Solvent Based Adhesives Market by Chemistry (Polyurethane, Acrylic, Chloroprene Rubber, Synthesized Rubber), End-Use Industry (Paper & Packaging, Medical, Automotive, Building & Construction, Woodworking), Region - Global Forecast to 2026

Solvent-Based Adhesives Market Analysis

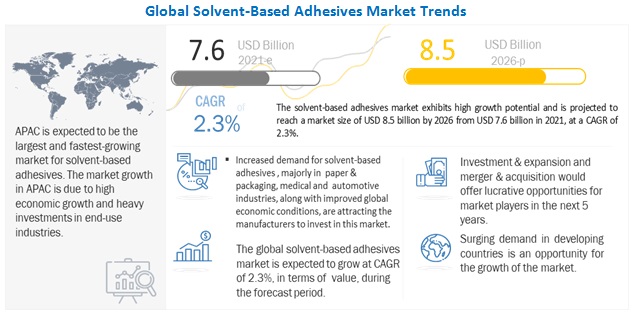

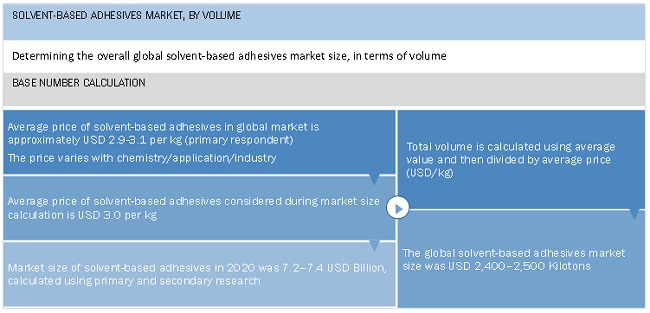

Solvent based adhesives market size was valued at USD 7.6 billion in 2021 and is projected to reach USD 8.5 billion by 2026, growing at a cagr 2.3% from 2021 to 2026. The market growth opportunities solvent based are increasing due to the strength of solvent based adhesives. They provide superior shear and peel strength. The growth of the market is supported by the increasing construction and automobile applications and growing demand in the APAC region.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Solvent Based Adhesives Market

COVID-19 has posed many challenges for the automotive sector. The US, Germany, the UK, Italy, South Korea, Spain, and Japan are among the adversely affected major industrialized economies. According to a study by Boston Consulting Group, despite encouraging reports on progress toward a vaccine, numerous risks remain. It is projected that the sales in Europe and the US will not rebound to pre-COVID levels until 2023 at the earliest.

COVID-19 has posed many challenges in the construction sector. Major economies across the world, such as the US, Germany, the UK, Italy, South Korea, Spain, and Japan, are among the severely affected countries by the pandemic. Social distancing measures, supply chain disruptions, and workforce dislocation have led to the suspension of construction activities in most countries due to the disruptions in supply chains and shortage of raw materials and labor. Construction companies with high debts and lower cash reserves faced a liquidity crisis. However, the construction of temporary hospitals and quarantine centers increased with this outbreak of coronavirus.

Solvent Based Adhesives Market Dynamics

Driver: Increasing demand for medical devices

The recent outbreak of the COVID-19 pandemic has driven the healthcare and medical devices sectors globally. Medical devices such as ventilators, pulse oximeters, oxygen concentrators/generators, syringe pumps, are being used in large numbers. This has increased the use of solvent based adhesives in the medical industry.

The aging population driven by increasing life expectancy fuels the demand for medical devices. Emerging economies are increasingly accounting for the consumption of healthcare products and services, including medical devices and related procedures, owing to rising economic prosperity, growing medical awareness, and increasing aging populations. The continuous increase in expenditure on healthcare globally has enhanced the sales of medical devices, thereby driving the growth of medical device companies that are mostly based in the US. According to the World Bank, all regions (except Sub-Saharan Africa and South Asia) have seen an increase in healthcare spending over the last two decades. Thus, the growth of the medical industry is expected to drive the market for solvent based adhesives.

Restraint: Volatility in raw material prices leading to fluctuation in demand

The price and availability of raw materials are the key factors that need to be considered by solvent based adhesive manufacturers to decide the cost structure of their products. PP, paper, PVC, adhesives, and release liners are the raw materials used in the manufacturing of solvent based adhesives. Most of these raw materials are petroleum-based derivatives that are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile in the past due to the increasing global demand and unrest in the Middle East region. The uncertainty and fluctuations in the cost and the availability of feedstock are negatively affecting the market.

The adhesives industry is affected by higher manufacturing costs resulting from increased energy costs. The consistently increasing global demand for chemicals and the capacity constraints in the supply of these primary chemicals and resin feedstock have fueled the increase in raw material prices. The supply shortages of monomers, such as Piperylene and C9 monomers, used to make the raw materials of adhesives have increased the cost of the raw materials.

Opportunity: Growth in the packaging industry in emerging economies

The demand for food and healthcare products is expected to increase in tandem with the rise in population. Food packaging is a mature sector in Europe and North America because of high market penetration and steady economic growth. As a result, emerging regions such as APAC and South America offer huge growth potential for the packaging industry. The increasing industrial and bulk packaging solutions are boosting the solvent based adhesive demand in the packaging industry in these regions.

