Explosion Proof Equipment Market with COVID-19 Impact Analysis by Product (Cable Glands & Accessories, Industrial Controls, Process Instruments, Sensors, and Signaling Devices), Connectivity Service, Zone Classification, Industry, and Geography Global Forecast to 2025

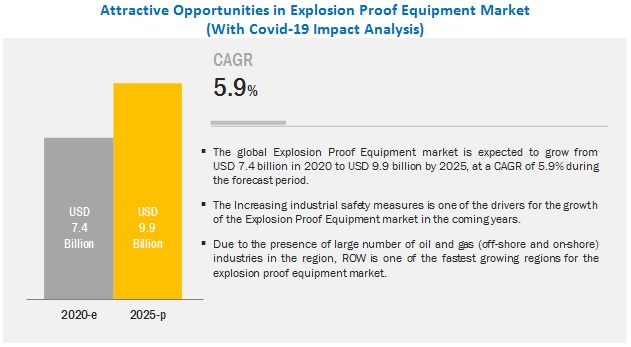

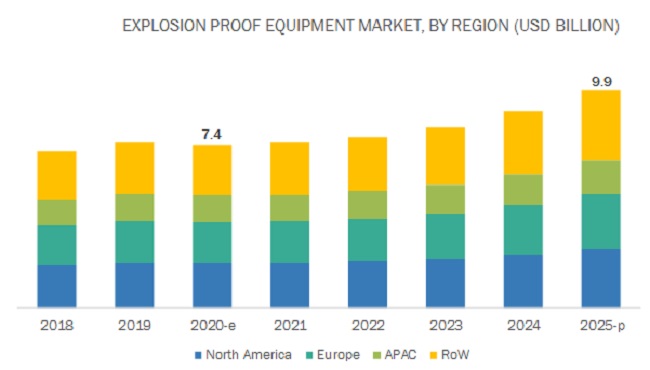

Explosion proof equipment market report size is projected to reach to USD 9.9 billion by 2025, at a CAGR of 5.9% during the forecast period. Factors such as the increasing industrial safety measures and rising energy requirements are driving the explosion proof equipment industry.

The explosion proof equipment market for wireless connectivity services is expected to grow at a higher rate during the forecast period

The explosion proof equipment market for wireless connectivity services is projected to grow at a high growth rate during the forecast period. The growth of the segment can be attributed to its lower installation cost, requirement for cable-free operations, and reduction in space occupied and weight. Wireless devices can minimize the number of devices installed, such as cabling and other installation equipment leading to low installation expenditure and low labor costs.

The explosion proof equipment market for cable glands & accessories segment held the largest share of the market

The explosion proof equipment market for cable glands & accessories segment held the largest share of the market in 2019. Cable glands and accessories are increasingly used for mechanical retention, strain relief, and earth continuity.

The explosion proof equipment market in RoW is projected to grow at the highest CAGR during the forecast period.

The explosion proof equipment market in Rest of the World is expected to grow at the highest CAGR during the forecast period, due to the presence of the worlds largest oil & gas production, mining, and energy & power industries, which are highly prone to explosions in the region. The rising demand for protection in the oil & gas industry led the manufacturers to certify their products for use in explosive atmospheres.

Key Players: Explosion Proof Equipment Market

The major players in the explosion proof equipment market are Siemens (Germany), Honeywell International Inc. (US), ABB Ltd. (Switzerland), Rockwell Automation, Inc. (US), and Eaton Corporation Plc (Ireland).

Honeywell International, Inc.

Honey well International is a multinational company, founded in 1906 and headquartered in New Jersey, US. The company offers a variety of commercial and consumer products and engineering services.

With respect to the explosion proof equipment market, Honeywell provides hazardous area limit switches and sensors. These are tailored to the exact specifications for superior performance, extended productivity, and increased safety. These products are designed for a wide range of industrial applications, from mud pumps, valve positioning, and pig position detectors to gate/door monitoring systems and conveyors.

ABB Ltd.

