Signaling Devices Market (Audible & Visual) for Hazardous and Safe Areas, by Product (Strobe Beacons, Lighting and Fire Alarms/Call Points), Connectivity Service (Wired & Wireless), Industry, & Geography - Global Forecast to 2022

The signaling devices market (audible & visual) was valued at USD 1.49 Billion in 2015 and is estimated to reach USD 2.03 Billion by 2022, at a CAGR of 4.43% during the forecast period. The base year used for this study is 2015, and the forecast period considered is between 2016 and 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the signaling devices market (audible & visual) segmented on the basis of product, connectivity service, and industry

- To provide market size estimations with respect to four main regions, namely, North America, Europe, Asia-Pacific, and Rest of the World

- To identify and analyze the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the key trends related to product, service, and industry that shape and influence the market

- To analyze the market with the help of Porter’s five forces framework and provide a detailed Porter’s analysis along with the value chain analysis, technology, and market roadmap

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape for the key players

- To analyze strategic developments such as joint ventures, mergers and acquisitions, product launches and developments, and research and development in the signaling devices market (audible & visual)

- To strategically profile the key players and comprehensively analyze their market share and core competencies

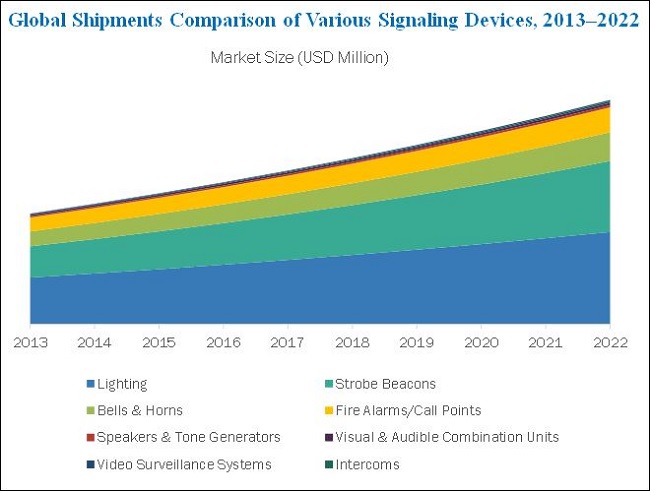

Signaling audible and visual devices are gaining momentum in the present era of hazardous area equipment industry due to their benefits and multiple add-on features. Moreover, these products are outpacing the traditional signaling device products such as liquid crystal diode (LCD) lighting and other less efficient products. This article provides insights through comparison of various signaling devices, as well as the recognition garnered by lighting products in the hazardous area equipment industry

During the study, it was observed that companies tend to provide utmost safety to their employees as well as the physical assets in the industry premises by following strict safety norms to avoid any hazards in the workplace caused by flammable gases, flammable liquid–produced vapors, combustible liquid–produced vapors, combustible dusts, or ignitable fibers. Use of signaling devices helps to prevent such hazards, especially visual signaling devices such as lighting and strobe beacons, which act as an emergency management system. Lighting products had a steady growth in the overall signaling devices market because of the advent of light-emitting diode (LED) technologies.

The major players in the overall signaling devices market are focusing on meeting their customers’ expectations by offering multiple certifications (ATEX, IEC, CES, etc.) to these products. Certifications have been mandatory for every manufacturer in the signaling device market and have a huge impact on the overall revenue.

Increasing usage of signaling devices in the oil and gas industry:

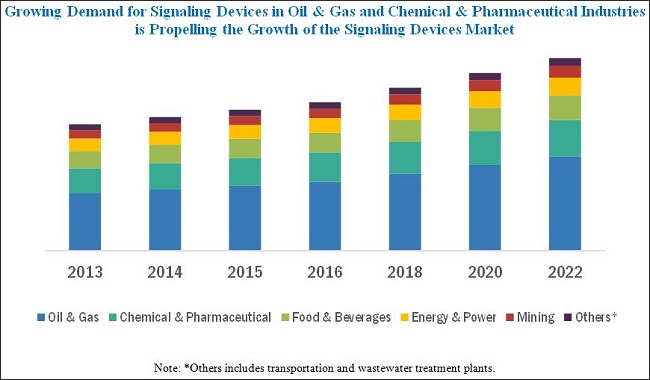

Signaling devices find application in several industries such as oil and gas, chemical and pharmaceutical, food and beverages, mining, and other industries.

