Train Dispatching Market by Railroad Type (Dedicated Freight Railroad, Dedicated Passenger Railroad, Mixed Railroad, Regional & Shortline), Offering (Solution, Service), Application, Deployment Model and Region - Global Forecast to 2027

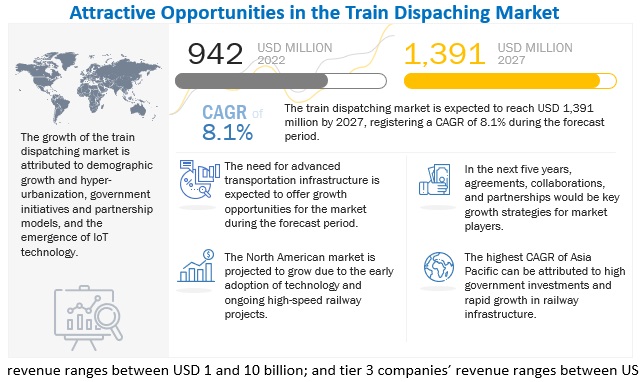

The global train dispatching market size is valued at USD 942 billion in 2022 and is expected to reach USD 1,391 billion by 2027, at a CAGR of 8.1%, during the forecast period 2022-2027. The dedicated freight railroads, dedicated passenger railroads, mixed railroads, regional railroads, and shortlines were all plotted in this study. train dispatching systems give dispatchers access to real-time data on the position, motion, and status of trains as well as the capability to remotely monitor and manage train movements. This enables dispatchers to better coordinate with other dispatchers and railway operators, optimise train timetables, and react swiftly to unforeseen occurrences like delays or accidents. Additionally, train dispatching systems can be utilised for a variety of applications, such as train dispatch, train timetables, railway tracks, train monitoring, and train control, which aid dispatchers in the effective and secure management of the rail network. These platforms give businesses a single point of access to all integrated capabilities, including phone handling and dispatching, field communications, third-party application integration, and data reporting and analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increased investments for public safety in smart city projects

Smart technologies are revolutionizing the structure of cities. Smart energy meters, security devices, smart appliances, and smart transportation are among the technologies used to develop smart cities. Ensuring public safety and security is a key factor in gaining the trust of citizens while evolving into a smart environment. Hence, integrating public safety solutions into the smart city process is important. Governments are rapidly investing in various sectors, such as smart homes and buildings, smart communication, smart transportation, smart utilities, public safety, and connected cars. For instance, the Government of India declared a budget of USD 1.2 billion for smart cities for 2020 to 2021, a 57% increase from 2019.

Similarly, in 2016, the US Department of Transportation (US DOT) spent approximately USD 550 billion on infrastructure, including roads, bridges, and mass transportation for smart cities and advanced transportation technologies. A survey in Asia Pacific by Hitachi Data Systems in 2015 revealed that 69% of the respondents were planning to invest in public safety projects. The report also stated that approximately 56% of respondents expected their countries to invest more than USD 100 million in public safety initiatives in the next two years. This highlights the importance of public safety in developing smart cities and the significant investments made in this direction by regional and national governments, especially for ITS systems for roadways and railways, including train dispatching systems.

Restraint: Lack of infrastructure for train dispatching systems in railways

The poorly developed telecommunication infrastructure and limited availability of access to smart devices in emerging countries create barriers in the train dispatching market. High internet access cost also acts as a barrier to smart railway concepts such as train dispatching. As organizations increasingly adopt IoT technologies, pursue ambient computing technology, and offer various IoT solutions, standardization across data standards, wireless protocols, and technologies have become more divergent to reduce complexities and costs. This is also happening due to the increasing number of newly developed connected devices that run on various platforms and technologies.

Connected railway train dispatching systems are complex to operate together, which is expected to cause difficulties in interoperability. Different systems and solutions, such as operations management systems, traffic management systems, control systems, and asset management systems, are connected through established networks. These solutions work on the same standards as well as defined protocols. Therefore, the lack of standards and protocol is projected as a key restraint in the train dispatching market.

The increasing demand for rail services is straining the existing systems. It requires optimization of the existing passenger and freight schedules to achieve increased throughput on the existing rail infrastructure. The operation of networks in the transportation industry has gradually transformed over the years. These changes require costly equipment to maintain and manage multiple aging proprietary networks, each supporting a specialized application with unique telecom requirements. The system includes various networks that have their upgrade, maintenance, and operational processes. The solution choices are limited and rigid without open standards across the infrastructure. Network rigidity also prevents new technologies from being added and new services from being delivered. Current IT systems are old and complex, making data sharing difficult. They can also not cope with the scale of growth predicted over the next few years. Frequent network failures and system outages can have a domino effect, negatively impacting customer satisfaction.

Opportunity: Globalization and need for advanced transportation infrastructure

Globalization directly affects the traffic of all types of railway transportation. There is a demand for increased speed, security, and reliability. Hence, the future railway transportation ecosystem must deliver solutions to satisfy the demand with a high level of service, regardless of the distance traveled or the number of steps required to reach the destination. The demand from people is changing daily, and therefore, there is a need for more convenient travel solutions.