The demand for packaged food products has increased over the past few years with changing lifestyle, particularly in the urban cities of developing countries such as China, India, and Malaysia. The changes in consumer demographics, especially in aging, infant, and female population, have increased the demand for nonwoven textile products such as baby diapers, sanitary pads, and adult diapers. Emerging economies, such as China, India, and Brazil, are projected to register a high CAGR during the forecast period for the solvent based adhesives market. Global players in this market are focusing on expansion and investment strategies to expand their presence in these countries.

Challenge: Increasing demand for non-hazardous, green, and sustainable adhesives

Stringent regulations by the USEPA (the United States Environmental Protection Association), Europe’s Registration, Evaluation, Authorisation and Restrictions of Chemicals (REACH), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities have compelled adhesive manufacturers to make eco-friendly products with no- or low-VOC levels. The shift toward more sustainable products has provided manufacturers with significant growth opportunities. Some products, such as H4500, H4710, H4720, and H3151, offered by the leading solvent based adhesives company, Henkel, are solvent-free and comply with environmental regulators.

There is a growing demand for environment-friendly or green buildings, which gives an opportunity for the development of green and sustainable adhesive solutions. Green adhesive solutions are made from renewable, recycled, remanufactured, or biodegradable materials.

Solvent Based Adhesives Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Paper & packaging segment accounted for the largest share of the solvent based adhesives market in 2020.

The global packaging industry in expanding and changing continuously. The developing countries are the fastest-growing markets due to the shift toward urban lifestyle and the growth of the e-commerce industry. The packaging methods are growing more and more eco-friendly. Economic growth and demographic change are the major factors driving the packaging industry. Incomes are expected to rise, which will lead to an increase in consumer spending on packaged goods. Another driving factor for the packaging industry is the increase in the demand for pharmaceutical products due to rising life expectancy, especially in developed markets such as Japan. The demand for pharmaceutical products has increased due the COVID-19 global pandemic. The pandemic also increased online shopping. It also had a negative effect as developed countries started putting their wastepaper in landfills or burning them to avoid coronavirus spread, which led to a shortage of raw materials for the developing countries such as India. It is estimated that the demand for packaging would increase due to the outbreak and the packaging industry is supposed to be the backbone of consumer market during the outbreak.

Polyurethane is projected to witness the fastest growth of the solvent based adhesives market during the forecast period.

Polyurethane provide better tint-ability, adhesion, and abrasion resistance. In the automotive industry, polyurethane adhesives are used in the manufacturing of vehicles, in the repair of auto glass, sealing of metal structures such as containers and trucks, in the manufacturing and installation of air conditioning in HVAC systems, to reduce vibration and provide sealing in metal sheet joints. In APAC, polyurethane adhesives are mainly used in automotive & transportation applications, as the region leads in vehicle production globally. More than 90% of automobiles are produced with bonded windshields and rear windows using polyurethane globally. Therefore, the increasing demand from automotive and other applications in APAC is expected to drive the polyurethane segment.

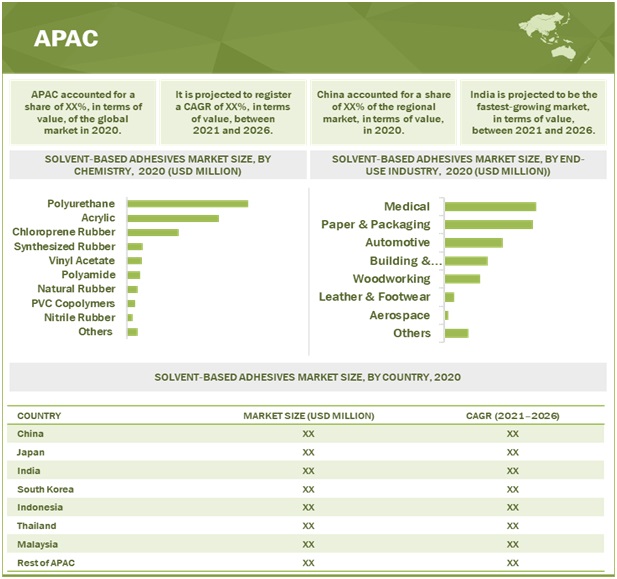

APAC is the largest solvent based adhesives market in the forecast period

APAC has emerged as one of the leading producers as well as consumers of solvent-based adhesives due to the increasing domestic demand, rising income levels, and easy access to resources. The automotive industry is one of the major consumers of solvent-based adhesives in this region. The economic growth in the APAC region, particularly in the emerging markets such as India, Taiwan, Indonesia, Malaysia, Thailand, and Vietnam, is contributing to the increase in the number of infrastructure projects, which is expected to drive the demand for solvent-based adhesives in the building & construction industry.

