Liquid Adhesives Market by Technology (Water-based, Solvent-based, Reactive& Others), End-Use Industry (Paper, Packaging & Related Products, Building & Construction, Medical, Assembly & Others), Region - Global Forecast to 2025

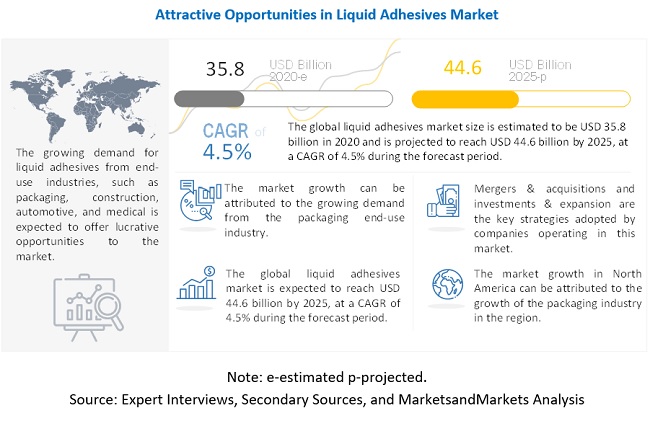

[252 Pages Report] The global liquid adhesives market size is projected to grow from USD 35.8 billion in 2020 to USD 44.6 billion by 2025, at a CAGR of 4.5%.The global liquid adhesives market is growing due to the rise in the demand for high-performance materials. However, the liquid adhesives market is expected to decline in 2020 due to the global COVID-19 pandemic.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Liquid Adhesives Market

The outbreak of COVID-19 has impacted various industries across geographies, and thereby the effect can be felt on the economy as well, with lockdowns and suspension of manufacturing operations. Many companies have devised short-term plans to keep their operations running amidst the COVID-19 pandemic, such as major companies selling their products through online platforms. Companies also have reduced the staff by 50%, allowed work from home, and are sourcing units and distribution centers.

The novel coronavirus pandemic has created ripples across the global aerospace industry, affecting the global supply chains, which move materials and components rapidly across borders and fabrication facilities. This has resulted in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers. These factors have affected the worlds biggest commercial aircraft providers, Boeing and Airbus, and their constellation of suppliers. Boeing did not have any orders in January 2020. Airbus also had zero orders in February 2020. The loss of the aerospace & defense industry has directly affected automotive & transportation segment of the liquid adhesive market.

The pandemic affected the construction companies with a high level of debt as the lockdowns delayed planned construction activities, reduced labor availability, and disrupted supply chain. It will also affect composite panel manufacturers due to the slowdown in the construction work.

The packaging industry has significantly benefitted as compared to automotive, aerospace, and other industries. The pandemic has led to people stocking up on essential supplies, such as sanitizers, disinfectants, masks, and groceries, among various other products. All these products require various types of packaging. Since these products have been in demand over the past few months more than ever, the packaging industry has grown. Both rigid and flexible packaging is being used in high quantities, and this has helped boost the demand for liquid adhesives in packaging applications.

In medical industry, the current outbreak of COVID-19 has increased the demand for respiration support devices, masks, gloves, personal protective equipment applications, and other products. There is considerable growth in the demand for adhesives and techniques, such as adhesive dispensing systems. There also has been a rapid surge in demand for various types of medicines for the treatment of COVID-19 infected patients. Pharmaceutical and medical product supply chains are struggling on a global scale to keep pace with the rapid spread of the virus. In the US, 72% of active pharmaceutical ingredients (APIs) that supply the domestic market are foreign-sourced. Manufacturers, such as 3M and Honeywell, are increasing their capacity to cater to the increased demand.

Market Dynamics

Driver: Increased demand in the healthcare industry

The demand for liquid adhesives has increased in the healthcare industry in the last few years. Recently, with the outbreak of COVID-19, these adhesives have been increasingly used for bonding and sealing of medical supplies and equipment, such as ventilators, masks, and personal protection equipment. Liquid adhesives are also used in respiration support devices for patients infected with COVID-19 and have existing medical conditions such as asthma and diabetics. Thus, the rise in the demand for liquid adhesives in the healthcare industry is expected to drive its market.

Restraint: Environmental regulations in North America and Europe

Europe and North America are strictly regulated by environmental laws regarding the production of chemical and petro-based products. Agencies such as the Epoxy Resin Committee (ERC) and the European Commission (EC) are governing the manufacturing of solvent-based products in these regions. This is affecting the production capacities of manufacturers in the European and North American regions. However, stringent environmental regulations are compelling the manufacturers to focus on producing eco-friendly adhesives such as water-based liquid adhesives.

Opportunity: Increasing opportunities in the Indian market

Amidst impending COVID-19 pandemic, economic slowdown, and the trade war between the US and China, the conditions could prove a boon to India. India's direct exposure to the US and China is modest compared to its regional peers. India could increase its trade, particularly under categories on which the US has imposed tariffs on China. India is keen to increase its market share in both countries and has carried out a detailed analysis where there is potential to increase exports.

Furthermore, the demand for liquid adhesives in the packaging industry is increasing with a higher number of end-use applications. The packaging applications of liquid adhesives are flexible packaging, composite containers, specialty packaging, and food packaging. India is the second-largest producer of food in the world. The country is one of the major consumers of packaged foods and beverages. According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is currently the 5th-largest sector of India's economy and has a growth rate of 22-25% per year. In addition, the per capita packaging consumption of India was significantly low at 8.7 kg, compared to countries, such as Taiwan and Germany, with 19 kg and 42 kg, respectively, in 2018. This provides the paper & packaging industry with a significant opportunity to grow, in turn, boosting the liquid adhesives market.

Challenge: Stringent regulations reshaping the liquid adhesives market

The chemical industry is facing challenges from the regulatory authorities, such as Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and Environmental Protection Agency (EPA), in Europe and North America. The manufacturers of these regions adhere to the regulations regarding the production and usage of liquid adhesive for various applications to reduce the effect of VOC. Various liquid adhesive manufacturers have shifted to water-based adhesives from solvent-based adhesives to reduce VOC emissions. These regulations were the key drivers for the development of water-based liquid adhesives.

Growing concern about the ill effects of formaldehyde and other VOCs on human health has triggered the development of low and no-VOC adhesives. This technological evolution is very significant, given the increasing use of adhesives in day-to-day life. According to a research cited in Eco Building pulse (American Institute of Architects publication), it is estimated that a typical home in the European Union contains 185 gallons (700 liters) of adhesives, either as pure adhesives or as part of other products. The entry of green products based on new formulations in the market has raised speculations about their long-term durability and performance.

Water-based technology is estimated to account for the largest share of the liquid adhesives market during the forecast period

Water-based is the most widely used formulating technology to manufacture adhesives. The water-based segment is driven by the steady increase in demand from paper, packaging & related products, and building & construction industries in North America and new infrastructure projects in India, Taiwan, and other developing countries across the world. Water-based liquid adhesives provide excellent adhesion to different substrates and are used in a wide variety of packaging applications, such as paper bags, cartons, labels, foils, paperboard decals, wood assembly, automobile upholstery, and leather binding.