Intelligent solutions such as advanced train dispatching, positive train control (PTC), centralized train control (CTC), advanced vehicle control systems, and other systems provide information on the real-time position of vehicles, which may be used to monitor schedule adherence and provide passengers information about the location of vehicles in transit. Providing accurate real-time information about the status and location of in-transit vehicles to passengers is expected to improve satisfaction.

All public and private sector participants have recognized the need for better transportation infrastructure. Organizations see the potential of smarter railway transportation to address this need. Regions such as Europe, North America, and Asia Pacific are increasing their focus on building smarter rail infrastructure. In the next five years, from 2021, approximately USD 310 billion will be used to improve and replace rail infrastructure facilities and services across the globe. These factors are expected to boost the demand for train dispatching in the near future eventually.

Challenge: Integration complexities with legacy infrastructure

Train dispatching systems are integrated through different technology elements, such as hardware, software, and network, which can be complex to configure. Without strong pre-existing IT and skilled personnel, the implementation of train dispatching infrastructure is difficult. Railway operators can overhaul the IT system; however, costs incurred in such an overhaul would take significant time to realize. Current IT systems are old and complex, making data sharing difficult. They can also not cope with the scale of growth predicted over the next few years. Frequent network failures and system outages can have a domino effect, negatively impacting customer satisfaction.

Due to protocol issues, legacy systems cannot integrate with new-generation smart devices. These systems are not capable enough to communicate efficiently with technologically advanced systems. As most developing countries still rely on their legacy infrastructure, these integration complexities will hinder market growth in developing regions in the coming years. IT and network security restrictions to reduce privacy intrusion and data breaches are projected to be major challenges to the growth of the train dispatching market.

Increased mining activities drive the dedicated freight railroads segment

The US, Russia, and China are major markets for freight transport. In 2019, the freight transported by rail between the US, Canada, and Mexico accounted for USD 179 billion. In Europe, rail freight transport declined from 398.16 billion ton-kilometers in 2018 to 389.34 billion ton-kilometers in 2019 and further plummeted to 366.54 billion ton-kilometers in 2020. However, in 2021, the Port of Gothenburg experienced remarkable growth of 9% compared to 2020 from rail freight. Dedicated freight railroads integrate minimal advanced train dispatching systems. Therefore, due to the low integration of train dispatching systems, dedicated freight railroads will have a medium impact on the train dispatching market during the forecast period

The US is expected to acquire the largest market share by 2027 as several rail operators in the country use software to automate and speed up the dispatch management process. In 2021, the Indian Railways earned USD 1.5 billion from freight transport, which is 26% higher than the previous year’s earnings, and also witnessed a rise in freight loading by 11.19%. Governments are focusing on freight transportation by rail by increasing budget allocations for freight corridors and rail networks. Freight transports have low integration of railway systems currently. Future demand for high-tech systems may lead to the integration of advanced train dispatching systems in freight transportation, impacting the computer-aided dispatch market.

Services segment to grow at higher cagr during forecast period

Train dispatching refers to dispatching/managing rail vehicles and emergency services assisted by computers. In this chapter, the train dispatching market is classified into solutions and services based on offering. Solutions include a primary interface with real-time status information and visual modeling tools, mobile data terminal and mapping, automatic vehicle location and GIS interface, and public awareness messages. Services considered in the study include implementation, support & maintenance, and training & education.

Train dispatching solutions can cater to single or multiple agency dispatching and provide an overall view of the incident, location information, and other related details for command and control centers. The integrated capabilities of dispatching, mapping, field communications, reporting, and analysis are available in the train dispatching solutions. These solutions help in real-time visual alerts and automatic logging.

Train dispatching solutions provide automatic rail vehicle location, GIS, mobile mapping, and real-time mapping. Real-time mapping of rail vehicles and dispatch units provides a clear picture for the dispatcher to have overall information on vehicles in the field or operation. The exact location of the vehicles is tracked, and their statuses are monitored for dispatch purposes. Tracsis plc (UK) and Wabtec Corporation (US), among others., are prominent solution providers.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The train dispatching market is primarily dominated by players Hitachi Rail Ltd. (Italy), Siemens AG (Germany), Motorola Solutions Inc. (US), Alstom SA (France), and Wabtec Corporation (US). These players have worked on providing offerings for the train dispatching ecosystem. They have initiated partnerships to develop their train dispatching technology and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion |

|

Segments Covered |

offering, deployment model, railroad type, application, and region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

|

Companies Covered |

Hitachi Rail Ltd. (Italy), Siemens AG (Germany), Motorola Solutions Inc. (US), Alstom SA (France), and Wabtec Corporation (US). |

This research report categorizes the train dispatching market based on offering, deployment model, railroad type, application, and region