Signaling devices are widely used in the oil and gas industry. Due to the highly explosive atmosphere and the presence of flammable gasses, this industry is highly prone to risks. Hence, the use of emergency management systems is crucial. Emergency management systems such as beacons, fire alarms/call points, and lighting systems are widely used in the oil and gas industry. Owing to the increased safety standards for hazardous areas, these products would be used extensively and are expected to grow exponentially in the future.

The growing focus on improving safety measures in industries, especially process and cooling, is creating a good demand for flame- and explosion-proof signaling audible and visual devices such as horns, speakers, strobe beacons, lighting, and so on. However, the key factor that is limiting the growth of the signaling devices market is the usage of wireless signaling devices, which may cause an explosion on the industry premises due to electromagnetic waves emitted by these devices. Moreover, the requirement of signaling devices that can operate in a wide area and overcome noise is the key challenge for industry players.

Figure 2 depicts the current market shares of different industries and estimates the market size till 2022. The trend witnessed by different industries in 2016 is likely to continue till 2022, wherein the oil and gas industry would dominate the market, followed by the chemical and pharmaceutical, and food and beverages industry.

The signaling device market is moderately competitive due to the presence of numerous players globally. The major companies identified in the signaling devices market are Honeywell International, Inc. (U.S.), PATLITE Corporation (U.S.), Eaton Corporation Plc (U.S.), Siemens AG (Germany), Emerson Electric Co. (U.S.), NHP Electric Engineering Products (Australia), Rockwell Automation (U.S.), E2S Warning Signals (U.S.), ABB Ltd. (Switzerland), and R.STAHL AG. (Germany).

A wide range of topics are covered in this report such as the market analysis, overview, industry analysis, market dynamics, market classification, and market landscape like competitive landscape as well as company profiles and key players.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Significant Market Opportunities in the Signaling Devices Market

4.2 Market Analysis, By Product

4.3 Market Analysis, By Connectivity Service, 2015

4.4 Market Analysis, By Industry

4.5 Market Share, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Signaling Devices Market, By Product

5.2.2 Market, By Connectivity Service

5.2.3 Market, By Industry

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Focus on Industrial Safety Measures

5.3.1.2 Rise in Led Lighting Solutions

5.3.2 Restraints

5.3.2.1 Wireless Signaling Devices Acting as A Source of Ignition in Hazardous Areas

5.3.2.2 High Inspection and Maintenance Costs

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Low-Cost, High Light Output Per Watt Lighting Solutions

5.3.4 Challenges

5.3.4.1 Requirement of Signaling Devices That Can Operate in Wide Area and Overcome Noise

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Signaling Devices Market, By Product (Page No. - 47)

