Highway Driving Assist Market by Vehicle Type (PC, BEV, HEV, PHEV, FCEV), Component (Radar, Camera, Ultrasonic Sensor, Software Module), Autonomous Level (Level 2, Level 3 & Above), Function (ACC, LKA, LCA, CAA) and Region - Global Forecast to 2027

Highway Driving Assist Market

Highway Driving Assist is a driving convenience and safety system that controls the vehicle’s steering, acceleration, and deceleration functions to reduce driver workload on highways and motorways. It maintains the speed set by the driver, keeps a safe distance from the vehicle directly ahead, keeps the vehicle in the center of its current lane, and automatically changes the lane when required. The various functions include adaptive cruise control, lane keeping assist, lane change assist, and collision avoidance assist.

Key Drivers:

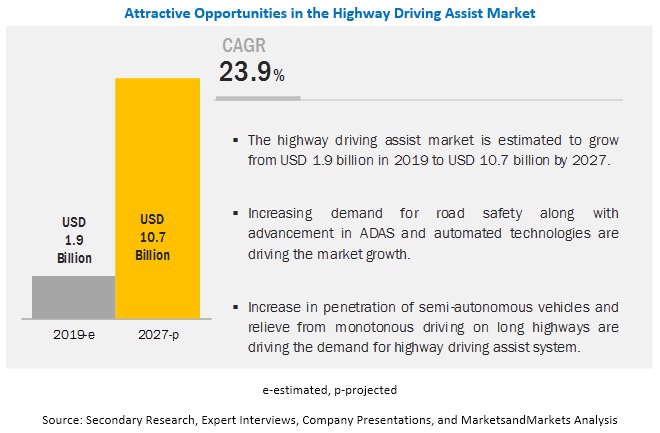

- Increase in road safety

- Advancements in ADAS and automated driving technologies

- Reduction in fuel consumption

Key Restraints:

- Cybersecurity and data security concerns

- Lack of information technology and communication infrastructure in developing nations

Top 10 Players:

- Robert Bosch: Robert Bosch was established in 1964 and is headquartered in Stuttgart, Germany. The company is a global supplier of technology and services, offering a range of products, including automotive components, drive and control technology, security systems, and household appliances. In June 2019, Bosch demonstrated a fifth-generation radar unit for applications such as cross-traffic assistance and high-speed adaptive cruise control for duties up to highly automated driving.

- ZF Friedrichshafen: ZF Friedrichshafen is a leading manufacturer of automotive components. The company was established in 1915 and has its headquarters in Friedrichshafen, Germany. The company manufactures automotive components for OEMs as well as the aftermarket. ZF Friedrichshafen has 17,100 employees working on R&D projects. In June 2019, ZF developed a dual-cam two lens camera, specifically designed for the commercial truck market and would be used in concert with other ZF ADAS technologies.

- Magna: Magna was established in 1957 and is headquartered in Aurora, Canada. The company designs, engineers, tests, and manufactures automotive systems, assemblies, modules, and components, primarily for sale to OEMs of cars and light trucks. The company also provides complete vehicle engineering and assembly services. In August 2017, Magna introduced a new functional autonomous driving platform concept, which can work with any vehicle without impacting either car design or aesthetics and can add scalable self-driving capabilities all the way up to SAE Level 4 (highly automated self-driving, which does not require human driver intervention).

- Continental: Continental AG was established in 1871 and is headquartered in Hanover, Germany. The company operates through five divisions—chassis & safety, powertrain, interior, tires, and ContiTech. The chassis & safety division develops, produces, and supplies intelligent systems to improve driving safety and vehicle dynamics. The company’s presence is spread across Europe, North America, and Asia. In August 2019, Continental developed the "Road AND Driver" camera that monitors both the driver and traffic in front of the vehicle. The dual-camera system continuously detects whether the driver is paying attention to the road, while also monitoring the surroundings.

- Valeo: Valeo was established in 1923 with headquarters in Paris, France. The company designs, produces, and sells components, integrated systems, and modules for the automobile industry. It is one of the largest suppliers of automotive products worldwide. It manufactures automotive components for OEMs as well as the aftermarket. The company has a significant presence in Europe, followed by Asia and North America.

- Visteon

- Mando

- AVL

- Aptiv

- Veoneer

Highway Driving Assist Market & Key Function:

- Adaptive Cruise Control (ACC) - Adaptive cruise control (ACC), also known as autonomous cruise control, is an advanced version of cruise control. In cruise control, the vehicle is maintained at a steady speed as the system takes over the throttle. However, in ACC, the vehicle adjusts its own speed to keep a safe distance from the vehicles ahead. ACC is being incorporated by automobile manufacturers such as BMW, Audi, Mercedes-Benz, Volkswagen, Volvo, Chevrolet, Chrysler, Ford, Honda, Toyota, Lexus, and Jaguar in premium models. ACC could be laser- or radar-based and are now equipped with cameras.