By Offering

- Solutions

- Services

By Application

- Dispatch Unit Management

- Reporting & Analysis

- Call Management

- Others

By Deployment Model

- Cloud-based

- On-premise

By Railroad type

- Dedicated Freight Railroads

- Dedicated Passenger Railroads

- Mixed Railroads

- Regional & Shortlines

By Region

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Spain

- Italy

- UK

- Rest of Europe

-

North America

- US

- Canada

-

Latin America

- Brazil

- Argentina

- Rest of Latin America

-

Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of MEA

Recent Developments

- In January 2022, Motorola Solutions Inc. has launched the MOTOTRBO R7, a digital two-way radio designed to connect teams in loud and harsh environments. The device has advanced audio features and a slim, rugged design and is programmed and updated over the air via Wi-Fi. It can also connect to various sensors over DMR and Bluetooth and can be integrated with video security and access control systems. The MOTOTRBO R7 is designed to support communication and collaboration in various work environments, and its integration with other safety systems and technologies allows teams to detect and respond more quickly to events and emergencies

- In December 2021, Siemens AG developed Digital Train Control System in collaboration with VGF (Germany). This system is expected to replace the conventional train control system used in metro and tram networks. This system is developed to increase the capacity and efficiency of train routes, especially in the underground sections.

- In September 2021, Hitachi Rail Ltd. launched PTC to automate product development, enhance product innovation, and reduce delivery time for rail applications. This launch will also improve the company’s manufacturing process and cost management.

- In September 2021, Hexagon AB has introduced a portfolio of integrated security & surveillance solutions for the rail industry. The portfolio combines 3D surveillance systems with software to enhance security, dispatching, and collaboration. It includes Leica BLK247 and accur8vision 3D security and surveillance systems, which use LiDAR, thermal sensors, video and 3D planning and tracking software, and HxGN OnCall Security | Guardian, a system that provides a common operational picture for alarms, sensors, IoT devices, and video data.

- In April 2021, Motorola Solutions Inc. has launched WAVE PTX in Singapore and Malaysia, a communication service designed to enable commercial and government organizations to increase safety and productivity. WAVE PTX allows organizations to expand the coverage and functionality of their business communications by connecting land mobile radio networks with broadband networks. It is available both as a cloud-based and on-premises service and supports Android, iOS, and web applications for PCs. The solution also includes advanced dispatch software, which allows the organization and coordination of team communications and includes mapping tools to track the location of people and resources. Motorola Solutions Inc. has also released two purpose-built communication devices, TLK 100 and TLK150 two-way radios, and the MOTOTRBO Ion smart radio to access the WAVE PTX service.

Frequently Asked Questions (FAQ):

What is the current size of the train dispatching market?

The current size of the train dispatching market is estimated at USD 942 million in 2022.

Who are the winners in the train dispatching market?

The train dispatching market is primarily dominated by players like Hitachi Rail Ltd. (Italy), Siemens AG (Germany), Motorola Solutions Inc. (US), Alstom SA (France), and Wabtec Corporation (US).

Which region will have the fastest-growing market for train dispatching market?

Asia Pacific will be the fastest-growing region in the train dispatching market due to the huge volume of investments in the region.

What are the key technologies affecting the train dispatching market?

The key technologies affecting the train dispatching market are the internet of things (IoT), sensors, IoT, and signaling systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased investments for public safety in smart city projects- Digitalization of railways- Growing adoption of cloud-based solutions- Use of artificial intelligence for decision-makingRESTRAINTS- Budget constraints and evolving equipment cycle- Lack of infrastructure for Train dispatching systems in railwaysOPPORTUNITIES- Globalization and need for advanced transportation infrastructure- Integration of artificial intelligence and machine learning technologiesCHALLENGES- Integration complexities with legacy infrastructure- Lack of knowledge about implementing optimized train dispatching solutions

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 MARKET SCENARIO ANALYSIS, 2022–2027MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

-

5.7 MNM INSIGHTS ON MARKETKEY CRITERIA FOR PURCHASING TRAIN DISPATCHING SOLUTIONS- Introduction- Procurement process- Rail simulation model- Rescheduling problemPRICING OF TRAIN DISPATCHING SOLUTIONS- Introduction- Pricing analysis- Maintenance and repair of train dispatching- Rail network development- Development and training costsPRICE SENSITIVITY FOR PROCURING TRAIN DISPATCHING SOLUTIONS ACROSS REGIONS- IntroductionFUNCTIONS OFFERED FOR VARIOUS RAILROADS- Introduction- Case studies- Dispatching technology and service suppliersFUNCTIONS PREFERRED FOR VARIOUS RAILROADS- IntroductionECONOMIC MODEL OF TRAIN DISPATCHING FOR RAILWAYS- Introduction- KEY challenges in implementing train dispatching- Regional economy and regulatory implications in railwaysINNOVATIVE OFFERINGS BY COMPANIES OPERATING IN MARKET- Introduction- Positive train control- Automatic Train Control- Communications-based Train Control

- 5.8 TRENDS AND DISRUPTIONS IN TRAIN DISPATCHING MARKET

-

5.9 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

-

5.10 TECHNOLOGY ANALYSISINTRODUCTIONAUTONOMOUS TRAINSINTERNET OF THINGSAUTOMATIC WARNING SYSTEMS

-

5.11 REGULATORY OVERVIEWREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 PATENT ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2025

