Sterility Testing Market by Product (Kits & Reagents, Instrument, Services), Test (Membrane Filtration, Direct Inoculation), Application (Pharma, Biological Manufacturing, Medical Device Manufacturing), End User (Pharma, Biotech) & Region - Global Forecasts to 2028

Market Growth Outlook Summary

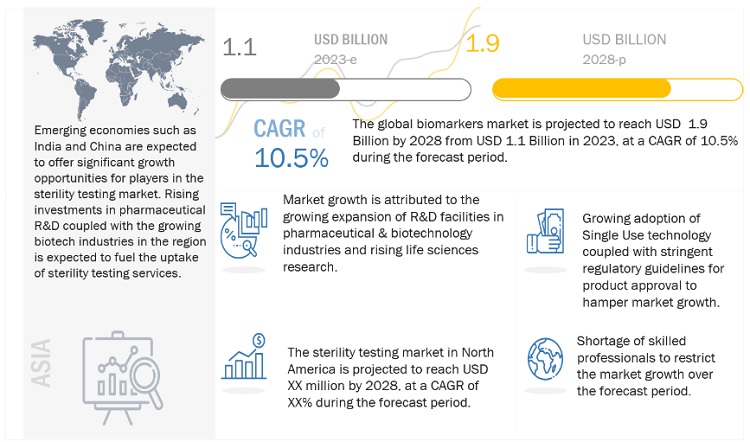

The global sterility testing market, stood at US$1.1 billion in 2023 and is projected to advance at a resilient CAGR of 10.5% from 2023 to 2028, culminating in a forecasted valuation of US$1.9 billion by the end of the period. Factors such as expanding pharmaceutical & biotechnology production capacities, increasing development of novel biopharmaceutical products, and rising investments in life sciences research are expected to drive market growth. However, the growing adoption of single-use technology and stringent regulatory guidelines for product approval are expected to restrain market growth to a certain extent.

Sterility Testing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Sterility Testing Market Dynamics

Driver: Rising expansion of pharmaceutical & biopharmaceutical production capacities

In pharmaceutical and biopharmaceutical industries, sterility testing is conducted at all manufacturing stages to minimize the risk of product contamination. Subsequently, the growth of this end-use industry in the coming years will considerably boost the utilization of sterility testing.

The production capacity expansion of pharmaceuticals and biopharmaceuticals worldwide will augment the demand for sterility testing products and services. Sterility testing is mandatory during the production process of pharmaceuticals and biopharmaceuticals. Therefore, the rising production capacities of pharmaceutical & biopharmaceutical companies will drive the adoption of additional kits, reagents, and instruments for sterility tests.

For instance:

- In 2022, Novartis (Switzerland) invested USD 300 million to bolster the capacity and capabilities for next-generation bio-therapeutics across Switzerland, Slovenia, and Austria.

- In 2022, Eli Lilly and Company (US) invested USD 1.5 billion to establish two new manufacturing facilities: Concord, NC, and Limerick, Ireland. Of the total investment, the company aims to invest USD 500 million, specifically in Limerick, to create a new biologics active ingredients site.

Restraint: Growing adoption of single-use technology

Single-use technology substitutes the stainless-steel and hard-piped configurations used in aseptic processing and sterile manufacturing. Gamma-irradiated pre-assembled process systems are used under single-use technology. Such technology is used for aseptic filling as well as upstream & downstream processing. The main benefit of SUT is that time and money are not invested in labor-intensive and expensive cleaning, sterilization validation tests, or their recurring revalidation. Moreover, it eliminates system cleaning and sterilization requirement between batches. Adopting such technologies will hamper the demand for sterility testing products and services.

However, the chances of human error will continue, even if closed systems and single-use technology are used more frequently. Personnel continues to be the principal source of contamination for pharmaceutical & biopharmaceutical formulations that cannot be terminally sterilized. Thus, a thorough training program is essential. When adhering to GMP and quality standards, operator comprehension is a crucial factor.

