Hazardous Area Equipment Market Size, Share, Statistics and Industry Growth Analysis by Product (Cable Glands & Accessories, Measurement Devices, Control Products, Alarm Systems, Motors, Lighting Products), Industry (Oil & Gas, Chemical & Pharmaceutical, Food & Beverage), Region - Global Forecast to 2028

Updated on : April 15, 2024

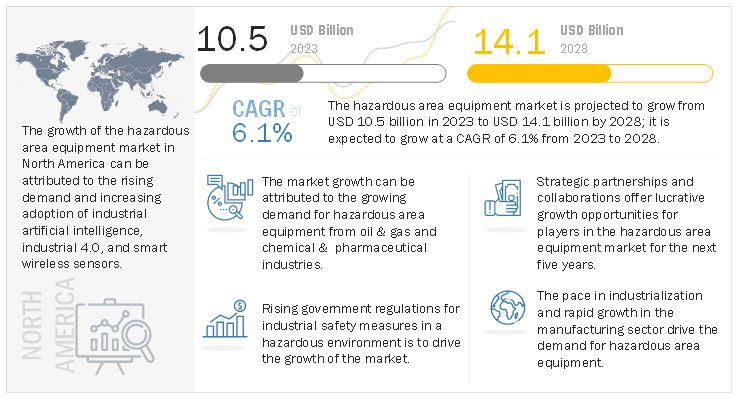

[195 Pages Report] The global hazardous area equipment market size is projected to grow from USD 10.5 billion in 2023 to USD 14.1 billion by 2028; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% from 2023 to 2028.

Hazardous area equipment offers several advantages such as intrinsic safety, reduced risk of a fire or explosion, protection of circuits in an explosive environment, minimize surface temperature, and lighting products for signaling- all of which are essential to achieving higher safety and efficiency in an organization. The adoption of advanced LED light fixtures over conventional lighting solutions in hazardous area is driving the growth of the market.

The objective of the report is to define, describe, and forecast the hazardous area equipment industry based on product, industry, and region.

Hazardous Area Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Hazardous Area Equipment Market Dynamics

Rising government regulations for industrial safety measures in a hazardous environment is to drive the hazardous area equipment market growth

Globally, every process industry such as, oil and gas, chemical and pharmaceutical, food & beverage, mining, energy and power, and so on required to follow safety measures. These measures need to be taken by installing effective and efficient hazardous area equipment such as cable glands & accessories, measurement devices, control products, motors, lighting products, alarm systems, etc. that maintain safety standards and allow the smooth functioning of processes in the above-mentioned industries.

Several standards have been introduced for hazardous area equipment such as NFPA 497 and NFPA 499, ATEX, NEMA, IECEx, and UL that defines the requirements for their installation, testing, and the quality of products to be considered.

Rapid transition from traditional lighting systems to connected lighting solutions is to create high growth opportunities for the market

In recent years, there has been a rapid shift in the adoption of connected lighting solutions from traditional lighting systems due to various advantages offered by connected lighting solutions, such as increased energy efficiency, improved luminance, and cost savings in the long run. Connected lighting enables users to remotely regulate the lights according to their requirements and hence, minimize energy costs. The embedded sensors and automated control functions give users updates on the light usage patterns for an enhanced lighting experience. As industries rely on cost optimization, the demand for connected lighting solutions is expected to create high growth opportunities for the market.

The high initial cost associated with the deployment of hazardous area equipment is restraining the growth of market

The hazardous equipment used in the hazardous area is basically contained in a heavy protective enclosure, these equipment are made up of die-cast steel, occasionally plastic. In case any heat or spark ignites from the faulty equipment, the enclosure prevents it from the explosion. Furthermore, country wise different methods are used to protect the equipment used in hazardous areas. This equipment provides benefits but by paying the high cost and becomes extremely heavy. That’s why the high initial cost associated with the deployment of hazardous area equipment is restraining the growth of market.