-

5.15 AVERAGE AGE OF ROLLING STOCK, BY REGIONLOCOMOTIVESMETROSPASSENGER COACHESFREIGHT CARS

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS AND BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

6.2 DEDICATED FREIGHT RAILROADSINCREASE IN MINING ACTIVITIES

-

6.3 DEDICATED PASSENGER RAILROADSRAPID URBANIZATIONPASSENGER RAILURBAN TRANSIT

-

6.4 MIXED RAILROADSNEED FOR CROSS-COUNTRY ON-ROAD TRANSPORTATION

-

6.5 REGIONAL & SHORTLINESIMPLEMENTATION OF ENHANCED TECHNOLOGIES

- 6.6 KEY PRIMARY INSIGHTS

-

7.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

7.2 ON-PREMISESSECURITY CONCERNS OVER SENSITIVE DATA

-

7.3 CLOUD-BASEDEASY DEPLOYMENT, SCALABILITY, ENHANCED COLLABORATION, AND COST-EFFECTIVENESS

- 7.4 KEY PRIMARY INSIGHTS

-

8.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

8.2 DISPATCH UNIT MANAGEMENTINCREASED AUTOMATION IN RAIL SECTOR

-

8.3 REPORTING & ANALYSISREAL-TIME DATA OF ALL TRAIN MOVEMENTS

-

8.4 CALL MANAGEMENTINCREASED DEMAND FOR TRAFFIC MANAGEMENT SOLUTIONS IN RAILWAYS

- 8.5 OTHERS

- 8.6 KEY PRIMARY INSIGHTS

-

9.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

9.2 SOLUTIONSREAL-TIME TRAIN PLANNING AND ROUTE SCHEDULING/OPTIMIZING

-

9.3 SERVICESNEED TO IMPROVE OPERATIONAL EFFICIENCY OF RAIL BUSINESSIMPLEMENTATIONTRAINING & EDUCATIONSUPPORT & MAINTENANCE

- 9.4 KEY PRIMARY INSIGHTS

- 10.1 INTRODUCTION

-

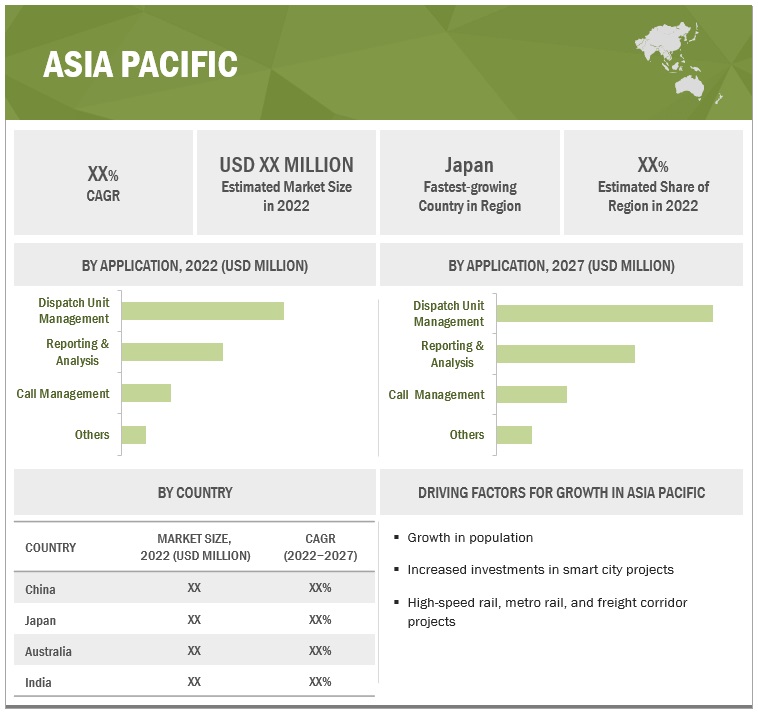

10.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Need for robust infrastructure for transportation managementJAPAN- R&D capabilities and regulatory reforms by governmentINDIA- Digitalization of rail routesAUSTRALIA- Smart city projects and government initiativesREST OF ASIA PACIFIC- Modernization of legacy systems

-

10.3 EUROPEEUROPE: RECESSION IMPACTFRANCE- Growing demand for managing rail traffic through cloud-based solutionsGERMANY- Major investments by public and private sectorsITALY- Ambitious investment programs for rapid transitSPAIN- Investments in high-speed rail linesUK- Collaborations and partnerships supported by government initiativesREST OF EUROPE

-

10.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUPCOMING RAPID TRANSIT PROJECTS IN NORTH AMERICAUS- Increase in urban mobilityCANADA- Growing concerns over traffic congestion

-

10.5 MIDDLE EAST & AFRICASAUDI ARABIA- Domestic infrastructure developmentSOUTH AFRICA- Advancements in railway technologiesREST OF MIDDLE EAST & AFRICA- Development of rail lines for tourism

