Circuit Protection Market by Type (Overcurrent Protection, Overvoltage Protection, ESD Protection), Device (Circuit Breakers, Fuses, ESD Protection Devices, Surge Protection Devices), Industry, Geography - Global Forecast to 2022

The circuit protection market was valued at USD 35.85 billion in 2015 and is expected to reach USD 53.56 billion by 2022, at a CAGR of 5.92% during the forecast period. The base year considered for the study is 2015 and the market size forecast is provided for the period between 2016 and 2022. Electrical equipment is constantly becoming complex and is considered critical for operations pertaining to industrial, commercial, and residential installations. This has resulted in an increase in the focus of various industries on circuit protection and overall equipment protection. Circuit protection includes protection from overvoltage, overcurrent, short circuit, thermal, electrostatic discharge, and electromagnetic interference to ensure the safety and reliability of electrical equipment. Circuit breakers, fuses, and electrostatic protection devices are some of the commonly used circuit protection devices. The increasing number of connected devices has resulted in the higher adoption of circuit protection devices to prevent system failures. Electronics and electrical equipment and automotive are some of the major industries that have adopted circuit protection devices.

Market Dynamics

Drivers

- Growth in the automotive electronics market

- Growing Internet of Things (IoT) market

Restraints

- Rising prices of raw materials

Opportunities

- Industrialization and urbanization in developing countries

Challenges

- Environmental regulations pertaining to SF6 circuit breaker technology

Usage of circuit protection in automobiles is driving the circuit protection market

An automobile, today, is an integration of mechanical systems and electronic controls. This has happened mainly due to the advent of automotive electronics and their successful incorporation at various levels in an automobile. These automotive electronics have enabled automobile manufacturers to bring together multiple applications on a single chip by cutting down the board area, thereby optimizing the performance. The growth in the market for automotive electronics necessitates the use of circuit protection devices; this is driving the growth of the circuit protection market. Also, automotive manufacturers are now designing intelligent and high performance, connected vehicles, which are complex in nature. This requires consistent circuit protection to the extent of adding protection to every wire.

Objective of the Study:

- To define, describe, and forecast the circuit protection market on the basis of type, device, industry, and geography

- To forecast the market size, in terms of value, for various segments with regard to four main regions—North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro-markets with respect to the individual growth trends, future prospects, and contributions to the total market

- To gauge the entry barriers to this market using the Porter’s five forces analysis, along with the value chain analysis and market roadmaps to study the evolution and timeline of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the market

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, new product developments, and research and development (R&D) in the market

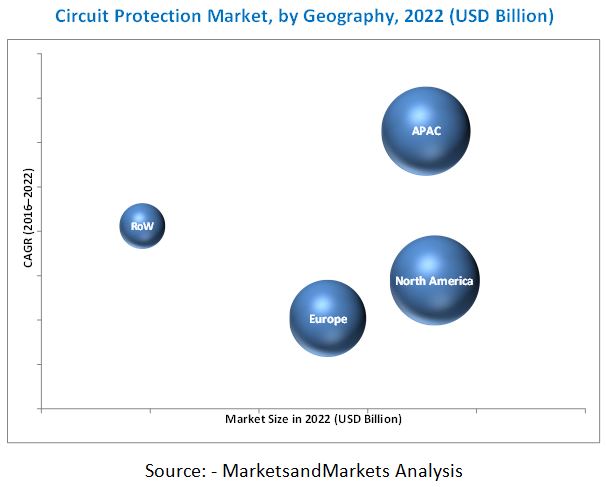

The circuit protection market was valued at USD 35.85 billion in 2015 and is expected to reach USD 53.56 billion by 2022, at a CAGR of 5.92% between 2016 and 2022. The growth in the automotive electronics and Internet of Things (IoT) markets is driving the growth of the market. Industrialization and urbanization lead to an increase in demand for energy in most industries. Developing countries such as China, India, and Brazil are currently increasing their power generation capacity to fulfil the growing demand for energy. Due to urbanization and industrialization, the developing countries hold a major share of the market for circuit breakers and fuses.

