Modified Bitumen Market by Modifier Type (SBS, APP, Crumb Rubber, Natural Rubber), Application Method (Hot Asphalt, Cold Asphalt, Torch-Applied), End-Use Industry (Road Construction, Building Construction), and Region - Global Forecast to 2021

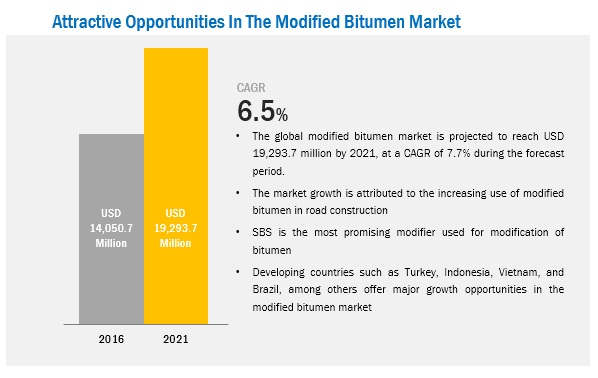

[211 Pages Report] The global Modified Bitumen Market was valued at USD 13.22 Billion in 2015 and is projected to reach USD 19.29 Billion by 2021, at a CAGR of 6.5% from 2016 to 2021. In this study, 2015 has been considered as the base year, and 20162021 as the forecast period to estimate the market size for modified bitumen.

Objectives of the study:

- To analyze and forecast the modified bitumen market, in terms of both volume and value

- To define, describe, and segment the global modified bitumen market based on modifier type, end-use industry, and application method

- To forecast the size of each market segment based on regions, such as Asia-Pacific, North America, Europe, the Middle East & Africa, and Latin America

- To provide detailed information regarding the key factors (drivers, restraints, and opportunities) influencing the growth of the market

- To strategically analyze the segmented markets with respect to individual growth trends, future prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments, such as expansion, merger & acquisition, contract, agreement, and new product development in the modified bitumen market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology:

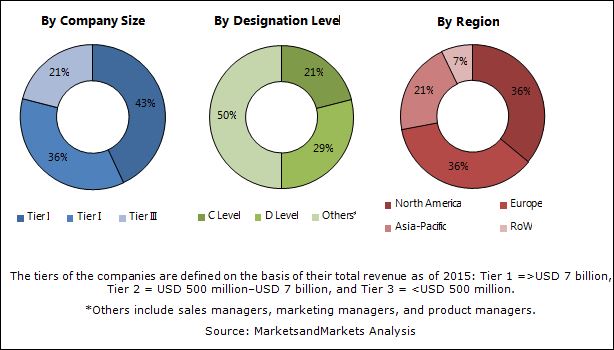

This study aims to estimate the market for modified bitumen for 2016, and its projection by 2021. It provides a detailed qualitative and quantitative analysis of the market. Various secondary sources, such as The American Association of State Highway and Transportation Officials (AASHTO), International Journal for Scientific Research & Development (IHSRD), Chemical Weekly, and Bloomberghave been used to identify and collect information useful for an extensive commercial study of the modified bitumen market. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects of the modified bitumen market.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

Modified bitumen is produced by blending normal bitumen with suitable polymers and other additives to improve the inherent properties of bitumen. The raw materials are supplied to the major modified bitumen manufacturers, such as Sika AG (Switzerland), Nynas AB (Sweden), Total S.A. (France), Royal Dutch Shell Plc (The Netherlands), and Colas S.A. (France). These manufacturers focus on increasing their regional presence by undertaking strategies such as contracts & agreements, mergers & acquisitions, and new product launches.

