Food Sterilization Equipment Market by Technology (Heat, Steam, Radiation, Chemical, and Filtration), Process (Batch and Continuous), Application (Spices, Seasonings, and Herbs and Dairy Products), and Region - Global Forecast to 2023

[119 Pages Report] Food Sterilization Equipment Market was valued at USD 637.2 million in 2017 and is projected to grow at a CAGR of 6.3% from 2018 and reach USD 922.7 million by 2023. The base year considered for the study is 2017 and the forecast period considered is from 2018 to 2023. The basic objective of the report is to define, segment, and project the global market size of the food sterilization equipment market on the basis of application, technology, process, and region. It also helps to understand the structure of the food sterilization equipment market by identifying various segments. The report also helps in analyzing the opportunities in the market for stakeholders, providing competitive landscape, and projecting the size of the food sterilization equipment market and its submarkets in terms of value.

For more details on this research, Request Free Sample Report

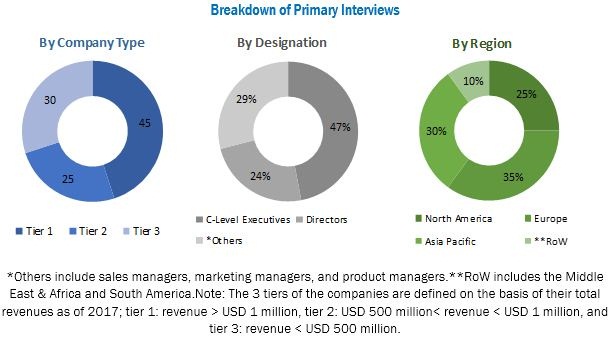

This research study involved secondary sources (which included directories and databases)-such as Hoovers, Forbes, Bloomberg Businessweek, and Factiva-to identify and collect information useful for this technical, market-oriented, and commercial study of the food sterilization equipment market. The primary sources that are involved in the study include industry experts from core and related industries as well as preferred suppliers, dealers, manufacturers, alliances, standards & certification organizations, and organizations related to all segments of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts, C-level executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess future prospects. The following figure depicts the market research methodology applied while drafting the report on the food sterilization equipment market.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the food sterilization equipment market include sterilization equipment manufacturers and suppliers. The key players that are profiled in the report include JBT Corporation (US), Buhler (Switzerland), Cosmed Group (US), Ventilex (Netherlands), Surdry (Spain), Steriflow (France), Allpax (US), Hisaka (Japan), Systec (Germany), De Lama (Italy), Raphanel (Spain), Sun Sterifaab (India), and International Sonomecanics (US).

This report is targeted at the existing stakeholders in the market, which include the following:

- Sterilization equipment manufacturers

- Regulatory bodies

- Intermediary suppliers

- Trade associations and industry bodies

- Government and research organizations

“The study answers several questions for the stakeholders; primarily, questions regarding which market segments to focus on in the next two to five years, for prioritizing efforts and investments.”

Scope of the Report

On the basis of application, the food sterilization equipment market has been segmented as follows:

- Spices, seasonings, and herbs

- Cereals & pulses

- Meat, poultry & seafood

- Dairy products

- Fruits & vegetables

- Dried fruits & nuts

- Beverages

- Others (edible seed, gums, starch, jelly, & other ingredients)

On the basis of technology, the food sterilization equipment market has been segmented as follows:

- Heat

- Steam

- Radiation

- Chemical

- Filtration

- Others (HPP and ultrasound technologies)

On the basis of process, the food sterilization equipment market has been segmented as follows:

- Batch sterilization

- Continuous sterilization

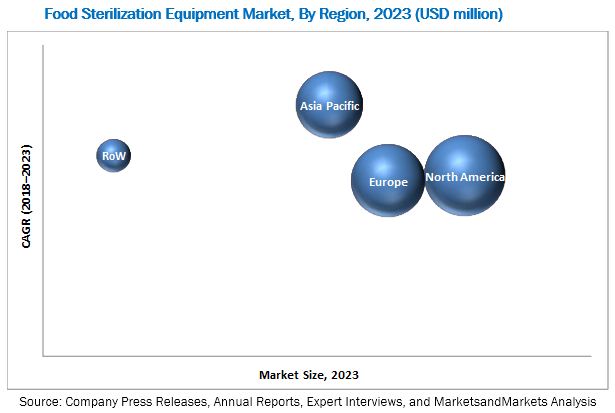

On the basis of region, the food sterilization equipment market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (The Middle East & Africa and South America)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific requirements.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific market for food sterilization equipment, by country

- Further breakdown of the Rest of European market for food sterilization equipment, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

