Automotive Ambient Lighting Market by IC & Electric Vehicle (BEV, FCEV, PHEV), Application (Footwell, Door, Dashboard, Center Console), Passenger Car (C, D, E & F), Aftermarket (Country & Application (Interior & Exterior)) - Global Forecast to 2027

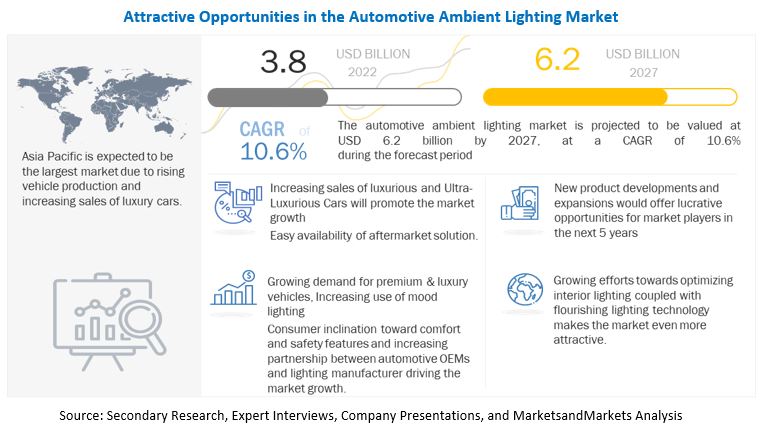

[246 Pages Report] The automotive ambient lighting market size is projected to reach USD 6.2 billion by 2027 from an estimated USD 3.8 billion in 2022, at a CAGR of 10.6% from 2022 to 2027. The growth of this market can be attributed to the increasing demand of premium and luxury vehicles, increasing utilization of mood lighting, and the rising popularity of multicolor ambient lighting in luxury vehicles. Therefore, the automotive ambient lighting market is expected to witness significant growth in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact on Automotive Ambient Lighting Market

Due to COVID-19 pandemic, the global market had noticed a sudden drop in vehicle production and sales owing to implementation of safety related measures such as physical distancing and lockdowns. This had resulted in a slow economic recovery, which forced the market experts that market would take many years to recover to achieve 2019 levels. Due to which, entire supply chain has impacted several in terms of raw material and labor availability. This prompted global players to resynthesize their business strategies and focus on core areas. Thus, the automotive ambient light manufacturers should come up with better strategies to sustain in this market demand and should bring more cost effective lighting systems to gain the market share

Automotive Ambient Lighting Market Dynamics

DRIVER: Efforts to optimize interior lighting

Initially, functional applications of automotive interior lighting such as good orientation and visibility were given prime importance. Now with the increasing demand for interior lighting, atmosphere, well-being, and character are also kept in mind. The desire for individual lighting that adapts to the preferences of the respective driver. In the future, it is expected that a greater accumulation of functional and emotional aspects will be there. The development in this sector has already gained momentum because of the trend of autonomous driving. Virtually no area of the car’s interior will be left out. The aim is to generate added value in the lighting segment through functional, emotional, and aesthetic aspects.

Luxury brands, namely Mercedes-Benz, Lexus, and BMW, have the most vibrant and attractive ambient lighting options for modern cars. The concept of ambient lighting is also popular among high-end automakers like Bentley and Rolls-Royce. They take opulence up a few notches by using ambient lighting to create beautiful visual effects. For instance, Rolls-Royce turns the headliner into a gorgeous night sky using fiber optic strands installed into the headliner. In Bentleys, the door speakers of high-end sound systems are illuminated to highlight intricate details

RESTRAINT: High cost of OE integration

Vehicle manufacturers' ambient lighting is mostly offered in the high-end variants of C,D segment and all E&F segment vehicles. Also, the difference of cost between a variant with ambient lighting against a variant without ambient lighting is significant. OEMs such as Daimler, BMW, Ford, Volkswagen and Hyundai among others, charge extra amount for installing ambient lighting to differentiate their high-end vehicles. Thus, the high cost of ambient lighting offered by OEMs may impact the market growth of automotive ambient lighting

OPPORTUNITY: Collaborations among automotive OEMs and lighting system manufacturers

Major automotive lighting manufacturers are collaborating with OEMs to design new products that not only meet the requirements of the OEM but also advance the technological scope and knowledge for lighting manufacturers. An example of such a collaboration is ams Osram (Austria) and BMW AG (Germany), who came together to develop front headlights for the BMW 7 series using laser technology.

While local players may not be as adept at developing new products, OEMs can partner with them to produce mass-scale lighting systems for large-scale production or higher selling models to get a cost advantage. The benefits of such collaborations are shared by both partners at different levels. On the one hand, OEMs equip their vehicles with advanced lighting technologies, customized as per their design standards. On the other hand, lighting manufacturers are facilitated to pursue and incorporate advanced technological features in their lighting products. The research & development costs are also shared, resulting in the reduction of expenses for each partner.

CHALLENGE: Possibility of driver distraction

According to a research study by a major OEM, ambient lighting that has more than 0.1 cd/square meter luminescence is considered a distraction to drivers. Bright ambiance light can be a major distraction at night, leading to fatalities. Moreover, ambient lighting on the dashboard can act as a hindrance by reducing the visibility of the driver at night. As people have different preferences, it becomes challenging for manufacturers to standardize and provide ambient lighting for different consumer segments. An individual who does not want lighting in the dashboard or mirrors should be able to turn it off in these specific applications. Vehicle manufacturers should ensure that ambient lighting enhances the experience and does not act as a hindrance while operating a vehicle.

