HVDC Converter Station Market by Configuration (Monopolar, Bi-Polar, Back-to-Back, Multi-Terminal), Technology (LCC, VSC), Component (Valve, Converter Transformer, Harmonic Filter, Reactor), Power Rating, and Region - Global Forecast to 2022

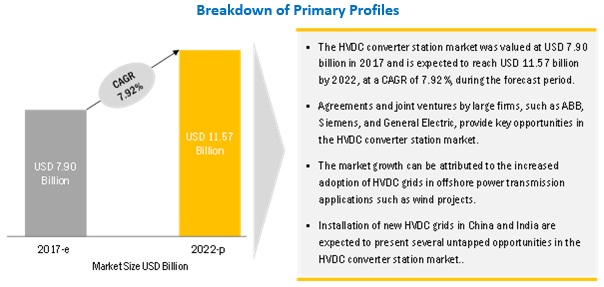

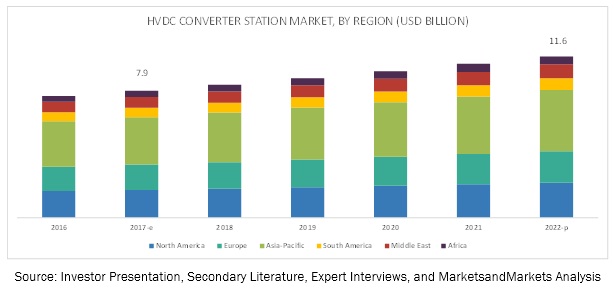

[139 Pages Report] The HVDC converter station market was valued at USD 7.31 billion in 2016 and is expected to grow at a CAGR of 7.92% to reach USD 11.57 billion by 2022. HVDC converter stations are specialized substations that form the terminal equipment for high voltage direct current transmission lines. They convert direct current to alternating current and vice versa. HVDC converter stations are economically beneficial for transferring bulk power over long distances as they lead to low power losses and lesser environmental impact as compared to HVAC converter stations.

By power rating, the >2,000 MW segment is expected to grow at the highest CAGR during the forecast period

The >2000 MW power rating segment is likely to grow at the highest CAGR, from 2017 to 2022. The >2000 MW segment had the largest market share in 2016 and the trend is projected to continue till 2022.

The >2000 MW segment is driven by the development of the power transmission capacity of valves, because of which major economies such as India and China have led to a high demand for HVDC converter stations. Moreover, the European Union targets for power generation through renewable resources have created an increasing demand for connecting renewable power sources to the grid, which is further expected to drive the demand for HVDC converter stations in Europe.

By technology, LCC segment is expected to hold the largest share of the HVDC converter station market during the forecast period

The LCC segment is expected to lead the HVDC converter station market, by technology from 2017 to 2022. The development of thyristor valves in the recent years have provided an edge for HVDC converter stations to transfer bulk power over long distances. Due to this, the LCC technology finds application in UHVDC projects proposed in major economies in Asia Pacific for bulk power transport.

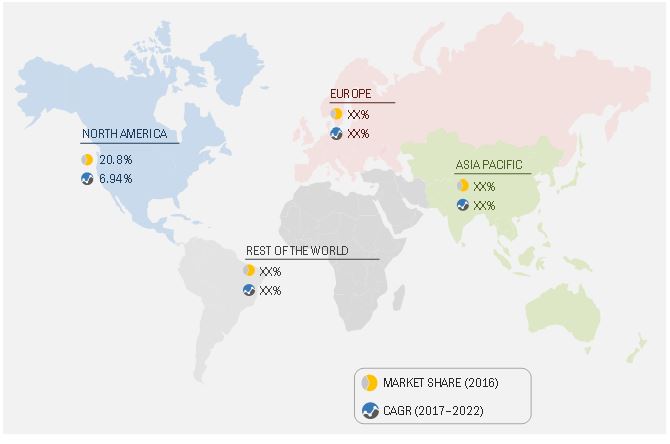

Asia Pacific to account for the largest market size during the forecast period.

