Timber Laminating Adhesives Market by Resin type (MF, PRF, PU, EPI), Application (Floor Beams, Roof Beams, Window & Door Headers, Trusses & Supporting Columns), End - use (Residential, Nonresidential) and Region - Global Forecast to 2028

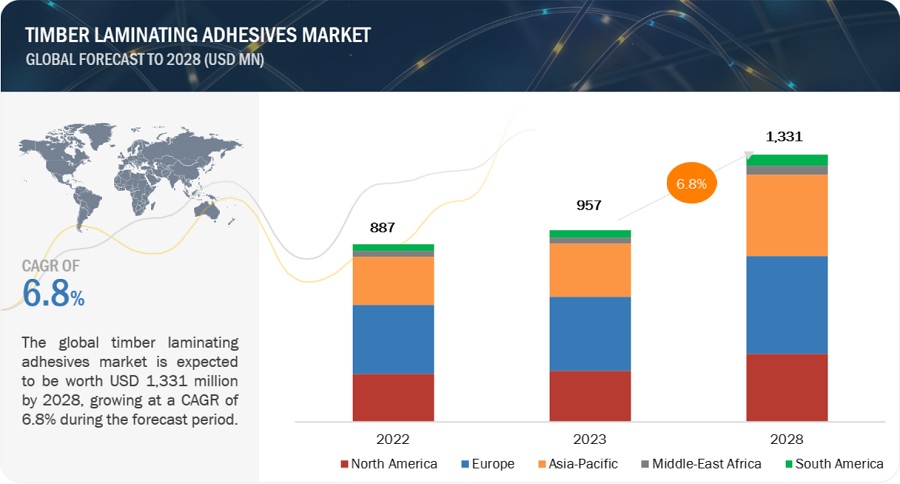

The timber laminating adhesives market is projected to grow from USD 957 million in 2023 to USD 1,331 million by 2028, at a CAGR of 6.8% between 2023 and 2028. The floor beam, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for timber laminating adhesives.

Attractive Opportunities in the Timber Laminating Adhesives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Timber Laminating Adhesives Market Dynamics

Drivers: Increasing Urban Population

Timber laminating adhesives offer a viable solution to the construction challenges posed by this urbanization trend. These adhesives enable the creation of engineered wood products that are not only structurally sound but also lightweight and versatile, making them ideal for the rapid construction needed to accommodate the growing urban population. As cities continue to evolve and accommodate the influx of people, the timber laminating adhesives market is set to thrive. The combination of sustainable construction, lightweight materials, and efficient building practices positions these adhesives as a strategic solution for meeting the demands of the burgeoning urban population while contributing to environmentally conscious construction practices.

Restraints: Volatility in Raw Material Prices

The timber laminating adhesive market can face constraints due to fluctuations in raw material prices. These price volatilities impact the overall stability and growth trajectory of the market. The market's susceptibility to these shifts arises from its dependence on specific materials used in adhesive formulations. When raw material prices experience frequent or substantial changes, it can directly influence the cost structure of timber laminating adhesive production. Manufacturers may struggle to maintain competitive pricing while dealing with unpredictable expenses for core ingredients. This, in turn, can affect profit margins and potentially deter market expansion.

Opportunities: Demand for Low VOC Adhesives

The increasing demand for low VOC (Volatile Organic Compounds) adhesives presents significant opportunities for the timber laminating adhesive market. Low VOC adhesives are formulated to have reduced emissions of harmful volatile organic compounds, which are detrimental to both human health and the environment. This growing preference for environmentally friendly and health-conscious products is reshaping various industries, including construction and manufacturing. Timber laminating adhesives that adhere to stringent VOC regulations not only contribute to improved indoor air quality in residential and commercial spaces but also support green building certifications and standards.

Challenges: Stringent regulatory policies

The principal challenge facing the timber laminating adhesive market is the implementation of stringent regulatory policies. As environmental concerns and health considerations take center stage, governments and regulatory bodies are tightening their grip on the use of various chemicals and materials in industries, including construction. For timber laminating adhesives, these regulations can encompass factors such as VOC emissions, formaldehyde content, and overall chemical composition. While such regulations are vital for safeguarding human health and the environment, they can also pose obstacles for manufacturers and suppliers who need to reformulate their products to meet the new standards.

