)

Table 16 Pre-Filled Syringes Market Size, By Region, 2015–2022 (Billion Units)

Table 17 Other Types Market Size, By Region, 2015–2022 (USD Billion)

Table 18 Other Types Market Size, By Region, 2015–2022 (Billion Units)

Table 19 Packaging Market Size, By Application, 2015–2022 (USD Billion)

Table 20 Packaging Market Size, By Application, 2015–2022 (Billion Units)

Table 21 Packaging Market Size for Food, By Sub-Application, 2015–2022 (USD Billion)

Table 22 Packaging Market Size for Food, By Sub-Application, 2015–2022 (Billion Units)

Table 23 Packaging Market Size for Food, By Region, 2015–2022 (USD Billion)

Table 24 Packaging Market Size for Food, By Region, 2015–2022 (Billion Units)

Table 25 Packaging Market Size for Beverages, By Sub-Application, 2015–2022 (USD Billion)

Table 26 Packaging Market Size for Beverages, By Sub-Application, 2015–2022 (Billion Units)

Table 27 Packaging Market Size for Beverages, By Region, 2015–2022 (USD Billion)

Table 28 Packaging Market Size for Beverages, By Region, 2015–2022 (Billion Units)

Table 29 Packaging Market Size for Pharmaceutical, By Region, 2015–2022 (USD Billion)

Table 30 Packaging Market Size for Pharmaceutical, By Region, 2015–2022 (Billion Units)

Table 31 Packaging Market Size for Other Applications, By Region, 2015–2022 (USD Billion)

Table 32 Packaging Market Size for Other Applications, By Region, 2015–2022 (Billion Units)

Table 33 Packaging Market Size, By Material, 2015–2022 (USD Billion)

Table 34 Paper & Paperboard Market Size, By Region, 2015–2022 (USD Billion)

Table 35 Plastics Market Size, By Region, 2015–2022 (USD Billion)

Table 36 Metal Market Size, By Region, 2015–2022 (USD Billion)

Table 37 Glass & Wood Market Size, By Region, 2015–2022 (USD Billion)

Table 38 Packaging Market Size, By Region, 2015–2022 (USD Billion)

Table 39 Packaging Market Size, By Region, 2015–2022 (Billion Units)

Table 40 North America: Packaging Market Size, By Country, 2015–2022 (USD Billion)

Table 41 North America: Packaging Market Size, By Country, 2015–2022 (Billion Units)

Table 42 North America: Packaging Market Size, By Material, 2015–2022 (USD Billion)

Table 43 North America: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 44 North America: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 45 North America: Packaging Market Size, By Application, 2015–2022 (USD Billion)

Table 46 North America: Packaging Market Size, By Application, 2015–2022 (Billion Units)

Table 47 U.S.: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 48 U.S.: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 49 Canada: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 50 Canada: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 51 Mexico: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 52 Mexico: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 53 Europe: Packaging Market Size, By Country, 2015–2022 (USD Billion)

Table 54 Europe: Packaging Market Size, By Country, 2015–2022 (Billion Units)

Table 55 Europe: Packaging Market Size, By Material, 2015–2022 (USD Billion)

Table 56 Europe: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 57 Europe: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 58 Europe: Packaging Market Size, By Application, 2015–2022 (USD Billion)

Table 59 Europe: Packaging Market Size, By Application, 2015–2022 (Billion Units)

Table 60 Germany: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 61 Germany: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 62 France: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 63 France: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 64 Italy: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 65 Italy: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 66 U.K.: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 67 U.K.: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 68 Russia: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 69 Russia: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 70 Rest of Europe: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 71 Rest of Europe: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 72 Asia-Pacific: Packaging Market Size, By Country, 2015–2022 (USD Billion)

Table 73 Asia-Pacific: Packaging Market Size, By Country, 2015–2022 (Billion Units)

Table 74 Asia-Pacific: Packaging Market Size, By Material, 2015–2022 (USD Billion)

Table 75 Asia-Pacific: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 76 Asia-Pacific: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 77 Asia-Pacific: Packaging Market Size, By Application, 2015–2022 (USD Billion)

Table 78 Asia-Pacific: Packaging Market Size, By Application, 2015–2022 (Billion Units)

