Portable Power Station Market by Technology (Lithium-ion, Sealed Lead Acid), Capacity (0-100, 100-200, 200-400, 400-1000, 1000-1500, >=1500 WH), Application (Emergency, Off-grid, Automotive), Power Source, Sales Channel, Region - Global Forecast to 2028

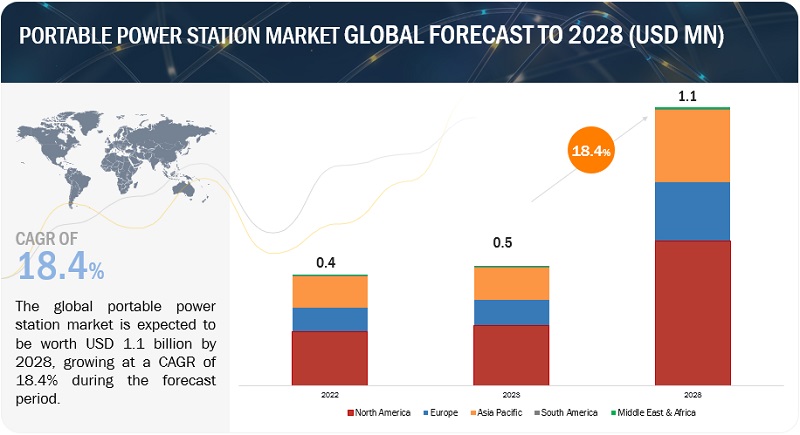

The global portable power station market size was estimated at USD 0.5 billion in 2023 and is projected to reach USD 1.1 billion by 2028, growing at a CAGR of 18.4% from 2023 to 2028. It is the millennial generation of campers, which is proficient in the use of the most advanced and recent technological gadgets and this has been the major factor that has led to a recent rush of portable power stations. The majority of people will be spending their leisure time in nature, which is a possibility to grow the market of portable charger stations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Portable Power Station Market Growth Dynamics

Driver: Increasing sales of smart electronic devices

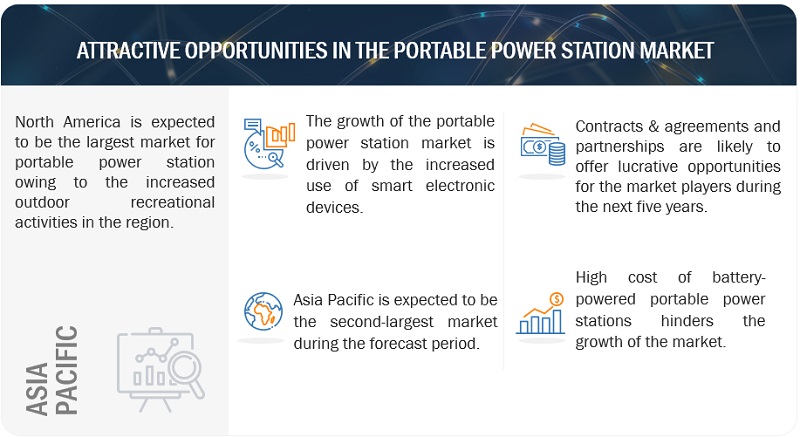

The assembly, manufacturing, design, and development of electronic components and equipment are carried out by organizations operating within the global electronics industry. The electronics industry stands out as one of the most innovative and rapidly evolving sectors. With fierce competition, companies continuously strive to introduce the latest technologies to the mobile power station market ahead of their competitors. The electronics manufacturing industry can be primarily categorized into four segments: consumer products, industrial products, government products, and electronic components. However, in recent years, there has been a notable emphasis on consumer products, which encompass a wide range of items such as alarm systems, home intercommunication systems, electronic ovens, personal computers, video game systems, radios, smartphones, DVD players, cell phones, and televisions. The consumer electronics market offers substantial growth opportunities, driven by increasing investments in applications like smart homes, smart cars, and smart cities. These applications necessitate uninterrupted consumer connectivity across platforms, thereby fueling the demand for the latest smart devices that facilitate seamless connectivity.

Restraint: Periodic battery replacements and maintenance of portable power stations

Common impediments are the frequent battery upkeep and the additional costs for buying new batteries, which make the portable power station market an unattractive market. The expense of new batteries and refurbishing old ones can make buying these products seem impractical, especially in the price-conscious markets. Besides, the need for regular maintenance can cause inconvenience for users. They have to allocate time and resources to ensure proper usage of the battery and, on top of cleaning and maybe procuring professional help for repair, they might monitor its performance. Also, However, batteries with relatively short lifespans are affecting the overall dependability and longevity of these power stations.

Opportunities: Capitalize on the energy transition and renewable integration

The energy transition and the integration of renewable sources of energy has turned out to be of immense benefits for the portable battery station market. Along with the extraction of more land and the increasing tendency towards green and more ecofriendly energy sources, green power plants are legally required to be the device that promotes energy savings and environmental performance. These power stations can draw power from solar, wind or other renewable sources to produce electricity, a great alternative to the traditional generators that use non-renewable energy. By doing so, portable power stations that can incorporate renewable energy are giving its users the chance to get a hold of non-polluting and sustainable energy, consequently, diminishing their carbon footprint and environmental effect. This is also in line with the current movement towards eco-friendly energy solutions which are driven by the increasing awareness and demand for environmentally friendly energy solutions.

Challenges: Low operational efficiency as compared to fossil fuel generators

Most of the times, the need for power supply becomes highly demanded and continuous. In such cases, the generators that use fossil fuels and produce a higher power output are the most suitable ones to be applied. On the contrary, typically, portable power stations have lower power capacities and in some situations, they need to be recharged or refueled before a second-time operation. As a result, this may become a difficulty for those cases that require a continuous power supply as well as those powered by high energy consumption of devices. Furthermore, the wave of followers of the ease of quickly refueling and using fossil fuel generators could also be seen in some cases.

