Collision Avoidance System Market by Device, Technology, Application (Automotive, Aerospace, Railway, Marine, and Construction & Mining), and Region (North America, Europe, Asia-Pacific, and RoW) - Global Trend & Forecast to 2020

The global collision avoidance system market is expected to grow from USD 31.19 Billion in 2014 to USD 50.38 Billion by 2020 at a CAGR of 7.74% between 2015 and 2020.

The report aims at estimating the market size and future growth potential of the collision avoidance system market based on devices, technologies, and regions. The base year considered for the study is 2014 and the market is forecast from 2015 to 2020.

The global collision avoidance system market is expected to grow from USD 31.19 Billion in 2014 to USD 50.38 Billion by 2020 at a CAGR of 7.74% between 2015 and 2020. The market is expected to be driven by the growing focus of consumers and OEMs on safety features of vehicles, government regulations, influence of the New Car Assessment Programs (NCAPs), and encouragement from insurance companies by reducing the premium for vehicles with collision avoidance systems.

Automotive, aerospace, railway, marine, construction & mining sectors are key application areas of collision avoidance systems. The automotive sector was the largest application area, followed by railway and construction & mining sectors in 2014. However, the construction sector is expected to provide the highest growth potential for collision avoidance systems, followed by automotive and railway during the forecast period. The collision avoidance system market in the automotive sector is expected to be driven by the increasing focus of consumers and OEMs on safety of vehicles, and the mandate of collision avoidance systems to automobiles across the globe, especially North America and developing economies.

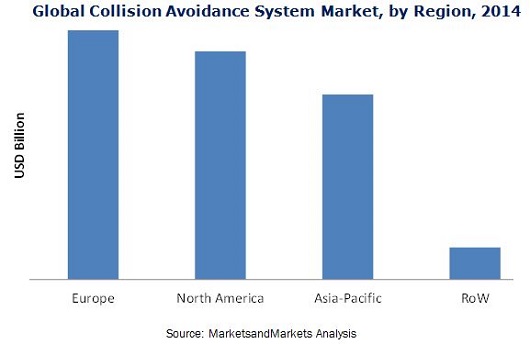

Europe accounted for the largest share of the collision avoidance systems market in 2014, followed by North America and Asia-Pacific. However, the market in RoW is expected to grow at the highest rate, followed by Asia-Pacific between 2015 and 2020. The collision avoidance system market in RoW and Asia-Pacific regions is expected to be driven by the increasing stringent regulations regarding installation of collision avoidance systems. Automotive and construction & mining sectors are expected to drive the market for collision avoidance systems during the forecast period.

However, the cyclical nature of automotive sales and production can adversely affect the active and passive safety systems market, because the growth or decline of the passenger car safety market is proportional to passenger car sales and production. This report describes the drivers, restraints, opportunities, and challenges pertaining to the collision avoidance system market. Furthermore, it analyzes the current market scenario and forecasts the market till 2020, including market segmentation based on technology and device in each application, and geography. Some of the major companies included in the report are Robert Bosch GmbH (Germany), Delphi Automotive Plc. (U.K.), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Mobileye N.V. (Israel), Becker Mining Systems AG (Germany), Hexagon AB (Sweden), Wabtec Corporation (U.S.), Rockwell Collins, Inc. (U.S.), Aviation Communication & Surveillance Systems, LLC (U.S.), Honeywell International, Inc. (U.S.), Saab AB (Sweden), General Electric Company (U.S.), Alstom SA (France), and Siemens AG (Germany), and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

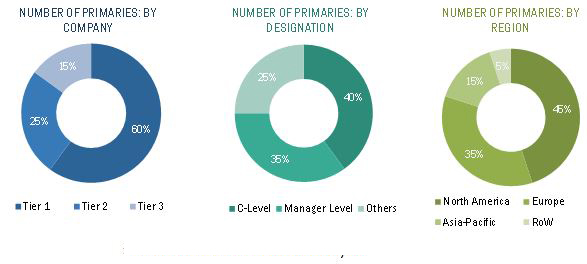

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Opportunities in the Market

4.2 Market, By Region

4.3 Market, By Region and Application

4.4 Colision Avoidance System Market, By Region

4.5 Automotive Collision Avoidance System Market, By Vehicle Type (2015 and 2020)

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 New Car Assessment Programs (Ncaps) & Regulations Drive Automotive Market