- Lane Keeping Assist (LKA) - Lane keeping assist is an advanced version of a lane departure warning system. The lane keeping assist system supports the driver by keeping the car at the center of the lane even at high speed. The function requires the driver to keep his hands on the steering wheel. To support the longitudinal and lateral control at the same time, the function can be coupled with adaptive cruise control.

- Lane Change Assist - Lane change assist function alerts the driver acoustically or haptically of potential collisions while changing lanes. The function helps reduce the risk of accidents, avoid collisions with cars in the blind spot, and prevents accidents caused by misjudgement of the speed of vehicles approaching from behind. The lane change assist function uses rear radar to detect approaching vehicles. The software installed in the vehicle collects the sensor information and alerts the driver in case of any potential collision.

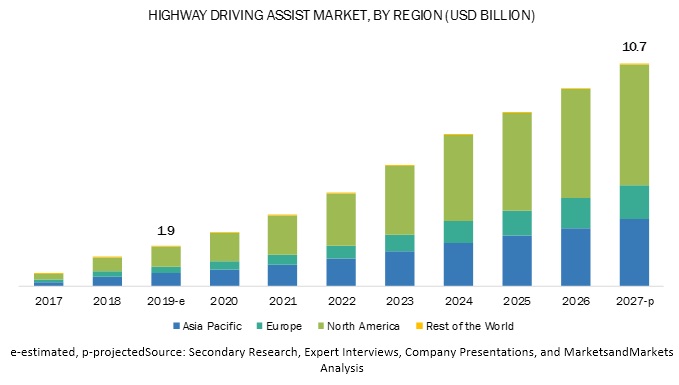

[179 Pages Report] The global highway driving assist market size was valued at USD 1.9 billion in 2019 and is expected to reach USD 10.7 billion by 2027 at a CAGR of 23.9% during the forecast period 2019-2027. Increase in road safety, advancement in ADAS, and automated driving technologies along with a reduction in fuel consumption will boost the demand for highway driving assist market.

North America and Europe are the major regions where the OEMs are offering features such as Tesla’s Autopilot, Traffic Jam Assist in Audi & Acura vehicles, Cadillac’s Super Cruise, BMW’s Driving Assistant Plus and Nissan’s ProPilot Assist in luxury and mid-segment passenger cars. It is expected that the demand will increase gradually in APAC as China, Japan, and Korea are working actively towards autonomous infrastructure.

BEV segment is estimated to be the largest market during the forecast period

The BEV segment is expected to hold the largest market share owing to higher sales of highway driving assist in BEVs over PHEV, HEV, and FCEV. For example, Tesla Model S can automatically steer down the highway, change lane, and adjust speeds according to traffic conditions and parallel park. All these features use a combination of cameras, radars, and ultrasonic sensors.

Mid-segment is expected to grow at highest CAGR

Mid-segment includes C and D categories of vehicles and models such as Audi A2, A3, Q3, BMW X1, BMW 1 Series, BMW 3 Series, and Audi A4, among others. Mid-segment captured the largest highway driving assist market share in 2018 owing to high sales of vehicles that fall under the mid-segment category. The models equipped with highway driving assist under the mid-segment category are Audi A4, Audi A5, BMW 3 series, BMW X3, BMW X4 and Tesla Model 3, among others.

The North America market is expected to register the fastest growth during the forecast period

The North America market is expected to witness the most rapid growth during the forecast period, followed by Europe and APAC. The North America highway driving assist system market share is estimated to be the largest within the global industry. The Department of Transportation’s National Highway Traffic Safety Administration data says more than 37,000 lives were lost on US roads in 2016. Upon which 94% of US vehicular accidents involved human error that could be potentially avoidable.

Technologies such as highway driving assist work as a semi-autonomous feature on highways designed to take human error out of driving actions, which should help make self-driving vehicles safer than human drivers and improve overall road safety. The system reduces the driver fatigue and stress on long drives or in stop-and-go traffic on highways, motorways or freeways. Thus, it will boost demand in the coming years.

