Total Station Market by Offering (Hardware, Services), Type (Manual, Robotic), Application (Construction, Agriculture, Oil & Gas, Mining, Transportation, Utilities, Forensic) and Region (2022-2027)

Updated on : October 23, 2024

The total station market is experiencing robust growth, driven by increasing demand in sectors such as construction, infrastructure development, mining, and agriculture. Total stations, which integrate electronic distance measurement and angle measurement capabilities, are essential for precise land surveying, mapping, and layout tasks. Key trends fueling the market include the rising adoption of advanced surveying technologies in large-scale infrastructure projects, the growing emphasis on accuracy and efficiency in construction workflows, and the use of total stations in smart city planning. Additionally, the increasing integration of GPS and robotic technologies in total stations, which enhances automation and remote control capabilities, is further boosting demand. As global urbanization and development continue, the need for highly accurate and efficient surveying tools like total stations is expected to drive market expansion.

Total Station Market Size & Growth

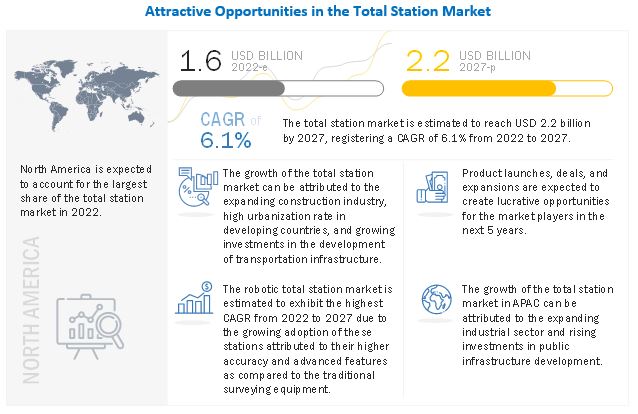

The total station market size in terms of revenue is estimated to be worth $1.6 billion in 2022 and is poised to reach $2.2 billion by 2027, growing at a CAGR of 6.1% during the forecast period from 2022 to 2027.

A total station measures distances, horizontal and vertical angles, and elevations in topographic and geodetic works. It is used in topographic surveys, general land surveys, road and corridor surveys, volumetric surveys, infrastructure surveys, utility design surveys, power/pipeline line inspections, and forensic investigations. The measurement results are recorded into the internal memory of the total station and can be transferred to a personal computer interface for analyses by using surveying/construction software tools. Total stations are used in various applications, such as construction, transportation, utilities, mining, agriculture, and oil and gas.

To know about the assumptions considered for the study, Request for Free Sample Report

Total Station Market Trends and Dynamics:

DRIVERS: Positive demand from thriving construction industry

The construction industry is expected to grow extensively over the next 10 years worldwide, especially in developing countries. According to an article published by Construction Global, the construction industry will grow 35% by 2030 at an average annual growth rate of 3.6% per year. With the increasing demand, contractors struggle through low productivity and high unexpected rework and change orders. Nowadays, the building structures are more complex and are expected to be low-priced and have a quick turnaround and superior quality. This, in turn, requires the adoption of new processes such as advanced equipment, building information modeling solutions, and digital workflows. Total stations help contractors measure angles and distances with high accuracy for laying out new construction and in building existing construction using discrete points.

In the global construction sector, the residential segment is expected to grow at an impressive pace with rising population and increasing disposable income worldwide. Residential construction trends, such as modular construction, enhanced safety, 3D printing, remote/connected technology, sustainable construction, have given a boost to residential renovations and reconstruction all around the world. The upgrowth in the residential construction industry will also strengthen the total station market. Most of the growth in the construction sector is anticipated to come from developing countries such as China, India, Indonesia, and others. Hence, the demand for total stations is projected to grow at an impressive rate in these markets over the forecast period.

RESTRAINTS: High cost and availability of other surveying instruments

Total stations, especially robotic total stations, are more expensive than other conventional surveying instruments such as theodolites and traditional/manual total stations. In addition, with increasing demand for advanced features from customers, the cost of total stations further increases. Besides, precautions are to be taken while working on a total station, as harsh environmental conditions may impact the functioning. Since skilled surveyors are required to operate a total station effectively, the lack of skilled professionals may also impact the growth of the market to some extent. Moreover, a total station is used for various measurements and functionalities, and there are dedicated instruments available for these specific tasks that are more reliable and cost-effective than a total station. For example, a total station has 3D scanning features, but customized 3D scanners are available in the market, which offers more dedicated features based on customer requirements. Similarly, for positioning and navigation features of a total station, GNSS acts as a more appropriate option. Also, for forensic investigation applications, complex, and indoor locations, 3D scanners are being widely adopted over total stations due to collection of large number of data points by these scanners and availability of advanced software solutions to create detailed 3D models. Thus, availability of alternative dedicated equipment for different surveying applications may act as a restraint for the total station market to some extent.