This report segments the circuit protection industry based on type, device, industry, and geographical regions. On the basis of type, the market has been segmented into overcurrent protection, ESD protection, and overvoltage protection. The most fundamental requirement in any electrical system is the proper overcurrent protection of conductors and equipment. An overcurrent protection device protects the circuit by opening the device when the current reaches a value that would cause an excessive or dangerous temperature rise in conductors. This factor is driving the growth of the market for overvoltage protection.

The circuit protection market, on the basis of device, has been segmented into circuit breakers, fuses, ESD protection devices, and surge protection devices. Electrostatic discharge is common in consumer electronics products, especially in smartphones. With the increasing use of consumer electronics, the demand for ESD protection devices is also rising. This factor is driving the growth of the market for ESD protection devices.

On the basis of industry, the market has been segmented into construction, automotive and transportation, electronics and electrical equipment, industrial, energy, and others. The residential and commercial buildings are the major consumers of electricity; this factor is leading to the increasing adoption of circuit protection devices in the construction industry.

North America is expected to hold the largest share of the circuit protection industry during the forecast period. According to the U.S. Environmental Protection Agency (EPA) report, Washington D.C., Los Angeles, San Francisco, Atlanta, New York City, Chicago, Dallas-Fort Worth, Houston, Denver, Phoenix, and Boston are the Top 11 cities with the most number of energy-certified buildings in 2015. This is driving the growth of the market for the construction industry in the region.

Application of circuit protection in industries such as construction, electronics & electrical equipment and automotive driving the growth of the circuit protection market.

Construction

The construction industry, comprising residential and commercial buildings, is a major application area for circuit protection devices. Due to the developments in the industrial and real estate market in the recent years, the adoption of circuit protection devices in residential and commercial buildings has drastically increased. One of the major reasons for the increasing demand for circuit protection devices in residential buildings is the growing market for smart homes and other connected devices.

Electronics and Electrical Equipment

Circuit protection is required in the electronics and electrical equipment industry for applications such communication, automation, home appliances, and battery cells in consumer electronics. A number of circuit protection devices can be used to help provide protection for small electric motors, LED displays, and control electronics found in home appliances from over temperature, overcurrent, and overvoltage. Due to external shorts, runaway charging conditions, or abusive charging, considerable damage can be sustained in both battery cells and pack surroundings.

Automotive & Transportation

Circuit protection devices protect automotive electronics and peripherals and/or portable electronics that can be charged in vehicles from damages caused by inductive voltage spikes, voltage transients, and reverse polarity. Providing coordinated overcurrent, overvoltage, and ESD protection, these devices are capable of withstanding the high-power fault conditions that can occur in automotive applications. An increasing number of displays, such as navigation systems, instrumentation displays, videos, and TV screens, are now integrated in automobiles; these displays require ESD protection.

Industrial

The uninterrupted delivery of power to machines is essential for all industries. Any interruption or breakdown can result in significant losses. Circuit protection devices are used in industries to prevent damages to expensive instruments caused by overcurrent, overvoltage, and electrostatics discharges. Circuit breakers and ESD protection devices are the major circuit protection devices used in the industrial sector.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- Which circuit protection device has major adoption based on different industries?

Rising price of raw materials is the major restraint of circuit protection market. The major raw materials required for the manufacturing of circuit breakers and fuses include glass, diodes, solenoids, and metal wirings, among others. The prices of these raw materials are gradually increasing. Certain circuit breakers, such as SF6 and vacuum, also have gold and silver content, particularly for tolerance purpose, which makes the overall assembly of these devices more expensive. The prices of silicon devices such as diodes and diode arrays are also rising.

