Medical Membranes Market

Medical Membranes Market by Material (PSU, PES, PVDF, PTFE, PP, PAN, PA, Modified Acrylics), Process Technology (Ultrafiltration, Microfiltration, Nanofiltration), Application (Pharmaceutical Filtration, Hemodialysis, IV Fusion & Sterile Filtration, Membrane Oxygenator), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

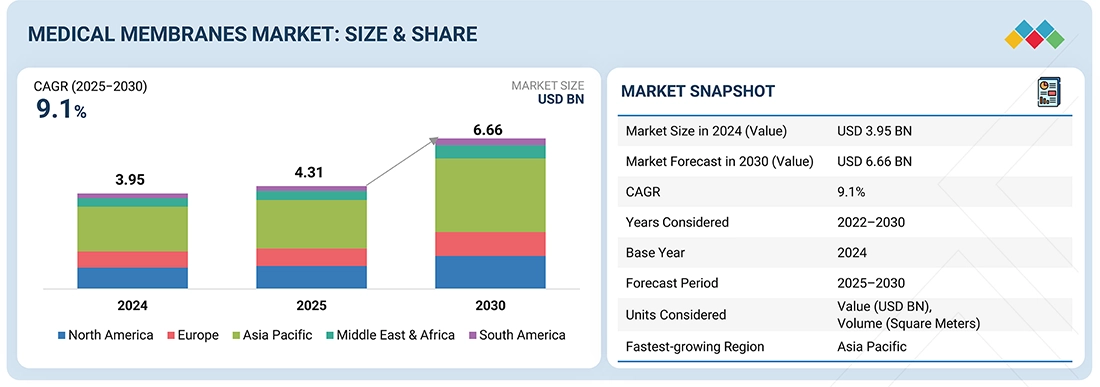

The medical membranes market is projected to reach USD 6.66 billion by 2030 from USD 4.31 billion in 2025, at a CAGR of 9.1% during the forecast period. The medical membranes market is primarily driven by the rising prevalence of chronic kidney diseases and diabetes, increasing demand for hemodialysis, and rapid growth in biopharmaceutical production requiring advanced filtration. Technological advancements in biocompatible, antifouling, and high-performance membranes, along with expanding healthcare infrastructure in emerging economies, further accelerate market expansion.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounts for the largest share of 33.1% of the global medical membranes market.

-

By MaterialTubing has the highest market share accounted for 45.2% in 2024.

-

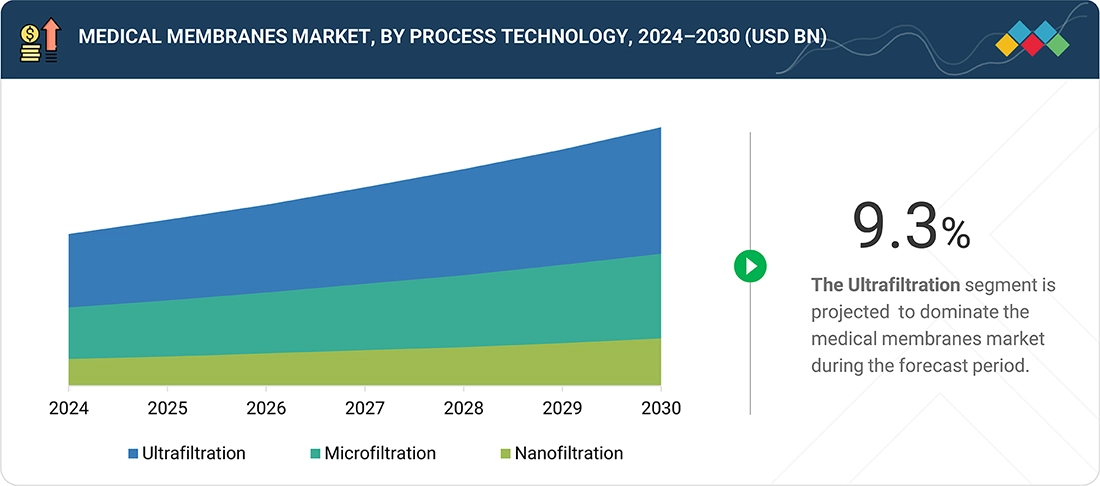

By Process TechnologyNanofiltration is projected to be the fastest-growing process technology segment at a CAGR of 9.7% during the forecast period.