OPPORTUNITIES: Growing investments in building and modernizing infrastructure by developing nations

Developing nations all around the world are investing heavily in building new infrastructure and upgrading existing infrastructure to support their increasing population, industrial growth, and economic development. From constructing highways, rail projects, airports or even state-of-art buildings, these countries are focusing on creating a strong infrastructure. Since total stations are the go-to tools for any surveying application in construction and industrial projects, the booming infrastructure development sector in developing countries is expected to drive the total station market. Total stations are fast, accurate, reduce human errors, and calculations are done from each and every angle in less effort and time.

Infrastructure in developing nations plays a key role in strengthening the economy. A good and better infrastructure invites global players of major markets to establish manufacturing units in these emerging economies. Hence, more countries are investing in developing their infrastructure. For instance, in May 2021, Brazil’s infrastructure minister predicted that around USD 50 billion would be invested in the infrastructure industry till the next year for modernization of ports, highways, railways, and airports. He also added that Brazil would become an immense construction site. In July 2020, the government of Indonesia announced an ambitious plan from 2020 to 2024, which involves the construction of 25 new airports, power plants, mass transit systems, and waste-to-energy projects. About 35% of investments from the private sector will be looked upon by the Indonesian government to build a modern and urban infrastructure for the country. Hence, the huge investments that are being made and planned in all such countries worldwide are anticipated to boost the demand for total stations over the forecast period.

CHALLENGES: Lack of expertise on modern day instruments

Total station operators are trained for their conventional roles/equipment, and the implementation of advanced total stations such as robotic total stations require them to learn new techniques/methods for operating these equipment. Though it does not take long for the operators to understand the benefits of the latest instruments and accept the complexities related to them, the implementation of advanced and complex instruments onto a construction project is still often met with resistance. At a construction or industrial site, it is necessary to employ a suitable person with in-depth knowledge about the capabilities of the latest total stations. This would help maximize the operator efficiency, particularly for larger projects that require numerous skilled operators. Hence, lack of skilled professionals to operate advanced total stations may impact their adoption, especially in developing and underdeveloped countries.

Total Station Market Segmentation

Robotic total station to grow at the highest CAGR during the forecast period

The high growth of the robotic total station industry is attributed to their increasing demand in various industries. Robotic total stations are much easier to use and highly preferred over manual total stations. The manual total station needs a two-person operation, whereas the robotic total station requires a one-person operation. Robotic total stations are costly in comparison to manual total stations, but they are cost-efficient and time-saving. Thus, the use of robotic total stations enhances both accuracy and efficiency of the layout process on the construction site, and their adoption has been increasing at an impressive pace across industries. Companies like Hexagon AB, Trimble Inc., and Topcon Corporation provide both manual as well as robotic total stations, and they are focusing on further enhancing their robotic total stations by integrating advanced features and technologies.

To know about the assumptions considered for the study, download the pdf brochure

Total Station Industry Regional Analysis

Total Station market in APAC to grow at the highest CAGR

The growing population, rising urbanization, and expanding construction industry in emerging economies such as China and India are the key factors driving the growth of the APAC total station market. In these countries, geospatial technologies are being utilized for construction, mining, agricultural activities, and rural development over the past decade. Companies belonging to various sectors and industries, such as construction, mining, manufacturing, transportation, and agriculture, are using total stations and geospatial information to make strategic decisions about the feasibility of large construction projects. Surveying and mapping technologies are widely used in APAC. The development of smart cities in China, India, and several countries in South-East Asia has driven demand for total stations.

Top Total Station Companies - Key Market Players

- Hexagon AB (Sweden),

- Trimble Inc. (US),

- Topcon Corporation (Japan),

- Suzhou FOIF Co. Ltd. (China),

- STONEX Srl (Italy) are a few major players in total station companies.

Scope of the report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.6 billion in 2022 |

|

Expected Market Size |

USD 2.2 billion by 2027 |

|

Growth Rate |

CAGR of 6.1% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Type, and Application |

|

Geographic Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Major Players: Hexagon AB (Sweden), Trimble Inc. (US), Topcon Corporation (Japan), Suzhou FOIF Co. Ltd. (China), and STONEX Srl (Italy) and Others- total 25 players have been covered. |

This research report categorizes the total station market by offering, type, application, and region.

By Offering:

- Hardware

- Services

By Type:

- Manual Total Station

- Robotic Total Station

By Application:

- Construction

- Agriculture

- Oil and Gas

- Mining

- Transportation

- Utilities

- Forensic Investigation

- Others

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In February 2021, Trimble Inc. launched Trimble SX12, a new scanning total station with new features such as complex 3D modeling, high-power laser point, and high-resolution for fast and efficient data capture.

- In November 2020, Leica Geosystems, a brand of Hexagon AB launched new Leica TS16 total station with the autoheight feature, which would help surveyors save time and work in any environmental condition with precision and reliability.

- In October 2020, Topcon launched GT-1200 and GT-600, robotic total stations. The new Topcon robotic GT series total stations come with features such as speed, tracking, and accuracy and new field and software enhancements.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the total station market size during 2022-2027?