CHALLENGE: Presence of unorganized aftermarket

As Original Equipment Manufacturers (OEMs) do not provide ambient lighting for all vehicles, consumers generally get them installed from the aftermarket. In the case of C & D segment vehicles, OEMs provide ambient lighting in the top variants only. As the top variants are significantly costlier, consumers will not buy them just for ambient lighting. They would prefer aftermarket ambient lighting kits. Thus, the aftermarket for ambient lighting is significantly large. OEMs generally have specifications to produce ambient lighting as brighter ambiance lights are a distraction; this aspect cannot be regulated when they are manufactured as an aftermarket accessory. This unorganized market is a major challenge for the growth of the OEM automotive ambient lighting market.

Interior application held the maximum share of automotive ambient lighting installations in aftermarket in 2022

Interior lighting includes center consoles, doors, cupholders, and the entire dashboards and footwells, among others. Interior automotive ambient lighting is mostly for decorative purposes. It is meant to enhance the overall ambiance of the vehicle from the inside and, in some cases, it also helps to improve the vehicle safety function. Further, in the coming years, the interior ambient light aftermarket may grow due to the offering of ambient lighting by OEMs as an accessory and also several options in ambient lighting provided by local suppliers.

Battery Electric Vehicles having extensive ambient lighting fitment from the OEMs.

BEV segment is anticipated to hold the largest share of the electric vehicle ambient lighting market during the forecast period. In the case of BEVs, ambient lighting is available in doors, center consoles, and footwells as a standard option in a few models, and also available in dashboards, headliners, and seats in some cases. The increasing launches of premium-end electric vehicles by global players would also fuel the demand for ambient lighting. For instance, Genesis launched a luxury electric SUV– Genesis GV60, which is equipped with a cabin ambient lighting system. Luxury brands such as Mercedes-Benz, Tesla, and Audi are gaining market share in luxury EV sales and are adding other luxury EV models to their product lineups. Multiple OEMs have announced their intention to launch several EV models in the coming years. Growing electric vehicle sales, including premium vehicles, would consequently push the demand for ambient lighting in this segment.

Demand of F segment cars are growing which results in fastest growth segment for automotive ambient lighting market

F segment cars is anticipated to grow at the highest rate under the review period of 2022-2027. The growth is mainly due to improving global economic conditions which has changed the overall lifestyle of consumers. With increasing disposable income, their demands have changed in line with new lifestyles, leading to a change in their preferences. This has positively affected the sales of ultra-luxurious cars across the globe. Luxury brands, namely Mercedes-Benz, Lexus, and BMW, offers most vibrant and attractive ambient lighting options for modern cars. The ambient lighting is also popular and common feature in high-end cars such as Bentley and Rolls-Royce. As ambient lighting is a key feature in ultra-luxurious vehicles, thereby increasing global production of F-segment vehicles is expected to drive the automotive ambient lighting market for F segment cars.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is projected to be the largest OE market by 2027

Asia Pacific is expected to hold the largest share of the automotive ambient lighting OE market during the forecast period. It witnessed higher growth in vehicle production than Europe and North America due to the availability of labor at lower wages, reduced production costs, lenient vehicle safety norms, and government initiatives for FDIs in the region in both pre and post-COVID-19. Vehicle production is mostly driven by countries such as China, South Korea, India, and Japan, which accounted for ~88% of the total vehicle production in the region, and these countries contributed ~55% to the global vehicle production in 2021. Further, although the average penetration of ambient lighting in Asia Pacific is around 25-30% and 35-40% in C & D segments passenger vehicles respectively, it is expected to reach 35-40% and 45-50% respectively by 2027. Thus, increasing vehicle production, along with changing consumer preferences towards more customized options and growing per capita income of the middle-class population, is driving the vehicle demand and encouraging automotive OEMs to increase production capacity and offer vehicles fitted with different ambient lighting systems in the lower-range cars as well.

Key Market Players & Start-ups

The global ambient lighting market is dominated by major players such as HELLA (Germany), Valeo S.A. (France), ams OSRAM (Austria), Grupo Antolin (Spain), Koito Manufacturing Co., Ltd. (Japan), Signify (Philip Lighting) (Netherlands), and Stanley Electric Co., Ltd. (Japan). These companies offer a wide variety of ambient lighting fulfilling all major functions and applications for various applications. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Scope of the report

|

Report Attributes |

Details |

|

Market size: |

USD 3.8 billion in 2022 to USD 6.2 billion by 2027 |

|

Growth Rate: |

10.6% |

|

Largest Market: |

Asia Pacific |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2022-2027 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

OE by Component, OE by Passenger Car Segment, Aftermarket by Application and Country, EV by Vehicle Type and Component |

|

Geographies Covered: |

North America, Europe, Asia Pacific, and Rest of the World |

|

Report Highlights:

|

Experts from both supply and demand side were interviewed to understand the future trends of the automotive ambient lighting market. |

|

Key Market Opportunities: |

Collaborations among automotive OEMs and lighting system manufacturers |

|

Key Market Drivers: |

Efforts to optimize interior lighting |

This research report categorizes the automotive ambient lighting market based on Application type, post-sale application, channel type, connection type, component type, end market type, and region.