5.3.1.2 Growing Focus of Consumers & Oems on Vehicle Safety

5.3.1.3 Insurance Companies Focusing on Reducing Costs for Vehicles With Collision Avoidance System

5.3.2 Restraints

5.3.2.1 Cyclic Nature of Automotive Sales & Production

5.3.3 Opportunities

5.3.3.1 Growing Automotive Safety Norms in Developing Countries

5.3.3.2 Growing Trend of Installing Advanced Driver Assistance System in Passenger Cars

5.3.4 Challenges

5.3.4.1 Passing the Increased Price of Collision Avoidance Systems Technology to Consumers, Especially in Middle- & Low-Income Countries

5.3.4.2 Train Collision Avoidance System Faces Challenges of Interoperability

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.4 Intensity of Competitive Rivalry

6.5 Bargaining Power of Suppliers

6.6 Bargaining Power of Buyers

6.7 Threat of New Entrants

6.8 Threat of Substitutes

6.9 Industry Lifecycle

7 Automotive Collision Avoidance System Market (Page No. - 63)

7.1 Introduction

7.2 Device

7.2.1 Adaptive Cruise Control (ACC)

7.2.2 Blind Spot Detection (BSD)

7.2.3 Lane Departure Warning (LDW)

7.2.4 Night Vision (NV)

7.2.5 Autonomous Emergency Braking (AEB)

7.2.6 Electronic Stability Control (ESC)

7.2.7 Tire Pressure Monitoring System (TPMS)

7.2.8 Driver Monitoring System (DMS)

7.3 Technology

7.3.1 Radar

7.3.2 Lidar:

7.3.3 Camera:

7.3.4 Ultrasonic:

7.4 Region

8 Airborne Collision Avoidance System Market (Page No. - 78)

8.1 Introduction

8.2 Device

8.2.1 Computer Unit

8.2.2 Mode S Transponder

8.2.3 Ads-B

8.2.4 Cockpit Presentation

8.2.5 Others

8.3 Technology

8.4 Region

9 Rail Collision Avoidance System Market (Page No. - 84)

9.1 Introduction

9.2 Device

9.2.1 On-Board Or Locomotive System

9.2.2 Wayside Interface Unit

9.2.3 Back Office Server System

9.3 Technology

9.4 Region

10 Marine Collision Avoidance System Market (Page No. - 93)

10.1 Introduction

10.2 Device

10.2.1 Automatic Identification Systems (AIS)

10.2.2 Electronic Chart Display and Information System (ECDIS)

10.3 Technology

10.4 Region

11 Construction & Mining Collision Avoidance System Market (Page No. - 99)

11.1 Introduction

11.2 Device

11.2.1 Tags

11.2.2 Antennas

11.2.3 Camera

11.3 Technology

11.3.1 Global Positioning System (GPS)

11.3.2 Radio Frequency Identification (RFID)

11.3.3 Ultrasonic

11.4 Region

12 Collision Avoidance System Market, By Region (Page No. - 107)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Rest of North America

12.3 Europe

12.3.1 U.K.

12.3.2 Germany

12.3.3 France

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.5 Rest of the World

12.5.1 Middle East & Africa

12.5.2 South America

13 Competitive Landscape (Page No. - 119)

13.1 Overview

13.2 Market Share Analysis of Collision Avoidance System Market

13.3 Competitive Situation and Trends

13.3.1 New Product Launches

13.3.2 Mergers and Acquisitions

13.3.3 Agreements, Collaborations, Contracts, and Partnerships

13.3.4 Expansions

14 Company Profiles (Page No. - 127)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Overview

14.2 Robert Bosch GmbH

14.3 Denso Corporation

14.4 Delphi Automotive PLC

14.5 Autoliv, Inc.

14.6 General Electric Company

14.7 Rockwell Collins, Inc.

14.8 Honeywell International, Inc.

14.9 Alstom SA

14.10 Siemens AG

14.11 Mobileye N.V.

14.12 Aviation Communication & Surveillance Systems, Llc

14.13 SAAB AB

14.14 Becker Mining Systems AG

14.15 Hexagon AB

14.16 Wabtec Corporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 171)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (79 Tables)

Table 1 Collision Avoidance System Market, By Application, 2013–2020 (USD Million)

Table 2 Impact Analysis of Drivers

Table 3 Impact Analysis of Restraint

Table 4 Upcoming Safety Legislations in the Next Five Years

Table 5 Impact Analysis of Opportunity

Table 6 Impact Analysis of Challenge

Table 7 Market Size, By Vehicle Type, 2013–2020 (USD Billion)