The market in Europe is currently the largest market for HVDC converter stations, followed by Asia Pacific. The market in Asia Pacific is primarily driven by China and India as these are the major economies in the region which have a huge demand for efficient power transmission systems. Asia Pacific has the largest installation of HVDC converter stations in the world owing to the requirement of bulk power transport. Moreover, China has a number of regional players as NR Electric and C-EPRI, among others in the HVDC converter station market to meet the requirement of its large UHVDC projects. China is planning to connect different power grids to a central line, driving the market for HVDC converter stations.

Market Dynamics

Driver: Increasing demand for cost-effective solutions for long distance power transmission

The stability of power systems in long-distance transmission has always been the main concern. It has been observed that the interruption caused by power failure results in economic losses and disrupts the life of the consumers. Owing to its various technological advancements, the HVDC technology is increasingly being used for transmitting more power over long distances. One such technological advancement is the development of converters, which has enhanced the reliability of transmission grids.

Most of the top HVDC converter station providers, such as ABB and Siemens, prefer HVDC instead of HVAC for their sources to transmit power. Following are some of the factors, which have been considered:

- Investment cost: HVDC transmission lines cost lesser than HVAC lines for the same transmission capacity. However, the terminal stations in case of HVDC are more expensive since they perform AC to DC conversion and vice versa. Moreover, the transmission medium (such as overhead lines and cables) and operation and maintenance costs are lesser in the case of HVDC.

- Lesser losses: The losses that occur by the application of HVDC transmission lines are negligible, as the losses in converter stations are only about 0.6% of the transmitted power compared to the HVAC lines. Moreover, HVDC cables witness lesser losses than HVAC cables.

- Environment: Unlike HVAC systems, HVDC systems are highly compatible with any environment and could be integrated into the environment without compromising on any critical environmental issues as it requires fewer overhead lines in comparison to HVAC systems to deliver the same amount of power. Furthermore, HVDC interconnections enable power systems to use generating plants more efficiently, for example substituting thermal generation with available hydropower resources

Restraint: Lengthy approval processes for transmission projects affect the growth of the HVDC substation

Transmission from several neighboring grids sometimes requires the approval of the government or local authority in order to check the standards of the converter station. Sometimes this reviewing and approval process takes time, which eventually affects the transmission of electricity and working of the converter station. As a result, it affects power generation at some places with the consequence being the lack of electricity. Thus, this standard procedure sometimes creates unnecessary problems for the HVDC market as well as for end-users. For instance, Plains and Eastern Clean Line project in the US took almost seven years of reviews, community meetings, and regulatory approvals from multiple agencies, including DOE and the Tennessee Regulatory Authority. The project is expected to be completed in 2020.

Opportunity: Favorable government policies bring opportunities for growth in offshore wind transmission projects

The growth of the offshore wind sector is expected to be driven largely by favorable government policies implemented by EUROPA, the Global Wind Energy Council (GWEC), and PGCIL. There is an increasing demand from grid operators for a new transmission corridor in India, especially in the context of renewable energy sources. Therefore, in this context, the government has put emphasis on regeneration and has nominated PGCIL to develop an environmentally friendly source for generating electricity from solar and wind power projects. High investments by market leaders, including ABB and Siemens, have led to the set-up of offshore HVDC power transmission systems in countries such as Norway, Italy, and the Netherlands.

For instance, in October 2016, ABB partnered with Aibel to deliver offshore wind integration solutions. As per this partnership, ABB provided its HVDC technology, whereas Aibel delivered turnkey engineering, procurement, and construction services for offshore platforms.

