Aircraft Survivability Equipment Market by Platform (Combat aircraft, Combat helicopter, Special mission aircraft, UAV), Subsystem (Electronic Support, Electronic Attack, Non-combat systems), Fit (Line fit, Forward Fit) and Region - Global Forecast to 2022

The Aircraft Survivability Equipment Market was valued at USD 3.34 Billion in 2016 and is projected to reach USD 4.62 Billion by 2022, at a CAGR of 5.49% from 2017 to 2022. The objective of this study is to analyze, define, describe, and forecast the market based on fit, platform, subsystem, and region. The report also focuses on the competitive landscape of this market by profiling companies based on their financial position, product portfolio, growth strategies, and analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report also tracks and analyzes competitive developments, such as partnerships, mergers & acquisitions, new product developments, and research & development (R&D) activities in the market. The base year considered for this study is 2016 and the forecast period is from 2017 to 2022.

The aircraft survivability equipment market is projected to grow from an estimated USD 3.54 billion in 2017 to USD 4.62 billion by 2022, at a CAGR of 5.49% from 2017 to 2022. Replacement of legacy systems with advanced combat systems, increase in asymmetric warfare, and the threat of advanced infrared (IR) and radio-frequency (RF) targeting systems are key factors expected to drive the market during the forecast period. The market has been segmented based on platform, subsystem, fit, and region.

Based on platform, the aircraft survivability equipment market has been segmented into combat aircraft, combat helicopter, special mission aircraft, and UAV. Rising threats, advancements in technology, and futuristic conflicts have increased the need for survivability equipment in unmanned aircraft and defense aircraft, among other platforms.

Based on subsystem, the aircraft survivability equipment market has been segmented into electronic support, electronic attack, and non-combat systems. The electronic support segment includes systems that detect incoming threats to an aircraft, such as surface-to-air missiles, air-to-air missiles, rocket-propelled grenades, shoulder-fired missiles, and anti-aircraft artilleries.

Based on fit, the market has been segmented into line fit and forward fit. The forward fit segment is projected to witness a higher growth rate than the line fit segment during the forecast period. This higher growth of the forward fit segment is due to upgradation of old aircraft by various defense organizations.

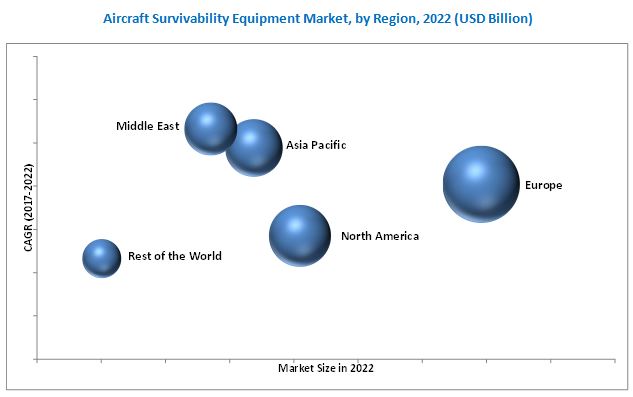

North America, Europe, Asia Pacific, the Middle East, and RoW (rest of the world) have been considered in the regional analysis of the aircraft survivability equipment market. Europe is estimated to lead the market in 2017, owing to the presence of major aircraft survivability equipment manufacturers, such as BAE Systems (UK), Chemring Group (UK), RUAG Holding AG (Switzerland), Saab AB (Sweden), Terma A/S (Denmark), and Thales Group (UK) in the region.

The increasing electronic warfare techniques can restrain the growth of the aircraft survivability equipment market. Aircraft will need to be equipped with anti-jamming technologies for protection against these electronic assaults. The traditional countermeasure techniques will become ineffective and obsolete against such threats.

