Terrain Awareness and Warning System (TAWS) Market by System Type (Class A, Class B, and Class C), Engine Type (Turbine Powered, and Pistonpowered), Application (Commercial, Military & Defence, Others), and Geography - Global Forecasts to 2022

[172 Pages Report] According to the new market research report on terrain awareness and warning system market is expected to be worth USD 253.0 Million by 2022, growing at a CAGR of 5.8% between 2016 and 2022. The base year considered for the study of TAWS is 2015, and the forecast period is 2016 to 2022.

- This report defines, describes, and forecasts the terrain awareness and warning system market segmented on the basis of system type, engine type, application, and geography

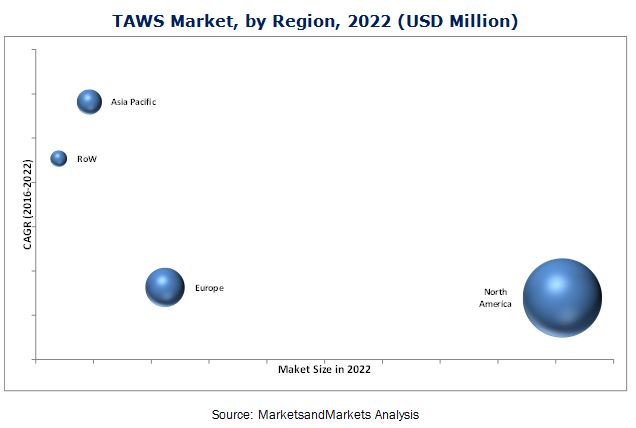

- This report forecasts the market size, in terms of value and volume, for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- This report provides detailed information regarding the major factors influencing the growth of the terrain awareness and warning system market (drivers, restraints, opportunities, and industry-specific challenges)

- This report strategically analyzes the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- This report provides a detailed overview of the value chain of the market and analyzes market trends using Porter’s five forces analysis

- This report analyzes the opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- This report strategically profiles the key players and comprehensively analyzes their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- This report analyzes competitive developments such as partnerships, mergers and acquisitions, new product launches and developments, expansions, and research and development (R&D) in the terrain awareness and warning system market

According to the new market research report on TAWS, the market in 2015 was valued at USD 144.6 Million and is expected to be worth USD 253.0 Million by 2022, at a CAGR of 5.8% between 2016 and 2022. The major drivers for the growth of the terrain awareness and warning system market is the mandate from the aviation industry globally and paradigm shift from rail/road transport to air transport. Other important drivers for the Market growth is due to the increase in the demand for fleet all over the world.

The market for the military and defence aircraft is expected to grow at the highest rate between 2016 and 2022. The demand for TAWS-installed military and defence operation aircraft is growing because of the increasing need for safety and increasing government expenditure in military and defence aircraft operation globally.

Class A system held a major share of the terrain awareness and warning system market owing to the high demand for Class A TAWS in commercial and military and defence aircraft. Class A system installation in commercial aircraft has reduced CFIT accidents in commercial aircraft globally. According to the International Air Transport Association (IATA) report published in 2014, CFIT accidents for commercial aircraft has reduced since TAWS was deployed in commercial aircraft. The report also states that in 2011, total 10 CFIT accidents were reported, whereas in 2014, it was reduced to total 5 CFIT accidents.

Turbine-powered aircraft hold a major share of the terrain awareness and warning system market because of its advanced safety features, durability, and reliability compared to the piston-powered aircraft and increasing demand for turbine engine-based aircraft in commercial operations.

North America held the largest share of the terrain awareness and warning system market. Presence of key players such as Universal Avionics Systems Corporation (U.S.), Honeywell International Inc. (U.S.), L3 Technologies, Inc., Avidyne Corporation. (U.S.), Aviation Communication & Surveillance Systems (ACSS), LLC (U.S.), Garmin Ltd. (U.S.), and Rockwell Collins (U.S.) and huge government funding in the U.S. make the Market attractive in the North American region.