Opportunity: Emerging markets

Emerging markets such as Brazil, India, and China are expected to present significant opportunities for the growth of the market. This can mainly be attributed to increased R&D funding for research in these countries. For instance, China's current healthcare expenditure (% of GDP) went from 5.1% in 2017 to 5.4% in 2019. Similarly, for India, the healthcare expenditure rose from 2.9% in 2017 to 3.0% in 2019, while for Brazil, it was 9.5% in 2017 and increased to 9.6% in 2019. (Source: World Bank)

Moreover, CDMOs and CROs based in emerging markets offer cost-efficient development and manufacturing services to pharma & biotech companies. Sterility testing is a mandatory step in pharmaceutical drug discovery & development. Therefore, the growing production capacities of CROs and CDMOs in emerging nations will augment the demand for sterility testing products and services. A few examples of such capacity expansions are as follows:

- In August 2022, Samsung Biologics announced plans to build a second biopharmaceutical campus, named Bio Campus II, at Songdo, Incheon, South Korea

- In July 2022, Wuxi Biologics announced a USD 1.4 billion investment for expanding its research, development, and large-scale drug substance and drug product manufacturing capacity and capabilities in Singapore.

Challenge: Shortage of skilled professionals

The success of sterility tests depends mainly on the expertise of the analysts on the same par as the environmental conditions under which the test is performed. For optimal efficacy, sterility testing needs to be conducted by skilled professionals with sufficient knowledge of the nuances of this field. Handling the instruments used in sterility testing also requires expertise. Consequently, the shortage of a sufficiently skilled workforce poses a key challenge to the growth of the market.

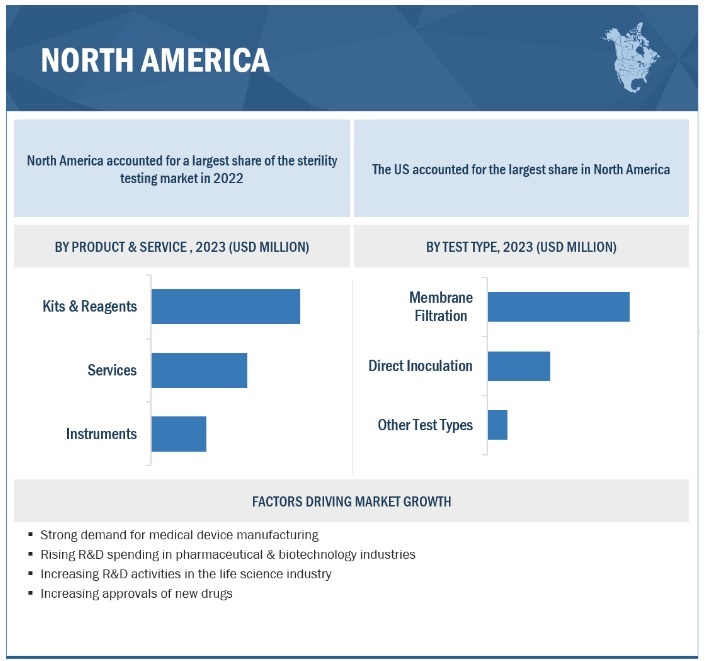

In 2022, by product & service segment, the consumables segment accounted for the largest share of the sterility testing industry

Based on product, the sterility testing market is segmented into membrane filtration, direct inoculation, and other tests. In 2022, the kits & reagents segment accounted for the largest share of the global market. The large share of this segment can primarily be attributed to ease of use, recurring purchase, and growing preference associated with kits & reagents.

In 2022, by test type, the membrane filtration segment accounted for the largest share of the sterility testing industry

On the basis of type, the sterility testing market is segmented into membrane filtration, direct inoculation, and other tests. In 2022, the membrane filtration segment accounted for the largest share of the global market. Factors responsible for the large share of this segment are the growing demand for liquid formulations coupled with the suitability of such tests with samples containing preservatives and bacteriostatic & fungistatic compounds.

In 2022, North America accounted for the largest share of the sterility testing industry

In 2022, North America accounted for the largest share of the sterility testing market. Increasing drug approvals are expected to boost the market in the region. Additionally, the rising prevalence of diseases and the growing patient pool are increasing the demand and production for medicines in North America. The pharmaceutical & biotechnology industries in North America invest heavily in R&D and are expected to witness significant growth in the coming years, which in turn, is expected to drive the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

The sterility testing market is dominated by a few globally established players such as Charles River Laboratories (US), Merck KGaA (Germany), bioMérieux SA (France), SGS SA (Switzerland), WuXi AppTec (China), Nelson Laboratories, LLC (US), Pacific BioLabs (US), Sartorius AG (Germany), Thermofisher Scientific Inc. (US), and Samsung Biologics (South Korea).