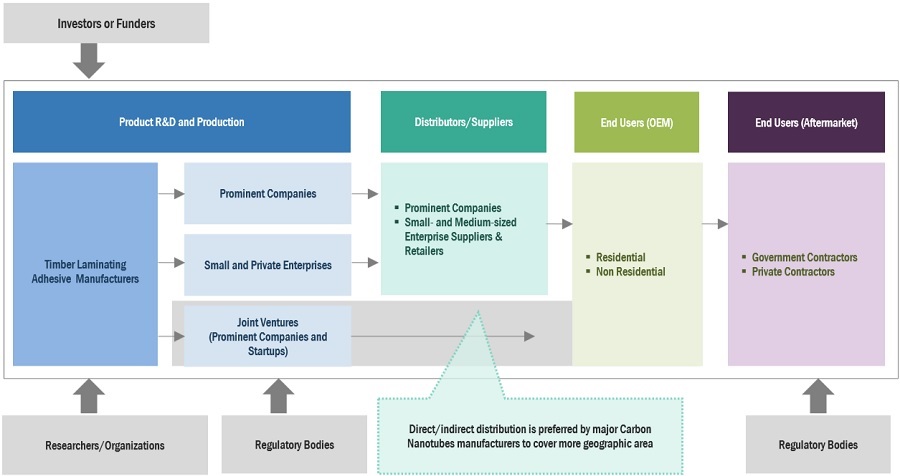

Timber Laminating Adhesives Market Ecosystem

Prominent companies in this market include well established , financially stable manufactures of timber laminating adhesives. These companies have been operating in the market for several years and posses a diversified product portfolio and strong global sales and marketing networks. Prominent companies in the market include H.B. Fuller (US), Henkel Ag (Germany), Arkema (France), Sika Ag(Switzerland), Dow Inc. (US).

Window & Door Header by application accounted for the second highest share of the global timber laminating adhesives market in terms of value

In terms of value for timber laminating adhesives market overall, Window & Door Header application held the second largest share in 2022. Window and door headers are structural elements that provide support for the weight above openings, distributing loads to the surrounding framing. Timber laminating adhesives play a pivotal role in enhancing the performance, strength, and longevity of these critical components. the timber laminating adhesive market's application in window and door headers is transforming the way these essential structural components are designed and constructed. By enabling the creation of engineered wood products with enhanced strength, sustainability, and ease of installation, timber laminating adhesives contribute to safer, more efficient, and environmentally responsible construction practices in the window and door industry.

To know about the assumptions considered for the study, download the pdf brochure

India is the fastest-growing timber laminating adhesive market.

India's rapid urbanization and burgeoning population are driving significant demand for housing and infrastructure development. As cities expand and modernize, the need for efficient and sustainable construction solutions becomes increasingly critical. Timber laminating adhesives offer a promising solution by enabling the creation of engineered wood products that are both structurally sound and environmentally friendly. Furthermore, the emphasis on sustainable construction practices is gaining momentum in India, driven by environmental concerns and regulatory initiatives. Timber, as a renewable resource, complements this focus, and the use of laminating adhesives further supports green building principles.

Key Market Players

H.B. Fuller (US), Henkel Ag (Germany), Arkema (France), Sika Ag(Switzerland), Dow Inc. (US) are the key players in the global timber laminating adhesives market.

Henkel AG & Co. KGaA is a multinational company headquartered in Düsseldorf, Germany. It operates in three main business areas: Adhesive Technologies, Beauty Care, and Laundry & Home Care. The company is renowned for its diverse range of products, spanning adhesives, sealants, coatings, cosmetics, and household products. Henkel has a strong global presence and is known for its commitment to innovation, sustainability, and customer-focused solutions. Adhesive Technologies is one of Henkel's core strengths. It provides a wide array of adhesive solutions for various industries, including automotive, aerospace, electronics, packaging, consumer goods, and construction. Their adhesive products encompass a broad range of technologies catering to different applications.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

By Resin Type, By Application, By End use, By Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies covered |

Henkel Ag (Germany), H.B. Fuller (US), Sika Ag (Switzerland), Dow Inc. (US), and Arkema (France) |

Based on resin type, the timber laminating adhesives market has been segmented as follows:

- Melamine (Urea) Formaldehyde Adhesives- MF & MUF

- Phenol Resorcinol Formaldehyde (PRF) Adhesives

- Polyurethane

- Emulsion Polymer Isocyanate (EPI) Adhesives

- Others

Based on application, the timber laminating adhesives market has been segmented as follows:

- Floor Beam

- Roof Beam

- Window & Door Header

- Trusses & Supporting Column

- Others

Based on end-use industry, the timber laminating adhesives market has been segmented as follows:

- Residential

- Non residential

Based on the region, the timber laminating adhesives market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2021, Sika acquired the leading tiles adhesive and stucco manufacturer in Mexico. The acquisition is expected to strengthen Sika’s hold on the Mexican mortar market.