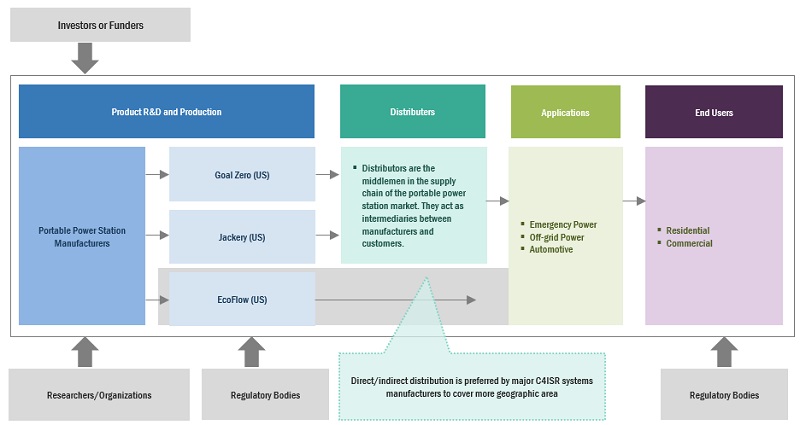

Portable Power Station Market Ecosystem

The portable power station market size is mainly dominated by well-financed manufacturers having many old-timers among them. These firms can do with the help of diverse product lines, cutting-edge technologies, and wide-reaching sales and marketing networks. Goal Zero, Jackery, Duracell, EcoFlow, Anker Innovation, and Lion Energy are the most prominent among all of them and are all credited to the US. Their dominance is undenied by their capability to invent and create quality power solutions, hence dismissing competition to the small few.

The 100–200 segment, by capacity, is expected to be the second-fastest growing market during the forecast period.

This report breaks the portable power station market into different segments based on capacity. The capacity segments are: 0−100 Wh, 100−200 Wh, 200−400 Wh, 400−1,000 Wh, 1,000−1,500, and 1,500 Wh and more. The 100-200 Wh portable power station is one of the portable power stations that are very useful in many outdoor activities such as camping, cottage, off-road and RV. The power stations can serve as a backup power source to charge different devices like mobile phones, small fans, laptops, radios, etc. The primary technology used in these portable power stations is lithium-ion, which is famous for its high energy density and lack of memory effect. They can be recharged using direct power(discovered in 2003) and solar power, which makes it easy for the user to choose how to charge it. The average cost for portable power stations of this category is around USD 200. These power stations, thanks to their fabulous capacity range, are able to charge tablets, drones and laptops multiple times and also smartphones up to 12 recharges.

By application, the emergency power segment is expected to be the second–fastest growing during the forecast period

This report segments the portable power station market based on application into three segments: emergency power, off-grid power, and automotive. The emergency power segment is expected to be the second–fastest growing segment during the forecast period. Portable power stations provide a reliable, independent source of electricity in case of emergencies such as natural disasters, power outages, or any other unexpected events. For such like events, access to the electricity is most valuable for communication, lighting, medical devices and operating other essential appliances. Portable power stations are the great way to charge equipment and sustain the functionality of necessary tools when they are a rather convenient solution, allowing the user to quickly restore power to their devices and provide basic functionality.

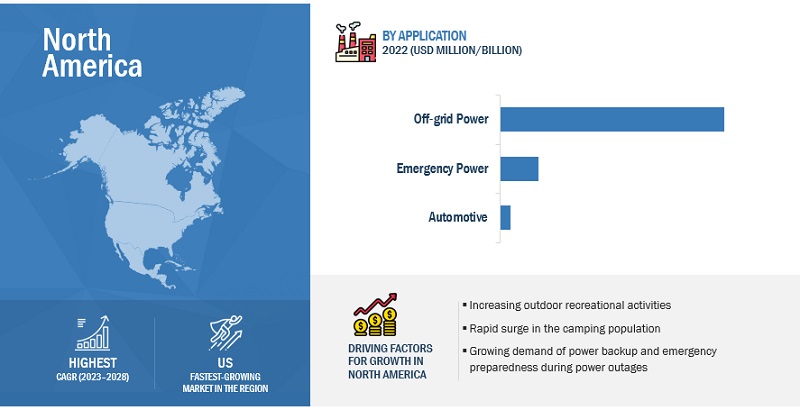

“North America”: The fastest in the portable power station market”

North America is expected to be the fastest growing region in the portable power station market between 2023–2028, followed by the Asia Pacific, Europe, and Middle East. The North American region witnessed an increase in camping population.

Key Market Players

There are only a few big players that dominate the portable power station industry, for the most part, on the regional level. They are such as Goal Zero (US), Jackery (US), Duracell (US), EcoFlow (US), Anker Innovation (US), and Lion Energy (US). Companies like Goal Zero (US), Jackery (US), ECARD (US), EcoFlow (US), Anker Innovations (US), and Lion Energy (US) have all gone into different strategies during 2018-2022 including contracts, agreements, partnerships, mergers, acquisitions, and expansions to boost their power market positions. As a part of their strategic activities, they have managed to secure their positions and keep on growing in the solar power station market that has exceeded the competition boundaries.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Billion) |

|

Segments Covered |

Technology, power source, sales channel, application, capacity and region |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, South America, Middle East and Africa. |

|

Companies Covered |

Goal Zero (US), Jackery (US), Lion Energy (US), EcoFlow (US), Anker Innovations (US), LIPOWER (China), iForway (China), ChargeTech (US), MIDLAND RADIO (US), Duracell Inc. (US), Drow Enterprise (China), Suaoki (China), Milwaukee Tool (US), ALLPOWERS Inc (China), Bluetti (US), Scott Electric Corporation (US), Oukitel (US), Rockpals (US), Aimtom (Canada), PowerOak (China). |

This research report categorizes the portable power station market by technology type, power source, sales channel, application, capacity and region.

