Train Lighting Market by Technology (Fluorescent, Halogen, LED, Xenon), Position (Interior, Exterior), Rolling Stock (Diesel, Electric, DMU, EMU, Metros, Light Rail, Passenger & Freight Wagon), Application, Component, and Region - Global Forecast to 2025

[152 Pages Report] The train lighting market was valued at USD 336.8 Million in 2016 and is projected to reach USD 370.8 Million by 2025, growing at a CAGR of 1.44% during the forecast period. The train lighting market is projected to grow due to the increasing demand for comfort & luxury features inside the rolling stock, government mandates for train lighting applications, and increase in upcoming railway projects for metro trains, high-speed trains, and refurbished trains.

Years considered for this report:

- 2016 - Base Year

- 2017 - Estimated Year

- 2017–2025 - Forecast Period

Objectives of the Study

- To define, describe, and forecast the train lighting market with respect to individual growth trends and prospects and determine the contribution of each segment to the total market

- To forecast the market size, by volume and value, of the Market by Rolling Stock Type

- To forecast the market size, by volume and value, of the Market by Technology

- To forecast the market size, by volume and value, of the Market by Position

- To forecast the market size, by volume and value, of the Market by Application

- To forecast the market size, by volume and value, of the Market by Component

- To forecast the market size, by volume and value, of the Market with respect to four main Regions, namely, Asia Oceania, Europe, North America, and RoW

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

The research methodology used in the report involved various secondary sources, including paid databases and directories. Experts from related industries and suppliers have been interviewed to understand the future trends of the train lighting market. To understand the market, the rolling stock production/sales trends were evaluated. Different types of rolling stocks were considered at country level. For each rolling stock the number of lighting application used, and the number of lighting units required were calculated based on model mapping, secondary research, and through primary interviews. Also, technology used for each application was derived using model mapping. The average number of units of each application was derived and multiplied by the country level production/sales of rolling stock. This gave us the country level market, which was further summed up for regional and global level markets in terms of volume. The ASP of each lighting unit was derived, which was later multiplied with the volume to get the value estimation.

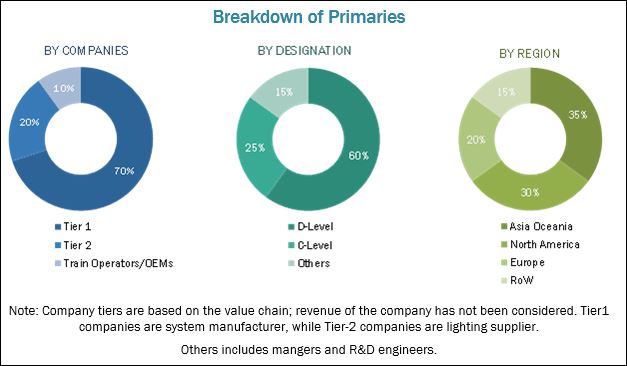

The figure below shows the break-up of the profile of industry experts who participated in the primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the train lighting market consists of manufacturers and Tier 1 suppliers such as Toshiba (Japan), General Electric (US), Hitachi (Japan), Koito (Japan), Federal-Mogul (US), Osram (Germany), Grupo Antolin (Spain), Dräxlmaier (Germany), and Teknoware (Finland).

Target Audience

- Dealers and distributors of train lighting systems

- Government regulatory authorities

- Industry associations

- Suppliers of lighting source, module, and other components for train lighting systems

- Manufacturers of automotive lighting systems

- Organized and unorganized aftermarket suppliers

- Manufacturers of raw material for train lighting components (suppliers for Tier I)

- Regional manufacturers associations

- Train lighting technology suppliers

“The study answers several questions for the stakeholders, primarily which market segments to focus in the next two to five years (depends on a range of forecast period) for prioritizing their efforts and investments.”