The spread of the coronavirus started in China in early January 2020. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand resulted in the pandemic situation, with numerous positive cases and deaths. This situation led national governments across APAC to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a global manufacturing hub, the impact of COVID-19 is anticipated to be much higher in the country. Considering the above factors, the solvent-based adhesives market is expected to decline in APAC in 2020.

Solvent Based Adhesives Market Players

The key players in the solvent-based adhesives market include Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (France), 3M Company (US), Huntsman Corporation (US), and Illinois Tool Works Inc. (US).

Solvent Based Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Chemistry |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (France), 3M Company (US), Huntsman Corporation (US), and Illinois Tool Works Inc. (US) |

This research report categorizes the solvent based adhesives market based on chemistry, end-use industry, and region.

Solvent Based Adhesives, By Chemistry:

- Polyurethane

- Acrylic

- Polyamide

- Vinyl Acetate

- Chloroprene Rubber

- PVC Copolymers

- Natural Rubber

- Synthesized Rubber

- Nitrile Rubber

- Others

Solvent Based Adhesives, By End-Use Industry:

- Paper & Packaging

- Building & Construction

- Woodworking

- Automotive

- Aerospace

- Medical

- Leather & Footwear

- Others

Solvent Based Adhesives, By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In May 2021, Henkel invested in an innovation center in Shanghai, China. The expansion aims at strengthening the position in APAC market.

- In December 2020, Avery Dennison acquired an Ohio-based manufacturer of self-wound (liner less) pressure-sensitive over laminate products, APCO Ltd. to expand its portfolio in North America.

Frequently Asked Questions (FAQ):

What is the current size of the global solvent-based adhesives market?

The global solvent based adhesives market is estimated to be USD 7.6 billion in 2020 and projected to reach USD 8.5 billion by 2026, at a CAGR of 2.3%.

Who are the major players of the solvent-based adhesives market?

Companies such as Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (France), 3M Company (US), Huntsman Corporation (US), and Illinois Tool Works Inc. (US) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, partnership & agreement, investments & expansions, and joint ventures are expected to help the market grow. Several mergers & acquisitions and investments are made on increasing the production capacity of solvent-based adhesives manufacturers for different industries.

Which segment has the potential to register the highest market share for solvent-based adhesives?

Paper & packaging was the largest industry of solvent based adhesives, in terms of both volume and value, in 2020. This is because of the increased use of adhesives in a wide variety of paper bonding applications ranging from corrugated box construction and the lamination of printed sheets to packaging material used for all types of consumer products and the production of large industrial tubes and cores used by manufacturers of roll goods and other materials.

Which is the fastest-growing region in the market?

APAC is expected to be the largest and fastest-growing market for solvent-based adhesives. APAC is an emerging market in terms of demand for solvent-based adhesives. China and India have been the driving forces behind the rapid development of the market in APAC, as well as globally. The growth in these countries is attributed to high economic growth and heavy investments in the packaging and automotive sectors. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 SOLVENT-BASED ADHESIVES MARKET SEGMENTATION

FIGURE 2 REGIONS COVERED

1.5 YEAR CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 SOLVENT-BASED ADHESIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION, BY VOLUME

FIGURE 6 SOLVENT-BASED ADHESIVES MARKET, BY REGION

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY REGION

FIGURE 8 SOLVENT-BASED ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 9 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH, BY CHEMISTRY

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST PROJECTION

2.3.2 DEMAND-SIDE FORECAST PROJECTION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 SOLVENT-BASED ADHESIVES MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS ASSESSMENT

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 1 SOLVENT BASED ADHESIVES MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 11 POLYURETHANE SEGMENT TO REGISTER THE HIGHEST CAGR IN THE SOLVENT BASED ADHESIVES MARKET

FIGURE 12 MEDICAL END-USE INDUSTRY TO REGISTER THE HIGHEST GROWTH IN THE SOLVENT BASED ADHESIVES MARKET

FIGURE 13 APAC TO BE THE FASTEST-GROWING SOLVENT BASED ADHESIVES MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SOLVENT-BASED ADHESIVES MARKET

FIGURE 14 SOLVENT BASED ADHESIVES MARKET TO REGISTER MODERATE GROWTH

4.2 SOLVENT BASED ADHESIVES MARKET, BY CHEMISTRY

FIGURE 15 POLYURETHANE SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE SOLVENT BASED ADHESIVES MARKET

4.3 SOLVENT BASED ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 16 PAPER & PACKAGING TO BE THE LARGEST END-USE INDUSTRY OF SOLVENT BASED ADHESIVES

4.4 APAC: SOLVENT BASED ADHESIVES MARKET, BY CHEMISTRY AND END-USE INDUSTRY, 2020

FIGURE 17 ACRYLIC AND PAPER & PACKAGING SEGMENTS ACCOUNTED FOR THE LARGEST SHARES

4.5 SOLVENT BASED ADHESIVES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 18 DEVELOPING COUNTRIES TO GROW FASTER THAN THE DEVELOPED COUNTRIES