On the basis of by technology type:

- Lithium-ion

- Sealed Lead-acid

On the basis of power source:

- Hybrid Power

- Direct Power

On the basis of sales channel:

- Online Sales

- Direct Sales

On the basis of application:

-

Emergency Power

- Residential

- Commercial

- Off-grid Power

- Automotive

On the basis of capacity:

- 0–100 Wh

- 100–200 Wh

- 200–400 Wh

- 400–1,000 Wh

- 1,000–1,500 Wh

- 1,500 Wh and above

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Lion Energy entered into an agreement with ABF. Under this agreement, ABF will supply Lion Energy with high-capacity prismatic cells with 50 and 300 Ah outputs, which will be used in a variety of Lion Energy solutions, including portable solar generators and power stations.

- In August 2022, Goal Zero partnered with Yeti Cycles, a leading manufacturer of high-performance mountain bikes. Goal Zero has integrated its portable solar panels and portable power banks into Yeti Cycles' bikes and accessories to provide a stable source of power for off-grid riding as part of this partnership.

- In 2021, Jackery and Toyota became’ partners to design a portable power station for the Toyota Prius Prime. The Jackery Explorer 500 Portable Power Station is a compact and portable power supply that can be hooked up to the Prius Prime's hybrid system. It is rechargeable through solar panels or a regular outlet and is capable of supplying a range of accessories, such as electronic cars.

- In November 2020, EcoFlow collaborated with SunPower to provide the EcoFlow - SunPower Energy bundle. This can be used to power small electronics and can be charged in 5 to 9 hours in direct sunlight.

Frequently Asked Questions (FAQ):

What is the market size of the portable power station market?

The portable power station market size is projected to grow from USD 0.5 billion in 2023 to USD 1.1 billion by 2028, at a CAGR of 18.4% during the forecast period.

What are the major drivers for the portable power station market?

Increasing need for uninterrupted power supply will be major drivers for the portable power station market.

Which is the largest region during the forecasted period in the portable power station market?

North America is expected to dominate the portable power station market between 2023–2028, followed by Asia Pacific and Europe. Increase recreational activities in recent years are driving the market for this region.

Which is the largest segment, by technology type during the forecasted period in the portable power station market?

During the entire forecast period, we are expecting the largest market in the lithium-ion section. Lithium-ion mobile power plants feature a high energy density that is the result of a substantial power amount stored in compact kits that are quite smaller and lighter thus making them best to be used in a place where space is an issue like for portable and on-the-go applications. Furthermore, they offer a longer lifespan, superior charging speeds, and stable power output over time compared to other battery technologies.

Which is the fastest segment, by sales channel during the forecasted period in the portable power station market?

The online sales segment is expected to be the fastest market during the forecast period. Online sales channels offer customers the advantage of accessing a wide selection of portable power stations from various brands, allowing them to easily compare features and prices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of smart electronic devices- Rising demand for uninterrupted and reliable power during power outages- Stringent emission regulationsRESTRAINTS- Periodic battery replacements and maintenance of battery-powered portable power stations- Long charging times for solar-powered portable power stationsOPPORTUNITIES- Increasing affordability with advancements in lithium-ion technology- Growing trend of capitalizing on energy transition and using renewables for power generationCHALLENGES- Lower operational efficiency compared with fossil fuel generators

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN PORTABLE POWER STATION MARKET

-

5.4 SUPPLY CHAIN ANALYSISRAW MATERIAL PROVIDERSASSEMBLERS/MANUFACTURERSDISTRIBUTORSEND USERS

- 5.5 MARKET MAP

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 TECHNOLOGY ANALYSISBATTERY TECHNOLOGYINVERTER TECHNOLOGYCHARGING TECHNOLOGYPOWER MANAGEMENT SYSTEMSOUTPUT PORTS AND CONNECTIVITYSAFETY AND PROTECTION MECHANISMSTECHNOLOGICAL ADVANCEMENTS

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.9 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 TRADE ANALYSISHS CODE 850760- Export scenario- Import scenario

-

5.12 INDICATIVE PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY CAPACITY

-

5.13 CASE STUDY ANALYSISGOAL ZERO’S PORTABLE POWER STATION SUCCESS IN IOT SPACE- Problem statement- Possible solution

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 LITHIUM-IONHIGHER ENERGY DENSITY OFFERED

-

6.3 SEALED LEAD-ACIDRELATIVELY STEADY DISCHARGE VOLTAGE PRODUCED

- 7.1 INTRODUCTION

-

7.2 0–100 WHCOST-EFFECTIVENESS, COMPACT SIZE, AND HIGH DEMAND IN RESIDENTIAL SECTOR

-

7.3 100–200 WHHIGHLY PREFERRED FOR CONNECTIVITY DURING CAMPING ACTIVITIES

-

7.4 200–400 WHUSED IN COMMUNICATION DEVICES IN RESIDENTIAL AND COMMERCIAL SECTORS

-

7.5 400–1,000 WHNEED FOR ADDITIONAL POWER CAPACITY AND CHARGING ELECTRONIC APPLIANCES WITH HIGH POWER REQUIREMENTS

-

7.6 1,000–1,500 WHGROWING NEED TO POWER SCIENTIFIC EXPEDITION EQUIPMENT AND RISING DEMAND TO PROVIDE POWER FOR LONGER TIME

