Trailer Assist System Market by Technology (Semi-Autonomous (L3), Autonomous (L4, L5)), Component (Camera/Sensor, Software Module), Vehicle (Passenger Cars, LCV, and Trucks), User (OEM Fitted & Aftermarket), and Region - Global Forecast to 2027

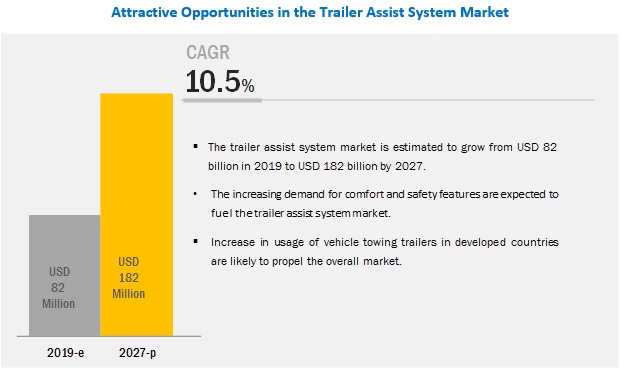

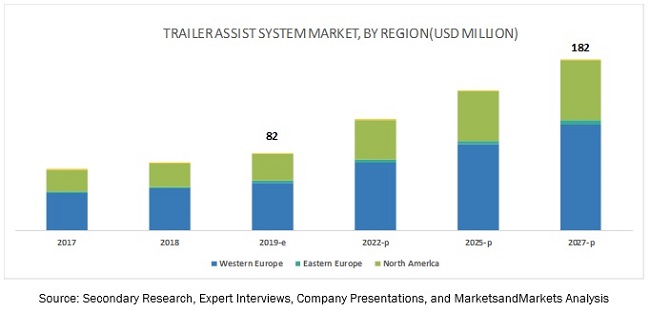

[116 Pages Report] The trailer assist system market is projected to reach USD 182 million by 2027 from an estimated USD 82 million in 2019, at a CAGR of 10.5% during the forecast period. The demand for safety and comfort has always been a prime preference in vehicles. With the increase in sales of passenger cars and LCVs, consumers are increasingly demanding comfort and safety for these vehicle segments. Due to the inefficiency of drivers, many accidents happen during the parking of a vehicle. Parking a vehicle attached with a trailer is a challenging task even for trained drivers. Driver errors can be minimized by providing driving assistance to the vehicle. The trailer assist works on the principle of park-assist that helps the driver to park or reverse a vehicle into a parking lane or a tight spot with a trailer towed at the rear. This system helps in saving time while reversing and provides safety and comfort to the driver.

Passenger cars segment is estimated to be the fastest growing market during the forecast period.

The passenger cars segment is expected to be the fastest growing market over the forecast period. Currently, the market is mostly limited to passenger cars only, and there are very few OEMs providing trailer assist system in LCVs, which includes Ford and Volkswagen. The trailer assist system that is available in trucks has different functioning from passenger cars and LCVs as it supports truck movement during reversing operations by detecting small, large, static and moving objects in the blind spot behind the vehicle and automatically brakes. It does not automatically steer the truck as it does in passenger cars and LCVs.

The North American market is expected to register the fastest growth during the forecast period.

The North American market is expected to witness the fastest growth, followed by Western Europe and Eastern Europe. The trailer assist system market in Canada is estimated to grow at a good pace over the next eight years. In Canada, various OEMs such as Ford and Land Rover are providing trailer assist system in vehicles as an optional feature. Increasing safety awareness among consumers, rise in the demand for a safe, efficient, & convenient driving experience and increase usage of towing trailers will drive the Canadian market which in turn will drive the demand for trailer assist system in the North American region.

Western Europe is expected to be the largest market during the forecast period.