Automotive Ambient Lighting Aftermarket, By Application

- Interior

- Exterior

Automotive Ambient Lighting Aftermarket, By Region

- North America

- Europe

- Asia Pacific

- Rest of World

Automotive Ambient Lighting OE Market, By Component

- Dashboard

- Footwell

- Doors

- Center Console

- Others

Automotive Ambient Lighting OE Market, Passenger Car Segments

- C

- D

- E

- F

Electric Vehicle Ambient Lighting OE Market, By Component

- Dashboard

- Footwell

- Doors

- Center Console

- Others

Electric Vehicle Ambient Lighting OE Market, By Vehicle Type

- BEV

- FCEV

- PHEV

Recent Developments

- In April 2022, ams OSRAM announced its intention to invest USD 843 million for LED plant development in Malaysia. The company also plans to make an additional investment in a significant new 8-inch LED front-end capacity in Malaysia (Kulim HiTech Park) to support advanced LED technology and micro-LED manufacturing.

- In March 2022, Marelli developed a 3D Shaped Rear Lamp for BMW 2 series. The very homogeneous light guide-based tail function of this rear lamp is a true eye-catcher. With its aerodynamic and wavy shape, the product fully supports the car’s styling concept.

- In October 2020, OSRAM manufactured the first LED based automotive retrofit lamps for the German market. The Night Breaker LED H7 from Osram is three times brighter than the minimum legal requirements and is comparable in color to daylight. The lamp creates strong contrasts, long range, requires less replace and consumes less energy. It is a cost-effective retrofit alternative to LED Headlight systems.

- In December 2021, ams OSRAM introduced the Oslon Black Flat X family of LEDs¯the brightest LEDs currently on the market for automotive front lights. Lead frame-based components provide brightness specifically designed for use in automotive low-beam and high-beam solutions.

- In September 2020, Grupo Antolin withstood the COVID-19 crisis and opened a new innovative centre in China. The purpose of opening the centre in China is to strengthen its R&D, innovation and technological development capabilities in the largest automotive market in the world. The company would be able to quickly adapt to the needs and requirements of its customers in China, especially in projects focused on the new electric mobility

- In January 2020, OSRAM announced that it is the supplier of exclusive lighting supplier for MetroSnap, the latest concept vehicle from Rinspeed. The lighting solution has provided solutions within the categories of mobility, safety and security, connection and health and wellbeing. It has created a biomonitoring and biometric applications enables by infrared light solutions

Critical Questions:

What is the current size of the global automotive ambient lighting market?

The automotive ambient lighting market is estimated to be USD 3.8 billion in 2022 with Asia Pacific dominating the market.

We are interested in the regional ambient lighting market for various application type. Does this report cover the component segment?

Yes, the ambient lighting market for application type is covered at a regional level.

Many companies are operating in the automotive ambient lighting market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The global ambient lighting market is dominated by major players such as HELLA (Germany), ams OSRAM (Austria), Valeo (France), Signify (Philips Lighting) (Netherlands), and KOITO (Japan). These companies offer a wide variety of ambient lighting fulfilling all major functions and applications for various applications. The key strategies adopted by these companies to sustain their market position are new product developments, expansions, mergers &acquisitions, and partnerships & collaboration.

Does this report contain the market size of aftermarket?

Yes, the market size of aftermarket is extensively covered in terms of value and volume.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS FOR AUTOMOTIVE AMBIENT LIGHTING MARKET

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: AUTOMOTIVE AMBIENT LIGHTING MARKET

1.3.2 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 AUTOMOTIVE AMBIENT LIGHTING MARKET: RESEARCH

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR BASE NUMBERS (VEHICLE PRODUCTION AND PARC DATA)

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.2.1 Key data from secondary sources

2.2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.3.1 Sampling techniques & data collection methods

2.2.3.2 Primary participants

2.3 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 GLOBAL AUTOMOTIVE AMBIENT LIGHTING MARKET SIZE: BOTTOM-UP APPROACH

FIGURE 7 AUTOMOTIVE AMBIENT LIGHTING MARKET: RESEARCH DESIGN & METHODOLOGY

2.3.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

2.4 FACTOR ANALYSIS

2.5 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ASSESSMENT AND RANGES

TABLE 2 AUTOMOTIVE AMBIENT LIGHTING MARKET: RISK ASSESSMENT AND RANGES

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

3.1 INTRODUCTION

3.2 PRE- VS POST-COVID-19 SCENARIO

FIGURE 9 PRE- & POST-COVID-19 SCENARIO: AUTOMOTIVE AMBIENT LIGHTING MARKET SIZE, 2018–2027 (USD MILLION)

TABLE 3 AUTOMOTIVE AMBIENT LIGHTING OE MARKET SIZE: PRE- VS. POST-COVID-19 SCENARIO, 2018–2027 (USD MILLION)

3.3 REPORT SUMMARY

FIGURE 10 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE AMBIENT LIGHTING OE MARKET

FIGURE 11 GROWING DEMAND FOR LUXURY VEHICLES, OPTIMIZED INTERIOR LIGHTING, AND CONSUMER PREFERENCE FOR PERSONALIZED FEATURES DRIVE MARKET

4.2 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT

FIGURE 12 FOOTWELL ESTIMATED TO HOLD MAXIMUM MARKET SHARE IN 2022 (USD MILLION)

4.3 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR SEGMENT

FIGURE 13 D SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE IN 2022

4.4 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT

FIGURE 14 DASHBOARD PROJECTED TO REGISTER FASTEST GROWTH RATE DURING FORECAST PERIOD

4.5 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE

FIGURE 15 BEV PROJECTED TO LEAD ELECTRIC VEHICLE AMBIENT LIGHTING MARKET DURING FORECAST PERIOD

4.6 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION

FIGURE 16 INTERIOR PROJECTED TO LEAD AFTERMARKET FOR AMBIENT LIGHTING DURING FORECAST PERIOD

4.7 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION

FIGURE 17 ASIA PACIFIC PROJECTED TO LEAD AFTERMARKET FOR AMBIENT LIGHTING DURING FORECAST PERIOD

4.8 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION

FIGURE 18 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF AUTOMOTIVE AMBIENT LIGHTING MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 AUTOMOTIVE AMBIENT LIGHTING MARKET: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing sale of ultra-luxurious vehicles

