Electric Insulator Market by Type (Ceramic, Glass, and Composite), Voltage (Low, Medium, and High), Category (Bushings), End-User (Utilities, Industries), Application (Transformer, Cables, Busbar), and Region - Global Forecast to 2023

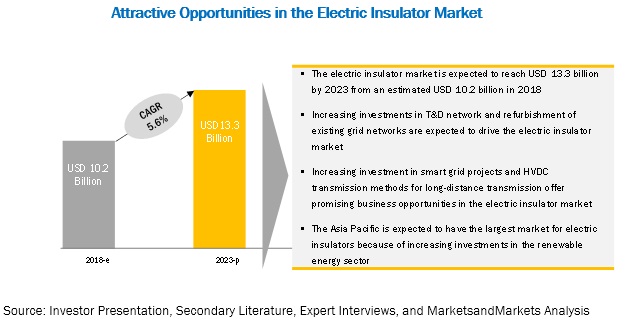

MarketsandMarkets forecasts the electric insulator market is projected to reach USD 13.3 billion by 2023, from an estimated USD 10.2 billion in 2018, at a CAGR of 5.6%. This growth can be attributed to the growing adoption of renewable energy sources, increasing investments in T&D networks, and refurbishment of existing grid networks across the globe. However, increasing grey market products of low quality can hinder the growth of the market.

The composite segment is expected to be the fastest growing market in the electric insulator market from 2018 to 2023.

The composite segment is estimated to be the fastest growing segment during the forecast period. Composite insulators consist of silicone rubber housing and sheds, fiberglass core rod and metal end fittings. Composite insulators have certain advantages such as lightweight, improved transmission line aesthetics, less gunshot damage, high shock resistance, and ease of installation. These advantages make composite insulators more suitable over conventional porcelain insulator.

Transformer: The fastest growing market for electric insulator market.

The transformer segment, by application, is estimated to be the fastest growing segment during the forecast period. Increasing installation of various transformer types for meeting the rising electricity requirements has led to the largest share of the transformer segment in the total electric insulator market.

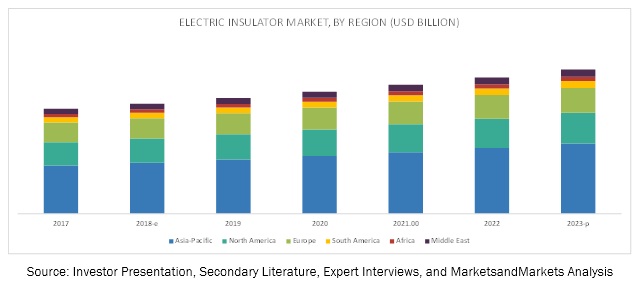

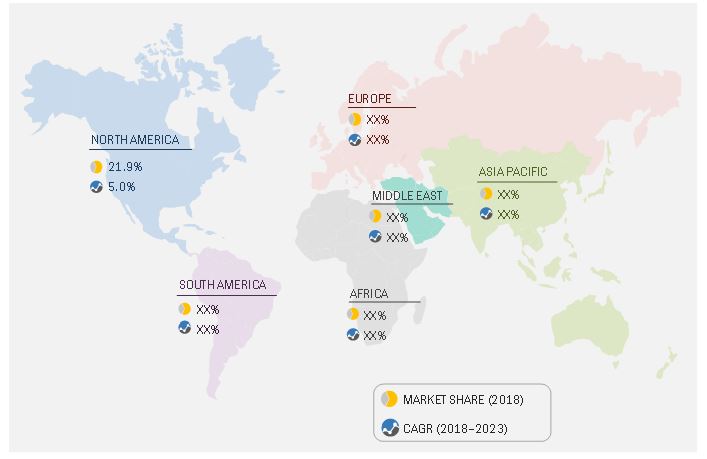

Asia Pacific: The fastest growing market for electric insulator market

The Asia Pacific is estimated to be the fastest growing market for electric insulator market in 2023 and is projected to grow at the highest CAGR during the forecast period. Increase in population, urbanization, and the growth of the industrial sector have increased the demand for power in countries such as China and India. The government of Asia Pacific countries is planning to develop more electrical grid and power generation capacity, which would further boost the demand for insulator in the region. Therefore, increasing demand for power and upgradation of existing electrical infrastructure is expected to boost the electric insulator demand in the region.