Moreover, several other countries are looking for renewable sources of power generation, due to which the demand for HVDC transmission systems to connect renewable power to the grids and transfer it over long distances to load centers is expected to increase, which in turn is expected to drive the demand for HVDC converter stations. The major advantages of HVDC transmission systems include increased energy efficiency, reduced transmission losses, less use of land, and flexibility to change the direction of power flow, which is expected to help in network integration for connecting the renewable energy such as wind, solar, and other sources beyond the national boundaries.

Challenge: Maintaining uniformity in the standards of HVDC transmission equipment and systems

Often the standard of HVDC transmission equipment and systems does not match the national standards, which is required to be customized accordingly. This adds up to the cost of the systems, which is eventually passed on to the end-users. A standard is required to attract the suppliers and broaden the range of options available, which ultimately leads to the lowering of the cost of the systems for the end-users. Some of the challenges with HVDC systems are as follows: AC systems and technologies have good interoperability and various pieces of hardware from different vendors can be integrated. This is not the case with DC systems where all hardware needs to be from the same manufacturer. Further, power devices in converter station have limited availability and are only accessible through large©\device manufacturers and are costly. Therefore standardization is required in HVDC, as it could improve interoperability and reduce costs in the near©\term and into the future, especially when considering maintenance and turnover.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016¨C2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017¨C2022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Technology, Components, Power Rating, Configuration And Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest Of The World |

|

Companies covered |

Siemens, ABB, General Electric, Mitsubishi, Toshiba, NR Electric, C-EPRI, china Xian XD power system, C-EPRi Power engineering company, XJ Electric, HYOSUNG, LSIS, and BHEL. |

The research report categorizes the HVDC converter station Market to forecast the revenues and analyze the trends in each of the following sub-segments:

HVDC converter station Market By Technology

- LCC:

- VSC:

HVDC converter station Market By Components

- Valve

- Converter Transformer

- Circuit Breakers

- Harmonic Filters

- Surge Arresters

- Reactors

- Others

HVDC converter station Market By Power Rating

- Below 500

- >500-1000

- >1000-1500

- >1500-2000

- >2000

HVDC converter station Market By Configuration

- Bi-Polar

- Monopolar

- Back-to-back

- Multi Terminal

HVDC converter station Market By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Key Market Players

Siemens, ABB, General Electric, Mitsubishi, Toshiba, NR Electric, C-EPRI, china Xian XD power system, C-EPRi Power engineering company, XJ Electric, HYOSUNG, LSIS, and BHEL..

ABB was founded in 1988 and is headquartered in Switzerland. The company is among the leading manufacturers of HVDC converter stations. ABB operates in more than 100 countries through a wide network of distributors and dealers. The company operates through its electrification products, discrete motion and automation, process automation, and power grid segments. It offers HVDC converter stations through its power grid business unit. ABB has entered into partnerships with companies such as Hitachi in Japan and BHEL in India, along with other regional companies to cater to clients across the globe. In February 2017 ABB was awarded a contract by Power Grid Corporation for a turnkey UHVDC project for approximately USD 640 million. The scope of the project includes designing, engineering, supply, installation, and commissioning, as well as providing major equipment, including transformers, converter valves, cooling systems, and the control and protection technology.

Recent Developments

- In October 2017, ABB received a contract from National Grid to design, manufacture, and install the new 400 kV Shurton substation. It will feature ABB¡¯s gas insulated switchgear, gas insulated busbars, and advanced digital control, protection, and telecommunications systems based on ABB¡¯s Ability platform.

- In February 2017, ABB was awarded a contract by Power Grid Corporation for a turnkey UHVDC project. The scope of the project includes designing, engineering, supply, installation, and commissioning, as well as providing major equipment, including transformers, converter valves, cooling systems, and control and protection technology.

- In December 2015, ABB and Hitachi formed a joint venture called Hitachi ABB HVDC Technologies, Ltd. for high-voltage direct current transmission in Japan. Hitachi owns 51% and ABB the remaining 49% of the joint venture.