FIGURE 20 E & F SEGMENT VEHICLE PRODUCTION OF KEY PLAYERS, 2016–2021 (THOUSAND UNITS)

TABLE 4 PRODUCTION OF KEY E & F SEGMENT VEHICLES FOR KEY OEMS

5.2.1.2 Efforts to optimize interior lighting

5.2.1.3 Consumer inclination toward comfort & safety features

FIGURE 21 C & D SEGMENT VEHICLE PRODUCTION, 2016–2021 (THOUSAND UNITS)

5.2.1.4 Easy availability of aftermarket solutions

TABLE 5 OE-RECOMMENDED AMBIENT LIGHTING COST (USD)

TABLE 6 AFTERMARKET AMBIENT LIGHTING COST

5.2.2 RESTRAINTS

5.2.2.1 High cost of OE integration

TABLE 7 OE INTEGRATION COST (USD)

5.2.2.2 Higher cost of LED lights compared to halogen lights

FIGURE 22 COMPARATIVE GLOBAL AVERAGE PRICE OF 55W HEADLIGHTS, 2021

5.2.3 OPPORTUNITIES

5.2.3.1 Enhanced functionalities in lighting

5.2.3.2 Increasing use of mood lighting

TABLE 8 PSYCHOLOGICAL EFFECTS OF AMBIENT LIGHTING COLORS

5.2.3.3 Collaborations among automotive OEMs and lighting system manufacturers

TABLE 9 PARTNERSHIPS & COLLABORATIONS, 2019–2022

5.2.4 CHALLENGES

5.2.4.1 Possibility of driver distraction

5.2.4.2 Presence of unorganized aftermarket

5.2.4.3 Volatility of raw material prices

5.2.4.4 Increase in competition from local companies offering counterfeit/aftermarket solutions

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 PORTER’S FIVE FORCES ANALYSIS: AUTOMOTIVE AMBIENT LIGHTING MARKET

5.3.1 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 INTENSITY OF COMPETITIVE RIVALRY IN AUTOMOTIVE AMBIENT LIGHTING MARKET IS CONSIDERED MEDIUM

5.3.2 COMPETITIVE RIVALRY

FIGURE 25 LARGE NUMBER OF PLAYERS IN THE MARKET LEADS TO A HIGH DEGREE OF COMPETITION

5.3.3 THREAT OF NEW ENTRANTS

FIGURE 26 DESIGN AND REGULATORY NORMS IN THIS MARKET ARE RELATIVELY LOW

5.3.4 THREAT OF SUBSTITUTES

FIGURE 27 LIGHTING BEING THE INTEGRAL COMPONENT OF AUTOMOBILE VEHICLES MAKES THREAT OF SUBSTITUTES LOW

5.3.5 BARGAINING POWER OF SUPPLIERS

FIGURE 28 LARGE NUMBER OF SUPPLIERS MAKES THE BARGAINING POWER OF SUPPLIERS LOW

5.3.6 BARGAINING POWER OF BUYERS

FIGURE 29 SPECIFIC BUYER REQUIREMENTS AND LARGE NUMBER OF SUPPLIERS MAKES THE BARGAINING POWER OF BUYERS HIGH

5.4 TRENDS/DISRUPTIONS IMPACTING AUTOMOTIVE AMBIENT LIGHTING MARKET

5.4.1 INTERIOR VEHICLE DESIGN HEAVILY INFLUENCED BY AUTONOMOUS DRIVING AND NEED FOR PERSONALIZATION

5.4.2 KEY DEVELOPMENTS IN INTERIOR VEHICLE LIGHTS FOR SHARED MOBILITY AND SELF DRIVING VEHICLES

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 30 AUTOMOTIVE AMBIENT LIGHTING MARKET: SUPPLY CHAIN ANALYSIS

5.5.1 RESEARCH AND PRODUCT DEVELOPMENT EXECUTIVES

5.5.2 RAW MATERIAL/COMPONENT SUPPLIERS

5.5.3 ORIGINAL EQUIPMENT MANUFACTURERS

5.5.4 VEHICLE MANUFACTURERS

5.5.5 DISTRIBUTORS AND SALES REPRESENTATIVES

5.5.6 END USERS

5.6 TRADE ANALYSIS

TABLE 11 IMPORT OF ELECTRIC LIGHTING AND VISUAL SIGNALING EQUIPMENT FOR MOTOR VEHICLES (EXCLUDING LAMPS), BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 12 EXPORT OF ELECTRIC LIGHTING AND VISUAL SIGNALING EQUIPMENT FOR MOTOR VEHICLE (EXCLUDING LAMPS), BY COUNTRY, 2017–2020 (USD THOUSAND)

5.7 TECHNOLOGY ANALYSIS

5.8 AUTOMOTIVE AMBIENT LIGHTING MARKET SCENARIO

FIGURE 31 AUTOMOTIVE AMBIENT LIGHTING MARKET SCENARIO, 2018–2027 (USD MILLION)

5.8.1 MOST LIKELY/REALISTIC SCENARIO

TABLE 13 REALISTIC SCENARIO: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2027 (USD MILLION)

5.8.2 HIGH COVID-19 IMPACT SCENARIO

TABLE 14 HIGH COVID-19 IMPACT SCENARIO: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2027 (USD MILLION)

5.8.3 LOW COVID-19 IMPACT SCENARIO

TABLE 15 LOW COVID-19 IMPACT SCENARIO: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2027 (USD MILLION)