Scope of the Report

Train Lighting Market, By Rolling Stock Type

Note: The chapter is further segmented at regional level and the regions considered are Asia Oceania, Europe, North America, and RoW

- Diesel Locomotive

- DMU

- Electric Locomotive

- EMU

- Metro

- Light Rail/Trams/Monorail

- Passenger Coaches

- Freight Wagon

Train Lighting Market, By Position

Note: The chapter is further segmented at regional level and the regions considered are Asia Oceania, Europe, North America, and RoW

- Interior Train Lighting

- Exterior Train Lighting

Train Lighting Market, By Application

Note: The chapter is further segmented at regional level and the regions considered are Asia Oceania, Europe, North America, and RoW

- Cabin Lights

- Door Lights

- Emergency Lighting Systems

- Reading Lights

- Toilet Lights

- Train Headlights

- Train Indicator Lights

- Train Led Spotlights

- Train Main Lights

- Marker Lights

- Vestibule Lights

- Other Train Lights

Train Lighting Market, By Technology

Note: The chapter is further segmented at regional level and the regions considered are Asia Oceania, Europe, North America, and RoW

- Halogen

- Xenon/HID

- Fluorescent

- LED

Train Lighting Market, By Component

Note: The chapter is further segmented at regional level and the regions considered are Asia Oceania, Europe, North America, and RoW

- Alternator

- Battery

- Rectifier

Train Lighting Market, By Region

Note: The chapter is further segmented by technology and the technologies considered are Halogen, Xenon/HID, Fluorescent, LED

- Asia Oceania

- China

- India

- Japan

- South Korea

- Europe

- Germany

- France

- UK

- North America

- Canada

- Mexico

- US

- Row

- Brazil

- Russia

Available Customizations

With the given market data, MarketsandMarkets can provide market data for below categories:

Train Lighting Application Market, By Technology & Country

Note: The chapter is further segmented at country level and the countries considered are Asia Oceania (China, India, Japan, South Korea), Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

- Halogen

- Xenon/HID

- Fluorescent

- LED

Train Lighting Market, By Application & Country

Note: The chapter is further segmented at country level and the countries considered are Asia Oceania (China, India, Japan, South Korea), Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

- Cabin lights

- Door lights

- Emergency lighting system

- Other train lights

- Reading lights

- Toilet lights

- Train headlights

- Train indicator lights

- Train LED spotlights

- Train main lights

- Train marker lights

- Vestibule lights

Train Lighting Market By Rolling Stock & Country

Note: The chapter is further segmented at country level and the countries considered are Asia Oceania (China, India, Japan, South Korea), Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

- Diesel locomotive

- DMU

- Electric locomotive

- EMU

- Metros

- Light Rail/Trams/Monorail

- Passenger coaches

- Freight wagon

Train Lighting Market By Component & Country

Note: The chapter is further segmented at country level and the countries considered are Asia Oceania (China, India, Japan, South Korea), Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

- Alternator

- Battery

- Rectifier

The train lighting market was valued at USD 330.8 Million in 2017 and is projected to reach USD 370.8 Million by 2025, growing at a CAGR of 1.44% during the forecast period. This growth can be attributed to the increasing demand for comfort & luxury features in rolling stock interiors; government mandates for lighting applications; and increase in different railway projects such as metro train, high-speed train, and refurbished train.

The study segments the market based on rolling stock (Diesel Locomotive, DMU, Electric Locomotive, EMU, Metro, Light Rail/Trams/Monorail, Passenger Coaches, and Freight Wagon). The market for freight wagon is projected to have the largest market; whereas, DMU is estimated to be the fastest growing market. The growing demand for public transport in urban areas is driving the growth of the rail industry. In earlier times, the urban transportation depended on DMU/EMU, which were equipped with basic lighting solutions. With the advent of technology and infrastructural development, the use of metros and monorails has increased. Lighting used in these new era trains is energy saving and gives better illumination than usual fluorescent lights

The study segments train lighting market by position, where interior lighting market is projected to grow as the largest market. Train interior lighting includes applications such as vestibule lights, door lights, emergency lights, bathroom lights, main lights, spot lights, and reading lights. The number of lights in the interior is higher in high-speed train and passenger train compared to trains such as metro, mono, and freight train. High-speed trains have many interior lights in the restaurant and dining area for enhancing aesthetics and luxury.