Key Target Audience:

- Manufacturers of Modified Bitumen

- Traders, Distributors, and Suppliers of Modified Bitumen

- Regional Manufacturers' Associations for Modified Bitumen

- Government and Regional Agencies and Research Organizations

Scope of the Report:

The modified bitumen market is segmented as follows:

On the basis of Modifier Type:

- Styrene-Butadiene-Styrene

- Atactic Polypropylene

- Crumb Rubber

- Natural Rubber

- Others

- Polypropylene

- Polyvinyl Chloride

- Epoxy Resin

- Polyurethane Resin

- Styrene Butadiene Rubber

- Ethylene Vinyl Acetate

- Gilsonite

- Fiber

On the basis of Application Method:

- Hot Asphalt

- Cold Asphalt

- Torch Applied

- Others

- Mechanically Fastened

- Self-Adhering

On the basis of End-Use Industry:

- Road Construction

- Building Construction

- Others

- Waste & Water Management

- Industrial Areas

On the basis of Region:

- Asia-Pacific

- North America

- Europe

- Middle East & Africa

- Latin America

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

- Product Analysis

Product matrix that gives a detailed comparison of product portfolio of each company

- Regional Analysis

Further breakdown of a region with respect to a particular country

- Company Information

Detailed analysis and profiling of additional market players (up to 5)

The global market size for modified bitumen is projected to reach USD 19.29 Billion by 2021, at a CAGR of 6.5% from 2016 to 2021. The market is driven by rise in demand in the Asia-Pacific region, growing construction industry in emerging nations, and cost-effectiveness of modified bitumen. Road construction is one of the major markets for modified bitumen in emerging as well as developed economies.

The various modifier types discussed in the report are styrene-butadiene-styrene (SBS), atactic polypropylene (APP), crumb rubber, and natural rubber. SBS is the largest modifier type segment of the modified bitumen market, in terms of volume and value, owing to the materials unique combination of properties making it useful across industries.

By end-use industry, the report segments the modified bitumen market into road construction (tunnel liners, bridges & flyovers, highways, and airport runways), building construction (roofing & walls, building, and structures), and others (waste & water management and industrial applications). Road construction is the fastest-growing end-use industry of the modified bitumen market in countries such as India, Vietnam, and Indonesia.

The application method discussed in the report are hot asphalt, cold asphalt, torch-applied, and others (mechanically fastened and self-adhering). Hot asphalt is the most widely used application method globally, as it provides firmness in summer heat and high penetration index which provides greater flexibility in colder temperatures.

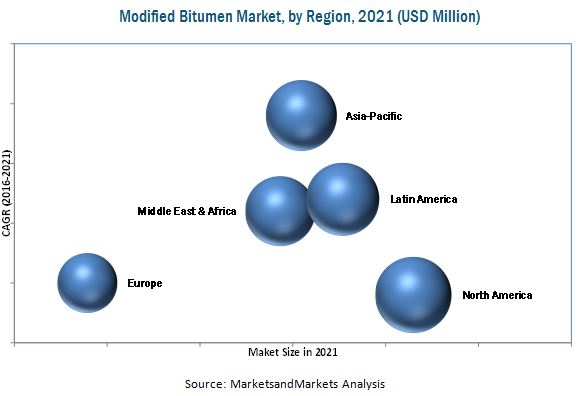

Asia-Pacific, Europe, and North America are the major modified bitumen markets. The Asia-Pacific region dominates the global modified bitumen market. The market in Asia-Pacific is estimated to record high growth owing to increasing demand from the construction industry. The demand for modified bitumen in North America and Europe is comparatively lower than that of Asia-Pacific due to the economic slowdown in these regions.

Though the modified bitumen market is growing at a significant rate, lack of awareness regarding the benefits of modified bitumen among potential industries of developing countries hampers the market growth.

Sika AG (Switzerland), Nynas AB (Sweden), Total S.A. (France), Royal Dutch Shell Plc (The Netherlands), and Colas S.A. (France) are the leading companies in the global modified bitumen market. These companies are expected to account for a significant market share in the near future.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objective of the Study

1.2 Market Definition

1.3 Market Scope

1.4.1 By Modifier Type

1.4.2 By End-Use Industry

1.4.3 By Application Method

1.4 Currency

1.5 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 Modified Bitumen Market Research Data

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.3 Key Industry Insights

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary

3.1 Executive Summary

3.2 Modified Bitumen Segment Analysis

3.3 Market Attractiveness Analysis

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.2.1 Modified Bitumen Market, By Region