5.9 AVERAGE SELLING PRICE (ASP) TREND ANALYSIS

TABLE 16 AVERAGE PRICES OF AUTOMOTIVE AMBIENT LIGHTING SYSTEM, 2019-2021

5.10 PATENT ANALYSIS

5.11 CASE STUDY ANALYSIS

5.11.1 USE CASE 1: LED HEADLAMPS DESIGN

5.11.2 USE CASE 2: BMW GROUP AND LIGHTING ENGINEERING GROUP AT ILMENAU UNIVERSITY

5.11.3 USE CASE 3: INFLUENCE OF AMBIENT LIGHTING IN A VEHICLE INTERIOR ON THE DRIVER'S PERCEPTIONS

5.12 REGULATORY LANDSCAPE

TABLE 17 NORTH AMERICA: AMBIENT LIGHTING/VEHICLE LIGHTING REGULATIONS

TABLE 18 EUROPE: AMBIENT LIGHTING/VEHICLE LIGHTING REGULATIONS

TABLE 19 ASIA PACIFIC: AMBIENT LIGHTING/VEHICLE LIGHTING REGULATIONS

5.13 REGULATORY BODIES/GOVERNMENT AGENCIES

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14 CONFERENCES AND EVENTS

5.14.1 AUTOMOTIVE AMBIENT LIGHTING MARKET: DETAILED LIST OF UPCOMING CONFERENCES & EVENTS

6 RECOMMENDATIONS FROM MARKETSANDMARKETS (Page No. - 91)

6.1 ASIA PACIFIC: POTENTIAL MARKET FOR AMBIENT LIGHTING MANUFACTURERS TO FOCUS ON

6.2 ADVANCED LIGHTING SOLUTIONS WITH EFFICIENT TECHNOLOGIES NEED OF THE FUTURE

6.3 CONCLUSION

7 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT (Page No. - 93)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS: BY COMPONENT & REGION

FIGURE 32 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 23 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2018–2021 (THOUSAND UNITS)

TABLE 24 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2022–2027 (THOUSAND UNITS)

TABLE 25 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 26 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 DASHBOARD

TABLE 27 DASHBOARD: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 28 DASHBOARD: AUTOMOTIVE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 29 DASHBOARD: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, 2018–2021 (USD MILLION)

TABLE 30 DASHBOARD: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, 2022–2027 (USD MILLION)

7.3 DOOR

TABLE 31 DOOR: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 32 DOOR: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 33 DOOR: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 DOOR: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 CENTER CONSOLE

TABLE 35 CENTER CONSOLE: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 36 CENTER CONSOLE: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 37 CENTER CONSOLE: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, 2018–2021 (USD MILLION)

TABLE 38 CENTER CONSOLE: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, 2022–2027 (USD MILLION)

7.5 FOOTWELL

TABLE 39 FOOTWELL: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 40 FOOTWELL: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 41 FOOTWELL: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 FOOTWELL: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHERS

TABLE 43 OTHERS: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 44 OTHERS: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 45 OTHERS: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 OTHERS: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR SEGMENT (Page No. - 105)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS: BY PASSENGER CAR & REGION

FIGURE 33 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR SEGMENT, 2022 VS. 2027 (USD MILLION)

TABLE 47 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR SEGMENT, 2018–2021 (THOUSAND UNITS)

TABLE 48 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR SEGMENT, 2022–2027 (THOUSAND UNITS)

TABLE 49 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR, 2018–2021 (USD MILLION)

TABLE 50 AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY PASSENGER CAR, 2022–2027 (USD MILLION)

8.2 C SEGMENT

TABLE 51 C SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 52 C SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 53 C SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 C SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 D SEGMENT

TABLE 55 D SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 56 D SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 57 D SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 D SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 E SEGMENT

TABLE 59 E SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 60 E SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 61 E SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 E SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 F SEGMENT

TABLE 63 F SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 64 F SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 65 F SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 F SEGMENT: AUTOMOTIVE AMBIENT LIGHTING OE MARKET, BY REGION, 2022–2027 (USD MILLION)

9 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT (Page No. - 116)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS: BY COMPONENT

FIGURE 34 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 67 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT, 2018–2021 (THOUSAND UNITS)

TABLE 68 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT, 2022–2027 (THOUSAND UNITS)

TABLE 69 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 70 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

9.2 DASHBOARD

TABLE 71 DASHBOARD: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 72 DASHBOARD: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 73 DASHBOARD: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 DASHBOARD: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 DOOR

TABLE 75 DOOR: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 76 DOOR: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 77 DOOR: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 DOOR: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CENTER CONSOLE

TABLE 79 CENTER CONSOLE: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 80 CENTER CONSOLE: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 81 CENTER CONSOLE: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 CENTER CONSOLE: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 FOOTWELL

TABLE 83 FOOTWELL: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 84 FOOTWELL: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 85 FOOTWELL: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 FOOTWELL: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 OTHERS

TABLE 87 OTHERS: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 88 OTHERS: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 89 OTHERS: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 OTHERS: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

10 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE (Page No. - 126)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS: BY VEHICLE TYPE& REGION

FIGURE 35 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 91 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 92 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 93 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE, 2018–2021 (USD MILLION)

TABLE 94 ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

10.2 BEV

TABLE 95 BEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 96 BEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 97 BEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 98 BEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 PHEV

TABLE 99 PHEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 100 PHEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 101 PHEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 PHEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 FCEV

TABLE 103 FCEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 104 FCEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (THOUSAND UNITS)