The lack of common standards for hazardous area equipment is a challenge to the growth of the market

To avoid workplace disasters, manufacturers and end users of hazardous area equipment need to follow common standards. Globally, there are two major organizations that provide hazardous area standards International Electrotechnical Commission (IEC) and National Electrical Code (NEC) published by National Fire Protection Association (NFPA). Despite the fact that basic explosion protection principles are similar all over the world but there is some difference in the particular regulations followed in North America, Asia Pacific, and Europe. The unavailability of common open standards is creating confusion in the industry.

Control Products to grow at a higher CAGR in hazardous area market between 2023 and 2028

The control products segment is projected to register the highest CAGR of 7.2% between 2023 and 2028. Process industries are required to follow safety measures that include the installation of hazardous area-certified control products. With the growing installation of new plants and the expansion of existing ones, process industries such as oil & gas and chemical & pharmaceutical are likely to demand efficient control products, such as relays, enclosures, and signal conditioners with certifications, for enabling safe operations.

The market for hazardous area equipment in oil & gas industry to record for largest market share throughout the forecast period

There is an increased application of hazardous area equipment such as measurement devices, control products, motors, alarm systems, and lighting products for the exploration and extraction of shale gas and oil, owing to which the oil & gas segment is expected to retain its market-leading position till 2028. Critical industries such as oil & gas and chemical & pharmaceutical are bound to have effective EHS (environment, health, and safety) to ensure the implementation and operation of appropriate equipment in hazardous areas.

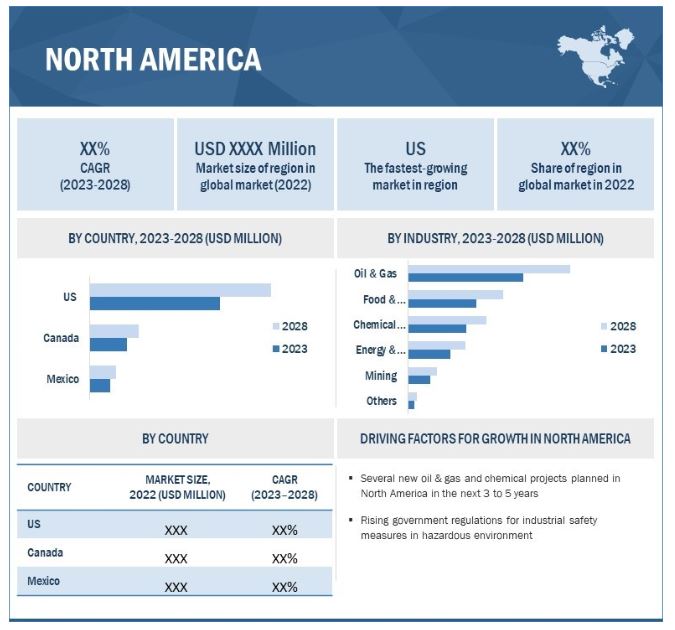

Market in North America to grow with the highest compound annual growth rate during the forecast period

The demand for hazardous area equipment in North America is expected to grow primarily because this region has emerged as a global focal point for large investments and business expansion opportunities. The fastest growth of the hazardous area equipment market in North America can be attributed to the presence of leading market players such as Rockwell (US), Honeywell (US), and Emerson (US), Also, many companies are focusing on the exploration and production of oil & gas assets in the region.

Hazardous Area Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Hazardous Area Equipment Companies - Key Market Players:

The Hazardous Area Equipment companies such as ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corporation (Ireland), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), Patlite Corporation (Japan), R. STAHL AG (Germany).