4.6 SOLVENT BASED ADHESIVES MARKET: GROWING DEMAND FROM APAC

FIGURE 19 India to register the highest cagr in the apac market

4.7 SOLVENT BASED ADHESIVES MARKET: MAJOR COUNTRIES

FIGURE 20 INDIA TO EMERGE AS A LUCRATIVE MARKET

5 MARKET OVERVIEW (Page No. - 50)

5.1 VALUE CHAIN OVERVIEW

5.1.1 VALUE CHAIN ANALYSIS

FIGURE 21 SOLVENT BASED ADHESIVES MARKET: VALUE CHAIN ANALYSIS

TABLE 2 SOLVENT BASED ADHESIVES MARKET: SUPPLY CHAIN ECOSYSTEM

5.1.2 COVID-19 IMPACT ON VALUE CHAIN

5.1.2.1 Action plan against current vulnerability

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE SOLVENT BASED ADHESIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Growth of the medical industry

5.2.1.2 Increasing demand for medical devices

5.2.1.3 High demand in the construction industry

5.2.1.4 Increasing pace of change in the appliances industry

5.2.1.5 Growing trend of lightweight and low carbon-emitting vehicles

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices leading to fluctuation in demand

5.2.2.2 Strict environmental regulations in North America and Europe

5.2.2.3 Availability of substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in the packaging industry in emerging economies

5.2.3.2 Industrial globalization emerging as a factor for market growth

5.2.3.3 Expected recovery of demand for adhesives in APAC

5.2.3.4 Growth of non-oil sector in the Middle East holding growth potential for the market

5.2.4 CHALLENGES

5.2.4.1 Increasing demand for non-hazardous, green, and sustainable adhesives

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 SOLVENT BASED ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 SOLVENT BASED ADHESIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 4 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

5.5 KEY INDUSTRY TRENDS

FIGURE 24 ESTIMATED GROWTH RATES FOR THE GLOBAL ELECTRONICS INDUSTRY FROM 2019 TO 2020, BY REGION

5.5.2 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 5 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

5.5.2.1 ELECTRIC VEHICLE MODELS, 2019–2028

TABLE 6 ELECTRIC VEHICLE MODELS, 2019–2028

5.5.3 TRENDS AND FORECASTS IN THE BUILDING & CONSTRUCTION INDUSTRY

FIGURE 25 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

5.5.4 TRENDS IN THE FOOTWEAR INDUSTRY

FIGURE 26 DISTRIBUTION OF FOOTWEAR PRODUCTION, BY CONTINENT (QUANTITY) 2019

TABLE 7 TOP 10 FOOTWEAR CONSUMERS (QUANTITY), 2019

5.5.5 GROWTH TRENDS IN AEROSPACE INDUSTRY

5.5.5.1 Growth indicators of aerospace industry, 2015–2033

TABLE 8 GROWTH INDICATORS OF AEROSPACE INDUSTRY, 2015–2033

5.5.5.2 Growth indicators of aerospace industry, by region, 2015–2033

TABLE 9 GROWTH INDICATORS OF AEROSPACE INDUSTRY, BY REGION, 2015–2033

FIGURE 27 PERCENTAGE SHARE OF JETS, BY MANUFACTURER, 2018

FIGURE 28 WORLD FLEET PRODUCTION FORECAST, 2018–2037

FIGURE 29 WORLD FLEET STATS, 2018—2037

TABLE 10 NUMBER OF REQUIRED AIRCRAFT, BY REGION

TABLE 11 NUMBER OF REQUIRED FREIGHTERS

TABLE 12 GROWTH INDICATORS OF AEROSPACE INDUSTRY

5.6 COVID-19 IMPACT ANALYSIS

5.6.1 COVID-19 ECONOMIC ASSESSMENT

FIGURE 30 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.6.2 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

FIGURE 31 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.6.3 IMPACT ON CONSTRUCTION INDUSTRY

5.6.4 IMPACT ON AUTOMOTIVE INDUSTRY

5.7 PRICING ANALYSIS

FIGURE 32 AVERAGE PRICE COMPETITIVENESS IN SOLVENT BASED ADHESIVES MARKET, BY REGION

FIGURE 33 AVERAGE PRICE COMPETITIVENESS IN SOLVENT-BASED ADHESIVES MARKET, BY END-USE INDUSTRY

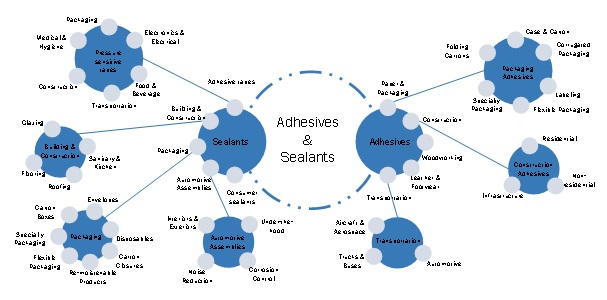

5.8 ADHESIVES ECOSYSTEM

FIGURE 34 ADHESIVES ECOSYSTEM

5.9 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF SOLVENT BASED ADHESIVES: YC AND YCC SHIFT