One of the key restraining factors for this market are the high cost of installation of TAWS in aircraft and lack of skilled workforce/integrators.

The companies that are profiled in the report are Honeywell International Inc. (U.S.), Universal Avionics Systems Corporation (U.S.), Aviation Communication & Surveillance Systems (ACSS), LLC (U.S.), L3 Technologies, Inc. (U.S.), Avidyne Corporation. (U.S.), Garmin Ltd. (U.S.), Rockwell Collins (U.S.), Sandel Avionics, Inc. (U.S.), Aspen Avionics, Inc. (U.S.) , Mid-Continent Instrument Co., Inc. (U.S.), and Genesys Aerosystems (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

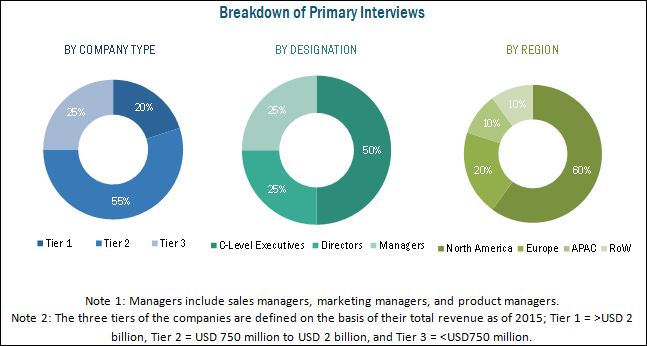

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.2 Secondary and Primary Research

2.2.1 Key Industry Insights

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.3.1.2 Approach for Capturing the Market Share With the Help of Various Players in the Value Chain of the Terrain Awareness and Warning System Market

2.3.2 Top-Down Approach

2.3.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 38)

4.1 Attractive Opportunities in the TAWS Market, 2016–2022 (USD Million)

4.2 Market, By End User

4.3 Market, By Region

4.4 Commercial Aircraft Held the Largest Market Share in 2015

4.5 The TAWS Market in APAC Expected to Grow at A High Rate Between 2016 and 2022

4.6 TAWS Market, By System

4.7 Market, By Engine Type

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Terrain Awareness and Warning System Market, By System Type

5.2.2 Market, By Engine Type

5.2.3 Market, By Application

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Directives From Major Aviation Agencies Mandate to Deploy TAWS