Market Dynamics

Driver: Refurbishment of Existing Grid Networks

Aging equipment requires replacement and upgrade of existing infrastructure. Rising energy demand has led to the need for stable and reliable T&D networks. Unreliable T&D infrastructure poses threat to national security due to sudden power outages. According to IEA, over the 2012-2035 period, planned investments in the electricity sector for the global generating capacity is about USD 9.7 trillion , with an additional USD 7.2 trillion for T&D grids (40% to replace existing infrastructure and 60% to build new infrastructure) According to the US Department of Energy (DoE) and the North American Electric Reliability Corp. (NERC), the US experiences more blackouts than any other developed nation as the number of power outages lasting more than an hour has increased steadily over the past few years. These blackouts cost American businesses around USD 150 billion per year. The main reasons behind the increasing number of blackouts are aging infrastructure, lack of investments, and lack of clear policy to modernize the grid. Nearly 75% of transmission lines and transformers are 25 years or older according to the US Department of Energy. According to the US Department of Energy, the US and Canadian power utilities of this region are planning to invest USD 980 billion over the next 20 years to replace, upgrade, and expand the prevailing aging transmission infrastructure. The robust infrastructure spending in this region will help to boost the market for electric insulator.

Restraint: Increasing Grey Market Products of Low Quality

The electric insulator market include both organized and unorganized players/sectors. The organized sector mainly targets industrial buyers and maintains high product quality, while players in the unorganized sector provide cheaper alternatives to increase their market presence and penetrate local markets. Leading market players are facing stiff competition from unorganized market players, who supply cheap and low-quality products. These market players from the unorganized sector overpower the big players in terms of price competitiveness and the local supply networks maintained by them, which are difficult for global players to achieve. The growth in electric insulator sales in the grey market degrades the brand names of the market leaders as cheap-quality goods are sold under their names. The increasing sales by both local and grey market players reduce the opportunities for the global players to increase their revenues (market shares).

Opportunity: Increasing Investment for Smart Grid Projects

A smart grid is an advanced technology with smart devices in the circuits, enabling remote monitoring of the normal operation. These devices have two-way communication technologies that allow the utility to interact with every device and control their working to detect and eliminate faults. Increasing smart city projects across the globe presents a huge opportunity for the technology companies, service providers, utility providers, and consulting companies. In smart cities, the key services such as utility, safety, transportation, and health are managed more efficiently and intelligently using technology and proper utilization of resources. Smart cities are likely to depend on the smart grids to provide robust energy to perform the key activities and functions. The rate of urbanization in APAC is the highest; both developed and developing countries in the region are looking to adopt smart city technologies. A rise in investments in smart grid technologies and smart cities that include distribution grid automation, power quality equipment, and demand response systems in countries such as Japan, South Korea, and Australia would create opportunities for the electric insulator market. In addition, government policies in favor of creating more smart cities will also boost the demand for electric insulator during the forecast period.

Challenge: Volatility in Raw Material Prices

Rapid changes in the prices of raw materials would have a significant impact on the production of electric insulators. Steel and silicon rubber are the raw materials used for manufacturing insulators. The prices of these materials are highly volatile and fluctuate frequently. This variation in the prices can be attributed to the fact that China being one of the largest steel producers has been facing slow economic growth since the last three years. The manufacturing sector in the country is expected to decline further in the future, which would result in further fluctuations in prices. The volatility in the prices of raw materials would pose would be a major challenge for the electric insulator market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Type (Ceramic, Glass, and Composite), Voltage (Low, Medium, and High), Category (Bushings), End-User (Utilities, Industries), Application (Transformer, Cables, Busbar), and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, South America, Middle East, and Africa |

|

Companies covered |

ABB (Switzerland), GE (US), Siemens (Germany), Toshiba (Japan), and Aditya Birla (India), General Electric (United States), NGK Insulators (Japan), Hubbell (United States) |

The research report categorizes the Electric Insulator Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Type

- Ceramic

- Composite

- Glass

By Voltage

- Low

- Medium

- High

By Category

- Bushing

- Other Insulators

By Application

- Transformer

- Cables

- Switchgear

- Busbar

- Surge Protection Devices

- Others

By End-User

- Utilities

- Industries

- Others

By Region

- Asia Pacific

- Europe

- North America

- South America

- Middle East

- Africa

Key Market Players

ABB (Switzerland), GE (US), Siemens (Germany), Toshiba (Japan), and Aditya Birla (India), General Electric (United States), NGK Insulators (Japan), Hubbell (United States), Bharat Heavy Electricals Limited (India), LAPP Insulators (United States), Maclean-Fogg (United States), Seves Group (Italy), TE Connectivity (Switzerland)