The medical segment is estimated to be the fastest-growing end-use industry of the liquid adhesives market during the forecast period.

Based on end-use industry, the medical segment is estimated to account for the highest growth rate during the forecast period. The current outbreak of COVID-19 has increased the demand for respiration support devices, masks, gloves, personal protective equipment applications, and other products. There is considerable growth in the demand for adhesives and techniques, such as adhesive dispensing systems.

There also has been a rapid surge in demand for various types of medicines for the treatment of COVID-19 infected patients. Pharmaceutical and medical product supply chains are struggling on a global scale to keep pace with the rapid spread of the virus. In the US, 72% of active pharmaceutical ingredients (APIs) that supply the domestic market are foreign-sourced. Manufacturers, such as 3M and Honeywell, are increasing their capacity to cater to the increased demand.

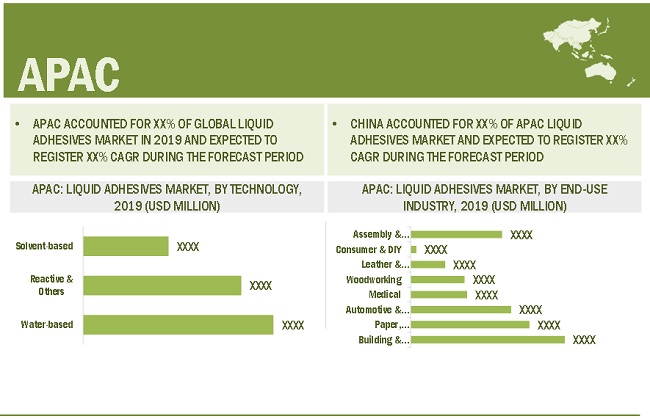

APAC to account for the largest share of the global liquid adhesives market during the forecast period.

The APAC liquid adhesives market is projected to register high growth, and the trend is projected to continue during the forecast period. The growth of the market can be attributed to the growing population and urbanization in the region.

The increasing industrial and infrastructural development in APAC is responsible for its high share. APAC has emerged as the leading consumer as well as producer of liquid adhesives because of the increasing demand from India, South Korea, China, Indonesia, and others. APAC is an emerging and potential market for liquid adhesives, in terms of both value and volume. The increasing demand from end-use industries is contributing to the demand for liquid adhesives in the APAC region. The market is also driven by increased foreign investments due to cheap labour and accessible raw materials. Government proposals to improve the manufacturing and infrastructure, and to increase cash-intensive non-residential construction activities, coupled with the increase in the manufacturing of end-use products, are other factors driving the liquid adhesives market.

To know about the assumptions considered for the study, download the pdf brochure

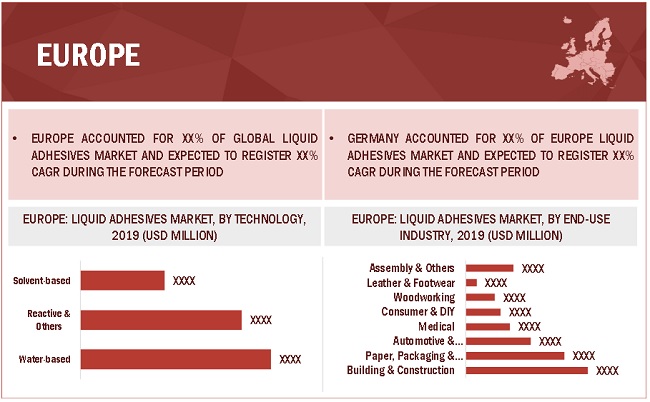

Europe to account for the second largest share of the global liquid adhesives market during the forecast period.

Europe is the second-largest market for liquid adhesives. Automotive, aerospace, and defense are the major industries in this region. Some of the major players operating in the liquid adhesives market are based in this region such as Henkel AG (Germany), Sika AG (Switzerland), and Arkema (France). The growth of liquid adhesives market in this region can be attributed to the increasing importance of packaging in the food & beverage sector.Thus, the growth of end-use industries and the presence of these players are expected to drive the market for liquid adhesives during the forecast period.

Key Market Players

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (France), The 3M Company (US), Jowat SE (Germany), RPM International Inc. (US), Avery Dennison Corporation (US), Dymax Corporation (US) and Permabond LLC (UK) are some of the players operating in the global market.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

20182025 |

|

Base year |

2019 |

|

Forecast period |

20202025 |

|

Units considered |

Value (USD Million) and Volume ( |

|

Segments |

Technology and End-Use Industry |

|

Regions |

APAC, North America, Europe, Rest of the World |

|

Companies |

Henkel AG (Germany), H.B. Fuller (US), Sika AG (Switzerland), Arkema (France), The 3M Company (US), Jowat SE (Germany), RPM International Inc. (US), Avery Dennison Corporation (US), Dymax Corporation (US) and Permabond LLC (UK). |

This research report categorizes the liquid adhesives market based on technology, end-use industry, and region.

Based on technology, the liquid adhesives market has been segmented as follows:

- Water-based

- Solvent-based

- Reactive & Others

Based on end-use industries, the liquid adhesives market has been segmented as follows:

- Paper, packaging & related products

- Building & Construction

- Woodworking

- Automotive & Transportation

- Consumer & DIY

- Leather & Footwear

- Medical

- Assembly & Others

Based on the region, the liquid adhesives market has been segmented as follows:

- North America

- Europe

- APAC

- Rest of the World

Recent Developments

- In February 2020, Henkel Adhesives Technologies opened its new production facility in Kurkumbh, India. The unit aims to serve the growing demand for high-performance adhesives, sealants, and surface treatment products.

- In October 2019, Henkel opened a new production facility in the high-tech industrial cluster in Songdo, South Korea. With an investment of more than 30 million euros, the new plant will become a global production hub for the electronics business of Henkel Adhesive Technologies. The plant is scheduled to commence full production from Q1 of 2022.

- In September 2019, Sika acquired Crevo-Hengxin, a Chinese manufacturer of silicone sealants and adhesives. With this acquisition, Sika expanded its Industry and Sealing & Bonding markets in China and the APAC region and gained additional technology along with a production footprint.

- In April 2019, Henkel opened a new OEM application center in Connecticut to deliver innovative solutions and design customized applications, technologies, and production processes to serve its customers better.

- In March 2019, H.B. Fuller established an engineering adhesives business in Japan. This expansion has strengthened its engineering adhesive (EA) business in Japan.

Frequently Asked Questions (FAQ):

Does this report covers the new applications of liquid adhesives?

Yes the report covers the new applications of liquid adhesives

Does this report cover the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the liquid adhesives market in terms of new applications, production, and sales?