Table 79 China: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 80 China: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 81 India: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 82 India: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 83 Australia: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 84 Australia: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 85 Japan: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 86 Japan: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 87 Rest of Asia-Pacific: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 88 Rest of Asia-Pacific: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 89 RoW: Packaging Market Size, By Country, 2015–2022 (USD Billion)

Table 90 RoW: Packaging Market Size, By Country, 2015–2022 (Billion Units)

Table 91 RoW: Packaging Market Size, By Material, 2015–2022 (USD Billion)

Table 92 RoW Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 93 RoW: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 94 RoW: Packaging Market Size, By Application, 2015–2022 (USD Billion)

Table 95 RoW: Packaging Market Size, By Application, 2015–2022 (Billion Units)

Table 96 Brazil: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 97 Brazil: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 98 Argentina: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 99 Argentina: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 100 South Africa: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 101 South Africa: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 102 Others in RoW: Packaging Market Size, By Type, 2015–2022 (USD Billion)

Table 103 Aseptic Packaging & Processing Equipment Market Size , 2015–2022 (USD Million)

Table 104 Processing Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 105 Packaging Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 106 Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 107 Equipment Market Size for Food & Beverage Sector, By Region, 2015–2022 (USD Million)

Table 108 Equipment Market Size for Food & Beverage Sector, By Sub-Application, 2015–2022 (USD Million)

Table 109 Equipment Market Size for Industrial Sector, By Region, 2015–2022 (USD Million)

Table 110 Equipment Market Size for Industrial Sector, By Sub-Application, 2015–2022 (USD Million)

Table 111 Others in RoW: Packaging Market Size, By Type, 2015–2022 (Billion Units)

Table 112 North America: Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 113 North America: Packaging & Processing Equipment Market Size, 2015–2022 (USD Million)

Table 114 North America: Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 115 North America: Equipment Market Size for Food & Beverages, By Subapplication, 2015–2022 (USD Million)

Table 116 North America: Equipment Market Size for Industrial, By Subapplication, 2015–2022 (USD Million)

Table 117 Europe: Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 118 Europe: Aseptic Packaging & Processing Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 119 Europe: Aseptic Packaging & Processing Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 120 Europe: Packaging Market Size for Food & Beverages, By Subapplication, 2015–2022 (USD Million)

Table 121 Europe: Equipment Market Size for Industrial, By Subapplication, 2015–2022 (USD Million)

Table 122 Asia-Pacific: Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 123 Asia-Pacific: Aseptic Packaging & Processing Equipment Market Size , 2015–2022 (USD Million)

Table 124 Asia-Pacific: Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 125 Asia-Pacific: Equipment Market Size, By Subapplication, 2015–2022 (USD Million)

Table 126 Asia-Pacific: Equipment Market Size, By Sub-Application, 2015–2022 (USD Million)

Table 127 RoW: Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 128 RoW: Aseptic Packaging & Processing Equipment Market Size, 2015-2022 (USD Million)

Table 129 RoW: Equipment Market Size, By Application, 2015–2022 (USD Million)

Table 130 RoW: Equipment Market Size, By Subapplication, 2015–2022 (USD Million)

Table 131 RoW: Equipment Market Size, By Industrial Subapplication, 2015–2022 (USD Million)

Table 132 Mergers & Acquisitions, 2011–2016 (Till November)

Table 133 New Product Launches, 2011–2016 (Till November)

Table 134 Expansions & Investments, 2011–2016 (Till November)

Table 135 Joint Ventures & Agreements, 2012–2016 (Till November)

List of Figures (65 Figures)

Figure 1 Aseptic Processing Market

Figure 2 Aseptic Processing Market: Research Design

Figure 3 Key Industry Insights

Figure 4 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Limitations of the Research Study

Figure 9 Evolution of Aseptic Packaging

Figure 10 Packaging Market Snapshot (2016 vs 2022): Cartons Segment to Have the Highest CAGR

Figure 11 China Projected to Be the Fastest-Growing Market for Packaging

Figure 12 India Projected to Be the Fastest-Growing Market for Equipment

Figure 13 Leading Packaging & Equipment Providers Adopted Mergers & Acquisitions as the Key Strategy (2010-2016 )