7.1 Introduction

7.1.1 Strobe Beacons

7.1.2 Lighting

7.1.3 Bells & Horns

7.1.4 Fire Alarms/Call Points

7.1.5 Speakers & Tone Generators

7.1.6 Visual & Audible Combination Units

7.1.7 Video Surveillance Systems

7.1.8 Intercoms

8 Signaling Devices Market, By Connectivity Service (Page No. - 67)

8.1 Introduction

8.2 Wired Connectivity Service

8.3 Wireless Connectivity Service

9 Signaling Devices Market, By Industry (Page No. - 71)

9.1 Introduction

9.1.1 Oil & Gas

9.1.2 Chemical & Pharmaceutical

9.1.3 Food & Beverages

9.1.4 Energy & Power

9.1.5 Mining

9.1.6 Others

10 Geographic Analysis (Page No. - 99)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Russia

10.3.2 Germany

10.3.3 U.K.

10.3.4 Others

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Others

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 Latin America

11 Competitive Landscape (Page No. - 113)

11.1 Overview

11.2 Market Ranking Analysis

11.2.1 Competitive Situations and Trends

11.2.2 New Product Launches and Developments

11.2.3 Partnerships & Expansions, 2014–2016

11.2.4 Mergers & Acquisitions, 2015–2016

12 Company Profile (Page No. - 119)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Siemens AG

12.3 Honeywell International, Inc.

12.4 ABB Ltd.

12.5 Rockwell Automation, Inc.

12.6 Eaton Corporation PLC (Cooper Industries)

12.7 Emerson Electric Co.

12.8 Patlite Corporation

12.9 R. Stahl AG

12.10 E2S Warning Signals

12.11 NHP Electrical Engineering Products Pty Ltd.

12.12 Federal Signal Corporation

12.13 Werma Signaltechnik GmbH

12.14 Potter Electric Signal Company, LLC

12.15 Tomar Electronics, Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 147)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (65 Tables)

Table 1 Signaling Devices Market, By Product, 2013–2022 (USD Million)

Table 2 Market, By Product, 2013–2022 (Thousand Units)

Table 3 Market for Strobe Beacons, By Industry, 2013–2022 (USD Million)

Table 4 Market for Strobe Beacons, By Industry, 2013–2022 (Thousand Units)

Table 5 Market for Lighting Products, By Industry, 2013–2022 (USD Million)

Table 6 Market for Lighting Products, By Industry, 2013–2022 (Thousand Units)

Table 7 Market for Bells & Horns, By Industry, 2013–2022 (USD Million)

Table 8 Market for Bells & Horns, By Industry, 2013–2022 (Thousand Units)

Table 9 Market for Fire Alarms/Call Points, By Industry, 2013–2022 (USD Million)

Table 10 Market for Fire Alarms/Call Points, By Industry, 2013–2022 (Thousand Units)

Table 11 Market for Speakers & Tone Generators, By Industry, 2013–2022 (USD Million)

Table 12 Market for Speakers & Tone Generators, By Industry, 2013–2022 (Thousand Units)

Table 13 Market for Visual & Audible Combination Units, By Industry, 2013–2022 (USD Million)

Table 14 Market for Visual & Audible Combination Units, By Industry, 2013–2022 (Thousand Units)

Table 15 Market for Video Surveillance Systems, By Industry, 2013–2022 (USD Million)

Table 16 Market for Video Surveillance Systems, By Industry, 2013–2022 (Thousand Units)

Table 17 Market for Intercoms, By Industry, 2013–2022 (USD Million)

Table 18 Market for Intercoms, By Industry, 2013–2022 (Thousand Units)

Table 19 Market, By Connectivity Service, 2013–2022 (USD Million)

Table 20 Market, By Industry, 2013–2022 (USD Million)

Table 21 Market for Oil & Gas Industry, By Product, 2013–2022 (USD Million)

Table 22 Market for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 23 Market in North America for Oil & Gas Industry, By Country,2013–2022 (USD Million)

Table 24 Market in Europe for Oil & Gas Industry, By Country, 2013–2022 (USD Million)

Table 25 Market in APAC for Oil & Gas Industry, By Country, 2013–2022 (USD Million)

Table 26 Market in RoW for Oil & Gas Industry, By Region, 2013–2022 (USD Million)

Table 27 Market Size for Chemical & Pharmaceutical Industry, By Product, 2013–2022 (USD Million)

Table 28 Market for Chemical & Pharmaceutical Industry, By Region, 2013–2022 (USD Million)

Table 29 Market in Europe for Oil & Gas Industry , By Country, 2013–2022 (USD Million)

Table 30 Market in North America for Chemical & Pharmaceutical Industry, By Country, 2013–2022 (USD Million)

Table 31 Market in APAC for Chemical & Pharmaceutical Industry, By Country, 2013–2022 (USD Million)