The study segments the train lighting market by various interior & exterior applications Cabin Lights, Door Lights, Emergency Lighting Systems, Reading Lights, Toilet Lights, Train Headlights, Train Indicator Lights, Train Led Spotlights, Train Main Lights, Marker Lights, Vestibule Lights, and other Train Lights. Train marker lights are estimated to have the largest market during the forecast period. The marker lights are mandated by the government and are installed in every rolling stock. Thus, the growth of this segment is directly proportional to the demand for the rolling stock.

The train lighting market is also segmented on the basis of technology used as Halogen, Xenon/HID, Fluorescent, and LED. LED is expected to be the fastest growing market and to have the largest market share. The growth can have attributed to the energy-saving capacity of LED and the increasing number of train lighting applications. The railway associations around the globe have started installing LED lights in train interior and exterior.

The study segments the train lighting market based on component used as Alternator, Battery, and Rectifier. Rectifier is estimated to have the largest market in terms of value during the forecast period. Rectifier is used to convert the flow of current as per the requirement and is an essential component required in each rolling stock.

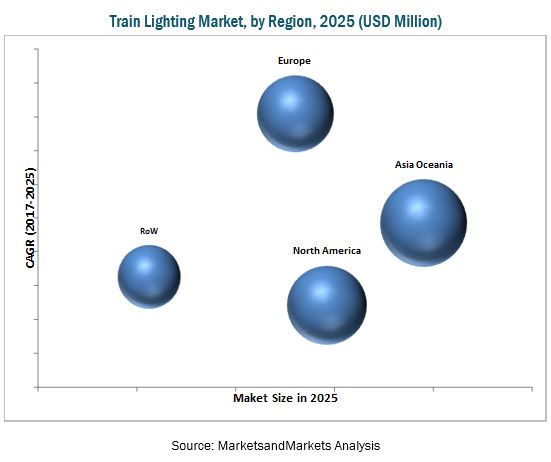

Europe is estimated to be the fastest growing market, in terms of value, for train lighting. The train lighting market of Europe would be driven by the increasing proposals of high-speed train projects. The emergence of high-speed train as the major mode of rail transportation in Europe will drive the market in the region.

On the other hand, the major factors hindering the growth of the train lighting market are the limited demand for the rolling stock and government interventions in major countries.

Train lighting manufacturers have adopted supply contract and geographical expansion as major strategies to gain traction in the train lighting market. The key market players include Toshiba (Japan), General Electric (US), Hitachi (Japan), Koito (Japan), Federal-Mogul (US), Osram (Germany), Grupo Antolin (Spain), Dräxlmaier (Germany), and Teknoware (Finland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Increase in Rail Infrastructure

2.4.1.2 High-Speed Rail Linkage Between Major Countries

2.4.1.3 Increase in Rate of Urbanization

2.4.1.4 Introduction of High Speed Trains

2.4.1.5 Impact of Increase in Bullet Train Projects on Train Lighting Demand

2.4.1.6 Impact of High Speed Train Projects on Train Lighting

2.4.1.6.1 Maglev

2.4.1.6.2 Hyperloop

2.4.2 Supply-Side Analysis

2.4.2.1 Technological Advancement

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.6 Market Breakdown and Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 42)

4.1 Steady Growth Opportunities in the Train Lighting Market

4.2 Market, By Rolling Stock

4.3 Market, By Position

4.4 Market, By Application

4.5 Market, By Technology

4.6 Market, By Component

4.7 Market, By Country

4.8 Market, By Region

5 Market Overview (Page No. - 48)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Train Lighting Regulation to Boost the Demand for Lighting Units/System