The major players in the market are ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corp. PLC (Ireland), Schneider Electric SE (France), General Electric Company (U.S.), ON Semiconductor Corp. (U.S.), Mitsubishi Electric Corporation (Japan), NXP Semiconductors N.V (Netherlands), Rockwell Automation Inc. (U.S.), Texas Instruments Inc. (U.S.), Bel Fuse Inc. (U.S.), and Larsen & Toubro Ltd. (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Demand-Side & Supply-Side Analysis of the Circuit Protection Market

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Electric Power Consumption

2.2.2.2 Growing Renewable Sources of Energy

2.2.3 Supply-Side Analysis

2.2.3.1 Electricity Generation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Circuit Protection Market

4.2 Market, By Device, 2015 vs 2022

4.3 Market, By Industry

4.4 Snapshot of the Circuit Protection Market Based on Type and Region

4.5 Market, By Geography

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Circuit Protection Market, By Type

5.2.2 Market, By Device

5.2.3 Market, By Industry

5.2.4 Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in the Automotive Electronics Market

5.3.1.2 Growing Internet of Things (IoT) Market

5.3.2 Restraints

5.3.2.1 Rising Prices of Raw Materials

5.3.3 Opportunities

5.3.3.1 Industrialization and Urbanization in Developing Countries

5.3.4 Challenges

5.3.4.1 Environmental Regulations Pertaining to SF6 Circuit Breaker Technology

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Research & Product Development

6.2.2 Manufacturing/Oem

6.2.3 Distribution

6.2.4 Marketing & Sales

6.2.5 End Users

6.2.6 Post-Sale Services

6.3 Porter’s Five Forces Analysis of the Circuit Protection Market, 2015

6.3.1 Bargaining Power of Suppliers

6.3.2 Bargaining Power of Buyers

6.3.3 Threat of Substitutes

6.3.4 Threat of New Entrants

6.3.5 Degree of Competition

7 Circuit Protection Market, By Type (Page No. - 52)

7.1 Introduction

7.2 Overcurrent Protection

7.3 Electrostatic Discharge (ESD) Protection

7.4 Overvoltage Protection

8 Circuit Protection Market, By Device (Page No. - 60)

8.1 Introduction

8.2 Circuit Breakers

8.2.1 Miniature Circuit Breaker (MCB) & Residual Current Device (RCD)

8.2.2 Vacuum Circuit Breakers

8.2.3 SF6 Circuit Breakers

8.2.4 Others

8.3 Fuses

8.4 ESD Protection Devices

8.5 Surge Protection Devices

9 Circuit Protection Market, By Industry (Page No. - 73)

9.1 Introduction

9.2 Construction

9.3 Electronics & Electrical Equipment

9.4 Automotive & Transportation

9.5 Industrial

9.6 Energy

9.7 Others

10 Geographic Analysis (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 U.K.

10.3.3 France

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 India

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East & Africa (MEA)

10.5.2 South America

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Key Players in the Circuit Protection Market

11.3 Competitive Situations and Trends

11.4 New Product Launches

11.5 Expansions

12 Company Profiles (Page No. - 119)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 ABB Ltd.

12.3 Siemens AG

12.4 Eaton Corp. PLC

12.5 Schneider Electric Se

12.6 General Electric Company

12.7 On Semiconductor Corp.

12.8 Mitsubishi Electric Corp.

12.9 NXP Semiconductors N.V.

12.10 Rockwell Automation Inc.

12.11 Texas Instruments Inc.

12.12 BEL Fuse Inc.

12.13 Larsen & Toubro Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 152)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customization

13.6 Related Reports

13.7 Author Details

List of Tables (66 Tables)

Table 1 Porter’s Five Forces Analysis: Bargaining Power of Buyers and Degree of Competition Have A High Impact on the Market

Table 2 Circuit Protection Market, By Type, 2014–2022 (USD Billion)

Table 3 Market for Overcurrent Protection, By Industry, 2014–2022 (USD Billion)