ABB is one of the key players that manufactures insulators. The company has adopted both organic and inorganic growth strategies to maintain its leading position in the electric insulator market. Contracts & agreements has been a prominent part of ABBs strategy to cover emerging markets such as India and Middle East. For instance, the Ministry of Electricity and Water of Kuwait and Polands transmission system operator would help ABB to enhance its product portfolio in the Middle East and European regions. Moreover, ABB is continuously addressing major technology trends and market challenges in the transformer industry by providing innovative products to meet the rising power demand. ABB has also been constantly investing in R&D expenditure and acquisitions of small-to-medium sized companies in the power and automation areas, which would help the company to maintain its leading position in the market.

Recent Developments

- In July 2016, ABB was awarded a contract to develop 1,100 kV UHVDC Changji-Guquan transmission link in China. The aim of the contract was to provide advanced converter transformers, HVDC converter valves, DC circuit breakers, wall bushings, tap changers, and capacitors.

- In June 2017, Siemens was awarded a contract from Con Edison to supply 6 units of mobile resiliency transformers. The transformers are highly optimized for weight and dimension through advanced voltage, power rating, impedance, and environmentally-friendly ester fluid technology. The transformers were designed as single-phase units and equipped with plug and play bushings and cable connections

- In May 2017, ABB introduced a Direct Current (DC) transformer bushing for Ultra-High Voltage Direct Current (UHVDC) transmission link project.

- In April 2015, Alstom, a GE company expanded its business by opening a new manufacturing site for bushings in Sesto San Giovanni, near Milan in Italy. The aim behind the expansion was to provide research, development, production and testing of bushings for both DC and AC applications.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Electric Insulator market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Electric Insulator Market, 20182023

4.2 Electric Insulator, By Type

4.3 Electric Insulator, By Category

4.4 Electric Insulator, By Voltage

4.5 Electric Insulator, By Application

4.6 Electric Insulator, By End-User

4.7 Asia Pacific Electric Insulator

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Increasing Investments in T&D Networks

5.3.2 Refurbishment of Existing Grid Networks

5.3.3 Growing Adoption of Renewable Energy Sources

5.4 Restraints

5.4.1 Increasing Grey Market Products of Low Quality

5.5 Opportunities

5.5.1 Increasing Investments in Smart Grid Projects

5.5.2 Hvdc Transmission Methods for Long-Distance Transmission

5.6 Challenges

5.6.1 Volatility in Raw Material Prices

6 Electric Insulator Market, By Type

6.1 Introduction

6.2 Ceramic Insulator

6.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

6.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

6.3 Composite Insulator

6.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

6.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

6.4 Glass Insulator

6.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

6.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

7 Electric Insulator Market, By Voltage

7.1 Introduction

7.2 Low Voltage

7.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

7.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

7.3 Medium Voltage

7.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

7.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

7.4 High Voltage

7.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

7.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

8 Electric Insulator Market, By Category

8.1 Introduction

8.2 Bushings

8.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

8.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

8.3 Others Insulator

8.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

8.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9 Electric Insulator Market, By Application

9.1 Introduction

9.2 Cable

9.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.3 Transformer

9.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.4 Switchgear

9.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.5 Busbar

9.5.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.5.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.6 Surge Protection Device

9.6.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.6.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

9.7 Others

9.7.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

9.7.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10 Electric Insulator Market, By End-User

10.1 Introduction

10.2 Utilities

10.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10.3 Industries

10.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

10.4 Others

10.4.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

10.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11 Electric Insulator Market, By Product

11.1 Introduction

11.2 Pin Insulator

11.2.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.2.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.3 Suspension Insulator

11.3.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.3.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.4 Shackle Insulator