-

10.6 LATIN AMERICABRAZIL- High spending on urban mobility projectsARGENTINA- Demand for improved rail infrastructure and related servicesREST OF LATIN AMERICA

- 11.1 OVERVIEW

-

11.2 MARKET RANKING ANALYSIS, 2021MARKET RANKING ANALYSIS, 2021MARKET RANKING ANALYSIS: ASIA PACIFICMARKET RANKING ANALYSIS: EUROPEMARKET RANKING ANALYSIS: NORTH AMERICA

- 11.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.4 REVENUE ANALYSIS OF KEY PLAYERS

-

11.5 COMPETITIVE SCENARIONEW PRODUCT LAUNCHESDEALSOTHERS

-

11.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.1 KEY PLAYERSHITACHI RAIL LTD.- Business overview- Products offered- Recent developments- MnM viewSIEMENS AG- Business overview- Products offered- Recent developments- MnM viewMOTOROLA SOLUTIONS INC.- Business overview- Products offered- Recent developments- MnM viewALSTOM SA- Business overview- Products offered- Recent developments- MnM viewWABTEC CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products offered- Recent developmentsHEXAGON AB- Business overview- Products offered- Recent developmentsTRACSIS PLC- Business overview- Products offered- Recent developmentsMITSUBISHI HEAVY INDUSTRIES, LTD.- Business overview- Products offered- Recent developmentsTOSHIBA- Business overview- Products offeredAVTEC INC.- Business overview- Products offered- Recent developmentsZETRON, INC.- Business overview- Products offered

-

12.2 OTHER PLAYERSHUAWEI TECHNOLOGIES CO., LTD.BOMBARDIER INC.CISCO SYSTEMS, INC. (CISCO)INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM)CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF)CALIFORNIA AMPLIFIER INC. (CALAMP)DXC TECHNOLOGYFUJITSU LIMITEDSTRUKTON GROEP N.V.ASSETIC PTY LTD.DELPHISONIC, INC.PASSIO TECHNOLOGIESZEDAS GMBH

- 13.1 ASIA PACIFIC TO BE KEY REGION FOR TRAIN DISPATCHING MARKET

- 13.2 GROWING PREDICTIVE MAINTENANCE MARKET

- 13.3 CONCLUSION

- 14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 TRAIN DISPATCHING MARKET DEFINITION, BY RAILROAD TYPE

- TABLE 2 MARKET DEFINITION, BY DEPLOYMENT MODEL

- TABLE 3 MARKET DEFINITION, BY APPLICATION

- TABLE 4 MARKET DEFINITION, BY OFFERING

- TABLE 5 INCLUSIONS AND EXCLUSIONS

- TABLE 6 CURRENCY EXCHANGE RATES

- TABLE 7 IMPACT OF MARKET DYNAMICS

- TABLE 8 PUBLIC-PRIVATE PARTNERSHIPS FOR RAILROAD INFRASTRUCTURE

- TABLE 9 ADVANTAGES OF DIGITALIZATION

- TABLE 10 RAILWAY PROJECTS BY AVERAGE COST

- TABLE 11 IMPACT OF PORTER’S FIVE FORCES

- TABLE 12 MOST LIKELY SCENARIO: TRAIN DISPATCHING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 13 OPTIMISTIC SCENARIO: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 14 PESSIMISTIC SCENARIO: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 ONE-TIME COST ESTIMATE FOR TRAIN DISPATCHING

- TABLE 16 RECURRING COST ESTIMATE FOR TRAIN DISPATCHING

- TABLE 17 TOP 10 RAILWAY PROJECTS, BY COST

- TABLE 18 PRICING ANALYSIS OF RAILWAY MANAGEMENT SYSTEMS

- TABLE 19 KEY TRAIN DISPATCHING SOLUTION PROVIDERS

- TABLE 20 TRAIN DISPATCHING SYSTEM OFFERINGS

- TABLE 21 AVERAGE COST OF TRAIN DISPATCHING SYSTEM PROCUREMENT

- TABLE 22 RAILROADS AND DISPATCHING CENTER LOCATIONS

- TABLE 23 REVENUE, BY COMPANY, 2019–2021

- TABLE 24 OFFERINGS BASED ON SAFETY AND SIGNALING SYSTEMS

- TABLE 25 OFFERINGS BASED ON SERVICES

- TABLE 26 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 ACTIVE PATENTS

- TABLE 32 CASE STUDY 1: EXCAVATION OF BIG ANALOG DATA VALUE—COMPACTRIO & NI INSIGHTCM

- TABLE 33 CASE STUDY 2: TAIWAN HIGH-SPEED RAIL CORPORATION SELECTED IBM MAXIMO TO BUILD MAINTENANCE MANAGEMENT SOLUTIONS