5.1.1.2 Increasing Demand for Comfort & Luxury to Drive the Market for Advanced Train Lighting Applications

5.1.2 Restraints

5.1.2.1 Limited OE Potential to Restrain the Growth of Train Lighting

5.1.2.1.1 Limited Rolling Stock Production to Hinder the Train Lighting Business

5.1.2.1.2 Government-Regularized Rail Industry in Key Countries

5.1.3 Opportunities

5.1.3.1 Future of Mobility

5.1.3.1.1 Advancement in Rolling Stock to Increase the Demand for Train Lighting Solutions

5.1.3.1.2 Advanced Lighting Solutions to Offer A New Business Avenue for Lighting Manufacturers

5.1.4 Challenges

5.1.4.1 Lack of Standardization and High Production Cost are Major Challenges for Manufacturers

6 Train Lighting Market, By Rolling Stock Type (Page No. - 55)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

6.1 Introduction

6.2 Diesel Locomotive

6.3 DMU

6.4 Electric Locomotive

6.5 EMU

6.6 Metro

6.7 Light Rail/TRAM/Monorail

6.8 Passenger COACH

6.9 Freight Wagon

7 Train Lighting Market, By Position (Page No. - 68)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

7.1 Introduction

7.2 Interior Train Lighting

7.3 Exterior Train Lighting

8 Train Lighting Market, By Application (Page No. - 73)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

8.1 Introduction

8.2 Cabin Lights

8.3 Door Lights

8.4 Emergency Lighting Systems

8.5 Reading Lights

8.6 Toilet Lights

8.7 Train Headlights

8.8 Train Indicator Lights

8.9 Train LED Spotlights

8.10 Train Main Lights

8.11 Marker Lights

8.12 Vestibule Lights

8.13 Other Train Lights

9 Train Lighting Market, By Technology (Page No. - 88)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

9.1 Introduction

9.2 Halogen

9.3 Xenon/HID

9.4 Fluorescent

9.5 LED

10 Train Lighting Market, By Component (Page No. - 95)

Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW

10.1 Introduction

10.2 Alternator

10.3 Battery

10.4 Rectifier

11 Train Lighting Market, By Region (Page No. - 101)

Note - The Chapter is Further Segmented By Technology and Considered Technologies are Halogen, Xenon/HID, Fluorescent, LED

11.1 Introduction

11.2 Asia Oceania

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 RoW

11.5.1 Brazil

11.5.2 Russia

12 Competitive Landscape (Page No. - 123)

12.1 Introduction

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.4 Recent Developments

13 Company Profiles (Page No. - 127)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

13.1 Introduction

13.2 Toshiba

13.3 General Electric

13.4 Hitachi

13.5 Koito

13.6 Federal-Mogul

13.7 Osram

13.8 Grupo Antolin

13.9 Dräxlmaier

13.10 Teknoware

13.11 Autolite

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 145)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.4.1 Train Lighting Application Market, By Technology & Country

Note - The Chapter is Further Segmented at Country Level and Considered Countries are Asia Oceania (China, India, Japan, South Korea, Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

14.4.1.1 Halogen

14.4.1.2 Xenon/HID

14.4.1.3 Fluorescent

14.4.1.4 LED

14.4.2 Train Lighting Market, By Application & Country

Note - The Chapter is Further Segmented at Country Level and Considered Countries are Asia Oceania (China, India, Japan, South Korea, Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

14.4.2.1 Cabin Lights

14.4.2.2 Door Lights

14.4.2.3 Emergency Lighting System

14.4.2.4 Other Train Lights

14.4.2.5 Reading Lights

14.4.2.6 Toilet Lights

14.4.2.7 Train Headlights

14.4.2.8 Train Indicator Lights

14.4.2.9 Train LED Spotlights

14.4.2.10 Train Main Lights

14.4.2.11 Train Marker Lights

14.4.2.12 Vestibule Lights

14.4.3 Train Lighting Market By Rolling Stock & Country

Note - The Chapter is Further Segmented at Country Level and Considered Countries are Asia Oceania (China, India, Japan, South Korea, Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

14.4.3.1 Diesel Locomotive

14.4.3.2 DMU

14.4.3.3 Electric Locomotive

14.4.3.4 EMU

14.4.3.5 Metro

14.4.3.6 Light Rail/TRAM/Monorail

14.4.3.7 Passenger COACH

14.4.3.8 Freight Wagon

14.4.4 Train Lighting Market By Component & Country

Note - The Chapter is Further Segmented at Country Level and Considered Countries are Asia Oceania (China, India, Japan, South Korea, Europe (Germany, France, UK), North America (US, Canada, Mexico), and RoW (Brazil, Russia)