Founded in 1988 and headquartered in Zurich, Switzerland, ABB Ltd. is a multinational company founded after the merger of Allmanna Svenska Elektriska Aktiebola ASEA (Sweden) and Brown, Boveri & Cie BBC (Switzerland). ABB Ltd. is a global leader in power and automation technologies. The company operates through five business segments, such as electrification, motion, industrial automation, and robotics & discrete automation.

Its explosion proof equipment line of products includes motors, generators, hazardous area lighting & emergency lighting, cable glands, and switches. These offerings are used across industries such as oil & gas, chemicals & pharmaceuticals, food & beverages, and mining & minerals.

Explosion Proof Equipment Market Report Scope

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 7.4 Billion |

| Projected Market Size | USD 9.9 Billion |

| Growth Rate | 5.9% |

| Base Year Considered | 2019 |

| Historical Data Available for Years | 20172025 |

|

Forecast Period |

20202025 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Cable glands & accessories Segment |

| Highest CAGR Segment | Wireless connectivity services Segment |

| Largest Application Market Share | Commercial and consumer products Application |

This research report categorizes the market based on product, zone classification, connectivity service, industry, and geography.

Explosion Proof Equipment Market By Product:

- Cable Glands & Accessories

- Process Instruments

- Industrial Controls

- Motors

- Strobe Beacons

- Lighting Products

- Sensors

- Bells & Horns

- Fire Alarms/Call Points

- Speakers & Tone Generators

- Visual & Audible Combination Units

Market, By Zone Classification

- Zone 0

- Zone 1

- Zone 2

- Zone 20

- Zone 21

- Zone 22

Market, By Connectivity Service

- Wired

- Wireless

Market, By Industry

- Oil & Gas

- Chemicals & Pharmaceuticals

- Food & Beverages

- Energy & Power

- Mining

- Others

Explosion Proof Equipment Market, By Region

- North America

- Europe

- Asia Pacific

- Rest Of the World

Recent Developments

- In January 2020, R. STAHL expanded its lighting range, adding modern explosion-protected lighting systems with DALI interfaces. The new EXLUX variants correspond to the DALI standard, according to IEC 62386, and are specifically designed for consistent lighting management.

- In September 2019, ABB integrated CO detectors into its home automation system to protect from carbon monoxide. ABB also launched an Alarm-Stick, which integrates ABBs smoke, heat and carbon monoxide (CO) detectors into [email protected]

- In August 2019, R. STAHL launched the new generation of EXLUX linear luminaires for use in Zones 1/21 and 2/22. These luminaires have 115 lm/W luminous efficacy with a diffusor and 145 lm/W luminous efficacy without a diffusor.

- In June 2019, ABBs launched a smaller flameproof motor that offers safety and reliability. The new low voltage IEC (LV) flameproof motors are ideal for use in hazardous and explosive environments, typically found in the chemical, mining, and oil & gas industries.

Key Questions Addressed by the Report

- Where will all these developments take the market in the mid- and long-term?

- What are the drivers, restraints, opportunities, and challenges impacting the growth of the market across the world?

- Which explosion proof equipment products are expected to witness an increased demand in the mid- and long-term?

- Which region is expected to witness significant demand for the market in the coming years?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 INCLUSIONS

1.8 EXCLUSIONS

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 SIGNIFICANT MARKET OPPORTUNITIES IN THE EXPLOSION PROOF EQUIPMENT MARKET

4.2 MARKET, BY PRODUCT TYPE

4.3 MARKET, BY CONNECTIVITY SERVICE

4.4 MARKET, BY INDUSTRY

4.5 MARKET, BY REGION

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing industrial safety measures

5.2.1.2 Increased oil & gas projects

5.2.2 RESTRAINTS

5.2.2.1 Wireless explosion proof equipment acts as a source of ignition in hazardous areas

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for low-cost, high light output lighting solutions