Western Europe is expected to be the largest market, followed by North America. Germany is the largest market for trailer assist system globally. The sales of luxury car vehicle in Germany is high also there is a demand for towing trailers, which makes the country highest growing and largest market, globally. Luxury vehicle manufacturers like Volkswagen, Land Rover, Audi Mercedes Benz, Bentley, and Skoda are providing trailer assist feature in the country. Majority of the tier-1 companies providing trailer assist systems headquartered in Germany include Continental, Bosch, and Westfalia, which is a significant driver of this market in Germany. Westfalia and Audi, in cooperation, have developed the trailer assist system called Towing Assistant (abbreviated TTA), a swiveling tow bar with a combined mechanical and electronic solution that measures the angle of the tow bar between the towing vehicle and the trailer. The system has its debut on the new Audi Q7.

Key Market Players

The trailer assist system market was dominated by major players such as Continental (Germany), Bosch (Germany), Magna (Canada), WABCO (Belgium), and Westfalia (Germany). These companies have strong distribution networks at a global level. Also, these companies offer an extensive product range in this market. These companies adopt strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units) and Value (USD Thousand) |

|

Segments covered |

Component Type, Technology Type, Vehicle Type, User Type |

|

Geographies covered |

North America, Western Europe, Eastern Europe and Rest of the World |

|

Companies covered |

Continental (Germany), Bosch (Germany), Magna (Canada), WABCO (Belgium), and Westfalia (Germany). |

This research report categorizes the given market based on component type, technology type, vehicle type, user type, and region.

On the basis of Component Type, the market has been segmented as follows:

- Camera/Sensor

- Software Module

On the basis of Technology type, the market has been segmented as follows:

- Semi-Autonomous (L3)

- Autonomous (L4, L5)

On the basis of Vehicle Type, the market has been segmented as follows:

- Passenger Cars

- LCV

- Trucks

On the basis of User Type, the market has been segmented as follows:

- OEM Fitted

- Aftermarket

On the basis of Region, the market has been segmented as follows:

-

Western Europe

- France

- Germany

- Italy

- Spain

- UK

- Netherlands

- Belgium

-

North America

- US

- Canada

-

Eastern Europe

- Poland

- Russia

-

Rest of the World

- Australia

- South Africa

Recent Developments

-

In January 2019, Valeo unveiled its Valeo XTRAVUE trailer, the invisible trailer system at CES 2019. The system uses video images captured from cameras located at the rear of both the vehicle and the trailer or caravan. It combines them into a single homogeneous image, allowing the driver to see, on a small screen right in front of him, everything happening behind the vehicle, rendering the trailer invisible.

Critical Questions:

- Many companies are operating in the trailer assist system across the globe. Do you know who the front leaders are, and what strategies have been adopted by them?

- Fast-paced developments in trailer assist system such as a wireless tablet, trailer angle detection, and blind spot detection by leading manufacturers are expected to change the dynamics of the trailer assist system. How will this transform the overall market?

- The feature is currently available for semi-autonomous passenger cars with partial manual functions, but do you think an autonomous version can be seen in development?

- Analysis of your competition that includes major players in the trailer assist system ecosystem. The major players include Continental (Germany), Bosch (Germany), Magna (Canada), WABCO (Belgium), and Westfalia (Germany) among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives

1.2 Trailer Assist System Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Trailer Assist System Market Size Estimation

2.4.1 Bottom-Up Approach

2.5 Trailer Assist System Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Trailer Assist System Market, 2019 vs. 2027 (USD Million)