- In October 2016, Mitsubishi is opening a new HVDC verification transmission and distribution facility to be built in Amagasaki, Japan

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the HVDC converter station market?

- Which segment provides the most opportunity for growth?

- Who are the leading manufacturers operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions of the Research Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the HVDC Converter Station Market

4.2 Market, By Country

4.3 Europe Market, By Configuration & Country

4.4 Market, By Technology

4.5 Market, By Component

4.6 Market, By Power Rating

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Cost-Effective Solutions for Long Distance Power Transmission

5.2.1.2 Integration of the LSC Technology Across Grids Enables System Security

5.2.1.3 Liberalization in Energy Policies in Europe

5.2.1.4 High Initial Capital to Establish the HVDC Converter Station

5.2.1.5 Lengthy Approval Processes for Transmission Projects Affect the Growth of the HVDC Substation

5.2.2 Opportunities

5.2.2.1 Favorable Government Policies Bring Opportunities for Growth in Offshore Wind Transmission Projects

5.2.2.2 Rapid Adoption Rate for the Uhvdc Technology in China

5.2.3 Challenges

5.2.3.1 Maintaining Uniformity in the Standards of HVDC Transmission Equipment and Systems

5.2.3.2 Controlling Congestion & Instability in HVDC Systems

6 HVDC Converter Station Market, By Configuration (Page No. - 45)

6.1 Introduction

6.1.1 HVDC Converter Station Market Size, By Configuration, 2015¨C2022 (USD Billion)

6.2 Monopolar

6.2.1 Monopolar: Market Size, By Configuration, 2015¨C2022 (USD Billion)

6.3 Bi-Polar

6.3.1 Bi-Polar: Market Size, By Configuration, 2015¨C2022 (USD Billion)

6.4 Back-To-Back

6.4.1 Back-To-Back: Market Size, By Configuration, 2015¨C2022 (USD Billion)

6.5 Multi-Terminal

6.5.1 Multi-Terminal: Market Size, By Configuration, 2015¨C2022 (USD Billion)

7 HVDC Converter Station Market, By Technology (Page No. - 51)

7.1 Introduction

7.1.1 Market Size, By Technology, 2015¨C2022 (USD Billion)

7.2 LCC

7.2.1 LCC: Market Size, By Technology, 2015¨C2022 (USD Billion)

7.3 LSC

7.3.1 LSC: Market Size, By Technology, 2015¨C2022 (USD Billion)

8 HVDC Converter Station Market, By Component (Page No. - 55)

8.1 Introduction

8.1.1 Market Size, By Component, 2015¨C2022 (USD Billion)

8.2 Valve

8.2.1 Valve: Market Size, By Component, 2015¨C2022 (USD Billion)

8.3 Converter Transformers

8.3.1 Converter Transformers: Market Size, By Component, 2015¨C2022 (USD Billion)

8.4 Harmonic Filters

8.4.1 Harmonic Filters: Market Size, By Component, 2015¨C2022 (USD Billion)

8.5 Reactors

8.5.1 Reactors: Market Size, By Component, 2015¨C2022 (USD Billion)

8.6 Circuit Breakers

8.6.1 Circuit Breakers: Market Size, By Component, 2015¨C2022 (USD Billion)

8.7 Surge Arresters

8.7.1 Surge Arresters: Market Size, By Component, 2015¨C2022 (USD Billion)

8.8 Others

8.8.1 Others: Market Size, By Component, 2015¨C2022 (USD Billion)

9 HVDC Converter Station Market, By Power Rating (Page No. - 63)

9.1 Introduction

9.1.1 HVDC Converter Station Market Size, By Power Rating, 2015¨C2022 (USD Billion)

9.2 Below 500 Mw

9.2.1 Below 500 Mw: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

9.3 >500¨C1000 Mw

9.3.1 > 500¨C1000 Mw: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

9.4 >1000¨C1500 Mw

9.4.1 >1000¨C1500 Mw: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

9.5 >1500¨C2000 Mw

9.5.1 >1500¨C2000 Mw: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

9.6 Above 2000 Mw

9.6.1 Above 2000 Mw: HVDC Converter Station Market Size, By Power Rating, 2015¨C2022 (USD Billion)

10 HVDC Converter Station Market, By Region (Page No. - 70)

10.1 Introduction

10.1.1 HVDC Converter Station Market Size, By Region, 2015¨C2022 (USD Billion)

10.2 North America

10.2.1 North America: Market Size, By Country, 2015¨C2022 (USD Billion)

10.2.2 North America: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.2.3 North America: Market Size, By Component, 2015¨C2022 (USD Billion)