The global total station market is expected to record a CAGR of 6.1% from 2022 to 2027.

Does this report include the impact of COVID-19 on the total station market?

Yes, the report includes the impact of COVID-19 on the total station market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the total station market share?

Positive demand from thriving construction industry and high demand for robotic total stations.

Which are the significant players operating in the total station market share?

Hexagon AB (Sweden), Trimble Inc. (US), Topcon Corporation (Japan), Suzhou FOIF Co. Ltd. (China), and STONEX Srl (Italy) are some of the major companies operating in the total station market.

Which region will lead the total station market in the future?

North America is expected to lead the total station market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 TOTAL STATION MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 TOTAL STATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

FIGURE 3 RESEARCH APPROACH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 4 TOTAL STATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by using top-down analysis (supply side)

FIGURE 5 TOTAL STATION MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET USING SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 8 IMPACT OF COVID-19 ON TOTAL STATION MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 9 HARDWARE TO BE DOMINANT SEGMENT IN MARKET DURING FORECAST PERIOD

FIGURE 10 ROBOTIC TOTAL STATION MARKET TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 11 CONSTRUCTION SEGMENT TO HOLD LARGEST SHARE OF TOTAL STATION MARKET BETWEEN 2022 AND 2027

FIGURE 12 APAC TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR TOTAL STATION MARKET

FIGURE 13 RISING ADOPTION OF ROBOTIC TOTAL STATIONS IN VARIOUS INDUSTRIES AND POSITIVE GROWTH OUTLOOK OF CONSTRUCTION INDUSTRY TO FUEL GROWTH OF TOTAL STATION MARKET DURING FORECAST PERIOD

4.2 TOTAL STATION MARKET, BY OFFERING

FIGURE 14 HARDWARE SEGMENT TO HOLD LARGER SHARE OF MARKET FROM 2022 TO 2027

4.3 MARKET, BY TYPE

FIGURE 15 ROBOTIC TOTAL STATION MARKET TO REGISTER HIGHER CAGR FROM 2022 TO 2027

4.4 MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 16 CONSTRUCTION APPLICATION SEGMENT AND US TO HOLD LARGEST SHARES OF NORTH AMERICAN TOTAL STATION MARKET IN 2027

4.5 MARKET, BY APPLICATION

FIGURE 17 CONSTRUCTION SEGMENT TO HOLD LARGEST SHARE OF TOTAL STATION MARKET IN 2027

4.6 TOTAL STATION MARKET, BY COUNTRY

FIGURE 18 TOTAL STATION MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 TOTAL STATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Positive demand from thriving construction industry

FIGURE 20 GROWTH RATE IN INFRASTRUCTURE CONSTRUCTION (%), 2020–2030

FIGURE 21 TOP 10 CONSTRUCTION MARKETS, 2030

5.2.1.2 Growing demand for 3D modeling and scanning across industries

5.2.1.3 Advanced robotic total stations

5.2.1.4 Constant improvements in data collection & analysis software

5.2.1.5 Use of total stations for essential measurements in railways

FIGURE 22 TOTAL STATION MARKET: IMPACT ANALYSIS OF DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 High cost and availability of other surveying alternatives

TABLE 3 COMPARISON: TOTAL STATIONS VS. 3D LASER SCANNERS

5.2.2.2 Harsh environmental factors may impact performance

FIGURE 23 TOTAL STATION MARKET: IMPACT ANALYSIS OF RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Growing investments in building and modernizing infrastructure by developing nations

5.2.3.2 High growth potential in forensic investigation applications

FIGURE 24 TOTAL STATION MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Lack of expertise on modern-day instruments

FIGURE 25 TOTAL STATION MARKET: IMPACT ANALYSIS OF CHALLENGES

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN: TOTAL STATION MARKET

5.4 ECOSYSTEM ANALYSIS

FIGURE 27 TOTAL STATION ECOSYSTEM ANALYSIS

TABLE 4 TOTAL STATION ECOSYSTEM: KEY PLAYERS

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

FIGURE 28 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN TOTAL STATION MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 TOTAL STATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 BARGAINING POWER OF SUPPLIERS

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 THREAT OF SUBSTITUTES

5.6.5 THREAT OF NEW ENTRANTS

5.7 CASE STUDY ANALYSIS

TABLE 6 BUCKINGHAM GROUP CONTRACTING LTD. AND SCCS SURVEY EQUIPMENT LTD. PARTNER TO MONITOR AND SURVEY LARGE CONSTRUCTION PROJECTS

TABLE 7 GROWING USE OF TOTAL STATIONS IN FORENSIC INVESTIGATION APPLICATON

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT

5.8.2 ARTIFICIAL INTELLIGENCE

5.8.3 3D LASER SCANNING

5.9 PRICING ANALYSIS

TABLE 8 AVERAGE PRICING OF TOTAL STATIONS

5.10 TRADE ANALYSIS

5.10.1 IMPORT SCENARIO OF THEODOLITES AND TACHYMETERS “TACHEOMETERS”

FIGURE 29 IMPORT DATA FOR THEODOLITES AND TACHYMETERS “TACHEOMETERS” BY COUNTRY, 2016-2020 (USD MILLION)