Sterility Testing Market Report Scope

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.1 billion |

|

Projected Revenue Size by 2028 |

$1.9 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 10.5% |

|

Market Driver |

Rising expansion of pharmaceutical & biopharmaceutical production capacities |

|

Market Opportunity |

Emerging markets |

The study categorizes the sterility testing market into the following segments & sub-segments:

By Product & Service

- Kits & Reagents

- Services

- Instruments

By Test Type

- Membrane Filtration

- Direct Inoculation

- Other Tests

By Application

- Pharmaceuticals And Biologicals

- Medical Devices

- Other Applications

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- Italy

- Spain

- UK

- France

- Rest of Europe

-

Asia

- China

- Japan

- India

- South Korea

- Rest of Asia

-

Rest of the World

- Africa

- Pacific and Oceania

- South America, Central America, and the Caribbean

Recent Developments of Sterility Testing Market

- In November 2022, Merck KGaA (Switzerland) invested USD 306.5 million in expanding its biosafety testing capacity at Rockville, Maryland, US. This site will provide biosafety testing and analytical development services in the US.

- In September 2022, Merck KGaA (Switzerland) opened its viral clearance (VC) laboratory as the first phase of the China Biologics Testing Center. This site is set to operate in China and will locally conduct viral clearance studies across pre-clinical development to commercialization.

- In June 2022, Charles River Laboratories, Inc. (US) opened a new facility of High Quality (HQ) Plasmid DNA Centre of Excellence at Bruntwood SciTech's Alderley Park in Cheshire, UK. The 16,000 sq. ft facility will provide plasmid DNA manufacturing services.

- In May 2022, bioMérieux SA (France) acquired Specific Diagnostics (US). With this acquisition, bioMérieux will improve its presence in antimicrobial resistance while expanding its market-leading position globally in clinical microbiology.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global sterility testing market between 2023 and 2028?

The global sterility testing market is projected to grow from USD 1.1 billion in 2023 to USD 1.9 billion by 2028, demonstrating a robust CAGR of 10.5%.

What factors are driving the sterility testing market?

The primary factors driving the sterility testing market include the rising expansion of pharmaceutical and biopharmaceutical production capacities, the increasing development of novel biopharmaceutical products, and growing investments in life science research.

What challenges does the sterility testing market face?

The sterility testing market faces challenges such as the growing adoption of single-use technology, which reduces the need for traditional sterility tests, and a shortage of skilled professionals capable of conducting these tests accurately.

Which regions are expected to show significant growth in the sterility testing market?

Emerging markets such as China, India, and Brazil are expected to show significant growth in the sterility testing market, driven by increased R&D investments and the expanding production capacities of Contract Development and Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs).

What are the key products in the sterility testing market?

The key products in the sterility testing market include kits and reagents, instruments, and services, with the kits and reagents segment accounting for the largest share due to their ease of use and recurring purchase nature.

How does the adoption of single-use technology impact the sterility testing market?

The growing adoption of single-use technology in aseptic processing and sterile manufacturing reduces the need for traditional sterility testing products and services. This technology streamlines the production process by eliminating system cleaning and sterilization requirements, thereby reducing the demand for sterility testing.

What role does membrane filtration play in the sterility testing market?

Membrane filtration is a widely used method in sterility testing, particularly suitable for liquid formulations and samples containing preservatives. In 2022, membrane filtration accounted for the largest share of the sterility testing market due to its compatibility with various test types.

How is the pharmaceutical and biopharmaceutical industry driving the sterility testing market?

The pharmaceutical and biopharmaceutical industries are key drivers of the sterility testing market as sterility tests are mandatory during drug discovery, development, and manufacturing processes. The industry's expansion will boost the demand for sterility testing products and services.

What is the role of emerging markets in the sterility testing industry?

Emerging markets such as Brazil, India, and China are playing a significant role in the sterility testing industry due to increased healthcare R&D funding and the growing presence of CDMOs and CROs offering cost-efficient manufacturing services.

What technological advancements are influencing the sterility testing market?