-

7.7 1,500 WH AND ABOVENEED FOR POWER DURING GRID BLACKOUTS AND LONGER HOURS OF CHARGING

- 8.1 INTRODUCTION

-

8.2 EMERGENCY POWER GENERATIONRISING DEMAND FOR CONTINUOUS POWER DURING GRID OUTAGESRESIDENTIALCOMMERCIAL

-

8.3 OFF-GRID POWER GENERATIONGROWING OUTDOOR CAMPING ACTIVITIES

-

8.4 AUTOMOBILEASSISTANCE PROVIDED BY PORTABLE POWER STATIONS IN JUMP-STARTING VEHICLES

- 9.1 INTRODUCTION

-

9.2 HYBRID POWERNEED FOR CHARGING AT REMOTE LOCATIONS AND INCREASING OUTDOOR ACTIVITIES

-

9.3 DIRECT POWERPREVENTS SUPPLY INTERRUPTIONS AND SELF-DISCHARGE

- 10.1 INTRODUCTION

-

10.2 ONLINE SALESPROVIDES CONSUMERS WITH FULL SPECTRUM OF PRODUCTS

-

10.3 DIRECT SALESPROVIDES LIVE PRODUCT DEMONSTRATION TO CUSTOMERS

-

11.1 INTRODUCTIONRECESSION IMPACT: INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT: NORTH AMERICABY POWER SOURCEBY TECHNOLOGY TYPEBY APPLICATION- Emergency power, by sub-applicationBY CAPACITYBY SALES CHANNELBY COUNTRY- US- Canada- Mexico

-

11.3 ASIA PACIFICRECESSION IMPACT: ASIA PACIFICBY POWER SOURCEBY TECHNOLOGY TYPEBY APPLICATION- Emergency power, by sub-applicationBY CAPACITYBY SALES CHANNELBY COUNTRY- China- Australia- Japan- India- South Korea- Rest of Asia Pacific

-

11.4 EUROPERECESSION IMPACT: EUROPEBY POWER SOURCEBY TECHNOLOGY TYPEBY APPLICATION- Emergency power, by sub-applicationBY CAPACITYBY SALES CHANNELBY COUNTRY- Germany- France- UK- Italy- Rest of Europe

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACT: MIDDLE EAST & AFRICABY POWER SOURCEBY TECHNOLOGY TYPEBY APPLICATION- Emergency power, by sub-applicationBY CAPACITYBY SALES CHANNELBY COUNTRY- Saudi Arabia- UAE- South Africa- Rest of Middle East & Africa

-

11.6 SOUTH AMERICARECESSION IMPACT: SOUTH AMERICABY POWER SOURCEBY TECHNOLOGY TYPEBY APPLICATION- Emergency power, by sub-applicationBY CAPACITYBY SALES CHANNELBY COUNTRY- Brazil- Argentina- Rest of South America

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 MARKET EVALUATION FRAMEWORK

-

12.4 COMPETITIVE SCENARIO AND TRENDSDEALSPRODUCT LAUNCHESOTHERS

-

12.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 MARKET: COMPANY FOOTPRINT

-

12.7 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE BENCHMARKING

-

13.1 KEY PLAYERSGOAL ZERO- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewJACKERY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLION ENERGY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewECOFLOW- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewANKER INNOVATIONS- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLIPOWER- Business overview- Products/Services/Solutions offered- Recent developmentsIFORWAY- Business overview- Products/Services/Solutions offered- Recent developmentsCHARGETECH- Business overview- Products/Services/Solutions offered- Recent developmentsMIDLAND RADIO- Business overview- Products/Services/Solutions offered- Recent developmentsDURACELL INC.- Business overview- Products/Services/Solutions offered- Recent developmentsDROW ENTERPRISE- Business overview- Products/Services/Solutions offered- Recent developmentsSUAOKI- Business overview- Products/Services/Solutions offered- Recent developmentsMILWAUKEE TOOL- Business overview- Products/Services/Solutions offered- Recent developmentsALLPOWERS INC- Business overview- Products/Services/Solutions offered- Recent developmentsBLUETTI- Business overview- Products/Services/Solutions offered- Recent developmentsSCOTT ELECTRIC CORPORATION- Business overview- Products/Services/Solutions offered

-

13.2 OTHER PLAYERSOUKITELROCKPALSAIMTOMIMUTOPOWEROAK

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 PORTABLE POWER STATION MARKET SNAPSHOT

- TABLE 2 AVERAGE COST OF PORTABLE POWER STATIONS AND GENERATORS

- TABLE 3 AVERAGE CHARGING TIMES OF BATTERY-POWERED PORTABLE POWER STATIONS

- TABLE 4 MARKET: ECOSYSTEM ANALYSIS

- TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 PORTABLE POWER STATION: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2016–NOVEMBER 2022