Table 4 Market for Overcurrent Protection, By Region, 2014–2022 (USD Billion)

Table 5 Circuit Protection Market for ESD Protection, By Industry, 2014–2022 (USD Billion)

Table 6 Market for ESD Protection, By Region, 2014–2022 (USD Billion)

Table 7 Market for Overvoltage Protection, By Industry, 2014–2022 (USD Million)

Table 8 Market for Overvoltage Protection, By Region, 2014–2022 (USD Billion)

Table 9 Circuit Protection Market, By Device, 2014–2022 (USD Billion)

Table 10 Market for Circuit Breakers, By Type, 2014–2022 (USD Billion)

Table 11 Market for Circuit Breakers, By Voltage Type, 2014–2022 (USD Billion)

Table 12 Market for Circuit Breakers, By Industry, 2014–2022 (USD Billion)

Table 13 Market for Circuit Breakers, By Region, 2014–2022 (USD Billion)

Table 14 Circuit Protection Market for Fuses, By Voltage Type, 2014–2022 (USD Billion)

Table 15 Market for Fuses Market, By Industry, 2014–2022 (USD Billion)

Table 16 Market for Fuses, By Region, 2014–2022 (USD Billion)

Table 17 Market for ESD Protection Devices, By Industry, 2014–2022 (USD Billion)

Table 18 Market for ESD Protection Devices, By Region, 2014–2022 (USD Billion)

Table 19 Market for Surge Protection Devices, By Industry, 2014–2022 (USD Billion)

Table 20 Market for Surge Protection Devices, By Region, 2014–2022 (USD Billion)

Table 21 Circuit Protection Market, By Industry, 2014–2022 (USD Billion)

Table 22 Market for Construction, By Building Type, 2014–2022 (USD Billion)

Table 23 Market for Construction, By Device, 2014–2022 (USD Billion)

Table 24 Market for Construction, By Region, 2014–2022 (USD Billion)

Table 25 Market for Electronics & Electrical Equipment, By Device, 2014–2022 (USD Billion)

Table 26 Market for Electronics & Electrical Equipment, By Region, 2014–2022 (USD Billion)

Table 27 Circuit Protection Market for Automotive & Transportation, By Device, 2014–2022 (USD Billion)

Table 28 Market for Automotive & Transportation, By Region, 2014–2022 (USD Billion)

Table 29 Market for Industrial, By Device, 2014–2022 (USD Billion)

Table 30 Market for Industrial, By Region, 2014–2022 (USD Billion)

Table 31 Market for Energy, By Device, 2014–2022 (USD Billion)

Table 32 Market for Energy, By Region, 2014–2022 (USD Billion)

Table 33 Circuit Protection Market for Other Industries, By Device, 2014–2022 (USD Billion)

Table 34 Market for Other Industries, By Region, 2014–2022 (USD Billion)

Table 35 Market, By Region, 2014–2022 (USD Billion)

Table 36 Market in North America, By Country, 2014–2022 (USD Billion)

Table 37 Circuit Protection Market in North America, By Industry, 2014–2022 (USD Billion)

Table 38 Market in North America, By Type, 2014–2022 (USD Billion)

Table 39 Market in the U.S., By Industry, 2014–2022 (USD Million)

Table 40 Market in Canada, By Industry, 2014–2022 (USD Million)

Table 41 Market in Mexico, By Industry, 2014–2022 (USD Million)

Table 42 Market in Europe, By Country, 2014–2022 (USD Billion)

Table 43 Market in Europe, By Industry, 2014–2022 (USD Billion)

Table 44 Circuit Protection Market in Europe, By Type, 2014–2022 (USD Billion)

Table 45 Market in Germany, By Industry, 2014–2022 (USD Million)

Table 46 Market in the U.K., By Industry, 2014–2022 (USD Million)

Table 47 Market in France, By Industry, 2014–2022 (USD Million)