- In December 2021, Arkema announced the proposed acquisition of Permoseal in South Africa, one of the leaders in adhesive solutions for woodworking, packaging, construction, and DIY. Its well-known brands, including Alcolin, and its extensive range of high-performance adhesive solutions will complement Bostik’s offerings in the region, strengthening their position in South Africa and Sub-Saharan Africa’s dynamic industrial, construction and DIY markets.

Frequently Asked Questions (FAQ):

What are the growth driving factors of timber laminating adhesives market?

Rising use in major emerging economies.

What are the major applications for timber laminating adhesives?

The major applications of timber laminating adhesives are Floor Beam, Roof Beam, Window & Door Header, Trusses & Supporting Column, and Others.

Who are the major manufacturers?

H.B. Fuller (US), Henkel Ag (Germany), Arkema (France), Sika Ag(Switzerland), Dow Inc. (US), are some of the leading players operating in the global carbon nanotube market.

What are the reasons behind timber laminating adhesive gaining market share?

Timber laminating adhesive are gaining market share due to emerging demand from Asia Pacific region.

Which is the largest region in the timber laminating adhesive market?

Europe is the largest region in timber laminating adhesive market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing use in non-residential sector- Growing demand in major emerging economies- Shift toward sustainable and eco-friendly construction- Increasing new construction activities- Rise in renovation and remodeling projectsRESTRAINTS- Volatility in raw material pricesOPPORTUNITIES- Demand for low-VOC adhesives- Rising demand in Europe and North AmericaCHALLENGES- Stringent regulatory policies

-

5.3 PORTER'S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 CASE STUDY

- 5.8 PRICING ANALYSIS

- 5.9 TRADE ANALYSIS

-

5.10 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHIMPACT OF SLOWDOWNRUSSIA-UKRAINE WAREUROPE RECESSIONENERGY CRISIS IN EUROPEASIA PACIFIC RECESSION IMPACT

- 5.11 SUPPLY CHAIN ANALYSIS

-

5.12 TIMBER LAMINATING ADHESIVES ECOSYSTEM AND INTERCONNECTED MARKETTRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.13 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSTOP APPLICANTSJURISDICTION ANALYSIS

-

5.14 REGULATIONS AND STANDARDSLEED STANDARDSSTANDARDS FOR CROSS-LAMINATED TIMBERSTANDARDS FOR GLUE-LAMINATED TIMBER

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES AND EVENTS

- 6.1 INTRODUCTION

- 6.2 MELAMINE (UREA) FORMALDEHYDE

- 6.3 PHENOL RESORCINOL FORMALDEHYDE

- 6.4 POLYURETHANE

- 6.5 EMULSION POLYMER ISOCYANATE

-

6.6 OTHERSPOLYVINYL ACETATEUREA-FORMALDEHYDEPHENOL FORMALDEHYDE

- 7.1 INTRODUCTION

-

7.2 FLOOR BEAMSEUROPE TO ACCOUNT FOR LARGEST SHARE OF MARKET IN FLOOR BEAMS SEGMENT

-

7.3 ROOF BEAMSRENOVATION AND REMODELING TO BE MAJOR DRIVERS IN ROOF BEAMS APPLICATION

-

7.4 WINDOW & DOOR HEADERSEUROPE AND NORTH AMERICA DRIVING USE OF TIMBER LAMINATING ADHESIVES IN WINDOW & DOOR HEADERS

-

7.5 TRUSSES & SUPPORTING COLUMNSASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

-

7.6 OTHERSUSE OF ARCHES INCREASING DUE TO DEMAND FOR TIMBER-EXPOSED ROOF LINES

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALEUROPE TO REMAIN LARGEST CONSUMER OF TIMBER LAMINATING ADHESIVES IN RESIDENTIAL SEGMENT

-

8.3 NON-RESIDENTIALCHANGES IN INTERNATIONAL BUILDING CODE (IBC) 2021 INCREASING CONSUMPTION IN NON-RESIDENTIAL SECTOR

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Competition among local timber laminating adhesive manufacturers to propel marketCANADA- Polyurethane-based timber laminating adhesives to register highest growth during forecast periodMEXICO- Rising awareness to drive market during forecast period

-

9.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- New developments and investments in technology to boost marketFRANCE- Development of affordable housing infrastructure to drive demandUK- Government initiatives to boost construction sector to drive market growthRUSSIA- Increasing awareness about laminated timber to support market growthITALY- Focus on modernization in woodworking industry to fuel demandTURKEY- Rapid urbanization, rising middle-class population, and increasing purchasing power to drive demandBALTIC COUNTRIES- Demand for sustainable and eco-friendly buildings to fuel market growthAUSTRIA- Demand from residential segment to drive marketSCANDINAVIA- Demand for modern design in construction driving marketREST OF EUROPE