Table 8 Market Size, By Vehicle Type, 2013–2020 (‘000 Units)

Table 9 Passenger Car Market Size, By Device, 2013–2020 (USD Billion)

Table 10 Passenger Car Market Size, By Device, 2013–2020 (‘000 Units)

Table 11 Commercial Vehicles Market Size, By Device, 2013–2020 (USD Billion)

Table 12 Commercial Vehicles Market Size, By Device, 2013–2020 (‘000 Units)

Table 13 Automotive Collision Avoidance System Market Size, By Device, 2013–2020 (USD Billion)

Table 14 Automotive Market Size, By Device, 2013–2020 (‘000 Units)

Table 15 Automotive Collision Avoidance System, By Technology, 2013–2020 (USD Billion)

Table 16 Passenger Car Market Size, By Region, 2013–2020 (USD Billion)

Table 17 Passenger Car Market Size, By Region, 2013–2020 (‘000 Units)

Table 18 Commercial Vehicle Market Size, By Region, 2013–2020 (USD Billion)

Table 19 Commercial Vehicle Market Size, By Region, 2013–2020 (‘000 Units)

Table 20 Automotive Market Size, By Region, 2013–2020 (USD Billion)

Table 21 Automotive Market Size, By Region, 2013–2020 (‘000 Units)

Table 22 North America: Automotive Collision Avoidance System Market Size, By Country, 2013–2020 (USD Billion)

Table 23 North America: Automotive Market Size, By Country, 2013–2020 (‘000 Units)

Table 24 Europe: Market Size, By Country, 2013–2020 (USD Billion)

Table 25 Europe: Market Size, By Country, 2013–2020 (‘000 Units)

Table 26 Asia-Pacific: Market Size, By Country, 2013–2020 (USD Million)

Table 27 Asia-Pacific: Market Size, By Country, 2013–2020 (‘000 Units)

Table 28 RoW: Market Size, By Region, 2013–2020 (USD Million)

Table 29 RoW: Market Size, By Region, 2013–2020 (‘000 Units)

Table 30 Airborne Collision Avoidance System Market, By Device, 2013—2020 (USD Million)

Table 31 Airborne Market, By Technology, 2013—2020 (USD Million)

Table 32 Airborne Market, By Region, 2013—2020 (USD Million)

Table 33 North America: Airborne Market, By Country, 2013—2020 (USD Million)

Table 34 Europe: Airborne Market, By Country, 2013—2020 (USD Million)

Table 35 Asia-Pacific: Airborne Market, By Country, 2013—2020 (USD Million)

Table 36 RoW: Airborne Market, By Region, 2013—2020 (USD Million)

Table 37 Rail Collision Avoidance System Market, By Device, 2013—2020 (USD Million)

Table 38 Rail Market, By Device, 2013—2020 (Units)

Table 39 Rail Market, By Technology, 2013—2020 (USD Million)

Table 40 Rail Market, By Region, 2013—2020 (USD Million)

Table 41 Wayside Interface Units Market, By Region, 2013—2020 (USD Million)

Table 42 Wayside Interface Units Market, By Region, 2013—2020 (Units)

Table 43 Locomotive On-Board System Market, By Region, 2013—2020 (USD Million)

Table 44 Locomotive On-Board System Market, By Region, 2013—2020 (Units)

Table 45 Back Office Server System Market, By Region, 2013—2020 (USD Million)

Table 46 Back Office Server System Market, By Region, 2013—2020 (Units)

Table 47 North America: Rail Collision Avoidance System Market, By Country, 2013—2020 (USD Million)

Table 48 Europe: Rail Market, By Country, 2013—2020 (USD Million)

Table 49 Asia-Pacific: Rail Market, By Country, 2013—2020 (USD Million)

Table 50 RoW: Rail Market, By Region, 2013—2020 (USD Million)

Table 51 Marine Market, By Device, 2013—2020 (USD Million)

Table 52 Marine Market, By Device, 2013—2020 (Units)

Table 53 Marine Market, By Technology, 2013—2020 (USD Million)

Table 54 Marine Market, By Region, 2013—2020 (USD Million)

Table 55 North America: Marine Market, By Country, 2013—2020 (USD Million)

Table 56 Europe: Marine Market, By Country, 2013—2020 (USD Million)

Table 57 Asia-Pacific: Marine Market, By Country, 2013—2020 (USD Million)

Table 58 RoW: Marine Market, By Region, 2013—2020 (USD Million)