FIGURE 35 SOLVENT-BASED ADHESIVES INDUSTRY: YC AND YCC SHIFT

5.9.1 AUTOMOTIVE & TRANSPORTATION

5.9.1.1 Electric vehicles

5.9.1.2 Shared mobility

5.9.1.3 Types of batteries for electric power vehicles

5.9.2 AEROSPACE

5.9.2.1 Ultralight and light aircraft

5.9.2.2 Unmanned Aircraft Systems (UAS) or Drones

5.9.3 HEALTHCARE

5.9.3.1 Wearable medical devices

5.9.3.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.9.4 ELECTRONICS

5.9.4.1 Digitalization

5.9.4.2 Artificial intelligence

5.9.4.3 Augmented reality

5.10 EXPORT-IMPORT TRADE STATISTICS

5.10.1 TRADE SCENARIO 2017-2019

TABLE 13 COUNTRY-WISE EXPORT DATA, 2017–2019

TABLE 14 COUNTRY-WISE IMPORT DATA, 2017–2019

5.11 REGULATIONS

5.11.1 LEED STANDARDS

TABLE 15 BY ARCHITECTURAL APPLICATIONS

TABLE 16 BY SPECIALTY APPLICATIONS

TABLE 17 BY SUBSTRATE-SPECIFIC APPLICATIONS

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 PUBLICATION TRENDS

FIGURE 36 NUMBER OF PATENTS PUBLISHED, 2016-2021

5.12.3 TOP APPLICANTS

FIGURE 37 PATENTS PUBLISHED BY MAJOR PLAYERS, 2015-2020

5.12.4 TOP JURISDICTION

FIGURE 38 PATENTS PUBLISHED BY JURISDICTION, 2015-2020

5.13 CASE STUDY

5.14 TECHNOLOGY ANALYSIS

6 SOLVENT-BASED ADHESIVES MARKET, BY CHEMISTRY (Page No. - 91)

6.1 INTRODUCTION

FIGURE 39 POLYURETHANE SEGMENT TO LEAD THE SOLVENT-BASED ADHESIVES MARKET

TABLE 18 SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 19 SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

6.1.1 POLYURETHANE ADHESIVES

6.1.1.1 Polyurethane solvent-based adhesives account for the largest share of the overall market

TABLE 20 POLYURETHANE: APPLICATIONS

TABLE 21 POLYURETHANE: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 22 POLYURETHANE: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.2 ACRYLIC ADHESIVES

6.1.2.1 Acrylics provide superior gap filling, good environmental resistance, and clear bond lines

TABLE 23 ACRYLIC: APPLICATIONS

TABLE 24 ACRYLIC: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 25 ACRYLIC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.3 POLYAMIDE ADHESIVES

6.1.3.1 Strong and versatile protective adhesives are produced by mixing solutions of polyamides with epoxy resins

TABLE 26 POLYAMIDE: APPLICATIONS

TABLE 27 POLYAMIDE: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 28 POLYAMIDE: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.4 VINYL ACETATE ADHESIVES

6.1.4.1 Vinyl acetate adhesives have a low resistance to weather and moisture

TABLE 29 VINYL ACETATE: APPLICATIONS

TABLE 30 VINYL ACETATE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 31 VINYL ACETATE: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.5 CHLOROPRENE RUBBER (CR) ADHESIVES

6.1.5.1 Adhesives based on CR offer higher performance than other adhesives in a wide variety of applications

TABLE 32 CHLOROPRENE RUBBER: APPLICATIONS

TABLE 33 CHLOROPRENE RUBBER: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 34 CHLOROPRENE RUBBER: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.6 PVC COPOLYMERS

6.1.6.1 PVC copolymers are preferred materials for applications wherelow flammability at a low cost is required

TABLE 35 PVC COPOLYMERS: APPLICATIONS

TABLE 36 PVC COPOLYMERS: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 37 PVC COPOLYMERS: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.7 NATURAL RUBBER

6.1.7.1 Natural rubber adhesives provide a lower price, outstanding flexibility, high initial tack, and good tack retention

TABLE 38 NATURAL RUBBER: APPLICATIONS

TABLE 39 NATURAL RUBBER: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 40 NATURAL RUBBER: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.8 SYNTHETIC RUBBER ADHESIVES

6.1.8.1 The key features of synthetic rubber adhesives make them suitable as multipurpose adhesives

TABLE 41 SYNTHETIC RUBBER: APPLICATIONS

TABLE 42 SYNTHETIC RUBBER: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 43 SYNTHETIC RUBBER: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.9 NITRILE RUBBER

6.1.9.1 Nitrile rubber adhesives offer good heat resistance for various bonding applications

TABLE 44 NITRILE RUBBER: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 45 NITRILE RUBBER: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

6.1.10 OTHERS

TABLE 46 OTHERS: APPLICATIONS

TABLE 47 OTHERS: SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (USD MILLION)

TABLE 48 OTHERS: SOLVENT BASED ADHESIVES MARKET SIZE, BY REGION, 2019-2026 (KILOTON)