Technological advancements in sterility testing, such as automation and improved membrane filtration techniques, are enhancing the efficiency and accuracy of sterility tests, driving the market forward by reducing contamination risks and operational costs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising expansion of pharmaceutical & biopharmaceutical production capacities- Increasing development of novel biopharmaceutical products- Rising investments in life sciences researchRESTRAINTS- Growing adoption of single-use technology- Stringent regulatory guidelines for product approvalOPPORTUNITIES- Emerging markets- Increasing outsourcing of services to sterility testing providersCHALLENGES- Shortage of skilled professionals

-

5.3 TARIF AND REGULATIONREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.7 INDICATIVE PRICING

-

5.8 PATENT ANALYSIS

-

5.9 ECOSYSTEM ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSSTERILITY TESTING MARKET: BUYING CRITERIA

- 5.12 TRADE ANALYSIS

- 6.1 INTRODUCTION

-

6.2 KITS & REAGENTSRISING DEMAND FOR STANDARD STERILITY TESTING TO DRIVE MARKET

-

6.3 SERVICESGROWING TREND OF OUTSOURCING SERVICES TO CROS TO DRIVE MARKET

-

6.4 INSTRUMENTSINCREASING ADOPTION OF RAPID MICROBIAL METHODS TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 MEMBRANE FILTRATIONRISING DEMAND FOR TESTING OF DRUGS IN LIQUID DOSAGE FORMS TO FUEL ADOPTION

-

7.3 DIRECT INOCULATIONABILITY TO PROVIDE TESTING FOR MICROBIAL CONTAMINANTS TO DRIVE MARKET

- 7.4 OTHER TEST TYPES

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOLOGICS MANUFACTURINGGROWING PHARMACEUTICAL & BIOPHARMACEUTICAL PRODUCTION CAPACITIES TO DRIVE MARKET

-

8.3 MEDICAL DEVICE MANUFACTURINGRISING DEMAND FOR STERILITY TESTING OF MEDICAL DEVICES TO DRIVE MARKET

- 8.4 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 PHARMACEUTICAL COMPANIESGROWING EXPANSION OF PRODUCTION CAPACITIES AND STRONG PIPELINE OF NOVEL DRUGS TO DRIVE MARKET

-

9.3 BIOTECHNOLOGY COMPANIESRISING R&D INVESTMENTS IN BIOTECH FIRMS TO DRIVE MARKET

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising growth in medical devices industry to fuel uptakeCANADA- Rising demand for pharmaceutical & biologics manufacturing to support market growthNORTH AMERICA: RECESSION IMPACT

-

10.3 EUROPEGERMANY- Favorable R&D funding by federal & state governments to fuel uptakeUK- Rising development of biotechnology manufacturing firms to drive marketFRANCE- Rising government initiatives for biologics manufacturing to support market growthITALY- Favorable government support for establishment of biotech startups to support market growthSPAIN- Increasing focus on development of APIs to fuel uptakeREST OF EUROPEEUROPE: RECESSION IMPACT

-

10.4 ASIACHINA- Favorable government policies to increase drug manufacturing to drive marketJAPAN- Rising investments for cell & gene therapy facilities to support market growthINDIA- Increasing demand for biosimilars to drive marketSOUTH KOREA- Significant exports of pharmaceutical drugs to fuel uptake of sterility testing servicesREST OF ASIA

-

10.5 REST OF THE WORLDSOUTH & CENTRAL AMERICA AND THE CARIBBEAN- Growing vaccine production to propel demand for sterility testingPACIFIC AND OCEANIA- Improving investments in pharmaceutical R&D to fuel uptakeAFRICA- Favorable government support for healthcare infrastructure to drive market

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

-

11.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPANY EVALUATION QUADRANT: STARTUPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE BENCHMARKINGCOMPANY PRODUCT FOOTPRINTCOMPANY GEOGRAPHIC FOOTPRINT

- 11.8 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSMERCK KGAA- Business overview- Products/Services offered- Recent developments- MnM viewCHARLES RIVER LABORATORIES- Business overview- Products/Services offered- Recent developments- MnM viewBIOMÉRIEUX SA- Business overview- Products/Services offered- Recent developments- MnM viewSGS S.A.- Business overview- Product/Services offered- MnM viewSARTORIUS AG- Business overview- Products/Services offered- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Services offered- Recent developmentsWUXI APPTEC- Business overview- Products/Services offered- Recent developmentsSAMSUNG BIOLOGICS- Business overview- Products/Services offered- Recent developmentsGENSCRIPT- Business overview- Products/Services offeredPACIFIC BIOLABS- Business overview- Products/Services offered- Recent developmentsNELSON LABORATORIES, LLC- Business overview- Products/Services offered- Recent developments