5.2.4 CHALLENGES

5.2.4.1 Adherence to government standards

5.3 IMPACT OF COVID-19

6 EXPLOSION PROOF EQUIPMENT MARKET, BY PRODUCT TYPE (Page No. - 38)

6.1 INTRODUCTION

6.2 CABLE GLANDS & ACCESSORIES

6.2.1 INCREASING NEED FOR MECHANICAL RETENTION, STRAIN RELIEF, AND EARTH CONTINUITY DRIVE THE DEMAND FOR EXPLOSION PROOF CABLE GLAND & ACCESSORIES

6.3 PROCESS INSTRUMENTS

6.3.1 PROCESS OPTIMIZATION FUEL THE DEMAND FOR EXPLOSION PROOF PROCESS INSTRUMENTS

6.4 INDUSTRIAL CONTROLS

6.4.1 ABILITY TO EFFECTIVELY CONTROL POWER AND PROTECT CIRCUITS IN EXPLOSIVE, WET, AND CORROSIVE ENVIRONMENTS INCREASE THE SIGNIFICANCE OF EXPLOSION PROOF INDUSTRIAL CONTROLS

6.5 MOTORS

6.5.1 MOTORS ARE DESIGNED TO MINIMIZE SURFACE TEMPERATURE AND PREVENT ACCIDENTS

6.6 STROBE BEACONS

6.6.1 STROBE BEACONS PROVIDE REAL-TIME WARNINGS REGARDING ANY POTENTIAL HAZARD

6.7 LIGHTING PRODUCTS

6.7.1 ADVANCEMENTS IN LED TECHNOLOGIES PROPEL THE MARKET FOR EXPLOSION PROOF LIGHTING PRODUCTS

6.8 SENSORS

6.8.1 SENSORS ENABLE SPEEDY DETECTION OF FLAMMABLE GAS, VAPOR, DUST, AND FIBER IN HAZARDOUS LOCATIONS

6.9 BELLS & HORNS

6.9.1 BELLS & HORNS ARE USED TO SEND WARNING SIGNALS TO THE WORKFORCE IN CASE OF DISASTERS/NATURAL CALAMITIES

6.1 FIRE ALARMS/CALL POINTS

6.10.1 FIRE ALARMS/CALL POINTS PROVIDE ALERT SIGNALS DURING INCIDENCES OF FIRE

6.11 SPEAKERS & TONE GENERATORS

6.11.1 SPEAKERS & TONE GENERATORS ARE DESIGNED TO MAKE EMERGENCY ALARMS AUDIBLE IN CHALLENGING ENVIRONMENTS

6.12 VISUAL & AUDIBLE COMBINATION UNITS

6.12.1 VISUAL & AUDIBLE COMBINATION UNITS PROVIDE TIMELY INSTRUCTIONS ALONG WITH A WARNING DURING A HAZARD

7 EXPLOSION PROOF EQUIPMENT MARKET, BY ZONE CLASSIFICATION (Page No. - 55)

7.1 INTRODUCTION

7.2 ZONE 0

7.2.1 ZONE 0 IS AN AREA WITH EXPLOSIVE GAS ATMOSPHERE PRESENT CONTINUOUSLY OR FOR LONGER PERIODS

7.3 ZONE 1

7.3.1 ZONE 1 IS AN AREA WHEREIN EXPLOSIVE GAS ATMOSPHERE IS LIKELY TO OCCUR DURING NORMAL OPERATIONS OCCASIONALLY

7.4 ZONE 2

7.4.1 ZONE 2 IS AN AREA WITH HIGH-RISK ATMOSPHERE EXPECTED TO BE PREVALENT FOR SHORT PERIOD OF TIME

7.5 ZONE 20

7.5.1 ZONE 20 IS AN AREA WITH PRESENCE OF A CLOUD OF COMBUSTIBLE DUST IN THE AIR FOR EXTENDED PERIODS

7.6 ZONE 21

7.6.1 ZONE 21 IS AN AREA WITH THE PRESENCE OF A CLOUD OF COMBUSTIBLE DUST IN THE AIR THAT IS LIKELY TO OCCUR OCCASIONALLY