TABLE 105 FCEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 FCEV: ELECTRIC VEHICLE AMBIENT LIGHTING MARKET, BY REGION, 2022–2027 (USD MILLION)

11 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION (Page No. - 135)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS: AFTERMARKET, BY APPLICATION

FIGURE 36 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 107 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 108 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 109 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 110 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2 INTERIOR

TABLE 111 INTERIOR: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 112 INTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 113 INTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (MILLION USD)

TABLE 114 INTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (MILLION USD)

11.3 EXTERIOR

TABLE 115 EXTERIOR: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 116 EXTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 117 EXTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 118 EXTERIOR: AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

12 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION (Page No. - 141)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS: AFTERMARKET, BY APPLICATION

FIGURE 37 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, 2022 VS. 2027 (USD MILLION)

TABLE 119 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (MILLION UNITS)

TABLE 120 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (MILLION UNITS)

TABLE 121 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET SNAPSHOT

TABLE 123 NORTH AMERICA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 124 NORTH AMERICA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 125 NORTH AMERICA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 126 NORTH AMERICA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.1 US

TABLE 127 US: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 128 US: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 129 US: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 US: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.2 CANADA

TABLE 131 CANADA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 132 CANADA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 133 CANADA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 134 CANADA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.2.3 MEXICO

TABLE 135 MEXICO: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 136 MEXICO: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 137 MEXICO: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 138 MEXICO: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3 EUROPE

FIGURE 39 EUROPE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, 2022 VS. 2027 (USD MILLION)

TABLE 139 EUROPE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 140 EUROPE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 141 EUROPE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 EUROPE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.1 GERMANY

TABLE 143 GERMANY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 144 GERMANY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 145 GERMANY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 146 GERMANY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.2 UK

TABLE 147 UK: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 148 UK: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 149 UK: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 150 UK: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.3 FRANCE

TABLE 151 FRANCE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 152 FRANCE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 153 FRANCE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 154 FRANCE: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.4 ITALY

TABLE 155 ITALY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 156 ITALY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 157 ITALY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 158 ITALY: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.3.5 SPAIN

TABLE 159 SPAIN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 160 SPAIN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 161 SPAIN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 162 SPAIN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET SNAPSHOT

TABLE 163 ASIA PACIFIC: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 164 ASIA PACIFIC: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 165 ASIA PACIFIC: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.1 CHINA

TABLE 167 CHINA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 168 CHINA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 169 CHINA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 170 CHINA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.2 JAPAN

TABLE 171 JAPAN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 172 JAPAN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 173 JAPAN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 174 JAPAN: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.3 SOUTH KOREA

TABLE 175 SOUTH KOREA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 176 SOUTH KOREA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 177 SOUTH KOREA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 178 SOUTH KOREA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.4.4 INDIA

TABLE 179 INDIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 180 INDIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 181 INDIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 182 INDIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5 ROW

FIGURE 41 ROW: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 183 ROW: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (MILLION UNITS)

TABLE 184 ROW: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (MILLION UNITS)

TABLE 185 ROW: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 186 ROW: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.1 RUSSIA

TABLE 187 RUSSIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 188 RUSSIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 189 RUSSIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 190 RUSSIA: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

12.5.2 BRAZIL

TABLE 191 BRAZIL: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 192 BRAZIL: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 193 BRAZIL: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 194 BRAZIL: AUTOMOTIVE AMBIENT LIGHTING AFTERMARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 172)

13.1 OVERVIEW

13.2 AUTOMOTIVE AMBIENT LIGHTING MARKET SHARE ANALYSIS, 2021

FIGURE 42 AUTOMOTIVE AMBIENT LIGHTING MARKET SHARE, 2021

TABLE 195 AUTOMOTIVE AMBIENT LIGHTING MARKET SHARE, 2021

13.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 43 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021

13.4 COMPETITIVE EVALUATION QUADRANT

13.4.1 TERMINOLOGY

13.4.2 STAR

13.4.3 EMERGING LEADERS

13.4.4 PERVASIVE

13.4.5 PARTICIPANTS

TABLE 196 AUTOMOTIVE AMBIENT LIGHTING MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 197 AUTOMOTIVE AMBIENT LIGHTING MARKET: COMPANY APPLICATION FOOTPRINT, 2021

TABLE 198 AUTOMOTIVE AMBIENT LIGHTING MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 44 AUTOMOTIVE AMBIENT LIGHTING MARKET: COMPETITIVE EVALUATION MATRIX, 2021

13.5 COMPETITIVE SCENARIO

13.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 199 NEW PRODUCT DEVELOPMENTS, 2019–2022

13.5.2 EXPANSIONS

TABLE 200 EXPANSIONS, 2019–2022

13.5.3 DEALS

TABLE 201 DEALS, 2018–2022

13.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2022

TABLE 202 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2018–2021

13.7 COMPANY EVALUATION QUADRANT: SME PLAYERS IN AUTOMOTIVE AMBIENT LIGHTING MARKET

13.7.1 STAR

13.7.2 EMERGING LEADERS

13.7.3 PERVASIVE

13.7.4 PARTICIPANTS

FIGURE 45 COMPETITIVE EVALUATION MATRIX: AUTOMOTIVE AMBIENT LIGHTING MARKET: SME PLAYERS

14 COMPANY PROFILES (Page No. - 188)

14.1 AUTOMOTIVE AMBIENT LIGHTING MARKET - KEY PLAYERS

(Business overview, Products offered, Recent developments, Product launches, MNM Views, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.1.1 HELLA