Products offered by various companies operating in the aircraft survivability equipment market have been listed in the report. The recent developments section of the report includes information on strategies adopted by various companies between 2014 and 2017. Northrop Grumman Corporation (US), Orbital ATK, Inc. (US), and Thales Group (France) are some of the major market players. These players have an extensive geographical reach and distribution channels.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Study Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Increase in Military Spending of Emerging Countries

2.2.2.2 Rising Incidences of Regional Disputes, Terrorism, and Political Conflicts

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities

4.2 Aircraft Survivability Equipment Market, By Platform

4.3 Market, By Subsystem

4.4 Market, By Fit

4.5 Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Replacement of Legacy Systems With Advanced Combat Systems

5.2.1.2 Increase in Asymmetric Warfare

5.2.1.3 Increasing Threat From Advanced Infrared (IR) and Radio-Frequency (RF) Targeting Systems

5.2.2 Restraints

5.2.2.1 Growing Electronic Warfare Techniques

5.2.3 Opportunities

5.2.3.1 System Upgrade for Aging Fleet of Fighter Jets and Combat Helicopters

5.2.3.2 Equipping Other Platforms With ASE

5.2.4 Challenges

5.2.4.1 Incapability of Existing Systems to Address Multiple Threats

5.2.4.2 Stringent Military Regulations and Standards

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Technological Trends

6.2.1 Directional Infrared Countermeasure

6.2.2 RF and IR Decoys

6.2.3 Integrated Systems

6.2.4 Missile Warning System

6.2.5 Aircraft Self-Protection Suite

6.2.6 Three-Dimensional Advanced Warning System (3DAWS)

6.2.7 Micro-UAV Dispenser

6.2.8 Self-Repairing Flight Control System (SRFCS)

6.3 Innovation and Patent Registration

7 Market, By Subsystem (Page No. - 46)

7.1 Introduction

7.2 Electronic Support

7.2.1 Identification, Friend Or FOE (IFF)

7.2.2 Radar Warning Receiver (RWR)

7.2.3 Laser Warning System (LWS)

7.2.4 Missile Warning System (MWS)

7.3 Electronic Attack

7.3.1 Countermeasure Dispensing System (CMDS)

7.3.1.1 Flare Dispenser

7.3.1.2 Chaff Dispenser

7.3.2 Electronic Countermeasure (ECM)

7.3.2.1 IR Jammer

7.3.2.2 RF Jammer

7.3.3 Non-Combat Systems

7.3.3.1 Terrain Following Radar (TFR)

7.3.3.2 Terrain Awareness and Warning System (TAWS)

8 Market, By Platform (Page No. - 53)

8.1 Introduction

8.2 Combat Aircraft, By Subsystem

8.3 Combat Helicopter, By Subsystem

8.4 Special Mission Aircraft, By Subsystem

8.4.1 Refueling Aircraft

8.4.2 Aew&C Aircraft

8.4.3 Search and Rescue Aircraft

8.4.4 Patrol Aircraft

8.4.5 Military Transport Aircraft

8.4.6 Reconnaissance Aircraft

8.5 UAV , By Subsystem

9 Market, By Fit (Page No. - 58)

9.1 Introduction

9.2 Line Fit

9.3 Forward Fit

10 Regional Analysis (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 By Subsystem

10.2.2 By Platform

10.2.3 By Fit

10.2.4 By Country

10.2.4.1 Us

10.2.4.1.1 By Subsystem

10.2.4.1.2 By Platform

10.2.4.2 Canada

10.2.4.2.1 By Subsystem

10.2.4.2.2 By Platform

10.3 Europe

10.3.1 By Subsystem

10.3.2 By Platform

10.3.3 By Fit

10.3.4 By Country

10.3.4.1 Russia

10.3.4.1.1 By Subsystem

10.3.4.1.2 By Platform

10.3.4.2 Germany

10.3.4.2.1 By Subsystem

10.3.4.2.2 By Platform

10.3.4.3 Uk

10.3.4.3.1 By Subsystem

10.3.4.3.2 By Platform

10.3.4.4 France

10.3.4.4.1 By Subsystem

10.3.4.4.2 By Platform

10.3.4.5 Italy

10.3.4.5.1 By Subsystem

10.3.4.5.2 By Platform

10.4 Asia Pacific

10.4.1 By Subsystem

10.4.2 By Platform

10.4.3 By Fit

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Subsystem