- TABLE 34 CASE STUDY 3: ATLANTA STREETCAR PARTNERED WITH SIEMENS DIGITAL RAIL SERVICES TO MANAGE LIGHT-RAIL VEHICLES

- TABLE 35 CASE STUDY 4: UPTAKE REVOLUTIONIZING NORTH AMERICAN RAILWAY MAINTENANCE WITH AI

- TABLE 36 CONFERENCES AND EVENTS

- TABLE 37 AVERAGE AGE OF LOCOMOTIVES, BY REGION

- TABLE 38 AVERAGE AGE OF METROS, BY REGION

- TABLE 39 AVERAGE AGE OF PASSENGER COACHES, BY REGION

- TABLE 40 AVERAGE AGE OF FREIGHT CARS, BY REGION

- TABLE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 42 KEY BUYING CRITERIA

- TABLE 43 TRAIN DISPATCHING MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 44 MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 45 ASSUMPTIONS, BY RAILROAD TYPE

- TABLE 46 DEDICATED FREIGHT RAILROADS: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 47 DEDICATED FREIGHT RAILROADS: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 48 DEDICATED PASSENGER RAILROADS: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 49 DEDICATED PASSENGER RAILROADS: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 50 PASSENGER RAIL: DEDICATED PASSENGER RAILROADS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 51 PASSENGER RAIL: DEDICATED PASSENGER RAILROADS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 52 URBAN TRANSIT: DEDICATED PASSENGER RAILROADS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 53 URBAN TRANSIT: DEDICATED PASSENGER RAILROADS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 54 MIXED RAILROADS: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 55 MIXED RAILROADS: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 56 REGIONAL & SHORTLINES: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 57 REGIONAL & SHORTLINES: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 58 MARKET, BY DEPLOYMENT MODEL, 2018–2021 (USD MILLION)

- TABLE 59 MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD MILLION)

- TABLE 60 ASSUMPTIONS, BY DEPLOYMENT MODEL

- TABLE 61 ON-PREMISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 62 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 CLOUD-BASED: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 64 CLOUD-BASED: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 66 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 67 ASSUMPTIONS, BY APPLICATION

- TABLE 68 DISPATCH UNIT MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 69 DISPATCH UNIT MANAGEMENT: TRAIN DISPATCHING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 70 REPORTING & ANALYSIS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 71 REPORTING & ANALYSIS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 72 CALL MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 73 CALL MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 74 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 75 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 76 MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 77 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 78 TRAIN DISPATCHING MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 79 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 80 ASSUMPTIONS, BY OFFERING

- TABLE 81 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 82 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 84 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 IMPLEMENTATION SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 86 IMPLEMENTATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 TRAINING & EDUCATION SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 88 TRAINING & EDUCATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 90 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 92 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 95 CHINA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 96 CHINA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 97 JAPAN: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 98 JAPAN: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 99 INDIA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 100 INDIA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 101 AUSTRALIA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 102 AUSTRALIA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 107 FRANCE: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 108 FRANCE: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 109 GERMANY: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 110 GERMANY: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 111 ITALY: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 112 ITALY: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 113 SPAIN: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 114 SPAIN: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 115 UK: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 116 UK: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 117 REST OF EUROPE: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 118 REST OF EUROPE: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 119 RAPID TRANSIT PROJECTS IN NORTH AMERICA

- TABLE 120 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 121 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 122 US: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 123 US: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 124 CANADA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 125 CANADA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 128 SAUDI ARABIA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 129 SAUDI ARABIA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 130 SOUTH AFRICA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 131 SOUTH AFRICA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 134 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 135 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 136 BRAZIL: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 137 BRAZIL: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 138 ARGENTINA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 139 ARGENTINA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 140 REST OF LATIN AMERICA: MARKET, BY RAILROAD TYPE, 2018–2021 (USD MILLION)

- TABLE 141 REST OF LATIN AMERICA: MARKET, BY RAILROAD TYPE, 2022–2027 (USD MILLION)

- TABLE 142 STRATEGIES ADOPTED BY PLAYERS IN MARKET

- TABLE 143 NEW PRODUCT LAUNCHES, 2019–2022

- TABLE 144 DEALS, 2019–2022

- TABLE 145 OTHERS, 2019–2022

- TABLE 146 MARKET: COMPANY FOOTPRINT, 2022

- TABLE 147 TRAIN DISPATCHING MARKET: PRODUCT FOOTPRINT, 2022

- TABLE 148 MARKET: REGIONAL FOOTPRINT, 2022

- TABLE 149 MARKET: KEY STARTUPS/SMES

- TABLE 150 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 151 HITACHI RAIL LTD.: BUSINESS OVERVIEW

- TABLE 152 HITACHI RAIL LTD.: PRODUCTS OFFERED

- TABLE 153 HITACHI RAIL LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 154 HITACHI RAIL LTD.: DEALS

- TABLE 155 SIEMENS AG: BUSINESS OVERVIEW

- TABLE 156 SIEMENS AG: PRODUCTS OFFERED

- TABLE 157 SIEMENS AG: NEW PRODUCT DEVELOPMENTS

- TABLE 158 SIEMENS AG: DEALS

- TABLE 159 MOTOROLA SOLUTIONS INC.: BUSINESS OVERVIEW

- TABLE 160 MOTOROLA SOLUTIONS INC.: PRODUCTS OFFERED

- TABLE 161 MOTOROLA SOLUTIONS INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 162 MOTOROLA SOLUTIONS INC.: DEALS