Key Market Players

The global highway driving assist market is dominated by major players such as Robert Bosch (Germany), Magna (Canada), ZF Friedrichshafen (Germany), Continental (Germany) and Valeo (France). These companies have strong distribution networks at a global level and offer an extensive product range. These companies adopt strategies, such as new product developments, collaborations, and contracts & agreements to sustain their market position.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Thousand Units) & Value (USD Million) |

|

Segments covered |

By Passenger Car Type, Component Type, Electric Vehicle, Autonomous Level and Function |

|

Geographies covered |

North America, Asia Pacific, Europe and Rest of the World |

|

Companies covered |

Robert Bosch (Germany), ZF Friedrichshafen (Germany), Magna (Canada), Continental (Germany) and Valeo (France). |

This research report categorizes the given market based on passenger car type, component type, electric vehicle, autonomous level, and function and region

Based on the passenger car type, the market has been segmented as follows:

- Mid Segment

- Luxury Segment

Based on the electric vehicle type, the market has been segmented as follows:

- BEV

- HEV

- PHEV

- FCEV

Based on component type, the market has been segmented as follows:

- Camera

- Radar

- Ultrasonic Sensor

- Software Module

- Navigation

Based on the autonomous level, the market has been segmented as follows:

- Level 2

- Level 3 & above

Based on function, the market has been segmented as follows:

- Adaptive Cruise Control

- Lane Keeping Assist

- Lane Centering Assist

- Collision Avoidance Assist

Based on the region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

-

Rest of the World

- Brazil

- Russia

Recent Developments

- In August 2019, Continental has developed a "Road AND Driver" camera, that monitors both the driver and traffic in front of the vehicle. The dual-camera system continuously detects whether the driver is paying attention to the road, while also monitoring the surroundings. The series production of the "Road AND Driver" camera is planned for 2021, around the same time the first automated vehicles are expected to be on the roads, equipped with camera systems to monitor the road and the interior.

- In June 2019, Robert Bosch demonstrated a fifth-generation radar unit for applications such as cross-traffic assistance and high-speed adaptive cruise control for duties up to highly automated driving. The company also presents a new braking system for highly automated driving and an updated integrated power brake; a new vehicle motion position sensor for localization during automated driving.

- In June 2019, ZF Friedrichshafen developed a Dual-cam two-lens camera specifically designed for the commercial truck market and will to be used in concert with other ZF ADAS technologies. The new camera will join the company's S-Cam4 family of automotive-grade cameras and is designed to help meet varying global regulatory requirements and delivers advanced functions such as Traffic Sign Recognition, Lane Keeping Assist and Centering an object and pedestrian detection to enable Automatic Emergency Braking and it is expected to launch in 2020.

- In June 2019, Nvidia unveiled its new DGX "SuperPOD," which the company says is one of the world's fastest supercomputers (the 22nd fastest to be more precise) that includes AI infrastructure to meet the massive demands of the company's autonomous-vehicle deployment program. The DGX-2H server is an enhanced version of NVIDIA's DGX-2 featuring 16 Tesla V100 GPUs running at 450 watts per GPU and higher frequency CPUs built to deliver the highest performance.

- In April 2019, The company announced the debut of the ZF coPILOT, an intelligent advanced driver assistance system (ADAS), which the company says will enable enhanced safety and driving comfort. The system leverages the power of AI and is equipped with a comprehensive sensor set that allows vehicles to perform various automated driving functions, especially on freeways.

Critical Questions:

- Many companies are operating in the highway driving assist market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

- Fast-paced developments in highway driving assist such as Level 2 and Level 3 & above offered by leading manufacturers are expected to change the dynamics of highway driving assist market. How will this transform the overall market?

- Which leading companies are working on the installation of highway driving assist in passenger car and what organic and inorganic strategies have they adopted?

- Analysis of your competition that includes major players in the highway driving assist ecosystem. The major players include Robert Bosch (Germany), Magna (Canada), ZF Friedrichshafen (Germany), Continental (Germany) and Valeo (France), among others.

- Discussion on your client’s imperatives based on our existing research on highway driving assist market and its ecosystems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Product Definition

1.2.1 Inclusions & Exclusions

1.3 Market Scope

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources for Vehicle Sales

2.1.1.2 Key Secondary Sources for Market Sizing

2.1.1.3 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions & Associated Risks

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Highway Driving Assist Market

4.2 North America to Lead the Global Market

4.3 Market, By Passenger Car, 2019 vs. 2027 (USD Million)

4.4 Market, By Electric Vehicle Type, 2019 vs. 2027 (USD Million)

4.5 Market, By Component, 2019 vs. 2027 (USD Million)

4.6 Market, By Autonomous Level, 2019 vs. 2027 (USD Million)

4.7 Market, By Function, 2019 vs. 2027 (USD Million)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Years Considered for the Study