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

FIGURE 1 LIQUID ADHESIVES MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED FOR STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 LIQUID ADHESIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary research

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION APPROACH

2.2.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 4 LIQUID ADHESIVES MARKET, BY REGION

FIGURE 5 GLOBAL LIQUID ADHESIVES MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

FIGURE 6 LIQUID ADHESIVES MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 1 LIQUID ADHESIVES MARKET SNAPSHOT, 2020 & 2025

FIGURE 7 WATER-BASED LIQUID ADHESIVES WAS THE LARGEST TECHNOLOGY SEGMENT IN 2019

FIGURE 8 PAPER, PACKAGING & RELATED PRODUCTS SEGMENT TO LEAD LIQUID ADHESIVES MARKET DURING THE FORECAST PERIOD

FIGURE 9 EUROPE ACCOUNTED FOR THE LARGEST SHARE OF LIQUID ADHESIVES MARKET IN 2019

FIGURE 10 LIQUID ADHESIVES MARKET IN APAC IS PROJECTED TO GROW AT THE HIGHEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN LIQUID ADHESIVES MARKET

FIGURE 11 HIGH DEMAND FROM PACKAGING & AUTOMOTIVE INDUSTRY DRIVE THE MARKET

4.2 LIQUID ADHESIVES MARKET, BY TECHNOLOGY AND REGION

FIGURE 12 WATER-BASED SEGMENT AND APAC ACCOUNTED FOR THE LARGEST SHARE OF LIQUID ADHESIVES MARKET IN 2019

4.3 LIQUID ADHESIVES MARKET, BY TECHNOLOGY

FIGURE 13 WATER-BASED SEGMENT EXPECTED TO LEAD LIQUID ADHESIVES MARKET DURING FORECAST PERIOD

4.4 LIQUID ADHESIVES MARKET, BY END-USE INDUSTRY

FIGURE 14 PACKAGING EXPECTED TO BE THE LARGEST END-USE INDUSTRY FROM 2020 TO 2025

4.5 LIQUID ADHESIVES MARKET, BY KEY COUNTRIES

FIGURE 15 LIQUID ADHESIVES MARKET IN INDIA EXPECTED TO GROW AT THE HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 VALUE CHAIN OVERVIEW

5.1.1 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS

5.1.2 COVID-19 IMPACT ON VALUE CHAIN DUE

5.1.2.1 Action plan against current vulnerability

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LIQUID ADHESIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Increased demand in the healthcare industry

5.2.1.2 Growing demand for packaged products and rising e-commerce sales

5.2.1.3 Increasing demand for adhesives from the building & construction industry

5.2.1.4 Growing trend of lightweight and low carbon-emitting vehicles

5.2.2 RESTRAINTS

5.2.2.1 Environmental regulations in North America and Europe

5.2.2.2 Volatility in raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing opportunities in the Indian market

5.2.3.2 Increasing demand for non-hazardous and sustainable adhesives

5.2.4 CHALLENGES

5.2.4.1 Stringent regulations reshaping the liquid adhesives market

5.2.4.2 Availability of substitutes

5.3 PORTERS FIVE FORCES ANALYSIS

FIGURE 18 LIQUID ADHESIVES MARKET: PORTERS FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 PRICING ANALYSIS

FIGURE 19 AVERAGE PRICE COMPETITIVENESS IN LIQUID ADHESIVES MARKET

5.5 ECOSYSTEM OF ADHESIVES & SEALANTS

FIGURE 20 ADHESIVE & SEALANTS ECOSYSTEM

5.6 IMPACT OF TRENDS AND TECHNOLOGY DISRUPTION ON MANUFACTURERS OF ADHESIVES & SEALANTS

FIGURE 21 ADHESIVES INDUSTRY: YC AND YCC SHIFT

5.6.1 AUTOMOTIVE & TRANSPORTATION

5.6.1.1 Electric vehicles

5.6.1.2 Shared mobility

5.6.1.3 Types of batteries to electric power vehicles

5.6.2 AEROSPACE

5.6.2.1 Ultralight and light aircraft

5.6.2.2 Unmanned aircraft systems (UAS) or drones

5.6.3 HEALTHCARE

5.6.3.1 Wearable medical devices

5.6.3.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.6.4 ELECTRONICS

5.6.4.1 Digitalization

5.6.4.2 Artificial intelligence

5.6.4.3 Augmented reality

5.7 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.7.1 INTRODUCTION

5.7.2 TRENDS AND FORECAST OF GDP

TABLE 2 GDP OF KEY COUNTRIES, 20192024

5.7.3 TRENDS AND FORECAST OF AUTOMOTIVE INDUSTRY

TABLE 3 AUTOMOTIVE PRODUCTION, BY COUNTRY, 2018-2019)

5.7.3.1 Electric vehicle models, 20192028

TABLE 4 ELECTRIC VEHICLE MODELS, 20192028

5.7.4 GROWTH TRENDS IN AEROSPACE INDUSTRY

5.7.4.1 Growth indicators of aerospace industry, 20152033

TABLE 5 GROWTH INDICATORS OF AEROSPACE INDUSTRY, 20152033

5.7.4.2 Growth indicators of aerospace industry, by region, 20152033

TABLE 6 GROWTH INDICATORS OF AEROSPACE INDUSTRY, BY REGION, 20152033

FIGURE 22 PERCENTAGE SHARE OF JETS, BY MANUFACTURERS, 2018

FIGURE 23 WORLD FLEET PRODUCTION FORECAST, 20182037

FIGURE 24 WORLD FLEET STATS, 20182037

TABLE 7 NUMBER OF REQUIRED AIRCRAFT, BY REGION

TABLE 8 NUMBER OF REQUIRED FREIGHTERS

TABLE 9 GROWTH INDICATORS OF AEROSPACE INDUSTRY

5.7.5 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

FIGURE 25 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 20172025

5.7.6 TRENDS AND FORECAST OF FURNITURE INDUSTRY

FIGURE 26 GLOBAL SPENDING ON FURNITURE INDUSTRY

5.7.7 TRENDS IN THE FOOTWEAR INDUSTRY

FIGURE 27 WORLD FOOTWEAR PRODUCTION, BY REGION, 2018

5.8 LIQUID ADHESIVES PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 PUBLICATION TRENDS

FIGURE 28 PUBLICATION TRENDS, 20152020

5.8.3 INSIGHTS

5.8.4 JURISDICTION ANALYSIS

FIGURE 29 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 20152020

5.8.5 TOP APPLICANTS

FIGURE 30 NUMBER OF PATENTS, BY COMPANY, 20152020

6 COVID-19 IMPACT (Page No. - 83)

6.1 OVERVIEW

6.2 COVID-19 ECONOMIC ASSESSMENT

6.2.1 MAJOR ECONOMIC EFFECTS OF COVID-19

6.2.2 EFFECTS ON GDP OF COUNTRIES

FIGURE 31 GDP FORECASTS OF G20 COUNTRIES IN 2020

6.2.3 SCENARIO ASSESSMENT

FIGURE 32 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

6.2.3.1 Scenarios based analysis of impact of COVID-19

FIGURE 33 SCENARIOS: IMPACT OF COVID-19

6.3 COVID-19 IMPACT ON THE INDUSTRY

6.3.1 IMPACT ON CONSTRUCTION INDUSTRY

6.3.2 IMPACT ON AUTO INDUSTRY

6.3.3 IMPACT ON AEROSPACE INDUSTRY

7 LIQUID ADHESIVES MARKET, BY TECHNOLOGY (Page No. - 89)

7.1 INTRODUCTION

FIGURE 34 WATER-BASED TECHNOLOGY EXPECTED TO LEAD LIQUID ADHESIVES MARKET DURING FORECAST PERIOD

TABLE 10 LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 11 LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (KILOTONS)