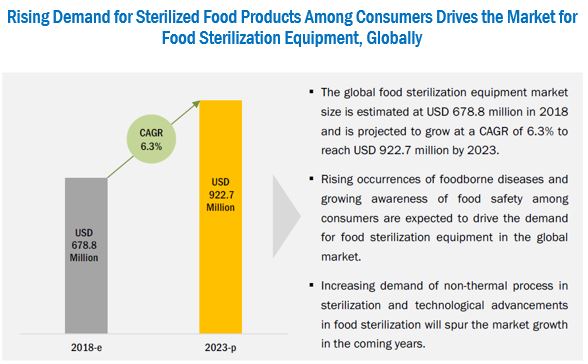

The food sterilization equipment market is estimated at USD 678.8 million in 2018 and is projected to reach USD 922.7 million by 2023, growing at a CAGR of 6.3% during the forecast period. Rising application of sterilization technology in food & beverage industry, increasing instances of foodborne diseases, and growing safety concerns related to food hygiene and contamination are the major factors fueling the demand for food sterilization equipment across the globe. Based on the process type, the batch food sterilization equipment dominated the market, holding the largest share in terms of value in 2018. The batch sterilization process is majorly used to control the temperature for reducing the contamination of microorganisms in food products. Due to these factors the batch process segment is projected to dominate in the food sterilization equipment market during the forecast period.

Based on application, the food sterilization equipment market is divided into spices, seasonings, and herbs, cereals & pulses, meat, poultry & seafood, dairy products, fruits & vegetables, dried fruits & nuts, beverages, and others. The spices, seasonings and herbs segment accounted for the largest share of the global food sterilization equipment market in 2018. Spices and herbs contain compounds such as antioxidants that have anti-inflammatory, antifungal, antibacterial, and anticancer properties and benefit the consumer’s health. As food producers use spices and herbs as an important ingredient in most of their products, the demand for the food sterilization equipment remains high. To offer high-quality food products containing spices, herbs, and seasonings, manufacturers are focusing on improving the sterilization process, which in turn, escalates the demand for sterilization equipment for the spices, seasonings, and herbs.

Based on technology, the food sterilization equipment market is divided into heat, steam, radiation, chemical, filtration, and others. The heat segment accounted for the largest share of the global food sterilization equipment market in 2018. Heat sterilization is one of the most widely used sterilization methods due to its easy-to-handle characteristic and low capital investment. The wide application of heat sterilization technology in the food & beverage processing industry is projected to drive the growth of this market during the forecast period. Heat sterilization technology is used to maintain long-term shelf stability for a broad range of high-moisture food products and ingredients. This technology is cost-effective as compared to the other methods and are preferred by many food manufacturing companies worldwide.

Asia Pacific is projected to witness the fastest growth in the food sterilization equipment market during the forecast period. Emerging economies such as India, China, and developed country such as Japan have favorable market growth potential for sterilized food products, which has encouraged the food manufacturers in these countries to adopt strategies such as expansions. Through expansions, the companies are focusing on catering to the consumer demands and through increasing the production capacity of sterilized food products and raw materials such as spices, seeds, and herbs by using food sterilization equipment. The growing population and per capita income in China, India, Australia, and New Zealand are expected to drive the demand for sterilized foods & beverages. On the account of these factors, the growth of the food sterilization equipment market is projected to increase during the forecast period.

One of the major restraining factors for the growth of the food sterilization equipment market is the growing concerns about highly processed food products and maintaining proper process control. The rise in the aging population in both, developed and developing countries has led to increasing health concerns. Due to these factors, preference for fresh and minimally processed food products, processed without using synthetic chemical preservatives, heat, or radiation, remain high among consumers.

Key players such as JBT Corporation (US), Buhler (Switzerland), De Lama (Italy), Hisaka (Japan), and Systec (Germany) have been actively strategizing their growth plans to expand in the food sterilization equipment market. These companies have a strong presence in Europe, North America, and Japan. In addition, these companies have manufacturing facilities across these regions with a strong distribution network.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in the Food Sterilization Equipment Market

4.2 North America: Food Sterilization Equipment Market, By Technology & Country

4.3 Market, By Process, 2018 vs 2023

4.4 Market, By Four Major Applications

4.5 Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Occurrences of Foodborne Diseases and Growing Awareness of Food Safety Among Consumers