5.3 Currency & Pricing

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Road Safety

5.4.1.2 Advancements in Adas and Automated Driving Technologies

5.4.1.3 Reduction in Fuel Consumption

5.4.2 Restraints

5.4.2.1 Cybersecurity and Data Security Concerns

5.4.2.2 Lack of Information Technology and Communication Infrastructure in Developing Nations

5.4.3 Opportunities

5.4.3.1 Advancements in Lidar Technology

5.4.3.2 Self-Driving Cars

5.4.4 Challenges

5.4.4.1 High Cost of System

5.4.4.2 Legal and Regulatory Framework Issues

5.5 Revenue Missed: Opportunities for Highway Driving Assist Manufacturers

5.6 Highway Driving Assist Market, Scenarios (2018–2027)

5.6.1 Market, Most Likely Scenario

5.6.2 Market, Optimistic Scenario

5.6.3 Market, Pessimistic Scenario

6 Industry Trends (Page No. - 51)

6.1 Technology Analysis

6.1.1 Ai and Machine Learning Technology

6.1.2 Advanced Sensor and Fusing of Sensor Data

6.1.3 Intelligent Mapping

6.2 Porter’s Five Forces Analysis

7 Highway Driving Assist Market, By Passenger Car (Page No. - 53)

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Industry Insights

7.2 Operational Data

7.2.1 Luxury and Mid Segment Vehicle Sales Data 2017–2018

7.3 Mid Segment

7.3.1 Proliferation of Automated Technologies From Luxury to Premium Mid Segment Vehicles is the Key Growth Area

7.4 Luxury Segment

7.4.1 Best Safety & Comfort Features are Equipped in Luxury Vehicles

7.5 Market Leaders

8 Highway Driving Assist Market, By Electric Vehicle Type (Page No. - 60)

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

8.2 Operational Data

8.2.1 Major Ev Models in North America Equipped With Highway Driving Assist

8.3 BEV

8.3.1 Heavy Investments in Advanced Technologies Will Increase the Demand

8.4 FCEV

8.4.1 Government Efforts to Promote FCEVs is the Key Growth Area

8.5 HEV

8.5.1 Advancements in Technology Will Increase the Demand

8.6 PHEV

8.6.1 Upcoming Models are Expected to Be Equipped With Highway Driving Assist

8.7 Market Leaders

9 Highway Driving Assist Market, By Autonomous Level (Page No. - 69)

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions

9.1.3 Industry Insights

9.2 Operational Data

9.2.1 Automated Driving Initiatives By Major Automakers

9.3 Level 2

9.3.1 Heavy Investments in Advanced Technologies Will Boost Demand

9.4 Level 3 & Above

9.4.1 Increasing Demand for Self Driving Cars Will Help the Market to Grow

9.5 Market Leaders

10 Highway Driving Assist Market, By Function (Page No. - 76)

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions

10.1.3 Industry Insights

10.2 Operational Data

10.2.1 Total Number of Crashes, Injuries, and Deaths

10.2.2 Automotive Application Features

10.2.3 Level-Wise Functions

10.3 Adaptive Cruise Control (ACC)

10.3.1 Addition of New Features in ACC is the Key Area of Market Growth

10.4 Lane Keeping Assist (LKA)

10.4.1 Growing Need for Lane Keeping and Centering During Autonomous Driving on Highways

10.5 Lane Change Assist

10.5.1 Growing Focus on Reducing Accidents and Improving Safety Will Boost Demand

10.6 Collision Avoidance Assist (CAA)

10.6.1 Need for Detection and Prevention of Collisions Due to Blind Spot Will Drive the Demand

10.7 Market Leaders

11 Highway Driving Assist Market, By Component (Page No. - 85)

11.1 Introduction

11.1.1 Research Methodology

11.1.2 Assumptions

11.1.3 Industry Insights

11.2 Operational Data

11.2.1 Next Generation Sensor Fusion

11.3 Camera

11.3.1 High Adaptability of Cameras in Luxury Vehicles Would Positively Affect Demand

11.4 Radar

11.4.1 Demand for Long-Range Radar is Fuelling the Overall Market

11.5 Ultrasonic Sensor

11.5.1 Monitoring and Managing Blind Spots Through Ultrasonic Sensors Would Drive Demand

11.6 Software Module

11.6.1 Need for Robust and High Precision Automated Features Makes Software Modules More Complex

11.7 Navigation

11.7.1 Need for High Definition Maps to Implement Higher Levels of Autonomy

11.8 Market Leaders