7.2 WATER-BASED

7.2.1 WATER-BASED ADHESIVES PROVIDE EXCELLENT BONDING STRENGTH TO DIFFERENT TYPES OF SUBSTRATES

TABLE 12 WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 13 WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

TABLE 14 WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 15 WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (KILOTONS)

7.2.2 ACRYLIC POLYMER EMULSION

7.2.2.1 Acrylic polymer emulsion is widely preferred in water-based adhesive formulation

TABLE 16 ACRYLIC POLYMER EMULSION: APPLICATION

TABLE 17 ACRYLIC POLYMER EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 18 ACRYLIC POLYMER EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.2.3 VINYL ACETATE ETHYLENE (VAE) EMULSION

7.2.3.1 VAE emulsion is widely used in the paper & packaging, and woodworking industries

TABLE 19 VAE EMULSION: APPLICATION

TABLE 20 VINYL ACETATE ETHYLENE EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 21 VINYL ACETATE ETHYLENE EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.2.4 POLYVINYL ACETATE EMULSION

7.2.4.1 Growth of polyvinyl acetate emulsion is backed by demand in the paper & packaging applications

TABLE 22 PVA EMULSION: APPLICATION

TABLE 23 POLYVINYL ACETATE EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 24 POLYVINYL ACETATE EMULSION IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.2.5 STYRENE BUTADIENE LATEX

7.2.5.1 Styrene butadiene latex segment is expected to register a moderate growth during the forecast period

TABLE 25 SB LATEX: APPLICATION

TABLE 26 STYRENE BUTADIENE LATEX IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 27 STYRENE BUTADIENE LATEX IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.2.6 POLYURETHANE DISPERSIONS (PUD)

7.2.6.1 PUD is expected to register high growth due to strong demand in profile lamination for interior decoration

TABLE 28 PUD: APPLICATION

TABLE 29 POLYURETHANE DISPERSIONS IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 30 POLYURETHANE DISPERSIONS IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.2.7 OTHERS

TABLE 31 OTHER CHEMISTRIES: APPLICATION

TABLE 32 OTHERS IN WATER-BASED LIQUID ADHESIVE MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 33 OTHERS IN WATER-BASED LIQUID ADHESIVE MARKET, BY REGION, 20182025 (KILOTONS)

7.3 SOLVENT-BASED

7.3.1 STRINGENT REGULATIONS ON VOC EMISSIONS LIMIT USE OF SOLVENT-BASED ADHESIVES

TABLE 34 SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 35 SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

TABLE 36 SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 37 SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (KILOTONS)

7.3.2 SYNTHETIC RUBBER

TABLE 38 SBSR ADHESIVES: APPLICATION

TABLE 39 SYNTHETIC RUBBER IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 40 SYNTHETIC RUBBER IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.3.3 POLYAMIDE

TABLE 41 POLYAMIDE ADHESIVES: APPLICATIONS

TABLE 42 POLYAMIDE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 43 POLYAMIDE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.3.4 OTHERS

TABLE 44 OTHERS IN SOLVENT-BASED LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 45 OTHERS IN SOLVENT-BASED LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4 REACTIVE & OTHERS

TABLE 46 REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 47 REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

TABLE 48 REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 49 REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (KILOTONS)

7.4.1 POLYURETHANE

TABLE 50 POLYURETHANE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 51 POLYURETHANE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.2 EPOXY

TABLE 52 EPOXY IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 53 EPOXY IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.3 CYANOACRYLATE

TABLE 54 APPLICATIONS OF CYANOACRYLATE ADHESIVES

TABLE 55 CYANOACRYLATE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 56 CYANOACRYLATE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.4 METHYL METHACRYLATE (MMA)

TABLE 57 METHYL METHACRYLATE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 58 METHYL METHACRYLATE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.5 ANAEROBIC

TABLE 59 APPLICATIONS OF ANAEROBIC ADHESIVES

TABLE 60 ANAEROBIC IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 61 ANAEROBIC IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.6 SILICONE

TABLE 62 SILICONE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 63 SILICONE IN LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

7.4.7 OTHERS

7.4.7.1 Formaldehyde-based (reactive-based) adhesives

7.4.7.2 Polyester

7.4.7.3 Resorcinol

7.4.7.4 Phenolic

TABLE 64 APPLICATIONS OF PHENOLIC RESINS IN VARIOUS ADHESIVE MIXES

7.4.7.5 Bio-based adhesives

TABLE 65 OTHERS IN REACTIVE & OTHERS LIQUID ADHESIVES MARKET, BY REGION, 20182025 (USD MILLION)

TABLE 66 OTHERS IN REACTIVE & OTHERS LIQUID ADHESIVES MARKET, BY REGION, 20182025 (KILOTONS)

8 LIQUID ADHESIVES MARKET, BY END-USE INDUSTRY (Page No. - 114)

8.1 INTRODUCTION

FIGURE 35 PAPER, PACKAGING & RELATED PRODUCTS SEGMENT TO LEAD LIQUID ADHESIVES MARKET DURING FORECAST PERIOD

TABLE 67 LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 68 LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTONS)

8.1.1 DISRUPTION DUE TO COVID-19

8.2 PAPER, PACKAGING & RELATED PRODUCTS

8.2.1 HIGH DEMAND FOR FLEXIBLE PACKAGING DRIVE THE DEMAND FOR LIQUID ADHESIVES IN THIS INDUSTRY

TABLE 69 LIQUID ADHESIVES MARKET IN PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 70 LIQUID ADHESIVES MARKET IN PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (KILOTONS)

TABLE 71 LIQUID ADHESIVES MARKET IN PAPER, PACKAGING & RELATED PRODUCTS, BY REGION, 20182025 (USD MILLION)

TABLE 72 LIQUID ADHESIVES MARKET IN PAPER, PACKAGING & RELATED PRODUCTS, BY REGION, 20182025 (KILOTONS)

8.2.2 COVID-19 IMPACT ON PACKAGING INDUSTRY

8.2.3 CASE & CARTON

TABLE 73 LIQUID ADHESIVES MARKET IN CASE & CARTON, BY REGION, 20182025 (USD MILLION)

TABLE 74 LIQUID ADHESIVES MARKET IN CASE & CARTON, BY REGION, 20182025 (KILOTONS)

8.2.4 CORRUGATED PACKAGING

TABLE 75 LIQUID ADHESIVES MARKET IN CORRUGATED PACKAGING, BY REGION, 20182025 (USD MILLION)

TABLE 76 LIQUID ADHESIVES MARKET IN CORRUGATED PACKAGING, BY REGION, 20182025 (KILOTONS)

8.2.5 LABELING

TABLE 77 LIQUID ADHESIVES MARKET IN LABELING, BY REGION, 20182025 (USD MILLION)