5.2.2 Modified Bitumen Market, By Modifier

5.2.3 Modified Bitumen Market, By End Use Industry

5.2.4 Modified Bitumen Market, By Application Method

5.3 Market Dynamics

5.3.1 Drivers

5.3.2 Restraints

5.3.3 Opportunities

5.3.4 Challenges

5.4 Impact Analysis

5.4.1 Short Term and Mid Term Outlook

5.4.2 Long Term Outlook

6 Industry Trends

6.1 Supply Chain Analysis

6.2 Porters Five Forces Analysis

6.2.1 Bargaining Power of Suppliers

6.2.2 Bargaining Power of Buyers

6.2.3 Threat of New Entrants

6.2.4 Threat of Substitutes

6.2.5 Intensity of Rivalry

6.3 Macroeconomic Overview

7 Modified Bitumen Market, By Modifier Type

7.1 Introduction

7.2 Styrene-Butadiene-Styrene (SBS)

7.3 Atactic Polypropylene (APP)

7.4 Crumb Rubber

7.5 Natural Rubber

7.6 Others

8 Modified Bitumen Market, By End-Use Industry

8.1 Introduction

8.2 Road Construction

8.3 Building Construction

8.4 Others

9 Modified Bitumen Market, By Application Method

9.1 Introduction

9.2 Hot Asphalt Method

9.3 Cold Asphalt Method

9.4 Torch Applied Method

9.5 Others

10 Modified Bitumen Market, By Region

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 France

10.3.2 Germany

10.3.3 Italy

10.3.4 Spian

10.3.5 United Kingdom

10.3.6 Russia

10.3.7 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Indonesia

10.4.5 Vietnam

10.4.6 Singapore

10.4.7 Malaysia

10.4.8 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 Saudi Arabia

10.6.2 U.A.E.

10.6.3 South Africa

10.6.4 Turkey

10.6.5 Rest of Middle East & Africa

11 Competitive Landscape

11.1 Overview

11.2 New Product Launches, 2015-2016

11.3 Mergers & Acquisitions, 2015-2016

11.4 Contracts & Agreements, 2015-2016

11.5 Expansions, 2015-2016

12 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Sika AG

12.2 Nynas AB

12.3 Total S.A.

12.4 Royal Dutch Shell PLC

12.5 Colas S.A.

12.6 Hindustan Colas Private Limited

12.7 Soprema Group

12.8 The DOW Chemical Company

12.9 GAF Materials Corporation

12.10 Gazprom Neft PJSC

12.11 PJSC Rosneft Oil Company

12.12 Saint-Gobain Weber

12.13 Orlen Asfalt Sp. Z.O.O.

12.14 Exxonmobil Corporation

12.15 W.R.Grace and Company

12.16 Firestone Building Products Company

12.17 Fosroc International Limited

12.18 Lagan Asphalt Group

12.19 Bitumina Group

12.20 Global Road Technology

12.21 Texsa Systems SLU

*Details Might Not Be Captured in Case of Unlisted Companies.

List of Tables (114 Tables)

Table 1 Modified Bitumen Market, By Modifier Type

Table 2 Modified Bitumen Market Size, By End-Use Industry

Table 3 Modified Bitumen Market Size, By Application Method

Table 4 Macroeconomic Indicators

Table 5 Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 6 Modified Bitumen Market Size, By Modifier Type, 20142021 (USD Million)

Table 7 SBS Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 8 APP Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 9 Crumb Rubber Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 10 Natural Rubber Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 11 Other Type of Modifiers

Table 12 Other Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 13 Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 14 Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 15 Modified Bitumen Application in Road Construction

Table 16 Modified Bitumen Market Size in Road Construction, By Region, 20142021 (KT)

Table 17 Modified Bitumen Market Size in Road Construction, By Region, 20142021 (USD Million)

Table 18 Modified Bitumen Application in Building Construction

Table 19 Modified Bitumen Market Size in Building Construction, By Region, 20142021 (KT)

Table 20 Modified Bitumen Market Size in Building Construction, By Region, 20142021 (USD Million)

Table 21 Modified Bitumen Application in Other End-Use Industries

Table 22 Modified Bitumen Market Size in Other End-Use Industry, By Region, 20142021 (KT)

Table 23 Modified Bitumen Market Size in Other End-Use Industry, By Region, 20142021 (USD Million)

Table 24 Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 25 Modified Bitumen Market Size, By Application Method, 20142021 (USD Million)

Table 26 Modified Bitumen Market Size for Hot Asphalt, By Region, 2014-2021 (KT)