7 SOLVENT-BASED ADHESIVES MARKET, BY END-USE INDUSTRY (Page No. - 104)

7.1 INTRODUCTION

FIGURE 40 MEDICAL SEGMENT TO LEAD THE SOLVENT-BASED ADHESIVES MARKET

TABLE 49 SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 50 SOLVENT BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

7.1.1 PAPER & PACKAGING

7.1.1.1 The growth of e-commerce due to the pandemic is leading to the sustainable growth of the market

TABLE 51 ADHESIVES USED FOR APPLICATIONS IN THE PACKAGING INDUSTRY

TABLE 52 SOLVENT-BASED ADHESIVES MARKET SIZE IN PAPER & PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 53 SOLVENT BASED ADHESIVES MARKET SIZE IN PAPER & PACKAGING, BY REGION, 2019–2026 (KILOTON)

7.1.2 BUILDING & CONSTRUCTION

7.1.2.1 The recovery of the construction industry to be beneficial for the market

TABLE 54 ADHESIVES USED IN APPLICATIONS IN THE BUILDING & CONSTRUCTION INDUSTRY

TABLE 55 SOLVENT-BASED ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 SOLVENT BASED ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (KILOTON)

7.1.3 WOODWORKING

7.1.3.1 The furniture industry will increase the demand for woodworking adhesives

TABLE 57 ADHESIVES USED IN APPLICATIONS IN THE WOODWORKING INDUSTRY

TABLE 58 SOLVENT-BASED ADHESIVES MARKET SIZE IN WOODWORKING, BY REGION, 2019–2026 (USD MILLION)

TABLE 59 SOLVENT BASED ADHESIVES MARKET SIZE IN WOODWORKING, BY REGION, 2019–2026 (KILOTON)

7.1.4 AUTOMOTIVE

7.1.4.1 The demand for solvent-based adhesives is driven by the growth of electric vehicles

TABLE 60 ADHESIVES USED IN APPLICATIONS IN THE AUTOMOTIVE INDUSTRY

TABLE 61 SOLVENT-BASED ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 SOLVENT BASED ADHESIVES MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (KILOTON)

7.1.5 AEROSPACE

7.1.5.1 Advancement in the drone industry is increasing the demand for solvent-based adhesives

TABLE 63 SOLVENT-BASED ADHESIVES MARKET SIZE IN AEROSPACE, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 SOLVENT BASED ADHESIVES MARKET SIZE IN AEROSPACE, BY REGION, 2019–2026 (KILOTON)

7.1.6 MEDICAL

7.1.6.1 Demand for medical facilities due to the pandemic leading to the growth of the adhesive industry

TABLE 65 SOLVENT-BASED ADHESIVES MARKET SIZE IN MEDICAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 SOLVENT-BASED ADHESIVES MARKET SIZE IN MEDICAL, BY REGION, 2019–2026 (KILOTON)

7.1.7 LEATHER & FOOTWEAR

7.1.7.1 High production of footwear in APAC to boost the demand for adhesives

TABLE 67 SOLVENT-BASED ADHESIVES MARKET SIZE IN LEATHER & FOOTWEAR, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 SOLVENT BASED ADHESIVES MARKET SIZE IN LEATHER & FOOTWEAR, BY REGION, 2019–2026 (KILOTON)

7.1.8 OTHERS

TABLE 69 SOLVENT-BASED ADHESIVES MARKET SIZE IN OTHERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 70 SOLVENT BASED ADHESIVES MARKET SIZE IN OTHERS, BY REGION, 2019–2026 (KILOTON)

8 SOLVENT-BASED ADHESIVES MARKET, BY REGION (Page No. - 119)

8.1 INTRODUCTION

FIGURE 41 MIDDLE EAST & AFRICA TO REGISTER THE HIGHEST CAGR BETWEEN 2021 AND 2026

TABLE 71 SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 72 SOLVENT-BASED ADHESIVES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.2 APAC

8.2.1 IMPACT OF COVID-19 ON APAC

FIGURE 42 APAC: SOLVENT-BASED ADHESIVES MARKET SNAPSHOT

TABLE 73 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 74 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

TABLE 75 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 77 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 APAC: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.2.2 CHINA

8.2.2.1 Largest solvent-based adhesives market in APAC

8.2.3 JAPAN

8.2.3.1 Infrastructural redevelopment to boost the demand

8.2.4 INDIA

8.2.4.1 Government’s initiative to boost the country’s economy contributing to the market growth

8.2.5 SOUTH KOREA

8.2.5.1 Growth in the automotive industry to fuel the demand for solvent-based adhesives

8.2.6 THAILAND

8.2.6.1 Government’s spending on infrastructure projects drives the demand for solvent-based adhesives in the country

8.2.7 INDONESIA

8.2.7.1 Country’s health ministry encouraging synergy between medical industry and research institutions

8.2.8 MALAYSIA

8.2.8.1 Automobile industry to impact the solvent-based adhesives market

8.2.9 REST OF APAC

8.3 EUROPE

FIGURE 43 EUROPE: SOLVENT-BASED ADHESIVES MARKET SNAPSHOT

8.3.1 COVID-19 IMPACT ON EUROPE

TABLE 79 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

TABLE 81 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 82 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 83 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.3.2 GERMANY