TABLE 203 HELLA: BUSINESS OVERVIEW

FIGURE 46 HELLA: COMPANY SNAPSHOT

TABLE 204 HELLA: DEALS

TABLE 205 HELLA: PRODUCT LAUNCHES

TABLE 206 HELLA: EXPANSIONS

14.1.2 VALEO S.A.

TABLE 207 VALEO S.A.: BUSINESS OVERVIEW

FIGURE 47 VALEO S.A.: COMPANY SNAPSHOT

TABLE 208 VALEO S.A.: DEALS

TABLE 209 VALEO S.A.: PRODUCT LAUNCHES

TABLE 210 VALEO S.A.: EXPANSIONS

14.1.3 GRUPO ANTOLIN

TABLE 211 GRUPO ANTOLIN: BUSINESS OVERVIEW

FIGURE 48 GRUPO ANTOLIN: COMPANY SNAPSHOT

TABLE 212 GRUPO ANTOLIN: DEALS

TABLE 213 GRUPO ANTOLIN: PRODUCT LAUNCHES

TABLE 214 GRUPO ANTOLIN: EXPANSIONS

14.1.4 KOITO MANUFACTURING CO. LTD.

TABLE 215 KOITO MANUFACTURING CO. LTD.: BUSINESS OVERVIEW

FIGURE 49 KOITO MANUFACTURING CO. LTD.: COMPANY SNAPSHOT

TABLE 216 KOITO MANUFACTURING CO. LTD.: DEALS

14.1.5 AMS OSRAM

TABLE 217 AMS OSRAM: BUSINESS OVERVIEW

FIGURE 50 AMS OSRAM: COMPANY SNAPSHOT

TABLE 218 AMS OSRAM: DEALS

TABLE 219 AMS OSRAM: EXPANSIONS

TABLE 220 AMS OSRAM: PRODUCT LAUNCHES

14.1.6 FEDERAL MOGUL (TENNECO)

TABLE 221 FEDERAL MOGUL (TENNECO): BUSINESS OVERVIEW

FIGURE 51 FEDERAL MOGUL (TENNECO): COMPANY SNAPSHOT

TABLE 222 FEDERAL MOGUL (TENNECO): DEALS

14.1.7 TUNGSRAM GROUP

TABLE 223 TUNGSRAM GROUP: BUSINESS OVERVIEW

TABLE 224 TUNGSRAM GROUP: DEALS

14.1.8 SIGNIFY (PHILIPS LIGHTING)

TABLE 225 SIGNIFY (PHILIPS LIGHTING): BUSINESS OVERVIEW

FIGURE 52 SIGNIFY (PHILIPS LIGHTING): COMPANY SNAPSHOT

TABLE 226 SIGNIFY (PHILIPS LIGHTING): PRODUCT LAUNCHES

14.1.9 MARELLI

TABLE 227 MARELLI: BUSINESS OVERVIEW

TABLE 228 MARELLI: DEALS

TABLE 229 MARELLI: PRODUCT LAUNCHES

TABLE 230 MARELLI: EXPANSIONS

14.1.10 STANLEY ELECTRIC CO. LTD.

TABLE 231 STANLEY ELECTRIC CO. LTD.: BUSINESS OVERVIEW

FIGURE 53 STANLEY ELECTRIC CO. LTD.: COMPANY SNAPSHOT

TABLE 232 STANLEY ELECTRIC CO. LTD.: DEALS

TABLE 233 STANLEY ELECTRIC CO. LTD: PRODUCT LAUNCHES

TABLE 234 STANLEY ELECTRIC CO. LTD.: EXPANSIONS

14.1.11 ZIZALA LICHTSYSTEME GMBH

TABLE 235 ZIZALA LICHTSYSTEME GMBH: BUSINESS OVERVIEW

TABLE 236 ZIZALA LICHTSYSTEME GMBH: PRODUCT LAUNCHES

TABLE 237 ZIZALA LICHTSYSTEME GMBH: EXPANSIONS

14.2 OTHER KEY PLAYERS

14.2.1 DRAXLMAIER GROUP

14.2.2 SCHOTT

14.2.3 TOSHIBA LIGHTING AND TECHNOLOGY CORPORATION

14.2.4 PACIFIC INSIGHT

14.2.5 OSHINO LAMPS LTD.

14.2.6 TEXAS INSTRUMENTS

14.2.7 SIGMA INTERNATIONAL

14.2.8 LUMAX INDUSTRIES LTD.

14.2.9 AUTOLITE (INDIA) LTD.

14.2.10 SAMVARDHANA MOTHERSON AUTOMOTIVE SYSTEMS

*Details on Business overview, Products offered, Recent developments, Product launches, MNM Views, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 239)

15.1 CURRENCY & PRICING

15.2 INSIGHTS OF INDUSTRY EXPERTS

15.3 DISCUSSION GUIDE

15.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.5 AVAILABLE CUSTOMIZATIONS

15.5.1 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY PASSENGER CAR AND COUNTRY*