-

9.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Foreign investment and growing infrastructure to drive marketINDIA- Growing real estate industry to fuel demand for timber laminating adhesivesJAPAN- Government reconstruction projects and growing tourism sector to boost marketSOUTH KOREA- Growing population of homeowners to drive marketTHAILAND- Increase in demand for home furniture to drive marketINDONESIA- Public and private investments to support market growthMALAYSIA- Strong furniture export sector to boost demand for timber laminating adhesivesREST OF ASIA PACIFIC

-

9.5 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Fast-growing manufacturing hubs to offer opportunities for market growthARGENTINA- Timber laminating adhesives market in Argentina dependent on importREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICAUAE- Urban development projects driving demand for timber laminating adhesivesSAUDI ARABIA- Development of real-estate sector and increasing demand for residential properties to spur market growthAFRICA- Rising population and urbanization to boost market growthREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.3 START-UPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING

- 10.4 STRENGTH OF PRODUCT PORTFOLIO

- 10.5 MARKET SHARE ANALYSIS

- 10.6 MARKET RANKING ANALYSIS

- 10.7 REVENUE ANALYSIS

-

10.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORK

- 10.9 STRATEGIC DEVELOPMENTS

-

11.1 KEY COMPANIESHENKEL AG & CO. KGAA- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSIKA AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewARKEMA (BOSTIK)- Business overview- Products/Services/Solutions offered- Recent developments- MnM view3M- Business overview- Products/Services/Solutions offered- MnM viewH.B. FULLER CO.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDOW INC.- Business overview- Products/Services/Solutions offered- Recent developmentsAKZO NOBEL N.V.- Business overview- Products/Services/Solutions offeredPIDILITE INDUSTRIES- Business overview- Products/Services/Solutions offeredJOWAT SE- Business overview- Products/Services/Solutions offeredILLINOIS TOOL WORKS INC.- Business overview- Products/Services/Solutions offered

-

11.2 OTHER KEY PLAYERSJUBILANT INDUSTRIESBEARDOW ADAMSBISON INTERNATIONAL BVBRITANNIA ADHESIVESCATTIE ADHESIVESDAP PRODUCTS INC.FOLLMANN GMBH & CO. KGFRANKLIN INTERNATIONALIFS INDUSTRIES, INC.MAPEI SPASTAUF USAASTRAL ADHESIVESPARKER HANNIFIN CORP (PARKER LORD)COLLANO AGBUHNEN ADHESIVE SYSTEMS

- 12.1 INTRODUCTION

- 12.2 ADHESIVES & SEALANT MARKET LIMITATIONS

-

12.3 ADHESIVES & SEALANTSMARKET DEFINITIONMARKET OVERVIEWADHESIVES & SEALANTS MARKET, BY ADHESIVES TECHNOLOGYADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATIONADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPEADHESIVES & SEALANTS MARKET, BY SEALANTS APPLICATIONADHESIVES & SEALANTS MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- TABLE 2 TIMBER LAMINATING ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP END USES (%)

- TABLE 4 KEY BUYING CRITERIA FOR TIMBER LAMINATING ADHESIVES

- TABLE 5 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2020–2028

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 7 COUNTRY-WISE IMPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 8 TIMBER LAMINATING ADHESIVES MARKET: STAKEHOLDERS IN SUPPLY CHAIN

- TABLE 9 NUMBER OF PATENTS PUBLISHED, BY COMPANY

- TABLE 10 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

- TABLE 11 STANDARDS FOR ARCHITECTURAL APPLICATIONS

- TABLE 12 STANDARDS FOR SPECIALTY APPLICATIONS

- TABLE 13 STANDARDS FOR SUBSTRATE-SPECIFIC APPLICATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ADHESIVES MARKET: KEY CONFERENCES AND EVENTS IN 2023

- TABLE 18 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 19 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 20 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 21 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 22 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 25 MELAMINE (UREA) FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 26 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 29 PHENOL RESORCINOL FORMALDEHYDE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 30 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 33 POLYURETHANE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 34 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 37 EMULSION POLYMER ISOCYANATE-BASED TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 38 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 41 OTHER TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 42 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 45 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 46 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2019–2022 (KILOTON)

- TABLE 49 TIMBER LAMINATING ADHESIVES MARKET SIZE IN FLOOR BEAMS, BY REGION, 2023–2028 (KILOTON)