5.10.2 EXPORT SCENARIO OF THEODOLITES AND TACHYMETERS “TACHEOMETERS”

FIGURE 30 EXPORT DATA FOR THEODOLITES AND TACHYMETERS “TACHEOMETERS,” BY COUNTRY, 2016-2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 32 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 9 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

TABLE 10 LIST OF FEW PATENTS IN TOTAL STATION MARKET, 2019–2021

5.12 MARKET REGULATIONS AND STANDARDS

TABLE 11 REGULATIONS AND STANDARDS RELATED TO TOTAL STATIONS

6 COMPONENTS OF TOTAL STATIONS (Page No. - 78)

6.1 INTRODUCTION

6.2 ELECTRONIC DISTANCE MEASUREMENT (EDM)

6.3 ELECTRONIC THEODOLITE

6.4 MICROPROCESSOR

6.5 STORAGE UNIT

6.6 OTHERS (DISPLAY, PRISM, AND ACCESSORIES)

7 TOTAL STATION MARKET, BY OFFERING (Page No. - 81)

7.1 INTRODUCTION

FIGURE 33 TOTAL STATION MARKET, BY OFFERING

FIGURE 34 HARDWARE SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 12 TOTAL STATION MARKET, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 13 TOTAL STATION MARKET, BY OFFERING, 2022–2027 (USD MILLION)

7.2 HARDWARE

7.2.1 INCREASING DEMAND FOR ROBOTIC TOTAL STATIONS TO DRIVE MARKET GROWTH

TABLE 14 TOTAL STATION MARKET FOR HARDWARE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 15 MARKET FOR HARDWARE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 16 MARKET FOR HARDWARE, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 17 MARKET FOR HARDWARE, BY TYPE, 2022–2027 (THOUSAND UNITS)

TABLE 18 MARKET FOR HARDWARE, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE, BY REGION, 2022–2027 (USD MILLION)

7.3 SERVICES

7.3.1 RISING DEMAND FOR MAINTENANCE AND TRAINING SERVICES TO DRIVE MARKET GROWTH

TABLE 20 TOTAL STATION MARKET FOR SERVICES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 21 MARKET FOR SERVICES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 22 MARKET FOR SERVICES, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR SERVICES, BY REGION, 2022–2027 (USD MILLION)

8 TOTAL STATION MARKET, BY TYPE (Page No. - 87)

8.1 INTRODUCTION

FIGURE 35 TOTAL STATION MARKET, BY TYPE

FIGURE 36 MANUAL TOTAL STATION SEGMENT TO HOLD LARGER SHARE OF TOTAL STATION MARKET FROM 2022 TO 2027

TABLE 24 TOTAL STATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 25 TOTAL STATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2 MANUAL TOTAL STATION

8.2.1 MANUAL TOTAL STATION SEGMENT TO HOLD SUBSTANTIAL MARKET SHARE DURING FORECAST PERIOD

TABLE 26 TOTAL STATION MARKET FOR MANUAL TOTAL STATION, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR MANUAL TOTAL STATION, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 28 MARKET FOR MANUAL TOTAL STATION, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR MANUAL TOTAL STATION, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 30 MARKET FOR MANUAL TOTAL STATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR MANUAL TOTAL STATION, BY REGION, 2022–2027 (USD MILLION)

8.3 ROBOTIC TOTAL STATION

8.3.1 ROBOTIC TOTAL STATION SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2022 AND 2027

TABLE 32 TOTAL STATION MARKET FOR ROBOTIC TOTAL STATION, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR ROBOTIC TOTAL STATION, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 34 MARKET FOR ROBOTIC TOTAL STATION, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR ROBOTIC TOTAL STATION, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR ROBOTIC TOTAL STATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR ROBOTIC TOTAL STATION, BY REGION, 2022–2027 (USD MILLION)

9 TOTAL STATION MARKET, BY APPLICATION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 37 TOTAL STATION MARKET, BY APPLICATION

FIGURE 38 CONSTRUCTION SEGMENT TO HOLD LARGEST SHARE OF TOTAL STATION MARKET FROM 2022 TO 2027

TABLE 38 TOTAL STATION MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 39 TOTAL STATION MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 CONSTRUCTION

9.2.1 RISING URBANIZATION TO FUEL GROWTH OF CONSTRUCTION SEGMENT

9.2.2 CIVIL INFRASTRUCTURE SECTOR

9.2.3 INDUSTRIAL AND COMMERCIAL SECTORS

9.2.4 RESIDENTIAL

9.2.5 IMPACT OF COVID-19

TABLE 40 TOTAL STATION MARKET FOR CONSTRUCTION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR CONSTRUCTION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR CONSTRUCTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR CONSTRUCTION, BY REGION, 2022–2027 (USD MILLION)