7.7 ZONE 22

7.7.1 ZONE 22 IS AN AREA WHEREIN EXPLOSIVE ATMOSPHERE IN THE FORM OF A CLOUD OF COMBUSTIBLE DUST IN THE AIR LIKELY TO OCCUR FOR SHORT PERIOD OF TIME

8 EXPLOSION PROOF EQUIPMENT MARKET, BY CONNECTIVITY SERVICE (Page No. - 59)

8.1 INTRODUCTION

8.2 WIRED CONNECTIVITY SERVICE

8.2.1 WIRED CONNECTIVITY SERVICES ARE MOSTLY PREFERRED IN OIL & GAS, PULP & PAPER, AND TRANSPORTATION INDUSTRIES

8.3 WIRELESS CONNECTIVITY SERVICE

8.3.1 WIRELESS CONNECTIVITY SERVICES HELP INCREASE PRODUCTIVITY AND EFFICIENCY ACROSS INDUSTRIES

9 EXPLOSION PROOF EQUIPMENT MARKET, BY INDUSTRY (Page No. - 62)

9.1 INTRODUCTION

9.2 OIL & GAS

9.2.1 EXPLOSION PROOF EQUIPMENT ARE USED ACROSS SEVERAL APPLICATIONS IN OIL & GAS INDUSTRY

9.3 CHEMICALS & PHARMACEUTICALS

9.3.1 INCREASING POSSIBILITY OF EXPLOSIONS DURING PROCESSING OF DRUGS AND PETROCHEMICAL MATERIALS EMPHASIZE THE NEED FOR MORE EXPLOSION PROOF EQUIPMENT

9.4 FOOD & BEVERAGES

9.4.1 PRESENCE OF COMBUSTIBLE DUSTS IN FOOD & BEVERAGE INDUSTRY ENVIRONMENT ENCOURAGE THE USE OF EXPLOSION PROOF EQUIPMENT TO PREVENT EXPLOSIONS

9.5 ENERGY & POWER

9.5.1 PRESENCE OF COMBUSTIBLE AND FLAMMABLE MATERIALS IN ENERGY & POWER INDUSTRY ENVIRONMENT DRIVES THE DEMAND FOR EXPLOSION PROOF EQUIPMENT TO PREVENT POTENTIAL HAZARDS

9.6 MINING

9.6.1 HARSH WORKING ENVIRONMENTS IN MINING INDUSTRY FUEL THE NEED TO USE EXPLOSION PROOF EQUIPMENT

9.7 OTHERS

10 GEOGRAPHIC ANALYSIS (Page No. - 84)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 Presence of signaling device providers in the US drive market

10.2.2 CANADA

10.2.2.1 Presence of regulatory bodies ensure usage of explosion proof equipment across hazardous

locations in Canada

10.2.3 MEXICO

10.2.3.1 Growth of the chemicals industry drive the demand for explosion proof equipment in Mexico

10.3 EUROPE

10.3.1 RUSSIA

10.3.1.1 Russias mining and energy & power industries being prone to hazards emphasize the use of explosion proof equipment

10.3.2 GERMANY

10.3.2.1 Stringent compliance with standards laid out by the European Committee for Electrotechnical standardization boost the use of explosion proof equipment in hazardous areas

10.3.3 UK

10.3.3.1 Britains vote to exit act as a restraint for the explosion proof equipment in the UK

10.3.4 REST OF EUROPE

10.3.4.1 Growth of energy & power and oil & gas industries the explosion proof equipment in Rest of Europe

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.1.1 Highly concentrated explosion prone energy & power and food & beverage industries propel the demand for explosion proof equipment in China

10.4.2 INDIA

10.4.2.1 Growing chemicals & pharmaceuticals, food & beverages, and oil & gas industries to drive the market for explosion proof equipment in India

10.4.3 JAPAN

10.4.3.1 Certifications from the Japanese Industrial Standard (JIS) ensure use of explosion proof equipment in hazardous locations across Japan