Table 48 Circuit Protection Market in Italy, By Industry, 2014–2022 (USD Million)

Table 49 Market in Spain, By Industry, 2014–2022 (USD Million)

Table 50 Market in the Rest of Europe, By Industry, 2014–2022 (USD Million)

Table 51 Market in APAC, By Country, 2014–2022 (USD Billion)

Table 52 Market in APAC, By Industry, 2014–2022 (USD Billion)

Table 53 Market in APAC, By Type, 2014–2022 (USD Billion)

Table 54 Market in China, By Industry, 2014–2022 (USD Million)

Table 55 Market in Japan, By Industry, 2014–2022 (USD Million)

Table 56 Circuit Protection Market in South Korea, By Industry, 2014–2022 (USD Million)

Table 57 Market in India, By Industry, 2014–2022 (USD Million)

Table 58 Market in the Rest of APAC, By Industry, 2014–2022 (USD Million)

Table 59 Market in RoW, By Region, 2014–2022 (USD Billion)

Table 60 Market in RoW, By Industry, 2014–2022 (USD Billion)

Table 61 Circuit Protection Market in RoW, By Type, 2014–2022 (USD Billion)

Table 62 Market in MEA, By Industry, 2014–2022 (USD Million)

Table 63 Market in South America, By Industry, 2014–2022 (USD Million)

Table 64 Top 5 Players in the Market, 2015

Table 65 New Product Launches, 2015–2016

Table 66 Expansions, 2014–2016

List of Figures (79 Figures)

Figure 1 Circuit Protection Market: Research Design

Figure 2 Electric Power Consumption, 2010–2013 (Kwh Per Capita)

Figure 3 Renewable Energy Consumption, 2010–2012 (Kwh Per Capita)

Figure 4 World Net Electricity Generation, 2012–2040 (Trillion Kwh)

Figure 5 Data Triangulation

Figure 6 Process Flow of Market Size Estimation

Figure 7 Circuit Protection Market, By Type, 2016 vs 2022

Figure 8 Market, By Device, 2016 vs 2022

Figure 9 MCB & RCD Expected to Dominate the Market for Circuit Breakers Between 2016 and 2022

Figure 10 Market, By Industry, 2016 vs 2022

Figure 11 Circuit Protection Market, By Geography, 2015

Figure 12 Market Expected to Grow at A Steady Rate Between 2016 and 2022

Figure 13 Circuit Breakers Expected to Hold the Largest Size of the Circuit Protection Device Market Between 2015 and 2022

Figure 14 Market for the Automotive & Transportation Industry Expected to Grow at Highest Rate During the Forecast Period

Figure 15 Overcurrent Protection Held the Largest Share of the Market in 2015

Figure 16 U.S. Held the Largest Share of the Market in 2015

Figure 17 Circuit Protection Market, By Geography

Figure 18 Market Dynamics

Figure 19 Urban Population, By Region, 1995–2015 (Millions)

Figure 20 Value Chain Analysis of the Market, 2015

Figure 21 Overview of the Porter’s Five Forces Analysis of the Market (2015)

Figure 22 Circuit Protection Market: Porter’s Five Forces Analysis (2015)

Figure 23 Medium Impact of Bargaining Power of Suppliers on the Market

Figure 24 High Impact of Bargaining Power of Buyers on the Market

Figure 25 Low Impact of Threat of Substitutes on the Market

Figure 26 Medium Impact of Threat of New Entrants on the Market

Figure 27 High Impact of Degree of Competition on the Market

Figure 28 Circuit Protection Market, By Type

Figure 29 Market for ESD Protection Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 30 APAC Region Expected to Grow at the Fastest Rate for Overcurrent Protection During 2016 and 2022

Figure 31 Construction Industry Likely to Hold the Largest Size of the Market for ESD Protection By 2022