9.3 AGRICULTURE

9.3.1 GROWING USE OF TOTAL STATIONS IN CROP SURVEYING AND PRECISION FARMING TO BOOST MARKET GROWTH

9.3.2 IMPACT OF COVID-19

TABLE 44 TOTAL STATION MARKET FOR AGRICULTURE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR AGRICULTURE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR AGRICULTURE, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR AGRICULTURE, BY REGION, 2022–2027 (USD MILLION)

9.4 OIL AND GAS

9.4.1 REQUIREMENT OF HIGHLY EFFICIENT EQUIPMENT IN OIL AND GAS EXPLORATION TO DRIVE MARKET GROWTH

9.4.2 IMPACT OF COVID-19

TABLE 48 TOTAL STATION MARKET FOR OIL AND GAS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR OIL AND GAS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR OIL AND GAS, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR OIL AND GAS, BY REGION, 2022–2027 (USD MILLION)

9.5 MINING

9.5.1 INCREASING EXPLORATION ACTIVITIES IN MINING INDUSTRY TO FUEL DEMAND FOR TOTAL STATIONS

9.5.2 IMPACT OF COVID-19

TABLE 52 TOTAL STATION MARKET FOR MINING, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR MINING, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 MARKET FOR MINING, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR MINING, BY REGION, 2022–2027 (USD MILLION)

9.6 TRANSPORTATION

9.6.1 HIGH INVESTMENTS IN DEVELOPMENT OF TRANSPORTATION INFRASTRUCTURE TO DRIVE GROWTH OF TOTAL STATION MARKET

9.6.2 IMPACT OF COVID-19

TABLE 56 TOTAL STATION MARKET FOR TRANSPORTATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR TRANSPORTATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 58 MARKET FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

9.7 UTILITIES

9.7.1 HIGH DEMAND FOR UTILITIES TO BOOST GROWTH OF TOTAL STATION MARKET

9.7.2 IMPACT OF COVID-19

TABLE 60 TOTAL STATION MARKET FOR UTILITIES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 MARKET FOR UTILITIES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 MARKET FOR UTILITIES, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 MARKET FOR UTILITIES, BY REGION, 2022–2027 (USD MILLION)

9.8 FORENSIC INVESTIGATION

9.8.1 GROWING DEMAND FOR ACCURATE MEASUREMENTS IN RECONSTRUCTION OF CRIME AND CRASH SCENES TO FUEL DEMAND FOR TOTAL STATIONS

TABLE 64 FORENSIC INVESTIGATION: KEY PRODUCT OFFERINGS

9.8.2 IMPACT OF COVID-19

TABLE 65 TOTAL STATION MARKET FOR FORENSIC INVESTIGATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR FORENSIC INVESTIGATION, BY TYPE, 2022–2027 (USD MILLION)

TABLE 67 MARKET FOR FORENSIC INVESTIGATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR FORENSIC INVESTIGATION, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHERS

9.9.1 IMPACT OF COVID-19

TABLE 69 TOTAL STATION MARKET FOR OTHERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR OTHERS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 114)

10.1 INTRODUCTION

FIGURE 39 TOTAL STATION MARKET, BY REGION

TABLE 73 TOTAL STATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 TOTAL STATION MARKET, BY REGION, 2022–2027 (USD MILLION)

FIGURE 40 GEOGRAPHIC SNAPSHOT: TOTAL STATION MARKET

10.2 NORTH AMERICA

10.2.1 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

FIGURE 41 SNAPSHOT: TOTAL STATION MARKET IN NORTH AMERICA

FIGURE 42 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN TOTAL STATION MARKET DURING FORECAST PERIOD

TABLE 75 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 76 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 83 MARKET FOR CONSTRUCTION IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR CONSTRUCTION IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 High investments in infrastructure development to boost US total station market growth

10.2.3 CANADA

10.2.3.1 Expanding mining industry to increase demand for total stations

10.2.4 MEXICO

10.2.4.1 Increasing urbanization to boost growth of total station market in Mexico

10.3 EUROPE

10.3.1 IMPACT OF COVID-19 ON EUROPEAN MARKET

FIGURE 43 SNAPSHOT: TOTAL STATION MARKET IN EUROPE

FIGURE 44 UK TO REGISTER HIGHEST CAGR IN EUROPEAN TOTAL STATION MARKET DURING FORECAST PERIOD

TABLE 85 TOTAL STATION MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 90 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 91 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 MARKET FOR CONSTRUCTION IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 MARKET FOR CONSTRUCTION IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Government-led initiatives for expanding residential infrastructure to drive growth of UK total station market

10.3.3 GERMANY

10.3.3.1 Adoption of sustainable construction to boost demand for total stations

10.3.4 FRANCE

10.3.4.1 Construction, transportation, and archaeology applications to play vital role in growth of French total station market