11.4.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

11.5 Others

11.5.1 Market Estimates and Forecasts, 2017 - 2024 (USD Million)

11.5.2 Market Estimates and Forecasts, By Region, 2017 - 2024 (USD Million)

13 Electric Insulator Market, By Region

13.1 Introduction

13.2 Asia Pacific

13.2.1 By Type

13.2.2 By Voltage

13.2.3 By Category

13.2.5 By End-User

13.2.6 By Country

13.2.6.1 China

13.2.6.2 India

13.2.6.3 Japan

13.2.6.4 Australia

13.2.6.5 Rest of Asia Pacific

13.3 Europe

13.3.1 By Type

13.3.2 By Voltage

13.3.3 By Category

13.3.4 By Application

13.3.5 By End-User

13.3.6 By Country

13.3.6.1 Russia

13.3.6.2 Germany

13.3.6.3 UK

13.3.6.4 France

13.3.6.5 Rest of Europe

13.4 North America

13.4.1 By Type

13.4.2 By Voltage

13.4.3 By Category

13.4.4 By Application

13.4.5 By End-User

13.4.6 By Country

13.4.6.1 US

13.4.6.2 Canada

13.4.6.3 Mexico

13.5 South America

13.5.1 By Type

13.5.2 By Voltage

13.5.3 By Category

13.5.4 By Application

13.5.5 By End-User

13.5.6 By Country

13.5.6.1 Brazil

13.5.6.2 Argentina

13.5.6.3 Rest of South America

13.6 Middle East

13.6.1 By Type

13.6.2 By Voltage

13.6.3 By Category

13.6.4 By Application

13.6.5 By Country

13.6.5.1 Saudi Arabia

13.6.5.2 Uae

13.6.5.3 Rest of Middle East

13.7 Africa

13.7.1 By Type

13.7.2 By Voltage

13.7.3 By Category

13.7.4 By Application

13.7.5 By End-User

13.7.6 By Country

13.7.6.1 South Africa

13.7.6.2 Egypt

13.7.6.3 Rest of Africa

14 Competitive Landscape

14.1 Overview

14.2 Ranking of Players and Industry Concentration, 2017

14.3 Competitive Scenario

14.3.1 Contacts & Agreements

14.3.2 New Product Launches

14.3.3 Investments and Expansions

14.3.4 Mergers & Acquisitions

14.3.5 Others

15 Company Benchmarking

(Business Overview, Products Offered, Recent Developments, MnM View)*

15.1 ABB

15.1.1 Business Overview

15.1.2 Products Offered

15.1.3 Recent Developments

15.1.4 MnM View

15.2 Aditya Birla Nuvo

15.2.1 Business Overview

15.2.2 Products Offered

15.2.3 Recent Developments

15.2.4 MnM View

15.3 Siemens

15.3.1 Business Overview

15.3.2 Products Offered

15.3.3 Recent Developments

15.3.4 MnM View

15.4 General Electric

15.4.1 Business Overview

15.4.2 Products Offered

15.4.3 Recent Developments

15.4.4 MnM View

15.5 NGK Insulators

15.5.1 Business Overview

14.5.2 Products Offered

15.6 Hubbell

15.6.1 Business Overview

15.6.2 Products Offered

15.6.3 Recent Developments

15.6.4 MnM View

15.7 Toshiba

15.7.1 Business Overview

15.7.2 Products Offered

15.7.3 Recent Developments

15.7.4 MnM View

15.8 Bharat Heavy Electricals Limited

15.8.1 Business Overview

15.8.2 Products Offered

15.8.3 Recent Developments

15.8.4 MnM View

15.9 Lapp Insulators

15.9.1 Business Overview

15.9.2 Products Offered

15.9.3 Recent Development

15.1 Maclean-Fogg

15.10.1 Business Overview

15.10.2 Products Offered

15.10.3 Recent Developments

15.11 Seves Group

15.11.1 Business Overview

15.11.2 Products Offered

15.11.3 Recent Developments

15.11.4 MnM View

15.12 TE Connectivity

15.12.1 Business Overview

15.12.2 Products Offered

*Details on Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets Subscription Portal

16.4 Available Customizations

16.5 Related Reports

16.6 Author Details

List of Tables (85 Tables)

Table 1 Electric Insulators Market Snapshot

Table 2 Global T&D Infrastructure Expansion Plans

Table 3 Key Smart Grid Investment Initiatives

Table 4 Market, By Type, 20162023 (USD Million)

Table 5 Ceramic Insulator: Electric Insulators Market Size, By Region, 20162023 (USD Million)

Table 6 Composite Insulator: Market Size, By Region, 20162023 (USD Million)

Table 7 Glass Insulator: Market Size, By Region, 20162023 (USD Million)

Table 8 Electric Insulator Market Size, By Voltage, 20162023 (USD Million)

Table 9 Low Voltage: Market Size, By Region, 20162023 (USD Million)