5.3.1.2 Paradigm Shift in Transport Sector

5.3.2 Restraints

5.3.2.1 High Deployment Cost of TAWS

5.3.3 Opportunities

5.3.3.1 Implementation of TAWS in Cargo and Private Jets

5.3.3.2 Growth in International Business and Trade

5.3.4 Challenges

5.3.4.1 Lack of Skilled Workforce and Integrators

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

7 Terrain Awareness and Warning System Market, By System Type (Page No. - 63)

7.1 Introduction

7.2 Class A System

7.3 Class B System

7.4 Class C System

8 Terrain Awareness and Warning System Market, By Engine Type (Page No. - 76)

8.1 Introduction

8.2 Turbine Engine

8.3 Piston Engine

9 Terrain Awareness and Warning System Market, By Application (Page No. - 88)

9.1 Introduction

9.2 Commercial Aircraft

9.2.1 Civil Aircraft

9.2.2 Chartered Planes

9.2.3 Civilian/Private Rotorcraft

9.3 Military & Defense Aircraft

9.3.1 Fighter Planes

9.3.2 Carrier Planes

9.3.3 Military Rotorcraft

9.4 Others

9.4.1 Search & Rescue Operation Aircraft

10 Geographic Analysis (Page No. - 104)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Asia Pacific

10.3.1 China

10.3.2 South Korea

10.3.3 India

10.3.4 Japan

10.3.5 Rest of APAC

10.4 Rest of the World (RoW)

10.4.1 Latin America

10.4.2 Middle East & Africa

10.5 Europe

10.5.1 U.K.

10.5.2 Germany

10.5.3 France

10.5.4 Italy

10.5.5 Rest of Europe

11 Competitive Landscape (Page No. - 126)

11.1 Overview

11.2 Market Rank Analysis: Terrain Awareness and Warning System

11.3 Competitive Situations and Trends

11.3.1 New Product Developments and Launches

11.3.2 Partnerships, Agreements, and Acquisitions

11.3.3 Contracts

11.3.4 Others (Certifications and Expansions)

12 Company Profiles (Page No. - 135)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 Honeywell International Inc.

12.3 L3 Technologies, Inc.

12.4 Aviation Communication & Surveillance Systems, LLC

12.5 Universal Avionics Systems Corporation

12.6 Avidyne Corporation

12.7 Garmin Ltd.

12.8 Rockwell Collins

12.9 Sandel Avionics, Inc.

12.10 Genesys Aerosystems

12.11 Aspen Avionics, Inc.

12.12 Mid-Continent Instrument Co., Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 161)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (75 Tables)

Table 1 Currency Table

Table 2 TAWS Remote Computer Pricing

Table 3 Cargo vs All Other Aircraft Fatalities and Fatal Accidents

Table 4 Country-Wise Rise in Passenger Travel

Table 5 Class A, Class B, and Class C Requirements

Table 6 Global Terrain Awareness and Warning System Market, By System Type, 2013–2022 (USD Million)

Table 7 Global Class A Terrain Awareness and Warning System Market, By Engine Type, 2013–2022 (USD Million)

Table 8 Global Class A TAWS Market, By Application, 2013–2022 (USD Million)

Table 9 Class A Market for Commercial Aircraft, By Type, 2013–2022 (USD Million)

Table 10 Class A Terrain Awareness and Warning System Market for Military and Defence Aircraft, By Type, 2013–2022 (USD Million)

Table 11 Class A TAWS Market for Other Aircraft, 2013–2022 (USD Million)

Table 12 Global Class B TAWS Market, By Engine Type, 2013–2022 (USD Million)

Table 13 Global Class B TAWS Market, By Application, 2013–2022 (USD Million)

Table 14 Class B Terrain Awareness and Warning System Market for Commercial Aircraft, By Type, 2013–2022 (USD Million)

Table 15 Class B TAWS Market for Military and Defence Aircraft, By Type, 2013–2022 (USD Million)

Table 16 Class B TAWS Market, By Other Aircraft, 2013–2022 (USD Million)

Table 17 Global Class C TAWS Market, By Engine Type, 2013–2022 (USD Thousand)

Table 18 Global Class C TAWS Market, By Application, 2013–2022 (USD Thousand)

Table 19 Class C Terrain Awareness and Warning System Market for Commercial Aircraft, By Type, 2013–2022 (USD Thousand)

Table 20 Class C TAWS Market for Military and Defence Aircraft, By Type, 2013–2022 (USD Thousand)

Table 21 Class C TAWS Market, By Other Aircraft, 2013–2022 (USD Thousand)

Table 22 Requirements for TAWS Equipment Based on Engine Type

Table 23 Global Terrain Awareness and Warning System Market, By Engine Type, 2013–2022 (USD Million)

Table 24 Global Market for Turbine-Powered Aircraft, By System Type, 2013–2022 (USD Million)

Table 25 Global TAWS Market for Turbine-Powered Aircraft, By Application, 2013–2022 (USD Million)

Table 26 Market for Turbine-Powered Commercial Aircraft, By Type (USD Million)

Table 27 Market for Turbine-Powered Military & Defense Aircraft, By Type, 2013–2022 (USD Million)

Table 28 Market for Turbine-Powered Other Aircraft, 2013–2022 (USD Million)

Table 29 Global TAWS Market for Piston-Powered Aircraft, By System Type, 2013–2022 (USD Million)

Table 30 Global TAWS Market for Piston-Powered Aircraft, By Application, 2013–2022 (USD Million)