4.2 Market, By Region, 2019 (USD Million)

4.3 Market, By Country (%)

4.4 Market, By Vehicle Type, 2019 vs. 2027 (USD Million)

4.5 Market, By User Type, 2019 vs. 2027 (USD Million)

4.6 Market, By Component, 2019 vs. 2027 (USD Million)

5 Trailer Assist System Market Overview (Page No. - 33)

5.1 Introduction

5.2 Trailer Assist System Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for Safety and Comfort Features

5.2.1.2 Increase in Usage of Vehicle Towing Trailers in Developed Countries

5.2.1.3 Advancements in Technology

5.2.2 Restraints

5.2.2.1 High Cost

5.2.2.2 Non-Availability of Required Infrastructure in Developing Countries

5.2.3 Opportunities

5.2.3.1 Increasing Developments in the Field of Autonomous and Semi-Autonomous Vehicles

5.2.4 Challenges

5.2.4.1 Limited Usage of Towing Trailers in Developing Countries

6 Industry Trends (Page No. - 38)

6.1 Introduction

6.2 Technology Analysis

6.2.1 Wireless Tablet/Smart Device to Operate

6.2.2 Trailer Angle Detection

6.2.3 Blind Spot Detection

6.3 Porter’s Five Forces

7 Trailer Assist System Market, By Vehicle Type (Page No. - 40)

7.1 Introduction

7.2 Research Methodology

7.3 Passenger Car

7.3.1 Increasing Usage of Towing Trailers Will Boost Demand

7.4 Light Commercial Vehicle (LCV)

7.4.1 North America Will Lead the LCV Trailer Assist System Market

7.5 Truck

7.5.1 Technological Advancements in Trucks to Drive the Market

8 Trailer Assist System Market, By User Type (Page No. - 47)

8.1 Introduction

8.2 Research Methodology

8.3 OEM Fitted

8.3.1 Demand for Towing Trailers in Western Europe is Estimated to Drive OEM Fitted Market

8.4 Aftermarket

8.4.1 Western Europe is Estimated to Lead the Market With Highest Growth Rate in Forecasted Period

9 Trailer Assist System Market, By Component (Page No. - 53)

9.1 Introduction

9.2 Research Methodology

9.3 Camera/Sensor

9.3.1 Western Europe to Lead the Market for Camera/Sensor

9.4 Software Module

9.4.1 Advancement in Technology and Autonomous Initiatives to Drive the Software Module Segment

10 Trailer Assist System Market, By Technology (Page No. - 58)

10.1 Observations: Semi-Autonomous (L3) and Autonomous Technology (L4, L5) for Trailer Assist System

11 Trailer Assist System Market, By Region (Page No. - 61)

11.1 Introduction

11.2 Western Europe

11.2.1 Belgium

11.2.1.1 Passenger Car is Estimated to Lead the Market With Highest Growth Rate in Forecasted Period

11.2.2 France

11.2.2.1 Passenger Car is Estimated to Lead the Market

11.2.3 Germany

11.2.3.1 Passenger Car is Growing With Highest Growth Rate in Forecasted Period Due to Demand for Comfort and Safety Features in Luxury Vehicle

11.2.4 Italy

11.2.4.1 Passenger Car is Estimated to Lead the Market With Highest Growth Rate in Forecasted Period By Volume and Value Both

11.2.5 Netherlands

11.2.5.1 LCV is Estimated to Lead the Market

11.2.6 Spain

11.2.6.1 Passenger Car is Estimated to Lead the Market With Highest Growth Rate in Forecasted Period

11.2.7 UK

11.2.7.1 Passenger Car is Estimated to Lead the Market With Highest Growth Rate in Forecasted Period

11.3 Eastern Europe

11.3.1 Poland

11.3.1.1 Passenger Car is Growing With Highest Growth Rate in Forecasted Period

11.3.2 Russia

11.3.2.1 Passenger Car is Estimated to Lead the Market

11.4 North America

11.4.1 Canada

11.4.1.1 LCV is Estimated to Be the Largest Market

11.4.2 US

11.4.2.1 Increase in Sales of LCV Along With Towing Trailer Will Lead LCV to Be the Highest Growing Segment

11.5 RoW

11.5.1 Australia

11.5.1.1 Passenger Car is Estimated to Be the Largest Market and Forecasted to Be the Highest Growing Segment

11.5.2 South Africa

11.5.2.1 Passenger Car is Forecasted to Be the Highest Growing in Segment

12 Competitive Landscape (Page No. - 82)

12.1 Overview

12.2 Trailer Assist: Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 Contracts & Agreements

12.3.2 New Product Developments

12.3.3 Expansions

12.3.4 Mergers & Acquisitions

12.3.5 Partnerships

12.4 Industry Leader Assessment/Benchmarking

13 Company Profiles (Page No. - 89)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

13.1 Continental AG

13.2 Bosch

13.3 Magna

13.4 Wabco

13.5 Westfalia

13.6 Towgo

13.7 Carit Automotive

13.8 Valeo

13.9 Garmin

13.10 Cogent Embedded

13.11 Dornerworks

13.12 Echomaster

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 110)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (61 Tables)