-

By ApplicationBy application, the pharmaceutical filtration segment is expected to dominate the medical membranes market.

-

Competitive Landscape - Key PlayersCompany Asahi Kasei Corporation, Mann+Hummel, and Sartorius AG were identified as some of the star players in the medical membranes market (global), given their strong market share and product footprint.

-

Competitive Landscape - StartupsRepligen, Synder Filtration, Inc., and Lenntech B.V., among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas.

The medical membranes market is driven by the surging global demand for biologics and biosimilars, which rely heavily on membrane-based purification and virus clearance processes, alongside a sharp rise in plasma fractionation for immunoglobulins and albumin. Growing investments in regenerative medicine, tissue engineering scaffolds, and bioartificial organs, combined with the shift toward continuous manufacturing and single-use technologies in pharmaceutical plants, are further fueling rapid market growth across developed and emerging regions.

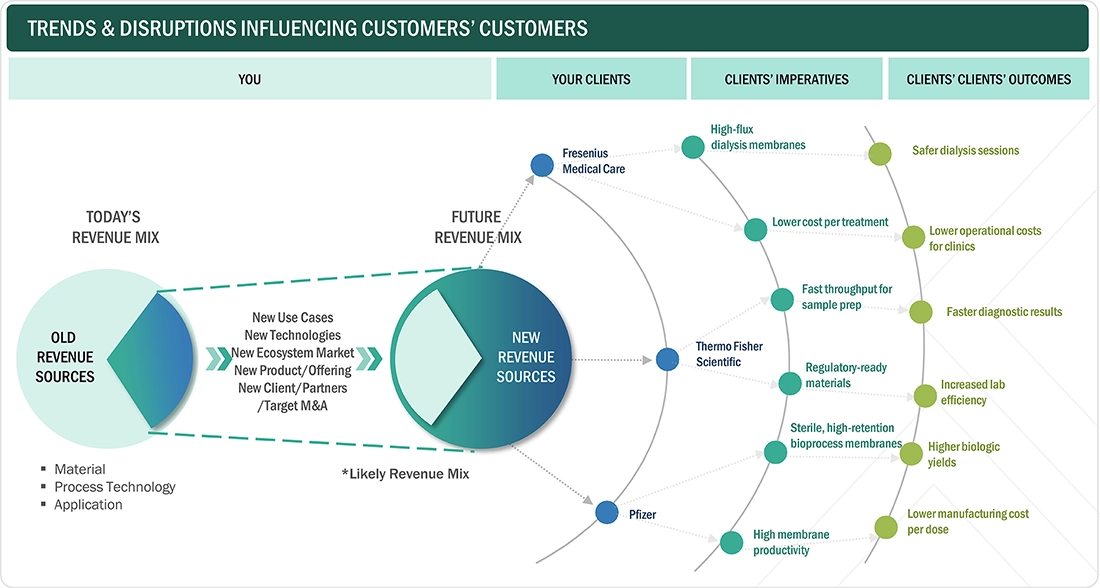

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on clients' businesses in the medical membranes market is driven by evolving priorities such as higher purity standards, regulatory compliance, process efficiency, and reliability. Leading companies like Fresenius Medical Care, Thermo Fisher Scientific, and Pfizer increasingly prioritize membranes that offer precise filtration, durability, and scalability for critical medical and pharmaceutical applications. These priorities result in improved product safety, reduced contamination risks, enhanced operational efficiency, and adherence to strict global regulations. This emphasis on performance and compliance underscores the vital role of innovation and quality in meeting the diverse and demanding needs of end users across healthcare and pharmaceutical sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of chronic diseases

-

Growing adoption of membrane-based separation technologies

Level

-

High cost of advanced medical membranes

-

Stringent regulatory approval processes

Level

-

Growing demand for single-use membrane systems in bioprocessing

-

Expansion in emerging markets

Level

-

Complexity in scaling up production of high-performance membranes

-

Environmental concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising prevalence of chronic diseases

The rising prevalence of chronic diseases is a major driver for the medical membranes market because it increases the demand for advanced medical treatments, diagnostic procedures, and high-purity water systems that rely on membrane-based filtration. Conditions such as kidney disease, diabetes, cardiovascular disorders, and cancer require frequent medical interventions, including dialysis, drug administration, and laboratory testing, all of which depend on reliable membrane technologies. As more patients require long-term and high-quality care, healthcare facilities and pharmaceutical manufacturers must adopt efficient, sterile, and precise filtration systems. This growing need for safe treatment environments and accurate diagnostics significantly boosts the adoption of medical membranes.