-

12.2 OTHER PLAYERSPACE ANALYTICALRAPID MICRO BIOSYSTEMS, INC.TENTAMUSSINGOTA SOLUTIONSNEOPHARM LABS INC.LEXAMEDASTELL SCIENTIFIC LTDHIMEDIA LABORATORIESPALL CORPORATION (PART OF DANAHER CORPORATION)BOSTON ANALYTICALSOLVIAS AGBD

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2021–2027 (% GROWTH)

- TABLE 2 NOVEL DRUG APPROVALS (2022)

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 STERILITY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 SELLING PRICE OF STERILITY TESTING PRODUCTS

- TABLE 9 STERILITY TESTING MARKET: SUPPLY CHAIN ECOSYSTEM

- TABLE 10 STERILITY TESTING MARKET: CONFERENCES AND EVENTS (2023−2024)

- TABLE 11 TOP 10 IMPORTERS OF MACHINERY AND APPARATUS FOR FILTERING/PURIFYING LIQUIDS (HS CODE – 842129)

- TABLE 12 TOP 10 EXPORTERS OF MACHINERY AND APPARATUS FOR FILTERING/PURIFYING LIQUIDS (HS CODE – 842129)

- TABLE 13 STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 14 STERILITY TESTING MARKET FOR KITS & REAGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: STERILITY TESTING MARKET FOR KITS & REAGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: STERILITY TESTING MARKET FOR KITS & REAGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA: STERILITY TESTING MARKET FOR KITS & REAGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 REST OF THE WORLD: STERILITY TESTING MARKET FOR KITS & REAGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 STERILITY TESTING MARKET FOR SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: STERILITY TESTING MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: STERILITY TESTING MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA: STERILITY TESTING MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 REST OF THE WORLD: STERILITY TESTING MARKET FOR SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 STERILITY TESTING MARKET FOR INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: STERILITY TESTING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: STERILITY TESTING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ASIA: STERILITY TESTING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 REST OF THE WORLD: STERILITY TESTING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 30 STERILITY TESTING MARKET FOR MEMBRANE FILTRATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: STERILITY TESTING MARKET FOR MEMBRANE FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 EUROPE: STERILITY TESTING MARKET FOR MEMBRANE FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 ASIA: STERILITY TESTING MARKET FOR MEMBRANE FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 REST OF THE WORLD: STERILITY TESTING MARKET FOR MEMBRANE FILTRATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 STERILITY TESTING MARKET FOR DIRECT INOCULATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: STERILITY TESTING MARKET FOR DIRECT INOCULATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: STERILITY TESTING MARKET FOR DIRECT INOCULATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA: STERILITY TESTING MARKET FOR DIRECT INOCULATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 REST OF THE WORLD: STERILITY TESTING MARKET FOR DIRECT INOCULATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 STERILITY TESTING MARKET FOR OTHER TEST TYPES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: STERILITY TESTING MARKET FOR KITS & REAGENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: STERILITY TESTING MARKET FOR OTHER TEST TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA: STERILITY TESTING MARKET FOR OTHER TEST TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 REST OF THE WORLD: STERILITY TESTING MARKET FOR OTHER TEST TYPES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 46 STERILITY TESTING MARKET FOR PHARMACEUTICAL & BIOLOGICS MANUFACTURING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: STERILITY TESTING MARKET FOR PHARMACEUTICAL & BIOLOGICS MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 EUROPE: STERILITY TESTING MARKET FOR PHARMACEUTICAL & BIOLOGICS MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 ASIA: STERILITY TESTING MARKET FOR PHARMACEUTICAL & BIOLOGICS MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 REST OF THE WORLD: STERILITY TESTING MARKET FOR PHARMACEUTICAL & BIOLOGICS MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 STERILITY TESTING MARKET FOR MEDICAL DEVICE MANUFACTURING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: STERILITY TESTING MARKET FOR MEDICAL DEVICE MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: STERILITY TESTING MARKET FOR MEDICAL DEVICE MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 ASIA: STERILITY TESTING MARKET FOR MEDICAL DEVICE MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 REST OF THE WORLD: STERILITY TESTING MARKET FOR MEDICAL DEVICE MANUFACTURING, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 STERILITY TESTING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: STERILITY TESTING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: STERILITY TESTING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA: STERILITY TESTING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 REST OF THE WORLD: STERILITY TESTING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 STERILITY TESTING MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: STERILITY TESTING MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 EUROPE: STERILITY TESTING MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 ASIA: STERILITY TESTING MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 REST OF THE WORLD: STERILITY TESTING MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 STERILITY TESTING MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: STERILITY TESTING MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: STERILITY TESTING MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 ASIA: STERILITY TESTING MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 REST OF THE WORLD: STERILITY TESTING MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 STERILITY TESTING MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: STERILITY TESTING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: STERILITY TESTING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 