- TABLE 50 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2019–2022 (KILOTON)

- TABLE 53 TIMBER LAMINATING ADHESIVES MARKET SIZE IN ROOF BEAMS, BY REGION, 2023–2028 (KILOTON)

- TABLE 54 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2019–2022 (KILOTON)

- TABLE 57 TIMBER LAMINATING ADHESIVES MARKET SIZE IN WINDOW & DOOR HEADERS, BY REGION, 2023–2028 (KILOTON)

- TABLE 58 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2019–2022 (KILOTON)

- TABLE 61 TIMBER LAMINATING ADHESIVES MARKET SIZE IN TRUSSES & SUPPORTING COLUMNS, BY REGION, 2023–2028 (KILOTON)

- TABLE 62 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2022 (KILOTON)

- TABLE 65 TIMBER LAMINATING ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 66 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (USD MILLION)

- TABLE 67 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (USD MILLION)

- TABLE 68 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 69 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 70 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2019–2022 (KILOTON)

- TABLE 73 TIMBER LAMINATING ADHESIVES MARKET SIZE IN RESIDENTIAL, BY REGION, 2023–2028 (KILOTON)

- TABLE 74 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2019–2022 (KILOTON)

- TABLE 77 TIMBER LAMINATING ADHESIVES MARKET SIZE IN NON-RESIDENTIAL, BY REGION, 2023–2028 (KILOTON)

- TABLE 78 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2019–2022 (KILOTON)

- TABLE 81 TIMBER LAMINATING ADHESIVES MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 82 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 85 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 86 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 89 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 90 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 93 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 94 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE 2019–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE 2023–2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 97 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 98 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 99 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 100 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 101 US: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 102 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 103 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 104 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 105 CANADA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 106 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 107 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 108 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 109 MEXICO: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 110 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 113 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 114 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 115 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 117 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 118 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 119 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 121 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 122 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (USD MILLION)

- TABLE 123 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (USD MILLION)

- TABLE 124 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 125 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 126 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 127 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 128 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 129 GERMANY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 130 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 131 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 132 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 133 FRANCE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 134 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 135 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 136 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 137 UK: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 138 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 139 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 140 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 141 RUSSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 142 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 143 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 144 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 145 ITALY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 146 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 147 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 148 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 149 TURKEY: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 150 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 151 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 152 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 153 BALTIC COUNTRIES: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 154 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 155 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 156 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 157 AUSTRIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 158 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 159 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 160 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 161 SCANDINAVIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 162 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 163 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 165 REST OF EUROPE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 166 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 169 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 170 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 173 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 174 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 177 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 178 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 181 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 182 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 183 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 184 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 185 CHINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 186 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 187 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 188 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 189 INDIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 190 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 191 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 192 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 193 JAPAN: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 194 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 195 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 197 SOUTH KOREA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 198 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 199 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 200 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 201 THAILAND: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 202 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 203 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 204 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 205 INDONESIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 206 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 207 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 208 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 209 MALAYSIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 210 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 213 REST OF ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 214 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 215 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 216 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 217 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 218 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 219 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 220 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 221 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 222 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 223 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 224 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 225 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 226 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (USD MILLION)

- TABLE 227 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (USD MILLION)

- TABLE 228 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 229 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 230 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 231 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 232 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 233 BRAZIL: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 234 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 235 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 236 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 237 ARGENTINA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 238 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 239 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 240 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 241 REST OF SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 242 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 245 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 249 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 253 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2019–2022 (KILOTON)

- TABLE 257 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY END USE, 2023–2028 (KILOTON)

- TABLE 258 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 259 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 260 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 261 UAE: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 262 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 263 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 264 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 265 SAUDI ARABIA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 266 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 267 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 268 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 269 AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 270 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 271 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 274 STRATEGIES ADOPTED BY KEY TIMBER LAMINATING ADHESIVES PLAYERS (2018–2023)

- TABLE 275 COMPANY REGION FOOTPRINT

- TABLE 276 COMPANY APPLICATION FOOTPRINT

- TABLE 277 COMPANY OVERALL FOOTPRINT

- TABLE 278 TIMBER LAMINATING ADHESIVES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 279 TIMBER LAMINATING ADHESIVES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 280 TIMBER LAMINATING ADHESIVES MARKET: DEGREE OF COMPETITION, 2022

- TABLE 281 STRATEGIC DEVELOPMENTS, BY KEY COMPANIES

- TABLE 282 HIGHEST ADOPTED STRATEGIES

- TABLE 283 NUMBER OF GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

- TABLE 284 TIMBER LAMINATING ADHESIVES MARKET: DEALS, 2017–2023

- TABLE 285 TIMBER LAMINATING ADHESIVES MARKET: OTHERS, 2017–2023

- TABLE 286 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 287 HENKEL AG & CO. KGAA: PRODUCT/SERVICES/SOLUTIONS OFFERED