12 Highway Driving Assist Market, By Region (Page No. - 94)

12.1 Introduction

12.1.1 Research Methodology

12.1.2 Assumptions

12.1.3 Industry Insights

12.2 North America

12.2.1 Canada

12.2.1.1 Large Share of Premium Vehicles and Proximity to US Drives the Canadian Market

12.2.2 Mexico

12.2.2.1 Mexico Does Not Have A Market for Highway Driving Assist Currently

12.2.3 US

12.2.3.1 Oems Initiatives, Technological Advancements, and Infrastructure Drive the US Market

12.3 Europe

12.3.1 France

12.3.1.1 Many Oems in France are Working on Autonomous Vehicles

12.3.2 Germany

12.3.2.1 Technological Advancements, Availability of Infrastructure, and Oem Initiatives Drive the German Market

12.3.3 Italy

12.3.3.1 Government and Oem Initiatives Fuel the Italian Market

12.3.4 Spain

12.3.4.1 Government Support to Establish Laws and Required Infrastructure to Drive the Spanish Market

12.3.5 UK

12.3.5.1 Oems Offering High-End Technologies and Infrastructure Availability Drive the UK Market

12.4 Asia Pacific

12.4.1 China

12.4.1.1 China is Considered as the Most Promising Country for Autonomous Vehicle Initiatives

12.4.2 India

12.4.2.1 There is No Market Available for Highway Driving Assist in India

12.4.3 Japan

12.4.3.1 R&D Strategies By Established Oems and Government Policies to Propel the Japanese Market

12.4.4 South Korea

12.4.4.1 Advanced Infrastructure and Heavy Investment in Autonomous Technologies are the Korean Market Drivers

12.5 RoW

12.5.1 Brazil

12.5.1.1 Establishment of Proper Infrastructure and R&D Initiatives Would Fuel the Brazilian Market

12.5.2 Russia

12.5.2.1 Many Nationally Established Companies are Taking Initiatives on Autonomous Driving

13 Competitive Landscape (Page No. - 118)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Product Comparison Mapping, By Key Competitors

13.4 Competitive Leadership Mapping

13.4.1 Terminology

13.4.2 Visionary Leaders

13.4.3 Innovators

13.4.4 Dynamic Differentiators

13.4.5 Emerging Companies

13.4.6 Strength of Product Portfolio

13.4.7 Business Strategy Excellence

13.5 Winners vs. Tail-Enders

13.6 Competitive Scenario

13.6.1 New Product Developments/Launches

13.6.2 Expansions

13.6.3 Acquisitions

13.6.4 Partnerships/Contracts

14 Company Profiles (Page No. - 133)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

14.1 Robert Bosch

14.2 ZF Friedrichshafen

14.3 Magna

14.4 Continental

14.5 Valeo

14.6 Visteon

14.7 Mando

14.8 AVL

14.9 Aptiv

14.10 Veoneer

14.11 Nvidia

14.12 Toyota Motor Corporation

14.13 Hyundai Motor Company

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

14.14 Other Key Regional Players

14.14.1 Asia Pacific

14.14.1.1 Denso

14.14.1.2 Hyundai Mobis

14.14.1.3 Samsung Electro Mechanics

14.14.2 Europe

14.14.2.1 Hella

14.14.2.2 Volvo

14.14.3 North America

14.14.3.1 Qualcomm

14.14.3.2 Intel

14.14.3.3 Tesla

14.14.4 RoW

14.14.4.1 Mobileye

15 Recommendations By Marketsandmarkets (Page No. - 170)

15.1 North America Will Be the Major Market for Highway Driving Assist

15.2 Level 3 & Above Autonomous Level Can Be A Key Focus for Manufacturers

15.3 Conclusion

16 Appendix (Page No. - 171)

16.1 Key Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Available Customizations

16.4.1 Highway Driving Assist Market, By Function

16.4.1.1 Adaptive Cruise Control

16.4.1.2 Lane Keeping Assist

16.4.1.3 Lane Change Assist

16.4.1.4 Collision Avoidance Assist

16.4.2 Company Profile

16.4.2.1 Company Overview

16.4.2.2 Products Offered

16.4.2.3 Product Development/Expansion/Partnership/Acquisition

16.4.2.4 SWOT Analysis

16.5 Related Reports

16.6 Author Details

List of Tables (121 Tables)

Table 1 Inclusions and Exclusions From the Definition

Table 2 Assumptions, Associated Risks and Impact

Table 3 Currency Exchange Rates (Wrt Per USD)

Table 4 Autonomous Level for Self Driving Cars

Table 5 Global Market (Most Likely), By Region, 2017–2027 (USD Million)

Table 6 Global Market (Optimistic), By Region, 2017–2027 (USD Million)