Table 27 Modified Bitumen Market Size for Cold Asphalt, By Region, 20142021 (KT)

Table 28 Modified Bitumen Market Size for Torch Applied, By Region, 2014-2021 (KT)

Table 29 Modified Bitumen Market Size in Other Application Method, By Region, 2014-2021 (KT)

Table 30 Modified Bitumen Market Size, By Region, 20142021 (KT)

Table 31 Modified Bitumen Market Size, By Region, 20142021 (USD Million)

Table 32 North America: Modified Bitumen Market Size, By Country, 20142021 (KT)

Table 33 North America: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 34 North America: Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 35 North America: Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 36 North America: Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 37 U.S.: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 38 Canada: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 39 Mexico: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 40 Europe: Modified Bitumen Market Size, By Country, 20142021 (KT)

Table 41 Europe: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 42 Europe: Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 43 Europe: Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 44 Europe: Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 45 France: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 46 Germany: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 47 Italy: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 48 Spain: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 49 U.K.: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 50 Russia: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 51 Rest of Europe: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 52 Asia-Pacific: Modified Bitumen Market Size, By Country, 20142021 (KT)

Table 53 Asia-Pacific: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 54 Asia-Pacific: Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 55 Asia-Pacific: Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 56 Asia-Pacific: Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 57 China: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 58 Japan: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 59 India: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 60 Indonesia: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 61 Vietnam: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 62 Singapore: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 63 Malaysia: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 64 Rest of Asia-Pacific: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 65 Latin America: Modified Bitumen Market Size, By Country, 20142021 (KT)

Table 66 Latin America: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 67 Latin America: Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 68 Latin America: Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 69 Latin America: Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 70 Brazil: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 71 Argentina: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 72 Rest of Latin America: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 73 Middle East & Africa: Modified Bitumen Market Size, By Country, 20142021 (KT)

Table 74 Middle East & Africa: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 75 Middle East & Africa: Modified Bitumen Market Size, By End-Use Industry, 20142021 (USD Million)

Table 76 Middle East & Africa: Modified Bitumen Market Size, By Modifier Type, 20142021 (KT)

Table 77 Middle East & Africa: Modified Bitumen Market Size, By Application Method, 20142021 (KT)

Table 78 Saudi Arabia: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 79 U.A.E.: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 80 South Africa: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 81 Turkey: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 82 Rest of Middle East & Africa: Modified Bitumen Market Size, By End-Use Industry, 20142021 (KT)

Table 83 New Product Launches, 2015-2016

Table 84 Mergers & Acquisitions, 2015-2016

Table 85 Contracts & Agreements, 2015-2016

Table 86 Expansions, 2015-2016

Table 87 Sika AG: Product Offered

Table 88 Sika AG: Recent Developments, 2015-2016

Table 89 Nynas AB: Product Offered

Table 90 Nynas AB: Recent Developments, 2015-2016

Table 91 Total S.A.: Product Offered

Table 92 Royal Dutch Shell PLC: Product Offered

Table 93 Royal Dutch Shell PLC: Recent Developments, 2015-2016

Table 94 Colas S.A.: Product Offered

Table 95 Colas S.A.: Recent Developments, 20152016

Table 96 Hindustan Colas Private Limited: Product Offered

Table 97 Soprema Group: Product Offered

Table 98 Soprema Group: Recent Developments, 2015-2016

Table 99 The DOW Chemical Company: Product Offered

Table 100 GAF Materials Corporation: Product Offered

Table 101 GAF Materials Corporation: Recent Developments, 2015-2016

Table 102 Gazprom Neft PJSC: Product Offered

Table 103 Gazprom Neft PJSC: Recent Developments, 2015-2016

Table 104 PJSC Rosneft Oil Company: Product Offered

Table 105 Saint-Gobain Weber: Product Offered

Table 106 Orlen Asfalt Sp. Z.O.O.: Product Offered

Table 107 Exxonmobil Corporation: Product Offered

Table 108 W.R.Grace and Company: Product Offered

Table 109 Firestone Building Products Company: Product Offered

Table 110 Fosroc International Limited: Product Offered

Table 111 Lagan Asphalt Group: Product Offered

Table 112 Bitumina Group: Product Offered

Table 113 Global Road Technology: Product Offered

Table 114 Texsa Systems SLU: Product Offered

List of Tables (61 Figures)