Table 31 Market for Piston-Powered Commercial Aircraft, By Type, 2013–2022 (USD Million)

Table 32 TAWS Market for Piston-Powered Military and Defence Aircraft, By Type, 2013–2022 (USD Million)

Table 33 TAWS Market for Piston-Powered Other Aircraft, 2013–2022 (USD Million)

Table 34 Global TAWS Market, By Application, 2013–2022 (USD Million)

Table 35 TAWS-Equipped Commercial Aircraft Market, By Type, 2013–2022 (USD Million)

Table 36 Market for Civil Airlines, By System Type, 2013–2022 (USD Million)

Table 37 Market for Civil Airlines, By Engine Type, 2013–2022 (USD Million)

Table 38 Market for Chartered Planes, By System Type, 2013–2022 (USD Million)

Table 39 Market for Chartered Planes, By Engine Type, 2013–2022 (USD Million)

Table 40 Terrain Awareness and Warning System Market for Civilian/Private Rotorcraft, By System Type, 2013–2022 (USD Million)

Table 41 TAWS Market for Civilian/Private Rotorcraft, By Engine Type, 2013–2022 (USD Million)

Table 42 TAWS Market for Military and Defence Aircraft, By Type, 2013–2022 (USD Thousand)

Table 43 Total Fighter Plane Strength Data 2015

Table 44 Market for Fighter Planes, By System Type, 2013–2022 (USD Thousand)

Table 45 Market for Fighter Planes , By Engine Type, 2013–2022 (USD Thousand)

Table 46 Market for Carrier Planes , By System Type, 2013–2022 (USD Thousand)

Table 47 TAWS Market for Carrier Planes , By Engine Type, 2013–2022 (USD Thousand)

Table 48 Market for Rotorcraft, By System Type, 2013–2022 (USD Thousand)

Table 49 Terrain Awareness and Warning System Market for Rotorcrafts, By Engine Type, 2013–2022 (USD Thousand)

Table 50 TAWS Market for Other Aircraft, By Type, 2013–2022 (USD Thousand)

Table 51 Market for Other Aircraft, By System Type, 2013–2022 (USD Thousand)

Table 52 Market Other Aircraft, By Engine Type, 2013–2022 (USD Thousand)

Table 53 Global TAWS Market, By Region, 2013–2022 (USD Million)

Table 54 Market in North America, By Country, 2013–2022 (USD Thousand)

Table 55 TAWS Market for Commercial Aircraft in North America, By Country, 2013–2022 (USD Thousand)

Table 56 TAWS Market for Military and Defence Aircraft in North America, By Country, 2013–2022 (USD Thousand)

Table 57 Terrain Awareness and Warning System Market for Other Aircraft in North America, By Country, 2013–2022 (USD Thousand)

Table 58 Market in Asia Pacific, By Country, 2013–2022 (USD Thousand)

Table 59 TAWS Market for Commercial Aircraft in APAC, By Country, 2013 (USD Thousand)

Table 60 TAWS Market for Military and Defence Aircraft in APAC, By Country, 2013 (USD Thousand)

Table 61 TAWS Market for Other Aircraft in APAC, By Country, 2013 (USD Thousand)

Table 62 TAWS Market in RoW, By Country, 2013–2022 (USD Thousand)

Table 63 Market for Commercial Aircraft in RoW, By Country, 2013–2022 (USD Thousand)

Table 64 Market for Military and Defence Aircraft in RoW , By Country, 2013–2022 (USD Thousand)

Table 65 TAWS Market for Other Aircraft in RoW, By Country, 2013–2022 (USD Thousand)

Table 66 TAWS Market in Europe, By Country, 2013–2022 (USD Thousand)

Table 67 TAWS Market for Commercial Aircraft in Europe, By Country, 2013–2022 (USD Thousand)

Table 68 TAWS Market for Military and Defence Aircraft in Europe, By Country, 2013–2022 (USD Thousand)