ASIA: STERILITY TESTING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 REST OF THE WORLD: STERILITY TESTING MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 STERILITY TESTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: STERILITY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 83 US: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 84 US: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 85 US: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 US: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 88 CANADA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 90 CANADA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 EUROPE: STERILITY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 EUROPE: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 93 EUROPE: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 94 EUROPE: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 EUROPE: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 GERMANY: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 97 GERMANY: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 98 GERMANY: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 GERMANY: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 UK: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 101 UK: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 102 UK: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 UK: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 FRANCE: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 105 FRANCE: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 106 FRANCE: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 FRANCE: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 ITALY: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 109 ITALY: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 110 ITALY: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 ITALY: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 SPAIN: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 113 SPAIN: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 114 SPAIN: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 115 SPAIN: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 120 ASIA: STERILITY TESTING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 ASIA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 122 ASIA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 123 ASIA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 ASIA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 125 CHINA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 126 CHINA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 127 CHINA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 128 CHINA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 JAPAN: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 130 JAPAN: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 131 JAPAN: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 132 JAPAN: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 INDIA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 134 INDIA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 135 INDIA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 INDIA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 SOUTH KOREA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 138 SOUTH KOREA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 139 SOUTH KOREA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 141 REST OF ASIA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 142 REST OF ASIA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 143 REST OF ASIA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 144 REST OF ASIA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 REST OF THE WORLD: STERILITY TESTING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 146 REST OF THE WORLD: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 147 REST OF THE WORLD: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 149 REST OF THE WORLD: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 150 SOUTH & CENTRAL AMERICA AND THE CARIBBEAN: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 151 SOUTH & CENTRAL AMERICA AND THE CARIBBEAN: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 152 SOUTH & CENTRAL AMERICA AND THE CARIBBEAN: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 153 SOUTH & CENTRAL AMERICA AND THE CARIBBEAN: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 154 PACIFIC AND OCEANIA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 155 PACIFIC AND OCEANIA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 156 PACIFIC AND OCEANIA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 PACIFIC AND OCEANIA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 AFRICA: STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 159 AFRICA: STERILITY TESTING MARKET, BY TEST TYPE, 2021–2028 (USD MILLION)

- TABLE 160 AFRICA: STERILITY TESTING MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 161 AFRICA: STERILITY TESTING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 162 STERILITY TESTING MARKET: KEY PLAYER STRATEGIES

- TABLE 163 STERILITY TESTING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 164 STERILITY TESTING MARKET: PRODUCT PORTFOLIO ANALYSIS

- TABLE 165 STERILITY TESTING MARKET: GEOGRAPHIC ANALYSIS

- TABLE 166 STERILITY TESTING MARKET: DEALS (JANUARY 2019−JANUARY 2023)

- TABLE 167 STERILITY TESTING MARKET: OTHER DEVELOPMENTS (JANUARY 2019−JANUARY 2023)

- TABLE 168 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 169 CHARLES RIVER LABORATORIES: BUSINESS OVERVIEW

- TABLE 170 BIOMÉRIEUX SA: BUSINESS OVERVIEW

- TABLE 171 SGS SA: BUSINESS OVERVIEW

- TABLE 172 SARTORIUS AG: BUSINESS OVERVIEW

- TABLE 173 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

- TABLE 174 WUXI APPTEC: BUSINESS OVERVIEW

- TABLE 175 SAMSUNG BIOLOGICS: BUSINESS OVERVIEW

- TABLE 176 GENSCRIPT: BUSINESS OVERVIEW

- TABLE 177 PACIFIC BIOLABS: BUSINESS OVERVIEW

- TABLE 178 NELSON LABORATORIES, LLC: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 STERILITY TESTING MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 STERILITY TESTING MARKET SIZE ESTIMATION (2022)