- TABLE 163 MOTOROLA SOLUTIONS INC.: OTHERS

- TABLE 164 ALSTOM SA: BUSINESS OVERVIEW

- TABLE 165 ALSTOM SA: PRODUCTS OFFERED

- TABLE 166 ALSTOM SA: DEALS

- TABLE 167 WABTEC CORPORATION: BUSINESS OVERVIEW

- TABLE 168 WABTEC CORPORATION: PRODUCTS OFFERED

- TABLE 169 WABTEC CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 170 WABTEC CORPORATION: DEALS

- TABLE 171 WABTEC CORPORATION: OTHERS

- TABLE 172 THALES GROUP: BUSINESS OVERVIEW

- TABLE 173 THALES GROUP: PRODUCTS OFFERED

- TABLE 174 THALES GROUP: NEW PRODUCT DEVELOPMENTS

- TABLE 175 THALES GROUP: DEALS

- TABLE 176 HEXAGON AB: BUSINESS OVERVIEW

- TABLE 177 HEXAGON AB: PRODUCTS OFFERED

- TABLE 178 HEXAGON AB: NEW PRODUCT DEVELOPMENTS

- TABLE 179 HEXAGON AB: DEALS

- TABLE 180 TRACSIS PLC: BUSINESS OVERVIEW

- TABLE 181 TRACSIS PLC: PRODUCTS OFFERED

- TABLE 182 TRACSIS PLC: DEALS

- TABLE 183 MITSUBISHI HEAVY INDUSTRIES, LTD.: BUSINESS OVERVIEW

- TABLE 184 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 185 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 186 TOSHIBA: BUSINESS OVERVIEW

- TABLE 187 TOSHIBA: PRODUCTS OFFERED

- TABLE 188 AVTEC INC.: BUSINESS OVERVIEW

- TABLE 189 AVTEC INC.: PRODUCTS OFFERED

- TABLE 190 AVTEC INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 191 AVTEC INC.: DEALS

- TABLE 192 ZETRON, INC.: BUSINESS OVERVIEW

- TABLE 193 ZETRON, INC.: PRODUCTS OFFERED

- TABLE 194 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 195 BOMBARDIER INC.: COMPANY OVERVIEW

- TABLE 196 CISCO SYSTEMS, INC. (CISCO): COMPANY OVERVIEW

- TABLE 197 INTERNATIONAL BUSINESS MACHINES CORPORATION (IBM): COMPANY OVERVIEW

- TABLE 198 CONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF): COMPANY OVERVIEW

- TABLE 199 CALIFORNIA AMPLIFIER INC. (CALAMP): COMPANY OVERVIEW

- TABLE 200 DXC TECHNOLOGY: COMPANY OVERVIEW

- TABLE 201 FUJITSU LIMITED: COMPANY OVERVIEW

- TABLE 202 STRUKTON GROEP N.V.: COMPANY OVERVIEW

- TABLE 203 ASSETIC PTY LTD.: COMPANY OVERVIEW

- TABLE 204 DELPHISONIC, INC.: COMPANY OVERVIEW

- TABLE 205 PASSIO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 206 ZEDAS GMBH: COMPANY OVERVIEW

- FIGURE 1 TRAIN DISPATCHING MARKETS COVERED

- FIGURE 2 REGIONS COVERED

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 RESEARCH DESIGN MODEL

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 7 MARKET ESTIMATION METHODOLOGY

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 11 MARKET: MARKET TRENDS

- FIGURE 12 MARKET, BY REGION, 2022–2027

- FIGURE 13 ON-PREMISES DEPLOYMENT TYPE TO HOLD LARGEST SHARE BY 2027

- FIGURE 14 HYPER-URBANIZATION AND DEMOGRAPHIC GROWTH TO PROPEL MARKET DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ESTIMATED TO SURPASS OTHER REGIONS IN 2022

- FIGURE 16 MIXED RAILROADS SEGMENT TO ACQUIRE LARGEST SHARE BY 2027

- FIGURE 17 CALL MANAGEMENT SEGMENT TO RECORD HIGHEST CAGR BY 2027

- FIGURE 18 ON-PREMISES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 SERVICES SEGMENT TO BE FASTEST-GROWING DURING FORECAST PERIOD

- FIGURE 20 MARKET: MARKET DYNAMICS

- FIGURE 21 EDGE COMPUTING RESHAPES RAILWAY SECTOR

- FIGURE 22 ARTIFICIAL INTELLIGENCE IN RAILWAYS

- FIGURE 23 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 SCHEDULE OF ACTIVITIES FOR ACQUIRING TRAIN DISPATCHING

- FIGURE 27 NEMO

- FIGURE 28 SIMONE

- FIGURE 29 ROUTE SYSTEM TOOLBOX

- FIGURE 30 METRONET—HIGH-CAPACITY SIGNALLING, WESTERN AUSTRALIA

- FIGURE 31 DRIVING DISPLAY

- FIGURE 32 TRAIN TRACKING

- FIGURE 33 AUTOMATIC ROUTE SETTING

- FIGURE 34 IDENTIFICATION AND OPTIMAL SOLUTION OF CONFLICTS BETWEEN TRAINS

- FIGURE 35 GENERATION OF MANAGEMENT REPORTS

- FIGURE 36 TRENDS IMPACTING CUSTOMER BUSINESSES

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 38 KEY BUYING CRITERIA

- FIGURE 39 DEDICATED FREIGHT RAILROADS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 CLOUD-BASED SEGMENT TO SURPASS ON-PREMISES SEGMENT BY 2027