Table 32 Market in RoW for Chemical & Pharmaceutical Industry, By Region, 2013–2022 (USD Million)

Table 33 Market for Food & Beverages Industry, By Product, 2013–2022 (USD Million)

Table 34 Market for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 35 Market Industry in North America for Food & Beverages, By Country, 2014–2022 (USD Million)

Table 36 Signaling Devices Market in Europe for Food & Beverages Industry, By Country, 2013–2022 (USD Million)

Table 37 Market in APAC for Food & Beverages Industry, By Country, 2013–2022 (USD Million)

Table 38 Market in RoW for Food & Beverages Industry, By Region, 2013–2022 (USD Million)

Table 39 Market for Energy & Power Industry, By Product, 2013–2022 (USD Million)

Table 40 Market for Energy & Power Industry, By Region, 2013–2022 (USD Million)

Table 41 Market in North America for Energy & Power Industry, By Country, 2013–2022 (USD Million)

Table 42 Market in Europe for Energy & Power Industry, By Country, 2013–2022 (USD Million)

Table 43 Market in APAC for Energy & Power Industry, By Country, 2013–2022 (USD Million)

Table 44 Market in RoW for Energy & Power Industry, By Region, 2013–2022 (USD Million)

Table 45 Market for Mining Industry, By Product, 2013–2022 (USD Million)

Table 46 Market for Mining Industry, By Region, 2013–2022 (USD Million)

Table 47 Market in North America for Mining Industry, By Country, 2013–2022 (USD Million)

Table 48 Market in Europe for Mining Industry, By Country, 2013–2022 (USD Million)

Table 49 Market in APAC for Mining Industry, By Country, 2013–2022 (USD Million)

Table 50 Market in RoW for Mining Industry, By Region, 2013–2022 (USD Million)

Table 51 Market for Other Industries, By Product, 2013–2022 (USD Million)

Table 52 Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 53 Market in North America for Other Industries, By Country, 2013–2022 (USD Million)

Table 54 Market in Europe for Other Industries, By Country, 2013–2022 (USD Million)

Table 55 Market in APAC for Other Industries, By Country, 2013–2022 (USD Million)

Table 56 Market in RoW for Other Industries, By Region, 2013–2022 (USD Million)

Table 57 Market, By Region, 2013–2022 (USD Million)

Table 58 Market in North America, By Country, 2013–2022 (USD Million)

Table 59 Market in Europe, By Country, 2013–2022 (USD Million)

Table 60 Market in APAC, By Country, 2013–2022 (USD Million)

Table 61 Market in RoW, By Region, 2013–2022 (USD Million)

Table 62 Market Ranking Analysis in the Signaling Devices Market, 2015

Table 63 New Product Launches, 2015–2016

Table 64 Partnershipsand Expansions, 2014–2016

Table 65 Mergers and Acquisitions, 2015–2016

List of Figures (80 Figures)

Figure 1 Signalling Devices Market Segmentation

Figure 2 Research Design

Figure 3 Breakdown of Primaries

Figure 4 Research Flow

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Signaling Devices Market Size: Value vs Volume, 2013–2022

Figure 9 Market Size of Signaling Device Products in Terms of Revenue, 2013–2022

Figure 10 Market, By Connectivity Service, 2013-2022

Figure 11 Market, Industry Ranking Analysis, 2015

Figure 12 RoW Held the Largest Share of the Signaling Devices in 2015

Figure 13 Signaling Devices Expected to Grow at A Significant Rate Between 2016 and 2022

Figure 14 Strobe Beacons to Lead the Market Between 2016 and 2022

Figure 15 Wireless Connectivity Service to Continue to Hold A Larger Share of the Signaling Devices During the Forcast Period

Figure 16 Oil & Gas Held the Largest Market Size of the Global Signaling Devices in 2015

Figure 17 Middle East & Africa Held the Largest Share of the Signaling Devices in 2015

Figure 18 Market, By Region

Figure 19 Drivers, Restraints, Opportunities & Challenges for the Signaling Devices Market