- FIGURE 4 STERILITY TESTING MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 STERILITY TESTING MARKET: CAGR PROJECTION (2023–2028)

- FIGURE 7 STERILITY TESTING MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 STERILITY TESTING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 STERILITY TESTING MARKET, BY TEST TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 STERILITY TESTING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 STERILITY TESTING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 STERILITY TESTING MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 14 RISING EXPANSION OF PHARMACEUTICAL & BIOPHARMACEUTICAL PRODUCTION CAPACITIES TO FUEL UPTAKE OF STERILITY TESTING SERVICES

- FIGURE 15 KITS & REAGENTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN CHINA

- FIGURE 16 ASIA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 STERILITY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

- FIGURE 18 STERILITY TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 19 STERILITY TESTING MARKET: PATENT TESTING APPLICATIONS (JANUARY 2012–DECEMBER 2022)

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR STERILITY TESTING PRODUCTS

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

- FIGURE 22 NORTH AMERICA: STERILITY TESTING MARKET SNAPSHOT

- FIGURE 23 ASIA: STERILITY TESTING MARKET SNAPSHOT

- FIGURE 24 STERILITY TESTING MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2022 (LEADING FOUR COMPANIES)

- FIGURE 25 STERILITY TESTING MARKET: REVENUE SHARE ANALYSIS OF KEY PLAYERS (TOP FOUR)

- FIGURE 26 STERILITY TESTING MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 27 STERILITY TESTING MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 28 MERCK KGAA: COMPANY SNAPSHOT (2021)

- FIGURE 29 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2021)

- FIGURE 30 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2021)

- FIGURE 31 SGS S.A.: COMPANY SNAPSHOT (2021)

- FIGURE 32 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- FIGURE 33 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 SAMSUNG BIOLOGICS: COMPANY SNAPSHOT (2021)

- FIGURE 35 GENSCRIPT: COMPANY SNAPSHOT (2021)

This research study involved extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Business, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the sterility testing market. Primary sources included several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, reimbursement providers, technology developers, alliances, and standards and certification organizations from companies and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

The secondary sources referred to for this research study include publications from organizations such as the World Bank, World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), National Cancer Institute (NCI), Food and Drug Administration (FDA), European Medicines Agency (EMA), National Comprehensive Cancer Network (NCCN), and National Institutes of Health (NIH). Secondary sources include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global Sterility testing market, which was validated through primary research.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various companies and organizations operating in the Sterility testing market. Primary sources from the demand side include industry experts such as software application specialists, product managers, medical device manufacturers, pharmaceutical firm R&D heads, packaging department heads, research scientists, and other related key opinion leaders. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

Segmental revenues were arrived at to calculate the global market value based on the revenue mapping of major players active in the Sterility testing market. This process involved the following steps:

- Generating a list of the major global players operating in the sterility testing market

- Mapping the annual revenues generated by major global players from the Sterility testing market or the nearest reported business unit/product category

- Identifying the revenues of the top five players in the sterility testing market

- Estimating the revenue of the key four players at 500-550 million in 2022 and adding up to 100% to derive the global value of the Sterility testing market

Data Triangulation

After arriving at the overall size of the sterility testing market through the methodology mentioned above, this market was split into several segments. Market breakdown procedures were employed, wherever applicable, to arrive at the exact market value for the key segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand and supply-side participants.

Report Objectives

- To define, describe, and forecast the sterility testing market based on product & service, test type, application, end-user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets concerning individual growth trends, future prospects, and contributions to the overall sterility testing market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders.

- To profile key players and comprehensively analyze their market shares and core competencies regarding market development and growth strategies.

- To forecast revenue of the market segments concerning four main regional segments, namely, North America, Europe, Asia, and the Rest of the World

- To track and analyze competitive developments such as collaborations, mergers and acquisitions, product launches, and expansions in the sterility testing market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the European sterility testing market into RoE countries

- Further breakdown of the Asia sterility testing market into RoA countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sterility Testing Market