Restraint: High cost of advanced medical membranes

The high cost of advanced medical membranes acts as a significant restraint for the medical membranes market because these technologies require specialized raw materials, sophisticated manufacturing processes, and strict quality control to meet medical and pharmaceutical standards. Premium membranes used in applications such as dialysis, sterilization, and biopharmaceutical filtration often involve advanced polymers, precision engineering, and rigorous testing, which increase production expenses. For healthcare facilities and manufacturers, these high upfront and maintenance costs can limit adoption, especially in cost-sensitive or resource-limited regions. As a result, budget constraints may slow the integration of cutting-edge membrane solutions despite their strong performance benefits.

Opportunity: Growing demand for single-use membrane systems in bioprocessing

The growing demand for single-use systems in bioprocessing presents a major opportunity for the medical membranes market because these systems rely heavily on high-performance membranes for filtration, purification, and sterilization. As biopharmaceutical manufacturers shift toward disposable technologies to reduce contamination risks, improve process flexibility, and lower cleaning and validation costs, the need for reliable membrane solutions increases significantly. Single-use bioreactors, filtration units, and purification assemblies all depend on advanced membranes to maintain product quality and process efficiency. This expanding adoption of modular, scalable, and contamination-free systems drives strong demand for innovative membrane materials and designs, creating substantial growth potential for the medical membranes market.

Challenge: Complexity in scaling up production of high-performance membranes

The complexity in scaling up production of high-performance membranes is a major challenge in the medical membranes market. These membranes require precise manufacturing conditions, advanced materials, and strict quality control to meet medical and pharmaceutical standards. Small-scale production allows tight control over pore size, uniformity, and material consistency, but maintaining these characteristics at large volumes is technically difficult and costly. Even slight variations can compromise filtration efficiency, sterilization performance, or biocompatibility. Additionally, scaling up requires significant investments in specialized equipment, skilled labor, and regulatory compliance. These hurdles slow down mass production, limit supply availability, and increase the overall cost for manufacturers and end users.

medical-membrane-advanced-technologies-and-global-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Hemodialysis membranes, hollow-fiber membranes for plasma separation, and microfiltration systems for medical and pharmaceutical use | High biocompatibility, efficient toxin and impurity removal, stable performance in dialysis, and enhanced patient safety |

|

Sterile filtration membranes for medical devices, hospital equipment, and life-science applications | Strong contamination control, high filtration purity, long membrane durability, and improved reliability in clinical environments |

|

Membrane systems for bioprocessing, sterile filtration, virus removal, and single-use pharmaceutical manufacturing | Ensures product integrity, accelerates processing, supports scalable production, and meets strict biopharma quality standards |

|

Membranes for pharmaceutical water purification, sterile drug filtration, and laboratory workflows | High filtration accuracy, broad chemical compatibility, regulatory compliance, and improved efficiency in drug development |

|

Medical-grade membranes for diagnostic devices, wound care products, and fluid management systems | Superior fluid control, strong protective barrier performance, enhanced patient safety, and reliable functionality in clinical applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The medical membranes market ecosystem consists of raw material suppliers (DuPont, Evonik Industries, Toray Industries), manufacturers (Asahi Kasei Corporation, Sartorius AG, Merck KGaA), distributors (Thermo Fisher Scientific, Avantor, Inc., Cardinal Health), and end users (Fresenius Medical Care, Pfizer, Roche). Raw material suppliers provide advanced polymers, specialty resins, and filtration materials essential for producing high-performance medical membranes. Manufacturers design and produce membranes used for hemodialysis, sterile filtration, water purification, and bioprocessing. Distributors manage inventory, quality handling, and logistics to ensure timely delivery of membrane products to medical facilities and pharmaceutical companies. End users—including healthcare providers, biotech firms, and pharmaceutical manufacturers—rely on these membranes to ensure safe patient care, sterile processing, and high-purity production across clinical and laboratory environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Medical membranes market, by material