Table 59 Collision Avoidance System in Construction & Mining Market Size, By Device, 2013–2020 (USD Million)

Table 60 Construction & Mining Market, By Technology, 2013–2020 (USD Million)

Table 61 Construction & Mining Market Size, By Region, 2013–2020 (USD Million)

Table 62 Mining Collision Avoidance System Market Size, By Region, 2013–2020 ( Units)

Table 63 North America Mining Market Size, By Region, 2013–2020 (USD Million)

Table 64 Europe Mining Market Size, By Region, 2013–2020 (USD Million)

Table 65 Asia Pacific Mining Market Size, By Region, 2013–2020 (USD Million)

Table 66 RoW Construction & Mining Market Size, By Region, 2013–2020 (USD Million)

Table 67 Market, By Region, 2013–2020 (USD Billion)

Table 68 North America: Collision Avoidance System Market, By Application, 2013–2020 (USD Million)

Table 69 North America: Market, By Country, 2013–2020 (USD Billion)

Table 70 Europe: Market, By Application, 2013–2020 (USD Million)

Table 71 Europe: Market, By Country, 2013–2020 (USD Billion)

Table 72 Asia-Pacific: Market, By Application, 2013–2020 (USD Million)

Table 73 Asia-Pacific: Market, By Country, 2013–2020 (USD Billion)

Table 74 RoW: Market, By Application, 2013–2020 (USD Million)

Table 75 RoW: Market, By Region, 2013–2020 (USD Million)

Table 76 New Product Launches, 2013–2015

Table 77 Mergers and Acquisitions, 2013–2015

Table 78 Agreements, Collaborations, Contracts, and Partnerships, 2014–2015

Table 79 Expansions, 2014–2015

List of Figures (72 Figures)

Figure 1 Collision Avoidance System: Markets Covered

Figure 2 Market, By Region

Figure 3 Years Considered for the Study of the Market

Figure 4 Research Design

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown and Data Triangulation

Figure 8 Assumptions of the Research Study

Figure 9 Limitations of the Research Study

Figure 10 Automotive Collision Avoidance System Market Snapshot (2014 vs 2020): Commercial Vehicles Segment to Witness Rapid Growth During the Forecast Period

Figure 11 Automotive Market Snapshot (2014 vs 2020): Cameras to Witness Rapid Growth During the Forecast Period

Figure 12 Europe Accounted for the Largest Market for Collision Avoidance Systems in 2014

Figure 13 Attractive Opportunities for the Growth of the Market (2015–2020)

Figure 14 Europe and North America are Expected to Hold A Large Share During the Forecast Period

Figure 15 Automotive Sector Held the Largest Share of the Market in 2014

Figure 16 Asia-Pacific, North America, and RoW Expected to Be Potential Markets for Collision Avoidance Systems During the Forecast Period, 2015-2020

Figure 17 Passenger Cars Segment is Expected to Account for the Largest Share in 2020

Figure 18 Market Segmentation

Figure 19 Market, By Geography

Figure 20 Drivers, Restraints, Opportunities, and Challenges for the Collision Avoidance Systems Market

Figure 21 Road Traffic Death Rates, By Country Income Status, 2010 (Per 100,000 Population)

Figure 22 Road Traffic Deaths, By Region, 2010 (Per 100,000 Population)

Figure 23 Collision Avoidance System Market: Value Chain Analysis

Figure 24 Collision Avoidance System: Porter's Five Forces Analysis

Figure 25 Porter’s Five Forces Analysis for the Market

Figure 26 Market: Intensity of Competitive Rivalry

Figure 27 Market: Bargaining Power of Suppliers

Figure 28 Market: Bargaining Power of Buyers

Figure 29 Market: Threat of New Entrants

Figure 30 Market: Threat of Substitutes

Figure 31 Automotive and Construction & Mining Sectors is in the Growth Stage of the Industry Life Cycle

Figure 32 Passenger Car has the Largest Share of the Collision Avoidance Systems Market, in 2015

Figure 33 Regional Snapshot: Rapid Growing Markets (North America and RoW) Emerging as New Hotspots

Figure 34 Airborne Collision Avoidance System Market

Figure 35 Rail Collision Avoidance System

Figure 36 Marine Collision Avoidance System

Figure 37 ECDIS Implementation Schedule: 2012–2018

Figure 38 Antenna Market in Construction & Mining Collision Avoidance Systems has the Largest Market Share in 2015

Figure 39 Regional Snapshot: Rapid Growing Markets (Asia-Pacific) Emerging as New Hotspots