Figure 32 APAC Expected to Be the Fastest-Growing Market for Overvoltage Protection Between 2016 and 2022

Figure 33 Circuit Protection Market, By Device

Figure 34 ESD Protection Devices Expected to Grow at the Fastest Rate for the Market During 2016 and 2022

Figure 35 MCB & RCD Expected to Dominate the Market for Circuit Breakers Between 2016 and 2022

Figure 36 APAC Expected to Be the Fastest-Growing Market for Circuit Breakers Between 2016 and 2022

Figure 37 Market for Low-Voltage Fuses to Grow at the Highest Rate Between 2016 and 2022

Figure 38 Electronics & Electrical Equipment to Hold the Largest Size of the Market for Fuses By 2022

Figure 39 APAC Region to Grow the Fastest for ESD Protection Devices During 2016 and 2022

Figure 40 Construction Industry to Hold the Largest Size of the Market for Surge Protection Devices By 2022

Figure 41 Circuit Protection Market, By Industry

Figure 42 Construction Expected to Hold the Largest Size of the Market By 2022

Figure 43 APAC Region is Expected to Grow at the Fastest Rate for the Construction Industry During 2016 and 2022

Figure 44 Market for Electronics & Electrical Equipment in APAC Likely to Grow at the Highest Rate Between 2016 and 2022

Figure 45 APAC Region is Expected to Have the Highest CAGR for the Automotive and Transportation Industry Between 2016 and 2022

Figure 46 Market for ESD Protection Devices for Industrial Likely to Grow at the Highest Rate During the Forecast Period

Figure 47 for the Energy Industry, ESD Protection Devices are Expected to Grow at the Fastest Rate Between 2016 and 2022

Figure 48 Market for ESD Protection Devices for the Other Industries to Grow at the Highest Rate Between 2016 and 2022

Figure 49 Circuit Protection Market, By Geography

Figure 50 Market in China & India Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 51 Snapshot of the Market in North America

Figure 52 U.S. Expected to Hold the Largest Size of the Market in North America By 2022

Figure 53 Construction Expected to Hold the Largest Size of the Market in the U.S. By 2022

Figure 54 Snapshot of the Circuit Protection Market in Europe

Figure 55 Market in Spain Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 56 Construction Likely to Hold the Largest Size of the Market in Spain By 2022

Figure 57 Snapshot of the Circuit Protection Market in APAC

Figure 58 Construction Expected to Hold the Largest Size of the Market in China By 2022

Figure 59 South America Expected to Lead the Market in RoW Between 2016 and 2022

Figure 60 Companies Adopted New Product Launches as the Key Growth Strategy in the Past Three Years (2014–2016)

Figure 61 Battle for Market Share: New Product Launches Emerged as the Key Strategy Adopted By the Companies Between 2014 and 2016

Figure 62 Geographic Revenue Mix of Major Companies

Figure 63 ABB Ltd.: Company Snapshot

Figure 64 SWOT Analysis: ABB Ltd.

Figure 65 Siemens AG: Company Snapshot

Figure 66 SWOT Analysis: Siemens Ag

Figure 67 Eaton Corp. PLC: Company Snapshot

Figure 68 SWOT Analysis: Eaton Corp. PLC

Figure 69 Schneider Electric Se: Company Snapshot

Figure 70 SWOT Analysis: Schneider Electric Se

Figure 71 General Electric Company: Company Snapshot

Figure 72 SWOT Analysis: General Electric Company

Figure 73 On Semiconductor Corp.: Company Snapshot

Figure 74 Mitsubishi Electric Corp.: Company Snapshot

Figure 75 NXP Semiconductors N.V.: Company Snapshot

Figure 76 Rockwell Automation Inc.: Company Snapshot

Figure 77 Texas Instruments Inc.: Company Snapshot

Figure 78 BEL Fuse Inc.: Company Snapshot

Figure 79 Larsen & Toubro Ltd.: Company Snapshot

The base year used for this study is 2015, and the forecast period considered is between 2016 and 2022.