Polysulfone (PSU) & polyethersulfone (PESU) dominate the medical membranes market because of their exceptional thermal stability, chemical resistance, and biocompatibility, making them ideal for demanding medical and pharmaceutical applications. These materials maintain structural integrity under high temperatures and harsh sterilization processes, which is essential for hemodialysis, sterile filtration, and bioprocessing. Their ability to create uniform pore structures ensures consistent filtration performance and high permeability. PSU & PESU membranes also resist fouling better than many alternatives, extending service life and reducing maintenance costs. Their durability, reliability, and compatibility with regulatory standards make them the preferred choice across healthcare and biopharmaceutical settings.

Medical membranes market, by process technology

Nanofiltration (NF) is rapidly emerging as the fastest-growing technology in the medical membranes market due to its precise separation capabilities and cost-effectiveness. NF membranes selectively remove multivalent ions, bacteria, and larger molecules while allowing essential monovalent salts and water to pass, making them ideal for medical applications such as pharmaceutical production, dialysis, and sterile water purification. Compared to traditional microfiltration and ultrafiltration, NF offers higher efficiency, lower energy consumption, and enhanced operational flexibility. Rising demand for safe, high-purity medical solutions, coupled with advancements in membrane materials and manufacturing, is driving the widespread adoption of nanofiltration in healthcare and biotechnology sectors.

Medical membranes market, by application

Pharmaceutical filtration dominates the medical membranes market due to the critical need for high-purity solutions in drug manufacturing. Membranes are essential for removing bacteria, endotoxins, and particulates from liquids, ensuring compliance with stringent regulatory standards. Applications include sterile filtration of injectables, vaccines, and biologics, where precision and reliability are paramount. The increasing production of complex drugs, biopharmaceuticals, and specialty medicines drives consistent demand for advanced filtration technologies. Additionally, growing emphasis on patient safety and quality assurance in pharmaceutical processes reinforces the reliance on membrane-based filtration, making this application segment the largest contributor to the overall growth of the medical membranes market.