10.3.5 ITALY

10.3.5.1 Increasing investments in infrastructure development to boost growth of total station market

10.3.6 REST OF EUROPE

10.4 APAC

10.4.1 IMPACT OF COVID-19 ON APAC MARKET

FIGURE 45 SNAPSHOT: TOTAL STATION MARKET IN APAC

FIGURE 46 CHINA TO ACCOUNT FOR LARGEST SHARE OF APAC TOTAL STATION MARKET DURING FORECAST PERIOD

TABLE 95 TOTAL STATION MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 MARKET IN APAC, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 98 MARKET IN APAC, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 99 MARKET IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN APAC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 101 MARKET IN APAC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN APAC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 103 MARKET FOR CONSTRUCTION IN APAC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 104 TOTAL STATION MARKET FOR CONSTRUCTION IN APAC, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Developments in transportation sector to propel demand for total stations

10.4.3 JAPAN

10.4.3.1 Increasing development of commercial and residential infrastructures to drive growth of total station market

10.4.4 INDIA

10.4.4.1 Increasing urbanization to drive growth of total station market in India

10.4.5 REST OF APAC

10.5 ROW

10.5.1 IMPACT OF COVID-19 ON ROW MARKET

FIGURE 47 MIDDLE EAST TO HOLD LARGEST SHARE OF ROW TOTAL STATION MARKET DURING FORECAST PERIOD

TABLE 105 TOTAL STATION MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 MARKET IN ROW, BY OFFERING, 2018–2021 (USD MILLION)

TABLE 108 MARKET IN ROW, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 109 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 110 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 111 MARKET IN ROW, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN ROW, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 113 MARKET FOR CONSTRUCTION IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 114 MARKET FOR CONSTRUCTION IN ROW, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 SOUTH AMERICA

10.5.2.1 Growing awareness regarding benefits of total stations to drive market growth

10.5.3 MIDDLE EAST

10.5.3.1 Increasing renovation activities to boost usage of total stations in Middle East

TABLE 115 TOTAL STATION MARKET IN MIDDLE EAST, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 TOTAL STATION MARKET IN MIDDLE EAST, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3.2 Saudi Arabia

10.5.3.3 UAE

10.5.3.4 Rest of the Middle East

10.5.4 AFRICA

10.5.4.1 Increasing focus on modernization of infrastructure to boost growth of African total station market

11 COMPETITIVE LANDSCAPE (Page No. - 143)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 117 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TOTAL STATION MARKET

11.3 TOP 3 COMPANY REVENUE ANALYSIS

FIGURE 48 TOTAL STATION MARKET: REVENUE ANALYSIS OF TOP 3 PLAYERS, 2016–2020

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 118 TOTAL STATION MARKET: MARKET SHARE ANALYSIS (2021)

11.5 COMPANY EVALUATION QUADRANT, 2021

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 49 TOTAL STATION MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 SMALL AND MEDIUM ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 50 TOTAL STATION MARKET, SME EVALUATION QUADRANT, 2021

11.7 TOTAL STATION MARKET: COMPANY FOOTPRINT

TABLE 119 COMPANY FOOTPRINT

TABLE 120 INDUSTRY: COMPANY FOOTPRINT

TABLE 121 REGIONAL: COMPANY FOOTPRINT

TABLE 122 TOTAL STATION MARKET: DETAILED LIST OF KEY SMES

TABLE 123 TOTAL STATION MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 124 TOTAL STATION MARKET: PRODUCT LAUNCHES, 2018–2021

11.8.2 DEALS

TABLE 125 TOTAL STATION MARKET: DEALS, 2018–2021

12 COMPANY PROFILES (Page No. - 158)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 HEXAGON AB

TABLE 126 HEXAGON AB: BUSINESS OVERVIEW

FIGURE 51 HEXAGON AB: COMPANY SNAPSHOT

TABLE 127 HEXAGON AB: PRODUCTS OFFERED

TABLE 128 HEXAGON AB: PRODUCT LAUNCHES

12.1.2 TRIMBLE INC.

TABLE 129 TRIMBLE INC.: BUSINESS OVERVIEW

FIGURE 52 TRIMBLE INC.: COMPANY SNAPSHOT

TABLE 130 TRIMBLE INC.: PRODUCTS OFFERED

TABLE 131 TRIMBLE INC.: PRODUCT LAUNCHES

TABLE 132 TRIMBLE INC.: OTHERS

12.1.3 TOPCON CORPORATION

TABLE 133 TOPCON CORPORATION: BUSINESS OVERVIEW

FIGURE 53 TOPCON CORPORATION: COMPANY SNAPSHOT

TABLE 134 TOPCON CORPORATION: PRODUCT OFFERING

TABLE 135 TOPCON CORPORATION: PRODUCT LAUNCHES

TABLE 136 TOPCON CORPORATION: DEALS

12.1.4 SUZHOU FOIF CO., LTD.

TABLE 137 SUZHOU FOIF CO., LTD.: BUSINESS OVERVIEW

TABLE 138 SUZHOU FOIF CO., LTD.: PRODUCT OFFERING

12.1.5 STONEX SRL

TABLE 139 STONEX SRL: BUSINESS OVERVIEW

TABLE 140 STONEX SRL: PRODUCTS OFFERED

TABLE 141 STONEX SRL: PRODUCT LAUNCHES

12.1.6 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.