- TABLE 7 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 8 EXPORT SCENARIO FOR HS CODE 850760, BY COUNTRY, 2019–2021 (USD)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 850760, BY COUNTRY, 2019–2021 (USD)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 12 MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 13 PORTABLE POWER STATION MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 14 LITHIUM-ION: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 15 LITHIUM-ION: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 16 SEALED LEAD-ACID: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 17 SEALED LEAD-ACID: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 18 MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 19 PORTABLE POWER STATION MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 20 0–100 WH: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 21 0–100 WH: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 22 100–200 WH: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 23 100–200 WH: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 24 200–400 WH: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 25 200–400 WH: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 26 400–1,000 WH: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 27 400–1,000 WH: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 28 1,000–1,500 WH: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 29 1,000–1,500 WH: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 30 1,500 WH AND ABOVE: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 31 1,500 WH AND ABOVE: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 32 PORTABLE POWER STATIONS MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 33 PORTABLE POWER STATION MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 34 EMERGENCY POWER: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 35 EMERGENCY POWER: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 36 RESIDENTIAL: EMERGENCY PORTABLE POWER MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 37 RESIDENTIAL: EMERGENCY PORTABLE POWER MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 38 COMMERCIAL: EMERGENCY POWER STATION MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 39 COMMERCIAL: EMERGENCY POWER STATION MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 40 OFF-GRID POWER GENERATION: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 41 OFF-GRID POWER GENERATION: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 42 AUTOMOBILE: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 43 AUTOMOBILE: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 44 MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 45 PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 46 HYBRID POWER: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 47 HYBRID POWER: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 48 DIRECT POWER: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 49 DIRECT POWER: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 50 MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 51 PORTABLE POWER STATION MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 52 ONLINE SALES: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 53 ONLINE SALES: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 54 DIRECT SALES: MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 55 DIRECT SALES: MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 56 MARKET, BY REGION, 2019–2022 (USD THOUSAND)

- TABLE 57 PORTABLE POWER STATION MARKET, BY REGION, 2023–2028 (USD THOUSAND)

- TABLE 58 NORTH AMERICA: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 59 NORTH AMERICA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 60 NORTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 61 MARKET IN NORTH AMERICA, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 63 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 64 NORTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 65 NORTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION 2023–2028 (USD THOUSAND)

- TABLE 66 NORTH AMERICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 67 NORTH AMERICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 68 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 69 NORTH AMERICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 71 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 72 US: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 73 US: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 74 US: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 75 US: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 76 US: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 77 US: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 78 US: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 79 US: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 80 US: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 81 US: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 82 US: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 83 US: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 84 CANADA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 85 CANADA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 86 CANADA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 87 CANADA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 88 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 89 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 90 CANADA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 91 CANADA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 92 CANADA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 93 CANADA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 94 CANADA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 95 CANADA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 96 MEXICO: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 97 MEXICO: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 98 MEXICO: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 99 MEXICO: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 100 MEXICO: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 101 MEXICO: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 102 MEXICO: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 103 MEXICO: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 104 MEXICO: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 105 MEXICO: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 106 MEXICO: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 107 MEXICO: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 108 ASIA PACIFIC: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 109 ASIA PACIFIC: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 110 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 111 ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 112 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 113 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 114 ASIA PACIFIC: EMERGENCY POWER GENERATIONMARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 115 ASIA PACIFIC: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 116 ASIA PACIFIC: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 117 ASIA PACIFIC: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 118 ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 119 MARKET IN ASIA PACIFIC, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 122 CHINA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 123 CHINA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 124 CHINA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 125 CHINA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 126 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 127 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 128 CHINA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 129 CHINA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 130 CHINA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 131 CHINA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 132 CHINA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 133 CHINA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 134 AUSTRALIA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 135 AUSTRALIA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 136 AUSTRALIA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 137 AUSTRALIA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 138 AUSTRALIA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 139 AUSTRALIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 140 AUSTRALIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 141 AUSTRALIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 142 AUSTRALIA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 143 AUSTRALIA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 144 AUSTRALIA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 145 AUSTRALIA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 146 JAPAN: PORTABLE POWER STATIONS MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 147 JAPAN: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 148 JAPAN: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 149 JAPAN: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 150 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 151 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 152 JAPAN: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 153 JAPAN: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 154 JAPAN: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 155 JAPAN: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 156 JAPAN: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 157 JAPAN: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 158 INDIA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 159 INDIA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 160 INDIA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 161 INDIA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 162 INDIA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 163 INDIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 164 INDIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 165 INDIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 166 INDIA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 167 INDIA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 168 INDIA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 169 INDIA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 170 SOUTH KOREA: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 171 SOUTH KOREA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 172 SOUTH KOREA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 173 SOUTH KOREA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 174 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 175 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 176 SOUTH KOREA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 177 SOUTH KOREA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 178 SOUTH KOREA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 179 SOUTH KOREA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 180 SOUTH KOREA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 181 SOUTH KOREA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 182 REST OF ASIA PACIFIC: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 183 REST OF ASIA PACIFIC: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 184 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 185 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 186 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 187 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 188 REST OF ASIA PACIFIC: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 189 REST OF ASIA PACIFIC: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 190 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 191 REST OF ASIA PACIFIC: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 192 REST OF ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 193 REST OF ASIA PACIFIC: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 194 EUROPE: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 195 EUROPE: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 196 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 197 EUROPE: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 198 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 199 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 200 EUROPE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 201 EUROPE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 202 EUROPE: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 203 EUROPE: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 204 EUROPE: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 205 EUROPE: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 206 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 207 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 208 GERMANY: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 209 GERMANY: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 210 GERMANY: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 211 GERMANY: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 212 GERMANY: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 213 GERMANY: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 214 GERMANY: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 215 GERMANY: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 216 GERMANY: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 217 GERMANY: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 218 GERMANY: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 219 GERMANY: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 220 FRANCE: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 221 FRANCE: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 222 FRANCE: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 223 FRANCE: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 224 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 225 FRANCE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 226 FRANCE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 227 FRANCE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 228 FRANCE: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 229 FRANCE: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 230 FRANCE: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 231 FRANCE: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 232 UK: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 233 UK: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 234 UK: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 235 UK: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 236 UK: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 237 UK: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 238 UK: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 239 UK: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 240 UK: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 241 UK: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 242 UK: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 243 UK: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 244 ITALY: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 245 ITALY: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 246 ITALY: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 247 ITALY: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 248 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 249 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 250 ITALY: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 251 ITALY: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 252 ITALY: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 253 ITALY: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 254 ITALY: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 255 ITALY: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 256 REST OF EUROPE: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 257 REST OF EUROPE: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 258 REST OF EUROPE: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 259 REST OF EUROPE: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 260 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 261 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 262 REST OF EUROPE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 263 REST OF EUROPE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 264 REST OF EUROPE: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 265 REST OF EUROPE: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 266 REST OF EUROPE: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 267 REST OF EUROPE: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 268 MIDDLE EAST & AFRICA: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 269 MIDDLE EAST & AFRICA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 270 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 271 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 272 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 273 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 274 MIDDLE EAST & AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 275 MIDDLE EAST & AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 276 MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 277 MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 278 MIDDLE EAST & AFRICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 279 MIDDLE EAST & AFRICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 280 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 281 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 282 SAUDI ARABIA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 283 SAUDI ARABIA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 284 SAUDI ARABIA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 285 SAUDI ARABIA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 286 SAUDI ARABIA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 287 SAUDI ARABIA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 288 SAUDI ARABIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 289 SAUDI ARABIA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 290 SAUDI ARABIA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 291 SAUDI ARABIA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 292 SAUDI ARABIA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 293 SAUDI ARABIA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 294 UAE: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 295 UAE: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 296 UAE: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 297 UAE: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 298 UAE: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 299 UAE: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 300 UAE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 301 UAE: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 302 UAE: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 303 UAE: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 304 UAE: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 305 UAE: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 306 SOUTH AFRICA: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 307 SOUTH AFRICA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 308 SOUTH AFRICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 309 SOUTH AFRICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 310 SOUTH AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 311 SOUTH AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 312 SOUTH AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 313 SOUTH AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 314 SOUTH AFRICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 315 SOUTH AFRICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 316 SOUTH AFRICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 317 SOUTH AFRICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 320 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 321 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 322 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 323 REST OF MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 324 REST OF MIDDLE EAST & AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 325 REST OF MIDDLE EAST & AFRICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 326 REST OF MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 327 REST OF MIDDLE EAST & AFRICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 328 REST OF MIDDLE EAST & AFRICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 329 REST OF MIDDLE EAST & AFRICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 330 MARKET IN SOUTH AMERICA, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 331 SOUTH AMERICA: PORTABLE POWER STATION MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 332 SOUTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 333 SOUTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 334 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 335 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 336 SOUTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 337 SOUTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 338 SOUTH AMERICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 339 SOUTH AMERICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 340 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 341 SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 342 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD THOUSAND)