10.4.4 SOUTH KOREA

10.4.4.1 Growth of the chemicals industry drive the demand for explosion proof equipment in South Korea

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Increase in demand for explosion proof equipment owing to the presence of oil field service companies in the region

10.5 REST OF THE WORLD (ROW)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Presence of the worlds largest oil & gas industries drive the demand for explosion proof equipment in the Middle East & Africa

10.5.2 LATIN AMERICA

10.5.2.1 Growing explosion prone industries such as pulp & paper and water & wastewater treatment fuel the market for explosion proof equipment in Latin America

11 COMPETITIVE LANDSCAPE (Page No. - 102)

11.1 INTRODUCTION

11.2 MARKET RANKING ANALYSIS: EXPLOSION PROOF EQUIPMENT MARKET

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 VISIONARY LEADERS

11.3.2 DYNAMIC DIFFERENTIATORS

11.3.3 INNOVATORS

11.3.4 EMERGING COMPANIES

11.4 STRENGTH OF PRODUCT PORTFOLIO

11.5 BUSINESS STRATEGY EXCELLENCE

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 PRODUCT LAUNCHES

11.6.2 PARTNERSHIPS & CONTRACTS

12 COMPANY PROFILES (Page No. - 113)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2.1 SIEMENS

12.2.2 HONEYWELL INTERNATIONAL, INC.

12.2.3 ABB LTD.

12.2.4 ROCKWELL AUTOMATION, INC.

12.2.5 EATON CORPORATION

12.2.6 EMERSON ELECTRIC CO.

12.2.7 PATLITE CORPORATION

12.2.8 R. STAHL

12.2.9 E2S WARNING SIGNALS

12.2.10 NHP ELECTRICAL ENGINEERING PRODUCTS

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 WERMA SIGNALTECHNIK GMBH

12.3.2 FEDERAL SIGNAL CORPORATION

12.3.3 POTTER ELECTRIC SIGNAL CO., LLC

12.3.4 TOMAR ELECTRONICS INC.

12.3.5 QUINTEX GMBH

12.3.6 SUPERMEC

12.3.7 WORKSITE LIGHTING

12.3.8 BARRIER GROUP

12.3.9 EXTRONICS LTD.

12.3.10 J.B. SYSTEMS

13 APPENDIX (Page No. - 139)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

LIST OF TABLES (101 Tables)

TABLE 1 EXPLOSION PROOF EQUIPMENT MARKET SIZE, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 2 MARKET SIZE, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 3 CABLE GLANDS & ACCESSORIES MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 4 CABLE GLANDS & ACCESSORIES MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 5 PROCESS INSTRUMENTS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 6 PROCESS INSTRUMENTS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 7 PROCESS INSTRUMENTS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 8 INDUSTRIAL CONTROLS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 9 INDUSTRIAL CONTROLS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 10 INDUSTRIAL CONTROLS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 11 MOTORS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 12 MOTORS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 13 STROBE BEACONS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 14 STROBE BEACONS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 15 STROBE BEACONS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 16 LIGHTING PRODUCTS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 17 LIGHTING PRODUCTS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 18 LIGHTING PRODUCTS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 19 SENSORS MARKET SIZE, BY INDUSTRY, 20172025(USD MILLION)

TABLE 20 SENSORS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 21 BELLS & HORNS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 22 BELLS & HORNS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 23 BELLS & HORNS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 24 FIRE ALARMS/CALL POINTS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 25 FIRE ALARMS/CALL POINTS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 26 FIRE ALARMS/CALL POINTS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 27 SPEAKERS & TONE GENERATORS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 28 SPEAKERS & TONE GENERATORS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 29 VISUAL & AUDIBLE COMBINATION UNITS MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 30 VISUAL & AUDIBLE COMBINATION UNITS MARKET SIZE, BY INDUSTRY, 20172025 (THOUSAND UNITS)

TABLE 31 VISUAL & AUDIBLE COMBINATION UNITS MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 32 EXPLOSION PROOF EQUIPMENT MARKET SIZE, BY ZONE CLASSIFICATION, 20172025 (USD MILLION)