TABLE 78 LIQUID ADHESIVES MARKET IN LABELING, BY REGION, 20182025 (KILOTONS)

8.2.6 FLEXIBLE PACKAGING

TABLE 79 LIQUID ADHESIVES MARKET IN FLEXIBLE PACKAGING, BY REGION, 20182025 (USD MILLION)

TABLE 80 LIQUID ADHESIVES MARKET IN FLEXIBLE PACKAGING, BY REGION, 20182025 (KILOTONS)

8.2.7 ENVELOPES

TABLE 81 LIQUID ADHESIVES MARKET IN ENVELOPES, BY REGION, 20182025 (USD MILLION)

TABLE 82 LIQUID ADHESIVES MARKET IN ENVELOPES, BY REGION, 20182025 (KILOTONS)

8.2.8 BAGS

TABLE 83 LIQUID ADHESIVES MARKET IN BAGS, BY REGION, 20182025 (USD MILLION)

TABLE 84 LIQUID ADHESIVES MARKET IN BAGS, BY REGION, 20182025 (KILOTONS)

8.2.9 OTHERS

TABLE 85 LIQUID ADHESIVES MARKET IN OTHER PACKAGING APPLICATIONS, BY REGION, 20182025 (USD MILLION)

TABLE 86 LIQUID ADHESIVES MARKET IN OTHER PACKAGING APPLICATIONS, BY REGION, 20182025 (KILOTONS)

8.3 BUILDING & CONSTRUCTION

8.3.1 INCREASING FOCUS OF GOVERNMENTS ON INFRASTRUCTURAL DEVELOPMENTS FUEL THIS SEGMENT

TABLE 87 LIQUID ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 88 LIQUID ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (KILOTONS)

TABLE 89 LIQUID ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 20182025 (USD MILLION)

TABLE 90 LIQUID ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 20182025 (KILOTONS)

8.3.2 COVID-19 IMPACT ON BUILDING & CONSTRUCTION INDUSTRY

8.3.3 RESIDENTIAL

TABLE 91 LIQUID ADHESIVES MARKET IN RESIDENTIAL, BY REGION, 20182025 (USD MILLION)

TABLE 92 LIQUID ADHESIVES MARKET IN RESIDENTIAL, BY REGION, 20182025 (KILOTONS)

8.3.4 COMMERCIAL & INDUSTRIAL

TABLE 93 LIQUID ADHESIVES MARKET IN COMMERCIAL & INDUSTRIAL, BY REGION, 20182025 (USD MILLION)

TABLE 94 LIQUID ADHESIVES MARKET IN COMMERCIAL & INDUSTRIAL, BY REGION, 20182025 (KILOTONS)

8.3.5 INFRASTRUCTURE

TABLE 95 LIQUID ADHESIVES MARKET IN INFRASTRUCTURE, BY REGION, 20182025 (USD MILLION)

TABLE 96 LIQUID ADHESIVES MARKET IN INFRASTRUCTURE, BY REGION, 20182025 (KILOTONS)

8.4 WOODWORKING

8.4.1 LIQUID ADHESIVES HELP RETAIN STRUCTURE OF WOOD PRODUCTS

TABLE 97 LIQUID ADHESIVES MARKET IN WOODWORKING, BY APPLICATION, 20182025 (USD MILLION)

TABLE 98 LIQUID ADHESIVES MARKET IN WOODWORKING, BY APPLICATION, 20182025 (KILOTONS)

TABLE 99 LIQUID ADHESIVES MARKET IN WOODWORKING, BY REGION, 20182025 (USD MILLION)

TABLE 100 LIQUID ADHESIVES MARKET IN WOODWORKING, BY REGION, 20182025 (KILOTONS)

8.4.2 COVID-19 IMPACT ON WOODWORKING INDUSTRY

8.4.3 FLOORING & DECKS

TABLE 101 LIQUID ADHESIVES MARKET IN FLOORING & DECKS, BY REGION, 20182025 (USD MILLION)

TABLE 102 LIQUID ADHESIVES MARKET IN FLOORING & DECKS, BY REGION, 20182025 (KILOTONS)

8.4.4 PLYWOOD

TABLE 103 LIQUID ADHESIVES MARKET IN PLYWOOD, BY REGION, 20182025 (USD MILLION)

TABLE 104 LIQUID ADHESIVES MARKET IN PLYWOOD, BY REGION, 20182025 (KILOTONS)

8.4.5 FURNITURE

TABLE 105 LIQUID ADHESIVES MARKET IN FURNITURE, BY REGION, 20182025 (USD MILLION)

TABLE 106 LIQUID ADHESIVES MARKET IN FURNITURE, BY REGION, 20182025 (KILOTONS)

8.4.6 CABINETS

TABLE 107 LIQUID ADHESIVES MARKET IN CABINETS, BY REGION, 20182025 (USD MILLION)

TABLE 108 LIQUID ADHESIVES MARKET IN CABINETS, BY REGION, 20182025 (KILOTONS)

8.4.7 PARTICLE BOARD

TABLE 109 LIQUID ADHESIVES MARKET IN PARTICLE BOARD, BY REGION, 20182025 (USD MILLION)

TABLE 110 LIQUID ADHESIVES MARKET IN PARTICLE BOARD, BY REGION, 20182025 (KILOTONS)

8.4.8 WINDOWS & DOORS

TABLE 111 LIQUID ADHESIVES MARKET IN WINDOWS & DOORS, BY REGION, 20182025 (USD MILLION)

TABLE 112 LIQUID ADHESIVES MARKET IN WINDOWS & DOORS, BY REGION, 20182025 (KILOTONS)

8.4.9 OTHER WOOD APPLICATIONS

TABLE 113 LIQUID ADHESIVES MARKET IN OTHER WOOD APPLICATIONS, BY REGION, 20182025 (USD MILLION)

TABLE 114 LIQUID ADHESIVES MARKET IN OTHER WOOD APPLICATIONS, BY REGION, 20182025 (KILOTONS)

8.5 AUTOMOTIVE & TRANSPORTATION

8.5.1 PROPERTIES OF LIQUID ADHESIVES INCREASE THEIR USAGE IN THIS INDUSTRY

TABLE 115 LIQUID ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 116 LIQUID ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (KILOTONS)

TABLE 117 LIQUID ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 20182025 (USD MILLION)

TABLE 118 LIQUID ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 20182025 (KILOTONS)

8.5.2 COVID-19 IMPACT ON AUTOMOTIVE & TRANSPORTATION INDUSTRY

8.5.3 AUTOMOTIVE

TABLE 119 LIQUID ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 20182025 (USD MILLION)

TABLE 120 LIQUID ADHESIVES MARKET IN AUTOMOTIVE, BY REGION, 20182025 (KILOTONS)

8.5.4 AEROSPACE

TABLE 121 LIQUID ADHESIVES MARKET IN AEROSPACE, BY REGION, 20182025 (USD MILLION)

TABLE 122 LIQUID ADHESIVES MARKET IN AEROSPACE, BY REGION, 20182025 (KILOTONS)