Table 69 Market for Other Aircraft in Europe, By Country, 2013–2022 (USD Thousand)

Table 70 Ranking of the Key Players in the Market, 2015

Table 71 Top 5 Players in the Terrain Awarness and Warning System Market, 2015

Table 72 New Product Developments (2011–2016)

Table 73 Partnerships, Agreements, and Acquisitions (2011–2016)

Table 74 Contracts (2015–2016)

Table 75 Others (2014–2016)

List of Figures (67 Figures)

Figure 1 Market Segmentation

Figure 2 Terrain Awareness and Warning System Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Major Players in Each Stage of Value Chain

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Market for Class A TAWS to Grow at the Highest Rate Between 2016 and 2022

Figure 8 Turbine-Powered Aircraft to Hold the Largest Share of the Overall Market Between 2016 and 2022

Figure 9 RoW is in the Growing Stage in the Market Between 2016 and 2022

Figure 10 North America Held the Largest Share of the TAWS Market in 2015

Figure 11 Commercial Aircraft Held the Largest Share of the TAWS Market Based on Application in 2015

Figure 12 Demand for Class A TAWS in Commercial Aircraft Driving the Market

Figure 13 Market for TAWS-Equipped Military and Defence Aircraft Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 14 North America Expected to Hold the Largest Share of the TAWS Market Between 2016 and 2022

Figure 15 North America Led the TAWS Market By Holding the Largest Share in 2015

Figure 16 Class A TAWS Expected to Lead the Market Between 2016 and 2022

Figure 17 Market for TAWS-Equipped Turbine-Powered Aircraft to Grow at A Higher Rate Compared to Piston-Powered Aircraft Between 2016 and 2022

Figure 18 TAWS: Block Diagram

Figure 19 Market Segmentation, By Geography

Figure 20 Increasing Need for Safety and Demand of Aircraft is Expected to Spur the Demand for Market

Figure 21 Europe: Rail and Air Transport Turnover in 2008

Figure 22 Value Chain Analysis: Major Value is Added By System Integrators and Original Equipment Manufacturers (Oems)

Figure 23 Key Industry Trends: Innovative Solutions Offered

Figure 24 Porter’s Five Forces Analysis, 2015

Figure 25 Market: Porter’s Five Forces Analysis, 2015

Figure 26 Industry Rivalry Had A High Impact on the TAWS Market in 2015

Figure 27 Threat of New Entrants Had A Medium Impact on the TAWS Market in 2015

Figure 28 Bargaining Power of Suppliers Had A Medium Impact on the TAWS Market in 2015

Figure 29 Bargaining Power of Buyers Had A Medium Impact on the Market in 2015

Figure 30 Classification of TAWS

Figure 31 Class A TAWS Market for Commercial Aircraft to Grow at the Highest Rate Between 2016 and 2022

Figure 32 Global Class B TAWS Market, By Engine Type (2016–2022)

Figure 33 Commercial Aircraft Held the Largest Share of the Class C TAWS Market in 2016 (USD Thousand)

Figure 34 Types of Turbine Engine

Figure 35 Commercial Aircraft Holds the Largest Share of the Global TAWS Market for Turbine Engines in 2016 and 2022

Figure 36 Civil Airlines to Dominate the Market for Turbine-Powered Commercial Aircraft

Figure 37 Piston Engine Types

Figure 38 Market for Piston-Powered Commercial Aircraft, By Type (2016–2022)

Figure 39 Market for Military Rotorcraft to Grow at A Highest Rate Between 2016 and 2022

Figure 40 Terrain Awareness and Warning System, By Application

Figure 41 Number of Cfit Accidents for Commercial Aircraft, 2010–2014

Figure 42 Class A System Expected to Dominate the Market for Chartered Planes Between 2016 and 2022

Figure 43 Types of Military and Defence Aircraft

Figure 44 Class A TAWS-Equipped Carrier Planes Held the Largest Market Share in 2016

Figure 45 Market for Class B TAWS-Equipped Rotorcraft to Grow at A Higher Rate Between 2016 and 2022.