14.4.4.1 Alternator

14.4.4.2 Battery

14.4.4.3 Rectifier

14.6 Related Reports

14.7 Author Details

List of Tables (110 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Investments in Rail Infrastructure & Surge, By Key Country

Table 3 Functional High-Speed Trains Between European Countries

Table 4 Proposed Maglev High Speed Train Projects in Key Countries

Table 5 Proposed Hyperloop High Speed Train Projects in Key Countries

Table 6 Train Lighting Regulations, By Key Country

Table 7 Regularized Rail Authority, By Country

Table 8 Train Lighting Market, By Rolling Stock Type, 2015–2025 (‘000 Units)

Table 9 Market, By Rolling Stock Type, 2015–2025 (USD Million)

Table 10 Diesel Locomotive: Market, By Region, 2015–2025 (‘000 Units)

Table 11 Diesel Locomotive: Market, By Region, 2015–2025 (USD Million)

Table 12 DMU: Train Lighting Market, By Region, 2015–2025 (‘000 Units)

Table 13 DMU: Market, By Region, 2015–2025 (USD Million)

Table 14 Electric Locomotive: Market, By Region, 2015–2025 (‘000 Units)

Table 15 Electric Locomotive: Market, By Region, 2015–2025 (USD Million)

Table 16 EMU: Market, By Region, 2015–2025 (‘000 Units)

Table 17 EMU: Market, By Region, 2015–2025 (USD Million)

Table 18 Metro: Train Lighting Market, By Region, 2015–2025 (‘000 Units)

Table 19 Metro: Market, By Region, 2015–2025 (USD Million)

Table 20 Light Rail/TRAM/Monorail: Market, By Region, 2015–2025 (‘000 Units)

Table 21 Light Rail/TRAM/Monorail: Market, By Region, 2015–2025 (USD Million)

Table 22 Passenger Coach: Market, By Region, 2015–2025 (‘000 Units)

Table 23 Passenger Coach: Market, By Region, 2015–2025 (USD Million)

Table 24 Freight Wagon: Market, By Region, 2015–2025 (‘000 Units)

Table 25 Freight Wagon: Market, By Region, 2015–2025 (USD Million)

Table 26 Train Lighting Market, By Position, 2015–2025 (‘000 Units)

Table 27 Market, By Position, 2015–2025 (USD Million)

Table 28 Interior: Market, By Region, 2015–2025 (‘000 Units)

Table 29 Interior: Market, By Region, 2015–2025 (USD Million)

Table 30 Exterior: Market, By Region, 2015–2025 (‘000 Units)

Table 31 Exterior: Market, By Region, 2015–2025 (USD Million)

Table 32 Market, By Application, 2015–2025 (’000 Units)

Table 33 Market, By Application, 2015–2025 (USD Million)

Table 34 Cabin Lights: Train Lighting Market, By Region, 2015–2025 (’000 Units)

Table 35 Cabin Lights: Market, By Region, 2015–2025 (USD Million)

Table 36 Door Lights: Market, By Region, 2015–2025 (’000 Units)

Table 37 Door Lights: Market, By Region, 2015–2025 (USD Million)

Table 38 Emergency Lighting Systems: Market, By Region, 2015–2025 (’000 Units)

Table 39 Emergency Lighting Systems: Market, By Region, 2015–2025 (USD Million)

Table 40 Reading Lights: Market, By Region, 2015–2025 (’000 Units)

Table 41 Reading Lights: Market, By Region, 2015–2025 (USD Million)

Table 42 Toilet Lights: Market, By Region, 2015–2025 (’000 Units)

Table 43 Toilet Lights: Train Lighting Market, By Region, 2015–2025 (USD Million)

Table 44 Train Headlights: Market, By Region, 2015–2025 (’000 Units)

Table 45 Train Headlights: Market, By Region, 2015–2025 (USD Million)

Table 46 Train Indicator Lights: Market, By Region, 2015–2025 (’000 Units)

Table 47 Train Indicator Lights: Market, By Region, 2015–2025 (USD Million)

Table 48 Train LED Spotlights: Market, By Region, 2015–2025 (’000 Units)

Table 49 Train LED Spotlights: Market, By Region, 2015–2025 (USD Million)