TABLE 33 MARKET SIZE, BY CONNECTIVITY SERVICE, 20172025 (USD MILLION)

TABLE 34 MARKET SIZE, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 35 MARKET FOR OIL & GAS INDUSTRY, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 36 MARKET FOR OIL & GAS INDUSTRY, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 37 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET FOR OIL & GAS INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 39 EUROPE: MARKET FOR OIL & GAS INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 40 ASIA PACIFIC: MARKET FOR OIL & GAS INDUSTRY, BY COUNTRY, 20172025 (USD THOUSAND)

TABLE 41 ROW: MARKET FOR OIL & GAS INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 42 MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 43 MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 44 MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 46 EUROPE: MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET FOR CHEMICALS & PHARMACEUTICALS INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 48 ROW: MARKET FOR CHEMICALS & PHARMACEUTICALS COUNTRY, BY REGION, 20172025 (USD MILLION)

TABLE 49 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 50 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 51 EXPLOSION PROOF EQUIPMENT MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 55 ROW: MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 56 MARKET FOR ENERGY & POWER INDUSTRY, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 57 MARKET FOR ENERGY & POWER INDUSTRY, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 58 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 60 EUROPE: MARKET FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 62 ROW: MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 63 MARKET FOR MINING INDUSTRY, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 64 MARKET FOR MINING INDUSTRY, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 65 MARKET FOR MINING INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR MINING INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 67 EUROPE: MARKET FOR MINING INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET FOR MINING INDUSTRY, BY COUNTRY, 20172025 (USD MILLION)

TABLE 69 ROW: MARKET FOR MINING INDUSTRY, BY REGION, 20172025 (USD MILLION)

TABLE 70 MARKET FOR OTHER INDUSTRIES, BY PRODUCT TYPE, 20172025 (USD MILLION)

TABLE 71 EXPLOSION PROOF EQUIPMENT MARKET FOR OTHER INDUSTRIES, BY PRODUCT TYPE, 20172025 (THOUSAND UNITS)

TABLE 72 MARKET FOR OTHER INDUSTRIES, BY REGION, 20172025 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 20172025 (USD MILLION)

TABLE 74 EUROPE: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 20172025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 20172025 (USD MILLION)

TABLE 76 ROW: MARKET FOR OTHER INDUSTRIES, BY REGION, 20172025 (USD MILLION)

TABLE 77 MARKET, BY REGION, 20172025 (USD MILLION)

TABLE 78 NORTH AMERICA : MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 20172025 (USD MILLION)

TABLE 80 US: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 81 CANADA: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 82 MEXICO: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY COUNTRY, 20172025 (USD MILLION)

TABLE 85 RUSSIA: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 86 GERMANY: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 87 UK: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 88 REST OF EUROPE: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 89 ASIA PACIFIC: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 20172025 (USD MILLION)

TABLE 91 CHINA: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 92 INDIA: MARKET, BY INDUSTRY, 20172025 (USD THOUSAND)

TABLE 93 JAPAN: MARKET, BY INDUSTRY, 20172025 (USD THOUSANDS)

TABLE 94 SOUTH KOREA: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 96 REST OF THE WORLD: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 97 REST OF THE WORLD: MARKET SIZE, BY REGION, 20172025(USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MARKET, BY INDUSTRY, 20172025 (USD MILLION)

TABLE 99 LATIN AMERICA: EXPLOSION PROOF EQUIPMENT MARKET, BY INDUSTRY, 20172025(USD MILLION)

TABLE 100 PRODUCT LAUNCHES, 20172020

TABLE 101 PARTNERSHIPS & CONTRACTS, 20172020

LIST OF FIGURES (33 Figures)

FIGURE 1 EXPLOSION PROOF EQUIPMENT MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 2 MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 DATA TRIANGULATION

FIGURE 6 MARKET SIZE, 20192025

FIGURE 7 MARKET, BY PRODUCT TYPE, 20202025 (USD MILLION)