5.2.1.2 Technological Advancements in Food Sterilization

5.2.1.3 Increasing Demand for Non-Thermal Process in Sterilization

5.2.2 Restraints

5.2.2.1 Growing Concerns About Highly Processed Food Products

5.2.2.2 Maintaining Proper Process Control

5.2.3 Opportunities

5.2.3.1 Opportunities in Packaging and Shelf-Life Enhancement for Processed Food

5.2.3.2 Emerging Economies in Asia Pacific, African, and South American Countries

5.2.4 Challenges

5.2.4.1 Stringent Government Regulations

6 Food Sterilization Equipment Market, By Technology (Page No. - 41)

6.1 Introduction

6.2 Heat

6.3 Steam

6.4 Radiation

6.5 Chemical

6.6 Filtration

6.7 Others

7 Food Sterilization Equipment Market, By Application (Page No. - 48)

7.1 Introduction

7.2 Spices, Seasonings, and Herbs

7.3 Cereals & Pulses

7.4 Meat, Poultry, and Seafood

7.5 Dairy Products

7.6 Fruits & Vegetables

7.7 Dried Fruits & Nuts

7.8 Beverages

7.9 Others

8 Food Sterilization Equipment Market, By Process (Page No. - 56)

8.1 Introduction

8.2 Batch Sterilization

8.3 Continuous Sterilization

9 Food Sterilization Equipment Market, By Region (Page No. - 60)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 Italy

9.3.4 France

9.3.5 Spain

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Australia & New Zealand

9.4.5 Rest of Asia Pacific

9.5 Rest of the World (RoW)

9.5.1 Middle East & Africa

9.5.2 South America

10 Competitive Landscape (Page No. - 91)

10.1 Overview

10.2 Competitive Scenario

10.2.1 Expansions

10.3 Market Ranking

10.4 Geographical Analysis of the Top Five Companies

10.5 Technological Analysis of the Top Five Companies

11 Company Profiles (Page No. - 94)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 JBT Corporation

11.2 Bühler

11.3 Ventilex

11.4 Surdry

11.5 Cosmed Group

11.6 Steriflow

11.7 Allpax

11.8 Hisaka

11.9 Systec

11.10 De Lama

11.11 Raphanel

11.12 Sun Sterifaab

11.13 Industrial Sonomecanics (ISM)

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 112)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (70 Tables)

Table 1 US Dollar Exchange Rate Considered, 2014–2017

Table 2 Food Sterilization Equipment Market Size, By Technology, 2016–2023 (USD Million)

Table 3 Heat Sterilization Equipment Market Size, By Region, 2016-2023 (USD Million)

Table 4 Steam Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 5 Foods Permitted to Be Irradiated By the US Food & Drug Administration

Table 6 Radiation Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 7 Chemical Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 8 Filtration Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 9 Food Sterilization Equipment Market Size for Other Technologies, By Region, 2016–2023 (USD Million)

Table 10 Food Sterilization Equipment Market Size, By Application, 2016–2023 (USD Million)

Table 11 Spices, Seasonings, and Herbs Market Size, By Region, 2016–2023 (USD Million)

Table 12 Cereals & Pulses Market Size, By Region, 2016–2023 (USD Million)

Table 13 Meat, Poultry, and Seafood Market Size, By Region, 2016–2023 (USD Million)

Table 14 Dairy Products Market Size, By Region, 2016–2023 (USD Million)

Table 15 Fruits & Vegetables Market Size, By Region, 2016–2023 (USD Million)

Table 16 Dried Fruits & Nuts Market Size, By Region, 2016–2023 (USD Million)

Table 17 Beverages Market Size, By Region, 2016–2023 (USD Million)

Table 18 Others Market Size, By Region, 2016–2023 (USD Million)

Table 19 Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 20 Batch Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 21 Continuous Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 22 Food Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 23 North America: Food Sterilization Equipment Market Size, By Technology, 2016–2023 (USD Million)

Table 24 North America: Market Size, By Application, 2016–2023 (USD Million)

Table 25 North America: Market Size, By Process, 2016–2023 (USD Million)

Table 26 US: Market Size, By Process, 2016–2023 (USD Million)

Table 27 US: Market Size, By Technology, 2016–2023 (USD Million)

Table 28 Canada: Market Size, By Process, 2016–2023 (USD Million)

Table 29 Canada: Market Size, By Technology, 2016–2023 (USD Million)

Table 30 Mexico: Market Size, By Process, 2016–2023 (USD Million)

Table 31 Mexico: Market Size, By Technology, 2016–2023 (USD Million)

Table 32 Europe: Food Sterilization Equipment Market Size, By Country, 2016–2023 (USD Million)

Table 33 Europe: Market Size, By Application, 2016–2023 (USD Million)

Table 34 Europe: Market Size, By Technology, 2016–2023

Table 35 Europe: Market Size, By Process, 2016–2023 (USD Million)