TABLE 142 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

TABLE 143 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

12.1.7 GUANGDONG KOLIDA INSTRUMENTS CO., LTD.

TABLE 144 GUANGDONG KOLIDA INSTRUMENTS CO., LTD.: BUSINESS OVERVIEW

TABLE 145 GUANGDONG KOLIDA INSTRUMENTS CO., LTD.: PRODUCTS OFFERED

TABLE 146 GUANGDONG KOLIDA INSTRUMENTS CO., LTD.: PRODUCT LAUNCHES

12.1.8 HI-TARGET

TABLE 147 HI-TARGET: BUSINESS OVERVIEW

TABLE 148 HI-TARGET: PRODUCTS OFFERED

TABLE 149 HI-TARGET: DEALS

12.1.9 HORIZON SG

TABLE 150 HORIZON SG: BUSINESS OVERVIEW

TABLE 151 HORIZON SG: PRODUCTS OFFERED

TABLE 152 HORIZON SG: PRODUCT LAUNCHES

12.1.10 TI ASAHI CO., LTD.

TABLE 153 TI ASAHI CO., LTD.: BUSINESS OVERVIEW

TABLE 154 TI ASAHI CO., LTD.: PRODUCTS OFFERED

12.2 OTHER PLAYERS

12.2.1 GEO-ALLEN CO., LTD.

TABLE 155 GEO-ALLEN CO., LTD.: COMPANY OVERVIEW

12.2.2 GEO-FENNEL GMBH

TABLE 156 GEO-FENNEL GMBH: COMPANY OVERVIEW

12.2.3 HILTI INC.

TABLE 157 HILTI INC.: COMPANY OVERVIEW

12.2.4 SATLAB GEOSOLUTIONS AB

TABLE 158 SATLAB GEOSOLUTIONS AB: COMPANY OVERVIEW

12.2.5 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

TABLE 159 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY OVERVIEW

12.2.6 CARLSON SOFTWARE

TABLE 160 CARLSON SOFTWARE: COMPANY OVERVIEW

12.2.7 SANDING OPTIC-ELECTRIC INSTRUMENT CO., LTD.

TABLE 161 SANDING OPTIC-ELECTRIC INSTRUMENT CO., LTD.: COMPANY OVERVIEW

12.2.8 LASER TECHNOLOGY, INC.

TABLE 162 LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

12.2.9 GPI CO., LTD.

TABLE 163 GPI CO., LTD.: COMPANY OVERVIEW

12.2.10 LAWRENCE & MAYO INDIA PVT. LTD.

TABLE 164 LAWRENCE & MAYO INDIA PVT. LTD: COMPANY OVERVIEW

12.2.11 ESURVEY GNSS

TABLE 165 ESURVEY GNSS: COMPANY OVERVIEW

12.2.12 BEIJING CAP HIGH TECHNOLOGY CO., LTD.

TABLE 166 BEIJING CAP HIGH TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.2.13 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.

TABLE 167 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

12.2.14 NWI

TABLE 168 NWI: COMPANY OVERVIEW

12.2.15 SHENG XING INSTRUMENT CO., LTD

TABLE 169 SHENG XING INSTRUMENT CO., LTD: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 193)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 BUILDING INFORMATION MODELING (BIM) MARKET

13.3.1 INTRODUCTION

FIGURE 54 NORTH AMERICA TO HOLD LARGEST SHARE OF BUILDING INFORMATION MODELING MARKET DURING FORECAST PERIOD

TABLE 170 BUILDING INFORMATION MODELING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 171 BUILDING INFORMATION MODELING MARKET, BY REGION, 2021–2026 (USD MILLION)

13.3.2 NORTH AMERICA

FIGURE 55 NORTH AMERICA: SNAPSHOT OF BUILDING INFORMATION MODELING MARKET

TABLE 172 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 173 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 174 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY OFFERING TYPE, 2017–2020 (USD MILLION)

TABLE 175 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY OFFERING TYPE, 2021–2026 (USD MILLION)

TABLE 176 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 177 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 178 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 179 BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.2.1 US

13.3.2.1.1 Strong economic position and active government support contribute to large-scale adoption of advanced technologies in construction segment in US

13.3.2.2 Canada

13.3.2.2.1 Significant rise in use of BIM in Canada due to growing awareness about technology

13.3.2.3 Mexico

13.3.2.3.1 Initiatives by several organizations to fuel demand for BIM in Mexico

13.3.3 EUROPE

FIGURE 56 EUROPE: SNAPSHOT OF BUILDING INFORMATION MODELING MARKET

TABLE 180 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 182 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY OFFERING TYPE, 2017–2020 (USD MILLION)

TABLE 183 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY OFFERING TYPE, 2021–2026 (USD MILLION)

TABLE 184 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 185 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 186 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 187 BUILDING INFORMATION MODELING MARKET IN EUROPE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.3.1 Germany