8.3.2.1 Various trends in food packaging industry to spur market growth

8.3.3 UK

8.3.3.1 Innovative and energy-efficient technology in household appliances to speed up market growth

8.3.4 FRANCE

8.3.4.1 Construction and automotive industries to drive the market

8.3.5 RUSSIA

8.3.5.1 Demand from domestic and regional airline services to impact the growth of the market

8.3.6 ITALY

8.3.6.1 Numerous motor manufacturing companies shifting their production facilities to the country creating market growth opportunities

8.3.7 TURKEY

8.3.7.1 Investment in various industries to boost the demand

8.3.8 REST OF EUROPE

8.4 NORTH AMERICA

8.4.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 44 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

TABLE 87 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 89 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019-2026 (KILOTON)

8.4.2 US

8.4.2.1 Growth in major end-use industries to boost the market

8.4.3 CANADA

8.4.3.1 Automotive sector to play the major role in the demand for solvent-based adhesives

8.4.4 MEXICO

8.4.4.1 Growth in the automotive industry is increasing the use of solvent-based adhesives

8.5 MIDDLE EAST & AFRICA

FIGURE 45 UAE IS THE KEY SOLVENT-BASED ADHESIVES MARKET IN THE REGION

8.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

TABLE 91 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

TABLE 93 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 95 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.5.2 SAUDI ARABIA

8.5.2.1 Increased local car sales to support market growth

8.5.3 UAE

8.5.3.1 Growing building & construction, woodworking, and paper & packaging industries will impact the growth of the market

8.5.4 SOUTH AFRICA

8.5.4.1 Paper & packaging is the largest consumer of solvent-based adhesives

8.5.5 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

FIGURE 46 BRAZIL IS THE KEY SOLVENT-BASED ADHESIVES MARKET IN THE REGION

8.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 97 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (USD MILLION)

TABLE 98 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY CHEMISTRY, 2019–2026 (KILOTON)

TABLE 99 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 101 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 SOUTH AMERICA: SOLVENT-BASED ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

8.6.2 BRAZIL

8.6.2.1 One of the fastest-growing manufacturing hubs in the world

8.6.3 ARGENTINA

8.6.3.1 Strategic Industrial Plan 2020 supporting the market for solvent-based adhesives

8.6.4 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 161)

9.1 OVERVIEW

FIGURE 47 LEADING PLAYERS ADOPTED THE INVESTMENT & EXPANSION STRATEGY BETWEEN 2017 AND 2021

9.2 MARKET SHARE ANALYSIS

TABLE 103 SOLVENT-BASED ADHESIVES MARKET: DEGREE OF COMPETITION

FIGURE 48 SOLVENT-BASED ADHESIVES MARKET: MARKET SHARE ANALYSIS, 2020

TABLE 104 RANKING OF SOLVENT-BASED ADHESIVES MARKET PLAYERS

9.2.1 HENKEL AG

9.2.2 H.B. FULLER

9.2.3 SIKA AG

9.2.4 ARKEMA (BOSTIK SA)

9.3 COMPANY REVENUE ANALYSIS

FIGURE 49 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST 5 YEARS

9.4 COMPANY EVALUATION QUADRANT MATRIX, 2020

9.4.1 STAR

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE

9.4.4 PARTICIPANTS

FIGURE 50 SOLVENT-BASED ADHESIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

9.5 STRENGTH OF PRODUCT PORTFOLIO

9.6 BUSINESS STRATEGY EXCELLENCE

9.7 COMPETITIVE SCENARIO

9.7.1 MARKET EVALUATION FRAMEWORK

9.7.2 MARKET EVALUATION MATRIX

TABLE 105 COMPANY PRODUCT FOOTPRINT

TABLE 106 COMPANY REGION FOOTPRINT

TABLE 107 COMPANY INDUSTRY FOOTPRINT

9.8 STRATEGIC DEVELOPMENTS

TABLE 108 NEW PRODUCT LAUNCH/DEVELOPMENT, 2018–2021

TABLE 109 DEALS, 2018–2021

TABLE 110 OTHERS, 2018–2021

10 COMPANY PROFILES (Page No. - 173)

10.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, MnM View, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats)*