15.5.2 AUTOMOTIVE AMBIENT LIGHTING MARKET, BY APPLICATION AND COUNTRY*

15.5.3 AMBIENT LIGHTING MARKET FOR RAPID TRANSIT SYSTEM, BY REGION

15.5.3.1 North America

15.5.3.2 Europe

15.5.3.3 Asia Pacific

15.5.3.4 RoW

15.6 RELATED REPORTS

15.7 AUTHOR DETAILS

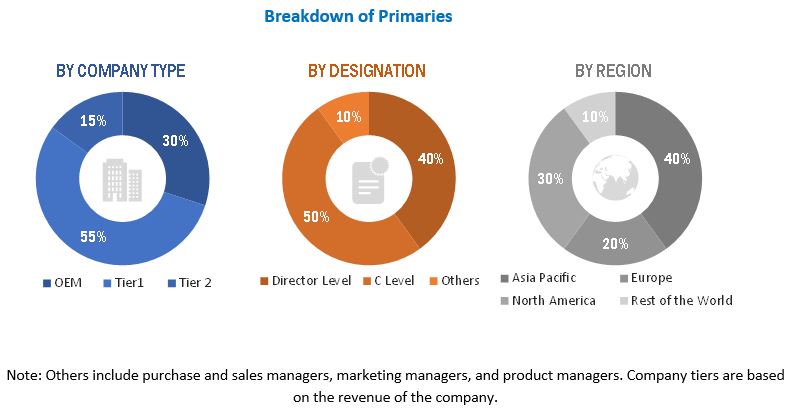

The study involved four major activities in estimating the current size of the automotive ambient lighting market. Extensive primary research was conducted after obtaining an understanding of the autmtoive ambient lighting market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- [(in terms of OEMs) country-level government associations, and trade associations] and supply-side (ambient lighting system and components providers) across major regions, namely, North America, Europe, Asia Pacific and RoW.

Secondary Research

The secondary sources referred for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary datahas been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of the automotive ambient lighting market through secondary research. Several primary interviews were conducted with the market experts from both demand- (OEM) and supply-side (manufacturers and distributors of automotive ambient lightings and data analyzing software) across 4 major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In our canvassing of primaries, we strived to cover various departments within organizations, which included sales, operations, and administration to provide a holistic viewpoint of the ambient lightings for the automotive industry in our report.

After interacting with the industry participants, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of the in-house subject-matter experts, led us to the findings as described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

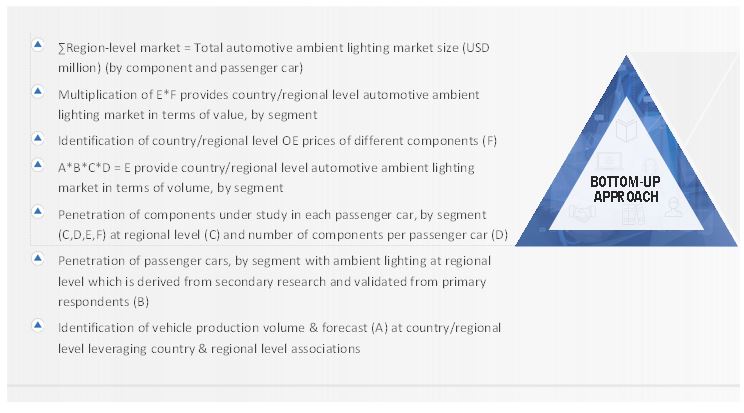

The bottom-up is used to estimate and validate the size of the global ambient lighting market. In these approaches, manufacturing plants, service centres, and regulatory bodies statistics for each vehicle type (passenger vehicle, light commercial vehicle, truck, and bus) at a country level have been considered.

Bottom-up Approach

The bottom-up approach was used to estimate and validate the size of both, the OE and aftermarket for automotive ambient lighting. The production volume of ICE vehicles was considered to derive the OE market, vehicle parc volume was considered to derive the aftermarket, and vehicle sales were considered to derive the electric vehicle ambient lighting market. The bottom-up approach was used to derive the aforementioned markets based on application. The penetration rates of each component and application were derived with the help of secondary research and validated through primary research. The penetration rates were then multiplied with the respective country/regional level volumes to derive the country/regional level ambient lighting market. This country/regional level market size, in terms of volume, was then multiplied by the country/regional level average OE price (AOP) of ambient lighting of each application. This was used to determine the country/regional-level market size in terms of value. A summation of the market is carried out to derive the global automotive ambient lighting market.

Automotive Ambient LightingMarket: Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns were determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Report Objectives

- To define, segment, and forecast the automotive ambient lighting market from 2022 to 2027 in terms of volume and value

- To provide a detailed analysis of various factors such as drivers, restraints, opportunities, and challenges influencing the growth of the automotive ambient lighting market

- To segment and forecast the size of the automotive ambient lighting market based on application, vehicle segment, EV type and aftermarket and Components.

- To segment and forecast the size of the automotive ambient lighting market, in terms of volume and value, based on Components (dashboards, footwell, doors, center console, and others)

- To segment and forecast the size of the automotive ambient lighting market, in terms of value, based on passenger car segment (C, D, E, and F)

- To segment and forecast the size of the electric vehicle ambient lighting market, in terms of volume and value, based on electric vehicle type (BEV, HEV, PHEV)

- To segment and forecast the size of the automotive ambient lighting market, in terms of volume and value, based on aftermarket [country and application (interior and exterior)]

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansions, and other activities carried out by key players in the automotive ambient lighting market

- To understand the dynamics of competitors in the automotive ambient lighting market and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze recent developments, joint ventures, mergers & acquisitions, supply contracts, new product launches, collaborations, and other activities carried out by key industry players in the fuel cell powertrain market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To analyze the impact of COVID-19 on the overall automotive ambient lighting market

- To strategically profile key players and comprehensively analyze their market share and core competencies

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

- Ambient lighting Market, By Passenger car segment, By Country*

- Ambient lighting, market, By Component, By Country*

-

Ambient lighting market for rapid transit systems, by Region

- North America

- Europe

- Asia Oceania

- RoW

*Countries included US, Canada, Mexico (North America), Germany, Frain, Spain, Itaky, UK (Europe), China, India, Japan, South Korea (Asia Pacific) and Brazil, Russia (RoW)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Ambient Lighting Market

I want to understand the current and future Global market/business potential of Ambient lighting Market