13.3.3.1.1 Increasing number of pilot projects would lead to higher adoption of BIM

13.3.3.2 UK

13.3.3.2.1 UK to lead market in Europe due to government mandates for BIM

13.3.3.3 France

13.3.3.3.1 Initiatives taken by construction companies to adopt BIM would surge BIM market growth

13.3.3.4 Italy

13.3.3.4.1 Implementation of decree BIM by government to fuel growth of BIM

13.3.3.5 Spain

13.3.3.5.1 Rising adoption of BIM to ensure effective collaboration among government, construction players, and BIM experts

13.3.3.6 Rest of Europe

13.3.4 APAC

FIGURE 57 APAC: SNAPSHOT OF BUILDING INFORMATION MODELING MARKET

TABLE 188 BUILDING INFORMATION MODELING MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 189 BUILDING INFORMATION MODELING MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 190 BUILDING INFORMATION MODELING MARKET IN APAC, BY OFFERING TYPE, 2017–2020 (USD MILLION)

TABLE 191 BUILDING INFORMATION MODELING MARKET IN APAC, BY OFFERING TYPE, 2021–2026 (USD MILLION)

TABLE 192 BUILDING INFORMATION MODELING MARKET IN APAC, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 193 BUILDING INFORMATION MODELING MARKET IN APAC, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 194 BUILDING INFORMATION MODELING MARKET IN APAC, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 195 BUILDING INFORMATION MODELING MARKET IN APAC, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.4.1 China

13.3.4.1.1 Rising investments in infrastructure to fuel growth of BIM in China

13.3.4.2 Japan

13.3.4.2.1 Adoption of digital technologies in infrastructure projects to drive BIM market in Japan

13.3.4.3 India

13.3.4.3.1 BIM to be adopted more in public projects in India

13.3.4.4 South Korea

13.3.4.4.1 Government mandates to use BIM for public domain projects to drive market

13.3.4.5 Rest of APAC

13.3.5 ROW

FIGURE 58 MIDDLE EAST & AFRICA TO DOMINATE BUILDING INFORMATION MODELING MARKET IN ROW DURING FORECAST PERIOD

TABLE 196 BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 197 BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 198 BUILDING INFORMATION MODELING MARKET IN ROW, BY OFFERING TYPE, 2017–2020 (USD MILLION)

TABLE 199 BUILDING INFORMATION MODELING MARKET IN ROW, BY OFFERING TYPE, 2021–2026 (USD MILLION)

TABLE 200 BUILDING INFORMATION MODELING MARKET IN ROW, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 201 BUILDING INFORMATION MODELING MARKET IN ROW, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 202 BUILDING INFORMATION MODELING MARKET IN ROW, BY SERVICE TYPE, 2017–2020 (USD MILLION)

TABLE 203 BUILDING INFORMATION MODELING MARKET IN ROW, BY SERVICE TYPE, 2021–2026 (USD MILLION)

13.3.5.1 Middle East and Africa

13.3.5.1.1 BIM market for oil & gas industry to grow at fastest rate in Middle East & Africa during forecast period

13.3.5.2 South America

13.3.5.2.1 Adoption of BIM in South America to be driven by AEC industry

14 APPENDIX (Page No. - 217)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

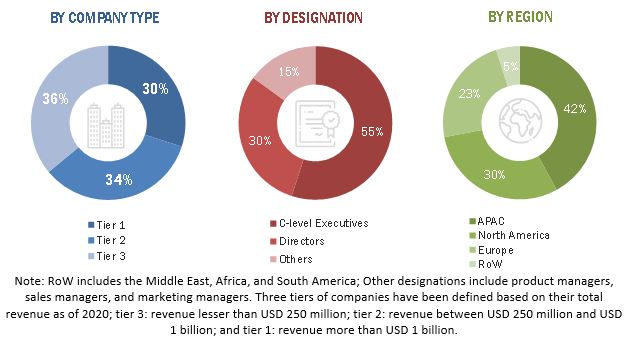

The study involved four major activities in estimating the current size of the total station market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the total station market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries, as well as total station market, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred total station providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from total station providers, such as Hexagon AB (Sweden), Trimble Inc. (US), Topcon Corporation (Japan), Suzhou FOIF Co. Ltd. (China), and STONEX Srl (Italy), research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

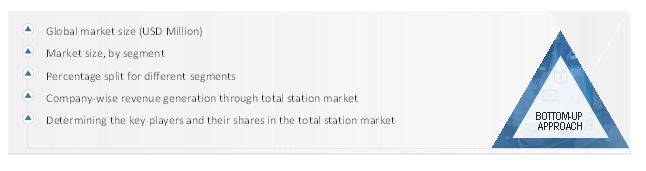

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the total station market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Total Station Market Size: Bottom-Up Approach

Data Triangulation:

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives:

- To define, describe and forecast the total station market, in terms of offering, type, and application.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of total station

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total station market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the total station.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the total station market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Market information of total station in some of the major countries in APAC and Europe

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Total Station Market