Table 1 Currency Exchange Rates (W.R.T. Per USD)

Table 2 Impact of Market Dynamics

Table 3 Trailer Assist System Market, By Vehicle Type, 2018–2027, (Units)

Table 4 Market, By Vehicle Type, 2018–2027, (USD Thousand)

Table 5 Passenger Car: TAS Market, By Region, 2018–2027 (Units)

Table 6 Passenger Car: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 7 LCV: TAS Market, By Region, 2018–2027 (Units)

Table 8 LCV: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 9 Truck: TAS Market, By Region, 2018–2027 (Units)

Table 10 Truck: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 11 Market, By User Type, 2018–2027 (Units)

Table 12 Trailer Assist System Market, By User Type, 2018–2027 (USD Thousand)

Table 13 OEM Fitted: TAS Market, By Region, 2018–2027 (Units)

Table 14 OEM Fitted: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 15 Aftermarket: TAS Market, By Region, 2018–2027 (Units)

Table 16 Aftermarket: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 17 Market, By Component, 2018–2027 (USD Thousand)

Table 18 Camera/Sensor: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 19 Software Module: TAS Market, By Region, 2018–2027 (USD Thousand)

Table 20 Trailer Assist System Market, By Region, 2018–2027 (Units)

Table 21 Market, By Region, 2018–2027 (USD Thousand)

Table 22 Western Europe: Market, By Country, 2018–2027 (Units)

Table 23 Western Europe: Market, By Country, 2018–2027 (USD Thousand)

Table 24 Belgium: Market, By Vehicle Type, 2018–2027 (Units)

Table 25 Belgium: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 26 France: Market, By Vehicle Type, 2018–2027 (Units)

Table 27 France: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 28 Germany: Market, By Vehicle Type, 2018–2027 (Units)

Table 29 Germany: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 30 Italy: Trailer Assist System Market, By Vehicle Type, 2018–2027 (Units)

Table 31 Italy: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 32 Netherlands: Market, By Vehicle Type, 2018–2027 (Units)

Table 33 Netherlands: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 34 Spain: Market, By Vehicle Type, 2018–2027 (Units)

Table 35 Spain: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 36 UK: Market, By Vehicle Type, 2018–2027 (Units)

Table 37 UK: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 38 Eastern Europe: Market, By Country, 2018–2027 (Units)

Table 39 Eastern Europe: Market, By Country, 2018–2027 (USD Thousand)

Table 40 Poland: Trailer Assist System Market, By Vehicle Type, 2018–2027 (Units)

Table 41 Poland: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 42 Russia: Market, By Vehicle Type, 2018–2027 (Units)

Table 43 Russia: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 44 North America: Market, By Country, 2018–2027 (Units)

Table 45 North America: Market, By Country, 2018–2027 (USD Thousand)

Table 46 Canada: Market, By Vehicle Type, 2018–2027 (Units)

Table 47 Canada: Trailer Assist System Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 48 US: Market, By Vehicle Type, 2018–2027 (Units)

Table 49 US: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 50 RoW: Market, By Country, 2018–2027 (Units)

Table 51 RoW: Market, By Country, 2018–2027 (USD Thousand)

Table 52 Australia: Market, By Vehicle Type, 2018–2027 (Units)

Table 53 Australia: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 54 South Africa: Trailer Assist System Market, By Vehicle Type, 2018–2027 (Units)

Table 55 South Africa: Market, By Vehicle Type, 2018–2027 (USD Thousand)

Table 56 Trailer Assist: Market Ranking Analysis, 2018

Table 57 Contracts & Agreements, 2013–2018

Table 58 New Product Developments, 2013–2018

Table 59 Expansions, 2013–2018

Table 60 Mergers & Acquisitions, 2013–2018

Table 61 Partnerships, 2015–2018

List of Figures (38 Figures)

Figure 1 Market Segmentation: Trailer Assist System Market

Figure 2 Trailer Assist System: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Trailer Assist System Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Trailer Assist System: Market Dynamics