Figure 20 Value Chain Analysis: Major Value is Added During the Raw Material Selection, Software Interfacing and Hardware Installation Stages

Figure 21 Market: Porter’s Five Forces Analysis, 2015

Figure 22 Porters Five Force Analysis of the Signaling Devices

Figure 23 Medium Impact of Threat of New Entrants Due to Less R&D Expenditure

Figure 24 High Impact of Threat of New Substitutes Because of High Substitute Product Quality

Figure 25 Medium Impact of Bargaining Power of Suppliers Due to the Brand Equity of Suppliers

Figure 26 High Impact of Bargaining Power of Buyers Due to Presence of Several Buyers in the Market

Figure 27 High Impact of Intensity of Competitive Rivalry Due to A Number of Large Firms and Several New Product Launches

Figure 28 Signaling Devices Segmentation, By Product

Figure 29 Strobe Beacons Expected to Hold the Largest Size of the Signaling Devices During the Forecast Period

Figure 30 Market Size, in Terms of Volume, By Product, 2013-2022 (Thousand Units)

Figure 31 Signaling Devices Product: Company Mapping

Figure 32 Oil & Gas Industry Held the Largest Size of the Signaling Devices for Strobe Beacons in 2015

Figure 33 Oil & Gas Held the Largest Size of the Signaling Devices for Lighting Products in 2015

Figure 34 Oil & Gas Industry Expected to Hold the Largest Size of the Signaling Devices for Lighting Products, in Terms of Volume, During the Forecast Period

Figure 35 Oil & Gas Industry Held the Largest Size of the Signaling Devices for Bells & Horns in 2015

Figure 36 Oil & Gas Industry Expected to Lead the Signaling Devices for Speakers & Tone Generators During the Forecast Period

Figure 37 Oil & Gas Industry Expected to Lead the Signaling Devices for Video Surveillance Systems During the Forecast Period

Figure 38 Signaling Devices for Intercoms, in Terms of Value and Volume, 2015 vs 2022

Figure 39 Signaling Devices , By Connectivity Service

Figure 40 Wireless Services to Hold the Largest Size of the Signaling Devices Market During the Forecast Period

Figure 41 Market, By Industry

Figure 42 Oil and Gas Industry to Lead the Signaling Devices Market During the Forecast Period

Figure 43 Strobe Beacons Held the Largest Size of the Signaling Devices Market Based on Product for Oil & Gas Industry in 2015

Figure 44 RoW Held the Largest Size of the Signaling Devices for Oil & Gas Industry in 2015

Figure 45 Europe Held the Largest Size of the Signaling Devices for Chemical & Pharmaceutical Industry in 2015

Figure 46 Germany Expected to Lead the European Signaling Devices for Chemical & Pharmaceutical Industry During the Forecast Period

Figure 47 U.S. Held the Largest Share of the North American Market for Chemical & Pharmaceutical Industry in 2015

Figure 48 North America Expected to Hold the Largest Size of the Market for Food & Beverages Industry During the Forecast Period

Figure 49 U.S. Held the Largest Size of the North American Market for Food & Beverages Industry in 2015

Figure 50 Strobe Beacons Expected to Dominate the Global Devices Market for Energy & Power Industry During the Forecast Period

Figure 51 APAC Region Expected to Lead the Global Market for Energy & Power Industry Between 2016 and 2022

Figure 52 Strobe Beacons Expected to Hold the Largest Size of the Market for Mining Industry Between 2016 and 2022

Figure 53 U.S. to Lead the North American Market for Mining Industry in 2015

Figure 54 North America to Lead the Market for Other Industries During the Forecast Period

Figure 55 Market, By Geography

Figure 56 APAC Market has Entered Into the Maturity Phase in 2015

Figure 57 RoW Expected to Lead the Devices Market in Terms of Value During the Forecast Period