Table 7 Global Market (Pessimistic), By Region, 2017–2027 (USD Million)

Table 8 Global Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 9 Global Market, By Passenger Car, 2017–2027 (USD Million)

Table 10 Mid Segment: Market, By Region, 2017–2027 (Thousand Units)

Table 11 Mid Segment : Market, By Region, 2017–2027 (USD Million)

Table 12 Luxury Segment: Market, By Region, 2017–2027 (Thousand Units)

Table 13 Luxury Segment: Market, By Region, 2017–2027 (USD Million)

Table 14 Recent Developments

Table 15 US and Canada: Major Electric Vehicles Equipped Highway Driving Assist With 2018 Sales

Table 16 Global Market, By Electric Vehicle Type, 2017–2027 (Thousand Units)

Table 17 Global Market, By Electric Vehicle Type, 2017–2027 (USD Million)

Table 18 BEV Market, By Region, 2017–2027 (Thousand Units)

Table 19 Battery Electric Vehicle Market, By Region, 2017–2027 (USD Million)

Table 20 FCEV: Market, By Region, 2017–2027 (Thousand Units)

Table 21 FCEV: Market, By Region, 2017–2027 (USD Million)

Table 22 HEV: Market, By Region, 2017–2027 (Thousand Units)

Table 23 HEV: Market, By Region, 2017–2027 (USD Million)

Table 24 PHEV: Market, By Region, 2017–2027 (Thousand Units)

Table 25 PHEV: Market, By Region, 2017–2027 (USD Million)

Table 26 Product Features

Table 27 Major Automakers Initiative Towards Level 3 & Above Functionality

Table 28 Highway Driving Assist Market, By Autonomous Level, 2017–2027 (Thousand Units)

Table 29 Market, By Autonomous Level Type, 2017–2027 (USD Million)

Table 30 Level 2: Market, By Region, 2017–2027 (Thousand Units)

Table 31 Level 2: Market, By Region, 2017–2027 (USD Million)

Table 32 Level 3 & Above: Market, By Region, 2017–2027 (Thousand Units)

Table 33 Level 3 & Above: Market, By Region, 2017–2027 (USD Million)

Table 34 Recent Developments

Table 35 Total Number of Crashes, Injuries, and Deaths That Selected Adas Could Potentially Help Prevent Individually and on Aggregate

Table 36 Automotive Application Features Related to Safety, Comfort, and Assistance

Table 37 Major Functions Needed for Different Automated Levels

Table 38 Highway Driving Assist Market, By Function, 2017–2027 (USD Million)

Table 39 Adaptive Cruise Control: Market, By Region, 2017–2027 (USD Million)

Table 40 Lane Keeping Assist: Market, By Region, 2017–2027 (USD Million)

Table 41 Lane Change Assist: Market, By Region, 2017–2027 (USD Million)

Table 42 Collision Avoidance Assist: Market, By Region, 2017–2027 (USD Million)

Table 43 Recent Development

Table 44 Level-Wise Requirement of Sensors

Table 45 Technological Superiority of Components in Automotive Applications

Table 46 Highway Driving Assist Market, By Component, 2017–2027 (USD Million)

Table 47 Camera: Market, By Region, 2017–2027 (USD Million)

Table 48 Radar: Market, By Region, 2017–2027 (USD Million)

Table 49 Ultrasonic Sensor: Market, By Region, 2017–2027 (USD Million)

Table 50 Software Module: Market, By Region, 2017–2027 (USD Million)

Table 51 Navigation: Market, By Region, 2017–2027 (USD Million)

Table 52 Recent Developments

Table 53 Countries Best Prepared for Autonomous Vehicles

Table 54 Highway Driving Assist Market, By Region, 2017–2027 (Thousand Units)

Table 55 Market, By Region, 2017–2027 (USD Million)

Table 56 North America: Market, By Country, 2017–2027 (Thousand Units)

Table 57 North America: Market, By Country, 2017–2027 (USD Million)

Table 58 Canada: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 59 Canada: Market, By Passenger Car, 2017–2027 (USD Million)

Table 60 Mexico: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 61 Mexico: Market, By Passenger Car, 2017–2027 (USD Million)

Table 62 US: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 63 US: Market, By Passenger Car, 2017–2027 (USD Million)

Table 64 Europe: Market, By Country, 2017–2027 (Thousand Units)

Table 65 Europe: Market, By Country, 2017–2027 (USD Million)

Table 66 France: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 67 France: Market, By Passenger Car, 2017–2027 (USD Million)

Table 68 Germany: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 69 Germany: Market, By Passenger Car, 2017–2027 (USD Million)