10.2.4 North America: Market Size, By Configuration, 2015¨C2022 (USD Billion)

10.2.5 North America: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

10.2.5.1 US

10.2.6 US: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.2.6.1 Canada

10.2.7 Canada: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3 Europe

10.3.1 Europe: HVDC Converter Station Market Size, By Country, 2015¨C2022 (USD Billion)

10.3.2 Europe: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3.3 Europe: Market Size, By Component, 2015¨C2022 (USD Billion)

10.3.4 Europe: Market Size, By Configuration, 2015¨C2022 (USD Billion)

10.3.5 Europe: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

10.3.5.1 UK

10.3.6 UK: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3.6.1 Germany

10.3.7 Germany: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3.7.1 France

10.3.8 France: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3.8.1 Norway

10.3.9 Norway: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.3.9.1 Rest of Europe

10.3.10 Rest of Europe: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.4 Asia Pacific

10.4.1 Asia Pacific: HVDC Converter Station Market Size, By Country, 2015¨C2022 (USD Billion)

10.4.2 Asia Pacific: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.4.3 Asia Pacific: Market Size, By Component, 2015¨C2022 (USD Billion)

10.4.4 Asia Pacific: Market Size, By Configuration, 2015¨C2022 (USD Billion)

10.4.5 Asia Pacific: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

10.4.5.1 China

10.4.6 China: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.4.6.1 India

10.4.7 India: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.4.7.1 Rest of Asia Pacific

10.4.8 Rest of Asia Pacific: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

10.5 Rest of the World

10.5.1 Rest of the World: Market Size, By Country, 2015¨C2022 (USD Billion)

10.5.2 Rest of the World: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.5.3 Rest of the World: Market Size, By Component, 2015¨C2022 (USD Billion)

10.5.4 Rest of the World: Market Size, By Configuration, 2015¨C2022 (USD Billion)

10.5.5 Rest of the World: Market Size, By Power Rating, 2015¨C2022 (USD Billion)

10.5.5.1 South America

10.5.6 South America: Market Size, By Technology, 2015¨C2022 (USD Billion)

10.5.6.1 Middle East & Africa

10.5.7 Middle East & Africa: Market Size, By Technology, 2015¨C2022 (USD Billion)

11 Competitive Landscape (Page No. - 97)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Contracts & Agreements

11.3.2 Investments & Expansions

11.3.3 Mergers & Acquisitions

11.3.4 Joint Ventures

12 Company Profiles (Page No. - 101)

12.1 ABB

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 GE

12.2.1 Business Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Siemens

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Toshiba

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.4.4 MnM View

12.5 Mitsubishi

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.5.4 MnM View

12.6 Bhel

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 Recent Developments

12.6.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.6.4 MnM View

12.7 NR Electric

12.7.1 Business Overview

12.7.2 Products Offered

12.7.3 Recent Developments

12.7.4 SWOT Analysis

12.7.5 MnM View

12.8 China Xian Xd Power System

12.8.1 Business Overview

12.8.2 Products Offered

12.8.3 MnM View

12.9 C-Epri Power Engineering Company

12.9.1 Business Overview

12.9.2 Products Offered

12.9.3 Recent Developments

12.9.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.9.4 SWOT Analysis

12.9.5 MnM View

12.1 XJ Electric

12.10.1 Business Overview

12.10.2 Products Offered

12.10.3 MnM View

12.11 Hyosung

12.11.1 Overview

12.11.2 Products Offered

12.11.3 MnM View

12.12 Lsis

12.12.1 Overview

12.12.2 Products Offered

12.12.3 Recent Developments

12.12.3.1 Partnerships/Collaborations/Joint Ventures/Contracts & Agreements/Mergers & Acquisitions/Investments and Expansions/Awards and Recognitions