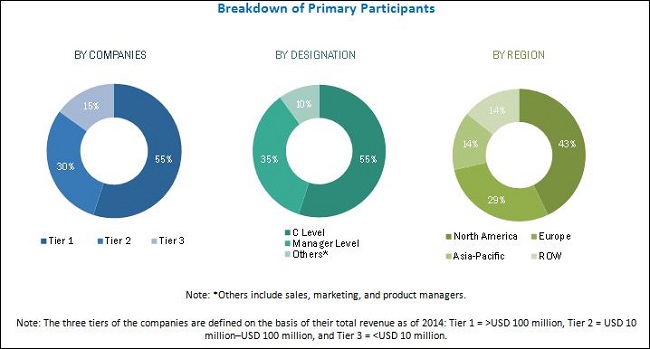

The research methodology used to estimate and forecast the circuit protection market begins with capturing data through secondary research such as Hoovers, Bloomberg Business, Factiva, and OneSource. The primary sources mainly comprised several industry experts from core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standards and certification organizations related to the various segments of this industry’s value chain. Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global market and to estimate the size of the other dependent submarkets. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. The market breakdown procedures and data triangulation have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major players in the circuit protection market are ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corp. PLC (Ireland), Schneider Electric SE (France), General Electric Company (U.S.), ON Semiconductor Corp. (U.S.), Mitsubishi Electric Corporation (Japan), NXP Semiconductors N.V (Netherlands), Rockwell Automation Inc. (U.S.), Texas Instruments Inc. (U.S.), Bel Fuse Inc. (U.S.), and Larsen & Toubro Ltd. (India).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2015 |

|

Forecast period |

2016–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corp. PLC (Ireland), Schneider Electric SE (France), General Electric Company (U.S.), ON Semiconductor Corp. (U.S.), Mitsubishi Electric Corporation (Japan), NXP Semiconductors N.V (Netherlands), Rockwell Automation Inc. (U.S.), Texas Instruments Inc. (U.S.), Bel Fuse Inc. (U.S.), and Larsen & Toubro Ltd. (India). |

Major Market Developments

- On November 2016, General Electric launched the SecoVac R, an IEEE retrofit vacuum circuit breaker. SecoVac is designed to easily replace vacuum circuit breakers in existing GE switchgears.

- On October 2016, Eaton launched the new SPC series of surge protective devices, giving its surge protection product line a complete range of offerings for a wide range of applications.

- On March 2016, Siemens expanded its range of arc-fault detection (AFD) units from the 5SM6 product line by launching a version for rated currents up to 40 amperes.

Key Target Audience:

- Raw materials and manufacturing component suppliers

- Electronic design automation (EDA) and design tool vendors

- Integrated device manufacturers

- Original equipment manufacturers—electronics modules, devices, equipment, instruments, and system manufacturers

- Technology standard organization, forums, alliances, and associations

- Distributors and retailers

- Technology investors

- End users: automotive and transportation, industrial, electronics and electrical equipment, communication, energy, and construction industries

Report Scope:

By Type:

- Overcurrent Protection

- ESD Protection

- Overvoltage Protection

By Device:

- Circuit Breakers

- Fuses

- ESD Protection Devices

- Surge Protection Devices

By Industry:

- Construction

- Automotive and Transportation

- Electronics and Electrical Equipment

- Industrial

- Energy

- Others (Healthcare, Chemicals and Petrochemicals, Cement, and Paper and Pulp)

By Geography:

- North America

- Europe

- APAC

- RoW

Critical questions which the report answers

- Which are key industries where circuit protection is being used?

- Who are the key players in the market and what strategies are being adopted by them?

Available Customizations:

- Analysis of industries in the circuit protection market in different geographical regions. Customization can be provided on country-wise analysis of the circuit protection with respect to industries.

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Circuit Protection Market