Figure 58 Market Snapshot in North America, 2015

Figure 59 The U.S. Held the Largest Share of the North American Market in 2015

Figure 60 Market Snapshot in Europe in 2015

Figure 61 Russia Held the Largest Size of the Market in Europe in 2015

Figure 62 Market Snapshot in APAC in 2015

Figure 63 China to Be the Leading Market for Signaling Devices in Asia-Pacific By 2022

Figure 64 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2016

Figure 65 Market Evolution Framework – New Product Launches and Developments Fueled the Growth of and Innovations in the Market Between 2014 and 2016

Figure 66 Battle for Market Share: New Product Launches and Developments Were the Key Growth Strategies, 2014–2016

Figure 67 Geographic Revenue Mix of Top 5 Players

Figure 68 Siemens AG: Company Snapshot

Figure 69 Siemens AG: SWOT Analysis

Figure 70 Honeywell International, Inc.: Company Snapshot

Figure 71 Honeywell International, Inc.: SWOT Analysis

Figure 72 ABB Ltd.: Company Snapshot

Figure 73 ABB Ltd.: SWOT Analysis

Figure 74 Rockwell Automation, Inc.: Company Snapshot

Figure 75 Rockwell Automation, Inc.: SWOT Analysis

Figure 76 Eaton Corporation PLC: Company Snapshot

Figure 77 Eaton Corporation PLC: SWOT Analysis

Figure 78 Emerson Electric Co.: Company Snapshot

Figure 79 R. Stahl AG: Company Snapshot

Figure 80 Federal Signal Corporation: Company Snapshot

The research methodology used to estimate and forecast the market (audible & visual) begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the global signaling devices market (audible & visual) from the revenues of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews of people holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The signaling devices ecosystem comprises manufacturers such as Honeywell International, Inc. (U.S.), PATLITE Corporation (U.S.), Eaton Corporation Plc (U.S.), Siemens AG (Germany), Emerson Electric Co. (U.S.), NHP Electric Engineering Products (Australia), Rockwell Automation (U.S.), E2S Warning Signals (U.S.), ABB Ltd. (Switzerland), R.STAHL AG (Germany). The end users of these signaling devices products are from a wide range of industries such as oil and gas, chemical and pharmaceutical, food and beverages, mining, and energy and power, majorly among others.

The Target Audience:

- Original equipment manufacturers

- Semiconductor component suppliers

- Signaling device distributors and sales firms

- Software solution providers

- Service providers for signaling electrical/nonelectrical equipment

- End users

- Research institutes and organizations

“The study answers several questions for the target audiences, primarily which market segments to focus on in next two to five years for prioritizing the efforts and investments.”

Report Scope:

In this report, the signaling devices market (audible & visual) has been segmented into the following categories, which have been detailed below:

Signaling Devices Market (Audible & Visual), by Product:

- Strobe Beacons

- Lighting

- Bells and Horns

- Fire Alarms/Call Points

- Speakers and Tone Generators

- Visual and Audible Combination Units

- Video Surveillance Systems

- Intercoms

Signaling Devices Market (Audible & Visual), by Connectivity Service:

- Wired

- Wireless

Signaling Devices Market (Audible & Visual), by Industry:

- Oil and Gas

- Chemical and Pharmaceutical

- Food and Beverages

- Energy and Power

- Mining

- Others (Pulp and Paper, Water and Wastewater Treatment, and Transportation)

Signaling Devices Market (Audible & Visual), by Geography:

- North America (U.S., Canada, and Mexico)

- Europe (U.K., Germany, Russia, and Others)

- Asia-Pacific (China, Japan, India, South Korea, and Others)

- Rest of the World

Competitive Landscape: Market share analysis

Company Profiles: Detailed analysis of the major companies present in the signaling devices market (audible & visual)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Signaling Devices Market

I am quite interested in this report, does the "Hazardous and safe areas" include public safety and road constructions? Or is there any of your report which could cover these segments? We specialized in providing light bars, modules and sirens, for Red/Blue and Amber market, looking for some market insights to support our product and marketing strategy.