Table 50 Train Main Lighting: Market, By Region, 2015–2025 (’000 Units)

Table 51 Train Main Lighting: Market, By Region, 2015–2025 (USD Million)

Table 52 Marker Lights: Market, By Region, 2015–2025 (’000 Units)

Table 53 Marker Lights: Market, By Region, 2015–2025 (USD Million)

Table 54 Vestibule Lights: Market, By Region, 2015–2025 (’000 Units)

Table 55 Vestibule Lights: Market, By Region, 2015–2025 (USD Million)

Table 56 Other Train Lights: Market, By Region, 2015–2025 (’000 Units)

Table 57 Other Train Lights: Market, By Region, 2015–2025 (USD Million)

Table 58 Train Lighting Market, By Technology, 2015–2025 (‘000 Units)

Table 59 Market, By Technology, 2015–2025 (USD Million)

Table 60 Halogen: Market, By Region, 2015–2025 (‘000 Units)

Table 61 Halogen: Market, By Region, 2015–2025 (USD Million)

Table 62 Xenon/HID: Market, By Region, 2015–2025 (‘000 Units)

Table 63 Xenon/HID: Market, By Region, 2015–2025 (USD Million)

Table 64 Fluorescent: Market, By Region, 2015–2025 (‘000 Units)

Table 65 Fluorescent: Market, By Region, 2015–2025 (USD Million)

Table 66 LED: Market, By Region, 2015–2025 (‘000 Units)

Table 67 LED: Market, By Region, 2015–2025 (USD Million)

Table 68 Train Lighting Market, By Component, 2015–2025 (’000 Units)

Table 69 Market, By Component, 2015–2025 (USD Million)

Table 70 Alternator: Market, By Region, 2015–2025 (’000 Units)

Table 71 Alternator: Market, By Region, 2015–2025 (USD Million)

Table 72 Battery: Market, By Region, 2015–2025 (’000 Units)

Table 73 Battery: Market, By Region, 2015–2025 (USD Million)

Table 74 Rectifier: Market, By Region, 2015–2025 (’000 Units)

Table 75 Rectifier: Market, By Region, 2015–2025 (USD Million)

Table 76 Train Lighting Market, By Region, 2015–2025 (000' Units)

Table 77 Market, By Region, 2015–2025 (USD Million)

Table 78 Asia Oceania: Market, By Country, 2015–2025 (‘000 Units)

Table 79 Asia Oceania: Market, By Country, 2015–2025 (USD Million)

Table 80 China: Market, By Technology, 2015–2025 (‘000 Units)

Table 81 China: Market, By Technology, 2015–2025 (USD Million)

Table 82 India: Market, By Technology, 2015–2025 (‘000 Units)

Table 83 India: Market, By Technology, 2015–2025 (USD Million)

Table 84 Japan: Market, By Technology, 2015–2025 (‘000 Units)

Table 85 Japan: Market, By Technology, 2015–2025 (USD Million)

Table 86 South Korea: Market, By Technology, 2015–2025 (‘000 Units)

Table 87 South Korea: Train Lighting Market, By Technology, 2015–2025 (USD Million)

Table 88 Europe: Market, By Country, 2015–2025 (‘000 Units)

Table 89 Europe: Market, By Country, 2015–2025 (USD Million)

Table 90 Germany: Market, By Technology, 2015–2025 (‘000 Units)

Table 91 Germany: Market, By Technology, 2015–2025 (USD Million)

Table 92 France: Market, By Technology, 2015–2025 (‘000 Units)

Table 93 France: Market, By Technology, 2015–2025 (USD Million)

Table 94 UK: Market, By Technology, 2015–2025 (‘000 Units)

Table 95 UK: Market, By Technology, 2015–2025 (USD Million)

Table 96 North America: Train Lighting Market, By Country, 2015–2025 (‘000 Units)

Table 97 North America: Market, By Country, 2015–2025 (USD Million)

Table 98 Canada: Market, By Technology, 2015–2025 (‘000 Units)

Table 99 Canada: Market, By Technology, 2015–2025 (USD Million)