8.5.5 OTHER APPLICATIONS

TABLE 123 LIQUID ADHESIVES MARKET IN OTHER AUTOMOTIVE & TRANSPORTATION APPLICATIONS, BY REGION, 20182025 (USD MILLION)

TABLE 124 LIQUID ADHESIVES MARKET IN OTHER AUTOMOTIVE & TRANSPORTATION APPLICATIONS, BY REGION, 20182025 (KILOTONS)

8.6 CONSUMER & DIY

8.6.1 GROWING AWARENESS ABOUT ADVANTAGES OF LIQUID ADHESIVES IN CONSUMER & DIY INDUSTRY IS LIKELY TO INCREASE THEIR DEMAND

TABLE 125 LIQUID ADHESIVES MARKET IN CONSUMER & DIY, BY REGION, 20182025 (USD MILLION)

TABLE 126 LIQUID ADHESIVES MARKET IN CONSUMER & DIY, BY REGION, 20182025 (KILOTONS)

8.6.2 COVID-19 IMPACT ON CONSUMER & DIY INDUSTRY

8.7 LEATHER & FOOTWEAR

8.7.1 TENACITY AND BOND STRENGTH, ELASTICITY, FLEXIBILITY & EASE OF APPLICATION OF LIQUID ADHESIVES MAKE THEM PREFERABLE IN THIS INDUSTRY

TABLE 127 LIQUID ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 20182025 (USD MILLION)

TABLE 128 LIQUID ADHESIVES MARKET IN LEATHER & FOOTWEAR, BY REGION, 20182025 (KILOTONS)

8.7.2 COVID-19 IMPACT ON LEATHER & FOOTWEAR INDUSTRY

8.8 MEDICAL

8.8.1 INCREASED USAGE OF ADHESIVES IN MEDICAL DEVICES PROPEL THIS SEGMENT

TABLE 129 LIQUID ADHESIVES MARKET IN MEDICAL, BY REGION, 20182025 (USD MILLION)

TABLE 130 LIQUID ADHESIVES MARKET IN MEDICAL, BY REGION, 20182025 (KILOTONS)

8.8.2 COVID-19 IMPACT ON MEDICAL INDUSTRY

8.9 ASSEMBLY & OTHERS

8.9.1 LIQUID ADHESIVES ARE EXTENSIVELY USED FOR PRODUCT AND INDUSTRIAL ASSEMBLY TO FORM BONDS BETWEEN MATERIALS

TABLE 131 LIQUID ADHESIVES MARKET IN ASSEMBLY & OTHERS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 132 LIQUID ADHESIVES MARKET IN ASSEMBLY & OTHERS, BY APPLICATION, 20182025 (KILOTONS)

TABLE 133 LIQUID ADHESIVES MARKET IN ASSEMBLY & OTHERS, BY REGION, 20182025 (USD MILLION)

TABLE 134 LIQUID ADHESIVES MARKET IN ASSEMBLY & OTHERS, BY REGION, 20182025 (KILOTONS)

8.9.2 ELECTRONICS

TABLE 135 LIQUID ADHESIVES MARKET IN ELECTRONICS, BY REGION, 20182025 (USD MILLION)

TABLE 136 LIQUID ADHESIVES MARKET IN ELECTRONICS, BY REGION, 20182025 (KILOTONS)

8.9.3 OTHER ASSEMBLY APPLICATIONS

TABLE 137 LIQUID ADHESIVES MARKET IN OTHER ASSEMBLY APPLICATIONS, BY REGION, 20182025 (USD MILLION)

TABLE 138 LIQUID ADHESIVES MARKET IN OTHER ASSEMBLY APPLICATIONS, BY REGION, 20182025 (KILOTONS)

9 LIQUID ADHESIVES MARKET, BY REGION (Page No. - 143)

9.1 INTRODUCTION

FIGURE 36 LIQUID ADHESIVES MARKET IN APAC TO REGISTER THE HIGHEST CAGR BETWEEN 2020 AND 2025

TABLE 139 LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 140 LIQUID ADHESIVES MARKET SIZE, BY REGION, 20182025 (KILOTONS)

9.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: LIQUID ADHESIVES MARKET SNAPSHOT

9.2.1 COVID-19 IMPACT ON NORTH AMERICA

9.2.2 BY TECHNOLOGY

TABLE 141 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 142 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (KILOTONS)

9.2.2.1 Water-based liquid adhesives

TABLE 143 NORTH AMERICA: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 144 NORTH AMERICA: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.2.2.2 Solvent-based liquid adhesives

TABLE 145 NORTH AMERICA: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 146 NORTH AMERICA: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.2.2.3 Reactive & other liquid adhesives

TABLE 147 NORTH AMERICA: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 148 NORTH AMERICA: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.2.3 BY END-USE INDUSTRY

TABLE 149 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 150 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTONS)

9.2.3.1 Paper, packaging & related products

TABLE 151 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 152 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (KILOTONS)

9.2.3.2 Building & construction

TABLE 153 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 154 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (KILOTONS)

9.2.3.3 Woodworking

TABLE 155 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY WOODWORKING, 20182025 (USD MILLION)

TABLE 156 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (KILOTONS)

9.2.3.4 Automotive & transportation

TABLE 157 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 158 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (KILOTONS)

9.2.3.5 Assembly & Other Industries

TABLE 159 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (USD MILLION)

TABLE 160 NORTH AMERICA: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (KILOTONS)

9.2.4 BY COUNTRY

TABLE 161 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 162 NORTH AMERICA: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (KILOTONS)

9.2.4.1 US

9.2.4.1.1 Presence of manufacturing facilities of key market players, strong economic sector, and increasing expenditure drive the market

9.2.4.1.2 COVID-19 impact on the US

9.2.4.2 Canada

9.2.4.2.1 Increased production of automobiles propel the demand for liquid adhesives in this country

9.2.4.2.2 COVID-19 impact on Canada

9.2.4.3 Mexico

9.2.4.3.1 Growth of automotive and construction industries is fueling the use of liquid adhesives

9.2.4.3.2 COVID-19 impact on Mexico

9.3 EUROPE

FIGURE 38 EUROPE: LIQUID ADHESIVES MARKET SNAPSHOT

9.3.1 COVID-19 IMPACT ON EUROPE

9.3.2 BY TECHNOLOGY

TABLE 163 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 164 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (KILOTONS)

9.3.2.1 Water-based liquid adhesives

TABLE 165 EUROPE: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 166 EUROPE: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.3.2.2 Solvent-based liquid adhesives

TABLE 167 EUROPE: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 168 EUROPE: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.3.2.3 Reactive & other liquid adhesives

TABLE 169 EUROPE: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 170 EUROPE: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.3.3 BY END-USE INDUSTRY

TABLE 171 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 172 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTONS)

9.3.3.1 Paper, packaging & related products

TABLE 173 EUROPE: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 174 EUROPE: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (KILOTONS)

9.3.3.2 Building & Construction

TABLE 175 EUROPE: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 176 EUROPE: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (KILOTONS)