FIGURE 8 MARKET, BY CONNECTIVITY SERVICE, 2019-2025 (USD MILLION)

FIGURE 9 MARKET, BY INDUSTRY, 2019

FIGURE 10 ROW ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

FIGURE 11 INCREASING INDUSTRIAL SAFETY MEASURES IS A MAJOR FACTOR DRIVING THE MARKET

FIGURE 12 CABLE GLANDS & ACCESSORIES SEGMENT TO LEAD THE MARKET BETWEEN 2020 AND 2025

FIGURE 13 WIRELESS CONNECTIVITY SERVICE SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING FORECAST PERIOD AS COMPARED WITH WIRED SEGMENT

FIGURE 14 OIL & GAS SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 15 ROW IS ESTIMATED TO LEAD THE MARKET IN 2020

FIGURE 16 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17 MARKET, BY PRODUCT TYPE, 2019

FIGURE 18 ROW IS PROJECTED TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 19 NORTH AMERICA MARKET SNAPSHOT

FIGURE 20 EUROPE MARKET SNAPSHOT

FIGURE 21 ASIA PACIFIC EXPLOSION PROOF EQUIPMENT SNAPSHOT

FIGURE 22 KEY GROWTH STRATEGIES ADOPTED BY TOP COMPANIES FROM 2017 TO 2020

FIGURE 23 MARKET RANKING OF TOP 5 PLAYERS IN MARKET, 2019

FIGURE 24 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 25 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 26 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

FIGURE 27 SIEMENS: COMPANY SNAPSHOT

FIGURE 28 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 29 ABB LTD.: COMPANY SNAPSHOT

FIGURE 30 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

FIGURE 31 EATON CORPORATION: COMPANY SNAPSHOT

FIGURE 32 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

FIGURE 33 R. STAHL: COMPANY SNAPSHOT

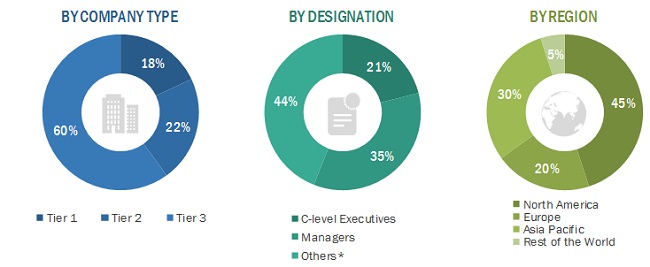

The study involves four major activities to estimate the size of the explosion proof equipment market from 2020 to 2025. Exhaustive secondary research was conducted to collect information about the market, its peer markets, and its parent market. It was followed by primary research that was carried out to validate these findings, assumptions, and sizing with industry experts across the value chain of the explosion proof equipment. Both top-down and bottom-up approaches were employed to estimate the overall size of the market, followed by the market breakdown and data triangulation methods to estimate the sizes of different segments and subsegments of the market.

Secondary Research

In the secondary research process, secondary sources such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to for the identification and collection of information for this study on the market. The other secondary sources used during the study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; gold-standard and silver-standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The explosion proof equipment market comprises stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations. The supply-side segmentation of the market includes product, zone classification, and connectivity service, while the demand-side segmentation includes industry and region. Primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the market. These approaches were used extensively to estimate the sizes of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research

- The supply chain of the explosion proof equipment industry and the market size, in terms of value, were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall size of the explosion proof equipment market through the market estimation process explained above, the total market was split into several segments and subsegments. Market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market based on product, zone classification, connectivity service, industry, and geography

- To forecast the market size, in terms of value and volume, for various segments with regard to four main regionsNorth America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market and provide a detailed competitive landscape for the market leaders

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze strategic developments such as new product launches and developments and partnerships undertaken by the leading players in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

The following customization options are available for the explosion proof equipment market report:

Company Information

- Detailed analysis and profiling of additional market players.

Growth opportunities and latent adjacency in Explosion Proof Equipment Market