Figure 46 Market for Class A TAWS-Installed Other Aircraft to Grow at A Higher Rate Between 2016 and 2022

Figure 47 Market Segmentation, By Region

Figure 48 Geographic Snapshot of the Market (2016–2022)

Figure 49 TAWS Market Snapshot in North America

Figure 50 U.S. Accounted for the Largest Share of the North American Market for Military and Defence Aircraft in 2015

Figure 51 Snapshot of the TAWS Market in APAC

Figure 52 China to Lead the Market for Aircraft Used for Search and Rescue Operations Between 2016 and 2022

Figure 53 Snapshot of the Market in RoW Market

Figure 54 Market in Italy to Grow at the Highest Rate Between 2016 and 2022

Figure 55 Companies Adopted New Product Developments as the Key Growth Strategy Between 2011 and 2016

Figure 56 Market Evolution Framework — New Product Launches and Developments as the Major Strategies Adopted By Top 5 Key Players (2013–2016)

Figure 57 Battle for Market Ranking: New Product Launches and Developments as the Key Growth Strategies

Figure 58 Geographic Revenue Mix of the Major Market Players (2015)

Figure 59 Honeywell International Inc: Company Snapshot

Figure 60 Honeywell International Inc.: SWOT Analysis

Figure 61 L3 Technologies, Inc.: Company Snapshot

Figure 62 L3 Technologies, Inc.: SWOT Analysis

Figure 63 ACSS: SWOT Analysis

Figure 64 Universal Avionics Systems Corporation: SWOT Analysis

Figure 65 Avidyne Corporation: SWOT Analysis

Figure 66 Garmin Ltd.: Company Snapshot

Figure 67 Rockwell Collins: Company Snapshot

To estimate the size of the terrain awareness and warning system market, top-down and bottom-up approaches have been considered in the study. This entire research methodology for TAWS includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, associations such as Federal Aviation Administration (FAA), Aircraft Owners and Pilots Association (AOPA), Aircraft Electronics Association (AEA), General Aviation Manufacturers Association (GAMA), International Air Transport Association (IATA), Canadian Federal Pilots Association - Association des pilotes fédéraux du Canada (CFPA), Cirrus Owners & Pilots Association (COPA), The WritePass Journal and interviews with industry experts. The overall terrain awareness and warning system market size was used in the top-down approach to estimate the Market from the addition of the estimated market size of all industry groups through percentage splits from secondary and primary research.

To know about the assumptions considered for the study, download the pdf brochure

The TAWS ecosystem comprises companies such as Universal Avionics Systems Corporation (U.S.), Honeywell International Inc. (U.S.), L3 Technologies (U.S.), Avidyne Corporation (U.S.), Aviation Communication & Surveillance Systems (ACSS), LLC (U.S.), Garmin Ltd. (U.S.), Rockwell Collins (U.S.), Sandel Avionics, Inc. (U.S.), Aspen Avionics, Inc. (U.S.), Mid-Continent Instrument Co., Inc. (U.S.), and Genesys Aerosystems (U.S.).

Target Audience:

- Military departments

- Original equipment manufacturers

- Players in the aerospace and defense industry

- Technology providers

- End users (commercial aircraft operators, military & defense aircraft operators, and others)

- Governments, financial institutions, and investment communities

- Research organizations

“This study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing the efforts and investments.”

TAWS Market Scope:

By System Type

- Class A

- Class B

- Class C

By Engine Type

- Turbine Powered

- Piston Powered

By Application

- Commercial Aircraft

- Civil Airlines

- Chartered Planes

- Civilian/Private Rotorcraft

- Military & Defence Aircraft

- Fighter Planes

- Carrier Planes

- Rotorcraft

- Other Aircraft

By Geography

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- U.K.

- Germany

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- Latin America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the clients’ specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Terrain Awareness and Warning System (TAWS) Market