10.1.1 HENKEL AG

TABLE 111 HENKEL AG: BUSINESS OVERVIEW

FIGURE 51 HENKEL AG: COMPANY SNAPSHOT

TABLE 112 HENKEL AG: PRODUCTS OFFERED

TABLE 113 HENKEL AG: OTHERS

10.1.2 3M COMPANY

TABLE 114 3M COMPANY: BUSINESS OVERVIEW

FIGURE 52 3M COMPANY: COMPANY SNAPSHOT

TABLE 115 3M COMPANY: PRODUCTS OFFERED

10.1.3 ARKEMA

TABLE 116 ARKEMA: BUSINESS OVERVIEW

FIGURE 53 ARKEMA: COMPANY SNAPSHOT

TABLE 117 ARKEMA: PRODUCT OFFERED

TABLE 118 ARKEMA: DEALS

10.1.4 AVERY DENNISON CORPORATION

TABLE 119 AVERY DENNISON CORPORATION: BUSINESS OVERVIEW

FIGURE 54 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

TABLE 120 AVERY DENNISON CORPORATION: PRODUCT OFFERED

TABLE 121 AVERY DENNISON CORPORATION: DEALS

10.1.5 H.B. FULLER

TABLE 122 H.B. FULLER: BUSINESS OVERVIEW

FIGURE 55 H.B. FULLER: COMPANY SNAPSHOT

TABLE 123 H.B. FULLER: PRODUCTS OFFERED

TABLE 124 H.B. FULLER: OTHERS

10.1.6 HUNTSMAN CORPORATION

TABLE 125 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 56 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 126 HUNTSMAN CORPORATION: PRODUCT OFFERED

TABLE 127 HUNTSMAN CORPORATION.: DEALS

TABLE 128 HUNTSMAN CORPORATION: OTHERS

TABLE 129 HUNTSMAN CORPORATION: PRODUCT LAUNCH

10.1.7 RPM INTERNATIONAL INC.

TABLE 130 RPM INTERNATIONAL INC. : BUSINESS OVERVIEW

FIGURE 57 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 131 RPM INTERNATIONAL INC.: PRODUCT OFFERED

10.1.8 SIKA AG

TABLE 132 SIKA AG: BUSINESS OVERVIEW

FIGURE 58 SIKA AG: COMPANY SNAPSHOT

TABLE 133 SIKA AG: PRODUCT OFFERED

TABLE 134 SIKA AG: DEALS

TABLE 135 SIKA AG: OTHERS

10.1.9 MAPEI CORPORATION

TABLE 136 MAPEI CORPORATION: BUSINESS OVERVIEW

TABLE 137 MAPEI CORPORATION: PRODUCT OFFERED

10.1.10 PARKER LORD

TABLE 138 PARKER LORD: BUSINESS OVERVIEW

TABLE 139 PARKER LORD: PRODUCTS OFFERED

TABLE 140 PARKER LORD: DEALS

TABLE 141 PARKER LORD: PRODUCT LAUNCH

10.2 OTHER PLAYERS

10.2.1 ILLINOIS TOOL WORKS INC

TABLE 142 ILLINOIS TOOL WORKS INC: COMPANY OVERVIEW

10.2.2 DOW

TABLE 143 DOW: COMPANY OVERVIEW

10.2.3 JOWAT SE

TABLE 144 JOWAT SE: COMPANY OVERVIEW

10.2.4 FRANKLIN INTERNATIONAL

TABLE 145 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

10.2.5 ASHLAND INC.

TABLE 146 ASHLAND INC.: COMPANY OVERVIEW

10.2.6 BHATIA COLOR CO.

TABLE 147 BHATIA COLOR CO.: COMPANY OVERVIEW

10.2.7 COIM GROUP

TABLE 148 COIM GROUP: COMPANY OVERVIEW

10.2.8 KCC CORPORATION

TABLE 149 KCC CORPORATION: COMPANY OVERVIEW

10.2.9 PERMABOND

TABLE 150 PERMABOND: COMPANY OVERVIEW

10.2.10 PIDILITE INDUSTRIES

TABLE 151 PIDILITE INDUSTRIES: COMPANY OVERVIEW

10.2.11 SOUDAL GROUP

TABLE 152 SOUDAL GROUP: COMPANY OVERVIEW

10.2.12 ESTER

TABLE 153 ESTER: COMPANY OVERVIEW

10.2.13 KLEBCHEMIE MG BECKER GMBH & CO. KG

TABLE 154 KLEBCHEMIE MG BECKER GMBH & CO. KG: COMPANY OVERVIEW

10.2.14 YOKOHAMA INDUSTRIES AMERICAS INC.

TABLE 155 YOKOHAMA INDUSTRIES AMERICAS INC.: COMPANY OVERVIEW

10.2.15 NANPAO

TABLE 156 NANPAO: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 209)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

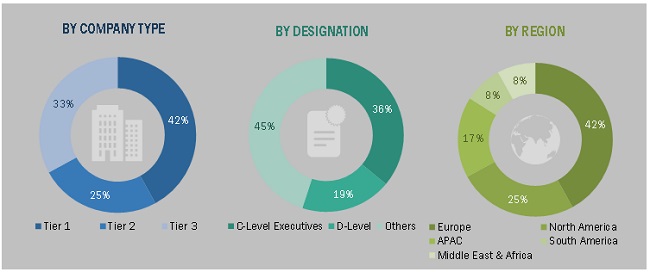

The study involves four major activities in estimating the current market size of solvent-based adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The solvent-based adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as paper & packaging, building & construction, woodworking, automotive, aerospace, medical, leather & footwear, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the solvent-based adhesives market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Solvent-Based Adhesives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the solvent-based adhesives market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size by chemistry and end-use industry

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as investment & expansion and merger & acquisition, new product development, and joint venture & partnership in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: Core competencies1 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the solvent-based adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solvent Based Adhesives Market