- TABLE 288 HENKEL AG & CO. KGAA: OTHERS

- TABLE 289 SIKA AG: COMPANY OVERVIEW

- TABLE 290 SIKA AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 291 SIKA AG: DEALS

- TABLE 292 SIKA AG: OTHERS

- TABLE 293 ARKEMA (BOSTIK): COMPANY OVERVIEW

- TABLE 294 ARKEMA (BOSTIK): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 295 ARKEMA (BOSTIK): DEALS

- TABLE 296 ARKEMA (BOSTIK): OTHERS

- TABLE 297 3M: COMPANY OVERVIEW

- TABLE 298 3M COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 299 H.B. FULLER CO.: COMPANY OVERVIEW

- TABLE 300 H.B. FULLER CO.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 H.B. FULLER: PRODUCT LAUNCHES

- TABLE 302 H.B. FULLER: DEALS

- TABLE 303 H.B. FULLER: OTHERS

- TABLE 304 DOW INC.: COMPANY OVERVIEW

- TABLE 305 DOW INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 306 DOW INC.: OTHERS

- TABLE 307 AKZO NOBEL N.V.: COMPANY OVERVIEW

- TABLE 308 AKZO NOBEL N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 310 PIDILITE INDUSTRIES: COMPANY OVERVIEW

- TABLE 311 PIDILITE INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 312 JOWAT SE: COMPANY OVERVIEW

- TABLE 313 JOWAT SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 314 ILLINOIS TOOL WORKS INC.: COMPANY OVERVIEW

- TABLE 315 ILLINOIS TOOL WORKS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 316 JUBILANT INDUSTRIES: COMPANY OVERVIEW

- TABLE 317 JUBILANT INDUSTRIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 318 BEARDOW ADAMS: COMPANY OVERVIEW

- TABLE 319 BEARDOW ADAMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 320 BISON INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 321 BISON INTERNATIONAL BV: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 322 BRITANNIA ADHESIVES: COMPANY OVERVIEW

- TABLE 323 BRITANNIA ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 324 CATTIE ADHESIVES: COMPANY OVERVIEW

- TABLE 325 CATTIE ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 326 DAP PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 327 DAP PRODUCTS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 328 FOLLMANN GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 329 FOLLMANN GMBH & CO. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 330 FRANKLIN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 331 FRANKLIN INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 332 IFS INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 333 IFS INDUSTRIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 334 MAPEI SPA: COMPANY OVERVIEW

- TABLE 335 MAPEI SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 336 STAUF USA: COMPANY OVERVIEW

- TABLE 337 STAUF USA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 338 ASTRAL ADHESIVES: COMPANY OVERVIEW

- TABLE 339 ASTRAL ADHESIVES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 340 PARKER HANNIFIN CORP (PARKER LORD): COMPANY OVERVIEW

- TABLE 341 PARKER HANNIFIN CORP (PARKER LORD): PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 342 COLLANO AG: COMPANY OVERVIEW

- TABLE 343 COLLANO AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 344 BUHNEN ADHESIVE SYSTEMS: COMPANY OVERVIEW

- TABLE 345 BUHNEN ADHESIVE SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 346 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 347 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 348 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2019–2022 (KILOTON)

- TABLE 349 ADHESIVES & SEALANTS MARKET, BY ADHESIVE TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 350 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2019–2022 (USD MILLION)

- TABLE 351 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2023–2028 (USD MILLION)

- TABLE 352 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2019–2022 (KILOTON)

- TABLE 353 ADHESIVES & SEALANTS MARKET, BY ADHESIVES APPLICATION, 2023–2028 (KILOTON)

- TABLE 354 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2019–2022 (USD MILLION)

- TABLE 355 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 356 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2019–2022 (KILOTON)

- TABLE 357 ADHESIVES & SEALANTS MARKET, BY SEALANTS RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 358 SEALANTS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 359 SEALANTS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 360 SEALANTS MARKET, BY APPLICATION, 2019–2022 (KILOTON)

- TABLE 361 SEALANTS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 362 ADHESIVES & SEALANTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 363 ADHESIVES & SEALANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 364 ADHESIVES & SEALANTS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 365 ADHESIVES & SEALANTS MARKET, BY REGION, 2023–2028 (KILOTON)