Figure 40 Market is Expected to Grow Higher in the Emerging Markets Between 2015 and 2020

Figure 41 Market in the Construction & Mining Sector is Expected to Grow Exponentially During the Forecast Period

Figure 42 North America: Collision Avoidance System Market, 2013-2020

Figure 43 Europe: Market, 2013–2020

Figure 44 Asia-Pacific: Market, 2013–2020

Figure 45 Top 5 Companies Adopted New Product Launches and Partnership/ Agreement as the Key Growth Strategy Over the Last Three Years

Figure 46 Market Share Analysis, 2014

Figure 47 Market Evolution Framework: New Product Launches, Partnerships Have Fuelled Growth in the Market

Figure 48 Battle for Market Share: New Product Launches has Emerged as the Key Strategy

Figure 49 Geographic Revenue Mix of Top Market Players

Figure 50 Robert Bosch GmbH: Company Snapshot

Figure 51 Robert Bosch GmbH: SWOT Analysis

Figure 52 Denso Corporation: Company Snapshot

Figure 53 Denso Corporation: SWOT Analysis

Figure 54 Delphi: Company Snapshot

Figure 55 Delphi Automotive PLC: SWOT Analysis

Figure 56 Autoliv, Inc.: Company Snapshot

Figure 57 Autoliv, Inc: SWOT Analysis

Figure 58 General Electric Company: Company Snapshot

Figure 59 General Electric Company: SWOT Analysis

Figure 60 Rockwell Collins, Inc.: Company Snapshot

Figure 61 Rockwell Collins, Inc.: SWOT Analysis

Figure 62 Honeywell International, Inc.: Company Snapshot

Figure 63 Honeywell International, Inc.: SWOT Analysis

Figure 64 Alstom SA: Company Snapshot

Figure 65 Alstom SA: SWOT Analysis

Figure 66 Siemens AG: Company Snapshot

Figure 67 Siemens AG: SWOT Analysis

Figure 68 Mobileye N.V.: Company Snapshot

Figure 69 Mobileye N.V.: SWOT Analysis

Figure 70 SAAB AB: Company Snapshot

Figure 71 Hexagon AB: Company Snapshot

Figure 72 Wabtec Corporation: Company Snapshot

The research methodology used to estimate and forecast the market begins with capturing data on key vendor revenues through the secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global collision avoidance system market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and sub-segments which were then verified through the primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors and executives. Market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The breakdown of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The collision avoidance systems ecosystem comprises collision avoidance system vendors, such as Robert Bosch GmbH (Germany), Delphi Automotive Plc. (U.K.), Autoliv, Inc. (Sweden), Denso Corporation (Japan), Mobileye N.V. (Israel), Becker Mining Systems AG (Germany), Hexagon AB (Sweden), Wabtec Corporation (U.S.), Rockwell Collins, Inc. (U.S.), Aviation Communication & Surveillance Systems, LLC (U.S.), Honeywell International, Inc. (U.S.), Saab AB (Sweden), General Electric Company (U.S.), Alstom SA (France), and Siemens AG (Germany), and others.

Target Audience of the Report:

The intended audience for this report includes:

- Collision avoidance system products and solutions providers

- Collision avoidance system related service providers

- Research organizations and consulting companies

- Vehicle safety related associations, organizations, forums, and alliances

- Government and corporate offices

- Venture capitalists, private equity firms, and startup companies

- Distributors and traders

- Forums, alliances, and associations

- End users who want to know more about the collision avoidance technology and latest technological developments in the market

Scope of the Report

The research report segments the collision avoidance system market into following submarkets:

By Application:

- Automotive

- Aerospace

- Railway

- Marine

- Construction & mining

Automotive Collision Avoidance System Market

- By Device

- By Technology

- By Geography

Airborne Collision Avoidance System Market:

- By Device

- By Technology

- By Geography

Train Collision Avoidance System Market

- By Device

- By Technology

- By Geography

Marine Collision Avoidance System Market

- By Device

- By Technology

-

By Geography

- By Device

- By Technology

- By Geography

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Market Analysis

- Further breakdown of the collision avoidance system applications market, by geography

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Collision Avoidance System Market

Automotive collision repair, Collision repair technology and design, Collision and Insurance Education. Does the scope of your research include the above things?

Several interests. Railway in all global regions. Also interested in other applications (auto, aerospace, marine, etc.). Have you considered them in your research? Also are there any smart devices that you have considered in the scope?