10.4.4.1.2 By Platform

10.4.4.2 India

10.4.4.2.1 By Subsystem

10.4.4.2.2 By Platform

10.4.4.3 Japan

10.4.4.3.1 By Subsystem

10.4.4.3.2 By Platform

10.4.4.4 South Korea

10.4.4.4.1 By Subsystem

10.4.4.4.2 By Platform

10.5 Middle East

10.5.1 By Subsystem

10.5.2 By Platform

10.5.3 By Fit

10.5.4 By Country

10.5.4.1 Saudi Arabia

10.5.4.1.1 By Subsystem

10.5.4.1.2 By Platform

10.5.4.2 Turkey

10.5.4.2.1 By Subsystem

10.5.4.2.2 By Platform

10.6 Rest of the World

10.6.1 By Subsystem

10.6.2 By Platform

10.6.3 By Fit

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.1.1 By Subsystem

10.6.4.1.2 By Platform

11 Competitive Landscape (Page No. - 92)

11.1 Introduction

11.2 Market Ranking Analysis

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Competitive Benchmarking

11.4.1 Strength of Product Portfolio

11.4.2 Business Strategy Excellence

12 Company Profiles (Page No. - 97)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Products Offering, Recent Development’s, Business Strategy)*

12.1 Northrop Grumman Corporation

12.2 BAE Systems

12.3 Saab AB

12.4 Aselsan A.S.

12.5 Elbit Systems Ltd.

12.6 Chemring Group

12.7 Thales Group

12.8 Israel Aerospace Industries Ltd.

12.9 Terma A/S

12.10 Ruag Holding AG

12.11 Orbital ATK, Inc.

12.12 Raytheon Company

*Details on Overview, Strength of Product Portfolio, Busines Strategy Excellence, Products Offering, Recent Development’s, Business Strategy Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 131)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

13.6 Author Details

List of Tables (68 Tables)

Table 1 Number of Military Special Mission Aircraft of Top 5 Countries in 2015

Table 2 Important Innovation and Patent Registration

Table 3 Aircraft Survivability Equipment Market, By Subsystem, 2015-2022 (USD Million)

Table 4 Electronic Support Segment, By Subsegment, 2015-2022 (USD Million)

Table 5 Radar Warning Receiver Types in Service

Table 6 Electronic Attack Segment, By Subsegment, 2015-2022 (USD Million)

Table 7 CMDS Subsegment, By Type, 2015-2022 (USD Million)

Table 8 ECM Subsegment, By Type, 2015-2022 (USD Million)

Table 9 Non-Combat Systems Segment, By Type, 2015-2022 (USD Million)

Table 10 Market, By Platform, 2015-2022 (USD Million)

Table 11 Combat Aircraft Segment, By Subsystem, 2015-2022 (USD Million)

Table 12 Combat Helicopter Segment, By Subsystem, 2015-2022 (USD Million)

Table 13 Special Mission Aircraft Segment, By Subsystem, 2015-2022 (USD Million)

Table 14 Special Mission Aircraft Segment, By Type, 2015-2022 (USD Million)

Table 15 UAV Segment, By Subsystem, 2015-2022 (USD Million)

Table 16 Aircraft Survivability Equipment Market, By Fit, 2015-2022 (USD Million)

Table 17 Line Fit Segment, By Region, 2015-2022 (USD Million)

Table 18 Forward Fit Segment, By Region, 2015-2022 (USD Million)

Table 19 ASE Market Size, By Region, 2015-2022 (USD Million)

Table 20 North America ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 21 North America ASE Market, By Platform, 2015–2022 (USD Million)

Table 22 North America ASE Market, By Fit, 2015–2022 (USD Million)

Table 23 North America ASE Market, By Country, 2015–2022 (USD Million)

Table 24 US ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 25 US ASE Market, By Platform, 2015–2022 (USD Million)

Table 26 Canada ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 27 Canada ASE Market, By Platform, 2015–2022 (USD Million)

Table 28 Europe ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 29 Europe ASE Market, By Platform, 2015–2022 (USD Million)

Table 30 Europe ASE Market, By Fit, 2015–2022 (USD Million)

Table 31 Europe ASE Market, By Country, 2015–2022 (USD Million)