- TABLE 343 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD THOUSAND)

- TABLE 344 BRAZIL: PORTABLE POWER STATIONS MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 345 BRAZIL: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 346 BRAZIL: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 347 BRAZIL: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 348 BRAZIL: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 349 BRAZIL: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 350 BRAZIL: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 351 BRAZIL: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 352 BRAZIL: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 353 BRAZIL: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 354 BRAZIL: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 355 BRAZIL: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 356 ARGENTINA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 357 ARGENTINA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 358 ARGENTINA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 359 ARGENTINA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 360 ARGENTINA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 361 ARGENTINA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 362 ARGENTINA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 363 ARGENTINA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 364 ARGENTINA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 365 ARGENTINA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 366 ARGENTINA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 367 ARGENTINA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 368 REST OF SOUTH AMERICA: MARKET, BY POWER SOURCE, 2019–2022 (USD THOUSAND)

- TABLE 369 REST OF SOUTH AMERICA: MARKET, BY POWER SOURCE, 2023–2028 (USD THOUSAND)

- TABLE 370 REST OF SOUTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2019–2022 (USD THOUSAND)

- TABLE 371 REST OF SOUTH AMERICA: MARKET, BY TECHNOLOGY TYPE, 2023–2028 (USD THOUSAND)

- TABLE 372 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 373 REST OF SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 374 REST OF SOUTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2019–2022 (USD THOUSAND)

- TABLE 375 REST OF SOUTH AMERICA: EMERGENCY POWER GENERATION MARKET, BY SUB-APPLICATION, 2023–2028 (USD THOUSAND)

- TABLE 376 REST OF SOUTH AMERICA: MARKET, BY CAPACITY, 2019–2022 (USD THOUSAND)

- TABLE 377 REST OF SOUTH AMERICA: MARKET, BY CAPACITY, 2023–2028 (USD THOUSAND)

- TABLE 378 REST OF SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2019–2022 (USD THOUSAND)

- TABLE 379 REST OF SOUTH AMERICA: MARKET, BY SALES CHANNEL, 2023–2028 (USD THOUSAND)

- TABLE 380 KEY DEVELOPMENTS IN MARKET, 2019–2023

- TABLE 381 MARKET EVALUATION FRAMEWORK, 2019–2023

- TABLE 382 PORTABLE POWER STATION MARKET: DEALS, 2019–2023

- TABLE 383 MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 384 MARKET: OTHERS, 2019–2023

- TABLE 385 CAPACITY: COMPANY FOOTPRINT

- TABLE 386 TECHNOLOGY TYPE: COMPANY FOOTPRINT

- TABLE 387 SALES CHANNEL: COMPANY FOOTPRINT

- TABLE 388 APPLICATION: COMPANY FOOTPRINT

- TABLE 389 POWER SOURCE: COMPANY FOOTPRINT

- TABLE 390 REGION: COMPANY FOOTPRINT

- TABLE 391 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 392 CAPACITY: STARTUP FOOTPRINT