Figure 8 Market, By Region, 2019–2027 (USD Thousand)

Figure 9 Market, By Vehicle Type, 2019 vs 2027, (USD Thousand)

Figure 10 Growing Towing Trailers Usage, Proven Advancement in Technologies, and Increase in Recreational Activities Across Will Be Major Drivers for the Market

Figure 11 Western Europe Leads the Market (By Value)

Figure 12 Germany to Witness the Highest Growth During the Forecast Period (By Value)

Figure 13 Passenger Car Segment Expected to Lead the Market, By Value

Figure 14 OEM Fitted Trailer Assist Systems to Lead the Market, By Value

Figure 15 Software Module to Witness the Highest Growth During the Forecast Period, By Value

Figure 16 Trailer Assist System Market: Market Dynamics

Figure 17 Porter’s Five Forces: Market

Figure 18 Passenger Car is Expected to Grow at A Higher CAGR During the Forecast Period (2019–2027)

Figure 19 Key Primary Insights

Figure 20 Aftermarket is Expected to Grow at A Higher CAGR During the Forecast Period (2019–2027)

Figure 21 Key Primary Insights

Figure 22 Software Module Segment is Expected to Grow at A Higher CAGR During the Forecast Period (2019–2027)

Figure 23 Key Primary Insights

Figure 24 Semi Autonomous and Autonomous Passenger Car Market By Level of Autonomy in Us, (Thousand Units)

Figure 25 Trailer Assist System Market: Geographical Growth Opportunities (2019–2027)

Figure 26 Western Europe: Market Snapshot

Figure 27 Eastern Europe: Market Snapshot

Figure 28 US is Projected to Be the Largest Market for Trailer Assist System in North America During the Forecast Period (2019–2027)

Figure 29 RoW: Market Snapshot

Figure 30 Companies Adopted Expansions as the Key Growth Strategy, 2013–2018

Figure 31 Trailer Assist System-Industry Leader Benchmarking

Figure 32 Continental AG: Company Snapshot

Figure 33 Bosch: Company Snapshot

Figure 34 Magna: Company Snapshot

Figure 35 Wabco: Company Snapshot

Figure 36 Westfalia: Company Snapshot

Figure 37 Valeo: Company Snapshot

Figure 38 Garmin: Company Snapshot

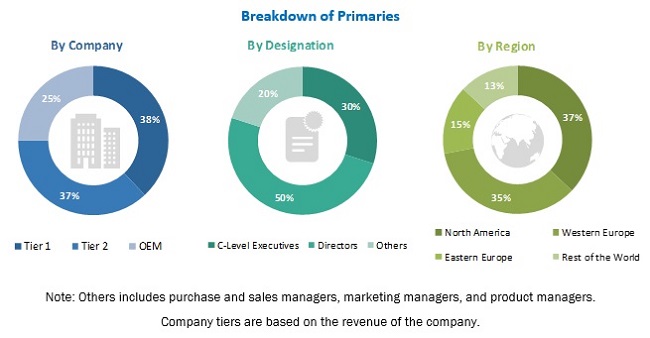

The study involved four major activities in estimating the current size of the trailer assist system market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of automotive OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global trailer assist system market.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Western Europe, Eastern Europe, North America, and Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the trailer assist system market size, in terms of volume (units) and value (USD Thousand)

- To define, describe, and forecast the trailer assist system market based on component, technology type, vehicle type, user type, and region

- To segment and forecast the market by component type (camera/sensor and software module)

- To segment and forecast the market by technology type (semi-autonomous (L3) and autonomous (L4, L5))

- To segment and forecast the market by vehicle type (Passenger cars, LCV, and Trucks)

- To segment and forecast the market by user type (OEM fitted and aftermarket)

- To forecast the market with respect to key regions, namely, North America, Western Europe, Eastern Europe and Rest of the World

- To provide detailed information regarding the major factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the regional markets with respect to individual growth trends, prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Trailer Assist System market, by component type at country level

-

Company information

- Profiling of additional market players (Up to 3)

Growth opportunities and latent adjacency in Trailer Assist System Market