9.3.3.3 Woodworking

TABLE 177 EUROPE: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (USD MILLION)

TABLE 178 EUROPE: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (KILOTONS)

9.3.3.4 Automotive & Transportation

TABLE 179 EUROPE: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 180 EUROPE: LIQUID ADHESIVES MARKET SIZE FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (KILOTONS)

9.3.3.5 Assembly & Other Industries

TABLE 181 EUROPE: LIQUID ADHESIVES MARKET SIZE FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (USD MILLION)

TABLE 182 EUROPE: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (KILOTONS)

9.3.4 BY COUNTRY

TABLE 183 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 184 EUROPE: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (KILOTONS)

9.3.4.1 Germany

9.3.4.1.1 Increased construction activities drive the demand for liquid adhesives in Germany

9.3.4.1.2 COVID-19 impact on Germany

9.3.4.2 France

9.3.4.2.1 Infrastructural developments are expected to drive the market in France

9.3.4.2.2 COVID-19 impact on France

9.3.4.3 UK

9.3.4.3.1 Growth of construction industry fuel the demand for liquid adhesives in this country

9.3.4.3.2 COVID-19 impact on the UK

9.3.4.4 Italy

9.3.4.4.1 New project finance rules and investment policies help improve and re-establish the construction industry and are expected to drive the market

9.3.4.4.2 COVID-19 impact on Italy

9.3.4.5 Russia

9.3.4.5.1 Multi-trillion-ruble investments by the government to modernize and expand infrastructure to drive the demand for liquid adhesives

9.3.4.5.2 COVID-19 impact on Russia

9.3.4.6 Rest of Europe

9.3.4.6.1 COVID-19 impact on Rest of Europe

9.4 APAC

FIGURE 39 APAC: LIQUID ADHESIVES MARKET SNAPSHOT

9.4.1 COVID-19 IMPACT ON APAC

9.4.2 BY TECHNOLOGY

TABLE 185 APAC: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 186 APAC: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (KILOTONS)

9.4.2.1 Water-based liquid adhesives

TABLE 187 APAC: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 188 APAC: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.4.2.2 Solvent-based liquid adhesives

TABLE 189 APAC: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 190 APAC: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.4.2.3 Reactive & others liquid adhesives

TABLE 191 APAC: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 192 APAC: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.4.3 BY END-USE INDUSTRY

TABLE 193 APAC: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 194 APAC: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTONS)

9.4.3.1 Paper, packaging & related products

TABLE 195 APAC: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 196 APAC: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (KILOTONS)

9.4.3.2 Building & Construction

TABLE 197 APAC: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 198 APAC: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (KILOTONS)

9.4.3.3 Woodworking

TABLE 199 APAC: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (USD MILLION)

TABLE 200 APAC: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (KILOTONS)

9.4.3.4 Automotive & Transportation

TABLE 201 APAC: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 202 APAC: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (KILOTONS)

9.4.3.5 Assembly & others

TABLE 203 APAC: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (USD MILLION)

TABLE 204 APAC: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (KILOTONS)

9.4.4 BY COUNTRY

TABLE 205 APAC: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 206 APAC: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (KILOTONS)

9.4.4.1 China

9.4.4.1.1 Growth of the packaging industry with the increase in e-commerce sales drive the demand for liquid adhesive in this country

9.4.4.1.2 COVID-19 impact on China

9.4.4.2 India

9.4.4.2.1 Increasing urbanization and disposable income fuel the growth of construction industry and thereby, the market for liquid adhesives

9.4.4.2.2 COVID-19 impact on India

9.4.4.3 Japan

9.4.4.3.1 Presence of a well-established industries drive the market for liquid adhesives in this country

9.4.4.3.2 COVID-19 impact on Japan

9.4.4.4 South Korea

9.4.4.4.1 Growth of automotive industry drive demand for liquid adhesives in this country

9.4.4.4.2 COVID-19 impact on South Korea

9.4.4.5 Taiwan

9.4.4.5.1 Large investments by global manufacturers and adoption of disruptive technologies to boost the demand for liquid adhesives

9.4.4.5.2 COVID-19 impact on Taiwan

9.4.4.6 Rest of APAC

9.4.4.6.1 COVID-19 impact on Rest of APAC

9.5 REST OF THE WORLD

FIGURE 40 REST OF THE WORLD: LIQUID ADHESIVES MARKET SNAPSHOT

9.5.1 COVID-19 IMPACT ON REST OF THE WORLD

9.5.2 BY TECHNOLOGY

TABLE 207 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (USD MILLION)

TABLE 208 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY TECHNOLOGY, 20182025 (KILOTONS)

9.5.2.1 Water-based liquid adhesives

TABLE 209 REST OF THE WORLD: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 210 REST OF THE WORLD: WATER-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.5.2.2 Solvent-based liquid adhesives

TABLE 211 REST OF THE WORLD: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 212 REST OF THE WORLD: SOLVENT-BASED LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.5.2.3 Reactive & other

TABLE 213 REST OF THE WORLD: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (USD MILLION)

TABLE 214 REST OF THE WORLD: REACTIVE & OTHER LIQUID ADHESIVES MARKET SIZE, BY CHEMISTRY, 20182025 (KILOTONS)

9.5.3 BY END-USE INDUSTRY

TABLE 215 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (USD MILLION)

TABLE 216 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 20182025 (KILOTONS)

9.5.3.1 Paper, packaging & related products

TABLE 217 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (USD MILLION)

TABLE 218 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR PAPER, PACKAGING & RELATED PRODUCTS, BY APPLICATION, 20182025 (KILOTONS)

9.5.3.2 Building & Construction

TABLE 219 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 220 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR BUILDING & CONSTRUCTION, BY APPLICATION, 20182025 (KILOTONS)

9.5.3.3 Woodworking

TABLE 221 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (USD MILLION)

TABLE 222 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR WOODWORKING, BY APPLICATION, 20182025 (KILOTONS)

9.5.3.4 Automotive & Transportation

TABLE 223 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (USD MILLION)

TABLE 224 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR AUTOMOTIVE & TRANSPORTATION, BY APPLICATION, 20182025 (KILOTONS)

9.5.3.5 Assembly & Other Industries

TABLE 225 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (USD MILLION)

TABLE 226 REST OF THE WORLD: LIQUID ADHESIVES MARKET FOR ASSEMBLY & OTHER INDUSTRIES, BY APPLICATION, 20182025 (KILOTONS)

9.5.4 BY COUNTRY

TABLE 227 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 228 REST OF THE WORLD: LIQUID ADHESIVES MARKET SIZE, BY COUNTRY, 20182025 (KILOTONS)

9.5.4.1 Brazil

9.5.4.1.1 Growth of construction industry is expected to drive the market in Brazil

9.5.4.1.2 COVID-19 impact on Brazil

9.5.4.2 Saudi Arabia

9.5.4.2.1 Continuation of mega housing projects and growing passenger vehicle production to drive the market

9.5.4.2.2 COVID-19 impact on Saudi Arabia

10 COMPETITIVE LANDSCAPE (Page No. - 192)

10.1 OVERVIEW

FIGURE 41 COMPANIES ADOPTED MERGER & ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