- TABLE 393 TECHNOLOGY TYPE: STARTUP FOOTPRINT

- TABLE 394 SALES CHANNEL: STARTUP FOOTPRINT

- TABLE 395 APPLICATION: STARTUP FOOTPRINT

- TABLE 396 REGION: STARTUP FOOTPRINT

- TABLE 397 GOAL ZERO: COMPANY OVERVIEW

- TABLE 398 GOAL ZERO: PRODUCT LAUNCHES

- TABLE 399 GOAL ZERO: DEALS

- TABLE 400 JACKERY: COMPANY OVERVIEW

- TABLE 401 JACKERY: PRODUCT LAUNCHES

- TABLE 402 JACKERY: DEALS

- TABLE 403 LION ENERGY: COMPANY OVERVIEW

- TABLE 404 LION ENERGY: PRODUCT LAUNCHES

- TABLE 405 LION ENERGY: DEALS

- TABLE 406 ECOFLOW: COMPANY OVERVIEW

- TABLE 407 ECOFLOW: PRODUCT LAUNCHES

- TABLE 408 ECOFLOW: DEALS

- TABLE 409 ECOFLOW: OTHERS

- TABLE 410 ANKER INNOVATIONS: COMPANY OVERVIEW

- TABLE 411 ANKER INNOVATIONS: PRODUCT LAUNCHES

- TABLE 412 ANKER INNOVATIONS: DEALS

- TABLE 413 LIPOWER: COMPANY OVERVIEW

- TABLE 414 LIPOWER: PRODUCT LAUNCHES

- TABLE 415 IFORWAY: COMPANY OVERVIEW

- TABLE 416 IFORWAY: PRODUCT LAUNCHES

- TABLE 417 IFORWAY: DEALS

- TABLE 418 CHARGETECH: COMPANY OVERVIEW

- TABLE 419 CHARGETECH: PRODUCT LAUNCHES

- TABLE 420 MIDLAND RADIO: COMPANY OVERVIEW

- TABLE 421 MIDLAND RADIO: PRODUCT LAUNCHES

- TABLE 422 DURACELL INC.: COMPANY OVERVIEW

- TABLE 423 DURACELL INC.: PRODUCT LAUNCHES

- TABLE 424 DROW ENTERPRISE: COMPANY OVERVIEW

- TABLE 425 DROW ENTERPRISE: PRODUCT LAUNCHES

- TABLE 426 SUAOKI: COMPANY OVERVIEW

- TABLE 427 SUAOKI: PRODUCT LAUNCHES

- TABLE 428 MILWAUKEE TOOL: COMPANY OVERVIEW

- TABLE 429 MILWAUKEE TOOL: PRODUCT LAUNCHES

- TABLE 430 MILWAUKEE TOOL: DEALS

- TABLE 431 ALLPOWERS INC: COMPANY OVERVIEW

- TABLE 432 ALLPOWERS INC: PRODUCT LAUNCHES

- TABLE 433 BLUETTI: COMPANY OVERVIEW

- TABLE 434 BLUETTI: PRODUCT LAUNCHES

- TABLE 435 SCOTT ELECTRIC: COMPANY OVERVIEW

- FIGURE 1 PORTABLE POWER STATION MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET: TOP-DOWN APPROACH

- FIGURE 6 METRICS CONSIDERED TO ANALYZE DEMAND FOR PORTABLE POWER STATIONS

- FIGURE 7 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF PORTABLE POWER STATIONS

- FIGURE 8 PORTABLE POWER STATION MARKET SHARE ANALYSIS

- FIGURE 9 LITHIUM-ION SEGMENT TO HOLD LARGER SHARE OF PORTABLE POWER MARKET DURING FORECAST PERIOD

- FIGURE 10 OFF-GRID POWER GENERATION SEGMENT TO LEAD PORTABLE POWER STATIONS MARKET DURING FORECAST PERIOD

- FIGURE 11 ONLINE SALES SEGMENT TO DOMINATE PORTABLE POWER STATIONS MARKET DURING FORECAST PERIOD

- FIGURE 12 400–1,000 WH SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 HYBRID POWER SEGMENT TO DOMINATE PORTABLE POWER STATIONS MARKET DURING FORECAST PERIOD

- FIGURE 14 NORTH AMERICA DOMINATED MARKET IN 2022

- FIGURE 15 GROWING USE OF ELECTRONIC DEVICES AND NEED FOR CONNECTIVITY

- FIGURE 16 NORTH AMERICAN MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 LITHIUM-ION SEGMENT TO DOMINATE PORTABLE POWER STATIONS MARKET IN 2028

- FIGURE 18 OFF-GRID POWER GENERATION SEGMENT TO DOMINATE PORTABLE POWER MARKET IN 2028

- FIGURE 19 ONLINE SALES SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 20 HYBRID POWER SEGMENT TO HOLD LARGER SHARE OF PORTABLE POWER STATIONS MARKET IN 2028

- FIGURE 21 400-1,000 WH SEGMENT TO HOLD LARGEST SHARE OF MARKET IN 2028

- FIGURE 22 OFF-GRID POWER GENERATION SEGMENT AND US DOMINATED NORTH AMERICAN PORTABLE POWER STATIONS MARKET IN 2022

- FIGURE 23 PORTABLE POWER STATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 REVENUE SHIFT FOR MARKET PLAYERS

- FIGURE 25 MARKET SUPPLY CHAIN ANALYSIS

- FIGURE 26 MARKET MAP

- FIGURE 27 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 EXPORT DATA FOR TOP 5 COUNTRIES, 2019–2021 (USD)