Table 10 Medium Voltage: Market Size, By Region, 20162023 (USD Million)

Table 11 High Voltage: Market Size, By Region, 20162023 (USD Million)

Table 12 Market, By Category, 20162023 (USD Million)

Table 13 Bushings: Market Size, By Region, 20162023 (USD Million)

Table 14 Other Insulators: Market Size, By Region, 20162023 (USD Million)

Table 15 Electric Insulator Market Size, By Application, 20162023 (USD Million)

Table 16 Cable: Market Size, By Region, 20162023 (USD Million)

Table 17 Transformer: Electric Insulators Market Size, By Region, 20162023 (USD Million)

Table 18 Switchgear: Market Size, By Region, 20162023 (USD Million)

Table 19 Busbar: Market Size, By Region, 20162023 (USD Million)

Table 20 Surge Protection Device: Market Size, By Region, 20162023 (USD Million)

Table 21 Others: Market Size, By Region, 20162023 (USD Million)

Table 22 Market, By End-User, 20162023 (USD Million)

Table 23 Utilities: Electric Insulators Market Size, By Region, 20162023 (USD Million)

Table 24 Industries: Market Size, By Region, 20162023 (USD Million)

Table 25 Others: Market Size, By Region, 20162023 (USD Million)

Table 26 Market Size, By Region, 20162023 (USD Million)

Table 27 Asia Pacific: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 28 Asia Pacific: Market Size, By Voltage, 20162023 (USD Million)

Table 29 Asia Pacific: Market Size, By Category, 20162023 (USD Million)

Table 30 Asia Pacific: Market Size, By Application, 20162023 (USD Million)

Table 31 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 32 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 33 China: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 34 India: Market Size, By End-User, 20162023 (USD Million)

Table 35 Japan: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 36 Australia: Market Size, By End-User, 20162023 (USD Million)

Table 37 Rest of Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 38 Europe: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 39 Europe: Market Size, By Voltage, 20162023 (USD Million)

Table 40 Europe: Market Size, By Category, 20162023 (USD Million)

Table 41 Europe: Market Size, By Application, 20162023 (USD Million)

Table 42 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 43 Europe: Market Size, By Country, 20162023 (USD Million)

Table 44 Russia: Market Size, By End-User, 20162023 (USD Million)

Table 45 Germany: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 46 UK: Market Size, By End-User, 20162023 (USD Million)

Table 47 France: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 48 Rest of Europe: Market Size, By End-User, 20162023 (USD Million)

Table 49 North America: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 50 North America: Market Size, By Voltage, 20162023 (USD Million)

Table 51 North America: Market Size, By Category, 20162023 (USD Million)

Table 52 North America: Market Size, By Application, 20162023 (USD Million)

Table 53 North America: Market Size, By End-User, 20162023 (USD Million)

Table 54 North America: Market Size, By Country, 20162023 (USD Million)

Table 55 US: Market Size, By End-User, 20162023 (USD Million)

Table 56 Canada: Market Size, By End-User, 20162023 (USD Million)

Table 57 Mexico: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 58 South America: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 59 South America: Market Size, By Voltage, 20162023 (USD Million)

Table 60 South America: Market Size, By Category, 20162023 (USD Million)

Table 61 South America: Market Size, By Application, 20162023 (USD Million)

Table 62 South America: Market Size, By End-User, 20162023 (USD Million)

Table 63 South America: Market Size, By Country, 20162023 (USD Million)

Table 64 Brazil: Market Size, By End-User, 20162023 (USD Million)

Table 65 Argentina: Market Size, By End-User, 20162023 (USD Million)

Table 66 Rest of South America: Market Size, By End-User, 20162023 (USD Million)

Table 67 Middle East: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 68 Middle East: Market Size, By Voltage, 20162023 (USD Million)

Table 69 Middle East: Market Size, By Category, 20162023 (USD Million)

Table 70 Middle East: Market Size, By Application, 20162023 (USD Million)

Table 71 Middle East: Market Size, By End-User, 20162023 (USD Million)

Table 72 Middle East: Market Size, By Country, 20162023 (USD Million)

Table 73 Saudi Arabia: Market Size, By End-User, 20162023 (USD Million)

Table 74 UAE: Electric Insulators Market Size, By End-User, 20162023 (USD Million)

Table 75 Rest of Middle East: Market Size, By End-User, 20162023 (USD Million)

Table 76 Africa: Electric Insulator Market Size, By Type, 20162023 (USD Million)