REGION

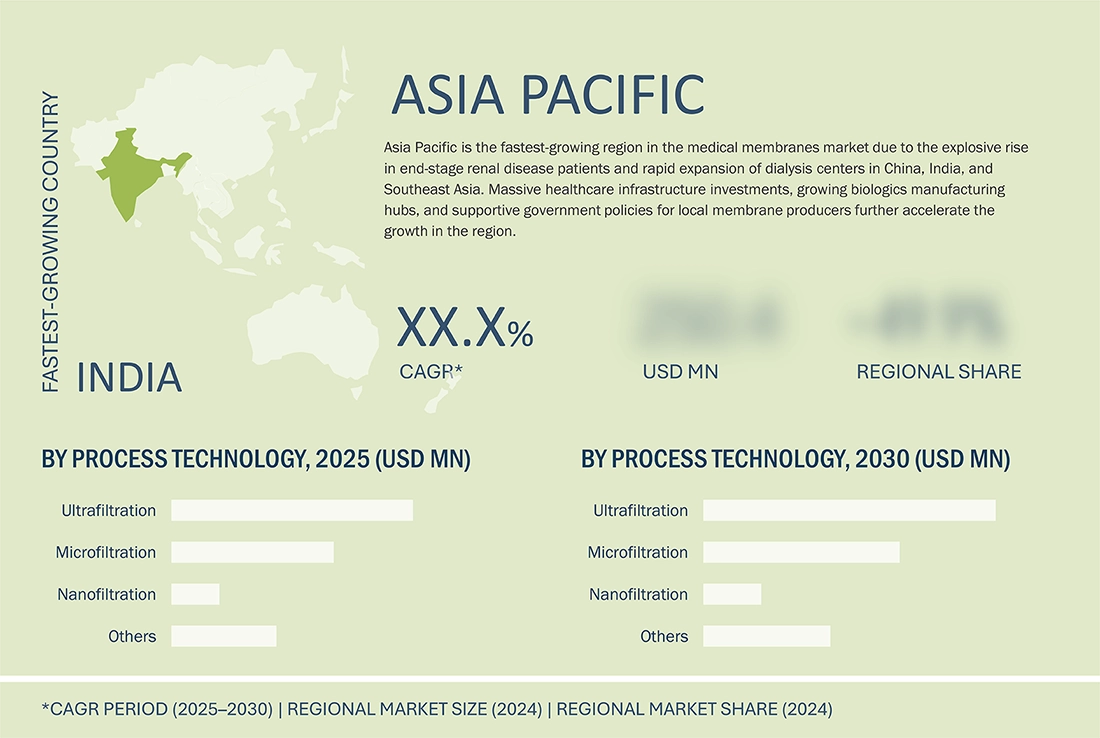

Asia Pacific to be fastest-growing region in global medical membranes market during forecast period

Asia Pacific is the fastest-growing region in the medical membranes market due to rising healthcare investments, expanding pharmaceutical manufacturing, and increasing demand for advanced medical treatments. Rapid population growth, urbanization, and higher prevalence of chronic diseases drive the need for purified water, dialysis solutions, and sterile pharmaceutical products. Countries like China and India are investing heavily in biopharmaceuticals and medical infrastructure, boosting membrane adoption. Additionally, cost-effective manufacturing and favorable government policies support the expansion of membrane technologies. The region’s combination of growing healthcare awareness, technological advancements, and strong industrial base positions Asia Pacific as a key driver of the global medical membranes market growth.

medical-membrane-advanced-technologies-and-global-market: COMPANY EVALUATION MATRIX

Asahi Kasei Corporation is considered a star in the medical membranes market due to its strong global presence, extensive portfolio of high-performance filtration membranes, and advanced manufacturing capabilities ensuring purity, reliability, and consistency. The company's continuous innovation in nanofiltration, ultrafiltration, and biopharmaceutical-grade membranes strengthens its leadership across pharmaceutical, biotechnology, and healthcare applications. Meanwhile, W. L. Gore & Associates, Inc. is an emerging leader due to its growing focus on sustainable and high-efficiency membrane technologies, leveraging its expertise in advanced materials. Its investments in energy-efficient, precision filtration solutions and collaborations with healthcare and biopharma manufacturers position Gore as a major driver of innovation and competition in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Asahi Kasei Corporation (Japan)

- Mann+Hummel (Germany)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Solventum (US)

- Cytiva (US)

- W. L. Gore & Associates, Inc. (US)

- Kovalus Separation Solutions (US)

- Cobetter (China)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.95 Billion |

| Market Forecast in 2030 (Value) | USD 6.66 Billion |

| Growth Rate | CAGR of 9.1% from 2025 to 2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Square Meters) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