- FIGURE 1 TIMBER LAMINATING ADHESIVES MARKET SEGMENTATION

- FIGURE 2 TIMBER LAMINATING ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 3 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 1

- FIGURE 4 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 2

- FIGURE 5 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 TIMBER LAMINATING ADHESIVES MARKET SIZE ESTIMATION, BY VOLUME

- FIGURE 7 TIMBER LAMINATING ADHESIVES MARKET, BY REGION

- FIGURE 8 TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 10 TIMBER LAMINATING ADHESIVES MARKET: DEMAND-SIDE FORECAST

- FIGURE 11 FACTOR ANALYSIS OF TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 12 TIMBER LAMINATING ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET BETWEEN 2023 AND 2028

- FIGURE 14 FLOOR BEAMS TO BE FASTEST-GROWING APPLICATION BETWEEN 2023 AND 2028

- FIGURE 15 RESIDENTIAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 MELAMINE RESIN TO BE LEADING SEGMENT BETWEEN 2023 AND 2028

- FIGURE 17 EUROPE ACCOUNTED FOR LARGEST SHARE OF TIMBER LAMINATING ADHESIVES MARKET IN 2022

- FIGURE 18 TIMBER LAMINATING ADHESIVES WITNESSING HIGH DEMAND FROM DEVELOPED ECONOMIES

- FIGURE 19 POLYURETHANE RESIN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 FLOOR BEAMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 CHINA DOMINATES TIMBER LAMINATING ADHESIVES MARKET IN ASIA PACIFIC

- FIGURE 22 EMERGING COUNTRIES TO GROW AT HIGHER CAGR

- FIGURE 23 INDIA TO EMERGE AS LUCRATIVE MARKET FOR TIMBER LAMINATING ADHESIVES

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA FOR TIMBER LAMINATING ADHESIVES

- FIGURE 28 COUNTRY-WISE CONTRIBUTION TO GLOBAL CONSTRUCTION GROWTH, 2020–2030

- FIGURE 29 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY RESIN TYPE

- FIGURE 30 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY APPLICATION

- FIGURE 31 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY END USE

- FIGURE 32 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY REGION

- FIGURE 33 PRICE COMPETITIVENESS IN TIMBER LAMINATING ADHESIVES MARKET, BY COMPANY

- FIGURE 34 TIMBER LAMINATING ADHESIVES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 35 TIMBER LAMINATING ADHESIVES MARKET: ECOSYSTEM MAPPING

- FIGURE 36 REVENUE SHIFT IN TIMBER LAMINATING ADHESIVES MARKET

- FIGURE 37 PATENT PUBLICATION TRENDS, 2018–2023

- FIGURE 38 PATENTS PUBLISHED BY MAJOR PLAYERS, 2018–2023

- FIGURE 39 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018–2023

- FIGURE 40 POLYURETHANE RESIN-BASED TIMBER LAMINATING ADHESIVES TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 41 FLOOR BEAMS TO ACCOUNT FOR LARGEST SHARE BETWEEN 2023 AND 2028

- FIGURE 42 RESIDENTIAL SEGMENT TO BE LARGER END USER OF TIMBER LAMINATING ADHESIVES BETWEEN 2023 AND 2028

- FIGURE 43 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 45 EUROPE: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 47 SOUTH AMERICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST & AFRICA: TIMBER LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 49 TIMBER LAMINATING ADHESIVES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 TIMBER LAMINATING ADHESIVES MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 51 TIMBER LAMINATING ADHESIVES MARKET: PRODUCT PORTFOLIO ANALYSIS

- FIGURE 52 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 53 RANKING OF LEADING PLAYERS IN TIMBER LAMINATING ADHESIVES MARKET, 2022

- FIGURE 54 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 55 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 56 SIKA AG: COMPANY SNAPSHOT

- FIGURE 57 ARKEMA (BOSTIK): COMPANY SNAPSHOT

- FIGURE 58 3M: COMPANY SNAPSHOT

- FIGURE 59 H.B. FULLER CO.: COMPANY SNAPSHOT

- FIGURE 60 DOW INC.: COMPANY SNAPSHOT

- FIGURE 61 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 62 PIDILITE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 63 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