FIGURE 42 MARKET EVALUATION FRAMEWORK

10.2 MARKET SHARE ANALYSIS

FIGURE 43 LIQUID ADHESIVES MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS, 2019

10.3 COMPANY EVALUATION QUADRANT, 2019

10.3.1 STAR

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE

10.3.4 EMERGING COMPANIES

FIGURE 44 LIQUID ADHESIVES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

10.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 45 PRODUCT PORTFOLIO ANALYSIS IN LIQUID ADHESIVES MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 46 BUSINESS STRATEGY EXCELLENCE IN LIQUID ADHESIVES MARKET

10.6 COMPETITIVE SCENARIO

10.6.1 NEW PRODUCT DEVELOPMENTS

TABLE 229 NEW PRODUCT DEVELOPMENTS, 20172020*

10.6.2 INVESTMENTS & EXPANSIONS

TABLE 230 INVESTMENTS & EXPANSIONS, 20172020*

10.6.3 MERGERS & ACQUISITIONS

TABLE 231 MERGERS & ACQUISITIONS, 20172020*

11 COMPANY PROFILES (Page No. - 202)

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Right to Win)*

11.1 HENKEL AG

FIGURE 47 HENKEL AG: COMPANY SNAPSHOT

FIGURE 48 HENKEL AG: SWOT ANALYSIS

11.2 H.B. FULLER

FIGURE 49 H.B. FULLER: COMPANY SNAPSHOT

FIGURE 50 H.B. FULLER: SWOT ANALYSIS

11.3 SIKA AG

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

FIGURE 52 SIKA AG: SWOT ANALYSIS

11.4 ARKEMA (BOSTIK SA)

FIGURE 53 ARKEMA (BOSTIK SA): COMPANY SNAPSHOT

FIGURE 54 ARKEMA (BOSTIK SA): SWOT ANALYSIS

11.5 3M COMPANY

FIGURE 55 3M COMPANY: COMPANY SNAPSHOT

FIGURE 56 3M COMPANY: SWOT ANALYSIS

11.6 JOWAT SE

11.7 RPM INTERNATIONAL INC.

11.8 AVERY DENNISON CORPORATION

FIGURE 57 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

FIGURE 58 AVERY DENNISON CORPORATION: SWOT ANALYSIS

11.9 DYMAX CORPORATION

11.10 PERMABOND LLC.

11.11 OTHER COMPANIES

11.11.1 LORD CORPORATION

11.11.2 PIDILITE INDUSTRIES

11.11.3 THREEBOND INTERNATIONAL, INC.

11.11.4 SOUDAL

11.11.5 MASTER BOND INC.

11.11.6 FRANKLIN INTERNATIONAL

11.11.7 PARAMELT B.V.

11.11.8 TAILORED CHEMICAL PRODUCTS, INC.

11.11.9 IFS INDUSTRIES, INC.

11.11.10 LD DAVIS

11.11.11 CAPITAL ADHESIVES

11.11.12 THE REYNOLDS COMPANY

11.11.13 SPECIALTY ADHESIVES AND COATINGS, INC.

11.11.14 EVAN ADHESIVE CORPORATION

11.11.15 SEALOCK ADHESIVES

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Right to Win might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 239)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 ADHESIVE RESINS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 ADHESIVE RESINS MARKET ANALYSIS, BY FORMULATING TECHNOLOGY

TABLE 232 ADHESIVE RESINS MARKET SIZE, BY FORMULATING TECHNOLOGY, 20132020 (USD MILLION)

TABLE 233 ADHESIVE RESINS MARKET SIZE, BY FORMULATING TECHNOLOGY, 20132020 (KILOTONS)

12.3.4 ADHESIVE RESINS MARKET, BY RESIN TYPE

TABLE 234 WATER-BASED ADHESIVES MARKET SIZE, BY RESIN TYPE, 20132020 (USD MILLION)

TABLE 235 WATER-BASED ADHESIVES MARKET SIZE, BY RESIN TYPE, 20132020 (KILOTONS)

TABLE 236 SOLVENT-BASED ADHESIVES MARKET SIZE, BY RESIN TYPE, 20132020 (USD MILLION)

TABLE 237 SOLVENT-BASED ADHESIVES MARKET SIZE, BY RESIN TYPE, 20132020 (KILOTONS)

TABLE 238 HOT-MELT ADHESIVES MARKET SIZE, BY RESIN TYPE, 2013-2020 (USD MILLION)

TABLE 239 HOT-MELT ADHESIVES MARKET SIZE, BY RESIN TYPE, 2013-2020 (KILOTONS)

TABLE 240 REACTIVE & OTHER ADHESIVES MARKET SIZE, BY RESIN TYPE, 2013-2020 (USD MILLION)

TABLE 241 REACTIVE & OTHER ADHESIVES MARKET SIZE, BY RESIN TYPE, 2013-2020 (KILOTONS)

12.3.5 ADHESIVE RESINS MARKET, BY APPLICATION

TABLE 242 ADHESIVE RESINS MARKET SIZE, BY APPLICATION, 20132020 (USD MILLION)

TABLE 243 ADHESIVE RESINS MARKET SIZE, BY APPLICATION, 20132020 (KILOTONS)

12.3.6 ADHESIVE RESINS MARKET, BY REGION

TABLE 244 ADHESIVE RESINS MARKET SIZE, BY REGION, 20132020 (USD MILLION)

TABLE 245 ADHESIVE RESINS MARKET SIZE, BY REGION, 20132020 (KILOTONS)

13 APPENDIX (Page No. - 246)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of liquid adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the liquid adhesives market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The liquid adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the paper & packaging, building & construction, automotive & transportation, woodworking, medical, consumer & Do-It-Yourself (DIY), medical and leather & footwear industries. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

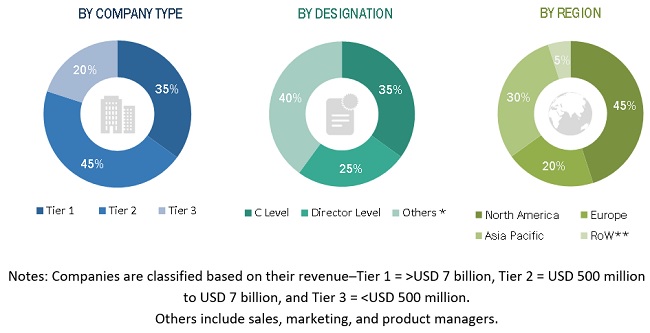

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the liquid adhesives market. These approaches have also been used extensively to estimate the size of various dependent sub-segments of the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research.

- The liquid adhesive industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall size of the liquid adhesives market from the estimation process explained above, the total market has been split into several segments and sub-segments. The data triangulation and market breakdown procedures have been employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Apart from this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the liquid adhesives market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market based on technology and end-use industry

- To analyze and forecast the market based on key regions, such as North America, Europe, Asia Pacific (APAC) and Rest of the World

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as new product launch, acquisition, and expansion

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Liquid Adhesives Market