Table 36 UK: Market Size, By Process, 2016–2023 (USD Million)

Table 37 UK: Market Size, By Technology, 2016–2023 (USD Million)

Table 38 Germany: Market Size, By Process, 2016–2023 (USD Million)

Table 39 Germany: Market Size, By Technology, 2016–2023 (USD Million)

Table 40 Italy: Market Size, By Process, 2016–2023 (USD Million)

Table 41 Italy: Market Size, By Technology, 2016–2023 (USD Million)

Table 42 France: Market Size, By Process, 2016–2023 (USD Million)

Table 43 France: Market Size, By Technology, 2016–2023 (USD Million)

Table 44 Spain: Market Size, By Process, 2016–2023 (USD Million)

Table 45 Spain: Market Size, By Technology, 2016–2023 (USD Million)

Table 46 Rest of Europe: Market Size, By Process, 2016–2023 (USD Million)

Table 47 Rest of Europe: Market Size, By Technology, 2016–2023 (USD Million)

Table 48 Asia Pacific: Food Sterilization Equipment Market Size, By Country, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size, By Application, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size, By Technology, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market Size, By Process, 2016–2023 (USD Million)

Table 52 China: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 53 China: Market Size, By Technology, 2016–2023 (USD Million)

Table 54 India: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 55 India: Market Size, By Technology, 2016–2023 (USD Million)

Table 56 Japan: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 57 Japan: Market Size, By Technology, 2016–2023 (USD Million)

Table 58 Australia & New Zealand: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 59 Australia & New Zealand: Market Size, By Technology, 2016–2023 (USD Million)

Table 60 Rest of Asia Pacific: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 61 Rest of Asia Pacific: Market Size, By Technology, 2016–2023 (USD Million)

Table 62 RoW: Food Sterilization Equipment Market Size, By Region, 2016–2023 (USD Million)

Table 63 RoW: Market Size, By Application, 2016–2023 (USD Million)

Table 64 RoW: Market Size, By Technology, 2016–2023 (USD Million)

Table 65 RoW: Market Size, By Process, 2016–2023 (USD Million)

Table 66 Middle East & Africa: Food Sterilization Equipment Market Size, By Process, 2016–2023 (USD Million)

Table 67 Middle East & Africa: Market Size, By Technology, 2016–2023 (USD Million)

Table 68 South America: Market Size, By Process, 2016–2023 (USD Million)

Table 69 South America: Food Sterilization Equipment Market Size, By Technology, 2016–2023 (USD Million)

Table 70 Expansions, 2018

List of Figures (30 Figures)

Figure 1 Food Sterilization Equipment Market Segmentation

Figure 2 Market For Food Sterilization Equipment, Regional Scope

Figure 3 Market For Food Sterilization Equipment: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Market Size For Food Sterilization Equipment, By Technology, 2018 vs 2023 (USD Million)

Figure 9 Market Size For Food Sterilization Equipment, By Application, 2018 vs 2023 (USD Million)

Figure 10 Market Share For Food Sterilization Equipment, By Region, 2017

Figure 11 Rising Demand for Sterilized Food Products Among Consumers Drives the Market for Food Sterilization Equipment, Globally

Figure 12 Heat Sterilization Was Dominant, in Terms of Technology, in the North American Market For Food Sterilization Equipment

Figure 13 Batch Sterilization to Dominate the Market During the Forecast Period

Figure 14 Spices, Seasonings, and Herbs Segment Dominated the Market Across All Regions in 2017

Figure 15 US Accounted for the Largest Share of the Global Food Sterilization Equipment Market

Figure 16 Market Dynamics: Market For Food Sterilization Equipment

Figure 17 Food Products Causing Outbreak-Associated Illnesses in the US (2015)

Figure 18 Companies Preferred Non-Thermal Processing for Better Nutrient/Sensory Quality

Figure 19 US Organic Food Retail Sales, 2013–2016

Figure 20 Heat Sterilization to Lead the Market By 2023 (USD Million)

Figure 21 Market Size For Food Sterilization Equipment, By Application, 2018 vs 2023

Figure 22 Batch Sterilization is Projected to Be the Leading Segment During the Forecast Period

Figure 23 North America to Lead the Market By 2023 (USD Million)

Figure 24 North America: Market Snapshot

Figure 25 Europe: Market Snapshot

Figure 26 Top Five Companies in the Food Sterilization Equipment Market

Figure 27 JBT Corporation: Company Snapshot

Figure 28 JBT: SWOT Analysis

Figure 29 Bühler: Company Snapshot

Figure 30 Bühler: SWOT Analysis

Growth opportunities and latent adjacency in Food Sterilization Equipment Market