Table 70 Italy: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 71 Italy: Market, By Passenger Car, 2017–2027 (USD Million)

Table 72 Spain: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 73 Spain: Market, By Passenger Car, 2017–2027 (USD Million)

Table 74 UK: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 75 UK: Market, By Passenger Car, 2017–2027 (USD Million)

Table 76 Asia Pacific: Market, By Country, 2017–2027 (Thousand Units)

Table 77 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 78 China: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 79 China: Market, By Passenger Car, 2017–2027 (USD Million)

Table 80 India: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 81 India: Market, By Passenger Car, 2017–2027 (USD Million)

Table 82 Japan: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 83 Japan: Market, By Passenger Car, 2017–2027 (USD Million)

Table 84 South Korea: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 85 South Korea: Market, By Passenger Car, 2017–2027 (USD Million)

Table 86 RoW: Market, By Country, 2017–2027 (Thousand Units)

Table 87 RoW: Market, By Country, 2017–2027 (USD Million)

Table 88 Brazil: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 89 Brazil: Market, By Passenger Car, 2017–2027 (USD Million)

Table 90 Russia: Market, By Passenger Car, 2017–2027 (Thousand Units)

Table 91 Russia: Market, By Passenger Car, 2017–2027 (USD Million)

Table 92 Product Comparison Mapping, By Key Competitors

Table 93 New Product Developments/Launches, 2017–2019

Table 94 Expansions, 2017–2019

Table 95 Acquisitions, 2018–2019

Table 96 Partnerships/Contracts, 2017–2019

Table 97 New Product Developments, 2018–2019

Table 98 Expansions, 2018

Table 99 Partnerships/Acquisitions/Contracts/Agreements, 2017

Table 100 New Product Developments, 2018–2019

Table 101 Partnerships/Acquisitions/Contracts/Agreements, 2017–2019

Table 102 New Product Developments, 2017

Table 103 Expansions, 2019

Table 104 Partnerships/Acquisitions/Contracts/Agreements, 2018

Table 105 New Product Developments, 2017–2019

Table 106 Expansions, 2017

Table 107 Partnerships/Acquisitions/Contracts/Agreements, 2018–2019

Table 108 Partnerships/Acquisitions/Contracts/Agreements, 2018–2019

Table 109 Expansions, 2018

Table 110 Partnership/Acquisitions/Contracts/Agreements, 2017–2019

Table 111 Expansions, 2019

Table 112 Partnerships/Acquisitions/Contracts/Agreements, 2018

Table 113 Expansions, 2018

Table 114 Expansions, 2019

Table 115 Partnerships/Acquisitions/Contracts/Agreements, 2018

Table 116 New Product Developments, 2019

Table 117 Partnerships/Acquisitions/Contracts/Agreements, 2019

Table 118 New Product Developments, 2019

Table 119 Partnerships/Acquisitions/Contracts/Agreements, 2019

Table 120 New Product Developments, 2015–2018

Table 121 Partnerships/Acquisitions/Contracts/Agreements, 2019

List of Figures (52 Figures)

Figure 1 Market Segmentation: Highway Driving Assist Market

Figure 2 Global Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Bottom-Up Approach: Global Market

Figure 6 Top-Down Approach: Global Market

Figure 7 Data Triangulation

Figure 8 Highway Driving Assist: Market Outlook

Figure 9 Global Market, By Passenger Car, 2019 vs. 2027 (USD Million)

Figure 10 Increasing Demand for Road Safety and Automated Technologies are Driving the Highway Driving Assist Market, 2019–2027 (USD Million)

Figure 11 Global Market, By Value, By Region, 2019–2027 (USD Million)

Figure 12 Mid Segment Expected to Dominate During the Forecast Period

Figure 13 BEV Segment is Expected to Dominate During the Forecast Period

Figure 14 Radar Segment Expected to Dominate During the Forecast Period

Figure 15 Level3 & Above Segment Expected to Grow Faster During the Forecast Period

Figure 16 Adaptive Cruise Control Segment Expected to Dominate During the Forecast Period

Figure 17 Highway Driving Assist Market: Market Dynamics

Figure 18 Us Fatal Traffic Crash Data for 2016

Figure 19 Automotive Adas Market, By Region 2018 vs. 2025 (USD Billion)

Figure 20 Revenue Shift Driving Market Growth

Figure 21 Global Fuel Economy and Co2 Emission Data (2016–2025)

Figure 22 5g Infrastructure Market, By Geography, 2020–2026 (USD Million)

Figure 23 Sales Data, By Passenger Car, 2017 vs. 2018 (Thousand Units)

Figure 24 Global Market, By Passenger Car, 2019 vs. 2027 (USD Million)