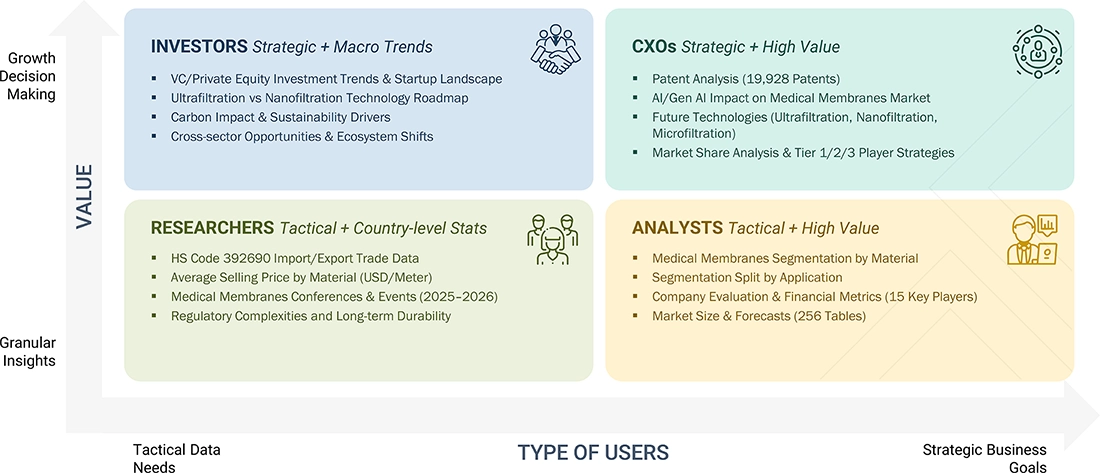

WHAT IS IN IT FOR YOU: medical-membrane-advanced-technologies-and-global-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Medical Membrane Manufacturer | Supplier profiling of medical membrane manufacturers (ultrafiltration, nanofiltration, microfiltration) based on certifications, production capacity, and quality standards | Benchmark supplier reliability, ensure regulatory compliance, and identify opportunities for long-term sourcing partnerships and supply chain optimization |

| Membrane Technology Developer | Technical and cost-benefit comparison of membrane materials (polyethersulfone, PVDF, cellulose acetate) for different medical applications (sterile filtration, dialysis, biopharmaceutical processing) | Support R&D decisions, material selection, and process optimization for improved filtration efficiency and cost reduction |

| Raw Material Supplier | Regional mapping of polymer and membrane production capacities and capabilities in healthcare and biopharma sectors | Identify high-growth medical membrane manufacturing hubs and assess forward integration or partnership opportunities |

RECENT DEVELOPMENTS

- September 2025 : Solventum entered into an agreement to sale its Purification & Filtration business to Thermo Fisher Scientific, marking a major step in its ongoing transformation plan. The company stated that the divestiture strengthened its balance sheet, reduced leverage, and increased flexibility for future investments. The development also shifted the ownership of key filtration and medical-membrane technologies to Thermo Fisher, positioning both companies for focused growth in their respective portfolios.

- April 2024 : Solventum announced that it had completed its spin-off from 3M and began trading independently on the New York Stock Exchange. The company noted that this milestone strengthens its ability to advance innovations across its portfolio, including its established range of medical filtration and membrane technologies used in critical healthcare applications. Solventum stated that operating independently will allow greater strategic focus, targeted investment, and long-term value creation in its core medical solutions business.

- May 2023 : Cytiva completed the integration of Pall Corporation’s life sciences business, uniting nearly 16,000 associates across 40 countries under the Cytiva brand. This strategic integration strengthens Cytiva’s medical membrane and bioprocessing portfolio, including the Supor line, widely used in sterile filtration and pharmaceutical applications. Combining decades of expertise and leading product brands, Cytiva now offers enhanced solutions to accelerate therapeutic development from discovery to delivery. The integration supports improved local manufacturing, adoption of digital process solutions, and a robust global supply of medical membranes, reinforcing Cytiva’s leadership in healthcare and biotechnology markets.

Table of Contents

Methodology

The study involved four major activities for estimating the current size of the global medical membranes market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of medical membranes through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the medical membranes market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study on the medical membranes market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, databases, and articles by recognized authors, regulatory bodies, and trade directories.

Primary Research

The medical membranes market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the medical membranes market. Primary sources from the supply side include associations and institutions involved in the medical membranes market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the medical membranes market by material, process technology, application, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the market were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders, such as directors and marketing executives, to obtain opinions.

Medical Membranes Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the medical membranes market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The medical membranes market encompasses specialized semipermeable materials used for separation, filtration, purification, and selective transport processes across healthcare and life-science applications. These membranes are essential components in hemodialysis, drug delivery systems, sterile filtration, diagnostic assays, and biopharmaceutical manufacturing. Made from materials such as polysulfone, polyethersulfone, PVDF, polypropylene, and cellulose derivatives, medical membranes enable high-precision control of molecule and particle movement. Market growth is driven by rising chronic diseases, expanding biologics production, stricter infection-control standards, and the adoption of advanced diagnostic technologies. Key end users include dialysis centers, medical device manufacturers, pharmaceutical companies, hospitals, and research laboratories.

Key Stakeholders

- Medical Membrane Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the medical membranes market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on material, process technology, application, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific, South America, and Middle East & Africa—along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments, such as product launches, expansions, and deals in the medical membranes market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Customization Options

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the market for different sources of medical membranes.

Regional Analysis

- Further breakdown of a country with respect to the medical membranes market.

Company Information

- Detailed analysis and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Medical Membranes Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Medical Membranes Market