- FIGURE 41 CALL MANAGEMENT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 MARKET, BY REGION, 2022 VS. 2027

- FIGURE 44 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 45 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

- FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 47 MARKET RANKING OF KEY PLAYERS

- FIGURE 48 MARKET RANKING OF KEY PLAYERS IN ASIA PACIFIC

- FIGURE 49 MARKET RANKING OF KEY PLAYERS IN EUROPE

- FIGURE 50 MARKET RANKING OF KEY PLAYERS IN NORTH AMERICA

- FIGURE 51 REVENUE OF TOP PUBLIC/LISTED PLAYERS IN MARKET, 2021

- FIGURE 52 TRAIN DISPATCHING MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 53 MARKET: STARTUP/ SME EVALUATION QUADRANT, 2022

- FIGURE 54 HITACHI LTD.: COMPANY SNAPSHOT

- FIGURE 55 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 56 MOTOROLA SOLUTIONS INC: COMPANY SNAPSHOT

- FIGURE 57 ALSTOM SA: COMPANY SNAPSHOT

- FIGURE 58 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 60 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 61 TRACSIS PLC: COMPANY SNAPSHOT

- FIGURE 62 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 63 TOSHIBA: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the train dispatching market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from OECD and International Railway Journal, Railway Gazette International, and US DoT. The railway spending of various countries was extracted from their respective transportation associations, such as Société Nationale Des Chemins De Fer Français (SNCF), Taiwan Railways Administration (TRA), Passenger Rail Agency of South Africa (PRASA), European Rail Freight Association, and European Union (EU) Agency for Railways.

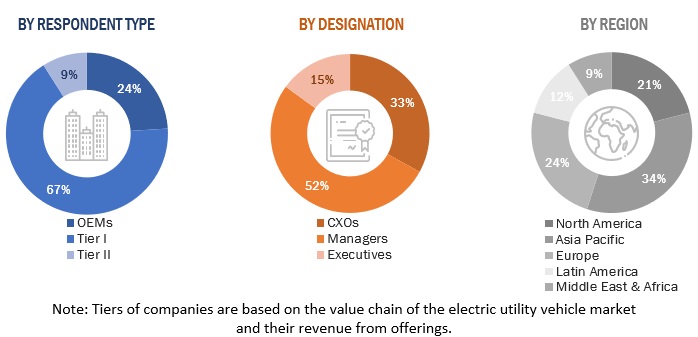

Primary Research

Extensive primary research was conducted after acquiring an understanding of the scenario of train dispatching market through secondary research. Several primary interviews were conducted with market experts from both demand-side rail manufacturers (in terms of adoption rate, country-level government associations, and trade associations) and supply-side (OEMs and software providers) across five regions, namely North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Approximately 23% and 77% of the primary interviews were conducted from the demand and supply sides. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, we strived to cover various departments within organizations, including sales, operations, and administration, to provide a holistic viewpoint in our report. After interacting with industry experts, we also conducted brief sessions with experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions of in-house subject-matter experts, led us to the findings described in this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the train dispatching market and other dependent submarkets, as mentioned below:

- Key players in the train dispatching market were identified through secondary research, and their market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports and regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

- All major penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Data Triangulation

After arriving at the overall market size through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

-

To segment and forecast the size of the train dispatching market in terms of value (USD Million/Billion)

- To define, describe, and forecast the size of the market based on offering, deployment model, railroad type, application, and region

- To segment and forecast the market size, by value, based on region (Asia Pacific, Europe, North America, Latin America, Middle East & Africa)

- To segment and forecast the market size, by value, based on offering (Solutions, Services)

- To segment and forecast the market size, by value, based on Deployment Model (Cloud-based, On-premise)

- To segment and forecast the market size, by value, based on railroad type (Dedicated Freight Railroads, Dedicated Passenger Railroads, Mixed Railroads, Regional & Shortlines)

- To segment and forecast the market size, by value, based on application (Dispatch Unit Management, Reporting & Analysis, Call Management, Others)

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders in the market

- To provide detailed information regarding the factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Porter’s Five Forces Analysis

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Average Selling Price Analysis

- Buying Criteria

- To strategically profile key players and comprehensively analyze their market ranking analysis for train dispatching and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Train dispatching market, by Deployment Type, at country level (For countries covered in the report)

- Train dispatching market, by Application Type, at country level (For countries covered in the report)

-

Company Information

- Profiling of Additional Market Players (Up to Five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Train Dispatching Market