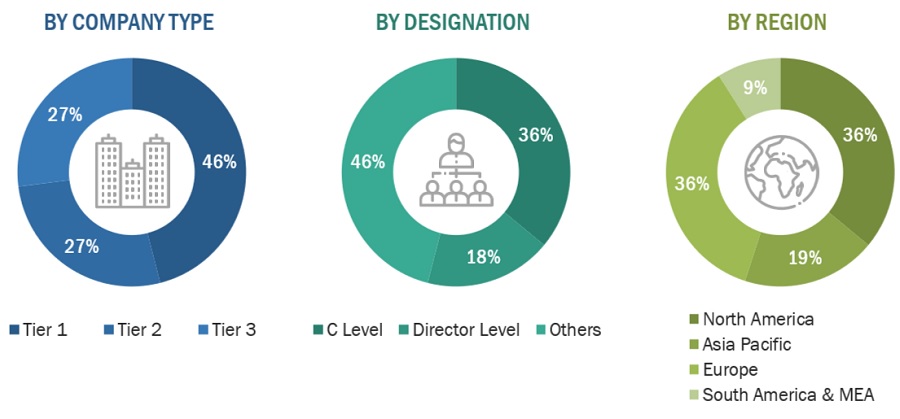

The study involved four major activities in order to estimating the current size of the timber laminating adhesives market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including Association of the European Adhesive & Sealant Industry (FEICA), British Adhesives and Sealants Association (BASA), Adhesive and Sealant Council (ASC), Society for Adhesion & Adhesives (SAA).

Primary Research

Extensive primary research was carried out after gathering information about timber laminating adhesives market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the timber laminating adhesives market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, applications, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

H.B. Fuller |

Sales Manager |

|

Sika Ag |

Project Manager |

|

Henkel Ag |

Individual Industry Expert |

|

Arkema |

Manager |

Market Size Estimation

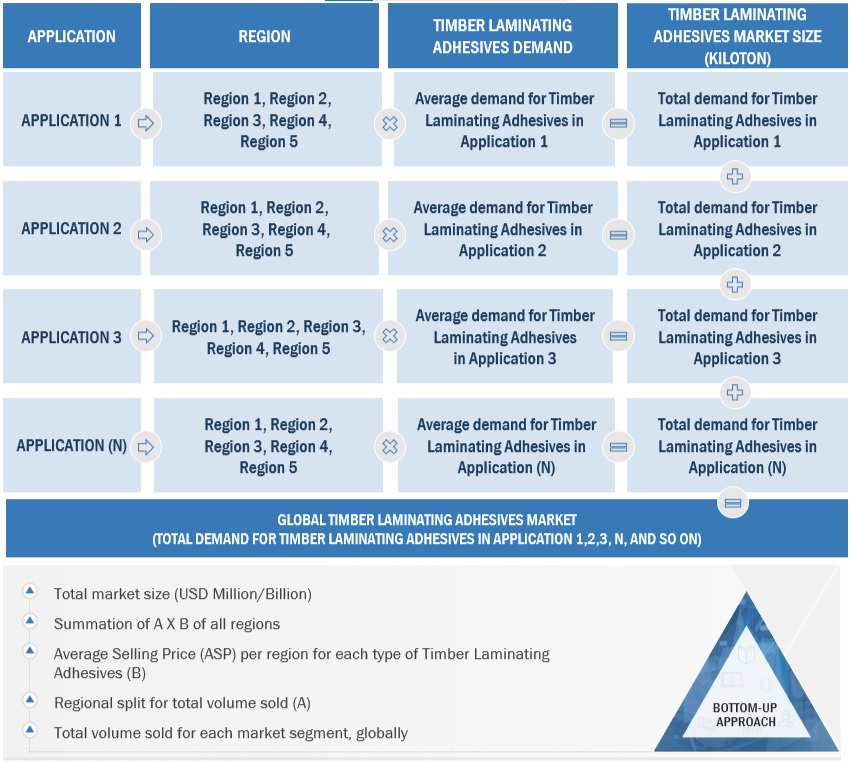

The following information is part of the research methodology used to estimate the size of the timber laminating adhesives market. The market sizing of the timber laminating adhesives market was undertaken from the demand side. The market size was estimated based on procurements and advancement in the CLT and Glulam industry at a regional level. Such procurements provide information on the demand for timber laminating adhesives.

Global Timber Laminating Adhesives Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Timber Laminating Adhesives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments.To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

An adhesive is a chemical compound utilized to connect materials, whether they are alike or dissimilar, by binding their surfaces together. In contemporary industrial wood construction, timber laminating adhesives assume a vital role. These adhesives contribute to wood conservation and enable the creation of lightweight yet robust structures, helping to mitigate the natural expansion and construction shifts resulting from wood's inherent moisture retention characteristics. Advanced industrial wood adhesives have been customized to cater to the timber industry's requirements and are continuously advancing.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the timber laminating adhesives market based on resin type, application, end use and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the timber laminating adhesives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the timber laminating adhesives market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the timber laminating adhesives Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Timber Laminating Adhesives Market