12.12.4 MnM View

13 Appendix (Page No. - 130)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets¡¯ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (60 Tables)

Table 1 HVDC Converter Station Market Snapshot

Table 2 HVDC Converter Station Market Size, By Configuration, 2015¨C2022 (USD Billion)

Table 3 Monopolar: HVDC Cnverter Station Market Size, By Region, 2015¨C2022 (USD Million)

Table 4 Bi-Polar: Market Size, By Region, 2015¨C2022 (USD Million)

Table 5 Back-To-Back: Market Size, By Region, 2015¨C2022 (USD Million)

Table 6 Multi-Terminal: Market Size, By Region, 2015¨C2022 (USD Million)

Table 7 HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Billion)

Table 8 LCC: HVDC Converter Station, By Region, 2015¨C2022 (USD Million)

Table 9 LSC: Market Size, By Region, 2015¨C2022 (USD Million)

Table 10 HVDC Converter Station Market Size, By Component, 2015¨C2022 (USD Billion)

Table 11 Valve: HVDC Cnverter Station Market Size, By Region, 2015¨C2022 (USD Million)

Table 12 Converter Transformers: Market Size, By Region, 2015¨C2022 (USD Million)

Table 13 Harmonic Filter: Market Size, By Region, 2015¨C2022 (USD Million)

Table 14 Reactors: Market Size, By Region, 2015¨C2022 (USD Million)

Table 15 Circuit Breaker: Market Size, By Region, 2015¨C2022 (USD Million)

Table 16 Surge Arrester: HVDC Converter Station Market Size, By Region, 2015¨C2022 (USD Million)

Table 17 Others: Market Size, By Region, 2015¨C2022 (USD Million)

Table 18 HVDC Converter Station Market Size, By Power Rating, 2015¨C2022 (USD Billion)

Table 19 Below 500 Mw: HVDC Converter Station, By Region, 2015¨C2022 (USD Million)

Table 20 >500¨C1000 Mw: Market Size, By Region, 2015¨C2022 (USD Million)

Table 21 >1000¨C1500 Mw: Market Size, By Region, 2015¨C2022 (USD Million)

Table 22 >1500¨C1000 Mw: Market Size, By Region, 2015¨C2022 (USD Million)

Table 23 >2000 Mw: Market Size, By Region, 2015¨C2022 (USD Million)

Table 24 HVDC Converter Station Market, By Region 2015¨C2022 (USD Billion)

Table 25 North America: Market Size, By Country, 2015¨C2022 (USD Million)

Table 26 North America: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 27 North America: Market Size, By Component, 2015¨C2022 (USD Million)

Table 28 North America: Market Size, By Power Rating, 2015¨C2022 (USD Million)

Table 29 North America: Market Size, By Configuration, 2015¨C2022 (USD Million)

Table 30 US: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 31 Canada: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 32 Europe: Market Size, By Country, 2015¨C2022 (USD Million)

Table 33 Europe: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 34 Europe: Market Size, By Component, 2015¨C2022 (USD Million)

Table 35 Europe: Market Size, By Power Rating, 2015¨C2022 (USD Million)

Table 36 Europe: Market Size, By Configuration 2015¨C2022 (USD Million)

Table 37 UK: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 38 Germany: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 39 France: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 40 Norway: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 41 Rest of Europe: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 42 Asia Pacific: Market Size, By Country, 2015¨C2022 (USD Million)