Figure 25 Global Market, By Electric Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 26 Global Market, By Autonomous Level, 2019 vs. 2027 (USD Million)

Figure 27 Global Market, By Function, 2019 vs. 2027 (USD Million)

Figure 28 Global Market, By Component, 2019 vs. 2027 (USD Million)

Figure 29 Global Market, By Country, 2019 (USD Million)

Figure 30 Global Market, By Region, 2019 vs. 2027 (USD Million)

Figure 31 Global Market: Regional Market Share & Growth Rate, 2019 (Value)

Figure 32 North America: Global Market Snapshot

Figure 33 Europe: Global Market Snapshot

Figure 34 Asia Pacific: Global Market, By Country, 2019 vs. 2027 (USD Million)

Figure 35 RoW: Global Market, By Country, 2019 vs. 2027 (USD Million)

Figure 36 Highway Driving Assist: Market Ranking Analysis, 2018

Figure 37 Highway Driving Assist Market (Global): Competitive Leadership Mapping, 2018

Figure 38 Highway Driving Assist Manufacturers: Company-Wise Product Offering Analysis

Figure 39 Highway Driving Assist Manufacturers: Company-Wise Business Strategy Analysis

Figure 40 Companies Adopted New Product Developments & Partnerships/ Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2017–2019

Figure 41 Robert Bosch: Company Snapshot

Figure 42 ZF Friedrichshafen: Company Snapshot

Figure 43 Magna: Company Snapshot

Figure 44 Continental Ag: Company Snapshot

Figure 45 Valeo: Company Snapshot

Figure 46 Visteon: Company Snapshot

Figure 47 Mando: Company Snapshot

Figure 48 Aptiv: Company Snapshot

Figure 49 Veoneer: Company Snapshot

Figure 50 Nvidia: Company Snapshot

Figure 51 Toyota Motor Corporation: Company Snapshot

Figure 52 Hyundai Motor: Company Snapshot

The study involved four major activities in estimating the current size of the highway driving assist market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approach were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [such as publications of vehicle sales’ OEMs, Canadian Automobile Association (CAA), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], electric vehicle magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles have been used to identify and collect information useful for an extensive commercial study of the global highway driving assist market.

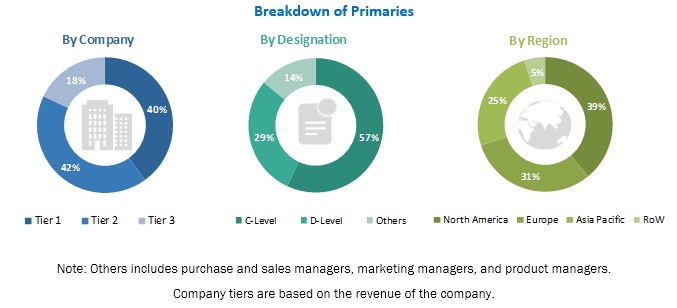

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Asia Pacific, Europe, North America and Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total market size. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast, the global market size in terms of volume and value.

- To define, describe, and provide a detailed analysis of the overall market for the highway driving assist and determine the contribution of each segment to the total sales.

- To analyze the highway driving assist market by vehicle type, electric vehicle type, autonomous level, by function, by components, and by region

- To analyze regional markets for growth trends, prospects, and their contribution towards the market.

- To provide a detailed analysis of several factors influencing the market (drivers, restraints, opportunities, and challenges)

- To project the market of highway driving assist across four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically profile key players globally and comprehensively analyze their market ranking and core competencies

- To analyze and define stakeholders in the market and provide a detailed competitive landscape

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, expansion and other industrial activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Highway Driving Assist Market, By Function type at country level

-

Company Information

-

Profiling of Additional Market Players (Up to 5)

- Highway Driving Assist Market, By Function

- Adaptive Cruise Control

- Lane Keeping Assist

- LAne ChAnge Assist

- Collision Avoidance Assist

-

Profiling of Additional Market Players (Up to 5)

Note: North America (the US, Canada, and Mexico), Europe (France, Germany, Spain, Italy, and the UK), Asia Pacific (China, India, South Korea, and Japan), RoW (Brazil and Russia)

- Company Profile (Upto 5)

- Company Overview

- Products Offered

- Product Development/Expansion/Partnership/Acquisition

- SWOT Analysis

Growth opportunities and latent adjacency in Highway Driving Assist Market

I am mainly interested in the way the autonomous vehicles will develop in the near future in terms of market size/value and technologies used. I am also interested in exploring the main players in the autonomous vehicle market now and in the near future. Hope that gives a better understanding.