Figure 14 Market for Packaging is Projected to Grow at A Higher Rate Market

Figure 15 Emerging Markets With Promising Growth Potential, 2017–2022 (USD Million)

Figure 16 Beverages Segment Occupied the Largest Share of the Packaging Market in 2015

Figure 17 Packaging Segment Accounted for Largest Share in the Asia-Pacific Equipment Market, 2015 (USD Million)

Figure 18 Developed Markets to Dominate & Developing Markets Show Strong Growth Opportunities in the Next Five Years

Figure 19 Equipment Market is Projected to Experience Strong Growth in the Asia-Pacific Region

Figure 20 European and North American Markets Expected to Grow at A Decreasing Rate

Figure 21 Evolution of Aseptic Processing

Figure 22 Packaging Market Segmentation, By Material

Figure 23 Packaging Market Segmentation, By Type

Figure 24 Packaging Market Segmentation, By Application

Figure 25 Packaging Market Segmentation, By Region

Figure 26 Equipment Market Segmentation, By Type

Figure 27 Equipment Market Segmentation, By Application

Figure 28 Equipment Market Segmentation, By Region

Figure 29 Growth in Demand for Pharmaceutical Supplies, Dairy & Convenience Products Results in Increased Demand for Aseptic Packaging

Figure 30 Package Development & Distribution are an Integral Part of the Supply Chain in the Aseptic Processing Market

Figure 31 Major Stakeholders Involved in the Supply Chain: Aseptic Processing

Figure 32 Packaging Market Size, By Type, 2016 vs 2022 (USD Billion)

Figure 33 Packaging Market Size, By Type, 2016 vs 2022 (Billion Units)

Figure 34 Packaging Market Size, By Application, 2017 vs 2022

Figure 35 Packaging Market Size, By Material, 2016 vs 2022 (USD Billion)

Figure 36 Geographic Snapshot (2016-2022): the Markets in Asia-Pacific are Projected to Register High Growth Rates

Figure 37 North American Aseptic Processing Market Snapshot

Figure 38 European Aseptic Processing Market Snapshot

Figure 39 Asia-Pacific Aseptic Processing Market Snapshot

Figure 40 Aseptic Packaging & Processing Equipment Market Size, 2016 vs 2022 (USD Million)

Figure 41 Aseptic Packaging & Processing Equipment Market, Y-O-Y Growth, 2016–2022

Figure 42 Processing Equipment Market, By Region, Y-O-Y Growth, 2017–2022

Figure 43 Packaging Equipment Market, By Region, Y-O-Y Growth, 2016–2022

Figure 44 Equipment Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 45 Equipment Market, By Application, Y-O-Y Growth, 2016–2022

Figure 46 Mergers & Acquisitions: the Most Preferred Strategy By Key Players, 2011–2016 (Till November)

Figure 47 Ranking Anaysis: Aseptic Processing Market

Figure 48 Mergers & Acquisitions Fuelled Growth, 2011–2016 (Till November)

Figure 49 Mergers & Acquisitions: the Key Strategy, 2011–2016 (Till November)

Figure 50 Geographic Revenue Mix of Top 5 Market Players

Figure 51 Robert Bosch GmbH: Company Snapshot

Figure 52 Robert Bosch GmbH: SWOT Analysis

Figure 53 E I Du Pont De Nemours and Company: Company Snapshot

Figure 54 E I Du Pont De Nemours and Company:SWOT Analysis

Figure 55 Tetra Laval International S.A.: Company Snapshot

Figure 56 Tetra Laval International S.A.: SWOT Analysis

Figure 57 SPX Flow, Inc.: Company Snapshot

Figure 58 SPX Flow, Inc.: SWOT Analysis

Figure 59 IMA S.P.A.: Company Snapshot

Figure 60 IMA S.P.A.: SWOT Analysis

Figure 61 Becton, Dickinson and Company: Company Snapshot

Figure 62 AMCOR Limited: Company Snapshot

Figure 63 GEA Group: Company Snapshot

Figure 64 Greatview Aseptic Packaging Co., Ltd.: Company Snapshot

Figure 65 JBT Corporation: Company Snapshot

Growth opportunities and latent adjacency in Aseptic Processing Market