Table 32 Russia ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 33 Russia ASE Market, By Platform, 2015–2022 (USD Million)

Table 34 Germany ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 35 Germany ASE Market, By Platform, 2015–2022 (USD Million)

Table 36 UK ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 37 UK ASE Market, By Platform, 2015–2022 (USD Million)

Table 38 France ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 39 France ASE Market, By Platform, 2015–2022 (USD Million)

Table 40 Italy ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 41 Italy ASE Market, By Platform, 2015–2022 (USD Million)

Table 42 Asia Pacific ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 43 Asia Pacific ASE Market, By Platform, 2015–2022 (USD Million)

Table 44 Asia Pacific ASE Market, By Fit, 2015–2022 (USD Million)

Table 45 Asia Pacific ASE Market, By Country, 2015–2022 (USD Million)

Table 46 China ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 47 China ASE Market, By Platform, 2015–2022 (USD Million)

Table 48 India ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 49 India ASE Market, By Platform, 2015–2022 (USD Million)

Table 50 Japan ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 51 Japan ASE Market, By Platform, 2015–2022 (USD Million)

Table 52 South Korea ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 53 South Korea ASE Market, By Platform, 2015–2022 (USD Million)

Table 54 Middle East ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 55 Middle East ASE Market, By Platform, 2015–2022 (USD Million)

Table 56 Middle East ASE Market, By Fit, 2015–2022 (USD Million)

Table 57 Middle East ASE Market, By Country, 2015–2022 (USD Million)

Table 58 Saudi Arabia ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 59 Saudi Arabia ASE Market, By Platform, 2015–2022 (USD Million)

Table 60 Turkey ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 61 Turkey ASE Market, By Platform, 2015–2022 (USD Million)

Table 62 Rest of the World ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 63 Rest of the World ASE Market, By Platform, 2015–2022 (USD Million)

Table 64 Rest of the World ASE Market, By Fit, 2015–2022 (USD Million)

Table 65 Rest of the World ASE Market, By Country, 2015–2022 (USD Million)

Table 66 Brazil ASE Market, By Subsystem, 2015–2022 (USD Million)

Table 67 Brazil ASE Market, By Platform, 2015–2022 (USD Million)

Table 68 Ranking of Key Players in the Aircraft Survivability Equipment Market

List of Figures (46 Figures)

Figure 1 Aircraft Survivability Equipment Market Segmentation

Figure 2 Research Process Flow

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Increasing Defense Budgets of Countries, 2005 & 2015 (USD Billion, %)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Assumptions of the Research Study

Figure 10 Regional Analysis: Global Market

Figure 11 UAV Platform Segment Expected to Witness the Highest Growth During the Forecast Period

Figure 12 Electronic Support Segment Expected to Witness Highest CAGR During the Forecast Period

Figure 13 Forward Fit Segment Expected to Witness Highest Growth During the Forecast Period

Figure 14 Demand for Aircraft Survivability Equipment in Combat Helicopters Expected to Drive the Market During the Forecast Period

Figure 15 Combat Helicopter Segment Projected to Lead the ASE Market During the Forecast Period

Figure 16 Electronic Support Expected to Be the Highest Growing Segment During the Forecast Period

Figure 17 Line Fit Estimated to Be the Largest Segment in Middle East During the Forecast Period

Figure 18 Middle East Market to Grow at Highest CAGR During the Forecast Period

Figure 19 Market Dynamics

Figure 20 Causalities Due to Terrorism Activities Worldwide: 2006-2016

Figure 21 Aircraft Survivability Equipment Technological Trends

Figure 22 Integrated Aircraft Survivability Equipment (IASE)

Figure 23 Companies Providing Aircraft Self-Protection Suite

Figure 24 3DAWS Layered Countermeasure Technique

Figure 25 Electronic Support Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 26 UAV Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Forward Fit Segment Expected to Witness the Highest CAGR During the Forecast Period

Figure 28 ASE Market: Regional Snapshot

Figure 29 North America ASE Market Snapshot

Figure 30 Europe ASE Market Snapshot

Figure 31 Asia Pacific ASE Market Snapshot

Figure 32 Middle East ASE Market Snapshot

Figure 33 Market Ranking Analysis of Key Player

Figure 34 Aircraft Survivability Equipment Market (Global) Competitive Leadership Mapping, 2017