Table 77 Africa: Electric Insulators Market Size, By Voltage, 20162023 (USD Million)

Table 78 Africa: Market Size, By Category, 20162023 (USD Million)

Table 79 Africa: Market Size, By Application, 20162023 (USD Million)

Table 80 Africa: Market Size, By End-User, 20162023 (USD Million)

Table 81 Africa: Market Size, By Country, 20162023 (USD Million)

Table 82 South Africa: Market Size, By End-User, 20162023 (USD Million)

Table 83 Egypt: Market Size, By End-User, 20162023 (USD Million)

Table 84 Rest of Africa: Market Size, By End-User, 20162023 (USD Million)

Table 85 Abb, the Most Active Player in the Market Between 2014 and 2018

List of Figures (38 Figures)

Figure 1 Electric Insulator Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Composite Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 5 Low Voltage Segment is Expected to Lead the Electric Insulator Market During the Forecast Period

Figure 6 Others Insulator Segment is Expected to Lead the Electric Insulator Market Between 2018-2023

Figure 7 Transformer Segment is Expected to Lead the Electric Insulator Market During the Forecast Period

Figure 8 Utilities Segment is Expected to Lead the Electric Insulator Market Between 2018-2023

Figure 9 Asia Pacific is Expected to Dominate the Electric Insulator Market During the Forecast Period

Figure 10 Increasing Growth of Renewable Energy Globally is Expected to Drive Electric Insulator Market During the Forecast Period

Figure 11 Ceramic Was the Largest Type and Asia Pacific Was the Largest Market in the Ceramic Segment in 2017

Figure 12 Others Insulator Segment Register the Highest CAGR During the Forecast Period

Figure 13 Low Voltage Segment Accounted Largest Market Share in 2017

Figure 14 Transformer Accounted for the Largest Market Share in 2017

Figure 15 Industries Segment to Register the Highest CAGR

Figure 16 China Was the Largest Electric Insulator Market in Asia Pacific

Figure 17 Electric Insulators Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Global Investment in Renewable Sector, 20132017 (USD Billion)

Figure 19 Ceramic Insulator Segment Dominated the Electric Insulators Market in 2017

Figure 20 Low Voltage Segment Dominated the Electric Insulator Market Between 2018 - 2023

Figure 21 Other Insulators Segment Dominated the Market for Electric Insulator in 2017

Figure 22 Transformer Segment Dominated the Electric Insulator Market Between 2018 - 2023

Figure 23 Utilities Segment Dominated the Electric Insulator Market Between 2018 - 2023

Figure 24 Asia Pacific is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 25 Electric Insulators Market Size, By Region, 20162023 (USD Million)

Figure 26 Asia Pacific: Market Snapshot

Figure 27 North America: Market Snapshot

Figure 28 Key Developments in the Electric Insulators Market, 20152018

Figure 29 ABB Led the Electric Insulators Market in 2017

Figure 30 ABB: Company Snapshot

Figure 31 Aditya Birla Nuvo: Company Snapshot

Figure 32 Siemens: Company Snapshot

Figure 33 General Electric: Company Snapshot

Figure 34 NGK Insulators: Company Snapshot

Figure 35 Hubbell: Company Snapshot

Figure 36 Toshiba: Company Snapshot

Figure 37 Bharat Heavy Electricals Limited: Company Snapshot

Figure 38 TE Connectivity: Company Snapshot

Research Methodology

This research study involved the use of extensive secondary sources, directories, journals on power generation technologies, and other related rental markets; newsletters and databases such as Hoovers, Bloomberg, Businessweek, and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the global electric insulators market. The primary sources include several industry experts from the core and related industries, vendors, preferred suppliers, technology developers, alliances, and organizations related to all the segments of this industrys value chain. The research methodology has been explained below.

- Study of annual revenues and market developments of major players providing electric insulators market

- Analysis of the major end-users and applications of electric insulators market

- Assessment of future trends and growth of market on the basis of investments in key end-user segments

- Study of contracts & developments related to the market by key players across different regions

- Finalization of the overall market sizes by triangulating the supply-side data, which includes product developments, supply chains, and annual revenues of companies manufacturing market across the globe

After arriving at the overall market size, the market was split into several segments and subsegments. The figure given below illustrates the breakdown of primary interviews conducted during the research study on the basis of company type, designation, and region.

Growth opportunities and latent adjacency in Electric Insulator Market