Table 100 Mexico: Market, By Technology, 2015–2025 (‘000 Units)

Table 101 Mexico: Market, By Technology, 2015–2025 (USD Million)

Table 102 US: Market, By Technology, 2015–2025 (‘000 Units)

Table 103 US: Market, By Technology, 2015–2025 (USD Million)

Table 104 RoW: Train Lighting Market, By Country, 2015–2025 (‘000 Units)

Table 105 RoW: Market, By Country, 2015–2025 (USD Million)

Table 106 Brazil: Market, By Technology, 2015–2025 (‘000 Units)

Table 107 Brazil: Market, By Technology, 2015–2025 (USD Million)

Table 108 Russia: Market, By Technology, 2015–2025 (‘000 Units)

Table 109 Russia: Market, By Technology, 2015–2025 (USD Million)

Table 110 Recent Developments, 2015-2017

List of Figures (46 Figures)

Figure 1 Train Lighting Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Railway Infrastructure Investment for Key Countries From 2010–2015 (USD Billion)

Figure 6 Introduction of High Speed Train Will Impact Market

Figure 7 Market: Bottom-Up Approach

Figure 8 Data Triangulation

Figure 9 Train Lighting Market Overview, 2017–2025

Figure 10 Market, By Rolling Stock Type, 2015–2025 (USD Million)

Figure 11 Market, By Position, 2015–2025 (USD Million)

Figure 12 Market, By Application, 2015–2025

Figure 13 Market, By Technology, 2017–2025 (USD Million)

Figure 14 Market, By Component, 2025 (USD Million)

Figure 15 Market, By Country, 2017–2025 (USD Million)

Figure 16 Increasing Demand for Comfort & Safety Features in Rolling Stock to Drive the Market During the Forecast Period

Figure 17 Freight Wagon & EMU are Estimated to Hold More Than 60% Market Share of Market, 2017 (USD Million)

Figure 18 Interior Lighting Segment is Estimated to Dominate the Train Lighting Market, 2017–2025 (USD Million)

Figure 19 Train Marker Lights are Estimated to Hold the Largest Market Share From 2015 to 2025 (USD Million)

Figure 20 LED is Estimated to Be the Largest and Fastest Growing Market, By Technology, 2017–2025 (USD Million)

Figure 21 Rectifier is Estimated to Witness the Highest Growth in theMarket, 2017–2025 (USD Billion)

Figure 22 South Korea is Estimated to Witness the Fastest Growth in the Market, 2017–2025

Figure 23 Asia Oceania is Estimated to Hold the Largest Share of the Market in 2017 (USD Million)

Figure 24 Train Lighting: Market Dynamics

Figure 25 Train Lighting Market, By Rolling Stock Type, 2015–2025 (USD Million)

Figure 26 Market, By Position, 2015–2025 (USD Million)

Figure 27 Market, By Application, 2015–2025 (USD Million)

Figure 28 Market, By Technology, 2015–2025 (USD Million)

Figure 29 Market, By Component, 2015–2025 (USD Million)

Figure 30 Market, By Country, 2015–2025 (USD Million)

Figure 31 Asia Oceania: Market Snapshot

Figure 32 Europe: Market, By Country, 2015–2025 (USD Million)

Figure 33 Market Ranking: 2017

Figure 34 Companies Adopted Expansion and Supply Contract as A Key Growth Strategy

Figure 35 Toshiba: Company Snapshot

Figure 36 Toshiba: SWOT Analysis

Figure 37 General Electric: Company Snapshot

Figure 38 General Electric: SWOT Analysis

Figure 39 Hitachi: Company Snapshot

Figure 40 Hitachi: SWOT Analysis

Figure 41 Koito: Company Snapshot

Figure 42 Koito: SWOT Analysis

Figure 43 Federal-Mogul: Company Snapshot

Figure 44 Federal Mogul: SWOT Analysis

Figure 45 Osram: Company Snapshot

Figure 46 Grupo Antolin: Company Snapshot

Growth opportunities and latent adjacency in Train Lighting Market

We wish to understand the current saturation of LED lighting in the non UK Rolling stock market. So we can see which countries have taken this up and which countries still have to take this up.