Hazardous Area Equipment Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 10.5 Billion in 2023 |

| Projected Market Size | USD 14.1 Billion by 2028 |

| Growth Rate | CAGR of 6.1% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographic regions covered |

|

|

Companies covered |

ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corporation (Ireland), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), Patlite Corporation (Japan), R. STAHL AG (Germany) are the major players in the market. |

Hazardous Area Equipment Market Highlights

This report categorizes the hazardous area equipment market based on product, industry, geography.

|

Aspect |

Details |

|

Hazardous Area Equipment Market, by product: |

|

|

Hazardous Area Equipment Market, by industry: |

|

|

Hazardous Area Equipment Market, by region: |

|

Recent Developments in Hazardous Area Equipment Industry :

- In March 2021, Basler AG launched Embedded vision processing kit that includes various interfaces for image processing and allows the connection of different camera types. The kit includes the reliable pylon Camera Software Suite, which provides certified drivers for all types of camera interfaces, simple programming interfaces, and a comprehensive set of tools for camera setup.

- In September 2021, KEYANCE launched High-resolution Camera, CV-X/XG-X Series of ultra-high resolution cameras, 64 mp camera significantly improves accuracy in conventional inspection. And the camera built-in angle sensor makes camera installation significantly easier and quickly detect camera misalignment during operation.

Frequently Asked Questions (FAQs):

Which are the major companies in the hazardous area equipment market ? What are their major strategies to strengthen their market presence?

ABB Ltd. (Switzerland), Siemens AG (Germany), Eaton Corporation (Ireland), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), Patlite Corporation (Japan), R. STAHL AG (Germany). These companies have adopted organic as well as inorganic growth strategies such as product launches, innovation in products, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for hazardous area equipment in terms of the region?

North America is the region with high growth opportunities owing to the presence of countries such as the US, Canada, and Mexico.

What are the opportunities for new market entrants?

The development of hazardous area equipment using industrial internet of things (IIoT), and smart wireless sensors are creating opportunities for the players in the market.

Which industries are expected to drive the growth of the market in the next six years?

The oil & gas industry is expected to hold the largest market of hazardous area equipment. The growth of this industry is attributed to the large investment and business expansion opportunities. The Chemical & pharmaceutical industry is also expected to hold a significant share of the hazardous area equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of hazardous area equipment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, hazardous area equipment-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

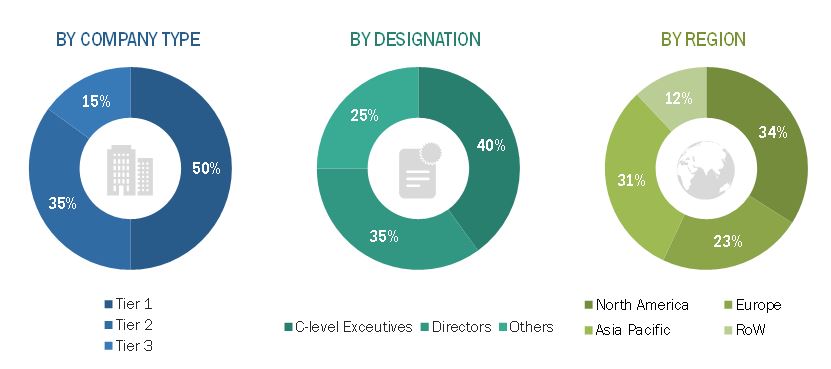

Extensive primary research has been conducted after understanding and analyzing the hazardous area equipment market through secondary research. Several primary telephonic interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW). Moreover, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the hazardous area equipment market.

Major players in the hazardous area equipment market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. The entire research methodology included the study of annual and financial reports of top players and interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative). All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Hazardous Area Equipment Market: Bottom-Up Approach

Hazardous Area Equipment Market: Top-Down Approach

Data Triangulation

After arriving at the overall size of the hazardous area equipment market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the hazardous area equipment market size, in terms of value, by product and industry

-

To describe and forecast the market size, in terms of value, by region—North America, Europe,

Asia Pacific, and the Rest of the World (RoW) - To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the process flow of the hazardous area equipment market

- To analyze opportunities for stakeholders in the hazardous area equipment market by identifying its high-growth segments

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players and comprehensively analyze their market shares and core competencies along with detailing the competitive leadership and analyzing growth strategies such as product launches and developments, expansions, acquisitions, agreements, mergers, joint ventures, and partnerships of leading players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Hazardous Area Equipment Market