Figure 1 Modified Bitumen Market Segmentation

Figure 2 Modified Bitumen Market Segmentation, By Region & By Country

Figure 3 Years Considered for the Study

Figure 4 Modified Bitumen Market: Research Design

Figure 5 Breakdown of Primary Interviews

Figure 6 Excerpts From Primary Interviews

Figure 7 Research Methodology: Top-Down Approach

Figure 8 Research Methodology: Bottom-Up Approach

Figure 9 SBS Based Modified Bitumen is Expected to Continue to Dominate the Modified Bitumen Market in 2021

Figure 10 Road Construction to Be the Fastest-Growing End-Use Segment During the Forecast Period

Figure 11 Asia-Pacific Market to Register Highest CAGR During Forecast Period

Figure 12 Modified Bitumen Market to Register High Growth Due to Booming Construction Industry

Figure 13 Asia-Pacific to Dominate the Modified Bitumen Market

Figure 14 Modified Bitumen Market Share (%), 2015 (By Value)

Figure 15 India to Register Highest Growth Rate in Asia During the Forecast Period

Figure 16 China to Continue Dominating the Modified Bitumen Market

Figure 17 Modified Bitumen Market, By Region

Figure 18 Modified Bitumen Market: Drivers, Restraints, Opportunities and Challenges

Figure 19 Impact Analysis for Modified Bitumen Market

Figure 20 Modified Bitumen Supply Chain

Figure 21 Porters Five Forces Analysis: Modified Bitumen

Figure 22 Modified Bitumen Market Segmentation, By Modifier Type

Figure 23 Modified Bitumen Market Segmentation, By End-Use Industry

Figure 24 Modified Bitumen Market Segmentation, By Application Method

Figure 25 Modified Bitumen Market Share, By Region, 2015 (Volume)

Figure 26 Modified Bitumen Market Share, By Region, 2015 (Value)

Figure 27 North America: Modified Bitumen Market

Figure 28 North America: Modified Bitumen Market Share (Volume), By Country, 2015

Figure 29 U.S.: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 30 Canada: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 31 Mexico: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 32 Mexico: Modified Bitumen Market Share, By End-Use, 2015 vs 2021 (Volume)

Figure 33 Europe: Modified Bitumen Market

Figure 34 Europe: Modified Bitumen Market Share, By Country, 2015 (Volume)

Figure 35 Italy: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 36 Germany: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 37 France: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 38 U.K.: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 39 Rest of Europe: Modified Bitumen Market Share, By End-Use, 2015 vs 2021 (Volume)

Figure 40 Asia-Pacific: Modified Bitumen Market

Figure 41 Asia-Pacific: Modified Bitumen Market Share, By Country, 2015 (Volume)

Figure 42 Indonesia: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 43 China: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 44 India: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 45 Vietnam: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 46 South America: Modified Bitumen Market

Figure 47 South America: Modified Bitumen Market Share, By Country, 2015 (Volume)

Figure 48 Brazil: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 49 Argentina: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 50 Rest of South America: Modified Bitumen Market Share, By End-Use, 2015 vs 2021 (Volume)

Figure 51 Middle East & Africa: Modified Bitumen Market

Figure 52 Middle East & Africa: Modified Bitumen Market Share, By Country, 2015 (Volume)

Figure 53 Turkey: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 54 Saudi Arabia: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 55 U.A.E.: Modified Bitumen Market Size, End-Use Industry, 2015 (KT)

Figure 56 South Africa: Modified Bitumen Market Size, By End-Use Industry, 2015 (KT)

Figure 57 Rest of Middle East & Africa: Modified Bitumen Market Share, By End-Use, 2015 vs 2021 (Volume)

Figure 58 Companies Adopted Expansions and New Product Launches as Their Key Growth Strategies (2015-2016)

Figure 59 Key Players in Modified Bitumen Market (2015)

Figure 60 Modified Bitumen Market Share for India

Figure 61 Battle for Market Share: New Product Launches is the Key Strategy (2015-2016)

Growth opportunities and latent adjacency in Modified Bitumen Market