Figure 35 Northrop Grumman Corporation: Company Snapshot

Figure 36 BAE Systems: Company Snapshot

Figure 37 Saab AB: Company Snapshot

Figure 38 Aselsan A.S.: Company Snapshot

Figure 39 Elbit Systems Ltd.: Company Snapshot

Figure 40 Chemring Group: Company Snapshot

Figure 41 Thales Group: Company Snapshot

Figure 42 Israel Aerospace Industries Ltd.: Company Snapshot

Figure 43 Terma A/S: Company Snapshot

Figure 44 Ruag Holding AG: Company Snapshot

Figure 45 Orbital ATK, Inc.: Company Snapshot

Figure 46 Raytheon Company: Company Snapshot

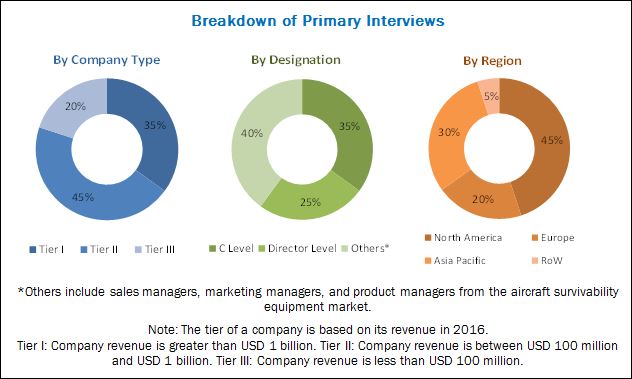

The research methodology used to estimate and forecast the aircraft survivability equipment market includes the study of data and revenue of key market players through secondary resources, such as annual reports, Yahoo Finance, Federal Aviation Administration (FAA), and Stockholm International Peace Research Institute (SIPRI). The bottom-up procedure was employed to arrive at the overall size of the market from the revenue of key market players. After arriving at the overall market size, the aircraft survivability equipment market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. Breakdown of profiles of primaries is shown in the figure given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The aircraft survivability equipment market has been segmented on the basis of fit, platform, subsystem, and region. ASELSAN A.S. (Turkey), BAE Systems (UK), Chemring Group (UK), Elbit Systems Ltd. (Israel), Israel Aerospace Industries Ltd. (Israel), Orbital ATK, Inc. (US), Northrop Grumman Corporation (US), Raytheon Company (US), RUAG Holding AG (Switzerland), Saab AB (Sweden), Terma A/S (Denmark), and Thales Group (France) are some of the manufacturers in this market. Contracts, new product launches, agreements, and acquisitions are the major strategies adopted by key players in the market.

Target Audience for this Report

- Manufacturers of Aircraft Survivability Equipment

- Component Manufacturers of Aircraft Survivability Equipment

- Military Aircraft Manufacturers

- Government and Certification Bodies

“This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

Aircraft Survivability Equipment Market, By Platform

- Combat Aircraft

- Combat Helicopter

- Special Mission Aircraft

- UAV

Aircraft Survivability Equipment Market, By Subsystem

-

Electronic Support

- Identification, Friend or Foe (IFF)

- Radar Warning Receiver (RWR)

- Laser Warning System (LWS)

- Missile Warning System (MWS)

-

Electronic Attack

-

Countermeasure Dispenser System (CMDS)

- Chaff Dispenser

- Flare Dispenser

-

Electronic Countermeasure (ECM)

- RF Jammer

- IR Jammer

-

Countermeasure Dispenser System (CMDS)

-

Non-Combat Systems

- Terrain Following Radar (TFR)

- Terrain Awareness and Warning System (TAWS)

Aircraft Survivability Equipment Market, By Fit

- Line Fit

- Forward Fit

Aircraft Survivability Equipment Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for this report:

-

Geographic Analysis

- Further breakdown of the Middle East and Rest of the World markets

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

Growth opportunities and latent adjacency in Aircraft Survivability Equipment Market