- FIGURE 29 IMPORT DATA FOR TOP 5 COUNTRIES, 2019–2021 (USD)

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 32 PORTABLE POWER STATION MARKET, BY TECHNOLOGY TYPE, 2022

- FIGURE 33 MARKET, BY CAPACITY, 2022

- FIGURE 34 MARKET, BY APPLICATION, 2022

- FIGURE 35 MARKET, BY POWER SOURCE, 2022

- FIGURE 36 MARKET, BY SALES CHANNEL, 2022

- FIGURE 37 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2022

- FIGURE 38 PORTABLE POWER STATIONS MARKET, BY REGION, 2022

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 41 PORTABLE POWER STATION MARKET SHARE ANALYSIS, 2022

- FIGURE 42 MARKET: COMPANY EVALUATION QUADRANT (GLOBAL), 2022

- FIGURE 43 MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

The study involved major activities in estimating the current size of the market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete portable power station market size. Thereafter, market breakdown and data triangulation were used to estimate the portable power station market size of the segments and subsegments.

Secondary Research

This research study on the market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, IMF, Kampgrounds of America, World Tourism Organization, US Bureau of Economic Analysis, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

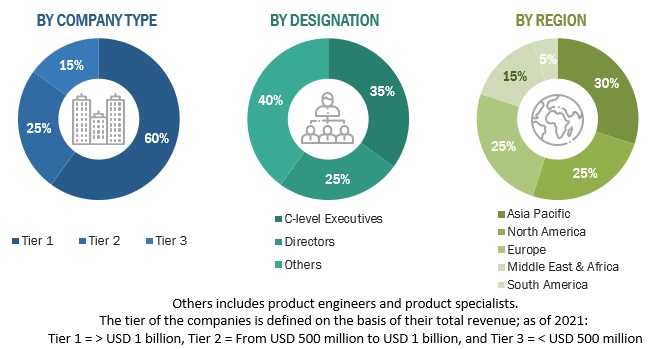

The market comprises several stakeholders such as portable power station manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for portable power station in, generation, transmission, and distribution application. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

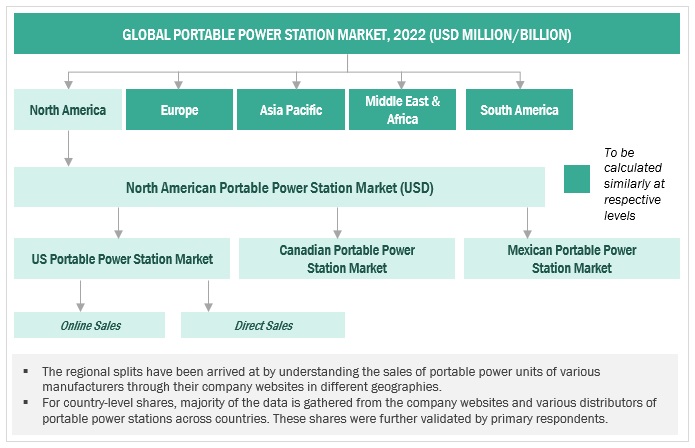

Portable Power Station Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the power station market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the portable power station market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their portable power station market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Portable Power Station Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall portable power station market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

A portable power station is a compact and mobile device that is utilized to generate electrical power in various environments. It is equipped with a rechargeable battery and multiple power outlets, including USB ports, AC outlets, and DC outputs. These power stations are designed to charge and operate a wide range of electronic devices such as smartphones, tablets, laptops, and appliances like fans, mini coolers, and electric blankets.

The market growth is being driven by the increasing use of smart electronic devices, the growing demand for uninterrupted and reliable power, and the implementation of stringent emission regulations for the off-grid power sector.

Key Stakeholders

- Camping associations

- Consulting companies in the energy and power sector

- Distributors of portable power stations

- Governments and research organizations

- Power equipment and garden tool manufacturers

- Portable power station manufacturers

- Spare parts and component suppliers

Objectives of the Study

- To define, describe, segment, and forecast the portable power station market size, by power source, technology type, capacity, application, and sales channel, in terms of value

- To forecast the market size across five key regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with the country-level market sizes, in terms of value

- To provide detailed information about the key drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the power station market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To provide information pertaining to the supply chain, trends/disruptions impacting customer business, market map, pricing of portable power stations, and regulatory landscape pertaining to the market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contributions to the overall market

- To analyze opportunities for stakeholders in the market and draw a competitive landscape for market players

- To benchmark players within the market using the company evaluation quadrant, which analyzes market players on various parameters within the broad categories of business and product strategies

- To compare key market players with respect to the market share, product specifications, and applications

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

- To track and analyze competitive developments in the market, such as sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Portable Power Station Market

Portable power stations are rechargeable, battery-powered DC to AC inverters that are used for powering electrical equipment. They are equipped with an AC outlet, a DC carport, and USB charging ports for charging equipment such as smartphones, tablets, laptops, and appliances, including fans, mini coolers, electric blankets, etc. Lithium-ion and sealed lead acid are the key battery technologies used in portable power stations. This report covers the latest industry trends, country level growth factors, market development insights and quantifies the market size and growth forecast at a regional and country level, furthe broken-down by each type ofPower Source, each Technology Type, by each Power capacity, by each industry applications and by sales channels, such as online sales and direct sales. Market share analysis of key players for the year 2020, including their revenue analysis for last three years, product and business revenues, key financial analysis, organic and in-organic growth strategies, contract awarded & details of the contracts, key investments and expansions plans and all other key development including SWOT analysis will be provided for all global and regional players.

Need to know more about the Portable Power Station Market size and scope in asia pacific for the forecast year.