Table 43 Asia Pacific: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 44 Asia Pacific: HVDC Converter Station Market Size, By Component, 2015¨C2022 (USD Million)

Table 45 Asia Pacific: Market Size, By Configuration, 2015¨C2022 (USD Million)

Table 46 Asia Pacific: Market Size, By Power Rating, 2015¨C2022 (USD Million)

Table 47 China: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 48 India: Market Size, By Technology, 2015¨C2022 (USD Million)

Table 49 Rest of Asia Pacific: HVDC Converter Station Market Size, By Technology, 2015¨C2022 (USD Million)

Table 50 RoW: Market, By Region, 2015¨C2022 (USD Million)

Table 51 RoW: Market, By Technology, 2015¨C2022 (USD Million)

Table 52 RoW: Market Size, By Component, 2015¨C2022 (USD Million)

Table 53 RoW: Market Size, By Power Rating, 2015¨C2022 (USD Million)

Table 54 RoW: Market Size, By Configuration, 2015¨C2022 (USD Million)

Table 55 South America: HVDC Converter Station Market, By Technology, 2015¨C2022 (USD Million)

Table 56 Middle East & Africa: Market, By Technology, 2015¨C2022 (USD Million)

Table 57 Contracts & Agreements, 2014¨C2017

Table 58 Investments and Expansions, 2015¨C2017

Table 59 Mergers & Acquisitions, 2014¨C2017

Table 60 Joint Ventures, 2014¨C2017

List of Figures (41 Figures)

Figure 1 Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 HVDC Converter Station Market in Apac is Expected to Grow at the Highest CAGR Between 2017 and 2022

Figure 6 LSC-Based HVDC Technology is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Valve as A Component is Expected to Lead the Market During the Forecast Period

Figure 8 >2000 Mw Power Rating for the Market is Expected to Lead the Market, By Power Rating During the Forecast Period

Figure 9 Bi-Polar Configuration is Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 10 Growing Demand for LSC Technology is Expected to Drive the Market During the Forecast Period

Figure 11 China is Expected to Lead the Market in 2017

Figure 12 The Bi-Polar Configuration is Expected to Dominate in Europe During the Forecast Period

Figure 13 The LCC-Based Technology is Expected to Dominate the Market During the Forecast Period

Figure 14 The Valves Segment is Expected to Dominate the Market During the Forecast Period

Figure 15 The >2000 Mw Segment is Expected to Dominate the Market During the Forecast Period

Figure 16 Market Dynamics: HVDC Converter Station Market

Figure 17 Cost Comparison Between HVDC & Hvac

Figure 18 The Bi- Polar Configuration Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 19 The LCC Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 20 The Converter Valve Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 21 The >2000 Mw Segment is Expected to Hold the Largest Market Share During the Forecast Period

Figure 22 Asia Pacific is Expected to Grow at the Highest CAGR

Figure 23 Europe: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments in the HVDC Converter Station Market, 2014¨C2017

Figure 26 Market Ranking Based on Revenue, 2016

Figure 27 ABB: Company Snapshot

Figure 28 ABB: SWOT Analysis

Figure 29 GE: Company Snapshot

Figure 30 GE: SWOT Analysis

Figure 31 Siemens: Company Snapshot

Figure 32 Siemens: SWOT Analysis

Figure 33 Toshiba: Company Snapshot

Figure 34 Mitsubishi: Company Snapshot

Figure 35 Bhel: Company Snapshot

Figure 36 NR-Electric: SWOT Analysis

Figure 37 China Xian Xd Power System: Company Snapshot

Figure 38 C-Epri Electric: SWOT Analysis

Figure 39 XJ Electric: Company Snapshot

Figure 40 Hyosung: Company Snapshot

Figure 41 LSIS: Company Snapshot

Growth opportunities and latent adjacency in HVDC Converter Station Market